Professional Documents

Culture Documents

PLI Based On CDS Grading

Uploaded by

ValorantOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PLI Based On CDS Grading

Uploaded by

ValorantCopyright:

Available Formats

eCircular

Department: P&HRD

Sl.No.: 438/2021 - 22

Circular No.: CDO/P&HRD-PM/36/2021 - 22

Date: Fri 30 Jul 2021

All Branches and Offices of

State Bank of India.

Madam / Dear Sir,

STAFF: MISCELLANEOUS

PERFORMANCE LINKED INCENTIVE (PLI) BASED ON CDS GRADING

FOR FINANCIAL YEAR 2020-21

Please refer to our e-Circular No. CDO/P&HRD-PM/49/2017-18 dated 12 th October, 2017.

2. The Competent Authority has accorded approval for payment of

Performance Linked Incentive (PLI) to eligible employees for the Financial Year 2020-

21. The salient features for payment of PLI are as under:

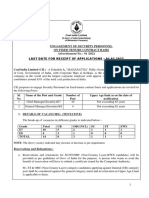

ELIGIBILITY

a. Eligibility for PLI shall be based on CDS grade as on 31 st March, 2021.

b. All Clerical Staff and Officers up to and including TEGSS-II, covered under

CDS, are eligible to be considered for PLI.

c. Employees, posted at both operating as well as administrative office, with

CDS grade of ‘AAA’ & ‘AA” shall be eligible for PLI.

d. Officers who are posted abroad or on deputation to other organizations/GOI/

subsidiaries, have been covered under the Scheme. However, if a separate

incentive scheme is there in operation at the deputed organisation, they will have

an option to choose either of the two.

EXCLUSION

a. Employees on Contract.

b. Employees Retired / Resigned / Removed / Voluntary Retired during the

year.

c. POs/CBOs not confirmed on or before 31.03.2021.

d. Clerical staff who has joined after 30.09.2020.

e. All other employees not covered under CDS Grading.

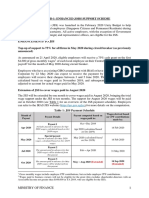

3.Payment of incentives under PLI to eligible employees for the FY. 2020-21 will be as

under:

Amount in Rs.

Scale / Grade Incentive per Employee Incentive per Employee

with CDS Grade “AAA” with CDS Grade “AA”

TEGSS-II 2,80,000 93,400

TEGSS-I 2,00,000 66,700

TEGS-VII 1,15,000 38,300

TEGS-VI 91,000 30,300

SMGS-V 69,000 23,000

SMGS-IV 55,000 18,300

MMGS-III 37,000 12,300

MMGS-II 25,500 8,500

JMGS-I 17,000 5,700

Clerical (Chief 10,000 3,300

Associates)

Clerical (Other than 7,500 2,500

Chief Associates)

i. Payment of incentives to employees will be done centrally by Corporate Centre

through HRMS and the applicable TDS will be recovered from the gross payment.

No manual payment will be made at the operating levels.

ii. Payment of PLI to employees where salary is not paid through HRMS, will be paid

separately by concerned offices. CD&S Department at Corporate Centre will

advise them the list of such employees along with PLI payable to the employees

concerned.

iii. Payment of incentives to eligible employees resigned/ removed after 1 st April,

2021 or on deputation will be done by the OAD of the respective pay roll areas

and to employees posted abroad will be done by IBG, HR Corporate Centre. The

respective offices paying incentives will ensure compliance with the applicable

taxation rules and reporting of the gross incentive amount along with TDS details

to HRMS department for issuing Form -16.

iv. Payment of incentives to those eligible employees retired after 1 st April, 2021, will

be done by HRMS department separately.

v. CGM (HR) has been authorised to issue any clarification in the matter.

