Professional Documents

Culture Documents

Chapter - 11 Portfolio Management

Uploaded by

D2N0 ratings0% found this document useful (0 votes)

52 views5 pagesinvestment bbs 4th year

Original Title

Chapter -11 Portfolio Management

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentinvestment bbs 4th year

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

52 views5 pagesChapter - 11 Portfolio Management

Uploaded by

D2Ninvestment bbs 4th year

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

What is Portfolio Management ?

The art of selecting the right investment policy for the

individuals in terms of minimum risk and maximum return is

called as portfolio management.

Portfolio management refers to managing an individual’s

investments in the form of bonds, shares, cash, mutual funds

etc so that he earns the maximum profits within the stipulated

time frame.

Portfolio management refers to managing money of an

individual under the expert guidance of portfolio managers.

Types of Portfolio Management

In a broader sense, portfolio management can be classified under 4 major

types, namely –

Active portfolio management

In this type of management, the portfolio manager is mostly concerned

with generating maximum returns. Resultantly, they put a significant share

of resources in the trading of securities. Typically, they purchase stocks

when they are undervalued and sell them off when their value increases.

Passive portfolio management

This particular type of portfolio management is concerned with a fixed

profile that aligns perfectly with the current market trends. The managers

are more likely to invest in index funds with low but steady returns which

may seem profitable in the long run.

Discretionary portfolio management

In this particular management type, the portfolio managers are entrusted

with the authority to invest as per their discretion on investors’ behalf.

Based on investors’ goals and risk appetite, the manager may choose

whichever investment strategy they deem suitable.

Measuring of the performance

HPR= (V1-V0)+C

V0

V1=Ending Value of investment

V0=Beginning Value of investment

C= Current income( interest /Dividend)

2. HPR portfolio= RGC +UGC+C

E0+(NF× ip/12) –(WF ×wp/12)

Where,

RGC=realized capital gain

UGC=Unrealized capital gain

C=dividend/ interest

E0=Initial Equity investment

Nf=New fund

Ip=number of months in portfolio

Wf=withdraw fund

Wp=number of month with draw from portfolio

1.Sharpe's Measure of Portfolio Performance

Sharpe's measure of portfolio performance, developed by

William F. Sharpe, is given after his name.

SP=RP-RF SM=RM-RF

QP QM

2. Treynor's Measure of Portfolio Performance

Treynor's measure of portfolio performance, developed by

Jack L. Treynor, is also given after his name. This measure is

different from the Sharpe's measure in consideration of

portfolio risk. This measure provides a portfolio performance

index that compares a portfolio's risk premium to the

systematic or non- diversifiable risk associated with the

portfolio.

TP =RP-RF

BP

Where

TP =Treynor's index of portfolio performance measure.

RP = total rate of return on portfolio.

RF = the risk-free rate of return.

BP= the beta coefficient of the portfolio.

3.Jensen's Measure of Portfolio Performance

Jensen's measure of portfolio performance, developed by Michael C. Jensen, is

also called Jensen's Alpha. The theoretical orientation of this measure is similar

to the Treynor's measure because both are based on the capital asset pricing

model. However, calculation aspect of Jensen measure differs significantly from

the Sharpe's measure and Treynor's measure. Jensen's measure calculates the

Jensen's Alpha which is the excess of portfolio return above the required rate of

return on the portfolio. The required rate of return on the portfolio is calculated

using the capital asset pricing model. The Jensen's Alpha is given by:

AP= Rp-[RF+ (RM-RF)ẞP]

Where

AP = Jensen's Alpha

RP = portfolio return

RF = risk-free rate

RM = market return

BP= portfolio beta

You might also like

- Chapter Eleven: Portfolio Performance EvaluationDocument23 pagesChapter Eleven: Portfolio Performance EvaluationGeorgina AlpertNo ratings yet

- Ecomm MCQ Sem2 PDFDocument11 pagesEcomm MCQ Sem2 PDFsharu skNo ratings yet

- Bicol University Field Study 1Document8 pagesBicol University Field Study 1Ralph Lowie NeoNo ratings yet

- CMPM Chapter 3Document22 pagesCMPM Chapter 3Joshua BacunawaNo ratings yet

- Prehensive Controller Implementation For Wind-PV-Diesel Based Standalone Microgrid - MATLAB 2018ADocument12 pagesPrehensive Controller Implementation For Wind-PV-Diesel Based Standalone Microgrid - MATLAB 2018AstarboyNo ratings yet

