Professional Documents

Culture Documents

Format Deferred Tax

Format Deferred Tax

Uploaded by

SARASVATHYDEVI SUBRAMANIAM0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document discusses the calculation of deferred tax liabilities for depreciation using a 4-step process. Step 1 calculates temporary differences between the carrying amount and tax base. Step 2 determines the deferred tax liability by multiplying temporary differences by the tax rate. Step 3 accounts for movements in the deferred tax liability balance. Step 4 calculates the total tax charge by combining the current tax charge and any increase or decrease to the deferred tax liability.

Original Description:

DEFERRED TAX

Original Title

FORMAT DEFERRED TAX

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the calculation of deferred tax liabilities for depreciation using a 4-step process. Step 1 calculates temporary differences between the carrying amount and tax base. Step 2 determines the deferred tax liability by multiplying temporary differences by the tax rate. Step 3 accounts for movements in the deferred tax liability balance. Step 4 calculates the total tax charge by combining the current tax charge and any increase or decrease to the deferred tax liability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesFormat Deferred Tax

Format Deferred Tax

Uploaded by

SARASVATHYDEVI SUBRAMANIAMThis document discusses the calculation of deferred tax liabilities for depreciation using a 4-step process. Step 1 calculates temporary differences between the carrying amount and tax base. Step 2 determines the deferred tax liability by multiplying temporary differences by the tax rate. Step 3 accounts for movements in the deferred tax liability balance. Step 4 calculates the total tax charge by combining the current tax charge and any increase or decrease to the deferred tax liability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

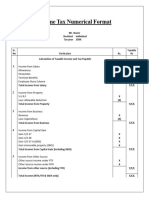

CHAPTER : DEFERRED TAX

SCENARIO 1 = DEPRECIATION

STEP 1 : CALCULATING THE TEMPORARY DIFFERENCES

At the end of Year 1: £

Carry Amount (Cost - Depreciation) XXXX

Tax Base (Cost - (Cost X TB %)) XXXX

Temporary differences XXXX

***TAX BASE ON REDUCING BALANCE

YEAR 1 = (COST - (COST X TB% )) = TAX BASE

YEAR 2 = (Y1 TB - (TB X TB% )) = TAX BASE

STEP 2 : CALCULATE DTL

DTL = TEMPORARY DIFFERENCES X TAX RATE%

STEP 3 : ACCOUNT FOR THE MOVEMENT ON DTL

DTL B/F XXXX

REQUIRED DTL AT THE YEAR END XXXX

NEED TO INCREASE / DECREASE DTL BY XXXX

DTL INCREASE DTL DECREASE

DT P & L DT DTL

XXX XXX

CR DTL XXX CR P & L XXX

STEP 4 : CALCULATE TOTAL TAX CHARGE

CURRENT TAX CHARGE XXXX

(-)/(+) DECREASE / INCREASE DTL XXXX

TOTAL TAX CHARGE XXXX

You might also like

- Format Sopl and SofpDocument3 pagesFormat Sopl and SofpMuhammad Faaiz IzzeawanNo ratings yet

- Chapter 8 Application The Costs of TaxationDocument35 pagesChapter 8 Application The Costs of Taxationsơn trần100% (1)

- WellSharp Formula MetricDocument5 pagesWellSharp Formula Metrictanolucascribd0% (1)

- Pas 12: Income Taxes Accounting Income Taxable IncomeDocument5 pagesPas 12: Income Taxes Accounting Income Taxable IncomeEmma Mariz GarciaNo ratings yet

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (2)

- 6 Externalities Price Quantity Regulation3Document29 pages6 Externalities Price Quantity Regulation3Arlene DaroNo ratings yet

- UntitledDocument3 pagesUntitledSARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Deferred Tax - Class Activity 1Document2 pagesDeferred Tax - Class Activity 1SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxKakay EspirituNo ratings yet