4. All other terms and conditions of the scheme shall remain unchanged.

5. Please arrange to bring the contents of this circular to the knowledge of all concerned.

Yours faithfully,

(OM PRAKASH MISHRA)

DEPUTY MANAGING DIRECTOR (HR) &

CORPORATE DEVELOPMENT OFFICER

You might also like

- Introduction To Project: The Concept of MotivationDocument20 pagesIntroduction To Project: The Concept of MotivationSmiti WaliaNo ratings yet

- Award Staff Rules 2022Document207 pagesAward Staff Rules 2022Prem Prem KumarNo ratings yet

- Module1 - Basic PrinciplesDocument14 pagesModule1 - Basic PrinciplesChristian Mark AbarquezNo ratings yet

- Budget 2022Document14 pagesBudget 2022Krisna Criselda Simbre100% (1)

- Multiple Choice Questions - V Commerce - V: Unit 1Document18 pagesMultiple Choice Questions - V Commerce - V: Unit 1Hari Krishna ChalwadiNo ratings yet

- Case Study:: The Enterprise Resource Planning ProjectDocument6 pagesCase Study:: The Enterprise Resource Planning ProjecttulikaNo ratings yet

- Final Exam 1st Semester 2018Document6 pagesFinal Exam 1st Semester 2018SHEREE BLAKENo ratings yet

- Revision of Monetary Ceiling of Entertainment Expenses and Casual Labour For Officers in The Grade of Jmgs-I To Tegs-ViiDocument3 pagesRevision of Monetary Ceiling of Entertainment Expenses and Casual Labour For Officers in The Grade of Jmgs-I To Tegs-Viiakshayg0792No ratings yet

- Ecircular: Mandatory Learning For Employees Upto SMGS-VDocument2 pagesEcircular: Mandatory Learning For Employees Upto SMGS-VSathish Kumar RNo ratings yet

- BudgetDocument81 pagesBudgetGeneral Sanction SectionNo ratings yet

- Circular No.05 SumptuaryDocument2 pagesCircular No.05 SumptuaryBalwinder SinghNo ratings yet

- Ifmis Om Reg Salary BillDocument2 pagesIfmis Om Reg Salary BillHmingsanga HauhnarNo ratings yet

- Spesifikasi Kaedah Pengiraan Berkomputer PCB 2023Document48 pagesSpesifikasi Kaedah Pengiraan Berkomputer PCB 2023Annie LimNo ratings yet

- Recruitment of Specialist Cadre Officers On Regular BasisDocument4 pagesRecruitment of Specialist Cadre Officers On Regular BasisSaraswati DeviNo ratings yet

- Det Ad (Eng) - 6 PostsDocument4 pagesDet Ad (Eng) - 6 PostsAjay VermaNo ratings yet

- GO-Ms-No 101-Dt 11 05 2022Document16 pagesGO-Ms-No 101-Dt 11 05 2022Dummy ZonalNo ratings yet

- Accounting Handbook For Regional Controllers PDFDocument66 pagesAccounting Handbook For Regional Controllers PDFAntara DeyNo ratings yet

- MTD CalculationsDocument50 pagesMTD CalculationsLeny HrNo ratings yet

- Saaodb 2014 2nd QTRDocument2 pagesSaaodb 2014 2nd QTRtesdaro12No ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument45 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORTitan KNo ratings yet

- Employment Notice: 1. VacanciesDocument22 pagesEmployment Notice: 1. VacanciesI Am SakshiNo ratings yet

- State Bank of India Officers' Association Chandigarh CircleDocument3 pagesState Bank of India Officers' Association Chandigarh CircleKuldeep KushwahaNo ratings yet

- 04-ZCSEZA2021 Executive SummaryDocument5 pages04-ZCSEZA2021 Executive SummaryBaliv MozamNo ratings yet

- Transfer PolicyDocument7 pagesTransfer PolicySukumar NayakNo ratings yet

- Employment Notice: 1. VacanciesDocument22 pagesEmployment Notice: 1. VacanciesDharmendra GautamNo ratings yet

- Case Study InformationDocument3 pagesCase Study InformationNafilah RahmaNo ratings yet

- Tax Nov Dec 2023 - QuestionDocument6 pagesTax Nov Dec 2023 - QuestionMd HasanNo ratings yet

- Incentive Scheme 2021Document11 pagesIncentive Scheme 2021shyam krishnaNo ratings yet

- Vidya Deepam Circ Gist Mar20 - Mar21Document105 pagesVidya Deepam Circ Gist Mar20 - Mar21pradeep kumar0% (1)

- Advt Cemil Ac 07092022Document12 pagesAdvt Cemil Ac 07092022vinothNo ratings yet

- Detailed Advertisement of Engagement of Security Personnel On Fixed Tenure Co DGn7Hl2Document8 pagesDetailed Advertisement of Engagement of Security Personnel On Fixed Tenure Co DGn7Hl2ShisArquamNo ratings yet

