Professional Documents

Culture Documents

May 2023 CV - Philip Green

Uploaded by

Philip GreenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 2023 CV - Philip Green

Uploaded by

Philip GreenCopyright:

Available Formats

Philip Green Chicago, IL | (312) 731-0965 | Email: derivativestradingdesk@gmail.

com |

LinkedIn: https://www.linkedin.com/in/greenderivativestradingdesk/

Professional Summary

Experienced FinTech Business Analyst, Platform Delivery Lead and Senior Requirements Analyst in

Capital Markets, Investment Management, Treasury, Banking, and Hedge Funds. Successfully

implemented platform delivery rollouts for major financial institutions.

Professional Experience

Mass Mutual/Empower, Springfield, Massachusetts Project Manager/Project Lead/Senior Business

Analyst Sep 2019 – Present Implemented Calypso derivatives trading system, Charles River IMS on

Microsoft Azure, Murex, DTCC Alert, State Street Charles River, Global Trade Surveillance, and pre-trade

compliance analysis. Acadia Soft real-time SIMM initial margin manager for OTC and ETD derivatives.

Worked with ERM team on PFE calculations and risk management tools.

Northern Trust Wealth Management, Chicago Project Manager/Project Lead/Senior Business Analyst

Mar 2018 – Sep 2019

Implemented Murex, Charles River IMS, Calypso, thinkFolio, BlackRock Aladdin for currency

management and collateral optimization, private equity, foreign exchange, Multi-Assets, Active Fixed

Income, Private Credit, Corporate Actions, Mandate Funds, FX currencies AUD, USD, CDN, GBP and

Eurodollar. Trade Surveillance and UMR for OTC Swaps, derivatives.

Western Digital/SanDisk Corporation, Irvine, California Project Manager, Treasury Consultant – Finance

and Operations Technology – FIS Treasury Integrity Implementation Mar 2017 - Mar 2018 Responsible

for implementing FIS Quantum Treasury, defining legal entities, setting up banks and bank accounts,

counterparty setup, bank statements, and payment schedules for IBOR & ABOR.

Deutsche Bank, Essen, Sossenheim, Frankfurt, Germany Sr. Business Analyst/Project Manager Mar 2016

– Mar 2017 Responsible for Accounting, Colline for Collateral Management, ISDA documentation,

pledged securities, IBOR, and ABOR implementation of Charles River IMS and BlackRock Aladdin.

Daiwa Sumitomo Capital Markets, London, United Kingdom Sr. Business Analyst/Project Manager Mar

2010 – Mar 2016 Responsible for the private equity capital markets teams, Finance & Treasury

regulatory reporting, and implementing a Master Data Management system.

Fortis Bank/Fortis Investments (BNP Paribas), Brussels & Amsterdam, Netherlands Sr. Business

Analyst/Project Manager Jan 2007 – Mar 2010 Responsible for Process Re-engineering for Calypso FO

Configuration Documentation, Calypso Catalog and Products and Asset Classes, and the Calypso to NPB

and P&L Attribution.

Skills: Capital Markets, Investment Management, Treasury, Banking, Hedge Funds, FinTech, Project

Management, Business Analysis, Platform Delivery Rollouts, Calypso, Charles River IMS, Murex, DTCC

Alert, State Street Charles River, Global One, TriOptima, ThinkFolio, Fidessa, SIMM Initial Margin

Manager, BlackRock Aladdin, Colline, UMR, FIS Quantum Treasury, Collateral Management, Master Data

Management, Trade Surveillance, Risk Management Tools.

Education: Bachelor of Science in Finance, University of Illinois at Urbana-Champaign, 2007

You might also like

- Derivatives, Capital Markets, Energy, Financial Markets Consultant ResumeDocument8 pagesDerivatives, Capital Markets, Energy, Financial Markets Consultant ResumePhilip Green100% (1)

- Derivatives, Capital Markets, Energy, Financial Markets Consultant ResumeDocument8 pagesDerivatives, Capital Markets, Energy, Financial Markets Consultant ResumePhilip Green100% (1)

- Conquering the Seven Faces of Risk: Automated Momentum Strategies that Avoid Bear Markets, Empower Fearless Retirement PlanningFrom EverandConquering the Seven Faces of Risk: Automated Momentum Strategies that Avoid Bear Markets, Empower Fearless Retirement PlanningNo ratings yet

- Google - Individual Notification Letter (California) - 0Document4 pagesGoogle - Individual Notification Letter (California) - 0SoftpediaNo ratings yet

