Professional Documents

Culture Documents

Chapter Two General Math

Chapter Two General Math

Uploaded by

Awais Humayun0 ratings0% found this document useful (0 votes)

5 views2 pages1) The document is a math exam from a 9th grade native school covering topics related to zakat and inheritance under Islamic law.

2) It contains multiple choice and short answer questions testing knowledge of zakat rates, calculation of zakat on different assets, rules regarding inheritance shares, and definitions of key terms.

3) The questions require students to demonstrate understanding of concepts like zakat, ushr, inheritance shares of different heirs, categories of exposed and unexposed wealth, and exemptions from zakat.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document is a math exam from a 9th grade native school covering topics related to zakat and inheritance under Islamic law.

2) It contains multiple choice and short answer questions testing knowledge of zakat rates, calculation of zakat on different assets, rules regarding inheritance shares, and definitions of key terms.

3) The questions require students to demonstrate understanding of concepts like zakat, ushr, inheritance shares of different heirs, categories of exposed and unexposed wealth, and exemptions from zakat.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesChapter Two General Math

Chapter Two General Math

Uploaded by

Awais Humayun1) The document is a math exam from a 9th grade native school covering topics related to zakat and inheritance under Islamic law.

2) It contains multiple choice and short answer questions testing knowledge of zakat rates, calculation of zakat on different assets, rules regarding inheritance shares, and definitions of key terms.

3) The questions require students to demonstrate understanding of concepts like zakat, ushr, inheritance shares of different heirs, categories of exposed and unexposed wealth, and exemptions from zakat.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

NATIVE SCHOOLS

Subject General Maths Class: 9th Chp# 2 Total Marks= 30

Date:________

Name Father’s Name 2nd Short term

2023

(Objective) Tick the right option. 6x1=6

QNo1: Choose the right option. A B C D

1# Zakat is deducted at the rate 2.5% 3.5% 4.5% 5.5%

of

2# On a crop produced on 5% 10% 2.5% 25%

artificial resources, Ushr is

deducted at rate of

3# The share of childless widow 1/4 1/8 1/2 3/2

inherited property is

4# Zakat on an amount of 2500 25000 2000 15000

Rs.100,000

5# The share of widow in the 1/4 1/8 1/2 1/6

presence of a child or agnatic

grand child is

6# If there are two or more than 2/3 1/4 1/2 1/8

two daughters or agnatic

grand daughter then their

share is

(Subjective)

QNo2:- Answer the following Questions. 8×2=16

1) Define zakat.

2) Define inheritance.

3) What do you know about Ushr?

4) Calculate ushr on a rice crop produced by natural resources amounting to Rs.

6,00,000.

5) Differentiate between exposed and unexposed wealth.

6) Calculate zakat on gold amounting Rs. 15,00,000.

7) Who is Sahib-e-Nisab?

8) What types of goods are exempted from zakat?

QNo3:- Answer the following Questions. 4 + 4=08

(i) Calculate Zakat on gold of worth Rs. 8,00,000, cash of amount Rs. 4,00,000 and silver of

weight 50 (Rs.5000 per tola).

(ii) Asghar left property of worth Rs.4,80,000 he left behind a widow, three sons and four

daughters. Calculate the share of each one.

You might also like

- Uncle Grumps Toys SolutionDocument17 pagesUncle Grumps Toys Solutionmanya100% (1)

- Alrajhi-0 Compressed.5133686765536793Document1 pageAlrajhi-0 Compressed.5133686765536793Abdul-rheeim Q OwiNo ratings yet

- Contract of EmploymentDocument4 pagesContract of EmploymentLö Räine AñascoNo ratings yet

- Mathematics ST5Document4 pagesMathematics ST5liezljoy.dudangNo ratings yet

- Test 1Document3 pagesTest 1lisbanewache2No ratings yet

- JPJC JC1 H2 Math Revision For WA2 Questions 2023Document6 pagesJPJC JC1 H2 Math Revision For WA2 Questions 2023vincesee85No ratings yet

- Ratio-rate-speed-G 7Document2 pagesRatio-rate-speed-G 7tripti aggarwalNo ratings yet