- DA RevisedDocument4 pagesDA RevisedArcGis TranscoNo ratings yet

- Sub: Work Order For TCI37715 For Implementing Short Termtraining Under PMKVY-3.0 CSSMDocument10 pagesSub: Work Order For TCI37715 For Implementing Short Termtraining Under PMKVY-3.0 CSSMSandip MandalNo ratings yet

- DDOs Preparatory Activities For Khajane II PDFDocument14 pagesDDOs Preparatory Activities For Khajane II PDFAnonymous VGA5G00% (1)

- Canara Bank (Officers') Service Regulations, 1979: Chapter - I Preliminary 1. Short Title and CommencementDocument56 pagesCanara Bank (Officers') Service Regulations, 1979: Chapter - I Preliminary 1. Short Title and CommencementAshmi JainNo ratings yet

- 6-2021 - Automatic Advancement SchemeDocument8 pages6-2021 - Automatic Advancement SchemePradeep ReddyNo ratings yet

- Staff Circular 07569Document11 pagesStaff Circular 07569Chetan RamtekeNo ratings yet

- Circular ESPS PDFDocument19 pagesCircular ESPS PDFSurabhi SaurabhNo ratings yet

- Annex B-1: Enhanced Jobs Support Scheme: Ministry of Finance 1Document5 pagesAnnex B-1: Enhanced Jobs Support Scheme: Ministry of Finance 1RicardoNo ratings yet

- Office Memorandum (Salary)Document2 pagesOffice Memorandum (Salary)PHED MizoramNo ratings yet

- OM No 1010 DT 20 Jan 2023 Modification in Career Growth Policy For Executives in Mining DisciplineDocument6 pagesOM No 1010 DT 20 Jan 2023 Modification in Career Growth Policy For Executives in Mining Disciplineshubham gavelNo ratings yet

- 1292 - Payment of Special Incentive CircularDocument4 pages1292 - Payment of Special Incentive Circularswamy ChinthalaNo ratings yet

- Grade Pay Scale .) Reservations: For MDL WebsiteDocument10 pagesGrade Pay Scale .) Reservations: For MDL WebsiteSantosh SharmaNo ratings yet

- Chap 15Document19 pagesChap 15Ghadaa Mahmoud AshorNo ratings yet

- Help Document - PLR Worksheet 2022-23Document1 pageHelp Document - PLR Worksheet 2022-23susheel8143No ratings yet

- RMP RulesDocument78 pagesRMP Rulessai varmaNo ratings yet

- 20231018151225Document34 pages20231018151225gaatpvtitiNo ratings yet

- Adobe Scan 24 Jan 2022Document11 pagesAdobe Scan 24 Jan 2022kailas bankNo ratings yet

- SBI-Circular DRDocument2 pagesSBI-Circular DREntirey HeroNo ratings yet

- 03-CNU2021 Executive SummaryDocument5 pages03-CNU2021 Executive SummaryMiss_AccountantNo ratings yet

- General Manager (Tech) Advertisement Ref. No. Mdl/Hr-O/05/2008Document7 pagesGeneral Manager (Tech) Advertisement Ref. No. Mdl/Hr-O/05/2008anon-987460No ratings yet

- Wages Oct 2020 PDFDocument8 pagesWages Oct 2020 PDFAshutosh SharmaNo ratings yet

- The Central Minimum Wages Notification 1st October 2020Document8 pagesThe Central Minimum Wages Notification 1st October 2020Vishal DombeNo ratings yet

- Nov 22-2Document34 pagesNov 22-2Sreerag R NairNo ratings yet

- Subject: Grant of Ad-Hoc Bonus To The State Government Employees and Some Other Categories of Employees For The Year 2019-2020Document3 pagesSubject: Grant of Ad-Hoc Bonus To The State Government Employees and Some Other Categories of Employees For The Year 2019-2020Satyaki Prasad MaitiNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument2 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsBella IlaganNo ratings yet

- 03-OVP2022 Executive SummaryDocument6 pages03-OVP2022 Executive SummaryarchaosdesigngroupNo ratings yet

- Loans PDFDocument10 pagesLoans PDFMubbashar ShafiqNo ratings yet

- IASG2 V 1 C WHTD JWV FSZ IUDocument9 pagesIASG2 V 1 C WHTD JWV FSZ IUBong RicoNo ratings yet

