Professional Documents

Culture Documents

Screenshot 2022-03-28 at 3.05.29 PM

Screenshot 2022-03-28 at 3.05.29 PM

Uploaded by

erisya aqilahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot 2022-03-28 at 3.05.29 PM

Screenshot 2022-03-28 at 3.05.29 PM

Uploaded by

erisya aqilahCopyright:

Available Formats

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 52 – 54

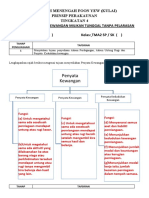

A. Lengkapkan jenis-jenis simpanan dan pelaburan.

Complete the types of savings and investments. SP3.1.1 TP1

i-THINK

Akaun simpanan Saham

Savings account Shares

Simpanan

dan

Akaun simpanan tetap Simpanan Pelaburan Pelaburan Amanah saham

Fixed deposit account Savings Savings Investments Unit trust

and

Investments

Akaun semasa Hartanah

Current account Real estate

B. Tentukan sama ada setiap pernyataan yang berikut adalah BENAR atau PALSU.

Determine whether each of the following statements is TRUE or FALSE SP3.1.1 TP2

1. Akaun simpanan membolehkan individu mengeluarkan wang pada bila-bila masa dengan menggunakan

kemudahan overdraf.

Savings account allows an individual to withdraw money at any time using overdraft facility.

PALSU/FALSE

2. Pengeluaran wang daripada akaun simpanan tetap sebelum tempoh matang boleh menyebabkan

kehilangan bayaran faedah.

Withdrawal of money from a fixed deposit account before the date of maturity can cause a loss of interest earned.

BENAR/TRUE

3. Pemegang saham merupakan seorang daripada pemilik sesebuah syarikat yang menerbitkan saham

dan akan menerima pulangan dalam bentuk dividen dan keuntungan modal.

A shareholder is one of the owners of a company that issue shares and will receive returns in the form of

dividends and capital gains.

BENAR/TRUE

4. Pelaburan dalam aset seperti rumah, kedai dan tanah boleh memperoleh pulangan yang tinggi dalam

tempoh yang singkat.

Investment on assets such as houses, shops and land can gain high returns in a short period.

PALSU/FALSE

23

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 23 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan,

Kredit dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 52 – 54

Pautan Digital

A. Padankan setiap situasi dengan jenis simpanan yang betul.

Match each of the situation with the correct type of savings. SP3.1.1 TP2

Situasi Jenis simpanan

Situation Type of savings

Encik Wong merupakan seorang usahawan

yang sering menggunakan cek dalam

1. Akaun simpanan tetap

urusan perniagaannya. Fixed deposit account

Mr Wong is an entrepreneur who often uses

cheques in his business.

Cik Sarah ialah seorang pekerja kilang

dan menyimpan gajinya dalam akaun yang

2. mudah diakses pada bila-bila masa. Akaun semasa

Miss Sarah is a factory worker and she saves Current account

her money in an account that is easy to access

at any time.

Encik Daud menyimpan bonus tahunannya

sebanyak RM30 000 di bank selama

3. Akaun simpanan

5 tahun. Savings account

Encik Daud saves his annual bonus of

RM30 000 in a bank for 5 years.

B. Nyatakan jenis pelaburan yang sesuai bagi setiap situasi yang berikut.

State the type of investment that is suitable for each of the following situations. SP3.1.1 TP2

Situasi Jenis pelaburan

Situation Type of investment

Encik Farid menerima dividen sebanyak 6% daripada wang pelaburannya

bagi tahun kewangan berakhir pada 31 Disember 2020. Amanah saham

1.

Encik Farid received a dividend of 6% of his invested money for the financial Unit trust

year ending 31 December 2020.

Encik Suresh menggunakan wang persaraannya untuk membeli sebuah

kedai. Dia bercadang untuk menjual kedai itu pada masa hadapan. Hartanah

2.

Mr Suresh uses his retirement money to buy a shop. He plans to sell the shop Real estate

in the future.

Cik Alice membeli 2 500 unit syer Syarikat Bakti yang bernilai RM1.40

sesyer di Bursa Saham Kuala Lumpur. Saham

3.

Miss Alice bought 2 500 units of Syarikat Bakti shares that worth RM1.40 per Shares

share at the Kuala Lumpur Stock Exchange. 24

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 24 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 55 – 56

NOTA

Rumus untuk mengira faedah mudah: I = Faedah/Interest

Formula to calculate simple interest: P = Prinsipal/Principal

r = Kadar faedah/Interest rate

I = Prt t = Masa dalam tahun/Time in years

Selesaikan setiap yang berikut.

Solve each of the following. SP3.1.2 TP3

1. Encik Zahid menyimpan sebanyak RM3 000 2. Cik Tan menyimpan wang sebanyak RM6 000

di sebuah bank dengan kadar faedah 2% setahun. di sebuah bank selama 2 tahun. Hitung kadar

Berapakah faedah yang akan diperoleh Encik faedah yang diberi oleh bank jika dia menerima

Zahid selepas 3 tahun? jumlah faedah sebanyak RM420.

Encik Zahid deposited RM3 000 in a bank with Miss Tan deposited RM6 000 in a bank for 2 years.

an interest rate of 2% per annum. How much interest Calculate the interest rate given by the bank if she

will be earned by Encik Zahid after 3 years? received a total interest of RM420.

I = Prt Katakan x% ialah kadar faedah.

Let x% be the interest rate.

2

= RM3 000 × × 3 I = Prt

100 x

420 = 6 000 × ×2

100

= 420 = 120x

RM180

x = 3.5

Maka, kadar faedah ialah 3.5%.

Thus, the interest rate is 3.5%.

3. Encik Raju menyimpan sebanyak RM5 000 di 4. Puan Ana menyimpan RM4 000 di sebuah bank

sebuah bank dengan kadar faedah 3.2% setahun. dengan kadar faedah 2.9% setahun. Hitung

Berapa tahunkah dia perlu menyimpan wangnya jumlah simpanannya di dalam bank selepas

untuk memperoleh jumlah faedah sebanyak 3 bulan.

RM640? Puan Ana deposited RM4 000 in a bank with an

Mr Raju deposits RM5 000 in a bank with an interest interest rate of 2.9% per annum. Calculate her total

rate of 3.2% per annum. How many years does savings in the bank after 3 months.

he need to save his money to earn a total interest

of RM640? P + Prt

2.9 3

I = Prt

3.2

= RM4 000 + RM4 000 × ! ×

100 12 "

640 = 5 000 × ×t

100 = RM4 000 + RM29

640 = 160t = RM4 029

t = 4 tahun/years

25

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 25 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 56 – 57

Jawab setiap yang berikut.

Answer each of the following. SP3.1.2 TP4

Encik Harun menyimpan RM8 000 di sebuah bank dengan kadar faedah 3.5% setahun. Hitung jumlah simpanan

Encik Harun selepas beliau menyimpan selama

Encik Harun deposits RM8 000 in a bank with an interest rate of 3.5% per annum. Calculate the total savings of Encik

Harun after he saved for

(a) 3 tahun/years,

(b) 5 tahun/years.

(a) 3 tahun/years

3.5

Faedah/Interest = RM8 000 × ×3

100

= RM840

Jumlah simpanan pada akhir tahun ke-3

Total savings at the end of the 3rd year

= RM8 000 + RM840

= RM8 840

(b) 5 tahun/years

3.5

Faedah/Interest = RM8 000 × ×5

100

Jumlah simpanan pada akhir tahun ke-5

Total savings at the end of the 5th year

= RM8 000 + RM1 400

= RM9 400

Berdasarkan penyelesaian di atas, semakin lama tempoh penyimpanan di bank, semakin tinggi

jumlah faedah yang diperoleh. Maka, jumlah akhir simpanan juga bertambah .

Based on the above solutions, the longer the savings period at the bank, the higher the amount of interest

earned. Thus, the final amount of savings also increases .

26

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 26 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 56 – 57

Jawab setiap yang berikut.

Answer each of the following. SP3.1.2 TP4

Cik Sharon bercadang untuk menyimpan RM6 000 di sebuah bank. Bank P menawarkan kadar faedah 2.5%

setahun, manakala bank Q menawarkan kadar faedah 4.2% setahun.

Miss Sharon plans to deposit RM6 000 in a bank. Bank P offers an interest rate of 2.5% per annum whereas bank Q

offers an interest rate of 4.2% per annum.

(a) Hitung jumlah simpanan Cik Sharon selepas 1 tahun jika dia menyimpan di

Calculate the amount of Miss Sharon’s savings after 1 year if she saved in

(i) bank P,

(ii) bank Q.

