Professional Documents

Culture Documents

Ai Finance 1

Uploaded by

Purnachandrarao SudaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ai Finance 1

Uploaded by

Purnachandrarao SudaCopyright:

Available Formats

www.ijcrt.

org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

A STUDY ON ARTIFICIAL INTELLIGENCE

IN FINANCE SECTOR

Dr. Pinky Soni

Lecturer, Department of Commerce & Management

Vidya Bhawan Rural Institute

Udaipur, Raj

ABSTRACT

Artificial Intelligence (AI) is a major innovation in technology includes machine learning (ML) and

algorithm language. It is popular not only in one field but many such as automobile, healthcare, Gaming,

Robotics, Finance, Surveillance, Entertainment, Space Exploration, Agriculture, E-Commerce, and Social

Media, etc. Its purpose is to develop an intelligent and autonomous system. Our study focuses on the

applications of artificial intelligence in the field of finance sectors (banking, investment companies,

insurance companies) with a brief introduction. The study explains challenges and their impacts with pros

and cons in financial sectors. The study also reveals how artificial intelligence makes changes in financial

industries in the future with few recommendations.

Keywords: Artificial Intelligence, BFSI, Fintech, Machine learning

INTRODUCTION

BACKGROUND OF ARTIFICIAL INTELLIGENCE (AI):

In the current market, artificial intelligence becomes trendy in many areas. Artificial Intelligence (AI) is a

major innovation in the technology that includes machine learning (ML) and algorithm language. AI could

be described as the ability of machines (computers) to make an intelligent decision like human beings i.e.

work out what to do – usually in the context of achieving a particular task.

Definition: According to John McCarthy (1955) defined “Artificial intelligence is making a machine

behave in ways that would be called intelligent if a human were so behaving”. ML is a subset of AL that

involves building models, mainly statistical models that give analytical results. In the finance sector, AI

plays a significant role for future forecasting like investment in stock market investors apply various

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g223

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

methods of investment analysis and data mining in the amount of stock data to predict the market trend

and maximize the profit. The stock market is highly affected by both market and non-market factors, so

this machine learning plays a significant role in the "black box" model prediction for increasing the

accuracy of market prediction. Similarly, regression algorithms and time series models in machine

learning are used in the performance measure problem in establishing a prediction model, which could

improve the accuracy of prediction and financial data analysis. A very brief history of AI as under:

Source: https://qbi.uq.edu.au/brain/intelligent-machines/history-artificial-intelligence

OBJECTIVES

1. To study the applications of artificial intelligence in the field of finance sectors with a brief

introduction.

2. To study the challenges and impacts of AI in financial sectors with pros and cons.

3. To study the Future prospectus of AI in India with recommendations

SCOPE:

The study covers the area of AI in financial sectors like banking industries, investment companies,

insurance companies, real estate firms, etc.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g224

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

METHODOLOGY:

The study is based on secondary data and descriptive. The data collected from various journals, reports,

and articles.

LIMITATIONS:

Our study is only based on AI in the field of Finance sector, there are many more applications of artificial

intelligence such as Automobile, healthcare, Gaming, Robotics, Surveillance, Entertainment, Space

Exploration, Agriculture, E-Commerce, Social Media on which further study can be done.

REVIEW OF LITERATURE

AS per Kunwar M (2019) present thesis on “Artificial Intelligence in Finance: Understanding how

automation and machine learning is transforming the financial industry” examines the influence of

artificial intelligence on the modern world, especially in the field of finance. The research concludes that

throughout the value chain in financial services whether it is processing, analytics, or investing, there's

going to be more and more technology that can get things done. Development of Artificial Intelligence

and Effects on Financial System by Xie, M (2019) focused on the development and application of

artificial intelligence and machine learning in the financial system, as well as its impacts on

macroeconomics and microeconomics. Some suggestions and strategies were provided for reasonable

usage of artificial intelligence in financial risk management, based on the financial risk management

raised by artificial intelligence. The thesis on “Artificial intelligence applications in corporate finance”

by Wallon (2019), focused on the usage of AI in corporate finance with the current usages and its

prospects in a near future. It offered a viewpoint on this subject through information retrieved from

papers, reports, and experts and an evolving survey using qualitative and quantitative analysis. It enables

to get perfect views on the current situational analysis and the future expectations of AI in finance and,

more precisely, in corporate finance. As per the article by Tom C.W. Lin, 2019 on “Artificial