- CV Akhil PoddarDocument5 pagesCV Akhil Poddarjalaj nakraNo ratings yet

- Senior Investment Analyst or Investment Analyst or Research AnalDocument3 pagesSenior Investment Analyst or Investment Analyst or Research Analapi-78556480No ratings yet

- Mayank Aggarwal's Resume - Finance Professional Seeking New OpportunityDocument2 pagesMayank Aggarwal's Resume - Finance Professional Seeking New OpportunityMAYANK AGGARWALNo ratings yet

- Philip Green CVDocument8 pagesPhilip Green CVPhilip GreenNo ratings yet

- Zara Rodriguez Manager: Governance Risk and ComplianceDocument3 pagesZara Rodriguez Manager: Governance Risk and CompliancecharpentierNo ratings yet

- Philip Green: Project Manager and Senior Business AnalystDocument5 pagesPhilip Green: Project Manager and Senior Business AnalystPhilip GreenNo ratings yet

- Philip Green: Project Manager and Senior Business AnalystDocument5 pagesPhilip Green: Project Manager and Senior Business AnalystPhilip GreenNo ratings yet

- Senior Business Analyst Equities in NYC NY Resume Mark MelzlDocument4 pagesSenior Business Analyst Equities in NYC NY Resume Mark MelzlMarkMelzlNo ratings yet

- Project Manager - DerivativesDocument4 pagesProject Manager - DerivativesrajeevjhNo ratings yet

- Local Tax Double Taxation CaseDocument1 pageLocal Tax Double Taxation CaseEmmanuel YrreverreNo ratings yet

- Unit 4 High Rise BuildingsDocument22 pagesUnit 4 High Rise BuildingsInfanta mary100% (3)

- CV Kulbir MinhasDocument3 pagesCV Kulbir MinhasKulbir MinhasNo ratings yet

- General - Resume - 6 2020 IAM and PM Okta 2Document8 pagesGeneral - Resume - 6 2020 IAM and PM Okta 2Rohit BhasinNo ratings yet

- Calypso Business Analyst - Case Study - Fortis InvestmentsDocument3 pagesCalypso Business Analyst - Case Study - Fortis InvestmentsPhilip Green100% (1)

- Solution Overview Presentation - SAP Treasury and Risk ManagementDocument59 pagesSolution Overview Presentation - SAP Treasury and Risk ManagementAna Maria Martins Doval91% (11)

- TRM ResumeDocument8 pagesTRM ResumeJustin PageNo ratings yet

- Todd Martin BSC Math Assuris Aug 29, 2016Document4 pagesTodd Martin BSC Math Assuris Aug 29, 2016Todd MartinNo ratings yet

- Investment Portfolio Manager CQF in New York NY Resume Debra CharlesDocument2 pagesInvestment Portfolio Manager CQF in New York NY Resume Debra CharlesDebraCharlesNo ratings yet

- Resume CritiqueDocument1 pageResume CritiqueJNo ratings yet

- Rahul Rangrao Kadam: Skill Set Profile SummaryDocument2 pagesRahul Rangrao Kadam: Skill Set Profile SummaryLostNo ratings yet

- Jonathan Charles ResumeDocument1 pageJonathan Charles ResumeJonathan CharlesNo ratings yet

- SutapanSomResume Fin Market IT-1-1Document2 pagesSutapanSomResume Fin Market IT-1-1Sutapan100% (1)

- Knowledge of Accounts PayableDocument5 pagesKnowledge of Accounts PayableGirish SonawaneNo ratings yet

- Raj v. Gutta 2014Document7 pagesRaj v. Gutta 2014sundeepkumarNo ratings yet

- John Smith: Your Address City, State Zip Code Phone Number E-MailDocument1 pageJohn Smith: Your Address City, State Zip Code Phone Number E-MailpsmadhusudhanNo ratings yet

- Kahlil Marion H. Carmona: Education Ie Business School Madrid, SpainDocument4 pagesKahlil Marion H. Carmona: Education Ie Business School Madrid, SpainKahlil CarmonaNo ratings yet

- Hussnain AhmadDocument6 pagesHussnain AhmadShivani MalhotraNo ratings yet

- PerezM Resume Consultant MasterDocument6 pagesPerezM Resume Consultant MasterHARSHANo ratings yet

- Professional Profile Talent and Knowledge Set: Equity Research, Portfolio Management, and Business DevelopmentDocument3 pagesProfessional Profile Talent and Knowledge Set: Equity Research, Portfolio Management, and Business DevelopmentTHOMAS pNo ratings yet

