Professional Documents

Culture Documents

6.3 Solutions To Quiz No. 2 - Job Order Costing

Uploaded by

Roselyn LumbaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6.3 Solutions To Quiz No. 2 - Job Order Costing

Uploaded by

Roselyn LumbaoCopyright:

Available Formats

1.

Placed in process 202,000

Cost of goods manufactured (185,000)

Work in process, end 17,000

Materials 4,400 (squeeze)

Labor (48/60) = 80%; 5,600/80% 7,000

FOH 5,600

2. Materials 2,500

Labor (15 x 7) 105

FOH (18 x 6) 108

Total 2,713

3. Discussed already.

4. Job 456:

Labor hours = 510/8.50

= 60

Overhead rate = 255/60 hrs.

Overhead rate = 4.25

5. Job 461:

Labor hours = 289/8.50

= 34 hours

= 34 x 4.25

= 144.50

6. Job 479:

Work in process 6,800

Other jobs (3,981)

Job 479 2,819

Labor (714/4.25 x 8.50) (1,428)

FOH (714)

Materials 677

7. Cost of goods sold 980,000

Overapplied (6,000)

Actual COGS 974,000

8 to 13: discussed already

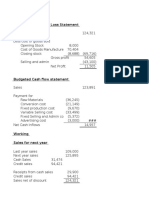

14. Sales 3,600,000

COGS (2,040,000)

Underapplied (52,000)

Selling and admin (900,000)

Net income 608,000

15 to 17: discussed already

18. Since charged to production, nothing will change in the unit cost.

19. Since charged to production, nothing will change in the unit cost.

20. discussed already.

You might also like

- Afar 2612 Job Order CostingDocument25 pagesAfar 2612 Job Order Costingcorpnet globalNo ratings yet

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Document9 pagesClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Process Costing Examples (Matz Uzry)Document24 pagesProcess Costing Examples (Matz Uzry)Muhammad azeem100% (3)

- Additional Answers Exercises COGM-COGS-JEs PDFDocument2 pagesAdditional Answers Exercises COGM-COGS-JEs PDFNicola Erika EnriquezNo ratings yet

- Chapter 5 Factory Overhead Accounting ExercisesDocument10 pagesChapter 5 Factory Overhead Accounting ExercisesxicoyiNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- 1Document10 pages1Love FreddyNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Assignment #1Document5 pagesAssignment #1Crizelda BauyonNo ratings yet

- 2021 Answer Chapter 1Document17 pages2021 Answer Chapter 1Jaime LegaspiNo ratings yet

- Job OrderDocument2 pagesJob Orderrose llarNo ratings yet

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersJolina MostalesNo ratings yet

- IMA Multiple Choice (CH 8-11) AnswersDocument2 pagesIMA Multiple Choice (CH 8-11) Answersgracia arethaNo ratings yet

- Cost Accounting - 2019 Chapter 2 - Costs - Concepts and ClassificationDocument4 pagesCost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification?????No ratings yet

- 2021 UTS JawabanDocument8 pages2021 UTS JawabanAdam FitraNo ratings yet

- Special ProjectDocument13 pagesSpecial ProjectKyle Harold BerkenkotterNo ratings yet

- Chapter 7, Cost AccountingDocument2 pagesChapter 7, Cost AccountingApril Joy ObedozaNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- CH 2 Problems and Solutions Cost Accounting BookDocument27 pagesCH 2 Problems and Solutions Cost Accounting BookInfinite MusicNo ratings yet

- 2023 Answer CHAPTER 7 PDFDocument19 pages2023 Answer CHAPTER 7 PDFRianne NavidadNo ratings yet

- Raw MaterialsDocument1 pageRaw Materialstan jamesNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersMark Angelo AlvarezNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- 9.1 Solution - Standard CostingDocument3 pages9.1 Solution - Standard CostingKendall Anne MendozaNo ratings yet

- Cost Accounting: Group Activity (Finals)Document11 pagesCost Accounting: Group Activity (Finals)Daniella mae ElipNo ratings yet

- Toaz - Info Chapter 5 2019 Problem 1 Alexis Company PRDocument3 pagesToaz - Info Chapter 5 2019 Problem 1 Alexis Company PRAngela Ruedas33% (3)

- Key To Corrections - LEVEL 2 MODULE 3Document10 pagesKey To Corrections - LEVEL 2 MODULE 3UFO CatcherNo ratings yet

- Chapter 6 AssignmentDocument4 pagesChapter 6 AssignmentJohnray ParanNo ratings yet

- Nones Cost AccountingDocument2 pagesNones Cost AccountingMary Rose NonesNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Accounting For Raw MaterialsDocument5 pagesAnsay, Allyson Charissa T. - BSA 2 - Accounting For Raw Materialsカイ みゆきNo ratings yet

