Professional Documents

Culture Documents

Auditing Problems 4

Uploaded by

czymon0 ratings0% found this document useful (0 votes)

10 views2 pages1) The journal entry on Jan 8 records a debit to Raw Materials Inventory for $141,120 to record the purchase of raw materials.

2) The repossessed inventory on Feb 14 is valued at $14,000, which is the estimated selling price less refinishing costs and normal profit.

3) The journal entries on April 3 records the reselling of the repossessed item, with $4,800 in cash received, $19,200 recorded to Accounts Receivable, and $24,000 recorded to Sales - Repossessed Inventory.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The journal entry on Jan 8 records a debit to Raw Materials Inventory for $141,120 to record the purchase of raw materials.

2) The repossessed inventory on Feb 14 is valued at $14,000, which is the estimated selling price less refinishing costs and normal profit.

3) The journal entries on April 3 records the reselling of the repossessed item, with $4,800 in cash received, $19,200 recorded to Accounts Receivable, and $24,000 recorded to Sales - Repossessed Inventory.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesAuditing Problems 4

Uploaded by

czymon1) The journal entry on Jan 8 records a debit to Raw Materials Inventory for $141,120 to record the purchase of raw materials.

2) The repossessed inventory on Feb 14 is valued at $14,000, which is the estimated selling price less refinishing costs and normal profit.

3) The journal entries on April 3 records the reselling of the repossessed item, with $4,800 in cash received, $19,200 recorded to Accounts Receivable, and $24,000 recorded to Sales - Repossessed Inventory.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

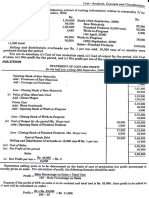

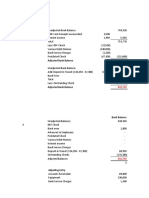

1. The entry on Jan. 8 will include a debit to Raw Materials Inventory of?

Raw Materials Inventory 141,120

Accounts Payable 141,120

To record the purchase of raw materials inventory (200,000 * 80% * 90% * 98%)

2. The repossessed inventory on Feb. 14 is most likely to be valued at?

Estimated selling price 24,000

Less: Refinishing costs 6,800

Net realizable value 17,200

Less: Normal Profit 3,200

Value of repossessed inventory on Feb. 14 14,000

3. The journal entries on April 3 will be?

Cash (24,000 * 20%) 4,800

Accounts Receivable (24,000 - 4,800) 19,200

Sales - Repossessed Inventory 24,000

To record the reselling of the repossessed item (20% down, 80% on account)

Cost of Repossessed Goods Sold (14,000 + 6,400) 20,400

Repossessed Inventory 20,400

To record the cost of the repossessed item sold

4. The trade-in inventory on Aug. 30 is most likely to be valued at?

Estimated selling price (net realizable value) 6,400

Less: Normal Profit (6,400 * 25%) 1,600

Value of trade-in inventory 4,800

5. How much will be recorded as Sales on Aug. 30?

Accounts Receivable (59,200 - 8,000) 51,200

Add: Value of trade-in inventory 4,800

Amount to be recorded as sales 56,000

You might also like

- AssignmentDocument3 pagesAssignmentalmira garciaNo ratings yet

- Problem 1Document1 pageProblem 1Abe Mayores CañasNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- Myco Paque InventoriesDocument5 pagesMyco Paque InventoriesMYCO PONCE PAQUENo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Inventories BRILLANTESDocument15 pagesInventories BRILLANTESParabuac, Angeline Joy S.No ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Elaine and Faith Form PartnershipDocument1 pageElaine and Faith Form PartnershipMayuki TakizawaNo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Latourneau Company (Cost Classification) PDFDocument3 pagesLatourneau Company (Cost Classification) PDFCeline Versace100% (3)

- Cost of Goods Available For SaleDocument4 pagesCost of Goods Available For SaleColeen RamosNo ratings yet

- Business Combination - GROUP 1Document4 pagesBusiness Combination - GROUP 1Ejoyce KimNo ratings yet

- Acc211 - Bedas - Lets AnalyzeDocument2 pagesAcc211 - Bedas - Lets AnalyzeRyll BedasNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- ACC 201 Ch5Document7 pagesACC 201 Ch5Trickster TwelveNo ratings yet