Intelligence, Finance, And the Law”, a study of those risks and limitations—the ways artificial

intelligence and misunderstandings of it can harm and hinder law, finance, and society. It highlights the

perils and pitfalls of artificial codes, data bias, virtual threats, and systemic risks relating to financial

artificial intelligence. It also raises larger issues about the implications of financial artificial intelligence

on financial cybersecurity, competition, and society soon. The research paper on “Artificial Intelligence

In Finance “by Patel, K (2018) studying the thought processes of human beings. Also focus that AI deals

with representing those processes via machines (like computers, robots, etc.). AI has now taken over many

sectors including the financial sector.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g225

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

APPLICATION OF ARTIFICIAL INTELLIGENCE IN FINANCE

i. Regulatory compliance – detection and prevention fraud: With the increasing trend in e-

commerce or online transaction the possibilities of fraud also increases exponentially. AI is based

on the anti-fraud system which detects fraudulent activities, reports, and blocked such transactions.

Banking and finance institutions have a Fraud Detection Software that patterns can be spotted by

using predictive analytics without any knowledge to the human analysts and applying machine

learning algorithms to detect the fraudulent transaction & minimizing fake decline.

ii. Prediction of Stock Market and Trading system: Several issues can cause obstacles in the

trading system. AI systems provide a faster analysis of data not only the cause of failure be known,

but also provided the solution related to that. A Computer system has been trained to forecast when

trade shares to maximize the returns & to reduce the losses during the uncertainties & help the

investors, institutions, companies to take quick decisions.

iii. Increasing security: In AI, Machine learning algorithms need a split minute to access fraudulent

transactions in real-time not spot them after the crime is committed. Many of the organization are

trying to implement the Artificial Intelligence to enhance the security in online transactions &

related services.

iv. Risk Management: Many organizations led to the subprime mortgage crisis due to a lack of risk

management. Traditional software applications focused only on the selected loan application and

financial reports. But new machine learning technology focused on every fact related to the current

market trend to prevent financial crime and financial crisis prediction by its credit-scoring tasks in

real life environment. It also helps to minimize underwriting risks. In the field of loan, health,

mortgage, or life insurance, it can help handle every risk. It also fits perfectly with the

underwriting tasks that are so common in finance and insurance.

v. Credit Card and Loan Decisions: In process of credit card and loan decisions, AI automatically

assessing the profile which reduces the cost and efforts involved significantly and making the

whole process fair and transparent.

vi. Protect Client by Spending Pattern Prediction: At present whole country is dependent on online

transactions. In case if their card/Mobile is stolen or the account is hacked AI is useful for client

spending detection to prevent fraud or theft. It identifies the user & allows the transaction to

happen.

vii. Personalized Banking: In banking, AI plays an important role to do all transactions online like

payments, deposits where clients no need to rush banks. Even handle a majority of a client

complaint and provide the clients with an efficient self-help interface. AI-based virtual supporters

like Alexa, Google Assistant, Echo, etc. are already gaining popularity in the consumer markets. It

presents true guidance to the prospective client and so that they can get accurate information and

fast solutions to their problems.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g226

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

viii. Process Automation: Process automation is central to boosting one’s productivity and minimizing

operational costs by doing its job in just a few minutes. AI reduce more than 50% repetitive task

perform by human and minimize cost. Process automation effectively interpreted documentation,

identify issue need human attention by its services like call center automation, chatbox (Robots do

chatting and give instruction), paperwork automation, etc.

ix. Security to World financial data – Cyberattack and virus-like worms, Trojan are the main challenges

in the modern era. Machine learning security solutions are capable of securing the world's financial data

by providing the power of intelligent pattern analysis, combined with big data capabilities through

security technology an edge over traditional and non-AI tools.

x. Marketing: AI also shows its significance in finance domain people by predictive marketing

analytics based on past behavior easily. It assists in accurately forecast sales by analyzing customer

expectations. Web action can be properly supervised and cell phone app usage can be understood

to discover trends and patterns.