(i) Bank P (ii) Bank Q

2.5 4.2

Faedah/Interest = RM6 000 × ×1 Faedah/Interest = RM6 000 × ×1

100 100

= RM150 = RM252

Jumlah simpanan selepas 1 tahun Jumlah simpanan selepas 1 tahun

Total savings after 1 year Total savings after 1 year

= RM6 000 + RM150 = RM6 000 + RM252

= RM6 150 = RM6 252

(b) Berapakah beza jumlah faedah yang diperoleh Cik Sharon di bank P dan bank Q?

What is the difference between the amounts of interest earned by Miss Sharon in bank P and bank Q?

Beza jumlah faedah yang diperoleh/Difference between the amounts of interest earned

= RM252 – RM150

= RM102

(c) Berdasarkan penyelesaian di atas, bagi prinsipal yang sama, apabila kadar faedah bertambah, maka jumlah

simpanan akhir tahun juga bertambah .

Based on the above solutions, for the same principal, when the interest rates increase, the total savings at the end

of the year also increases .

27

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 27 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 57 – 59

NOTA

Rumus untuk mengira faedah kompaun: MV = Nilai matang/Matured value

Formula to calculate compound interest: P = Prinsipal/Principal

r = Kadar faedah tahunan/Yearly interest rate

nt

MV = P!1 + r " n = Bilangan kali faedah dikompaun dalam setahun

n Number of periods the interest is compounded per year

t = Tempoh dalam tahun/Term in years

Selesaikan setiap yang berikut.

Solve each of the following. SP3.1.2 TP3

1. Encik Fauzi menyimpan RM13 000 pada awal tahun di sebuah bank dengan kadar faedah 5% setahun.

Berapakah jumlah wang simpanan Encik Fauzi pada akhir tahun itu jika faedah dikompaun setiap

setengah tahun?

Encik Fauzi saved RM13 000 at the beginning of the year in a bank with an interest rate of 5% per annum. How

much is Enck Fauzi’s total savings at the end of the year if the interest is compounded half yearly?

r nt

MV = P 1 + n ! "

0.05 (2)(1)

= RM13 000 1 + ! 2 "

= RM13 658.13

2. Encik Chandran mendeposit RM16 000 dalam akaun simpanan di sebuah bank yang memberi kadar

faedah 4.5% setahun dan dikompaun setiap dua bulan.

Encik Fuad deposited RM16 000 in a savings account in a bank that gives an interest rate of 4.5% per annum

and compounded every two months.

(a) Cari jumlah wang simpanan Encik Chandran pada akhir tahun kedua.

Find Mr Chandran’s total savings at the end of the second year.

(b) Cari jumlah faedah kompaun yang diterima oleh Encik Chandran.

Find the total compound interest received by Mr Chandran.

r nt

(a) MV = P 1 + n ! "

0.045 (6)(2)

= RM16 000 1 + ! 6 "

= RM17 500.91

(b) Jumlah faedah kompaun yang diterima oleh Encik Chandran

Total compound interest received by Mr Chandran

= RM17 500.91 – RM16 000

= RM1 500.91

28

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 28 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 58 – 59

Jawab setiap yang berikut.

Answer each of the following. SP3.1.2 TP4

1. Sebuah bank menawarkan kadar faedah 5.2% setahun untuk simpanan dalam akaun simpanan tetap.

Jika Puan Rafeah menyimpan RM12 000 pada awal tahun, hitung jumlah wang dalam akaun simpanan

tetap Puan Rafeah pada akhir tahun jika faedah dikompaunkan

A bank offers an interest rate of 5.2% per annum for savings in a fixed deposit account. If Puan Rafeah saves

RM12 000 at the beginning of the year, calculate the amount of money in Puan Rafeah’s fixed deposit account

at the end of the year if the interest is compounded

(a) 4 bulan sekali, (b) 2 bulan sekali.

once every 4 months, once every 2 months.

n=3 n=6

0.052

! "

(3)(1)

MV = RM12 000 1 + 0.052

! "

(6)(1)

3 MV = RM12 000 1 +

6

= RM12 634.88 = RM12 637.68

Berdasarkan penyelesaian di atas, apabila kekerapan pengkompaunan bertambah, nilai masa hadapan

simpanan juga bertambah .

Based on the above solutions, when the compounding frequency inreases, the future value of savings also

increases .

2. Encik Amirul mendeposit RM15 000 dalam akaun simpanan tetap di sebuah bank selama 3 tahun

dengan kadar faedah 4.8% setahun. Cari beza antara jumlah faedah yang diperoleh Encik Amirul jika

dia diberikan faedah kompaun yang dikompaun setiap bulan berbanding dengan faedah mudah.

Encik Amirul deposited RM15 000 in a fixed deposit account in a bank for 3 years with an interest rate of 4.8%

per annum. Find the difference between the amount of interest Encik Amirul earned if he was given compound

interest compounded monthly compared to simple interest.

Faedah mudah/Simple interest: Faedah kompaun/Compound interest:

4.8 0.048 (12)(3)

I = RM15 000 ×

100

×3 MV = RM15 000 1 +

12 ! "

= RM15 000 × 0.048 × 3 = RM17 318.29

= RM2 160 Jumlah faedah yang terkumpul

Total accumulated interest

= RM17 318.29 – RM15 000

= RM2 318.29

Rujuk Panduan Guru m.s. E1

Beza/Difference = RM2 318.29 – RM2 160

= RM158.29

Aktiviti PAK-21

Berdasarkan penyelesaian di atas, simpanan dengan faedah kompaun membawa pulangan yang

lebih tinggi daripada simpanan dengan faedah mudah.

Based on the above solutions, savings with compound interest gives higher returns than savings with

29 simple interest.

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 29 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan,

Kredit dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 59 – 61

Pautan Digital

A. Selesaikan yang berikut.

Solve the following. SP3.1.2 TP4

Encik Sofian menyimpan sejumlah wang dalam akaun simpanan di sebuah bank Islam, mengikut prinsip

wadiah selama satu tahun. Pada akhir tahun itu, dia menerima sebanyak RM25 800 sebagai pulangan

daripada simpanan tersebut. Jika peratus hibah yang diperoleh Encik Sofian ialah 3.2%, hitung jumlah

wang yang disimpan oleh Encik Sofian.

Encik Sofian saved an amount of money in a savings account in an Islamic bank, according to the principle of wadiah

for one year. By the end of the year, he received a sum of RM25 800 as a return from the savings. If the percentage

of hibah obtained by Encik Sofian is 3.2%, calculate the amount of money saved by Encik Sofian.

Katakan jumlah wang yang disimpan oleh Encik Sofian ialah RMy.

Let the amount of money saved by Encik Sofian be RMy.

y(1 + 3.2%) = 25 800

y(1 + 0.032) = 25 800

1.032y = 25 800

25 800

y=

1.032

= 25 000

Maka, jumlah wang yang disimpan oleh Encik Sofian ialah RM25 000.

Thus, the amount of money saved by Encik Sofian was RM25 000.

B. Hitung dividen yang diperoleh Encik Chong atas setiap pelaburan yang berikut.

Calculate the dividend obtained by Mr Chong on each of the following investments. SP3.1.3 TP3

Harga saham seunit Bilangan unit Kadar dividen Dividen

Share price per unit Number of units Dividend rate Dividend

5 × (6 000 × RM1.30)

RM1.30 6 000 5% 100

= RM390

4 × (9 000 × RM1.60)

1. RM1.60 9 000 4% 100

= RM576

6 × (10 000 × RM1.45)

2. RM1.45 10 000 6% 100

= RM870

5.5 × (8 500 × RM2.20)

3. RM2.20 8 500 5.5% 100

= RM1 028.50

30

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 30 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 60 – 61

Selesaikan setiap yang berikut.

Solve each of the following. SP3.1.3 TP4

1. Pada 1 Januari 2019, Encik Azuan melabur dalam Syarikat Megah sebanyak 6 000 unit saham yang

bernilai RM1.50 seunit. Bagi tahun kewangan berakhir 31 Disember 2019, Syarikat Megah membayar

dividen sebanyak 5%. Pada 1 Januari 2020, Encik Azuan menjual semua saham yang dimiliki dengan

harga RM1.80 seunit. Hitung nilai pulangan pelaburan bagi Encik Azuan.

On 1 January 2019, Encik Azuan invested 6 000 units of shares valued at RM1.50 per unit in Syarikat Megah.

For the financial year ending 31 December 2019, Syarikat Megah paid a dividend of 5%. On 1 January 2020,

Encik Azuan sold all the shares he owned at RM1.80 per unit. Calculate the return on investment for Encik Azuan.

