Professional Documents

Culture Documents

Correlation of Securities

Uploaded by

Ngô Việt ĐứcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Correlation of Securities

Uploaded by

Ngô Việt ĐứcCopyright:

Available Formats

Correlation of Securities

© Copyright 2017 Fervent | All Rights Reserved

What is Correlation?

Correlation (𝜌!,# ) is an alternative measure

of the relationship between securities.

You can think of it as an “extension” of the

covariance (𝜎!,# )

© Copyright, Fervent | All Rights Reserved

Recall the Covariance

The covariance measures the relationship

between securities by estimating their co-

variability.

(

1

𝑐𝑜𝑣(𝑟! , 𝑟" ) ≡ 𝜎#!,#" = . 𝑟! − 𝐸 𝑟! 𝑟" − 𝐸 𝑟"

𝑛−1

%&'

© Copyright, Fervent | All Rights Reserved

Limitation of the Covariance

The covariance tends to be a very small

number, making its interpretation quite

challenging.

It can also theoretically be any value, which

doesn’t help with interpretation either.

© Copyright, Fervent | All Rights Reserved

Correlation Bounds

Correlation (𝜌!,# ) is bounded between

−1 and +1 inclusive

This allows us to objectively understand and

comment on the strength of relationships

© Copyright, Fervent | All Rights Reserved

Interpreting the Correlation

Correlation Relationship between stocks 𝒋 and 𝒌

𝜌!,# = +1 Perfectly positively correlated

𝜌!,# = −1 Perfectly negatively correlated

𝜌!,# = 0 Completely uncorrelated

© Copyright, Fervent | All Rights Reserved

Interpreting the Correlation

Correlation Relationship between stocks 𝒋 and 𝒌

𝜌!,# = +1 If 𝑗 increases by 5%, 𝑘 will increase by 5%

𝜌!,# = −1 If 𝑗 increases by 5%, 𝑘 will decrease by 5%

If 𝑗 increases by 5%, 𝑘 could increase,

𝜌!,# = 0

decrease, or remain unchanged

© Copyright, Fervent | All Rights Reserved

Crucially, correlation does NOT imply

causality.

Just because 2 stocks are moving in the same

direction, it doesn’t mean one’s causing the

other to move.

© Copyright, Fervent | All Rights Reserved

Correlation ≠ Causality

Adapted from Vigen (2020), ‘Spurious Correlations’. Available [Online]: https://tylervigen.com/spurious-correlations

Original chart released under Creative Commons 4.0

© Copyright, Fervent | All Rights Reserved

Estimating the Correlation

Correlation is calculated by scaling the

covariance by the product of standard

deviations.

𝜎!,#

𝜌!,# =

𝜎! 𝜎#

© Copyright, Fervent | All Rights Reserved

Correlation

𝜎!,#

𝜌!,# =

𝜎! 𝜎#

Where:

𝜌!,# = Correlation between stocks 𝑗 and 𝑘

𝜎!,# = Covariance between stocks 𝑗 and 𝑘

𝜎! = Standard deviation (of stock 𝑗; subscript 𝑘 for stock 𝑘).

© Copyright, Fervent | All Rights Reserved

Correlation of an asset with itself

Importantly, the correlation of any asset

with itself is always equal to 1

That’s because the covariance of any asset

with itself is equal to its variance

© Copyright, Fervent | All Rights Reserved

Correlation of an asset with itself

𝜎!,"

𝜌!," =

𝜎! 𝜎"

𝜎!,!

𝜌!,! =

𝜎! 𝜎!

𝜎!)

𝜌!,! = =1

𝜎!)

© Copyright, Fervent | All Rights Reserved

Correlation Example

Imagine you hold a portfolio of 2 stocks, and

have the following information:

Stocks Betflix Inc. (BFLX) Lotify Tech (LOT)

Total risk (Std. Dev, 𝜎! ) 24.39% 31.94%

Covariance (𝜎"#$%,$'( ) 0.01792

What is the correlation between Betflix and

Lotify?

© Copyright, Fervent | All Rights Reserved

Correlation Example (Solution)

𝜎!,"

𝜌!," =

𝜎! 𝜎"

𝜎*+,-,,./

𝜌*+,-,,./ =

𝜎*+,- 𝜎,./

0.01792

𝜌*+,-,,./ = ≈ 0.23

0.2439×0.3194

© Copyright, Fervent | All Rights Reserved

Interpreting the Correlation

Correlation Strength of relationship

0.01 ≤ 𝜌!,# ≤ 0.5 Relatively weak

0.5 < 𝜌!,# < 0.8 Relatively strong

𝜌!,# ≥ 0.8 Strong

© Copyright, Fervent | All Rights Reserved

Summary

Correlation, similar to the covariance, measures the relationships

between securities.

