Professional Documents

Culture Documents

2

Uploaded by

Marvin Cinco0 ratings0% found this document useful (0 votes)

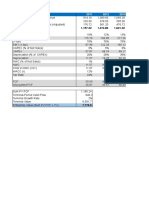

3 views2 pagesThis document presents a discounted cash flow valuation of a company over a 10 year forecast period with a continuing value. It shows projected annual free cash flows (FCF), the discounted value of each year's FCF, accumulated debt each year, and the interest rate. It then calculates the present value of FCF as $818.39 and adds the present value of interest tax shields of $220.05 to get a total present value of FCF and tax shields of $1,038.44. It applies a midyear adjustment factor of 0.93 to get a value of operations of $961.52.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document presents a discounted cash flow valuation of a company over a 10 year forecast period with a continuing value. It shows projected annual free cash flows (FCF), the discounted value of each year's FCF, accumulated debt each year, and the interest rate. It then calculates the present value of FCF as $818.39 and adds the present value of interest tax shields of $220.05 to get a total present value of FCF and tax shields of $1,038.44. It applies a midyear adjustment factor of 0.93 to get a value of operations of $961.52.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pages2

Uploaded by

Marvin CincoThis document presents a discounted cash flow valuation of a company over a 10 year forecast period with a continuing value. It shows projected annual free cash flows (FCF), the discounted value of each year's FCF, accumulated debt each year, and the interest rate. It then calculates the present value of FCF as $818.39 and adds the present value of interest tax shields of $220.05 to get a total present value of FCF and tax shields of $1,038.44. It applies a midyear adjustment factor of 0.93 to get a value of operations of $961.52.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Forecast Year FCF Discounted FCF Prior-year debt Interest rate, %

1 100.0 92.59 1,000.0 0.08

2 105.0 90.02 1,040.0 0.08

3 110.3 87.56 1,081.6 0.08

4 115.8 85.12 1,124.9 0.08

5 121.6 82.76 1,169.9 0.08

6 127.6 80.41 1,216.7 0.08

7 134.0 78.19 1,265.3 0.08

8 140.7 76.02 1,315.9 0.08

9 147.7 73.89 1,368.6 0.08

10 155.1 71.84 1,423.3 0.08

Continuing value 1,480.2 0.08

Sum of discounted FCFs 818.39

Marginal tax rate, % 35.00

Unlevered cost of equity, % 10.00

FCF / (1 + (Interest rate, %))^Forecast Year

FCF = 100.0 / (1 + 0.08)^1 = 92.59

Interest Tax Shield (ITS) = Interest Payment * Marginal Tax Rate

Discounted ITS = ITS / (1 + Interest rate, %)^Forecast Year

PV of FCF and ITS = Sum of Discounted FCF + Sum of Discounted ITS

Midyear Adjustment Factor = 1 / (1 + Interest rate, %)

Value of Operations = PV of FCF and ITS * Midyear Adjustment Factor

Interest Payment Marginal tax rate, % Interest tax shield (ITS) Discounted ITS

80.00 0.35 28.00 25.93

83.20 0.35 29.12 24.97

86.53 0.35 30.28 24.04

89.99 0.35 31.50 23.15

93.59 0.35 32.76 22.29

97.34 0.35 34.07 21.47

101.22 0.35 35.43 20.67

105.27 0.35 36.85 19.91

109.49 0.35 38.32 19.17

113.86 0.35 39.85 18.46

118.42 Continuing value

Sum of discounted ITCs 220.05

PV of FCF and ITS 1,038.44

Midyear adjustment factor 0.93

Value of operations 961.52

You might also like

- Prepaid Cards (VCC) @cashout - KingdomDocument3 pagesPrepaid Cards (VCC) @cashout - Kingdomradohi6352100% (1)

- Ten Mile Day-SummaryDocument1 pageTen Mile Day-SummaryPsic. Ó. Bernardo Duarte B.100% (1)

- How Hitler Defied The BankersDocument9 pagesHow Hitler Defied The Bankerskoroga100% (1)

- White Star LineDocument9 pagesWhite Star Lineelenaanalia88No ratings yet

- Diamond Chemicals Team 6's DCF Analysis of Merseyside ProjectDocument1 pageDiamond Chemicals Team 6's DCF Analysis of Merseyside Projectkwarden13No ratings yet

- Project Finance - Hydro Electric Power - ValuationDocument14 pagesProject Finance - Hydro Electric Power - ValuationSrikant Rajan50% (2)

- Economics - Supply and DemandDocument34 pagesEconomics - Supply and DemandAnusha Ivaturi0% (1)

- Paulina Bren, Mary Neuburger - Communism Unwrapped - Consumption in Cold War Eastern Europe-Oxford University Press (2012)Document430 pagesPaulina Bren, Mary Neuburger - Communism Unwrapped - Consumption in Cold War Eastern Europe-Oxford University Press (2012)Corina DobosNo ratings yet

- Sayna Plastic Shubham Plastic IndustriesDocument111 pagesSayna Plastic Shubham Plastic Industries325 hiral doshiNo ratings yet

- Acknowledgment ReceiptDocument1 pageAcknowledgment ReceiptDeil L. NaveaNo ratings yet

