Professional Documents

Culture Documents

GSTR-1 Report Testing 1

Uploaded by

Singb BabluCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR-1 Report Testing 1

Uploaded by

Singb BabluCopyright:

Available Formats

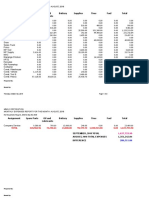

processgstin customerGSTIN customerName invoiceNo

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9110000303

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9110000303

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9110000303

27AABCB1382J1ZQ 32AAEFA8537E1ZR ALBATROSS 9121102923

27AABCB1382J1ZQ RAJKOTIA MEDICARE PVT. LTD. 9121102924

27AABCB1382J1ZQ RUMEX PHARMACEUTICALS 9121102925

27AABCB1382J1ZQ VIDARBHA MEDICAL AGENCIES 9121102926

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9210000585

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9210000585

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9410001222

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9410001222

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9410001223

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9410001223

27AABCB1382J1ZQ EURIMEX PHARMA 9410001224

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9561100207

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9561100207

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9561100207

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9561100208

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9561100208

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9911100006

27AABCB1382J1ZQ TOBINCO PHARMACEUTICALS LTD. 9911100006

invoiceDate invType originalInvoiceNo originalInvoiceDate invoiceValue hsnsac

2/6/2018 E 127,900.00 30043200

2/6/2018 E 85,350.00 30043200

2/6/2018 E 56,000.00 30043200

2/6/2018 R 6,720.00 30049090

2/6/2018 7,440.00 30049090

2/7/2018 6,720.00 30049090

2/7/2018 7,440.00 30049090

2/13/2018 E 1,600.00 30049049

2/13/2018 E 0.00 30049049

2/1/2018 E 9,000.00 30049099

2/1/2018 E 0.00 30049099

2/6/2018 E 4,500.00 30049099

2/6/2018 E 0.00 30049099

3/8/2018 E 5,600.00000 30049069

2/6/2018 E 127,900.00 30043200

2/6/2018 E 85,350.00 30043200

2/6/2018 E 56,000.00 30043200

2/13/2018 E 1,600.00 30049049

2/13/2018 E 0.00 30049049

2/12/2018 E 2,240.00 30049099

2/12/2018 E 120.00 30049099

ProdDesc quantity uqc taxablevalue igstRate igstAmount

ANOMEX SUPPOSITORIES -1X5 EXPORT 25,580 PAC 127,900.00 12.00 0.00

ANOMEX SUPPOSITORIES -1X5 EXPORT 17,070 PAC 85,350.00 12.00 0.00

ANOMEX SUPPOSITORIES -1X5 EXPORT 11,200 PAC 56,000.00 12.00 0.00

RECTOL-80 SUPP. (SALE PACK) 1X5 - LOCAL 500 PAC 6,000.00 12.00 720.00

RECTOL-80 SUPP. (SALE PACK) 1X5 - LOCAL 500 PAC 6,000.00 0.00 0.00

RECTOL-80 SUPP. (SALE PACK) 1X5 - LOCAL 500 PAC 6,000.00 12.00 720.00

RECTOL-80 SUPP. (SALE PACK) 1X5 - LOCAL 500 PAC 6,000.00 0.00 0.00

BG-GLUTAMIN TABLETS -1X30 TABS. 3,200 PAC 1,600.00 0.00 0.00

BG-GLUTAMIN TABLETS -1X30 TABS. 800 PAC 0.00 0.00 0.00

AMITONE SYRUP (200ML) PLAIN 9,000 BT 9,000.00 12.00 0.00

AMITONE SYRUP (200ML) PLAIN 1,000 BT 0.00 12.00 0.00

AMITONE SYRUP (200ML) PLAIN 4,500 BT 4,500.00 12.00 0.00

AMITONE SYRUP (200ML) PLAIN 1,000 BT 0.00 12.00 0.00

UPRADONE CAPSULES ( 3 X 10 CAP.) 5,000 PAC 5,000.00000 12.00 600.00000

ANOMEX SUPPOSITORIES -1X5 EXPORT 25,580 PAC 127,900.00 12.00 0.00

ANOMEX SUPPOSITORIES -1X5 EXPORT 17,070 PAC 85,350.00 12.00 0.00

ANOMEX SUPPOSITORIES -1X5 EXPORT 11,200 PAC 56,000.00 12.00 0.00

BG-GLUTAMIN TABLETS -1X30 TABS. 3,200 PAC 1,600.00 0.00 0.00

BG-GLUTAMIN TABLETS -1X30 TABS. 800 PAC 0.00 0.00 0.00

AMITONE SYRUP (200ML) PLAIN 2,000 BT 2,000.00 12.00 240.00

AMITONE SYRUP (200ML) PLAIN 1,000 BT 0.00 12.00 120.00

cgstRate cgstAmount sgstRate sgstAmount utgstRate utgstAmount cessAmount indsupply