- Wage Revision For Workmen of GAIL W.E.F. 01.01.2017 - Office Order - 24.06.2020Document9 pagesWage Revision For Workmen of GAIL W.E.F. 01.01.2017 - Office Order - 24.06.2020sukbabNo ratings yet

- GV - Subex Assurance - HY1 - FY - 22-2 - v01 - 10oct2022 - Draft - Report - AS 15 (R)Document20 pagesGV - Subex Assurance - HY1 - FY - 22-2 - v01 - 10oct2022 - Draft - Report - AS 15 (R)Ajay GoelNo ratings yet

- Details NotificationDocument36 pagesDetails Notificationdadan vishwakarmaNo ratings yet

- GSL Recruitment 2024Document8 pagesGSL Recruitment 2024VijayachandranNo ratings yet

- De0artment: of @lucattonDocument25 pagesDe0artment: of @lucattonMs. Dana RevoltarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Module in MANA2013Document29 pagesModule in MANA2013Tong KennedyNo ratings yet

- Customer Service in The Aviation IndustryDocument36 pagesCustomer Service in The Aviation IndustryVyl CebrerosNo ratings yet

- Chapter 7 BelardoDocument8 pagesChapter 7 BelardoAndrea BelardoNo ratings yet

- Stock Valuation With Exercises IvanaDocument62 pagesStock Valuation With Exercises Ivanafrancis dungcaNo ratings yet

- 1QFY2022 FinancialResultsDocument17 pages1QFY2022 FinancialResultsCheah ChenNo ratings yet

- Alteration - Object Clause - Table - 52Document2 pagesAlteration - Object Clause - Table - 52Divesh GoyalNo ratings yet

- CMS Marketing Practices MemoDocument3 pagesCMS Marketing Practices MemoJakob EmersonNo ratings yet

- Muthoot Finance PDFDocument4 pagesMuthoot Finance PDFSandeep KaurNo ratings yet

- Cover Letter of Salah VaiDocument3 pagesCover Letter of Salah VaiShahedur RahamnNo ratings yet

- Issue Analysis Group 2Document16 pagesIssue Analysis Group 2anamargaridajoaquim66No ratings yet

- Jurnal Kelompok 9 Hukum Pelayanan Publik Kelas E-2Document13 pagesJurnal Kelompok 9 Hukum Pelayanan Publik Kelas E-2Laurensia SimanihurukNo ratings yet

- Articles of PartnershipDocument2 pagesArticles of Partnershiprylee7100% (2)

- Supply ChainDocument5 pagesSupply ChainCHUAN LANNo ratings yet

- Pull 1. Push: (Attraction of The Chosen Solution) (Motivation For Progress)Document2 pagesPull 1. Push: (Attraction of The Chosen Solution) (Motivation For Progress)hNo ratings yet

- Tools and Techniques of Environmental Accounting For Business DecisionsDocument32 pagesTools and Techniques of Environmental Accounting For Business DecisionsRonoNo ratings yet

- Jurnal Audit Report LagDocument14 pagesJurnal Audit Report LagDaniswara HerlanggaNo ratings yet

- Institutions, Institutional Change, and Economic PerformanceDocument6 pagesInstitutions, Institutional Change, and Economic PerformancePaula MartinezNo ratings yet

- SME Financing PPT DTDocument28 pagesSME Financing PPT DTdeepaktandon86% (7)

- Industrial - Cooler FaridabadDocument9 pagesIndustrial - Cooler FaridabadYogesh TiwariNo ratings yet

- Fishing Farming Business Plan (Fifa Enterprises) : January 2021Document33 pagesFishing Farming Business Plan (Fifa Enterprises) : January 2021joachim judeNo ratings yet

- Request For Expressions of Interest (Consulting Services - Firms Selection)Document2 pagesRequest For Expressions of Interest (Consulting Services - Firms Selection)Akhmad Syibli HusniNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Subhashree PriyadarsiniNo ratings yet

- ACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentDocument8 pagesACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentAnn Marie Dela FuenteNo ratings yet

- ListDocument5 pagesListCaha OroNo ratings yet

- House of Oyster MushroomDocument7 pagesHouse of Oyster MushroomTaufik SaputraNo ratings yet