- Class VIII Test 13-11-2023Document1 pageClass VIII Test 13-11-2023Veena DhingraNo ratings yet

- Simplify Without Using A CalculatorDocument2 pagesSimplify Without Using A CalculatorMark MisokaNo ratings yet

- F3 Supp. Ex.6Document2 pagesF3 Supp. Ex.6chowkamchuenNo ratings yet

- Course Diagnostic G6Document9 pagesCourse Diagnostic G6Rancy OsamaNo ratings yet

- Y10 Calc Revision 3aDocument12 pagesY10 Calc Revision 3aSyukur GuloNo ratings yet

- KS3 Maths 03Document42 pagesKS3 Maths 03NexusNo ratings yet

- Applied Maths Sample PaperDocument2 pagesApplied Maths Sample PaperGyanendra AryaNo ratings yet

- 1st Periodical ExamDocument16 pages1st Periodical ExamJhuanna Marie CabalteraNo ratings yet

- Numbers and CalculationsDocument3 pagesNumbers and CalculationsDaniel 'Bassman' ChristiantoNo ratings yet

- GRADE 7 - REVISION ASSIGNMENT - Half Yearly 2022-23Document15 pagesGRADE 7 - REVISION ASSIGNMENT - Half Yearly 2022-23Sidra QueenNo ratings yet

- GR VIII - Week 4 - MathDocument11 pagesGR VIII - Week 4 - MathAyaan AtifNo ratings yet

- 2.1.2 Discrete Random Variable 2 (Find K) - 1959061744Document3 pages2.1.2 Discrete Random Variable 2 (Find K) - 1959061744Jorge Eduardo Caro OrtizNo ratings yet

- Lesson 32Document21 pagesLesson 32Byron CabatbatNo ratings yet

- Mathematics 91644 Paper 4 November 2015 SessionDocument8 pagesMathematics 91644 Paper 4 November 2015 SessionAshlynNo ratings yet

- Holiday Assignment 2022Document5 pagesHoliday Assignment 2022Mohd RadhwanNo ratings yet

- Class 07 Chapter Fraction Practice Paper - 2Document1 pageClass 07 Chapter Fraction Practice Paper - 2manishaNo ratings yet

- SoftskillsDocument1 pageSoftskillspanditadesh123No ratings yet

- Arithmatic Class 6 Final ExamDocument2 pagesArithmatic Class 6 Final ExamTanzimNo ratings yet

- C7,8 TestDocument7 pagesC7,8 TestPremNo ratings yet

- 2014GR12GENERALMATHSEXAMPAPER2Document11 pages2014GR12GENERALMATHSEXAMPAPER2anowNo ratings yet

- Prelims Exam 2018Document7 pagesPrelims Exam 2018Shairon palmaNo ratings yet

- ExaminationDocument6 pagesExaminationJeevetha DharmaNo ratings yet

- Grade 4 PPT - Math - Q2 - Changing - Improper - Fraction - To - Mixed - Numbers - and - Vice - VersaDocument21 pagesGrade 4 PPT - Math - Q2 - Changing - Improper - Fraction - To - Mixed - Numbers - and - Vice - VersaCher Geri100% (1)

- Problem Set 2 - InequalitiesDocument1 pageProblem Set 2 - InequalitiesTamoya PinnockNo ratings yet

- ProbabilityDocument17 pagesProbabilityLochi LiyanageNo ratings yet

- Infosys Question PaperDocument4 pagesInfosys Question PaperReganNo ratings yet

- Mathematics ST7Document4 pagesMathematics ST7liezljoy.dudangNo ratings yet

- ExaminationDocument5 pagesExaminationJeevetha DharmaNo ratings yet

- F1 Maths TQDocument6 pagesF1 Maths TQTeacher AlexNo ratings yet

- 7 - MathsDocument4 pages7 - MathsArya JeyanNo ratings yet

- EOSARevision Grade 7Document9 pagesEOSARevision Grade 7Chirag HasijaNo ratings yet

- MATH Q2 Lesson 32 Improper FractionDocument32 pagesMATH Q2 Lesson 32 Improper FractionJasmin Cabral100% (1)

- Mathematics - Question and AnswersDocument9 pagesMathematics - Question and Answersphirihannock43No ratings yet