CHALLENGES OF ARTIFICIAL INTELLIGENCE

As know AI is used in every field but have some challenges are there:

i. Difficult to understand – Machine learning language is not easy to understand. It leads to some

extent of risk and maximizes the level of governance. To reduce its complexities banks need to

make clear about models and facts behind them in deep to their users so they can prevent from bad

business decision

ii. Based on data availability and quality - As we know that AI technology is based on big data.

When sufficient and good quality of data uploaded then only it provides reliable information. Even

in quality sources, biases can be hidden in the data. In the financial industry, the reconciliation of

the data from front to back is already problematic, and data referential are often plagued with

quality issues. Having a data-quality program in place is a prerequisite to any large-scale artificial

intelligence initiative. Lack of this causes dangerous losses to the users.

iii. Responsibility – Another main challenge in AI is if something goes wrong who will be liable for

responsibility and accountability. The fact that there is no explanation as to why the algorithm

provided a positive or negative answer to a specific question can be disturbing for a banker’s

rational mind. So it becomes necessary to keep a human supervisor to validate the machine's

decisions for critical activities such as releasing/blocking payments or validating trades, partially

defeating the purpose of using a machine in the first place.

iv. Fast changing technology: As technology change rapidly each financial organization must look to

move abstract concepts about AI from theory to practice so they can be used in daily operations.

The right AI technology can automate labor-intensive manual processes, offer the level of

performance needed to make use of the latest technologies, and mix with active systems and be

reusable for other reasons.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g227

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

v. Reliability of AI – For security reasons Reliability of AI depends on its data and degree of control

over the system. The slow but steady method of Test Driven Development which places

assessment and verification to develop the required algorithm at its core is needed for a reliable

system that can withstand the test of time.

vi. Lack of emotional intelligence: AI is intelligent in solving various specific problems; detect

fraudulent activities but lacks emotional intelligence. For instance, chatboxes are smart but lack

empathy. They do what the program is loaded.

vii. Regulatory barriers – Transparency in AI is important to succeed in the well-regulated world of

financial services. The domain expert is required who can explain the reasoning and main context

related to data. The capability of machine learning to communicate their reasoning will go a long

way in crossing regulatory hurdles and gain acceptance from the users

viii. Tracking measure of success: AI forecasting is based on the future prospectus, not provide a

100% guarantee whether your investment gives you profit or loss. It is a challenge to tracking

measure of success like how ML positively impact on human behavior, how to reduce cost, how

improved efficiencies. As AI grows the challenges in financial institutions too will vary.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g228

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

IMPACT OF AI IN FINANCE SECTOR

AI provides huge benefits to a large number of concerns. Every factor has their positive and

negative impact: Similarly AI also have some as under:

IMPACT OF AI IN FINANCE SECTOR

PROS CONS

Efficient in handling a large volume of Complex in nature need high production

information and maintenance cost

More efficient in forecasting assist High-end fintech technology is too costly

business relationship strong and do so each organization could not afford the

advisory work as well premium application of AI

Eliminate bias from metrics Due to rapid technology changes many

experts issue warnings about the

dangerous nature of AI

Better informative charts and graphs help Lack of regulatory scrutiny may present a

to make a safe decision problem in the upcoming period

Provide 24/7 hours service as compare to Possibility of misuse of data cause serious

human resources. losses like delivered to wrong hand can

cause serious threats to humankind.

Quickly perform the task related to Wide-reaching unemployment as replaces

finance like Insurance, Trading, workforce with machines and computers.

accounting, etc. Financial users get Also, block the human mind and increase

transaction records online and offline dependency on the machine.

which saves time, money, and effort.

Fraud detection is a smart card-based Lack of creativity mind

system with the use of AI.

