Professional Documents

Culture Documents

Scs 5

Scs 5

Uploaded by

LokiOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document• Instructions

• Objectives

• Study Tips

• Overview

• Accounting Applications

• Class Interaction and Discussion

• Optional Small Group Extension Activity

• Optional Internet Exploration and Research Activity

• Summary Questions

Instructions:

1. Print and read the following case study.

2. On your own, complete the Accounting Application questions.

3. As a class, complete the Class Interaction and Discussion questions.

4. Optional: Complete the Small Group Extension Activity and Internet

Exploration and Research Activity.

5. Complete the Summary Questions.

Objectives:

After completing the following case study, you will be able to:

Record earnings and deductions for a worker in a payroll register

Record payroll register totals in a cash payments journal

Discuss the contract settlement between UPS and Teamsters

Explain the Taft-Hartley Act

Study Tips:

Complete this case study after Chapter 13, Glencoe Accounting, First-Year Course.

Approximate time to complete: 2 hours.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 1

Overview:

On Sunday, August 3, 1997, United Parcel Service’s (UPS) operations slowed to a crawl

as most of the company’s 185,000 Teamsters employees walked off the job to participate

in UPS’s first-ever nationwide strike. Neither the Teamsters union nor the UPS company

showed any willingness to budge on the major issues that prompted the strike.

What is a strike? A strike is a refusal by employees to work. Most often workers strike

due to insufficient pay rates, benefits, or working conditions. In many kinds of work,

employees belong to unions because they will negotiate for better pay and working

conditions on the employees’ behalf. The management of a company and union

representatives work together to reach an agreement and sign a labor contract. A labor

contract usually lasts from one to five years and it states pay rates, benefits, and dispute

procedures. If an agreement is not reached and a contract lapses, sometimes a union goes

on strike to force management to reach an agreement.

The Teamsters are a labor union organized for the benefit of truck drivers, chauffeurs,

warehouse workers, and other laborers. Out of 1.4 million Teamsters, UPS employs

200,000. UPS is the largest employer of Teamsters in the nation.

UPS has a total of 370,000 employees. At the time of the strike, UPS was the fifth-largest

private employer in the United States. Its quarterly payroll is approximately $4 billion.

The table below shows the issues and offers made during negotiations between UPS and

the Teamsters in 1997.

ISSUES UPS TEAMSTERS

Length of

Five years Three to four years

contract

$1.50-an-hour increase over five

$2.60-an-hour increase

years, plus profit sharing of

Full-time over four years.

$3,060 this year and a bonus in

pay * Current pay is $19.95

2000 based on 1999 profit

per hour.

margins.

Current employees get a $2.60-

an-hour increase over five years

plus profit-sharing bonus of $3.60-an-hour increase

$1,530 this year and another over four years. Current

Part-time payment in 2000 based on profits pay is $8 for loaders, $9

pay in 1999. New hires get $3 for sorters, and $12 for

increase over five years and part-time drivers

retention bonuses of $500 in the handling air deliveries.

first six months and are eligible

for profit-sharing bonus in 2000.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 2

Create 200 full-time jobs from

Create 2,500 full-time

part-time jobs each year of the

jobs from part-time jobs

Part-timers contract, and guarantee that 2,000

in each year of the

part-timers would advance to

contract.

full-time positions.

Wants to retain UPS’s

participation in

Wants to pull out of the

Teamsters multi-

Teamsters multi-employer

employer pension plans

pension plans, to which it

Pensions jointly administered by

contributed $1.6 billion last year,

the companies and the

and set up a plan only for UPS

Teamsters. These plans

employees, with joint trusteeship.

cover all Teamsters,

regardless of employer.

Source: The Atlanta Journal/Constitution, August 15, 1997.

* “Current” here means as of August 15, 1997.

Accounting Applications:

Instructions: Now that you have reviewed the case study above, answer the following

questions on your own.

1. Fill in the line of a payroll register for a UPS employee using the “current” part-

time pay rate and the following information. Compute FICA taxes at 6.2% for

social security and 1.45% for Medicare and use IRS tax tables from text.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 3

Vanessa Bridges is a sorter for UPS. Her employee number is 0633. She is single,

claims no exemptions, and worked 28 hours during the week ending January 15.

In addition to FICA and federal income tax, she had deductions of state income

tax of 3 percent of total earnings, a health insurance premium of $9.45, and union

dues of $5. She was paid with check number 4432.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 4

2. Fill in another line of a payroll register for Vanessa Bridges using the Teamsters’

suggested part-time pay increase in four years. Use the same pay period ending

and date of payment as in question 1. Assume that her hours worked, the FICA

tax, the IRS tax table, her exemption status, and the state income tax rate have not

changed. Health insurance has increased to $13.13 and her weekly union dues are

now $6.75. The paycheck number is 18972.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 5

3. Given the following totals from a payroll register for the week ending March 22,

record the entry for payroll in the general journal below, page 42.

