Professional Documents

Culture Documents

64 A 6 B 685 A 1126

Uploaded by

Kevin ParkerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

64 A 6 B 685 A 1126

Uploaded by

Kevin ParkerCopyright:

Available Formats

Seanergy Maritime Announces Repurchases of $1.

6 Million of Common Shares

and Agreement to Acquire a Newcastlemax Vessel through a Bareboat-in

Charter

CEO Provides Brief Market Commentary

July 6, 2023 - Glyfada, Greece - Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”)

(NASDAQ: SHIP) announced today that it has repurchased 362,161 common shares, or approximately

2% of its issued and outstanding shares, at an average price of approximately $4.35 per share pursuant

to its previously announced share repurchase program. The average share repurchase price represents

approximately a 11.2% discount from the closing price of July 5, 2023.

Moreover, the Company entered into a 12-month bareboat charter agreement with an unaffiliated third

party in Japan for a 2011-built Newcastlemax dry bulk vessel of 207,855 dwt built at Nantong COSCO KHI

Ship Engineering Co Ltd (NACKS). Pursuant to the terms of the bareboat charter, Seanergy has advanced

a down payment of $3.5 million and will pay an additional $3.5 million on delivery of the vessel to the

Company, as well as a daily bareboat rate of $9,000 over the charter period. Delivery is estimated to take

place between August and December 2023 while at the end of the 12-month bareboat period, Seanergy

has an option to purchase the Vessel for $20.2 million.

Stamatis Tsantanis, the Company’s Chairman & Chief Executive Officer, stated:

“Consistent with our commitment to enhance shareholder value, we have repurchased approximately 2%

of our outstanding shares. We continue to be very confident in our Company’s prospects and the industry’s

fundamentals.

“The bareboat-in agreement for our first Newcastlemax vessel expands our presence in the sector, without

substantial capital outlay on its delivery, and provides a purchase option at the end of the bareboat period.

We believe the overall purchase price of approximately $30.5 million, including the bareboat payments, is

beneficial to the Company.

“Regarding current market conditions, we see that demand for seaborne transportation of dry bulk

commodities is very robust. DWT-miles have grown by 5.8% year-on-year1, while the relevant figures from

January until the end of May are the strongest of the last three years.

“We believe current freight-rate weakness is due to three main factors:

• First, the unwinding of vessel congestion has released a significant amount of tonnage in the

market creating a temporary oversupply of vessels. We believe that later in the year this will be

reversed to historical averages that will tighten the supply of tonnage.

• Second, certain charterers and operators have been reluctant to comply with new environmental

rules relating to reduced carbon emissions and resultant speed caps for their chartered-in fleets.

We believe that these vessels will eventually need to abide by the new requirements as charterers

and operators come to terms with the new regulations and the global fleet’s average speed will be

reduced further. This is also expected to tighten the supply of tonnage.

• Lastly, the highly volatile trading of FFA contracts is becoming increasingly disconnected from the

fundamentals of the physical market. Instead of its intended use as a hedging tool, following the

emergence of algorithmic trading, it is becoming a high-risk instrument that may negatively impact

sentiment, which subsequently creeps into the physical market.

“We remain committed to the Capesize sector with a solid operational platform and believe we have

1 According to independent research

positioned Seanergy optimally to capitalize on improvements in the dry bulk market. We will continue to

focus on shareholder returns and sustainable growth.”

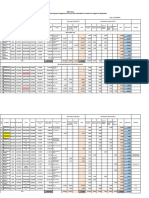

Company Fleet:

FFA Maximum

Capacity Year Scrubber Employment Minimum T/C

Vessel Name Yard conversion T/C Charterer

(DWT) Built Fitted Type expiration

option(1) expiration(2)