FUTURE OF AI IN INDIA WITH SOME RECOMMENDATION

Today, the world is shifting towards artificial intelligence technology. Google, Amazon, Flipkart some

tech giant has using AI to build predictive models of consumer behaviour. In the field of education, most

universities have offered various coursework in AI. Bitcoin gets its popularity has made the use of AI in

finance by providing robotic advisory services. Insurance companies already dominated to AI for big data

which provide personalized recommendation replaces personal financial assistance. Huge investment is

made by companies, firms, investors on basis of data of AI which saves their money and avoiding human

errors. These BFSI (Banking, financial services & insurance) industries adopting AI-based fintech

solutions at a very large scale.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g229

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

The speed at which AL adopted by finance industry we can't deny saying that very soon this progressive

steps replace human resource and provide quick and efficient solution to users and it is the future of

Finance industry as below diagram shows:

Source: Mckinsey

By 2035, there is the possibility that the use of AI increases massively in the Indian economy. Recently,

the US and China are the top countries making the adoption of AI technology, India is in progressive ways

but positively it opens the door for jobs approximately 2 lakh for AI experts and others in many sectors

like education, healthcare, retail, etc. Right skilling is regarded as the crucial factor for achievement in

technology adoption. In the year 2018, when the start-up scheme started it shows tremendous growth in

the financial sectors. Recently, more than 400 startups working in AI and machine learning areas. Many

start-up cities in India like Bangalore, Hyderabad, Mumbai, and New Delhi work on AI and deliver better

customer services. A million of the amount is spent by private industry players in AI. In June 2018, NITI

Aayog set the roadmap on how you can develop artificial intelligence in India. It is considered that

Artificial Intelligence may help the nation to develop economic and social growth. Shortly, we can see AI

is used to handling traffic problems, the health of roads, track blacklisted folks, biometry, etc. In a report

on 17th May 2021, LG companies announce to invest more than $100 million for the next three years to

establish a massive high-performance computing infrastructure for Artificial intelligence development. LG

establish top class computing infrastructure that can perform 95.7 quadrillion calculations per second.

They believe that AI systems will be useful from customer counselling to production development. They

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g230

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

also plan to use AI solutions to the development of cancer treatment vaccines and environment-friendly

plastics.

According to joint research conducted by the National Business Research Institute and Narrative Science

more than 32% of financial services providers making use of AI technologies in voice recognition,

government finance, audit, predictive analytics, etc. Some opinions of industrialist expert on AI are as

under:

Rajeev Agarwal, CEO of payments platform accepts that AI is still in its growing stages of

development and will require a strong digital backbone supported by high-quality data and a skilled

workforce to fully draw the essence of the technology. Similarly, Rahul Sekar, cofounder, and CTO at

Shubh Loans said “In a fast-changing environment, policies and processes need to be nimble and tailored

to customer characteristics. It is not possible to provide the next-gen customer experience without AI,”

Gaurav Chopra, Founder & CEO, India Lends and Manish Patel, cofounder of Mswipe further

agrees to the fact that Artificial Intelligence has the potential of becoming a significant facet in the future

growth of the Fintech sector and AI can be a real game-changer in boosting the efficiency and accuracy of

the financial services sector.

RECOMMENDATIONS

1. AI is used in every field and probability to reduce human job opportunities, need deep learning of

AI. The business will achieve great success if the machine and human staff work together.

2. AI must be adopted according to the needs of sectors for that skilled managers are required.

3. AI needs specific talents, so students need to gain extraordinary training in learning and creating

machine learning and algorithm language. Such courses should cheer up by universities and

institutions.

4. Government support to encourage AI, so we are not backward by other countries in the field of

technology

CONCLUSION:

Experts believed that AI soon becomes the part and parcel of human life. It completely changes the

way we see our world. It solves many problems in minutes. There is a possibility that AI reduces

human needs, so we need to balance by updating ourselves according to the changes. We must be

kept in mind that we made machines, machines not made us. We get benefits by making its proper

utilization.