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Taxable

6.00 360.00 6.00 360.00 0.00 0.00 0.00 Taxable

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Taxable

6.00 360.00 6.00 360.00 0.00 0.00 0.00 Taxable

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00000 0.00 0.00000 0.00 0.00000 0.00000 Taxable

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Exempt

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Taxable

0.00 0.00 0.00 0.00 0.00 0.00 0.00 Taxable

statecode pos reverseCharge ecommerceGSTIN advanceDocumentNo AdvDate AdvAmt AdvTaxAmt

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

27 0 0.00 0.00

0 0.00 0.00

27 0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

0 0.00 0.00

AdvCessAmt invCan shippingBillCode shippingBillNo shippingBillDate paymentofGST branchcode

0.00 YES 112222 1235466 2/7/2018 with GST 10MH

0.00 YES 112222 1235466 2/7/2018 with GST 10MH

0.00 YES 112222 1235466 2/7/2018 with GST 10MH

0.00 with GST 10MH

0.00 with GST 10MH

0.00 with GST 10MH

0.00 with GST 10MH

0.00 YES without GST 10MH

0.00 YES without GST 10MH

0.00 112222 with GST 10MH

0.00 112222 with GST 10MH

0.00 112222 4567891 2/7/2018 with GST 10MH

0.00 112222 4567891 2/7/2018 with GST 10MH

0.00 112222 with GST 10MH

0.00 with GST 10MH

0.00 with GST 10MH

0.00 with GST 10MH

0.00 without GST 10MH

0.00 without GST 10MH

0.00 with GST 10MH

0.00 with GST 10MH

erpitemcode Ccode erpdocno erpdocdate Flags Posting Date Exchange Rate as per Invoice Date

17000018 1000 6,145,000

17000018 1000 6,145,000

17000018 1000 6,145,000

17000177 1000 2/6/2018 100,000

17000177 1000 2/6/2018 100,000

17000177 1000 2/7/2018 100,000

17000177 1000 2/7/2018 100,000

17000266 1000 6,145,000

17000266 1000 6,145,000

17000374 1000 6,145,000

17000374 1000 6,145,000

17000374 1000 6,145,000

17000374 1000 6,145,000

17000488 1000 3/8/2018 6,970,000

17000018 1000 6,145,000

17000018 1000 6,145,000

17000018 1000 6,145,000

17000266 1000 6,145,000

17000266 1000 6,145,000

17000374 1000 6,145,000

17000374 1000 6,145,000

Exchange Rate as per Shipping Bill Date Exchange Rate as per Posting Date

Exchange Rate as per B/L Date FOB Value DC Freight Value DC Insurance Value in DC

127,900.00 0.00 0.00

85,350.00 0.00 0.00

56,000.00 0.00 0.00

0.00 0.00 0.00

0.00 0.00 0.00

0.00 0.00 0.00

0.00 0.00 0.00

1,600.00 0.00 0.00

400.00 0.00 0.00

9,000.00 0.00 0.00

1,000.00 0.00 0.00

4,500.00 0.00 0.00

0.00 0.00 0.00

4,945.00000 5.00000 50.00000

127,900.00 0.00 0.00

85,350.00 0.00 0.00

56,000.00 0.00 0.00

1,600.00 0.00 0.00

400.00 0.00 0.00

2,000.00 0.00 0.00

1,000.00 0.00 0.00

Posting Status Currency Type (USD/EUR/INR) Delivery Document No.