- Problem 1-1 (IFRS) : Operations To Be Sold Beyond 12 Months Amounting ToDocument1 pageProblem 1-1 (IFRS) : Operations To Be Sold Beyond 12 Months Amounting ToSIAN DAVIDNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- Partnership Formation QuizDocument1 pagePartnership Formation QuizMaria Carmela MoraudaNo ratings yet

- Applied Overhads 60,000 Calculation of Actual OverheadDocument2 pagesApplied Overhads 60,000 Calculation of Actual OverheadRoshaanNo ratings yet

- HW Chap 5Document9 pagesHW Chap 5uong huonglyNo ratings yet

- PANOPIO Activity1 BLOCK3209Document6 pagesPANOPIO Activity1 BLOCK3209panopiojessiemae4No ratings yet

- Kings Inc - Cost AcctgDocument2 pagesKings Inc - Cost AcctgShinjiNo ratings yet

- Chapter 1Document20 pagesChapter 1Coursehero PremiumNo ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- Exercise Business CombinationDocument1 pageExercise Business CombinationAbbygail PantorillaNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- Inventories and Related Expenses: Multiple Choice - TheoryDocument14 pagesInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNo ratings yet

- Module 2Document5 pagesModule 2Alpha RamoranNo ratings yet

- Activity Preparing Journal EntriesDocument5 pagesActivity Preparing Journal EntriesJomir Kimberly DomingoNo ratings yet

- Accounting For Business Transaction Final ExamDocument7 pagesAccounting For Business Transaction Final ExamtiffNo ratings yet

- Goodah Products Company FSADocument1 pageGoodah Products Company FSAFood EyeNo ratings yet

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- Danielle Rachel Mina 1209 Male Q.4: Requirement ADocument4 pagesDanielle Rachel Mina 1209 Male Q.4: Requirement AWaz KaBoomNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- Module 3 - Subsequent To AcquisitionDocument8 pagesModule 3 - Subsequent To AcquisitionRENZ ALFRED ASTRERONo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Midterm QuizDocument5 pagesMidterm QuizyelzNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Cost Accounting Practical Problems 1Document25 pagesCost Accounting Practical Problems 1Rishika MadhukarNo ratings yet

- Intercompany Sales Business CombiDocument26 pagesIntercompany Sales Business CombiElai grace FernandezNo ratings yet

- Cost Ass 3Document1 pageCost Ass 3Adugna MegenasaNo ratings yet

- Bucom 2Document3 pagesBucom 2dmangiginNo ratings yet

- Problem: I - Comprehensive Problem: Goodwill Computation With Contingent ConsiderationDocument5 pagesProblem: I - Comprehensive Problem: Goodwill Computation With Contingent Considerationasdasda100% (4)

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- AssignmentDocument10 pagesAssignmentczymonNo ratings yet

- 1 Notes To Income StatementDocument4 pages1 Notes To Income StatementczymonNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2czymonNo ratings yet

- 3 Notes To Financial PositionDocument6 pages3 Notes To Financial PositionczymonNo ratings yet

- 4 Statement of Financial PositionDocument4 pages4 Statement of Financial PositionczymonNo ratings yet

- 2 Statement of IncomeDocument4 pages2 Statement of IncomeczymonNo ratings yet

- Auditing Problems 6Document1 pageAuditing Problems 6czymonNo ratings yet

- Auditing Problems 1Document4 pagesAuditing Problems 1czymonNo ratings yet

- Auditing Problems 5Document8 pagesAuditing Problems 5czymonNo ratings yet

- Chapter 2 - EthicsDocument2 pagesChapter 2 - EthicsczymonNo ratings yet

- Chapter 5 - EthicsDocument2 pagesChapter 5 - EthicsczymonNo ratings yet

- Chapter 1 - EthicsDocument6 pagesChapter 1 - EthicsczymonNo ratings yet

- Chapter 4 - EthicsDocument3 pagesChapter 4 - EthicsczymonNo ratings yet

- Chapter 3 - EthicsDocument2 pagesChapter 3 - EthicsczymonNo ratings yet