Professional Documents

Culture Documents

Auditing Problems 6

Uploaded by

czymon0 ratings0% found this document useful (0 votes)

7 views1 pageThe document shows the calculation of carrying values and depreciation expense for land, buildings, and machinery. It starts with the original balances, makes adjustments for donated stock and assets sold, calculates accumulated depreciation using rates of 2% for buildings and 10% for machinery, and determines a loss on machinery sold in 2021. Total depreciation expense for 2021 was $63,900.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows the calculation of carrying values and depreciation expense for land, buildings, and machinery. It starts with the original balances, makes adjustments for donated stock and assets sold, calculates accumulated depreciation using rates of 2% for buildings and 10% for machinery, and determines a loss on machinery sold in 2021. Total depreciation expense for 2021 was $63,900.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageAuditing Problems 6

Uploaded by

czymonThe document shows the calculation of carrying values and depreciation expense for land, buildings, and machinery. It starts with the original balances, makes adjustments for donated stock and assets sold, calculates accumulated depreciation using rates of 2% for buildings and 10% for machinery, and determines a loss on machinery sold in 2021. Total depreciation expense for 2021 was $63,900.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

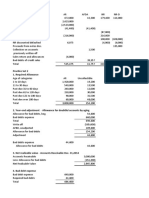

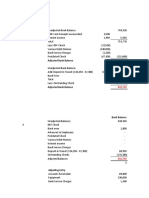

1 Land Building Total

Unadjusted balances 660,000 990,000 1,650,000

Sale of donated stock

Land(75,000 * 660/1650) (30,000) (30,000)

Building(75,000 * 990/1650) (45,000) (45,000)

Adjusted balances 630,000 945,000 1,575,000

2

Adjusted balance of building 945,000

Less: Accumulated depreciation(945,000 * 2% * 2) 37,800

Carrying value of Building as of December 31, 2021 907,200

3 Machinery (444,000 + 6,000) 450,000

Less: Machinery sold 15,000

Adjusted balance of machinery 435,000

Less: Accumulated depreciation(435,000 * 10% * 2) 87,000

Carrying value of Machinery as of December 31, 2021 348,000

4 Depreciation Expense - Building(945,000 * 2%) 18,900

Depreciation Expense - Machinery(450,000 * 10%) 45,000

Total depreciation expense for 2021 63,900

5 Sales price 6,000

Less: Carrying value

Cost 15,000

Less: Accumulated depreciation(15,000 * 10% * 2) 3,000 12,000

Gain(Loss) on sale (6,000)

You might also like

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- MTP 12 16 Answers 1696782053Document14 pagesMTP 12 16 Answers 1696782053harshallahotNo ratings yet

- MTP 10 16 Answers 1694780069Document13 pagesMTP 10 16 Answers 1694780069jiotv0050No ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- Chapter: Non-Current Assets and Depreciation Answers For Model QuestionDocument4 pagesChapter: Non-Current Assets and Depreciation Answers For Model QuestionRAJIB HOSSAINNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- MARTIN AUD314 Recognition and DepreciationDocument57 pagesMARTIN AUD314 Recognition and DepreciationLorraineMartinNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- Solution Case 1Document2 pagesSolution Case 1Ario LintangNo ratings yet

- Soltion of Chemalite BDocument13 pagesSoltion of Chemalite BAITHARAJU SAI HEMANTHNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- Dr-Acc. Depreciation RM 25 Mill CR - Building RM25 MillDocument7 pagesDr-Acc. Depreciation RM 25 Mill CR - Building RM25 MillsyuhadahNo ratings yet

- Jawaban Tugas Ke-11 SOAL-1: Jurnal: Depreciation Expense $ 12.500 Accum Depre Machine $ 12.500Document2 pagesJawaban Tugas Ke-11 SOAL-1: Jurnal: Depreciation Expense $ 12.500 Accum Depre Machine $ 12.500Anisa Siti WahyuniNo ratings yet

- Land and Buildings Fixtures and Fittings Total N$'000 N$'000 N$'000Document6 pagesLand and Buildings Fixtures and Fittings Total N$'000 N$'000 N$'000PRECIOUSNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Kunci Jawaban Laporan KeuanganDocument16 pagesKunci Jawaban Laporan KeuanganreiNo ratings yet

- 30 1 To 30 4Document2 pages30 1 To 30 4Away To PonderNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- BUSI 353 S18 Assignment 6 SOLUTIONDocument4 pagesBUSI 353 S18 Assignment 6 SOLUTIONTanNo ratings yet