E USD 8400002483

E USD 8400002483

E USD 8400002483

C INR 8100003130

C INR 8100003131

C INR 8100003132

C INR 8100003133

E USD

E USD

A USD 8400002481

A USD 8400002481

A USD 8400002482

A USD 8400002482

C EURO 8400002486

E USD

E USD

E USD

E USD

E USD

A USD

A USD

Delivery Document Posting Date B/L / AWB Date B/L / AWB NO Consignee Code Customer Code

2/6/2018 4000048 4000048

2/6/2018 4000048 4000048

2/6/2018 4000048 4000048

2/6/2018 1000005 1000005

2/6/2018 1000092 1000092

2/7/2018 1000097 1000097

2/7/2018 1000142 1000142

4000048 4000048

4000048 4000048

9/21/2017 4000048 4000048

9/21/2017 4000048 4000048

2/6/2018 4000048 4000048

2/6/2018 4000048 4000048

3/8/2018 4000016 4000016

4000048 4000048

4000048 4000048

4000048 4000048

4000048 4000048

4000048 4000048

4000048 4000048

4000048 4000048

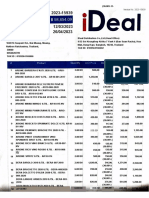

GSTR -1 Report Development - observations; Comments

1 Report should be displayed in both detailed and consolidated formats pending

2 Report should be executed- posting date wise pending

3 Report should be executed Invoice wise pending

4 Report should be executed by Consignee pending

Invoice Value i.e. Taxable value + amount of GST for all items of the Invoice shouls be displayed in invoiceValue column

5 ans same should repeat for all line items of the same Invoice. prashant will rectify

In case of released Invoices, Exchange rate should be considered as

per Posting Date;

In case of unreleased Invoices, Exchange Rate should be considered as

per Shipping Bill Date where shipping bill date available otherwise

should be considered as per Invoices date and the same should again

6 All values except FOB Value DC, Freight Value DC & Insurance Value in DC columns should be displayed in INR. be considered as per posting date when Invoice is released.

7 reverse Charge column field should display result as % of reverse charge i.e. 100 or 0 (zero) prashant will rectify

Recipient state code should appear in statecode column and repeat for all items of same Invoice; field length for state

8 code is only 2 as per Karvy templet. prashant will rectify

9 Billed to address state code should be displayed in pos column and should repeat for all line items of the same invoice. prashant will rectify

Exchange Rate as per Shipping Bill Date, Exchange Rate as per Posting Date, Exchange Rate as per B/L Date etc.

10 should be displayed in respective columns and should repeated for each line item of the same Invoice. prashant will rectify

11 Invoice Value for Invoice No. 9121102924 9121102926 is not correct. prashant will rectify

12 Invoice Value for Invoce No. 9210000585 & 9410001222 - line item No. 2 is negative prashant will rectify done

13 Supplies against Invoice No. 9210000585 indicated as Exempt whereas they are taxable prashant will rectify all supplies indicated as exempt are not exempt, all are taxable supplies

14 Simillar supplies against Invoice No. 9410001222 & 9410001223 are once indicated as Taxable & once Exempt prashant will rectify indicated as exempt

15 In all fields, decimal places should be seperated by '.' (dot) instead of ',' (comma) user parameter to be changed at our end

16 In case of reversal entries, values and Qty should appear in negative number billing types for cancelled & BTT invoices to be provided to Prashant

17 Kindly map Advance docement (type RP & DA) in the report prashant will map the details in report

18 Exchange rates should be properly displayed (e.g. 61.45, 1.00 etc.) user parameter to be changed at our end

You might also like

- Indian Economy NotesDocument10 pagesIndian Economy NotesAbhishek Verma93% (14)

- Syngas Sdn Bhd projected cashflow analysisDocument17 pagesSyngas Sdn Bhd projected cashflow analysisShukri SallehNo ratings yet

- Business Blueprint: by Kpit Cummins InfosystemsDocument59 pagesBusiness Blueprint: by Kpit Cummins InfosystemsLoganathan Arthanari100% (1)

- 13.1 Objective 13.1: Chapter 13 Pricing Decisions and Cost ManagementDocument43 pages13.1 Objective 13.1: Chapter 13 Pricing Decisions and Cost ManagementAlanood WaelNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingDocument7 pagesAP Macroeconomics Assignment: Apply Concepts of AD/AS: SlopingSixPennyUnicornNo ratings yet

- Ingenzi Mu Mategeko Y'umuhandaDocument21 pagesIngenzi Mu Mategeko Y'umuhandaNdayisaba100% (3)

