Professional Documents

Culture Documents

1.17 Ac15 Sample Size Table

Uploaded by

Parbati AcharyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.17 Ac15 Sample Size Table

Uploaded by

Parbati AcharyaCopyright:

Available Formats

Appendix 1.

17

Ac15/1

Prepared by: Date:

Client:

Reviewed by: Date:

Period:

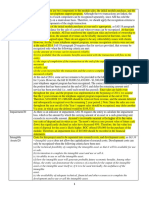

AUDIT APPROACH AND SAMPLE SIZE CALCULATION

To complete the table below enter the risk level as per Ac10 and the materiality level as documented at Ac13. Where a different risk level is relevant for different assertions the table can be expanded as indicated on the lefthand margin.

The audit approach should be selected by entering 'Y' or 'N' as appropriate. Where sampling is not required under the approach selected the remainder of the row will be greyed out.

Where substantive testing is to be undertaken document whether this will be supported by controls testing or supportive analytical procedures. For each area, enter the population and any large or key items on the appropriate

supporting schedule. The residual sample size will then be automatically calculated by dividing the residual population (after large and key items) by materiality and multiplying this by the risk factor which is determined by the audit

approach as documented on the reference table below.

Where transaction testing is to be undertaken select the approximate number of transactions from the drop down. This together with the risk level entered will calculate the appropriate sample size, again based on the information on the

reference table below.

A B C

General Substantive Transaction

Audit approach (Y/N)

Audit Assertion (1) Value of

(Expand if different risks Tests of Supportive Risk population after No of material / Approximate Transaction

apply to different Risk per control # analytical factor (as large and key Residual key items to be number of sample size

Audit Area assertions) Ac10 I P % S T (2) @ procedures # below) items Section Ref sample size tested transactions from table B

High

Intangible Assets All High N N N Y 1.3 3,304,565,580 Ac15/3 182 1

PPE All Ac15/4

Investments All Ac15/5

Inventories All Ac15/6

Trade Receivables All Ac15/7

All Other Receivables All Ac15/8

Bank and Cash All Ac15/9

Trade Payables All Ac15/10

All Other Payables All Ac15/11

Provisions All Ac15/12

Low

Revenue All Ac15/13

Costs All Ac15/14

Payroll All Ac15/15

Materiality 22,803,716

Audit - Apr '18 App. 1.17 / 1 of 15 04/18

Appendix 1.17

Ac15/2

(1) Risk must be assessed for each area at assertion level. If for an area, all assertions have the same risk use the "all" line. However, if there are different levels of risks then the various assertion rows should be

expanded in each area as relevant. At the testing stage the key assertions are occurrence, completeness, accuracy, cut off and classification for transactions and existence, rights and obligations, completeness, valuation

and allocation and disclosure for balances.

(2) If testing controls then the operating effectiveness of the non critical controls must be tested at least every three years to ensure that they are effective, all critical controls should still be tested annually. Walkthrough

tests should be carried out every year to ensure that controls have not changed.

(3) It will usually only be appropriate to test controls where they are expected to be effective therefore a low risk sample size should be used.

Reference Table Balance Sheet Profit or Loss

Audit Approach Risk Level Risk Level

A B C H M L Population H M L

Approach Control AR Risk Factor Size Risk Factor

I,P,% N/A N/A N/A N/A N/A N/A N/A N/A

S** No No 2.5 1.8 1.2 1.2 0.9 0.6

S** Yes No 1.3 0.9 0.6 0.4 0.3 0.2

S** No Yes 1.7 1.2 0.8 0.8 0.6 0.4

S** Yes Yes 0.9 0.6 0.4 0.4 0.3 0.2

Method of obtaining audit evidence Sample Sizes**

T/C N/A N/A N/A N/A N/A > 401 60+ 40 25

T/C N/A N/A N/A N/A N/A 226-400 48+ 32 20

T/C N/A N/A N/A N/A N/A 101-225 36+ 24 15

T/C N/A N/A N/A N/A N/A 26-100 24+ 16 10

T/C N/A N/A N/A N/A N/A 1-25 12+ 8 5

Key

I Less than performance materiality

P Proof in total (extensive analytical procedures)

% 100% testing

S Substantive sampling

T Transaction testing

# If a yes is recorded in either column B or C then suitable testing must be undertaken and the validity of this response must be reviewed at the end of the

fieldwork and it must be cross referenced to supporting working papers

@ It is only possible to record a yes in this column if controls have been tested, and they are effective. If the controls are ineffective, a no must be

recorded in this column. This column may be completed with a yes at the planning stage if it is intended to test controls.