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g231

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 5 May 2021 | ISSN: 2320-2882

REFERENCES

1. M, Kunwar (2019). Artificial Intelligence in Finance Understanding: How Automation and

Machine Learning is Transforming the Financial Industry. Centria University of Applied Sciences

Business Management.

2. C, Wallon. (2019). Artificial intelligence applications in corporate finance.

http://hdl.handle.net/2268.2/7558,

3. Tom C. W. Lin. 2019. Artificial Intelligence, Finance, and the Law. Fordham L. Rev., 88, Pp. 531.

https://ir.lawnet.fordham.edu/cgi/viewcontent.cgi?article=5630&context=flr

4. Patel, K. (2018). Artificial Intelligence in Finance. IJSART, 4(4), 2787–2788

5. Xie, M. (2019). Development of Artificial Intelligence and Effects on Financial System. Journal of

Physics: Conference Series, 1187(3), 032084. https://doi.org/10.1088/1742-6596/1187/3/032084

6. Agarwal, M. (2019, December 16). Will Artificial Intelligence Become The Future Of Fintech In

India? Inc42 Media. https://inc42.com/features/will-artificial-intelligence-become-the-future-of-

fintech-in-india/

7. https://digitalwellbeing.org/artificial-intelligence-defined-useful-list-of-popular-definitions-from-

business-and-science/

8. https://www.aismartz.com/blog/use-cases-of-ai-in-the-finance-sector/

9. https://data-flair.training/blogs/machine-learning-in-finance/

10. https://internationalbanker.com/finance/the-impacts-and-challenges-of-artificial-intelligence-in-

finance/

11. https://analyticsweek.com/content/21-top-ai-adoption-challenges-for-the-finance-

industry/?doing_wp_cron=1620625345.3792779445648193359375

12. https://analyticsjobs.in/business/future-of-ai-in-india

13. https://www.stoodnt.com/blog/scopes-of-machine-learning-and-artificial-intelligence-in-banking-

financial-services-ml-ai-the-future-of-fintechs/

14. https://businessstandard.com/

IJCRT2105683 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org g232

You might also like

- Tutorial MagIC Net 2.XDocument99 pagesTutorial MagIC Net 2.XJuan Diego Aznar Fernández100% (1)

- BROC Mackam Dab en v1.0Document2 pagesBROC Mackam Dab en v1.0jangri1098No ratings yet

- Digitalisation and Platform Economy - Disruption IDocument11 pagesDigitalisation and Platform Economy - Disruption ITriptiNo ratings yet

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraNo ratings yet

- Plastic PackagingDocument47 pagesPlastic PackagingRajaSekarsajja100% (1)

- ELEC 121 - Philippine Popular CultureDocument10 pagesELEC 121 - Philippine Popular CultureMARITONI MEDALLANo ratings yet

- NTPC Limited: (A Government of India Enterprise)Document7 pagesNTPC Limited: (A Government of India Enterprise)Yogesh PandeyNo ratings yet

- A New Service For Sharing Economy: Ecole de Commerce de Lyon International Business AdministrationDocument34 pagesA New Service For Sharing Economy: Ecole de Commerce de Lyon International Business AdministrationValerio RomanielloNo ratings yet

- Innovations in Modern Banking and Innova PDFDocument14 pagesInnovations in Modern Banking and Innova PDFСергей ЗайцевNo ratings yet

- Analytical Study of Investment Patterns and Investment Preferences ofDocument18 pagesAnalytical Study of Investment Patterns and Investment Preferences ofHCM DIGITAL CLASSESNo ratings yet

- 18th Century Political Formation. CL 7Document22 pages18th Century Political Formation. CL 7Gamer AditKills100% (1)

- 200059-Metaverse PowerPoint SlideDocument36 pages200059-Metaverse PowerPoint SlideFauzan AdzimaNo ratings yet

- Syllabus Physics S67 en (2020!02!11)Document62 pagesSyllabus Physics S67 en (2020!02!11)Barthélemy HoubenNo ratings yet

- Presentation On VRDocument13 pagesPresentation On VRAryan AdhikariNo ratings yet

- Tinas Resturant AnalysisDocument19 pagesTinas Resturant Analysisapi-388014325100% (2)