- GSTR-1 Report TestingDocument14 pagesGSTR-1 Report TestingSingb BabluNo ratings yet

- GSTR1 Report TestingDocument14 pagesGSTR1 Report TestingSingb BabluNo ratings yet

- ProjectionReport_20240331Document3 pagesProjectionReport_20240331IaM Rajesh RajNo ratings yet

- Cash FlowDocument71 pagesCash Flowpuput utomoNo ratings yet

- NR26Q Q2Document82 pagesNR26Q Q2Sachin KumarNo ratings yet

- Ejercicio PlanillaDocument17 pagesEjercicio Planillamanfredo pastoraNo ratings yet

- Abridores e Cardas: Mat. Título kg/SAÍDA % Prima Fita Hora EficDocument36 pagesAbridores e Cardas: Mat. Título kg/SAÍDA % Prima Fita Hora EficErivaldo José CavalcantiNo ratings yet

- Penjualan Obat Gudang 1 Bulan 09-01-2024Document18 pagesPenjualan Obat Gudang 1 Bulan 09-01-2024Inne pualamNo ratings yet

- Stok Opname Suplemen dan Batch ExpiredDocument5 pagesStok Opname Suplemen dan Batch ExpiredindraNo ratings yet

- Ejercicio 2017: Maquinas de ExplotaciónDocument9 pagesEjercicio 2017: Maquinas de ExplotaciónThalia Huayllahuaman FloresNo ratings yet

- Anticipos A ProveedoresDocument2 pagesAnticipos A ProveedoresAlisNo ratings yet

- Traslados UrbanityDocument17 pagesTraslados UrbanityLuis Diaz LeònNo ratings yet

- Devis OulmesDocument1 pageDevis Oulmeschahidi.mouradNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- 2016 Income Tax Tables To 500kDocument56 pages2016 Income Tax Tables To 500kcayusbonusNo ratings yet

- Reporte VAN - OkDocument4 pagesReporte VAN - OkEdgar HurtadoNo ratings yet

- Turnover Estimations March 2017 - Feb 2018Document24 pagesTurnover Estimations March 2017 - Feb 2018pradyumnagaliNo ratings yet

- 28-Hoja de Cálculo 20211102172535-Ma-02-11-2021Document29 pages28-Hoja de Cálculo 20211102172535-Ma-02-11-2021Daniel Corahua AlvarezNo ratings yet

- Tax Statement As On Oct 2023: Employee DetailsDocument1 pageTax Statement As On Oct 2023: Employee DetailsParthiban ManiNo ratings yet

- Met 35Document2 pagesMet 35Percypto RojasNo ratings yet

- Profit and Loss Statemen1Document8 pagesProfit and Loss Statemen1Meha DaveNo ratings yet

- Control de Prestamo (Autoguardado)Document29 pagesControl de Prestamo (Autoguardado)Jose Luis NoesiNo ratings yet

- Inv Ntui 31052020Document12 pagesInv Ntui 31052020jodex verlain AwoumaNo ratings yet

- YTD Payslip-2020-2021Document1 pageYTD Payslip-2020-2021SudharsanNo ratings yet

- Penyusutan - Peralatan KantorDocument16 pagesPenyusutan - Peralatan KantorSiti Hajar AsmawiahNo ratings yet

- Hidro Scienza Sociadad Anonima Closed Document RecordsDocument4 pagesHidro Scienza Sociadad Anonima Closed Document RecordsEmmabells AllenNo ratings yet

- Taxsheet 10007162Document2 pagesTaxsheet 10007162Narender KapoorNo ratings yet

- Balanta - Verificare CompletatDocument5 pagesBalanta - Verificare CompletatAura-Maria ErhanNo ratings yet

- Varian Material ReconcilDocument1 pageVarian Material ReconcilMelio SoepraptoNo ratings yet

- Schedule of CT Ledger: For The Month Ended November, 2018Document6 pagesSchedule of CT Ledger: For The Month Ended November, 2018Nahid HossainNo ratings yet

- Informe General de Facturación: Ignacio Alvarez 12167769 de Enero 01 2023 A Diciembre 31 2023Document5 pagesInforme General de Facturación: Ignacio Alvarez 12167769 de Enero 01 2023 A Diciembre 31 2023Daniela Ortega MendietaNo ratings yet