Modal awal/Initial capital = 6 000 × RM1.50 = RM9 000

5

Dividen/Dividend = × RM9 000 = RM450

100

Peningkatan harga saham/Increase in share price = RM1.80 – RM1.50 = RM0.30

Keuntungan modal/Capital gain = RM0.30 × 6 000 = RM1 800

Jumlah pulangan/Total return = RM450 + RM1 800 = RM2 250

RM2 250

Nilai pulangan pelaburan/Return on investment = × 100% = 25%

RM9 000

2. Pada tahun 2018, Encik Vincent melabur dalam Syarikat Gemilang sebanyak 8 000 unit yang bernilai

RM1.20 seunit. Dia mendapat dividen RM150 sebanyak dua kali dan 3.5% bonus dalam tempoh dia

memegang unit saham itu. Selepas menjual semua unit saham itu, dia mendapat RM10 500. Hitung nilai

pulangan pelaburan bagi Encik Vincent.

In 2018, Mr Vincent invested 8 000 units of shares valued at RM1.20 per unit in Syarikat Gemilang. He received

dividend of RM150 twice and a bonus of 3.5% during the time he was holding the shares. After selling all the

units of shares, he received RM10 500. Calculate the return on investment for Mr Vincent.

Modal awal/Initial capital = 8 000 × RM1.20 = RM9 600

Dividen/Dividend = RM150 × 2 = RM300

3.5

Bonus = × RM9 600 = RM336

100

Keuntungan modal/Capital gain = RM10 500 – RM9 600 = RM900

Jumlah pulangan/Total return = RM300 + RM336 + RM900 = RM1 536

RM1 536

Nilai pulangan pelaburan/Return on investment = × 100% = 16%

RM9 600

31

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 31 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 62 – 63

Selesaikan setiap yang berikut.

Solve each of the following. SP3.1.3 TP4

Pada tahun 2015, Encik Yap membeli satu lot kedai dengan harga RM520 000. Dia membayar 10%

wang pendahuluan dan bakinya dibayar melalui pinjaman. Lot kedai tersebut disewakan selama

5 tahun dengan sewa bulanan sebanyak RM2 300. Encik Yap mengambil keputusan untuk menjual lot kedai

tersebut dengan harga RM980 000. Jumlah pinjaman yang dia masih berhutang kepada pihak bank berjumlah

RM416 000 manakala jumlah pinjaman yang telah dilunaskan kepada pihak bank berjumlah RM390 000.

Caj-caj lain yang terlibat dalam urusan jual beli adalah seperti berikut:

In 2015, Mr Yap bought a shoplot at a price of RM520 000. He paid 10% down payment and the balance was paid

through a loan. The shoplot was rented for 5 years with a monthly rental of RM2 300. Mr Yap decided to sell the shoplot

at RM980 000. The loan amount that he still owed to the bank was RM416 000 while the loan amount that has been

amortised to the bank was RM390 000. Other charges involved in the sale and purchase transactions are as follows:

Kos guaman/Legal cost RM13 000

Duti setem/Stamp duty RM13 000

Komisen ejen/Agent’s commission RM15 600

(a) Hitung keuntungan modal.

Calculate the capital gain.

10

Wang pendahuluan/Down payment = × RM520 000

100

= RM52 000

Keuntungan modal/Capital gain

= RM980 000 – RM52 000 – RM416 000 – RM390 000 – RM13 000 – RM13 000 – RM15 600

= RM80 400

(b) Hitung nilai pulangan pelaburan bagi Encik Yap.

Calculate the return on investment for Mr Yap.

Jumlah sewa/Total rent = RM2 300 × 5 × 12 bulan/months

= RM138 000

Jumlah pulangan/Total return = RM138 000 + RM80 400

= RM218 400

RM218 400

Nilai pulangan pelaburan/Return on investment = × 100%

RM520 000

= 42%

32

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 32 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 65 – 66

A. Padankan setiap yang berikut dengan pernyataan yang betul.

Match each of the following with the correct statements. SP3.1.4 TP2

Kemungkinan mengalami ketidakpastian

1. Kecairan dalam suatu pelaburan.

Liquidity The probability of having uncertainty in

an investment.

Keuntungan atau kerugian yang diperoleh

2. Risiko

daripada suatu pelaburan.

Risk

The profit or loss obtained from an investment.

Keupayaan menukar suatu simpanan,

3. Pulangan pelaburan atau aset menjadi wang tunai.

Return The ability of converting savings, investments

or assets into cash.

B. Nyatakan jenis pelaburan bagi setiap pernyataan yang berikut.

State the type of investment for each of the following statements. SP3.1.4 TP2

1. Tahap risiko rendah, tahap pulangan sederhana dan tahap kecairan tinggi. Amanah saham

Low risk level, moderate return level and high liquidity level. Unit trust

2. Tahap risiko rendah, tahap pulangan tinggi dan tahap kecairan rendah. Hartanah

Low risk level, high return level and low liquidity level. Real estate

3. Bebas risiko, tahap pulangan rendah dan tahap kecairan tinggi. Simpanan tetap

Risk free, low return level and high liquidity level. Fixed deposit

4. Tahap risiko tinggi, tahap pulangan tinggi dan tahap kecairan sederhana. Saham

High risk level, high return level and moderate liquidity level. Shares

C. Isi tempat kosong dengan perkataan ‘lebih rendah’ atau ‘lebih tinggi’.

Fill in the blanks with the word ‘lower’ or ‘higher’. SP3.1.4 TP2

1. Risiko saham adalah lebih tinggi daripada akaun simpanan.

The risk of shares is higher than the savings account.

2. Pulangan akaun simpanan tetap adalah lebih rendah daripada saham.

The return of fixed deposit account is lower than the shares.

3. Kecairan amanah saham adalah lebih tinggi daripada kecairan hartanah.

The liquidity of unit trust is higher than the liquidity of real estate.

33

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 33 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 67 – 69

Selesaikan setiap yang berikut.

Solve each of the following. SP3.1.5 TP4

Berikut ialah dua orang pelabur yang melabur dengan cara yang berbeza.

The following are two investors who invested using different strategies.

Encik Saya melabur RM8 000 secara sekali gus dengan membeli saham Syarikat Bestari yang

Benjamin berharga RM1.60 seunit.

Mr Benjamin I invested a lump sum of RM8 000 to purchase Syarikat Bestari shares at RM1.60 per unit.

Saya mempunyai RM8 000. Saya melabur secara berkala dan konsisten dalam setiap

Encik Mohan bulan dengan membeli saham Syarikat Bestari.

Mr Mohan I have RM8 000. I invested consistently on periodic basis each month to purchase Syarikat Bestari

shares.

Jadual di bawah menunjukkan harga saham yang dibeli oleh Encik Mohan mengikut bulan.

The table shows the share prices bought by Mr Mohan on a monthly basis.

Bulan/Month Januari/January Februari/February Mac/March April/April

Harga saham seunit (RM)

1.60 1.45 1.30 1.80

Share price per unit (RM)

(a) Hitung kos purata seunit dan jumlah saham yang dimiliki oleh Encik Benjamin dan Encik Mohan.

Calculate the average cost per share unit and the number of shares owned by Mr Benjamin and Mr Mohan.

(b) Siapakah pelabur yang bijak? Berikan justifikasi anda.

Who is a wise investor? Justify your answer.

(a) Encik Benjamin/Mr Benjamin:

Jumlah saham/Total shares = RM8 000 = 5 000 unit saham/share units

RM1.60

Kos purata seunit saham/Average cost per share = RM8 000 = RM1.60

5 000 unit saham/share units

Encik Mohan/Mr Mohan:

Bulan Jumlah pelaburan (RM) Harga seunit (RM) Bilangan unit saham

Month Total investment (RM) Price per unit (RM) Number of share units

Januari/January 2 000 1.60 1 250

Februari/February 2 000 1.45 1 379

Mac/March 2 000 1.30 1 538

April/April 2 000 1.80 1 111

Jumlah/Total 8 000 5 278

RM8 000

Kos purata seunit saham/Average cost per share = = RM1.52

5 278 unit/units

(b) Encik Mohan merupakan seorang pelabur yang bijak kerana mengamalkan strategi pemurataan yang boleh

membantu dia memiliki lebih banyak saham dengan jumlah wang yang sama.

Mr Mohan is a wise investor for practising the cost averaging strategy that helped him to accumulate more shares

with the same amount of money.

34

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 34 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 67 – 69

Selesaikan setiap yang berikut.

Solve each of the following. SP3.1.6 TP5

Pada 1 Januari 2019, Puan Aishah melabur RM500 saham Syarikat Makmur yang bernilai RM1.65 seunit.

Dia meneruskan pembelian tersebut secara konsisten sebanyak RM500 setiap bulan selama satu tahun.

Harga pembelian seunit saham adalah berbeza-beza bergantung kepada harga pasaran setiap bulan. Pada

31 Disember 2019, dia memiliki 4 054 unit saham tersebut.

On 1 January 2019, Puan Aishah invested RM500 of Syarikat Makmur shares valued at RM1.65 per unit. She continued

to purchase that particular shares consistently at RM500 each month for one year. The purchase price of the share per

unit varies depending on the market price each month. On 31 December 2019, she owned 4 054 units of the shares.