T/C Index Anglo

Fellowship 179,701 2010 Daewoo - Yes 06/2024 10/2024

Linked American

Koyo – T/C Index

Worldship 181,415 2012 Yes Yes 09/2023 01/2024 Cargill

Imabari Linked

Sungdong T/C Index

Championship 179,238 2011 Yes Yes 04/2025 11/2025 Cargill

SB Linked

T/C Index

Flagship 176,387 2013 Mitsui - Yes 05/2026 07/2026 Cargill

Linked

T/C Index

Patriotship 181,709 2010 Imabari Yes Yes 11/2023 06/2024 Glencore

Linked

T/C Index

Knightship 178,978 2010 Hyundai Yes Yes 10/2024 12/2024 Glencore

Linked

Sungdong T/C Index

Premiership 170,024 2010 Yes Yes 04/2024 06/2024 Glencore

SB Linked

Sungdong T/C Index

Squireship 170,018 2010 Yes Yes 05/2024 07/2024 Glencore

SB Linked

T/C Index

Dukeship 181,453 2010 Sasebo - Yes 04/2024 09/2024 NYK

Linked

T/C Index

Hellasship 181,325 2012 Imabari - Yes 12/2023 03/2024 NYK

Linked

T/C Index

Honorship 180,242 2010 Imabari - Yes 02/2024 07/2024 NYK

Linked

Sungdong T/C Index

Geniuship 170,057 2010 - Yes 04/2024 08/2024 NYK

SB Linked

T/C Index

Friendship 176,952 2009 Namura - Yes 12/2023 03/2024 NYK

Linked

T/C Index

Paroship 181,415 2012 Koyo-Imabari Yes Yes 10/2023 12/2023 Oldendorff

Linked

T/C Index

Partnership 179,213 2012 Hyundai Yes Yes 09/2024 12/2024 Uniper

Linked

T/C Index

Lordship 178,838 2010 Hyundai Yes Yes 08/2024 09/2024 Uniper

Linked

Titanship3 207,855 2011 NACKS - TBD TBD TBD TBD TBD

Total / Average

3,054,820 12.4 - - - - - - -

age

(1) The Company has the option to convert the index-linked rate to fixed for periods ranging between 1 and 12 months, based

on the prevailing Capesize FFA Rate for the selected period.

(2) The latest redelivery date does not include any additional optional period.

(3) To be delivered between August and December 2023.

About Seanergy Maritime Holdings Corp.

Seanergy Maritime Holdings Corp. is an international shipping company that provides marine dry bulk

transportation services through the ownership and operation of dry bulk vessels. As of today, the

Company's operating fleet consists of 16 Capesize vessels with an average age of 12.4 years and

aggregate cargo carrying capacity of approximately 2,846,965 dwt. Upon completion of the

aforementioned transaction, the Company's operating fleet will consist of 17 vessels (16 Capesize and 1

Newcastlemax), with an aggregate cargo carrying capacity of 3,054,820 dwt.

The Company is incorporated in the Marshall Islands and has executive offices in Glyfada, Greece. The

Company's common shares trade on the Nasdaq Capital Market under the symbol “SHIP”.

Please visit our company website at: www.seanergymaritime.com.

Forward-Looking Statements

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning

future events. Words such as "may," "should," "expects," "intends," "plans," "believes," "anticipates,"

"hopes," "estimates" and variations of such words and similar expressions are intended to identify forward-

looking statements. These statements involve known and unknown risks and are based upon a number of

assumptions and estimates, which are inherently subject to significant uncertainties and contingencies,

many of which are beyond the control of the Company. Actual results may differ materially from those

expressed or implied by such forward-looking statements. Factors that could cause actual results to differ

materially include, but are not limited to, the Company's operating or financial results; the Company's

liquidity, including its ability to service its indebtedness; competitive factors in the market in which the

Company operates; shipping industry trends, including charter rates, vessel values and factors affecting

vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy,

areas of possible expansion or contraction, and expected capital spending or operating expenses; risks

associated with operations outside the United States; broader market impacts arising from war (or

threatened war) or international hostilities, such as between Russia and Ukraine; risks associated with the

length and severity of the pandemics, (including COVID-19), including effects on demand for dry bulk

products and the transportation thereof; and other factors listed from time to time in the Company's filings

with the SEC, including its most recent annual report on Form 20-F. The Company's filings can be obtained

free of charge on the SEC's website at www.sec.gov. Except to the extent required by law, the Company

expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change in the Company's expectations with

respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information please contact:

Seanergy Investor Relations

Tel: +30 213 0181 522

E-mail: ir@seanergy.gr

Capital Link, Inc.