- Lap Manbun Tri I, II, III, 2023 Sebangau KualaDocument6 pagesLap Manbun Tri I, II, III, 2023 Sebangau KualaT.A. AribrataNo ratings yet

- Cronogramas de TareasDocument2 pagesCronogramas de TareasIan Kevi Arce RodriguezNo ratings yet

- Table: Assembled Joint Masses: Kel 8.SDB SAP2000 v14.0.0 - License # 17 Juli 2018Document7 pagesTable: Assembled Joint Masses: Kel 8.SDB SAP2000 v14.0.0 - License # 17 Juli 2018eki wpNo ratings yet

- (All Column Values) 39076110 4 Between 05/01/2020 - 05/31/2021Document12 pages(All Column Values) 39076110 4 Between 05/01/2020 - 05/31/2021shawon azamNo ratings yet

- Project Costs for Starting a Dairy Farm Project with Three CowsDocument11 pagesProject Costs for Starting a Dairy Farm Project with Three CowsAmoud MimouneNo ratings yet

- Accounting Books ASDC 88Document199 pagesAccounting Books ASDC 88Rodel, Jr BaldemorNo ratings yet

- Devolucion Iva 3bim 2018Document6 pagesDevolucion Iva 3bim 2018Merly Yoheny Parra TarazonaNo ratings yet

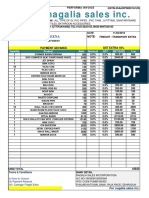

- Quotation PadDocument1 pageQuotation PadNagalia SalesNo ratings yet

- Presupuesto RRSSS 2023Document2 pagesPresupuesto RRSSS 2023Siles Melanio Izquierdo ValdezNo ratings yet

- LaporanRekapPenjualan Per Produk1Document42 pagesLaporanRekapPenjualan Per Produk1Shinka KumalaNo ratings yet

- IT Card SaneepDocument4 pagesIT Card Saneephajabarala2008No ratings yet

- UntitledDocument4 pagesUntitledancestral chileNo ratings yet

- UntitledDocument3 pagesUntitledmihaiNo ratings yet

- Tarea V - Alfredo NororiDocument24 pagesTarea V - Alfredo NororiALFREDO ANTONIO NORORI ARIASNo ratings yet

- Book 3Document6 pagesBook 3Titania ErzaNo ratings yet

- Unrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15Document2 pagesUnrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15ErUmangKoyaniNo ratings yet

- Projected Broiler Farm (20,000)Document1 pageProjected Broiler Farm (20,000)Eean KicapNo ratings yet

- GR50SE13Document11 pagesGR50SE13Novianto RachmadNo ratings yet

- Janitorial Summary 2022Document1 pageJanitorial Summary 2022Kim Patrick VictoriaNo ratings yet

- LC 13-04-2020 Al 19-04-2020 BauDocument15 pagesLC 13-04-2020 Al 19-04-2020 BauWIRBERT RIVASNo ratings yet

- Balance de Prueba de INNOVACIONES EMPRESARIALES E INMOBILIARIAS S.A.SDocument3 pagesBalance de Prueba de INNOVACIONES EMPRESARIALES E INMOBILIARIAS S.A.SYury Nayduth MUNOZ GOMEZNo ratings yet

- Cuadro de Cargas Eléctricas Ejemplo TrifásicoDocument15 pagesCuadro de Cargas Eléctricas Ejemplo TrifásicoMau AcostaNo ratings yet

- Assignment Spare Parts Oil and Battery Supplies Tires Fuel Total LubricantsDocument2 pagesAssignment Spare Parts Oil and Battery Supplies Tires Fuel Total LubricantsEliseo Dugan JrNo ratings yet

- Take Profit Mejorado-2Document6 pagesTake Profit Mejorado-2KEISY ESCALANTE SARMIENTONo ratings yet

- Clinica Crear Vision Libro Mayor 2012Document3 pagesClinica Crear Vision Libro Mayor 2012angelNo ratings yet

- Startup BudgetDocument1 pageStartup BudgetAri HalosNo ratings yet

- 13mar 2023 15939Document3 pages13mar 2023 15939Tira MetaNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- Implementation of An ERP System: A Case Study of A Full-Scope SAP ProjectDocument16 pagesImplementation of An ERP System: A Case Study of A Full-Scope SAP ProjectHBNo ratings yet