(a) Berapakah kos purata seunit saham yang dimiliki oleh Puan Aishah?

What is the average cost per share unit owned by Puan Aishah?

Jumlah pelaburan

Total investment

= RM500 × 12 bulan/months

= RM6 000

Kos purata seunit saham

Average cost per share unit

= RM6 000

4 054 unit/units

= RM1.48

(b) Jika Puan Aishah membeli saham tersebut sekali gus dengan RM6 000 pada 1 Januari 2019, hitung jumlah

unit saham yang diperoleh Puan Aishah.

If Puan Aishah purchased the shares with a lump sum of RM6 000 on 1 January 2019, calculate the total units of

shares obtained by Puan Aishah.

Jumlah unit saham yang diperoleh Puan Aishah

Total units of shares obtained by Puan Aishah

RM6 000

=

RM1.65

= 3 636 unit/units

(c) Bandingkan pelaburan secara berkala dan konsisten dan pelaburan secara sekali gus, yang manakah

pelaburan yang lebih baik? Berikan justifikasi anda.

Compare the investment on a periodic basis and consistently and the investment with a lump sum, which is the better

investment? Give your justification. KBAT Menilai

Pelaburan secara berkala dan konsisten adalah lebih baik kerana strategi pemurataan ini membolehkan

lebih banyak saham dimiliki dengan kos purata seunit yang lebih rendah.

Investment on a periodic basis and consistently is better because the cost averaging strategy enable more share

owned with a lower average cost per unit.

35

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 35 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.1 Simpanan dan Pelaburan Buku Teks: m.s. 70 – 72

Selesaikan yang berikut.

Solve the following. SP3.1.6 TP5

Berikut ialah dua orang pelabur yang melabur wang persaraan mereka.

The following are two investors investing their retirement money.

Encik Nazri menerima wang persaraan dari syarikatnya sebanyak RM500 000. Beliau menyimpan

RM200 000 dalam akaun simpanan tetap di sebuah bank dengan kadar faedah 4.2% setahun. Baki wang

persaraan digunakan untuk membeli saham Syarikat Maju. Pada tahun tersebut, syarikat itu mengistiharkan

dividen sebanyak 6%.

Encik Nazri received RM500 000 as gratuity from his company. He saved RM200 000 in a fixed deposit account at

a bank with an interest rate of 4.2% per annum. The balance of the gratuity is used to buy shares from Syarikat Maju.

In that year, the company declared a dividend of 6%.

Encik Saiful menerima wang persaraan dari syarikatnya sebanyak RM500 000. Beliau membeli sebuah

rumah dua tingkat dan menerima sewa bulanan sebanyak RM1 800.

Encik Saiful received RM500 000 as gratuity from his company. He bought a double-storey house and received

a monthly rental of RM1 800.

Siapakah pelabur yang bijak? Berikan justifikasi anda.

Who is a wise investor? Give your justification. KBAT Menilai

Encik Nazri:

Faedah simpanan tetap Dividen Nilai pulangan pelaburan (ROI)

Fixed deposit interest Dividend Return on investment (ROI)

4.2 6 RM26 400

× RM200 000 × RM300 000 ROI = × 100%

100 100 RM500 000

= RM8 400 = RM18 000 = 5.28%

Encik Saiful:

Sewa Nilai pulangan pelaburan (ROI)

Rental Return on investment (ROI)

RM21 600

RM1 800 × 12 bulan/months ROI = × 100%

RM500 000

= RM21 600

= 4.32%

Encik Nazri merupakan seorang pelabur yang bijak kerana nilai pulangan pelaburannya adalah lebih tinggi

berbanding Encik Saiful.

Encik Nazri is a wise investor because his return on investment value is higher than Encik Saiful.

36

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 36 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 73 – 74

A. Bulatkan jawapan yang betul bagi setiap pernyataan yang berikut.

Circle the correct answer for each of the following statements. SP3.2.1 TP1

Encik Rosli membayar balik pinjaman perumahannya di sebuah bank. Kredit Hutang

1.

Encik Rosli made repayment for his house loan at a bank. Credit Debt

Puan Mariya menggunakan kad kreditnya untuk membeli sebuah peti sejuk. Kredit Hutang

2.

Puan Mariya uses her credit card to buy a refrigerator. Credit Debt

Cik Geetha mendapat pinjaman peribadi daripada sebuah bank. Kredit Hutang

3.

Miss Geetha got a personal loan from a bank. Credit Debt

Encik Leong membuat pembayaran balik ke atas pinjaman keretanya. Kredit Hutang

4.

Mr Leong made repayment for his car loan. Credit Debt

B. Tandakan ‘✓’ bagi pernyataan yang menunjukkan pengurusan kredit dan hutang yang bijak atau ‘✗’ bagi

pengurusan kredit dan hutang yang tidak bijak.

Mark ‘✓’ for the statement that shows good management of credits and debts or ‘✗’ for the statement that shows

bad management of credits and debts. SP3.2.1 TP2

Puan Rozita sering membeli barangan yang bukan keperluannya dengan

1. menggunakan kad kredit. ✗

Puan Rozita often buys unnecessary items using her credit card.

Puan Dahlia merancang belanjawan bulanannya dengan cermat.

2. ✓

Puan Dahlia plans her monthly budget carefully.

Encik Stanley memastikan baki tunggakan kad kreditnya dilangsaikan sebelum

3. tempoh tanpa faedah tamat. ✓

Mr Stanley makes sure his credit card balance is settled before the due date of the

interest free period.

Cik Ng selalu menggunakan kad kreditnya untuk membeli barangan berjenama

4. dan sering lewat membayar baki tunggakan kad kreditnya. ✗

Miss Ng always uses her credit card to buy branded goods and is often late in paying

her credit card balance.

37

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 37 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan,

Kredit dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 75

Pautan Digital

A. Padankan yang berikut.

Match the following. SP3.2.2 TP2

1. Mudah digunakan untuk 5. Memberi tempoh bayar

pembelian atas talian. balik tanpa faedah.

Easy to use for online Provide interest free

purchases. payback period.

2. Mudah berbelanja 6. Boleh dikenakan faedah

Kelebihan

melebihi kemampuan. Kad Kredit dan caj-caj.

Easy to spend beyond Advantages of Interest and other charges

ability. Credit Card could be imposed.

3. Boleh menikmati sistem 7. Pembayaran boleh

ganjaran. Kekurangan

dibuat tanpa tunai.

Can enjoy a reward Kad Kredit Cashless payment can be

system. Disadvantages of made.

Credit Card

4. Kadar faedah yang 8. Sesetengah kedai tidak

tinggi. menerima pembayaran

High interest rates. melalui kad kredit.

Some stores do not accept

credit payment.

B. Nyatakan ‘Benar’ atau ‘Palsu’ bagi setiap pernyataan yang berikut.

State ‘True’ or ‘False’ for the following statements. SP3.2.2 TP2

Pernyataan Benar/Palsu

Statement True/False

Kontrak dan syarat-syarat kad kredit sukar difahami dan boleh

Benar

1. mengelirukan.

The contract and conditions of the credit card are difficult to understand and True

can be misleading.

Kadar faedah yang dikenakan ke atas penggunaan kad kredit adalah

Palsu

2. sangat rendah.

False

The interest rate charged on the use of credit card is very low.

Penggunaan kad kredit menggalakkan perbelanjaan melebihi kemampuan

Benar

3. kewangan pemegang kad kredit.

The use of credit card encourages spending beyond credit cardholder’s financial True

ability.

38

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 38 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 76 – 77

Selesaikan yang berikut.

Solve the following. SP3.2.3 TP4

Encik Hafiz menerima penyata kad kredit untuk bulan April 2019 dari sebuah bank. Penyata menunjukkan Encik

Hafiz mempunyai baki tertunggak sebanyak RM3 600. Anggapkan bahawa Encik Hafiz tidak menggunakan

kad kredit dalam bulan Mei dan bayaran minimum adalah 5% daripada jumlah baki akhir penyata kad kredit,

atau minimum RM50.

Encik Hafiz received the credit card statement for April 2019 from a bank. The statement shows that Encik Hafiz has an

outstanding balance of RM3 600. Assume that Encik Hafiz did not use his credit card in May and the minimum payment

is 5% of the total balance of the credit card statement, or minimum RM50.

(a) Berapakah bayaran minimum yang harus dibayar oleh Encik Hafiz?

What is the minimum payment to be paid by Encik Hafiz?

5% daripada jumlah akhir penyata kad kredit/5% of the total balance of the credit card statement

= 5 × RM3 600 = RM180

100

Jumlah ini melebihi RM50, maka bayaran minimum yang harus dibayar oleh Encik Hafiz ialah RM180.

This amount exceeds RM50, thus the minimum payment to be paid by Encik Hafiz is RM180.