Paul Lampoutis

230 Park Avenue Suite 1540

New York, NY 10169

Tel: (212) 661-7566

E-mail: seanergy@capitallink.com

You might also like

- Scientologist Grant Cardone & Cardone Capital LLC Sued - Copy of LawsuitDocument32 pagesScientologist Grant Cardone & Cardone Capital LLC Sued - Copy of LawsuitJeffrey AugustineNo ratings yet

- PDFDocument2 pagesPDFPranab Kumar MahapatraNo ratings yet

- Piping Class Summary 076328C-TP-00-M-SA-0001 - 4Document28 pagesPiping Class Summary 076328C-TP-00-M-SA-0001 - 4parameswaran r nairNo ratings yet

- Financial Modelling 2016Document25 pagesFinancial Modelling 2016SukumarNo ratings yet

- Black Book 07Document57 pagesBlack Book 07akshat50% (2)

- DMT 219004 AbDocument518 pagesDMT 219004 AbCiprian MariusNo ratings yet

- DDM Federal BankDocument15 pagesDDM Federal BankShubhangi 16BEI0028No ratings yet

- CE-23 - Material Tracking Schedule - 30.03.2020Document3 pagesCE-23 - Material Tracking Schedule - 30.03.2020Deepak KumarNo ratings yet

- JIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test MethodsDocument43 pagesJIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test Methodsbignose93gmail.com0% (1)

- Carbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersFrom EverandCarbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersNo ratings yet

- Sea NergyDocument10 pagesSea NergyKevin ParkerNo ratings yet

- Seanergy Announces Delivery & Immediate Period Employment of One Capesize Vessel and New Bank Loan FacilityDocument3 pagesSeanergy Announces Delivery & Immediate Period Employment of One Capesize Vessel and New Bank Loan FacilityMohammedAfrozNo ratings yet

- Seanergy Maritime Reports Financial Results For The Third Quarter and Nine Months Ended September 30, 2023 and Declares Dividend of $0.025 Per ShareDocument10 pagesSeanergy Maritime Reports Financial Results For The Third Quarter and Nine Months Ended September 30, 2023 and Declares Dividend of $0.025 Per ShareKevin ParkerNo ratings yet

- Demurrage & MiscDocument4 pagesDemurrage & Misctanvirmahabub IslamNo ratings yet

- 1565235061tenders Awards DD2 PND 2019 07Document4 pages1565235061tenders Awards DD2 PND 2019 07Rasika SirisenaNo ratings yet

- Claimspaid Eng 2019Document4 pagesClaimspaid Eng 2019sNo ratings yet

- Process Datasheet FOR Vgo HDT Feed Storage Tank (203-Tk-012)Document6 pagesProcess Datasheet FOR Vgo HDT Feed Storage Tank (203-Tk-012)pavanNo ratings yet

- PSHG Presentation 18012023Document17 pagesPSHG Presentation 18012023pcmurreNo ratings yet

- WNC 35 16 152 Vol-7.7.20Document5 pagesWNC 35 16 152 Vol-7.7.20lakshNo ratings yet

- SupplyInward 830 RRADocument1 pageSupplyInward 830 RRAskgts787737No ratings yet

- Bakun Mos SummaryDocument1 pageBakun Mos SummarydominicNo ratings yet

- Balaji FRT MPDocument2 pagesBalaji FRT MPBalaji DelhiNo ratings yet

- OE Upload TemplateDocument22 pagesOE Upload TemplateSathish JayapalanNo ratings yet