- 03.05.2023 Revision Questions On Non-Current AssetsDocument12 pages03.05.2023 Revision Questions On Non-Current Assetssiamesamuel229No ratings yet

- 0 - AE 17 ProblemsDocument3 pages0 - AE 17 ProblemsMajoy BantocNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- Acctg 303 Midterm Quiz 1 With Solution at 2 Ma T1 Ma Addtnl TTHDocument4 pagesAcctg 303 Midterm Quiz 1 With Solution at 2 Ma T1 Ma Addtnl TTHOly VieenaNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Hospital Supply: Alternative Choice Decisions Differential CostingDocument13 pagesHospital Supply: Alternative Choice Decisions Differential Costingksandeep25No ratings yet

- DAIBB Accounting 2020Document14 pagesDAIBB Accounting 2020BelalHossainNo ratings yet

- Chapter 9 Exercises: Exercise 9 1Document8 pagesChapter 9 Exercises: Exercise 9 1karenmae intangNo ratings yet

- MTP 3 16 Answers 1681098469Document13 pagesMTP 3 16 Answers 1681098469Umar MalikNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Fima Week 2 ActivitiesDocument9 pagesFima Week 2 ActivitiesKatrina PaquizNo ratings yet

- Assignment 01: Audit of Property, Plant and Equipment Problem SolvingDocument2 pagesAssignment 01: Audit of Property, Plant and Equipment Problem SolvingDan Andrei BongoNo ratings yet

- Rs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Document4 pagesRs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Sameen KhanNo ratings yet

- B2 2022 May AnsDocument15 pagesB2 2022 May AnsRashid AbeidNo ratings yet

- Unit and Batch Homework SolutionsDocument2 pagesUnit and Batch Homework Solutionsnikhilcoke7No ratings yet

- F2 Past Paper - Ans05-2005Document10 pagesF2 Past Paper - Ans05-2005ArsalanACCANo ratings yet

- Intangible Assets QuizDocument3 pagesIntangible Assets QuizKarlo PalerNo ratings yet

- Confidential 1 AC/TEST MAY 2021/FAR270Document5 pagesConfidential 1 AC/TEST MAY 2021/FAR270Lampard AimanNo ratings yet

- Sol. Man. - Chapter 7 - Inventories - Ia Part 1aDocument19 pagesSol. Man. - Chapter 7 - Inventories - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Problem 4Document4 pagesProblem 4Mitch MinglanaNo ratings yet

- FAC2601 Assignment 02Document4 pagesFAC2601 Assignment 02SibongileNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- ACCTDocument23 pagesACCTLê Việt HoàngNo ratings yet

- Practice Set 1Document6 pagesPractice Set 1moreNo ratings yet

- Exercise 5: To Record The Investment PropertyDocument6 pagesExercise 5: To Record The Investment PropertyPearl Isabelle SudarioNo ratings yet

- Baicua Dieu 5Document1 pageBaicua Dieu 5Phạm DiệuNo ratings yet

- 3 - IAS 36 SolutionDocument3 pages3 - IAS 36 Solutionsandeshjhanbia021No ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- AssignmentDocument10 pagesAssignmentczymonNo ratings yet

- 1 Notes To Income StatementDocument4 pages1 Notes To Income StatementczymonNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2czymonNo ratings yet

- 3 Notes To Financial PositionDocument6 pages3 Notes To Financial PositionczymonNo ratings yet

- 4 Statement of Financial PositionDocument4 pages4 Statement of Financial PositionczymonNo ratings yet

- 2 Statement of IncomeDocument4 pages2 Statement of IncomeczymonNo ratings yet

- Auditing Problems 4Document2 pagesAuditing Problems 4czymonNo ratings yet

- Auditing Problems 1Document4 pagesAuditing Problems 1czymonNo ratings yet

- Auditing Problems 5Document8 pagesAuditing Problems 5czymonNo ratings yet

- Chapter 2 - EthicsDocument2 pagesChapter 2 - EthicsczymonNo ratings yet

- Chapter 5 - EthicsDocument2 pagesChapter 5 - EthicsczymonNo ratings yet

- Chapter 1 - EthicsDocument6 pagesChapter 1 - EthicsczymonNo ratings yet

- Chapter 4 - EthicsDocument3 pagesChapter 4 - EthicsczymonNo ratings yet

- Chapter 3 - EthicsDocument2 pagesChapter 3 - EthicsczymonNo ratings yet