(b) Diberi bahawa bank mengenakan caj kewangan sebanyak 18% setahun. Jika Encik Hafiz hanya membuat

bayaran minimum untuk bulan April dan tarikh penyata ialah 15 hari daripada tarikh tamat tempoh tanpa

faedah, hitung jumlah baki tertunggak dalam penyata bulan Mei untuk Encik Hafiz.

Given that the bank charged a finance charge of 18% per annum. If Encik Hafiz only makes a minimum payment for

April and the statement date is 15 days from the expiry date of the interest free period, calculate the total outstanding

balance in May statement for Encik Hafiz.

Baki belum dijelaskan/Outstanding balance = RM3 600 – RM180 = RM3 420

Faedah yang dikenakan/Interest charged = RM3 420 × 18 × 15 = RM25.30 ! " ! "

100 365

Jumlah baki tertunggak dalam bulan Mei/Total outstanding balance in May

= RM3 420 + RM25.30

= RM3 445.30

(c) Jika Encik Hafiz gagal membuat sebarang pembayaran untuk bulan April dan bank mengenakan caj

bayaran lewat sebanyak 1% daripada jumlah baki tertunggak atau minimum RM10, hitung jumlah baki

tertunggak dalam penyata bulan Mei untuk Encik Hafiz.

If Encik Hafiz failed to make any payment for the month of April and the bank imposed a late payment charge of

1% of total outstanding balance or minimum RM10, calculate the total outstanding balance in May statement for

Encik Hafiz.

Baki belum dijelaskan/Outstanding balance = RM3 600

Faedah yang dikenakan/Interest charged = RM3 600 × 18 × 15 = RM26.63 ! " ! "

100 365

Caj bayaran lewat/Late payment charges = 1 × (RM3 600 + RM26.63) = RM36.27 ! "

100

Jumlah baki tertunggak dalam bulan Mei/Total outstanding balance in May

39 = RM3 600 + RM26.63 + RM36.27 = RM3 662.90

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 39 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 76 – 77

Selesaikan yang berikut.

Solve the following. SP3.2.3 TP4 TP5

1. Puan Azimah membeli sebuah televisyen yang berharga RM2 650 dengan menggunakan kad kredit pada

bulan Februari. Dia terlupa untuk membuat bayaran balik dan tarikh penyata ialah 15 hari daripada tarikh

tamat tempoh tanpa faedah. Bank mengenakan caj kewangan 18% setahun dan caj bayaran lewat 1%

daripada jumlah baki tertunggak atau minimum RM10. Anggapkan Puan Azimah tidak menggunakan

kad kredit sebelum dan selepas pembelian televisyen itu. Hitung jumlah baki dalam penyata bulan Mac

untuk Puan Azimah.

Puan Azimah bought a television costing RM2 650 using credit card in February. She forgot to make repayment

and the statement date was 15 days from the due date of interest free period. The bank charged a finance charge

of 18% per annum and late payment charge 1% of the outstanding balance or minimum RM10. Assume that Puan

Azimah did not use credit card before and after purchasing the television. Calculate the total balance in March

statement for Puan Azimah.

Baki belum dijelaskan/Outstanding balance = RM2 650

Faedah yang dikenakan/Interest charged = RM2 650 × 18 × 15 = RM19.60 ! " ! "

100 365

Caj bayaran lewat/Late payment = 1 × (RM2 650 + RM19.60) = RM26.70

100

Jumlah baki tertunggak dalam bulan September/Total outstanding balance in September

= RM2 650 + RM19.60 + RM26.70 = RM2 696.30

2. Encik Gan membeli sebuah komputer yang berharga RM3 280 dengan menggunakan kad kredit pada

bulan Ogos. Dia hanya membuat bayaran minimum sebanyak RM164 dan tarikh penyata ialah 15 hari

daripada tarikh tamat tempoh tanpa faedah. Bank mengenakan caj kewangan 18% setahun dan caj

bayaran lewat 1% daripada baki tertunggak.

Mr Gan bought a computer costing RM3 280 using credit card in August. He only made minimum repayment of

RM164 and the statement date was 15 days from the due date of interest free period. The bank charged a finance

charge of 18% per annum and late payment charge 1% of the outstanding balance.

(a) Berapakah jumlah baki tertunggak dalam penyata bulan September untuk Encik Gan?

What is the total outstanding balance in the September statement for Mr Gan?

(b) Jika Encik Gan membayar jumlah baki tertunggak pada bulan September, hitung beza amaun yang

dibayar untuk komputer itu antara pembelian secara kad kredit dengan pembelian secara tunai.

If Mr Gan paid the outstanding balance in September, calculate the difference in the amount paid for the

computer between purchase by credit card payment and purchase by cash payment.

KBAT Mengaplikasi

(a) Baki belum dijelaskan/Outstanding balance = RM3 280 – RM164 = RM3 116

Faedah yang dikenakan/Interest charged = RM3 116 × 18 × 15 = RM23.05 ! " ! "

100 365

Jumlah baki tertunggak dalam bulan September/Total outstanding balance in September

= RM3 116 + RM23.05 = RM3 139.05

(b) Jumlah pembayaran dengan kad kredit/Total credit card payment = RM164 + RM3 139.05

= RM3 303.05

Bayaran secara tunai/Cash payment = RM3 280

Beza bayaran yang dibuat/Difference in the amount paid = RM3 303.05 – RM3 280 = RM23.05 40

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 40 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 77

Selesaikan setiap yang berikut.

Solve each of the following. SP3.2.4 TP5

1. Sarah melancong ke Australia bersama keluarganya. Dia menggunakan kad kredit untuk membuat suatu

pembelian dengan harga AUD170 (mata wang Australia) semasa berada di sana. Bank mengenakan

Sarah RM510 bagi pembelian tersebut yang termasuk caj tambahan 2% bagi penukaran mata wang

asing. Hitung kadar pertukaran mata wang untuk dolar Australia yang bersamaan dengan satu ringgit

Malaysia.

Sarah travelled to Australia with her family. She used credit card for a purchase at a price of AUD170 (Australia

currency) while she was there. The bank charged Sarah RM510 for the purchase which included 2% additional

charge on foreign currency exchange. Calculate the currency exchange rate for Australian dollar which equals

to one Malaysian ringgit. KBAT Menganalisis

Katakan RMx ialah harga asal pembelian dalam ringgit Malaysia.

Let RMx be the original price of the purchase in Malaysian ringgit.

x + 0.02x = 510

1.02x = 510

x = 500 RM500 = AUD170

AUD170

Maka/Thus, RM1 = × RM1 = AUD0.34

RM500

2. Encik Brian membuat pembelian atas talian dari laman web luar negara untuk seutas jam tangan yang

berharga USD280 melalui transaksi kad kreditnya. Pada hari pembelian jam tangan tersebut, kadar

pertukaran mata wang asing adalah USD1.00 bersamaan dengan RM4.10. Bank mengenakan caj

tambahan 2% ke atas setiap transaksi daripada luar negara. Jika Encik Brian dibenarkan membayar

secara ansuran selama 12 bulan dengan kadar faedah 18% setahun, hitung

Mr Brian made an online purchase from an oversea website for a watch costing USD280 via credit card transaction.

On the purchase day of the watch, the foreign currency exchange rate was USD1.00 equals to RM4.10. The bank

charged an additional charge of 2% on each transaction from abroad. If Mr Brian is allowed to pay by instalment

for 12 months with an interest rate of 18% per annum, calculate

(a) jumlah wang yang perlu dibayar oleh Encik Brian untuk jam tangan itu,

the total amount of money that Mr Brian needs to pay for the watch,

(b) bayaran ansuran bulanan bagi jam tangan itu.

the monthly instalment for the watch. KBAT Menganalisis

(a) Harga jam tangan/Price of the watch = 280 × RM4.10 = RM1 148

2

Caj tambahan/Additional charge = × RM1 148 = RM22.96

100

18

Faedah tahunan/Yearly interest = × RM1 148 = RM206.64

100

Jumlah wang yang perlu dibayar oleh Encik Brian untuk jam tangan itu

Total amount of money that Mr Brian needs to pay for the watch

= RM1 148 + RM22.96 + RM206.64 = RM1 377.60

(b) Bayaran ansuran bulanan bagi jam tangan itu/Monthly instalment for the watch

= RM1 377.60 ÷ 12 bulan/months = RM114.80

41

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 41 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 78

NOTA

Rumus untuk mengira jumlah bayaran balik pinjaman: A = Jumlah bayaran balik/Total repayment

Formula to calculate the total amount of loan repayment: P = Prinsipal/Principal

r = Kadar faedah/Interest rate

A = P + Prt t = Masa dalam tahun/Time in years

Selesaikan setiap yang berikut.