- Chapter 2 TQMDocument9 pagesChapter 2 TQMJustine Marie BalderasNo ratings yet

- Thesis ExampleDocument54 pagesThesis ExampleJohn Neil Miles RejanoNo ratings yet

- Science Technology and SocietyDocument21 pagesScience Technology and SocietyJanna pnlbNo ratings yet

- Phedo 704a Learning Module Midterm 2021 2022Document15 pagesPhedo 704a Learning Module Midterm 2021 2022Shaira IwayanNo ratings yet

- WEEK 2 Management of Patients With Chest and Lower Respiratory Tract DisordersDocument9 pagesWEEK 2 Management of Patients With Chest and Lower Respiratory Tract DisordersTin tinNo ratings yet

- Cse Reviewer JuliusDocument52 pagesCse Reviewer JuliusKimberly VicencioNo ratings yet

- ACYMAG2 NotesDocument60 pagesACYMAG2 NotesAngel JamianaNo ratings yet

- Geometry EssentialsDocument25 pagesGeometry EssentialsDeeksha KapoorNo ratings yet

- Esas QuizDocument6 pagesEsas QuizAilyn BalmesNo ratings yet

- Classification of CropsDocument11 pagesClassification of CropsAnna BaybayNo ratings yet

- Audit Theory OverviewDocument180 pagesAudit Theory OverviewGela ValesNo ratings yet

- Philhealth Advisory 1% DifferentialDocument2 pagesPhilhealth Advisory 1% DifferentialKe VinNo ratings yet

- Introduction to Electrical Systems Design Module 5Document28 pagesIntroduction to Electrical Systems Design Module 5JACIEL HERNANDEZ HERNANDEZNo ratings yet

- Executive Order No. 02 s. 2016 Right to InformationDocument35 pagesExecutive Order No. 02 s. 2016 Right to InformationMaria Fiona Duran MerquitaNo ratings yet

- Gross Income (Tax 2)Document46 pagesGross Income (Tax 2)HOOPE JISONNo ratings yet

- English 3Document6 pagesEnglish 3Aj PascualNo ratings yet

- OceArizona350GT BERTL2009Report v1 m56577569830565511Document34 pagesOceArizona350GT BERTL2009Report v1 m56577569830565511Nikolche MitrikjevskiNo ratings yet

- Home of Local Goods CooperativeDocument20 pagesHome of Local Goods CooperativeMark Angelo SonNo ratings yet

- Financial Statement Analysis RatiosDocument6 pagesFinancial Statement Analysis RatiosMonica GarciaNo ratings yet

- Nepal Education Cluster Contingency Plan (2011-2012)Document45 pagesNepal Education Cluster Contingency Plan (2011-2012)ansumansatapathyNo ratings yet

- Case Report Diabetic Retinopaty in EnglishDocument13 pagesCase Report Diabetic Retinopaty in Englishsasha anka DilanNo ratings yet

- 93-06 - Fringe Benefit TaxDocument8 pages93-06 - Fringe Benefit TaxJuan Miguel UngsodNo ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- 5 - Online Particle Monitor OPM II R928052298Document8 pages5 - Online Particle Monitor OPM II R928052298EGOTRONICNo ratings yet

- Seda Hotel Water Survey Report Analyzes Water UsageDocument15 pagesSeda Hotel Water Survey Report Analyzes Water UsageMohammad Ali MaunaNo ratings yet

- What Is Monetary PolicyDocument12 pagesWhat Is Monetary PolicyNain TechnicalNo ratings yet

- Chain Link Fencing - R0Document1 pageChain Link Fencing - R0Muzzammil ShaikhNo ratings yet

- Philippine Health Care Providers v. CIR: Health Care Agreements Subject to DSTDocument2 pagesPhilippine Health Care Providers v. CIR: Health Care Agreements Subject to DSTJohn Mark RevillaNo ratings yet

- Lighting and Acoustical Treatment and Design: A Case Study of Robert B. Estralla, Sr. Memorial Stadium, RosalesDocument16 pagesLighting and Acoustical Treatment and Design: A Case Study of Robert B. Estralla, Sr. Memorial Stadium, Rosaleselizabeth agustinNo ratings yet