- L4 Examples - Exact Differential Equations PDFDocument16 pagesL4 Examples - Exact Differential Equations PDFCarlo EdolmoNo ratings yet

- Huawei Tecal RH2288 V2 Server Compatibility List PDFDocument30 pagesHuawei Tecal RH2288 V2 Server Compatibility List PDFMenganoFulanoNo ratings yet

- BPM Governance Platform Progress Business ProcessDocument22 pagesBPM Governance Platform Progress Business ProcessLando ReyesNo ratings yet

- AG PROG Bachelor Master enDocument32 pagesAG PROG Bachelor Master enMargareta Fedora Prima ArtariNo ratings yet

- SD WANarchitecturefunctionsandbenefitsDocument7 pagesSD WANarchitecturefunctionsandbenefitsMamoudou IyaNo ratings yet

- Lect 2 Introduction To Managerial EconomicsDocument23 pagesLect 2 Introduction To Managerial EconomicskonchojNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- The Effect of Change Management On Organizational Performance in The Banking SectorDocument63 pagesThe Effect of Change Management On Organizational Performance in The Banking SectorTJ SITENo ratings yet

- Document Translation ServicesDocument71 pagesDocument Translation ServicesHussain ElarabiNo ratings yet

- Aditidaryan WiproDocument19 pagesAditidaryan WiproAditi DaryanNo ratings yet

- The Effectiveness of South African Smart ID Card-Tshepo-MagomaDocument52 pagesThe Effectiveness of South African Smart ID Card-Tshepo-MagomacarinaNo ratings yet

- Wolkite University College of Social Sciences and Humanities Department of Governance and Development Studies Challenges and ProspectsDocument41 pagesWolkite University College of Social Sciences and Humanities Department of Governance and Development Studies Challenges and ProspectsSefa MisebahNo ratings yet

- 3 PBDocument6 pages3 PBruchna dabyNo ratings yet

- Full-Paper 1 3Document44 pagesFull-Paper 1 3Kevin MagnoNo ratings yet

- Primary Market - Definition, Types & Functions of Primary MarketDocument10 pagesPrimary Market - Definition, Types & Functions of Primary MarketNandhini PrabakaranNo ratings yet

- ICT For GrowthDocument11 pagesICT For Growthfilipfilipfilip100% (1)

- Urkund Report - Plagiarism NOT checkedSHUBHANGI DASH 1720357.docx (D64868194) PDFDocument60 pagesUrkund Report - Plagiarism NOT checkedSHUBHANGI DASH 1720357.docx (D64868194) PDFShetty RakshithNo ratings yet

- A212 - BWFF2033 SyllabusDocument9 pagesA212 - BWFF2033 SyllabusLi XuanNo ratings yet

- Artificial Intelligence: Friend or Foe?Document6 pagesArtificial Intelligence: Friend or Foe?Pankita TibrewalaNo ratings yet

- Chapter 1. Introduction To International BusinessDocument30 pagesChapter 1. Introduction To International BusinessReshma RaoNo ratings yet

- Tourism Theory of ChangeDocument42 pagesTourism Theory of ChangeCC's Online ShopNo ratings yet

- 2020 Ccaf Legal Regulatory Considerations ReportDocument50 pages2020 Ccaf Legal Regulatory Considerations ReportKarem MahmoudNo ratings yet

- Scaling Technology Ventures in Africa New Opportunities For Research - FinalDocument27 pagesScaling Technology Ventures in Africa New Opportunities For Research - FinalEmmanuel Cocou kounouhoNo ratings yet

- Fintech &cryptoDocument9 pagesFintech &cryptoKhushi JoshiNo ratings yet

- Hiring For: Event Registration Date Date of Test Mode of Test LinkDocument3 pagesHiring For: Event Registration Date Date of Test Mode of Test Linkpinninti rameshNo ratings yet

- Rajepratap Jadhav-VITDocument1 pageRajepratap Jadhav-VITRajepratap JadhavNo ratings yet