Solve each of the following. SP3.2.5 TP3 TP4

1. Encik Yusuf membeli sebuah kereta bernilai RM72 000. Dia membayar RM7 200 sebagai wang

pendahuluan dan bakinya dia mendapat pinjaman daripada sebuah bank untuk tempoh 9 tahun dengan

kadar faedah sama rata 2.85% setahun. Berapakah bayaran ansuran bulanan yang perlu dibayar oleh

Encik Yusuf?

Encik Yusuf bought a car worth RM72 000. He paid RM7 200 down payment and got a loan for the balance

from a bank for a period of 9 years with a flat interest rate of 2.85% per annum. What is the monthly instalment

payable by Encik Yusuf?

Jumlah pinjaman/Total loan = RM72 000 – RM7 200

= RM64 800

Jumlah bayaran balik/Total repayment = RM64 800 + RM64 800 × 2.85 × 9 ! "

100

= RM81 421.20

Bayaran ansuran bulanan/Monthly instalment = RM81 421.20

108 bulan/months

= RM753.90

2. Encik Kumaran membuat pinjaman peribadi sebanyak RM18 000 dari Bank Bersatu dan tempoh bayar

balik adalah selama 5 tahun. Jika jumlah bayaran balik Encik Kumaran ialah RM22 680, hitung kadar

faedah tahunan yang dikenakan oleh bank itu.

Mr Kumaran obtained a personal loan of RM18 000 from Bank Bersatu and the payback period is 5 years. If Mr

Kumaran’s total repayment was RM22 680, calculate the yearly interest rate imposed by the bank.

Katakan x% ialah kadar faedah tahunan yang dikenakan oleh bank.

Let x% be the yearly interest rate imposed by the bank.

A = P + Prt

x

22 680 = 18 000 + 18 000 × ! 100

×5 "

22 680 = 18 000 + 900x

900x = 4 680

x = 5.2

Maka, kadar faedah yang dikenakan oleh bank ialah 5.2%.

Thus, the yearly interest rate imposed by the bank is 5.2%.

42

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 42 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 78

Selesaikan setiap yang berikut.

Solve each of the following. SP3.2.6 TP4

1. Encik Khairul meminjam sejumlah wang dari sebuah bank untuk kegunaan peribadi dengan kadar faedah

4.5% setahun. Tempoh bayaran balik adalah selama 6 tahun. Jika jumlah faedah yang perlu dibayar ialah

RM6 750, hitung jumlah wang yang dipinjam oleh Encik Khairul.

Encik Khairul borrows a sum of money from a bank for personal use with an interest rate of 4.5% per annum.

The payback period is 6 years. If the amount of interest payable is RM6 750, calculate the amount of money

borrowed by Encik Khairul.

Katakan RMx ialah jumlah wang yang dipinjam oleh Encik Khairul.

Let RMx be the amount of money borrowed by Encik Khairul.

A = P + Prt

4.5

x + 6 750 = x + !x × × 6"

100

x + 6 750 = x + 0.27x

0.27x = 6 750

x = 25 000

Maka, jumlah wang yang dipinjam oleh Encik Khairul ialah RM25 000.

Thus, the amount of money borrowed by Encik Khairul was RM25 000.

2. Encik Soh membuat pinjaman peribadi sebanyak RM24 000 dari bank P dengan kadar faedah 4.2%

setahun bagi 7 tahun manakala Encik Jamil membuat pinjaman peribadi dengan amaun yang sama dari

bank Q dengan kadar 5.5% setahun bagi 7 tahun. Berapakah beza antara jumlah faedah yang dibayar

oleh Encik Soh dan Encik Jamil?

Mr Soh takes a personal loan of RM24 000 from bank P with an interest rate of 4.2% per annum for 7 years

whereas Encik Jamil takes the same amount of personal loan from bank Q with a rate of 5.5% per annum for

7 years. What is the difference between the total interest paid by Mr Soh and Encik Jamil?

Jumlah faedah yang dibayar oleh Encik Soh/Total interest paid by Mr Soh

4.2

= RM24 000 × ×7

100

= RM7 056

Jumlah faedah yang dibayar oleh Encik Jamil/Total interest paid by Encik Jamil

5.5

= RM24 000 × ×7

100

= RM9 240

Beza antara jumlah faedah yang dibayar/Difference between the total interest paid

= RM9 240 – RM7 056

= RM2 184

43

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 43 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

BAB 3: Matematik Pengguna: Simpanan dan Pelaburan, Kredit

dan Hutang

Consumer Mathematics: Savings and Investments, Credit and Debt

PBD 3.2 Pengurusan Kredit dan Hutang Buku Teks: m.s. 78 – 81

Selesaikan setiap yang berikut.

Solve each of the following. SP3.2.6 TP5

1. Encik Jeffrey ingin mengubah suai rumahnya. Dia membuat pinjaman peribadi sebanyak RM45 000 dari

sebuah bank dengan kadar faedah 5% setahun dan tempoh bayar balik ialah 6 tahun.

Mr Jeffrey wants to renovate his house. He takes a personal loan of RM45 000 from a bank with an interest rate

of 5% per annum and the payback period is 6 years.

(a) Berapakah ansuran bulanan yang perlu dibayar oleh Encik Jeffrey?

What is the monthly instalment payable by Mr Jeffrey?

(b) Jika Encik Jeffrey ingin mengurangkan satu tahun daripada tempoh bayar balik pinjaman, hitung

jumlah wang yang perlu ditambah kepada ansuran yang sedia ada.

If Mr Jeffrey wants to reduce one year from the loan repayment period, calculate the amount of money needs

to be added to the existing instalment. PENDIDIKAN SIVIK

Bertanggungjawab

(a) Jumlah bayaran balik/Total repayment (b) Jumlah bayaran balik/Total repayment

5 5

= RM45 000 + !RM45 000 × × 6" = RM45 000 + !RM45 000 × × 5"

100 100

= RM45 000 + RM13 500 = RM45 000 + RM11 250

= RM58 500 = RM56 250

Bayaran ansuran bulanan Bayaran ansuran bulanan/Monthly instalment

Monthly instalment RM56 250

RM58 500 = = RM937.50

= 5 × 12

6 × 12 Wang yang perlu ditambah

= RM812.50 Amount of money needs to be added

= RM937.50 – RM812.50 = RM125

2. Cik Nora membuat pinjaman peribadi sebanyak RM20 000 dari sebuah bank dengan kadar faedah

4.5% atas baki. Tempoh bayaran balik adalah selama 8 tahun manakala ansuran bulanan adalah sebanyak

RM275. Berapakah jumlah faedah yang perlu dibayar oleh Cik Nora bagi dua bulan pertama?

Cik Nora wants to make a personal loan of RM20 000 from a bank with an interest rate of 4.5% on the balance. The

repayment period is 8 years while the monthly instalment is RM275. What is the amount of interest payable by Cik Nora

for the first two months? KBAT Mengaplikasi

4.5 1

Faedah bulan pertama/First month interest = RM20 000 × × = RM75

100 12

Jumlah pinjaman pada akhir bulan pertama/Loan at the end of first month = RM20 000 + RM75

= RM20 075

Baki selepas bayaran ansuran bulan pertama/Balance after first instalment = RM20 075 – RM275

= RM19 800

Jumlah baki pinjaman pada awal bulan kedua = RM19 800

Balance of the loan at the beginning of second month

4.5 1

Faedah bulan kedua/Second month interest = RM19 800 × × = RM74.25

100 12

Jumlah faedah bagi dua bulan pertama/Total interest for the first two months

= RM75 + RM74.25 = RM149.25 44

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 44 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PRAKTIS PT3 (3)

PT3 Bahagian A 5. Keupayaan menukar suatu simpanan, pelaburan

atau aset menjadi wang tunai ialah

1. Apakah jenis simpanan yang memberi kemudahan The ability of converting savings, investments or

overdraf? assets into cash is

What type of savings provides overdraft facility? A faedah/interest. B kecairan/liquidity.

A Akaun simpanan/Savings account C pulangan/return. D risiko/risk.

B Akaun simpanan tetap/Fixed deposit account

C Akaun simpanan semasa/Current account 6. Encik Fahmi bercadang untuk menyimpan

D Akaun asset/Assets account RM20 000 dengan kadar faedah 5% setahun di

satu daripada bank berikut:

2. Encik Tan merupakan pemilik sebuah kilang. Encik Fahmi decided to save RM20 000 with an

Dia membuat pembayaran kepada pembekalnya interest rate of 5% per annum in one of the following

dengan menggunakan cek. Apakah jenis simpanan banks:

yang paling sesuai untuk Encik Tan?

Mr Tan is the owner of a factory. He makes payments Bank P: Faedah dikompaunkan 4 bulan sekali.

to his suppliers using cheques. What type of savings Interest is compounded once every

is most suitable for Mr Tan? 4 months.

A Akaun semasa/Current account Bank Q: Faedah dikompaunkan setiap bulan.

B Akaun simpanan/Savings account Interest is compounded once a month.