- Barclays India 2021 - MBA GradDocument3 pagesBarclays India 2021 - MBA GradHARSH MATHURNo ratings yet

- Turki Alghamdi ResumeDocument2 pagesTurki Alghamdi Resumeturki gNo ratings yet

- David Navarro MooK CV 2017Document8 pagesDavid Navarro MooK CV 2017M MURSINo ratings yet

- Kahlil Marion H. Carmona: Education Ie Business School Madrid, SpainDocument4 pagesKahlil Marion H. Carmona: Education Ie Business School Madrid, SpainKahlil CarmonaNo ratings yet

- Mukesh Sharma_Resume V2.0-2Document5 pagesMukesh Sharma_Resume V2.0-2chandresh.vyasukNo ratings yet

- CV InglesDocument3 pagesCV InglesHernan PNo ratings yet

- Jcolladoresume - Full HistoryDocument4 pagesJcolladoresume - Full HistoryHARSHANo ratings yet

- AvantGarde Systems Solutions Nigeria LTD Company ProfileDocument18 pagesAvantGarde Systems Solutions Nigeria LTD Company ProfileGboyegaAboderinNo ratings yet

- Careers in FinanceDocument7 pagesCareers in Financeapi-528769095No ratings yet

- Job Description: Teamwork Client CentricDocument3 pagesJob Description: Teamwork Client CentricMOHD SAMEERNo ratings yet

- Capital Markets Senior Vice President in New York City Resume David GrossmanDocument3 pagesCapital Markets Senior Vice President in New York City Resume David GrossmanDavidGrossman3No ratings yet

- Purushotham (5,4)Document6 pagesPurushotham (5,4)anandkrishna2006No ratings yet

- DBRS Morningstar Analyst RoleDocument2 pagesDBRS Morningstar Analyst RolePiyush LalwaniNo ratings yet

- Resume - Shah AlamDocument5 pagesResume - Shah Alamkhanshahalam79No ratings yet

- Arcesium Whitebook 2022Document12 pagesArcesium Whitebook 2022Srilekha BasavojuNo ratings yet

- Axis Mutual Fund_Karthik Kumar_ScrabbleDocument2 pagesAxis Mutual Fund_Karthik Kumar_ScrabbleNaman VasalNo ratings yet

- Ramesh Resume - Director - BI, Financial Risk & ComplianceDocument5 pagesRamesh Resume - Director - BI, Financial Risk & ComplianceSri GuruNo ratings yet

- Skill 1 Interview - Job - Description - Capital Market JDDocument4 pagesSkill 1 Interview - Job - Description - Capital Market JDSaiRohith MaddiNo ratings yet

- President CEO CFO COO in United States Resume Barry KellyDocument3 pagesPresident CEO CFO COO in United States Resume Barry KellyBarryKellyNo ratings yet

- San ResumeDocument6 pagesSan ResumeKarthick ThoppanNo ratings yet

- Mentors' Business Titles Participating Mentors' Business FunctionsDocument2 pagesMentors' Business Titles Participating Mentors' Business Functions7211785No ratings yet

- Phuong (Lily) Tran Package 3Document7 pagesPhuong (Lily) Tran Package 3phtran123No ratings yet

- Sarbani Maiti: Role in Headstrong Relevant ExperienceDocument3 pagesSarbani Maiti: Role in Headstrong Relevant ExperienceneerajteNo ratings yet

- Upendra SAP SD Consultant Email: Call: +1 609-632-0621 EXT 109Document4 pagesUpendra SAP SD Consultant Email: Call: +1 609-632-0621 EXT 109Shubham GhodapkarNo ratings yet

- Northern Arc - JD0Document6 pagesNorthern Arc - JD0SDDDDNo ratings yet

- Syed - Iqbal (10072019) UDocument2 pagesSyed - Iqbal (10072019) USyed Iqbal AbidiNo ratings yet

- Morgan Stanley - 14th April - UpdatedDocument4 pagesMorgan Stanley - 14th April - UpdatedShubhangi VirkarNo ratings yet

- Marson's CV - 230712 - 064240Document3 pagesMarson's CV - 230712 - 064240Akramurridjal RahmanNo ratings yet

- Dilli Babu - Sap Fico With MBC 2023Document10 pagesDilli Babu - Sap Fico With MBC 2023Samir SahooNo ratings yet

- Resume - Sneha ChandakDocument3 pagesResume - Sneha ChandakSnehaNo ratings yet

- SAP FICO Sr. ConsultantDocument3 pagesSAP FICO Sr. ConsultantsankpaldNo ratings yet