- Naukri MeeraVenkitaraman (12y 0m)Document3 pagesNaukri MeeraVenkitaraman (12y 0m)Singb BabluNo ratings yet

- Naukri NitinSharma (9y 0m)Document3 pagesNaukri NitinSharma (9y 0m)Singb BabluNo ratings yet

- Main QWeigh UAT Test Case Report - 22022022Document225 pagesMain QWeigh UAT Test Case Report - 22022022Singb BabluNo ratings yet

- Module No. 2: Compound InterstDocument8 pagesModule No. 2: Compound Interstyhan borlonNo ratings yet

- UCSP - Q2 - Lesson 1 - State and Non State InstitutionsDocument47 pagesUCSP - Q2 - Lesson 1 - State and Non State InstitutionsZei VeursechNo ratings yet

- Nepal Development Update Post Pandemic Nepal Charting A Resilient Recovery and Future Growth Directions PDFDocument62 pagesNepal Development Update Post Pandemic Nepal Charting A Resilient Recovery and Future Growth Directions PDFSanjeev PradhanNo ratings yet

- Screenshot 2021-09-09 at 7.56.06 PMDocument1 pageScreenshot 2021-09-09 at 7.56.06 PMPraveen SinghNo ratings yet

- Group 6 - BSIT 1203 (GEd 109 Final Requirement)Document10 pagesGroup 6 - BSIT 1203 (GEd 109 Final Requirement)PurpleMe07No ratings yet

- 50 Most Important Questions Economics SPCCDocument4 pages50 Most Important Questions Economics SPCCtwisha malhotraNo ratings yet

- Republic of The Philippines Province of Bulacan: Municipality of San Ildefonso BarangayDocument4 pagesRepublic of The Philippines Province of Bulacan: Municipality of San Ildefonso BarangayEldie NazarNo ratings yet

- Theory of Production (Economics)Document13 pagesTheory of Production (Economics)Keshvi LakhaniNo ratings yet

- IFRS - 2019 - Solved QPDocument14 pagesIFRS - 2019 - Solved QPSharan ReddyNo ratings yet

- Property Law ProjectDocument11 pagesProperty Law ProjectNikhil Hans100% (1)

- Principle of Business Past PaperDocument8 pagesPrinciple of Business Past PaperDark PlaceNo ratings yet

- Coase Theorem: - Aaksha Sajnani - Muskaan DargarDocument16 pagesCoase Theorem: - Aaksha Sajnani - Muskaan DargarKuldeep jajraNo ratings yet

- Pas Genap B Ing Kls XDocument4 pagesPas Genap B Ing Kls XDimas SaputraNo ratings yet

- MhizhaDocument84 pagesMhizhaInnocent MakayaNo ratings yet

- Solution To Assignment 1Document7 pagesSolution To Assignment 1Dương Ngọc HuyềnNo ratings yet

- Chapter 3 International Financial MarketsDocument93 pagesChapter 3 International Financial Marketsธชพร พรหมสีดาNo ratings yet

- Persuasive LetterDocument2 pagesPersuasive Letterapi-2379809760% (1)

- MCQs - National Income StatisticsDocument3 pagesMCQs - National Income StatisticsNikhil AdhavanNo ratings yet

- Dubai - Britannica Online EncyclopediaDocument3 pagesDubai - Britannica Online EncyclopediaAlejandro YanzNo ratings yet

- Kinyarwanda S5 TGDocument150 pagesKinyarwanda S5 TGJean d'Amour GateteNo ratings yet

- MJNV1W03 - Business Mathematics: Session 2 September 13, 2019Document23 pagesMJNV1W03 - Business Mathematics: Session 2 September 13, 2019Katarina KimNo ratings yet

- Narrative Report - Chapter 10Document4 pagesNarrative Report - Chapter 10Hazel BorboNo ratings yet

- Tugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiDocument3 pagesTugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiFICKY ardhikaNo ratings yet

- Filling Points 28jul17 PDFDocument5 pagesFilling Points 28jul17 PDFaleemhakNo ratings yet

- Ecb 401 National IncomeDocument19 pagesEcb 401 National IncomeSuryansh SrinetNo ratings yet

- Korea Power System and North Asia Super Grid IntroductionDocument85 pagesKorea Power System and North Asia Super Grid Introductionardin fadollyNo ratings yet