C Akaun simpanan tetap/Fixed deposit account Bank R: Faedah dikompaunkan setiap suku

D Amanah saham/Unit trust tahun.

Interest is compounded quarterly.

3. Antara berikut, yang manakah merupakan Bank S: Faedah dikompaunkan setiap setengah

pulangan bagi amanah saham? tahun.

Which of the following are the returns for unit trusts? Interest is compounded once every half

I Syer bonus/Bonus shares year.

II Dividen/Dividend

III Sewa/Rental Bank manakah yang patut Encik Fahmi pilih

IV Keuntungan modal/Capital gain untuk mendapat faedah yang paling tinggi pada

A I dan/and II B I, II dan/and III akhir tahun?

C I, II dan/and IV D I, II, III dan/and IV Which bank should Encik Fahmi choose to obtain the

highest interest at the end of the year?

4. Antara berikut, yang manakah merupakan A Bank P

kelemahan penggunaan kad kredit? B Bank Q

Which of the following are the disadvantages of using C Bank R

credit card? D Bank S

I Mudah untuk pembelian atas talian.

Convenience for online purchases. 7. Antara berikut, yang manakah mempunyai tahap

II Boleh dikenakan faedah dan caj-caj. risiko yang tinggi, tahap pulangan yang tinggi

Could be imposed interest and charges. dan tahap kecairan yang sederhana?

III Memberi tempoh bayar balik tanpa faedah. Which of the following has a high risk level, a high

Provide interest free payback period. return level and a moderate liquidity level?

IV Mudah berbelanja melebihi kemampuan. A Saham/Shares

Easy to spend beyond ability. B Amanah saham/Unit trust

A I dan/and II B I dan/and III C Hartanah/Real estate

C II dan/and III D II dan/and IV D Simpanan tetap/Fixed deposit

45

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 45 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

8. Encik Wee membayar ansuran bulanan sebanyak RM1 145 untuk pinjaman keretanya. Bank mengenakan

kadar faedah 2.9% setahun untuk tempoh selama 5 tahun. Hitung jumlah pinjaman keretanya.

Mr Wee paid a monthly instalment of RM1 145 for his car loan. The bank charged an interest rate of 2.9% for a

period of 5 years. Calculate the total amount of his car loan.

A RM55 000

B RM60 000

C RM60 145

D RM61 145

9. Encik Hilmi melabur dalam Syarikat Bakti sebanyak 6 000 unit saham yang bernilai RM1.50 seunit.

Syarikat itu kemudian mengisytiharkan dividen sebanyak 4%. Selepas menerima dividen itu, Encik Hilmi

menjual semua saham yang dimiliki dengan harga RM1.80 seunit. Hitung nilai pulangan pelaburan bagi

Encik Hilmi.

Encik Hilmi invested 6 000 units of shares valued at RM1.50 per unit in Syarikat Bakti. The company then declared

a dividend of 4%. After receiving the dividend, Encik Hilmi sold all the shares at the price of RM1.80 per unit.

Calculate the return on investment for Encik Hilmi.

A 20%

B 22%

C 24%

D 25%

PT3 Bahagian B

10. (a) Tandakan ( ✓ ) pada simpanan yang boleh memperoleh faedah.

Mark ( ✓ ) for savings that can receive interest.

[2 markah/2 marks]

Akaun simpanan

✓

Savings account

Akaun semasa

Current account

Akaun simpanan tetap

✓

Fixed deposit account

(b) Bulatkan jenis pelaburan yang betul.

Circle the correct types of investments.

[2 markah/2 marks]

Akaun simpanan tetap Hartanah Amanah saham Akaun semasa

Fixed deposit account Real estate Unit trust Current account

11. Lengkapkan pengiraan faedah kompaun yang berikut.

Complete the following compound interest calculation.

[4 markah/4 marks]

0.04

MV = RM6 000 ! 1 +

2 "( 2 )(6)

1.02 12

= RM6 000

= RM7 609.45

46

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 46 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

12. Tentukan sama ada setiap pernyataan berikut ‘Benar’ atau ‘Palsu’. Tandakan ( ✓ ) pada jawapan yang

betul.

Determine whether each of the following statements is ‘True’ or ‘False’. Mark ( ✓ ) for the correct answer.

[4 markah/4 marks]

(a) Faedah sama rata dikira pada jumlah pinjaman asal dan jumlah faedah setiap bulan adalah tetap

sehingga akhir tempoh pinjaman.

A flat rate interest is calculated on the original loan and the total interest each month is fixed till the end of

the loan period.

Benar Palsu

✓

True False

(b) Faedah kompaun dikira hanya pada jumlah wang simpanan.

A compound interest is calculated only on the deposited amount.

Benar Palsu

✓

True False

(c) Faedah atas baki digunakan dalam pengiraan pinjaman kereta.

An interest on balance is used in calculating car loan.

Benar Palsu

✓

True False

(d) Faedah mudah ialah ganjaran yang diberikan kepada penyimpan mengikut suatu kadar tertentu ke atas

jumlah deposit untuk suatu tempoh masa yang tertentu.

A simple interest is a reward given to the depositor at a certain rate on the deposit amount for a certain period

of time.

Benar Palsu

✓

True False

13. (a) Isi tempat kosong dengan ‘tinggi’ atau ‘rendah’.

Fill in the blank with ‘higher’ or ‘lower’.

[1 markah/1 mark]

Pelaburan memberi pulangan yang lebih tinggi daripada simpanan.

Investment gives a higher return than savings.

(b) Padankan setiap pernyataan yang berikut dengan rumus yang betul.

Match each of the following statements with the correct formula.

[3 markah/3 marks]

Faedah kompaun

(i) A = P + Prt

Compound interest

Faedah mudah r nt

(ii) Simple interest

MV = P 1 + n ! "

Jumlah bayaran balik pinjaman

(iii) Total loan repayment I = Prt

47

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 47 11/25/20 9:25 AM

Nama: ........................................................................................... Kelas: ..................................... Tarikh: .....................................

PT3 Bahagian C

14. (a) (i) Vivian menyimpan sebanyak RM6 000 di sebuah bank dengan kadar faedah 4% setahun.

Berapakah faedah yang diperoleh Vivian selepas 8 bulan?

Vivian deposited RM6 000 in a bank with an interest rate of 4% per annum. How much is the interest

earned by Vivian after 8 months?

[2 markah/2 marks]

Faedah yang diperoleh Vivian

Interest earned by Vivian

4 8

= RM6 000 × × = RM160

100 12

(ii) Pada tahun 2019, Encik Hilmi melabur dalam Syarikat Cemerlang sebanyak 4 000 unit syer yang

bernilai RM1.30 seunit. Pada akhir tahun itu, syarikat itu telah mengistiharkan dividen sebanyak

5.5%. Hitung jumlah dividen yang diperoleh Encik Hilmi.

In the year 2019, Encik Hilmi invested in Syarikat Cemerlang a total of 4 000 units of shares worth

RM1.30 per unit. At the end of the year, the company declared a dividend of 5.5%. Calculate the amount

of dividend received by Encik Hilmi.

[2 markah/2 marks]

Dividen/Dividend

5.5

= × (4 000 × RM1.30)

100

5.5

= × RM5 200 = RM286

100

(b) Nazri mendeposit RM20 000 ke dalam akaun simpanan di sebuah bank dengan kadar faedah 6% untuk

PT3 tempoh 3 tahun. Faedah dikompaun 4 bulan sekali. Hitung nilai matang yang diperoleh Nazri.

KLON

Nazri deposits RM20 000 into a saving account at a bank with an interest rate of 6% for 3 years. The interest

is compounded once 4 months. Calculate the maturity value obtained by Nazri.

[2 markah/2 marks]

Nilai matang/Maturity value

0.06 (3)(3)

= RM20 000 1 +

3 ! "

= RM200 000(1.02)9 = RM23 901.85

(c) Zahid ingin membeli sebuah kereta yang berharga RM84 000 dan dia telah menjelaskan 9% wang

PT3 pendahuluan daripada harga kereta. Bank telah meluluskan pinjaman dengan kadar 2.95% setahun

KLON

untuk 7 tahun. Hitung jumlah pinjaman yang perlu dibayar balik oleh Zahid.

Zahid wants to buy a car at a price of RM84 000 and he has put 9% down payment from the price of the car.

Bank has approved the loan with an interest rate of 2.95% per annum for 7 years. Calculate the total loan

needed to be repaid by Zahid.