The correlation is bounded between −1 and +1 inclusive, and is

estimated by:

𝜎!,)

𝜌!,) =

𝜎! 𝜎)

The correlation of any asset with itself is always equal to 1.

© Copyright, Fervent | All Rights Reserved

Now have a go

at the quiz!

© Copyright, Fervent | All Rights Reserved

You might also like

- An R Companion To Political Ana - Pollock, Philip H., IIIDocument632 pagesAn R Companion To Political Ana - Pollock, Philip H., IIIJohnNo ratings yet

- Comparing PassagesDocument3 pagesComparing Passagesapi-257598685No ratings yet

- Sentence ConnectorsDocument10 pagesSentence ConnectorsTatin Farida WahyantoNo ratings yet

- Comparative SuperlativeDocument8 pagesComparative SuperlativeMerve Acer100% (1)

- Pinheiro y Bates 2000 - Mixed Effects Models in S and S-PlusDocument537 pagesPinheiro y Bates 2000 - Mixed Effects Models in S and S-PlusNatalia Morandeira100% (1)

- Calculating Stock Returns (Applied Python)Document11 pagesCalculating Stock Returns (Applied Python)vkvyddr846No ratings yet

- Adj. AdvDocument1 pageAdj. Advapi-436596151No ratings yet

- Moody'SKMVproject Studentsample2Document17 pagesMoody'SKMVproject Studentsample2springfield12No ratings yet

- Writing Task 2 - LanguageDocument17 pagesWriting Task 2 - LanguagechowchowdangiiuNo ratings yet

- Rubrics For QuestionnaireDocument1 pageRubrics For QuestionnaireKhai BonghanoyNo ratings yet

- Language in IELTS Writing Task 2 - Pages From IELTS Writing Answer KeyDocument17 pagesLanguage in IELTS Writing Task 2 - Pages From IELTS Writing Answer KeyHồ Quốc KhánhNo ratings yet

- Linking WordsDocument3 pagesLinking WordsLinh ChiNo ratings yet

- Word Formation-M.BiałekDocument22 pagesWord Formation-M.BiałekMichalina BiałekNo ratings yet

- Comparative and Superlative AdjectivesDocument5 pagesComparative and Superlative AdjectivesRw KhNo ratings yet

- Amin BookletDocument17 pagesAmin BookletPeter Norton LegaspiNo ratings yet

- Describe Proportional Relationships: Constant of ProportionalityDocument10 pagesDescribe Proportional Relationships: Constant of Proportionalityafnan a.muhammadNo ratings yet

- Systems Thinking Learning Episode 04 Speaking in SystemsDocument112 pagesSystems Thinking Learning Episode 04 Speaking in SystemsFernan Fangon TadeoNo ratings yet

- List of ConnectorsDocument3 pagesList of ConnectorsSATE Oneshot100% (1)

- Estimating Market Risk IDocument20 pagesEstimating Market Risk IEddu NavyaNo ratings yet

- Connectors LinkersDocument2 pagesConnectors LinkersAndreea CernatNo ratings yet

- Lesson 8: Equivalent Ratios Defined Through The Value of A RatioDocument6 pagesLesson 8: Equivalent Ratios Defined Through The Value of A Ratiodrecosh-1No ratings yet

- Sa Mincut AdityaDocument36 pagesSa Mincut AdityaPredictive Analysis CPINo ratings yet

- Ratio/Proportion Lesson Plan: ObjectivesDocument2 pagesRatio/Proportion Lesson Plan: ObjectivesRom Flor CobradoNo ratings yet

- Blank Social Skils Pragmatics RubricDocument1 pageBlank Social Skils Pragmatics RubricErin Cooper100% (1)

- Business Letter Writing RubricDocument1 pageBusiness Letter Writing RubricAiren FerrerNo ratings yet

- Writing 2Document3 pagesWriting 2FILLERAL CedeñoNo ratings yet

- Airborn Script AssignmentDocument2 pagesAirborn Script Assignmentapi-271650264No ratings yet

- Meaning Sentence Connectors Subordinates Phrase Linkers Cause and EffectDocument9 pagesMeaning Sentence Connectors Subordinates Phrase Linkers Cause and EffectDiegoNo ratings yet

- Class 27 de MayoDocument12 pagesClass 27 de MayoLaura Hoyos suarezNo ratings yet