- Answer Key To Practice Test in Weed ScienceDocument4 pagesAnswer Key To Practice Test in Weed ScienceRAFTITTI IncNo ratings yet

- Laboratory Worksheet 12 Heart Structure and FunctionDocument4 pagesLaboratory Worksheet 12 Heart Structure and FunctionAndrea SaldivarNo ratings yet

- Imh Asi Mat Id 053 SanitarywareDocument87 pagesImh Asi Mat Id 053 SanitarywareBaha ShehadehNo ratings yet

- Financial Markets Instructional GuideDocument62 pagesFinancial Markets Instructional GuideSky LawrenceNo ratings yet

- THE ROLE OF DIGITAL TECHNOLOGIES COPING WITH THE NEW NORMAL EDUCATION. (Research)Document45 pagesTHE ROLE OF DIGITAL TECHNOLOGIES COPING WITH THE NEW NORMAL EDUCATION. (Research)richmonde kenzo cruzNo ratings yet

- BOTAONE Long Exam 4 PDFDocument19 pagesBOTAONE Long Exam 4 PDFKimNo ratings yet

- Exam Program Apr 2023 (Civil Engg)Document4 pagesExam Program Apr 2023 (Civil Engg)Aika MontecilloNo ratings yet

- The Differences of The Legislation in The 1950 S and of The CurrentDocument5 pagesThe Differences of The Legislation in The 1950 S and of The CurrentMikaela Francesca EchaluceNo ratings yet

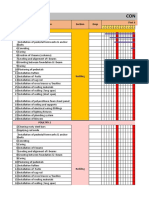

- Schedule of 2poultries Building in PangasinanDocument9 pagesSchedule of 2poultries Building in PangasinanJhunie FlorestaNo ratings yet

- Principles of Crop ScienceDocument4 pagesPrinciples of Crop ScienceAngeline Esteban De GuzmanNo ratings yet

- Tax Digest 10-27-22Document23 pagesTax Digest 10-27-22angelicaNo ratings yet

- Compound AdjectivesDocument7 pagesCompound AdjectivesCELIA IBÁÑEZ ALCOLEANo ratings yet

- Engineering Economics Chapter 5Document15 pagesEngineering Economics Chapter 5ali mahmoudNo ratings yet

- Annamalai University: Directorate of Distance EducationDocument148 pagesAnnamalai University: Directorate of Distance EducationMALU_BOBBYNo ratings yet

- Chapter 6 AnnuityDocument35 pagesChapter 6 AnnuityfatinNo ratings yet

- Week 7 Lesson 5 Role of Managers, Curators, Buyers, Collectors, Art Dealers in The CommunityDocument24 pagesWeek 7 Lesson 5 Role of Managers, Curators, Buyers, Collectors, Art Dealers in The CommunityErnest Real ReaNo ratings yet

- HeadWaters Resort and CasinoDocument34 pagesHeadWaters Resort and CasinoWTKR News 3No ratings yet

- MODULE 4 PPT GE 11 FacilitationDocument31 pagesMODULE 4 PPT GE 11 FacilitationMiaNo ratings yet

- Christian Concept of ManDocument17 pagesChristian Concept of ManMark Angelo EspirituNo ratings yet

- Financial Markets and InstitutionsDocument29 pagesFinancial Markets and InstitutionsAdriana Del rosarioNo ratings yet

- Fish 6 Physiology of Aquatic Organisms: Module ForDocument23 pagesFish 6 Physiology of Aquatic Organisms: Module ForLeah Jane Arandia100% (1)

- Pow Const of Drainage Canal - StationDocument16 pagesPow Const of Drainage Canal - StationDA 3No ratings yet

- CSC Rule On TardinessDocument6 pagesCSC Rule On TardinessMarc QuiaNo ratings yet

- INFO 4504 Technopreneurship: Jamaludin IbrahimDocument40 pagesINFO 4504 Technopreneurship: Jamaludin IbrahimAbdullahAli50% (2)

- Portfolio EvaluationDocument19 pagesPortfolio EvaluationAKHIL SAVIOUR URK18COM039No ratings yet

- TanviDocument16 pagesTanviHiren Choksi100% (1)

- Economy Probability ReturnDocument9 pagesEconomy Probability ReturnMichael CavucaNo ratings yet