[4 markah/4 marks]

Bayaran pendahuluan/Down payment

9

= × RM84 000 = RM7 560

100

Jumlah pinjaman/Loan amount

= RM84 000 – RM7 560 = RM76 440

Faedah untuk 7 tahun/Interest for 7 years

2.95

= RM76 440 × × 7 = RM15 784.86

100

Jumlah bayaran balik/Total repayment

= RM76 440 + RM15 784.86 = RM92 224.86

48

03 MAMD MATEMATIK TG3 (NM)-BAB 3-Azie F.indd 48 11/25/20 9:25 AM

You might also like

- Conquer! Matematik - Buku 1 - Tingkatan 3 Pages 29 54Document26 pagesConquer! Matematik - Buku 1 - Tingkatan 3 Pages 29 54bruh bruhNo ratings yet

- Tingkatan 3 Matematik Bab 3Document48 pagesTingkatan 3 Matematik Bab 3Mohd Faizal79% (185)

- 60 8 Matematik Tingkata 3 8 Matematik Tingkata 3Document36 pages60 8 Matematik Tingkata 3 8 Matematik Tingkata 3ZhiYing BoeyNo ratings yet

- MODUL PDPC T3 2023 - BAB 3 SIMPANAN DAN PELABURAN, KREDIT DAN HUTANG LandscapeDocument30 pagesMODUL PDPC T3 2023 - BAB 3 SIMPANAN DAN PELABURAN, KREDIT DAN HUTANG LandscapeSALINI BINTI OTHMAN KPM-GuruNo ratings yet

- MT T3 KSSM BAB 3 Matematik Pengguna Simpanan Dan Pelaburan, KreditDocument147 pagesMT T3 KSSM BAB 3 Matematik Pengguna Simpanan Dan Pelaburan, KreditOmar Danni AhmadNo ratings yet

- Bab 3 Simpanan Dan Pelaburan NotaDocument9 pagesBab 3 Simpanan Dan Pelaburan NotaFara Kamarudin100% (1)

- TINGKATAN 3 Matematik BAB 3Document51 pagesTINGKATAN 3 Matematik BAB 3MAHFUZAH MAHMUDNo ratings yet

- Nota K7 BPP3023Document5 pagesNota K7 BPP3023Zafirah yunusNo ratings yet

- 3.1 Simpanan Dan PelaburanDocument53 pages3.1 Simpanan Dan Pelaburansofeah solehah100% (2)

- Bab 3Document4 pagesBab 3MrizHj Mohamed Idris IbrahimNo ratings yet

- t3 Latihan Maths Bab 3 - CompressDocument4 pagest3 Latihan Maths Bab 3 - Compresssyakir ichigoNo ratings yet

- T3 Latihan Maths Bab 3Document4 pagesT3 Latihan Maths Bab 3Seaon Wong Hoi Kit100% (12)

- Makalah Bab 3 Investasi Pada Efek Tertentu (Kel 1, AKUNTANSI 4B)Document14 pagesMakalah Bab 3 Investasi Pada Efek Tertentu (Kel 1, AKUNTANSI 4B)Gledys Jatitesih GNo ratings yet

- Math PenggunaDocument23 pagesMath PenggunaFadilah IlaNo ratings yet

- Bab 3Document3 pagesBab 3abc xyzNo ratings yet

- Nota Matematik Tingkatan 3 Bab 3Document7 pagesNota Matematik Tingkatan 3 Bab 3Low Shuen YuNo ratings yet

- Awareness Course Coa Negeri SembilanDocument170 pagesAwareness Course Coa Negeri SembilanbhanuNo ratings yet

- Math PresentationDocument10 pagesMath Presentationashraf samsuddinNo ratings yet

- Matematik Pengguna Simpanan Dan Pelaburan - MatDocument1 pageMatematik Pengguna Simpanan Dan Pelaburan - MatHAKIMAH BINTI MAT SALLEH MoeNo ratings yet

- Kursus Intensif JTW113 24Document30 pagesKursus Intensif JTW113 24sitirabitah908No ratings yet

- Senarai Tugasan Bab 4Document5 pagesSenarai Tugasan Bab 4Mohd Arif Abdul GhaniNo ratings yet

- Makalah Aspek KeuanganDocument24 pagesMakalah Aspek KeuanganAnggi Purwati muntheNo ratings yet

- NK 04 Business FinanceDocument9 pagesNK 04 Business FinanceMuhammad AriffNo ratings yet

- Akaun Simpanan Dan Pelaburan Dalam Sistem Perbankan IslamDocument12 pagesAkaun Simpanan Dan Pelaburan Dalam Sistem Perbankan IslamEzry Fahmy100% (12)

- Bab 6 Analisa Penyata KewanganDocument95 pagesBab 6 Analisa Penyata KewanganzahiruddinNo ratings yet

- 2022 Matematik RPT t3Document13 pages2022 Matematik RPT t3khalidNo ratings yet

- Modul 7 - EX7 (Answer)Document7 pagesModul 7 - EX7 (Answer)张佳文No ratings yet

- Awfar-PDSMal Aug2022Document4 pagesAwfar-PDSMal Aug2022sufiansynergy groupNo ratings yet

- Nota Eko F4 Bab 3Document14 pagesNota Eko F4 Bab 3ehm252525No ratings yet

- MyNOTE Prinsip AkaunDocument35 pagesMyNOTE Prinsip AkaunzarinaadenaNo ratings yet

- Modul Pelupusan Aset Bukan SemasaDocument5 pagesModul Pelupusan Aset Bukan SemasaLim Kang Chooi0% (2)

- Penyata KewanganDocument12 pagesPenyata KewanganMay LeeNo ratings yet

- Tajuk 2 Klasifikasi Akaun Alephb Dan Akaun KontraDocument50 pagesTajuk 2 Klasifikasi Akaun Alephb Dan Akaun KontraSyarafina AbdullahNo ratings yet

- Bab 2 - Klasifikasi AkaunDocument39 pagesBab 2 - Klasifikasi AkaunSiti Nor Suhaidah AzmiNo ratings yet

- Bab 6 Wang Dan Institusi KewanganDocument10 pagesBab 6 Wang Dan Institusi KewanganSyam TebaiyooNo ratings yet

- Akaun Simpanan DefinisiDocument3 pagesAkaun Simpanan Definisiعزيز الهوىNo ratings yet

- 3.1 Simpanan Dan PelaburanDocument14 pages3.1 Simpanan Dan Pelaburanrobin hood100% (2)

- Tutorial Akaun Mggu 2Document3 pagesTutorial Akaun Mggu 2Abd RahmanNo ratings yet

- Bab 6 - LiabilitiDocument56 pagesBab 6 - LiabilitiFATIN HAFIZAH MOHAMMAD SUKRI80% (5)

- Makalah Kel 3 Akuntansi Keuangan Lanjutan 1Document13 pagesMakalah Kel 3 Akuntansi Keuangan Lanjutan 1Salsa DheaNo ratings yet

- Modul 8 - Pelarasan Pada Tarikh Imbangan Dan Penyediaan Penyata Kewangan Milikan TunggalDocument11 pagesModul 8 - Pelarasan Pada Tarikh Imbangan Dan Penyediaan Penyata Kewangan Milikan Tunggalnr dawesyaNo ratings yet

- Nota AkaunDocument13 pagesNota AkaunpriyaNo ratings yet

- Koleksi Soalan ObjektifDocument32 pagesKoleksi Soalan Objektifailiz tiaNo ratings yet

- Bab 2 Klasifikasi AkaunDocument4 pagesBab 2 Klasifikasi Akaunhani100% (1)

- Takaful Malay CDocument86 pagesTakaful Malay CKendra LeeNo ratings yet

- EkonomiAsas Tingkatan4 Bab2 PDFDocument6 pagesEkonomiAsas Tingkatan4 Bab2 PDFSuzana SuzanaNo ratings yet

- EkonomiAsas Tingkatan4 Bab2Document6 pagesEkonomiAsas Tingkatan4 Bab2Suzana SuzanaNo ratings yet

- Ujian Pengesanan Tahap Penguasaan Murid Dalam Asas PerakaunanDocument3 pagesUjian Pengesanan Tahap Penguasaan Murid Dalam Asas PerakaunannurainNo ratings yet

- Topik 2 Klasifikasi & Persamaan PerakaunanDocument14 pagesTopik 2 Klasifikasi & Persamaan PerakaunanruhaznaNo ratings yet

- Makalah Manajemen KeuanganDocument9 pagesMakalah Manajemen KeuanganSsssNo ratings yet

- Pengenalan Kepada PerakaunanDocument24 pagesPengenalan Kepada PerakaunanDHARANIYA A/P SUBRAMANIAMNo ratings yet

- Aneka Modal VenturaDocument54 pagesAneka Modal VenturaSrie Maryati0% (1)

- Tajuk 5Document64 pagesTajuk 5Joseph Ignatius LingNo ratings yet

- Makalah Akuntansi Keuangan IiDocument12 pagesMakalah Akuntansi Keuangan IiIndika Nurul AuliaNo ratings yet

- 3.3.8 Belanjawan PeribadiDocument19 pages3.3.8 Belanjawan PeribadiMay ChanNo ratings yet

- Pembubaran KongsiDocument7 pagesPembubaran KongsiZuly FakhrudinNo ratings yet