- Tax3702 Exam Quick NotesDocument8 pagesTax3702 Exam Quick NotesnhlakaniphoNo ratings yet

- 5 PigovianTax2Document38 pages5 PigovianTax2api-3709940No ratings yet

- Tax Rev Worksheet Tuesday 2020 2021Document9 pagesTax Rev Worksheet Tuesday 2020 2021Wayne Nathaneal E. ParulanNo ratings yet

- 5QQMN937 - Week 8Document25 pages5QQMN937 - Week 8example3335273No ratings yet

- Trade Policies: Tariffs and Quotas Classification of PoliciesDocument10 pagesTrade Policies: Tariffs and Quotas Classification of Policiesspavankumar141No ratings yet

- Contract Costing 07Document16 pagesContract Costing 07Kamal BhanushaliNo ratings yet

- Soe With Sterilized Intervention HandoutDocument29 pagesSoe With Sterilized Intervention HandoutDavid Carlo -sadameNo ratings yet

- Summary Sheet NumericalDocument2 pagesSummary Sheet NumericalSamina HyderNo ratings yet

- Proforma of Vertical IncomeDocument2 pagesProforma of Vertical IncomeBheemeswar ReddyNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- Accounting For Income TaxDocument1 pageAccounting For Income Taxgummydummy5678No ratings yet

- MFRS 112 DtadtlDocument19 pagesMFRS 112 DtadtlAlisa FarhaNo ratings yet

- Tax Fa2Document2 pagesTax Fa2chilevan1992No ratings yet

- RV Public Finance V18-19Rettevejledning OrdinærDocument13 pagesRV Public Finance V18-19Rettevejledning OrdinærTemu AmalayNo ratings yet

- Chapter 2 JOCDocument2 pagesChapter 2 JOCAnis AshsiffaNo ratings yet

- Notes For Econ202A: Consumption: Pierre-Olivier Gourinchas UC BerkeleyDocument52 pagesNotes For Econ202A: Consumption: Pierre-Olivier Gourinchas UC BerkeleyJaydeep MukherjeeNo ratings yet

- Measures TAX AggressivenessDocument9 pagesMeasures TAX AggressivenessAnonymous KJBbPI0xeNo ratings yet

- Pert 3 (Laporan Keuangan 2)Document7 pagesPert 3 (Laporan Keuangan 2)Yani SupriyaniNo ratings yet

- Investment Decisions NotesDocument2 pagesInvestment Decisions NotesSaumya AllapartiNo ratings yet

- Additional NoteDocument6 pagesAdditional NoteLJ BNo ratings yet

- Formats of Income Statement, Balance Sheet & Cash Flow StatementDocument3 pagesFormats of Income Statement, Balance Sheet & Cash Flow StatementAli RazaNo ratings yet

- Working Capital Management Formula SheetDocument2 pagesWorking Capital Management Formula SheetAnonymous SJ4xSoIvbNo ratings yet

- Final Exam Answer TemplateDocument4 pagesFinal Exam Answer Templatebrip selNo ratings yet

- Lecture Four 2024Document9 pagesLecture Four 2024Khulekani SbonokuhleNo ratings yet

- TAX SMOOTHING - TESTS ON INDONESIAN DATA - LibreDocument11 pagesTAX SMOOTHING - TESTS ON INDONESIAN DATA - Libremichael.fozouniNo ratings yet

- Tax Credits - TY 2022 (Taweez)Document3 pagesTax Credits - TY 2022 (Taweez)Taaha JanNo ratings yet

- TaxitionDocument43 pagesTaxitionZakirullah ZakiNo ratings yet

- MFRS 112Document26 pagesMFRS 112Arjun Don67% (6)

- FFS Working NotesDocument3 pagesFFS Working NotesVignesh NarayananNo ratings yet