- GCSE Problems of The Day Full Set With SolutionsDocument18 pagesGCSE Problems of The Day Full Set With Solutionsjames kiNo ratings yet

- Online Tuition For Any Subjects and Level (0192878384)Document25 pagesOnline Tuition For Any Subjects and Level (0192878384)swordmanoneNo ratings yet

- EXAMINATION NO. - The Public Accountants Examination Council of Malawi Accounting Technician Programme Paper TC 3: Business Mathematics & StatisticsDocument8 pagesEXAMINATION NO. - The Public Accountants Examination Council of Malawi Accounting Technician Programme Paper TC 3: Business Mathematics & StatisticsGiboNo ratings yet

- P6 ISMC 2018 - W AnswersDocument12 pagesP6 ISMC 2018 - W AnswersAileen Mimery100% (1)

- Post - Tests (Algebra)Document5 pagesPost - Tests (Algebra)jimtumangkeNo ratings yet

- DP1 Math App Anticipated Mock - P2Document20 pagesDP1 Math App Anticipated Mock - P2hafiz gmNo ratings yet

- H VII Social III TermDocument2 pagesH VII Social III Termroselin sahayamNo ratings yet

- Set 3 Paper 1H - Monday 4th DecemberDocument11 pagesSet 3 Paper 1H - Monday 4th Decembersorenarai22No ratings yet

- PENILAIAN TENGAH SEMESTER MTK Kls. 5Document11 pagesPENILAIAN TENGAH SEMESTER MTK Kls. 5Fitri SetiawatiNo ratings yet

- PROBABILITYDocument2 pagesPROBABILITYSwati AshtakeNo ratings yet

- Math F1 QSDocument11 pagesMath F1 QSgeorgembunikeyaNo ratings yet

- Explore and Discover!: Read and Solve The ProblemDocument1 pageExplore and Discover!: Read and Solve The ProblemJoan Garay CarinanNo ratings yet

- P.6 Maths Lesson Notes Term Ii 2020Document67 pagesP.6 Maths Lesson Notes Term Ii 2020sanju BarmanNo ratings yet

- Year 10 Revision Pack Spring 2Document26 pagesYear 10 Revision Pack Spring 2RaahimNo ratings yet

- StatsProb Day 1 9 Completed Day 10 PendingDocument64 pagesStatsProb Day 1 9 Completed Day 10 PendingShaneloveNo ratings yet

- CMO Previous Year For Class 8Document11 pagesCMO Previous Year For Class 85jttgwdm4mNo ratings yet

- G. D Goenka Public School, Jammu: Class: Xii Subject: Mathematics Name: Roll NoDocument2 pagesG. D Goenka Public School, Jammu: Class: Xii Subject: Mathematics Name: Roll NoKeshvi AggarwalNo ratings yet

- GR 10 Edwardsmaths Test or Assignment Probability T3 2022 EngDocument3 pagesGR 10 Edwardsmaths Test or Assignment Probability T3 2022 Engb0767212No ratings yet

- Algebra Class 6 Final ExamDocument2 pagesAlgebra Class 6 Final ExamTanzimNo ratings yet

- Worksheet - D15 Jul 2023Document5 pagesWorksheet - D15 Jul 2023Arjun ShethNo ratings yet

- Class-Viii: Mathematics Rational Numbers Worksheet-3Document1 pageClass-Viii: Mathematics Rational Numbers Worksheet-3Puneet ManglaNo ratings yet

- Summer Term 3 2023-05-06 08 - 01 - 08Document2 pagesSummer Term 3 2023-05-06 08 - 01 - 08xavier.hinhNo ratings yet

- Preboard 1 Plumbing ArithmeticDocument8 pagesPreboard 1 Plumbing ArithmeticMarvin Kalngan100% (1)

- NEXON - Price - List 14 09 2023 1Document2 pagesNEXON - Price - List 14 09 2023 1mandapatiNo ratings yet

- Effective Community P Chapter 02Document18 pagesEffective Community P Chapter 02Abdulnasser Binasing100% (1)