C Tests of control

** When performing substantive procedures, the number of items selected from the residual population (after testing all "large" / "key" items) may be

capped at the levels noted for transaction / control testing.

Audit - Apr '18 App. 1.17 / 2 of 15 04/18

Appendix 1.17

Ac15/3

Intangible Non-Current Assets and Goodwill

CU

Value Per Financial Statements 3,648,594,580

Less Large Items (to include all items greater than performance materiality)

Name Balance

344,029,000

Less Key Items

Description Reason Balance

Total Large and Key Items 344,029,000

Population after Large and Key Items 3,304,565,580

Audit - Apr '18 App. 1.17 / 3 of 15 04/18

Appendix 1.17

Ac15/4

Property, Plant and Equipment (Including Investment Properties)

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 4 of 15 04/18

Appendix 1.17

Ac15/5

Investments (Excluding Investment Properties)

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 5 of 15 04/18

Appendix 1.17

Ac15/6

Inventories

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 6 of 15 04/18

Appendix 1.17

Ac15/7

Trade Receivables

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 7 of 15 04/18

Appendix 1.17

Ac15/8

Other Receivables

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 8 of 15 04/18

Appendix 1.17

Ac15/9

Bank and Cash

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 9 of 15 04/18

Appendix 1.17

Ac15/10

Trade Payables

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 10 of 15 04/18

Appendix 1.17

Ac15/11

Other Payables

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 11 of 15 04/18

Appendix 1.17

Ac15/12

Provisions

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 12 of 15 04/18

Appendix 1.17

Ac15/13

Revenue

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 13 of 15 04/18

Appendix 1.17

Ac15/14

Costs

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 14 of 15 04/18

Appendix 1.17

Ac15/15

Payroll

CU

Value Per Financial Statements

Less Large Items (to include all items greater than performance materiality)

Name Balance

Less Key Items

Description Reason Balance

Total Large and Key Items

Population after Large and Key Items

Audit - Apr '18 App. 1.17 / 15 of 15 04/18

You might also like

- Risk Assessment of Conduit Pipe InstallationDocument17 pagesRisk Assessment of Conduit Pipe InstallationJayson Escamillan75% (4)

- 4 2 Risk Register PDFDocument2 pages4 2 Risk Register PDFcontrax8No ratings yet

- 2.2 Project Management Capstone-RACI - Create A RAMDocument1 page2.2 Project Management Capstone-RACI - Create A RAMKimNo ratings yet

- Auditing Theory - Overview of The Audit Process With AnswersDocument44 pagesAuditing Theory - Overview of The Audit Process With AnswersShielle Azon90% (30)

- APQP Review File - Production Suppliers RecomendacionesDocument12 pagesAPQP Review File - Production Suppliers RecomendacionesBenygg GlezNo ratings yet

- Risk Assessment of Scaffolding Works - Rev. 1Document20 pagesRisk Assessment of Scaffolding Works - Rev. 1Jayson Escamillan67% (3)

- Risk Assessment of Manual Excavation and TrenchingDocument14 pagesRisk Assessment of Manual Excavation and TrenchingJayson Escamillan100% (1)

- NO. Inspection/Test Item Action by Remarks Reference Document (S) Acceptance Criteria Method of InspectionDocument123 pagesNO. Inspection/Test Item Action by Remarks Reference Document (S) Acceptance Criteria Method of InspectionYoseph Maulana0% (1)

- QAF12 Process Audit Rev 09Document4 pagesQAF12 Process Audit Rev 09ukavathekarNo ratings yet

- Ehs - Hazard Identification and Risk Assessment (Hira) : SL.N oDocument5 pagesEhs - Hazard Identification and Risk Assessment (Hira) : SL.N oNarayanasami KannanNo ratings yet

- Progress Report - FormatDocument15 pagesProgress Report - Formatbolsamir75% (4)