- Vĩ MôDocument13 pagesVĩ Môbonglinh2830No ratings yet

- Isc Econ BudgetDocument5 pagesIsc Econ BudgetanuhyaextraNo ratings yet

- 02.9.2021 - Application of Integration in Economics and Business 20.3.2021Document8 pages02.9.2021 - Application of Integration in Economics and Business 20.3.20212K19/EN/055 SHIVAM MISHRANo ratings yet

- Advanced Macroeconomics Part 2 Problem Set 2Document1 pageAdvanced Macroeconomics Part 2 Problem Set 2christina0107No ratings yet

- FORMAT OF THE TRADING Account With The AdjustmentsDocument2 pagesFORMAT OF THE TRADING Account With The AdjustmentsTajay Kadeem ThomasNo ratings yet

- Some Macro FormulasDocument2 pagesSome Macro FormulasDoan PhamNo ratings yet

- Basic Income StatementsDocument2 pagesBasic Income StatementsTanjim BhuiyanNo ratings yet

- 2022 Macro and Global Formulae 1Document2 pages2022 Macro and Global Formulae 1Sandeep SudhakarNo ratings yet

- Accounting For DepreciationDocument5 pagesAccounting For DepreciationRithvik SangilirajNo ratings yet

- Market Models PDFDocument14 pagesMarket Models PDF0612001No ratings yet

- Homework 1 Master FES-10Document2 pagesHomework 1 Master FES-10xbdrsk6fbgNo ratings yet

- Audit of PPE - SlidesDocument16 pagesAudit of PPE - SlidesJoshua LisingNo ratings yet

- Income TaxesDocument6 pagesIncome TaxesKezNo ratings yet

- Cash Flow Statement: 1 Cash Flows From Operating ActivitiesDocument5 pagesCash Flow Statement: 1 Cash Flows From Operating ActivitiesPRABAL BHATNo ratings yet

- Depreciation MethodsDocument13 pagesDepreciation MethodsOl Qab KeNo ratings yet

- INVOICE FOR SERVICES Orig.Document8 pagesINVOICE FOR SERVICES Orig.micffj12No ratings yet

- Incomplete Record 2019Document3 pagesIncomplete Record 2019Parvatee Ramessur100% (1)

- AMA1 Lecture1Document39 pagesAMA1 Lecture1D. KNo ratings yet

- Notes On Intertemporal Trade in Goods and Money: Journal of Applied Economics, Vol. I, No. 1 (Nov. 1998), 165-177Document13 pagesNotes On Intertemporal Trade in Goods and Money: Journal of Applied Economics, Vol. I, No. 1 (Nov. 1998), 165-177juancahermida3056No ratings yet

- Transfer Taxes (Estate and Donor'S Taxation) Estate Tax ModelDocument4 pagesTransfer Taxes (Estate and Donor'S Taxation) Estate Tax ModelJohn Karlo CamineroNo ratings yet

- Lecture 25 Working SheetDocument5 pagesLecture 25 Working Sheetsobian356No ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Chapter 4Document13 pagesChapter 4SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Set 1Document2 pagesSet 1SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Chapter 5Document19 pagesChapter 5SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Chapter 3Document19 pagesChapter 3SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- A) Deferred TaxDocument2 pagesA) Deferred TaxSARASVATHYDEVI SUBRAMANIAMNo ratings yet

- IAS 12 Income TaxesDocument2 pagesIAS 12 Income TaxesSARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Set 2Document12 pagesSet 2SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- IAS 12 TaxesDocument16 pagesIAS 12 TaxesSARASVATHYDEVI SUBRAMANIAMNo ratings yet

- DEFERRED TAX - TUTORIAL - Part 2Document5 pagesDEFERRED TAX - TUTORIAL - Part 2SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- DEFERRED TAX - TUTORIAL SOLUTION - Part 2Document4 pagesDEFERRED TAX - TUTORIAL SOLUTION - Part 2SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Deffered Tax Part 2Document16 pagesDeffered Tax Part 2SARASVATHYDEVI SUBRAMANIAMNo ratings yet