- 2020 Q4 PresentationDocument27 pages2020 Q4 PresentationzesmemNo ratings yet

- Mooring Line Record TemplateDocument6 pagesMooring Line Record TemplateViết Thuật TrịnhNo ratings yet

- SL P.O.NO Supplier Name From TO From TO Status Locati On Description (Equipments / Vehicles) Days To Expire Last Po ValueDocument1 pageSL P.O.NO Supplier Name From TO From TO Status Locati On Description (Equipments / Vehicles) Days To Expire Last Po Valuefaizal4inNo ratings yet

- Trimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainDocument8 pagesTrimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainHeryadi IndrakusumaNo ratings yet

- Claimspaid 2021Document72 pagesClaimspaid 2021sNo ratings yet

- Project Reference - List - EurotechDocument12 pagesProject Reference - List - EurotechEurotech Tra TranNo ratings yet

- Bci 2014Document1 pageBci 2014byrsideNo ratings yet

- Claimspaid 2018Document124 pagesClaimspaid 2018sNo ratings yet

- GST Tax Invoice Format For GoodsDocument17 pagesGST Tax Invoice Format For GoodsRagesh KNo ratings yet

- Santhosh Site Expenses: SL - No Date Description Charges (RS)Document9 pagesSanthosh Site Expenses: SL - No Date Description Charges (RS)DECWOOTZ DESIGNNo ratings yet

- Transmittal Record As of November 27,2020Document111 pagesTransmittal Record As of November 27,2020Pamela Mae Derecho BatuigasNo ratings yet

- Application For Utilization Permission/utilization Declaration/Amendment/Export Order Office Use OnlyDocument1 pageApplication For Utilization Permission/utilization Declaration/Amendment/Export Order Office Use OnlyShakirNo ratings yet

- Shelf Drilling Fleet Status Report Updated March 2019Document4 pagesShelf Drilling Fleet Status Report Updated March 2019Rohan SandesaraNo ratings yet

- Claimspa 2022Document54 pagesClaimspa 2022sNo ratings yet

- Requirements Approval Document (RAD) #20392Document3 pagesRequirements Approval Document (RAD) #20392Tty SmithNo ratings yet

- Basic QES FormDocument3 pagesBasic QES FormrajeshNo ratings yet

- HSSE Bridging DocumentDocument27 pagesHSSE Bridging DocumentOleg NesterenkoNo ratings yet

- Prequalification RegisterDocument41 pagesPrequalification Registershahid047No ratings yet

- Smbf37a00015 PDFDocument6 pagesSmbf37a00015 PDFCJ DARCL SambalpurNo ratings yet

- P.I.C Description Date of Order Due Date Status Plan To Do RemarksDocument1 pageP.I.C Description Date of Order Due Date Status Plan To Do RemarksAjeng Kartika PutriNo ratings yet

- D031180207 10506829823535257 SchedulescDocument2 pagesD031180207 10506829823535257 SchedulescTeja SreeNo ratings yet

- Grand Total: DA: UnallocDocument1 pageGrand Total: DA: UnallocratiozNo ratings yet

- Concor Bill Payment StatusDocument23 pagesConcor Bill Payment Statusanuj sharmaNo ratings yet

- Claimspaid 2020Document46 pagesClaimspaid 2020sNo ratings yet

- Atlanta 12 Core PODocument3 pagesAtlanta 12 Core POKarteek PattaswamiNo ratings yet

- Najeem Cashew Industries, 2019-20: Particulars Credit Debit Opening Balance 92,26,042.94Document1 pageNajeem Cashew Industries, 2019-20: Particulars Credit Debit Opening Balance 92,26,042.94Bindu M PillaiNo ratings yet

- Fortnightly Brief Dte of HousingDocument3 pagesFortnightly Brief Dte of HousingAdnan BaseerNo ratings yet

- Vendor List For GRP Pipes and Fittings - 23052022055904Document1 pageVendor List For GRP Pipes and Fittings - 23052022055904Ahmed BakrNo ratings yet