- Bahasa InggrisDocument19 pagesBahasa InggrisAgustinus SaniNo ratings yet

- Scientific Notation Graphic OrganizerDocument5 pagesScientific Notation Graphic OrganizerJoel ValdezNo ratings yet

- Arabic TestDocument16 pagesArabic TestLaith AlshaheenNo ratings yet

- Bab IiDocument29 pagesBab IiDias AnnuriaNo ratings yet

- 08le 13 VV HorrorgenreDocument11 pages08le 13 VV Horrorgenre3bada.kan3anNo ratings yet

- L2 Word Structure AnalysisDocument9 pagesL2 Word Structure AnalysisqruinalgranzuelaNo ratings yet

- FINS5513 Lecture 2B: Forming Efficient PortfoliosDocument32 pagesFINS5513 Lecture 2B: Forming Efficient Portfolios萬之晨No ratings yet

- VENN Diagram RubricsDocument1 pageVENN Diagram RubricsJohn Bernoulli R. RoblesNo ratings yet

- English 5 Q4 Las Week 6 Edessa Marie Z. Tiwanak Olarte Ramirez Mante Clerigo PedralbaDocument9 pagesEnglish 5 Q4 Las Week 6 Edessa Marie Z. Tiwanak Olarte Ramirez Mante Clerigo PedralbaEdessaMarieTiwanakNo ratings yet

- Directing I Scene Grading Rubric 2018Document2 pagesDirecting I Scene Grading Rubric 2018Michelle LevineNo ratings yet

- Meaning Sentence Connectors Subordinates Phrase LinkersDocument2 pagesMeaning Sentence Connectors Subordinates Phrase LinkersceciliaNo ratings yet

- The Hot Prefixes and Roots That Denote The Same Meaning or FeelingDocument8 pagesThe Hot Prefixes and Roots That Denote The Same Meaning or FeelingYouSoco WaryaNo ratings yet

- Sense Properties and Stereotype: Imam Maulana: 20138100322 Jamar Sugianto: 20138100362 Dita Dwi Amanda: 20138100534Document45 pagesSense Properties and Stereotype: Imam Maulana: 20138100322 Jamar Sugianto: 20138100362 Dita Dwi Amanda: 20138100534Mạch TangNo ratings yet

- Grade 11Document1 pageGrade 11r.elmasri2No ratings yet

- GCSE DirectInverseProportionDocument4 pagesGCSE DirectInverseProportionJavaria RasulNo ratings yet

- FBA Formula Sheet PDFDocument1 pageFBA Formula Sheet PDFPardeep SinghNo ratings yet

- (A-MATH) Chapter 3 - SurdsDocument9 pages(A-MATH) Chapter 3 - SurdswengiemotshegweNo ratings yet

- Double Entry Journal RubricDocument1 pageDouble Entry Journal Rubricapi-431370252No ratings yet

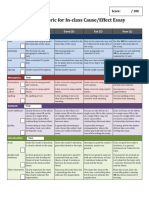

- Scoring Rubric For in - Class Cause/Effect EssayDocument2 pagesScoring Rubric For in - Class Cause/Effect EssayLuis Alejandro SerranoNo ratings yet

- Unit 12 Vocabulary List Answer Key For B2 PW2 October 2019 PDFDocument2 pagesUnit 12 Vocabulary List Answer Key For B2 PW2 October 2019 PDFMary UzhgorodskaNo ratings yet

- Degrees of ComparisonDocument6 pagesDegrees of ComparisonMawar HitamNo ratings yet

- ConfusedwordsDocument29 pagesConfusedwordsJeb Asyraff JoutingNo ratings yet

- Recognizing Degrees of ComparisonDocument11 pagesRecognizing Degrees of ComparisonBramhesh AptekarNo ratings yet

- Of Mice and Men Assignment SheetDocument2 pagesOf Mice and Men Assignment Sheetapi-395950323No ratings yet

- Types of Linker Example Broad Meaning Example Cause and Effect Comparison Similarly, Likewise, On The Other HandDocument1 pageTypes of Linker Example Broad Meaning Example Cause and Effect Comparison Similarly, Likewise, On The Other HandKirsten Shayne ManingasNo ratings yet

- Adv. Prep. Adv. Prep.: Heav Ily Fro M - of Freel y Fro MDocument2 pagesAdv. Prep. Adv. Prep.: Heav Ily Fro M - of Freel y Fro Mapi-436596151No ratings yet

- Vocab Dictionary Dictation Older KidsDocument6 pagesVocab Dictionary Dictation Older KidsFunninhaNo ratings yet