Regular earnings: $50,039; overtime earnings: $9,701; total earnings: $59,740;

social security tax: $3,703.88; Medicare tax: $866.23; federal income tax:

$4,361.02; state income tax: $2,509.08; health insurance: $2,240.25; and union

dues: $1,194.80.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 6

Class Interaction and Discussion:

Instructions: Read the following question. As a class, discuss your responses.

On Wednesday, August 20, 1998, the UPS Teamsters went back to work. Consider the

contract settlement and discuss as a class who got what they wanted and who didn’t.

Agreement between Teamsters and UPS

Length of Five years

contract:

Full-time Pay raises of $3.10 an hour over five years. No profit

pay: sharing.

Part-time New part-time loaders start at $8.50 with pay raises of

pay: $4.10 over five years. No profit sharing.

Part-time Create 10,000 full-time jobs from existing part-time

jobs: positions over five years, predicated on package volume

growth. These new full-timers will start at $15 an hour

and advance to $17.50 by the end of the five-year

contract.

Pensions: UPS will continue participation in Teamsters multi-

employer pension plans.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 7

Optional Small Group Extension Activity:

Instructions: Break into pairs and complete following activity.

During the strike, UPS asked President Clinton to intervene and order workers back to

their jobs, arguing that the economic impact was widespread. However, President Clinton

insisted that the strike hadn’t met the high standards of the Taft-Hartley Act.

Research the Taft-Hartley Act in your library or on the Internet and write a brief report

explaining the Act.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 8

Optional Internet Exploration and Research Activity:

Instructions: Using your favorite search engine, research the following activity.

Find either the Teamsters or the UPS Web site. What information can you find

about the union or the company? Write a brief report about what you learned.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 9

Summary Questions:

1. How is overtime pay calculated? How was this established?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

2. Name three voluntary payroll deductions.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

3. What is the difference between total earnings and net pay?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2019 Country Reports On Human Rights Practices - United States Department of StateDocument10 pages2019 Country Reports On Human Rights Practices - United States Department of StateLokiNo ratings yet

- Culture - The GuardianDocument8 pagesCulture - The GuardianLokiNo ratings yet

- Scs 3Document8 pagesScs 3LokiNo ratings yet

- Unmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018Document1 pageUnmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018LokiNo ratings yet

- Language Learning With Free PodcastsDocument3 pagesLanguage Learning With Free PodcastsLokiNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Tax Assessments: Required Supplementary Information (Unaudited) 208Document1 pageTax Assessments: Required Supplementary Information (Unaudited) 208LokiNo ratings yet

- Food - The GuardianDocument7 pagesFood - The GuardianLoki100% (1)

- Social Insurance: Social Security and MedicareDocument26 pagesSocial Insurance: Social Security and MedicareLokiNo ratings yet

- Note 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsDocument1 pageNote 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsLokiNo ratings yet

- Largest Income Tax Expenditures As of September 30, 2019Document2 pagesLargest Income Tax Expenditures As of September 30, 2019LokiNo ratings yet

- Tax Gap: Corporate Income Tax Liability For Tax Year 2016Document1 pageTax Gap: Corporate Income Tax Liability For Tax Year 2016LokiNo ratings yet

- Notes To The Financial Statements27Document1 pageNotes To The Financial Statements27LokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Sustainability of Fiscal PolicyDocument11 pagesSustainability of Fiscal PolicyLokiNo ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- Deferred Maintenance and RepairsDocument1 pageDeferred Maintenance and RepairsLokiNo ratings yet

- Notes To The Financial Statements18Document7 pagesNotes To The Financial Statements18LokiNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Note 17. Collections and Refunds of Federal RevenueDocument3 pagesNote 17. Collections and Refunds of Federal RevenueLokiNo ratings yet

- Note 15. Insurance and Guarantee Program LiabilitiesDocument2 pagesNote 15. Insurance and Guarantee Program LiabilitiesLokiNo ratings yet

- Notes To The Financial Statements14Document1 pageNotes To The Financial Statements14LokiNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

- Notes To The Financial Statements16Document2 pagesNotes To The Financial Statements16LokiNo ratings yet

- Notes To The Financial Statements20Document6 pagesNotes To The Financial Statements20LokiNo ratings yet

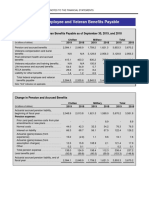

- Note 12. Federal Employee and Veteran Benefits PayableDocument10 pagesNote 12. Federal Employee and Veteran Benefits PayableLokiNo ratings yet

- Note 13. Environmental and Disposal LiabilitiesDocument2 pagesNote 13. Environmental and Disposal LiabilitiesLokiNo ratings yet

- Note 11. Federal Debt Securities Held by The Public and Accrued InterestDocument4 pagesNote 11. Federal Debt Securities Held by The Public and Accrued InterestLokiNo ratings yet