- Investment PortfolioDocument6 pagesInvestment PortfolioNorma BlancoNo ratings yet

- CFA Level 3 Syllabus OverviewDocument1 pageCFA Level 3 Syllabus OverviewPhi AnhNo ratings yet

- Portfolio Selection Using Sharpe, Treynor & Jensen Performance IndexDocument15 pagesPortfolio Selection Using Sharpe, Treynor & Jensen Performance Indexktkalai selviNo ratings yet

- 100971-Capital IQ Quant Research-January2011 - MinVariancePortfoliosDocument15 pages100971-Capital IQ Quant Research-January2011 - MinVariancePortfoliosAnonymous 2rtrIS90% (1)

- Portfolio Performance EvaluationDocument15 pagesPortfolio Performance EvaluationMohd NizamNo ratings yet

- Multi-Act MSSP PMSDocument39 pagesMulti-Act MSSP PMSAnkurNo ratings yet

- Certified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDocument6 pagesCertified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDivyesh ChadotraNo ratings yet

- APT - Arbitrage Pricing Theory ExplainedDocument16 pagesAPT - Arbitrage Pricing Theory Explaineda_karimNo ratings yet

- Vanguard Asset AllocationDocument19 pagesVanguard Asset AllocationVinicius QueirozNo ratings yet

- Review of LiteratureDocument7 pagesReview of LiteratureAshish KumarNo ratings yet

- Risk Factors As Building Blocks For Portfolio Diversification: The Chemistry of Asset AllocationDocument15 pagesRisk Factors As Building Blocks For Portfolio Diversification: The Chemistry of Asset AllocationCallanNo ratings yet

- Strategic Asset Allocation For Optimize Return & RiskDocument6 pagesStrategic Asset Allocation For Optimize Return & RiskInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 1 What Is Portfolio Performance EvaluationDocument17 pages1 What Is Portfolio Performance EvaluationDarshan GadaNo ratings yet

- CAIA Level II Essay Questions Asset Allocation OptimizationDocument31 pagesCAIA Level II Essay Questions Asset Allocation Optimizationmirela2g100% (2)

- Research Paper - Risk & Return On PortfolioDocument4 pagesResearch Paper - Risk & Return On PortfolioVijayBhasker VeluryNo ratings yet

- Expert Systems With Applications: S.R. Nanda, B. Mahanty, M.K. TiwariDocument3 pagesExpert Systems With Applications: S.R. Nanda, B. Mahanty, M.K. TiwariSoumya DasNo ratings yet

- GIC Report 2015Document66 pagesGIC Report 2015sdgaNo ratings yet

- Course Outline MGMT 3050 - Investment AnalysisDocument5 pagesCourse Outline MGMT 3050 - Investment Analysisda.arts.ttNo ratings yet

- Filetype PDF Portfolio Selection Journal of Finance 7 MarchDocument2 pagesFiletype PDF Portfolio Selection Journal of Finance 7 MarchAshleyNo ratings yet

- Fixed Income Portfolio Benchmarks 2012 01Document10 pagesFixed Income Portfolio Benchmarks 2012 01Grimoire HeartsNo ratings yet

- Linear Programming ApplicationsDocument12 pagesLinear Programming ApplicationsManoranjan DashNo ratings yet

- Investment Analysis and Portfolio Management Chapter 7Document15 pagesInvestment Analysis and Portfolio Management Chapter 7Oumer Shaffi100% (1)

- Chua Kritzman and Page - The Myth of Diversification PDFDocument0 pagesChua Kritzman and Page - The Myth of Diversification PDFDavid CliffordNo ratings yet

- Chap 6Document52 pagesChap 6Danial HemaniNo ratings yet

- Consumer Behavior Syllabus For MBA 3 Sem 2016 Scheme - VTU 16MBAMM301 SyllabusDocument8 pagesConsumer Behavior Syllabus For MBA 3 Sem 2016 Scheme - VTU 16MBAMM301 SyllabusGirishNo ratings yet

- R29 Active Equity Investing Portfolio ConstructionDocument56 pagesR29 Active Equity Investing Portfolio ConstructionRayBrianCasazolaNo ratings yet

- Chris OpuchDocument40 pagesChris Opuchmale jeffNo ratings yet

- A Project Report On Portfolio ManagementDocument30 pagesA Project Report On Portfolio ManagementmonasreeNo ratings yet