- 5-6 Poetry RubricDocument1 page5-6 Poetry RubricMarinette Ricalde ParraNo ratings yet

- H 5 Correction Symbols and Confused WordsDocument3 pagesH 5 Correction Symbols and Confused WordsKarl D. ObispoNo ratings yet

- Selecting Vocabulary: Academic Word ListDocument19 pagesSelecting Vocabulary: Academic Word ListsubirNo ratings yet

- UntitledDocument5 pagesUntitledCheng PengseNo ratings yet

- Quantum Strategy: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy: Winning Strategies of Professional InvestmentNo ratings yet

- Before and After Definition:: ExampleDocument6 pagesBefore and After Definition:: ExampleBabarNo ratings yet

- STATA Commands For Unobserved Effects PaDocument23 pagesSTATA Commands For Unobserved Effects PasmatiNo ratings yet

- A Collection of Multiple-Choice Cumulative Questions: Answers Are in RedDocument11 pagesA Collection of Multiple-Choice Cumulative Questions: Answers Are in RedEugene Embalzado Jr.No ratings yet

- 01 Skeweness, Freq DistDocument47 pages01 Skeweness, Freq Distdevavrat.singhNo ratings yet

- Two Samples (T-Test and Z-Test) - 2Document9 pagesTwo Samples (T-Test and Z-Test) - 2Letlie SemblanteNo ratings yet

- Statistics: N Valid Missing Mean Median Mode Std. Deviation Minimum MaximumDocument10 pagesStatistics: N Valid Missing Mean Median Mode Std. Deviation Minimum MaximumSeptine Eka PutriNo ratings yet

- Correlation AnalysisDocument18 pagesCorrelation AnalysissalhotraonlineNo ratings yet

- Forecasting Construction Cost EscalationDocument11 pagesForecasting Construction Cost Escalationmisterd99No ratings yet

- MStat PSB 2019Document3 pagesMStat PSB 2019DHIRAJ DILLEP S NAIRNo ratings yet

- Marketing PPT TestsDocument10 pagesMarketing PPT Testsvishnu m vNo ratings yet

- Exercises Variables Control ChartsDocument49 pagesExercises Variables Control ChartsPisak PanapirukkullNo ratings yet

- Chapter1-Nature of StatisticsDocument10 pagesChapter1-Nature of StatisticsNelia Olaso InsonNo ratings yet

- Eco 303 - Econometrics: Final ExamDocument10 pagesEco 303 - Econometrics: Final ExamTrương Hoàng DươngNo ratings yet

- Reliability, Validity & NormsDocument25 pagesReliability, Validity & NormsRonita SahaNo ratings yet

- RobiSetiawan - Tugas 4 .IpynbDocument13 pagesRobiSetiawan - Tugas 4 .IpynbROBI SETIAWANNo ratings yet

- CorrelationDocument23 pagesCorrelationanonymice0% (1)

- Dispersion MCQ No 4.1Document3 pagesDispersion MCQ No 4.1Noman AnserNo ratings yet

- 10 Process CapabilityDocument33 pages10 Process CapabilityJose-Pepe SVNo ratings yet

- 2 Pearson CorrelationDocument7 pages2 Pearson Correlationlarry jamesNo ratings yet

- PangeaDocument33 pagesPangeamikeful mirallesNo ratings yet

- Discussion - Dihybrid CrossDocument2 pagesDiscussion - Dihybrid CrossAriey MaQueenNo ratings yet

- Constantine Habana Deber11Document4 pagesConstantine Habana Deber11HabanitaConstantineFrancoNo ratings yet

- Generalized Poisson-Lindley Linear Model For Count Data: Journal of Applied StatisticsDocument14 pagesGeneralized Poisson-Lindley Linear Model For Count Data: Journal of Applied StatisticsMajid KarimiNo ratings yet

- BRM MODEL Question PaperDocument4 pagesBRM MODEL Question Paperraja30gNo ratings yet

- Measure of Dispersion and LocationDocument51 pagesMeasure of Dispersion and LocationTokyo TokyoNo ratings yet

- S6 Skewness2Document42 pagesS6 Skewness2Alice KrodeNo ratings yet

- 4 - Mathematical ExpectationsDocument40 pages4 - Mathematical ExpectationsRemylin De GuzmanNo ratings yet

- Econometrics I: Chapter 3: Two Variable Regression Model: The Problem of EstimationDocument35 pagesEconometrics I: Chapter 3: Two Variable Regression Model: The Problem of EstimationawidyasNo ratings yet