- Millichem Solution XDocument6 pagesMillichem Solution XMuhammad JunaidNo ratings yet

- Chapter 6: Job Order Costing Exercise 6-1Document25 pagesChapter 6: Job Order Costing Exercise 6-1Iyah AmranNo ratings yet

- 2023 Answer CHAPTER 6 PDFDocument8 pages2023 Answer CHAPTER 6 PDFRianne NavidadNo ratings yet

- Cost Accounting (1105) : Activity 1 Problem 1 Problem 2Document10 pagesCost Accounting (1105) : Activity 1 Problem 1 Problem 2Krisha Joselle MilloNo ratings yet

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Final Exam MA2Document5 pagesFinal Exam MA2Aramina Cabigting BocNo ratings yet

- Ca 4Document4 pagesCa 4lerabadolNo ratings yet

- FANFE File-4Document16 pagesFANFE File-4Asad NaveedNo ratings yet

- Finch Excel ReportDocument15 pagesFinch Excel ReportshuvorajbhattaNo ratings yet

- Jan Mark Castillo - BSA 1 FARDocument4 pagesJan Mark Castillo - BSA 1 FARJan Mark CastilloNo ratings yet

- Activity in JITDocument3 pagesActivity in JITEross Jacob SalduaNo ratings yet

- Cost and Management AccountingDocument7 pagesCost and Management AccountingJoseph PhaustineNo ratings yet

- Code 4Document8 pagesCode 4Đỗ Hải MyNo ratings yet

- Process Costing-FifoDocument8 pagesProcess Costing-FifoMang OlehNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Solution CostingDocument21 pagesSolution CostingANo ratings yet

- 2021 Answer Chapter 5Document15 pages2021 Answer Chapter 5prettyjessyNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- Module 4.2 Activity-Based Costing ProblemsDocument5 pagesModule 4.2 Activity-Based Costing ProblemsDanica Ramos100% (1)

- Multiple Choice Questions TheoreticalDocument13 pagesMultiple Choice Questions TheoreticalAiraNo ratings yet

- Solutions-Chapter 2Document5 pagesSolutions-Chapter 2Saurabh SinghNo ratings yet

- Standard Costing - Answer KeyDocument6 pagesStandard Costing - Answer KeyRoselyn LumbaoNo ratings yet

- Assignment - Joint Products and by Products Costing - Without AnswersDocument5 pagesAssignment - Joint Products and by Products Costing - Without AnswersRoselyn LumbaoNo ratings yet

- Standard CostingDocument14 pagesStandard CostingRoselyn LumbaoNo ratings yet

- Discussion of Assignment - Just in Time and Backflush CostingDocument4 pagesDiscussion of Assignment - Just in Time and Backflush CostingRoselyn Lumbao100% (1)

- ABC System - Problem (With Answers and Solutions)Document9 pagesABC System - Problem (With Answers and Solutions)Roselyn LumbaoNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Erratum - Activities - Process CostingDocument4 pagesErratum - Activities - Process CostingRoselyn LumbaoNo ratings yet

- Discussion of Assignment - Process CostingDocument12 pagesDiscussion of Assignment - Process CostingRoselyn LumbaoNo ratings yet

- Standard CostingDocument9 pagesStandard CostingRoselyn LumbaoNo ratings yet

- 4.2 Assignment - Principles To Accounting Period and MethodsDocument7 pages4.2 Assignment - Principles To Accounting Period and MethodsRoselyn LumbaoNo ratings yet

- Assignment - Service Cost AllocationDocument4 pagesAssignment - Service Cost AllocationRoselyn LumbaoNo ratings yet

- 3.1 Assignment - Job Order CostingDocument3 pages3.1 Assignment - Job Order CostingRoselyn LumbaoNo ratings yet

- 4.2 Answers and Solutions - Assignment On Materials and LaborDocument8 pages4.2 Answers and Solutions - Assignment On Materials and LaborRoselyn LumbaoNo ratings yet

- 6.2 Midterm Quiz No. 2 - Job Order CostingDocument7 pages6.2 Midterm Quiz No. 2 - Job Order CostingRoselyn Lumbao100% (1)

- 3.3 MCQ - Job Order Costing (With Spoilage and Defective Goods)Document2 pages3.3 MCQ - Job Order Costing (With Spoilage and Defective Goods)Roselyn LumbaoNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingRoselyn LumbaoNo ratings yet

- 1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Document8 pages1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Roselyn LumbaoNo ratings yet

- 4.0 Notes and Applications - Accounting For Materials and LaborDocument16 pages4.0 Notes and Applications - Accounting For Materials and LaborRoselyn LumbaoNo ratings yet

- 4.0 Notes and Applications - Accounting For Materials and LaborDocument14 pages4.0 Notes and Applications - Accounting For Materials and LaborRoselyn LumbaoNo ratings yet