- ECIL AppraisalDocument15 pagesECIL AppraisalNeeraj KumarNo ratings yet

- FOR: Wilma D. NaviamosDocument3 pagesFOR: Wilma D. NaviamosAnonymous QSBY9Ay39No ratings yet

- Acct Statement - XX5252 - 05112022Document23 pagesAcct Statement - XX5252 - 05112022Amazing HR SolutionsNo ratings yet

- NWRB Regulations: A Presentation For "Public Dialogue On Bulk Water Meter Arrangements" Quezon City, June 26, 2014Document19 pagesNWRB Regulations: A Presentation For "Public Dialogue On Bulk Water Meter Arrangements" Quezon City, June 26, 2014Catherine Kaye Belarmino AlmonteNo ratings yet

- Agricultural Business Plan GuidelinesDocument12 pagesAgricultural Business Plan GuidelinesRaj K Adhikari100% (1)

- PCF 2016 Milestones and GuidelinesDocument23 pagesPCF 2016 Milestones and Guidelinesruss8dikoNo ratings yet

- Stdy PostalDocument149 pagesStdy PostalSamina PathanNo ratings yet

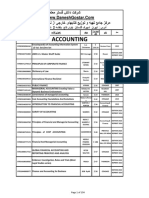

- Accounting Urmia UniversityDocument154 pagesAccounting Urmia UniversityTrollannNo ratings yet

- En Banc Commissioner OF Internal Revenue, G. R. No. 163653Document12 pagesEn Banc Commissioner OF Internal Revenue, G. R. No. 163653ecinue guirreisaNo ratings yet

- BeneficiaryDetailForSocialAuditReport PMAYG 3179001 2022-2023 PDFDocument5 pagesBeneficiaryDetailForSocialAuditReport PMAYG 3179001 2022-2023 PDFAmarchandra PrajapatiNo ratings yet

- Unit 8 - South AmericaDocument4 pagesUnit 8 - South AmericaJoshua MirandaNo ratings yet

- Hero MotoCorp LimitedDocument7 pagesHero MotoCorp Limitedanjali jainNo ratings yet

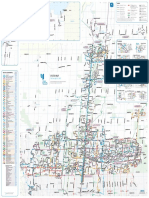

- YRT System Map Web Apr2023Document1 pageYRT System Map Web Apr2023Bernadette ChoyNo ratings yet

- ASSESSMENTDocument55 pagesASSESSMENTDiane Kiara AnasanNo ratings yet

- Brajesh Sohrot: Sypply Chain, Logistics, Purchasing, Materials, Operations & General Management ProfessionalDocument3 pagesBrajesh Sohrot: Sypply Chain, Logistics, Purchasing, Materials, Operations & General Management ProfessionalGhanshyam MeenaNo ratings yet

- Red CatalogDocument31 pagesRed CatalogKath YuNo ratings yet

- Section: Difference EquationsDocument12 pagesSection: Difference EquationsS.M. Fauzul AzimNo ratings yet

- Kerala Tourism Marketing StrategiesDocument5 pagesKerala Tourism Marketing StrategiesRubayet Hossain IdleNo ratings yet

- Thomas Sowell - Wisdom Within Intellectuals and SocietyDocument3 pagesThomas Sowell - Wisdom Within Intellectuals and SocietyMick Rynning100% (1)

- BULACAN WI Report 2019 2020Document42 pagesBULACAN WI Report 2019 2020christian baltaoNo ratings yet

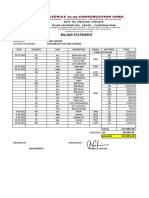

- Billing Statement: Engr. Elizalde Bagumbayan San Jose, AntiqueDocument1 pageBilling Statement: Engr. Elizalde Bagumbayan San Jose, AntiqueMark OlandresNo ratings yet

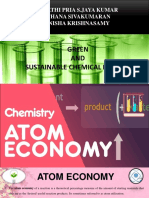

- Value Added Tax: Commercial MathematicsDocument9 pagesValue Added Tax: Commercial MathematicsMridulNo ratings yet

- Membreve, Dannah EricabuenDocument3 pagesMembreve, Dannah EricabuenSEAN ANDREX MARTINEZNo ratings yet

- MDocument16 pagesMRathish RagooNo ratings yet