- Global Finance Lesson 2 - International Finance OverviewDocument5 pagesGlobal Finance Lesson 2 - International Finance OverviewEloysa CarpoNo ratings yet

- Implementation of National Academic DepositoryDocument2 pagesImplementation of National Academic DepositoryWasim KhanNo ratings yet

- Subject: Strategic Management: ON Analysis of Ncell and NTC Telecommunication CompaniesDocument13 pagesSubject: Strategic Management: ON Analysis of Ncell and NTC Telecommunication CompaniesKaemon BistaNo ratings yet

- Shobhit Singh: Male, 26 YearsDocument2 pagesShobhit Singh: Male, 26 YearsZero IndiaNo ratings yet

- A Project Report On Comparative Analysis of Demat Account and OnlineDocument82 pagesA Project Report On Comparative Analysis of Demat Account and OnlineNITIKESH GORIWALENo ratings yet

- Expert Banking Professional with 15+ Years ExperienceDocument5 pagesExpert Banking Professional with 15+ Years ExperienceJyoti Sanjay KalraNo ratings yet

- 06 Value Added TaxDocument43 pages06 Value Added TaxGolden ChildNo ratings yet

- Indian Banks Building Resilient LeadershipDocument88 pagesIndian Banks Building Resilient Leadershiparul.btugNo ratings yet

- Examining Customer Channel Selection Intention in The Omni-Channel RetailDocument52 pagesExamining Customer Channel Selection Intention in The Omni-Channel RetailKarla Quispe MendezNo ratings yet

- BSP Circular 1061Document21 pagesBSP Circular 1061tastytreatsNo ratings yet

- Relationship Among Strategic Positioning, Strategic Customer Relationship Management and Organization's PerformanceDocument14 pagesRelationship Among Strategic Positioning, Strategic Customer Relationship Management and Organization's PerformanceInternational Journal of Management Research and Emerging SciencesNo ratings yet

- Moreblessing Mukayami DissertationDocument87 pagesMoreblessing Mukayami DissertationESTHERNo ratings yet

- Kotak Security Intenship ReportDocument34 pagesKotak Security Intenship ReportEk Deewana RajNo ratings yet

- Fintech and The Future of FinanceDocument14 pagesFintech and The Future of FinanceFaizan KhanNo ratings yet

- Yesuf Research (1) .Docx..bakDocument45 pagesYesuf Research (1) .Docx..bakTesnimNo ratings yet

- Reader 1 Chapter 1 Thinking About ManagingDocument50 pagesReader 1 Chapter 1 Thinking About ManagingMaroun BoujaoudeNo ratings yet

- UNIDO-OVG Workshop Focuses on Railway Engineering Capacity BuildingDocument53 pagesUNIDO-OVG Workshop Focuses on Railway Engineering Capacity BuildingAhmed GamalNo ratings yet

- Role of Investment Bankers in Indian Stock Market: An Empirical StudyDocument28 pagesRole of Investment Bankers in Indian Stock Market: An Empirical StudyashishNo ratings yet

- Dual Degree Exchange Program Student Handbook FEB UGMDocument48 pagesDual Degree Exchange Program Student Handbook FEB UGMMac HamdanasNo ratings yet

- Smart Irrigation Systems Using Internet of Things For Smart FarmingDocument12 pagesSmart Irrigation Systems Using Internet of Things For Smart FarmingIJRASETPublicationsNo ratings yet

- Comparative Study Between Fiscal and Non-Fiscal Incentives On The Execution of Selected ForeignOwnedProjects in The ICT Sector of RwandaDocument8 pagesComparative Study Between Fiscal and Non-Fiscal Incentives On The Execution of Selected ForeignOwnedProjects in The ICT Sector of RwandaInternational Journal of Innovative Science and Research Technology100% (1)

- Micro Finance-Lessons From International Experience: Lecture - 19811Document102 pagesMicro Finance-Lessons From International Experience: Lecture - 19811dipu jaiswalNo ratings yet

- Citizens Readiness To Crowdsource Smart City Services A Developing Country PerspectiveDocument11 pagesCitizens Readiness To Crowdsource Smart City Services A Developing Country PerspectiveCipp AngelNo ratings yet