- Psa 320Document18 pagesPsa 320Joanna CaballeroNo ratings yet

- ACCA - Advanced Audit and Assurance (AAA) - Course Exam 2 Answers - 2019Document18 pagesACCA - Advanced Audit and Assurance (AAA) - Course Exam 2 Answers - 2019Ruddhi JainNo ratings yet

- Itp 116Document4 pagesItp 116muralidmurthyNo ratings yet

- At MCQ Salogsacol Auditing Theory Multiple ChoiceDocument32 pagesAt MCQ Salogsacol Auditing Theory Multiple Choicealmira garciaNo ratings yet

- 9686-6150-ITP-000-0006 - A1 ITP For Piping Fabrication and ErectionDocument23 pages9686-6150-ITP-000-0006 - A1 ITP For Piping Fabrication and Erectionvenkatesh100% (1)

- Chapter 17 Basic Audit Sampling ConceptsDocument32 pagesChapter 17 Basic Audit Sampling ConceptsClar Aaron Bautista100% (1)

- The Reality of MaterialityDocument41 pagesThe Reality of MaterialityComunicarSe-ArchivoNo ratings yet

- Cpa A1.2 - Audit Practice & Assurance Services - Study ManualDocument236 pagesCpa A1.2 - Audit Practice & Assurance Services - Study ManualJoan Marie AgnesNo ratings yet

- Bernard Madoff Ponzi SchemeDocument10 pagesBernard Madoff Ponzi Schemecoleen paraynoNo ratings yet

- 2.6.3.1 Water - Cooled.chiller - Construction.checklistDocument4 pages2.6.3.1 Water - Cooled.chiller - Construction.checklistdana setiawanNo ratings yet

- INTERNSHIP UNDER CA Final ReportDocument62 pagesINTERNSHIP UNDER CA Final ReportChahatNo ratings yet

- Risk Assessment For BorescopeDocument14 pagesRisk Assessment For BorescopeJayson Escamillan100% (1)

- 1.17 Ac15 Sample Size Table - 7540-05Document15 pages1.17 Ac15 Sample Size Table - 7540-05Huon HirikaNo ratings yet

- Schedule 1 BOQ Civil TC04 R05 25 04 17Document13 pagesSchedule 1 BOQ Civil TC04 R05 25 04 17azad khalil tofeq soseNo ratings yet

- Master Activity Plan For Battery Retainer: Z BracketDocument1 pageMaster Activity Plan For Battery Retainer: Z BracketUsman FarooqNo ratings yet

- Solutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210Document13 pagesSolutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210JudithGarciabzom100% (51)

- Testing and Commissioning of Chilled Water Balancing: Inspection Test Plan (ITP)Document3 pagesTesting and Commissioning of Chilled Water Balancing: Inspection Test Plan (ITP)Samboy DionisioNo ratings yet

- BA0150036 - Rishi EswarDocument81 pagesBA0150036 - Rishi EswarNimalanNo ratings yet

- LSC-HSP Par Form SDD2017 7.10.17Document1 pageLSC-HSP Par Form SDD2017 7.10.17Sai KumarNo ratings yet

- Hanson Dell - 1390 - ScannedDocument6 pagesHanson Dell - 1390 - ScannedZach EdwardsNo ratings yet

- Theilen Jerry - 1294 - ScannedDocument3 pagesTheilen Jerry - 1294 - ScannedZach EdwardsNo ratings yet

- 2002-10-19 DR2 Summary AmendedDocument2 pages2002-10-19 DR2 Summary AmendedZach EdwardsNo ratings yet

- Check-In PartiesDocument1 pageCheck-In PartiessbiliristhodNo ratings yet

- Routine Penalties Due For Late Filed Reports Range From $20 To $800Document10 pagesRoutine Penalties Due For Late Filed Reports Range From $20 To $800Zach EdwardsNo ratings yet

- 2.APQP Timing Plan - R01Document11 pages2.APQP Timing Plan - R01Chethan Nagaraju KumbarNo ratings yet

- 1187 - StandardDocument1 page1187 - StandardKYROLOS ZARZORNo ratings yet

- Disclosure Summary Page I) Support Sfsl9Gy - (Rszi., Dr-2Document6 pagesDisclosure Summary Page I) Support Sfsl9Gy - (Rszi., Dr-2Zach EdwardsNo ratings yet