- Green Derivatives Trading Desk Limited Certificate Philip GreenDocument1 pageGreen Derivatives Trading Desk Limited Certificate Philip GreenPhilip GreenNo ratings yet

- Data Attributes For Natural Gas Storage and Transport Deals in Openlink EndurDocument1 pageData Attributes For Natural Gas Storage and Transport Deals in Openlink EndurPhilip GreenNo ratings yet

- Quantitative and Qualitative Disclosures About Derivatives and Risk Management ActivitiesDocument4 pagesQuantitative and Qualitative Disclosures About Derivatives and Risk Management ActivitiesPhilip Green100% (14)

- Structured Energy Trading Contract - FAS 133 Accounting Treatment - Phillip GreenDocument4 pagesStructured Energy Trading Contract - FAS 133 Accounting Treatment - Phillip GreenPhilip Green100% (1)

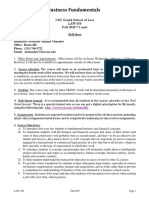

- Business FundamentalsDocument7 pagesBusiness FundamentalsjfasldjflakdjqdfNo ratings yet

- reportImpRelsPerm (15) - 230105 - 175643Document2 pagesreportImpRelsPerm (15) - 230105 - 175643Kiya MathewosNo ratings yet

- Alibaba Ecosystem For E-Commerce: - Building A Social SustainabilityDocument16 pagesAlibaba Ecosystem For E-Commerce: - Building A Social SustainabilityLaila RashedNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Thamesbay PPT Training Size Reduice PDFDocument40 pagesThamesbay PPT Training Size Reduice PDFRiyas ct80% (5)

- ACC 102 ReviewerDocument18 pagesACC 102 ReviewerFlo-an Marie Gello-aniNo ratings yet

- Ch02 Test Bank Jeter Advanced Accounting 3rd EditionDocument19 pagesCh02 Test Bank Jeter Advanced Accounting 3rd EditionAnne Claire Agad Maghinay100% (1)

- 18bba033 OAPDocument49 pages18bba033 OAPBhoomi MeghwaniNo ratings yet

- Central Bank V CADocument31 pagesCentral Bank V CAlawNo ratings yet

- Services Marketing Assignment 1Document3 pagesServices Marketing Assignment 1Jazzi KhanNo ratings yet

- Property Law-II ProjectDocument19 pagesProperty Law-II ProjectVanshita GuptaNo ratings yet

- Fast TrackDocument45 pagesFast TrackSAUMYA MNo ratings yet

- Wise v. MeerDocument2 pagesWise v. MeerSosthenes Arnold MierNo ratings yet

- Fatal falls from heightDocument3 pagesFatal falls from heightEric LimNo ratings yet

- American Friends Final ShowDocument23 pagesAmerican Friends Final Showmoses njengaNo ratings yet

- Consumers True Brand Loyalty The Central Role of CommitmentDocument16 pagesConsumers True Brand Loyalty The Central Role of CommitmentkeshavNo ratings yet

- Project1 3Document89 pagesProject1 3eyob yohannes100% (1)

- PDF Anjab Abk Guru TK DLDocument161 pagesPDF Anjab Abk Guru TK DLPink PandaNo ratings yet

- RRJ EnterprisesDocument1 pageRRJ EnterprisesOFC accountNo ratings yet

- Test Bank For International Business Environments Operations 14 e 14th Edition John Daniels Lee Radebaugh Daniel SullivanDocument26 pagesTest Bank For International Business Environments Operations 14 e 14th Edition John Daniels Lee Radebaugh Daniel Sullivannataliebuckdbpnrtjfsa100% (24)

- ANU College of Law: Legal Studies Research Paper SeriesDocument38 pagesANU College of Law: Legal Studies Research Paper SeriesPratim MajumderNo ratings yet

- Expenses Internal AuditDocument19 pagesExpenses Internal AuditLamineNo ratings yet

- Apple VS SAMSUNGDocument37 pagesApple VS SAMSUNGMohammed Akhtab Ul HudaNo ratings yet

- Audit QP - 1Document18 pagesAudit QP - 1sanket karwaNo ratings yet

- ECO 202 Group AssignmentDocument12 pagesECO 202 Group AssignmentIrfanul HoqueNo ratings yet

- HBNDocument14 pagesHBNaNo ratings yet

- RWJ Chapter 1 Introduction To Corporate FinanceDocument21 pagesRWJ Chapter 1 Introduction To Corporate FinanceAshekin Mahadi100% (1)