- Practical Research 1 M2 Q3 No AnswerDocument15 pagesPractical Research 1 M2 Q3 No Answerbarentoy sabueroNo ratings yet

- Materi Pertemuan 1Document26 pagesMateri Pertemuan 1donny antaraNo ratings yet

- Annexure-129 Updated BBA (FIA) Revised Syllabus 2019 (Final)Document120 pagesAnnexure-129 Updated BBA (FIA) Revised Syllabus 2019 (Final)Tihor LuharNo ratings yet

- Review of Literature On The Topic of The Gig Economy in IndiaDocument8 pagesReview of Literature On The Topic of The Gig Economy in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Agriculture Sector Growth Driven by Livestock, DairyingDocument31 pagesAgriculture Sector Growth Driven by Livestock, DairyingDeepanshu YadavNo ratings yet

- RISHAB GOLADocument7 pagesRISHAB GOLAManan AswalNo ratings yet

- Sample PresentationDocument26 pagesSample PresentationMitali MishraNo ratings yet

- Pulse of Fintech h2 2020Document72 pagesPulse of Fintech h2 2020OleksandraNo ratings yet

- Thermodynamics d201Document185 pagesThermodynamics d201Rentu PhiliposeNo ratings yet

- Java Programming: Lab Assignment 2Document17 pagesJava Programming: Lab Assignment 2Sanjana chowdary50% (4)

- 12.CEH Module 3 Assignment 3.1Document7 pages12.CEH Module 3 Assignment 3.1piyuhNo ratings yet

- Group Assignment For Quantitative: Analysis For Decisions MakingDocument45 pagesGroup Assignment For Quantitative: Analysis For Decisions Makingsemetegna she zemen 8ተኛው ሺ zemen ዘመንNo ratings yet

- Oop Lab 1 MHDDocument13 pagesOop Lab 1 MHDMaahd JunaidNo ratings yet

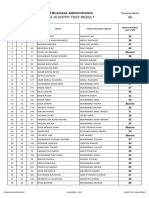

- Entry Test Result MPhil 2014 PDFDocument11 pagesEntry Test Result MPhil 2014 PDFHafizAhmadNo ratings yet

- Career Profile: Nidhi PathakDocument4 pagesCareer Profile: Nidhi PathaknidhipathakNo ratings yet

- Safety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/undertakingDocument8 pagesSafety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/undertakingFerry Dela RochaNo ratings yet

- Themed: MathematicsDocument32 pagesThemed: MathematicsMohamed LamihNo ratings yet

- COURSE Strucure - M.tech (S.E) I & II Sem (Autonomous)Document40 pagesCOURSE Strucure - M.tech (S.E) I & II Sem (Autonomous)Fresherjobs IndiaNo ratings yet

- Osg VS Ayala LandDocument17 pagesOsg VS Ayala LandJan BeulahNo ratings yet

- WheelHorse Power Take Off Manual 8-3411Document4 pagesWheelHorse Power Take Off Manual 8-3411Kevins Small Engine and Tractor ServiceNo ratings yet

- Market Profiling, Targeting and PositioningDocument16 pagesMarket Profiling, Targeting and PositioningMichelle RotairoNo ratings yet

- RCT Methodology ChecklistDocument6 pagesRCT Methodology ChecklistSyahidatul Kautsar NajibNo ratings yet

- Delphi28236381 20190611 112907Document2 pagesDelphi28236381 20190611 112907คุณชายธวัชชัย เจริญสุขNo ratings yet

- Column:C2 900X900: Basic Design ParametersDocument2 pagesColumn:C2 900X900: Basic Design ParametersAnonymous tBhJoH5wgMNo ratings yet

- How efficient is a wind turbineDocument8 pagesHow efficient is a wind turbinejNo ratings yet

- 3 Manacsa&Tan 2012 Strong Republic SidetrackedDocument41 pages3 Manacsa&Tan 2012 Strong Republic SidetrackedGil Osila JaradalNo ratings yet