- 1016-Itp 103Document3 pages1016-Itp 103yasser elhousseiniNo ratings yet

- Objective:: (1) Keating Manufacturing Inc. Fixed Assets Movement Analysis As of December 31, 2015Document18 pagesObjective:: (1) Keating Manufacturing Inc. Fixed Assets Movement Analysis As of December 31, 2015Maria Fatima AlambraNo ratings yet

- JAN 2 8 2002 Disclosure Summary Pag DR-2 J) R,: See Instructions On Back and Complete The Following SentenceDocument16 pagesJAN 2 8 2002 Disclosure Summary Pag DR-2 J) R,: See Instructions On Back and Complete The Following SentenceZach EdwardsNo ratings yet

- Top View 1:5 A - A: 1 No Angle Required As Drawn Marked 3Document1 pageTop View 1:5 A - A: 1 No Angle Required As Drawn Marked 3KYROLOS ZARZORNo ratings yet

- Disclosure Summary Page ®R-2: Routine Penalties Due For Late Filed Reports Range From $20 To $800Document3 pagesDisclosure Summary Page ®R-2: Routine Penalties Due For Late Filed Reports Range From $20 To $800Zach EdwardsNo ratings yet

- CMH-17 Priorities and Topics For Chapter 12 Rev. H (NSE)Document19 pagesCMH-17 Priorities and Topics For Chapter 12 Rev. H (NSE)Lukas GneistNo ratings yet

- Osterhaus Bob - 979 - ScannedDocument3 pagesOsterhaus Bob - 979 - ScannedZach EdwardsNo ratings yet

- CASH FLOW ANALYSIS: PROFIT PLAN / CASH BUDGET FOR - Projections For The Fiscal YearDocument1 pageCASH FLOW ANALYSIS: PROFIT PLAN / CASH BUDGET FOR - Projections For The Fiscal YearArlisa FitriaNo ratings yet

- Submittal ScheduleDocument2 pagesSubmittal SchedulenadeeshaofficialNo ratings yet

- Starter Relay CircuitDocument5 pagesStarter Relay CircuitDaniel Mamani ParedezNo ratings yet

- For Instructions, See Back of Form: Important: Type You T 2 Pac (3 4 5 PA Cis 7 8) Support FDocument7 pagesFor Instructions, See Back of Form: Important: Type You T 2 Pac (3 4 5 PA Cis 7 8) Support FZach EdwardsNo ratings yet

- Powell Linda - 1348 - ScannedDocument4 pagesPowell Linda - 1348 - ScannedZach EdwardsNo ratings yet

- Financial Statement Analysis: True/FalseDocument2 pagesFinancial Statement Analysis: True/FalseChloe Gabriel Evangeline ChaseNo ratings yet

- Bukta Polly - 975 - ScannedDocument9 pagesBukta Polly - 975 - ScannedZach EdwardsNo ratings yet

- Common SIP Form MAHINDRADocument2 pagesCommon SIP Form MAHINDRAsathisha123No ratings yet

- ATR 72-212A 01 of 2016Document1 pageATR 72-212A 01 of 2016SatishReddyNo ratings yet

- Disclosure Summary Page DR-2Document9 pagesDisclosure Summary Page DR-2Zach EdwardsNo ratings yet

- R T C 5 2 10 M 0 L 0 L #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/aDocument8 pagesR T C 5 2 10 M 0 L 0 L #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/a #N/asheela bethapudiNo ratings yet

- Tyrrell Phil - 133 - ScannedDocument3 pagesTyrrell Phil - 133 - ScannedZach EdwardsNo ratings yet

- Vicki Diju/1, JD 4 Y Supc) 2'jisop-0 (: Disclosure Summary Page DR-2 IDocument5 pagesVicki Diju/1, JD 4 Y Supc) 2'jisop-0 (: Disclosure Summary Page DR-2 IZach EdwardsNo ratings yet

- Kettering Steve - 699 - ScannedDocument5 pagesKettering Steve - 699 - ScannedZach EdwardsNo ratings yet

- HSE-CR Risk Assessment For Bhit Black Top Road From CP5 To D9 Repair WorksDocument15 pagesHSE-CR Risk Assessment For Bhit Black Top Road From CP5 To D9 Repair WorksMirNo ratings yet

- 9 Diferencia Entre Diagrama A Colores y OEMDocument20 pages9 Diferencia Entre Diagrama A Colores y OEMJuan Pablo LoayzaNo ratings yet