- Mhban14374600000012832 2018Document1 pageMhban14374600000012832 2018swapnildanavale17No ratings yet

- InsuranceDocument3 pagesInsuranceafnan8873108850No ratings yet

- Btl-Ben-Shp-F 0020 Cotonou Port Line-Up - XDocument1 pageBtl-Ben-Shp-F 0020 Cotonou Port Line-Up - XStaff TrmOverseasNo ratings yet

- Lanea E-2 TCP-GR Invoice 2019-01-18Document2 pagesLanea E-2 TCP-GR Invoice 2019-01-18DIEUDONNE MBAIKETENo ratings yet

- Opco Listing 09 Sierra Leone20200722Document2 pagesOpco Listing 09 Sierra Leone20200722Julius SamboNo ratings yet

- GST Tax Invoice Format For GoodsDocument1 pageGST Tax Invoice Format For GoodsRagesh KNo ratings yet

- Access125 - Insurance - D120776605 - Policy ScheduleDocument3 pagesAccess125 - Insurance - D120776605 - Policy Scheduleಪವನ್ ಕೆNo ratings yet

- Monywa ONT DNDocument2 pagesMonywa ONT DNMatthew Sa LoneNo ratings yet

- Date: Driver Name: Contact No: Vehicle No: Client: Hydro: Repair Witnessed by StatusDocument8 pagesDate: Driver Name: Contact No: Vehicle No: Client: Hydro: Repair Witnessed by StatusAnonymous 0JNjBINo ratings yet

- CIMFR Uploading TemplateDocument27 pagesCIMFR Uploading Templaterabindra lalNo ratings yet

- Pending Bill StatusDocument5 pagesPending Bill StatusSanu RajNo ratings yet

- Claimspaid Fir 20Document39 pagesClaimspaid Fir 20sNo ratings yet

- Freight Payment NVsDocument1 pageFreight Payment NVssajjadNo ratings yet

- Due Madri MenuDocument1 pageDue Madri MenuKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Consumer Products Update - April 2024Document31 pagesConsumer Products Update - April 2024Kevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 RichmondDocument1 pageFive Fast Facts Q1 2024 RichmondKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Due Madri - Catering MenuDocument1 pageDue Madri - Catering MenuKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Office Market ReportDocument1 pageRoanoke 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 FredericksburgDocument1 pageFive Fast Facts Q1 2024 FredericksburgKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Industrial Market ReportDocument1 pageRoanoke 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- LeadershipDocument4 pagesLeadershipKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- 2024 Real Estate Event InvitationDocument1 page2024 Real Estate Event InvitationKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Manufacturing Update - March 2024Document31 pagesManufacturing Update - March 2024Kevin ParkerNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- HO Waterways WV 231108Document2 pagesHO Waterways WV 231108Kevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 CharlottesvilleDocument1 pageFive Fast Facts Q1 2024 CharlottesvilleKevin ParkerNo ratings yet

- HO Waterways TN 231108Document2 pagesHO Waterways TN 231108Kevin ParkerNo ratings yet

- BestConstructionPracticesBUDMWorkshop Midwest FlyerDocument2 pagesBestConstructionPracticesBUDMWorkshop Midwest FlyerKevin ParkerNo ratings yet

- FY2023 Results - Transcript WebcastDocument20 pagesFY2023 Results - Transcript WebcastKevin ParkerNo ratings yet

- 2023 H2 Healthcare Houston Report ColliersDocument2 pages2023 H2 Healthcare Houston Report ColliersKevin ParkerNo ratings yet

- Linesight Construction Market Insights Americas - March 2024 1Document36 pagesLinesight Construction Market Insights Americas - March 2024 1Kevin ParkerNo ratings yet

- GLDT Webinar Agenda APRIL 3 - 2024Document1 pageGLDT Webinar Agenda APRIL 3 - 2024Kevin ParkerNo ratings yet