- Appendix 13 3 PFEMA and DFEMADocument5 pagesAppendix 13 3 PFEMA and DFEMADearRed FrankNo ratings yet

- Cargo Operations - ContainerDocument15 pagesCargo Operations - ContainerleNo ratings yet

- Plasier Lee - 340 - ScannedDocument1 pagePlasier Lee - 340 - ScannedZach EdwardsNo ratings yet

- Risk AssesmentDocument1 pageRisk Assesmentshipdesigner088No ratings yet

- A2.20 Economics of Transformer Management 93ID55VER20 PDFDocument47 pagesA2.20 Economics of Transformer Management 93ID55VER20 PDFAbhishek KumarNo ratings yet

- Contract Plan Kriel U2 OrganogramDocument1 pageContract Plan Kriel U2 OrganogramPieter BezuidenhoutNo ratings yet

- 250 and 540Document10 pages250 and 540Parbati AcharyaNo ratings yet

- Audit Evidence SequenceDocument32 pagesAudit Evidence SequenceParbati AcharyaNo ratings yet

- Front Paper DeterminamtsDocument2 pagesFront Paper DeterminamtsParbati AcharyaNo ratings yet

- A Study On Equity Analysis of Nabil Bank Limited: A Project Work Report ProposalDocument24 pagesA Study On Equity Analysis of Nabil Bank Limited: A Project Work Report ProposalParbati AcharyaNo ratings yet

- Goodman Group AAAR1Document2 pagesGoodman Group AAAR1FarNo ratings yet

- CH05Document30 pagesCH05FachrurroziNo ratings yet

- General Principles of Audit NOTESDocument65 pagesGeneral Principles of Audit NOTESHanna Sobreviñas AmanteNo ratings yet

- Philippine Standard On Auditing 402 (Revised and Redrafted) Audit Considerations Relating To An Entity Using A Service OrganizationDocument23 pagesPhilippine Standard On Auditing 402 (Revised and Redrafted) Audit Considerations Relating To An Entity Using A Service OrganizationRaiel B. Buenviaje RNNo ratings yet

- Annual Report 2019Document416 pagesAnnual Report 2019Saima Binte IkramNo ratings yet

- Calculate Materiality: Assignment 2Document3 pagesCalculate Materiality: Assignment 2ge baijingNo ratings yet

- 05 - Planning - ROMM, Materiality Part 2 of 2Document14 pages05 - Planning - ROMM, Materiality Part 2 of 2nontheNo ratings yet

- Audit Tutorial 6Document7 pagesAudit Tutorial 6Chong Soon KaiNo ratings yet

- Audit 411 Rev4Document18 pagesAudit 411 Rev4MimiNo ratings yet

- Cfap 6 Code of Ethics Updated 2024Document66 pagesCfap 6 Code of Ethics Updated 2024mnouman0309No ratings yet

- Chapter 8 AuditDocument22 pagesChapter 8 AuditMisshtaCNo ratings yet

- Issai: Performance Audit StandardDocument33 pagesIssai: Performance Audit StandardJoko PurwantoronnNo ratings yet

- chapter 08 Trần thị mỹ dungDocument21 pageschapter 08 Trần thị mỹ dungBii HeeNo ratings yet

- Atomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response CompositeDocument16 pagesAtomic Excellence Case - Marking Key - With Examples of Exhibits and Student Response Compositedmcook3No ratings yet

- IFRS Practice Statement 2Document44 pagesIFRS Practice Statement 2JPNo ratings yet

- FAM MCQs Solved (Adnan UA)Document15 pagesFAM MCQs Solved (Adnan UA)arsalanssgNo ratings yet

- EW Ch3 Materiality GuidelinesDocument2 pagesEW Ch3 Materiality GuidelinesaizureenNo ratings yet

- 5TH ActivityDocument15 pages5TH ActivityMelanie SamsonaNo ratings yet

- Auditing 1chapter 1213Document48 pagesAuditing 1chapter 1213Nathalie GetinoNo ratings yet

- Global Audit SyllabusDocument30 pagesGlobal Audit SyllabusSehra GULNo ratings yet

- Booklet Int. To AccountingDocument51 pagesBooklet Int. To Accountingsamuel debebeNo ratings yet