- 2024 02 21 Item F2 Surfers-Beach-Staff-ReportDocument5 pages2024 02 21 Item F2 Surfers-Beach-Staff-ReportKevin ParkerNo ratings yet

- HO Waterways OK 231108Document2 pagesHO Waterways OK 231108Kevin ParkerNo ratings yet

- Holthausen&WattsDocument73 pagesHolthausen&WattsMariska PramitasariNo ratings yet

- Financial Analysis of Coca-Cola: Financial Successes and FailuresDocument3 pagesFinancial Analysis of Coca-Cola: Financial Successes and FailuresStefan HeheNo ratings yet

- MBA LECTURE-lecture 1Document160 pagesMBA LECTURE-lecture 1takawira chirimeNo ratings yet

- Assign 3 - Sem 2 11-12 - RevisedDocument5 pagesAssign 3 - Sem 2 11-12 - RevisedNaly BergNo ratings yet

- BIG - Fintech Academy 2020Document11 pagesBIG - Fintech Academy 2020Roberto SantosNo ratings yet

- Berkadia 2020 Forecast PDFDocument68 pagesBerkadia 2020 Forecast PDFtwinkle goyalNo ratings yet

- SDM - Best Practices From FMCG IndDocument51 pagesSDM - Best Practices From FMCG IndShubham Abrol100% (1)

- Insular 61Document120 pagesInsular 61Celine ClaudioNo ratings yet

- Job - JD Specialist - 2 IPA v1 (Wad) Rev (Regulatory & BEE Reform Specialist)Document4 pagesJob - JD Specialist - 2 IPA v1 (Wad) Rev (Regulatory & BEE Reform Specialist)Osman Bin SaifNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Bitcoin Vs Share-MarketDocument15 pagesBitcoin Vs Share-MarketSAGAR SANTOSH MORENo ratings yet

- Fasb 115 PDFDocument2 pagesFasb 115 PDFJosephNo ratings yet

- Corporate Reputation: Image and IdentityDocument15 pagesCorporate Reputation: Image and IdentityInês PereiraNo ratings yet

- Product Portfolio Analysis BCG Matrix: Julian Grail Jgrail2@glos - Ac.ukDocument11 pagesProduct Portfolio Analysis BCG Matrix: Julian Grail Jgrail2@glos - Ac.ukIshrat JafriNo ratings yet

- NovaOil 2019 EnglishDocument13 pagesNovaOil 2019 EnglishCESAR ANDRES BERNAL HUICOCHEANo ratings yet

- Appraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Document11 pagesAppraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Movie SenderNo ratings yet

- Quizlet - SOM 122 Chapter 17 - Managing Business FinancesDocument3 pagesQuizlet - SOM 122 Chapter 17 - Managing Business FinancesBob KaneNo ratings yet

- IMT AssignmentDocument21 pagesIMT AssignmentAbdulla MunfizNo ratings yet

- Prob 2-1: Mayberry Personal Receivers: Original Situation: Income Statement ($ Thousands) 2001 2002 2003Document8 pagesProb 2-1: Mayberry Personal Receivers: Original Situation: Income Statement ($ Thousands) 2001 2002 2003Ankit AgarwalNo ratings yet

- Global Integrated Energy May 13Document14 pagesGlobal Integrated Energy May 13Ben ChuaNo ratings yet

- G3-4-Oil Industry Derivative CaseDocument11 pagesG3-4-Oil Industry Derivative CaseKim Margaux LimbacoNo ratings yet

- tài liệu thuyết trìnhDocument2 pagestài liệu thuyết trìnhPhung Khanh Bang K14 FUG CTNo ratings yet

- 104 QuizDocument25 pages104 Quizricamae saladagaNo ratings yet

- Accounting For Notes PayableDocument10 pagesAccounting For Notes PayableLiza Mae MirandaNo ratings yet

- Mukesh GarmentsDocument2 pagesMukesh GarmentsPARASHAR GULSHANNo ratings yet

- At FinalsDocument33 pagesAt FinalsJester LumpayNo ratings yet