- 2Document2 pages2Marvin CincoNo ratings yet

- 2Document3 pages2Marvin CincoNo ratings yet

- Liberty ShoesDocument18 pagesLiberty ShoesvishalNo ratings yet

- LIC Housing FinDocument18 pagesLIC Housing FinvishalNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- Lanco InfratechDocument18 pagesLanco InfratechvishalNo ratings yet

- PNB HousingDocument18 pagesPNB HousingvishalNo ratings yet

- Bharat ElectronDocument18 pagesBharat ElectronVishalPandeyNo ratings yet

- Info SysDocument18 pagesInfo SysVishalPandeyNo ratings yet

- Provisional Balance Sheet & Financial Highlights Year-2009Document11 pagesProvisional Balance Sheet & Financial Highlights Year-2009Syed DidarNo ratings yet

- Kansai NerolacDocument18 pagesKansai NerolacVishalPandeyNo ratings yet

- Lab - 3a - Losses in Pipes and Pipe FittingsDocument13 pagesLab - 3a - Losses in Pipes and Pipe FittingsShehan FernandoNo ratings yet

- Yuken IndiaDocument18 pagesYuken IndiaVishalPandeyNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalNo ratings yet

- Solutions Format BDocument23 pagesSolutions Format BBineeta SahooNo ratings yet

- Linde IndiaDocument18 pagesLinde IndiavishalNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalNo ratings yet

- Motherson SumiDocument18 pagesMotherson SumivishalNo ratings yet

- Karur Vysya BankDocument18 pagesKarur Vysya BankVishalPandeyNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- UltraTech CemDocument18 pagesUltraTech CemvishalNo ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- Assignment 5 Abhilash BollamDocument12 pagesAssignment 5 Abhilash BollamAbhilash BollamNo ratings yet

- Kalpataru PowerDocument18 pagesKalpataru PowerVishalPandeyNo ratings yet

- Narration Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalNo ratings yet

- Ashok LeylandDocument18 pagesAshok LeylandVishalPandeyNo ratings yet

- Profit and Loss: Rs. CR IncomeDocument2 pagesProfit and Loss: Rs. CR IncomeRavi KumarNo ratings yet

- FRM Assignment 1 v1.1Document8 pagesFRM Assignment 1 v1.1MrDorakonNo ratings yet

- Bajaj FinservDocument18 pagesBajaj FinservVishalPandeyNo ratings yet

- JSW EnergyDocument18 pagesJSW EnergyVishalPandeyNo ratings yet

- 3 Statement Model Alphabet GoogleDocument8 pages3 Statement Model Alphabet GoogleSimran GargNo ratings yet

- Oriental BankDocument18 pagesOriental BankvishalNo ratings yet

- Profit & Loss: Mar 10E Mar 11E Mar 12EDocument15 pagesProfit & Loss: Mar 10E Mar 11E Mar 12Ebhavesh_mankani7373No ratings yet

- AmortizationDocument11 pagesAmortizationJoen SinamagNo ratings yet

- Financial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosDocument93 pagesFinancial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosAayushi ChandwaniNo ratings yet

- Solution To ATCDocument17 pagesSolution To ATCGuru Charan ChitikenaNo ratings yet

- Jindal SteelDocument18 pagesJindal SteelVishalPandeyNo ratings yet

- UNITED SPIRITS LTD-SIrDocument39 pagesUNITED SPIRITS LTD-SIrnishantNo ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyNo ratings yet

- (Daweoo Express) : Income StatementDocument1 page(Daweoo Express) : Income StatementHammad AltafNo ratings yet

- Apollo HospitalsDocument18 pagesApollo HospitalsvishalNo ratings yet

- Bank of IndiaDocument18 pagesBank of IndiaVishalPandeyNo ratings yet

- Coal IndiaDocument18 pagesCoal IndiaVishalPandeyNo ratings yet

- Ejer 7 EvaDocument17 pagesEjer 7 EvavaleNo ratings yet

- Bajaj FinDocument18 pagesBajaj FinVishalPandeyNo ratings yet

- Pressure RatioDocument3 pagesPressure RatioAhmad AzriNo ratings yet

- Coal IndiaDocument18 pagesCoal IndiavishalNo ratings yet

- Lloyds SteelsDocument10 pagesLloyds SteelsRDX YADAVNo ratings yet

- RatiosDocument2 pagesRatiosKishan KeshavNo ratings yet

- Total Revenue 1,157.32 1,374.80 1,621.32: (Unit: Million USD)Document6 pagesTotal Revenue 1,157.32 1,374.80 1,621.32: (Unit: Million USD)Peter PandaNo ratings yet

- Guj. ContainersDocument10 pagesGuj. Containersdipyaman patgiriNo ratings yet

- Yes BankDocument18 pagesYes BankVishalPandeyNo ratings yet

- BAV Mid Sem SolutionDocument3 pagesBAV Mid Sem SolutionMAYANK JAINNo ratings yet

- Xpro IndiaDocument18 pagesXpro IndiavishalNo ratings yet

- Final Project of AnalysisDocument22 pagesFinal Project of Analysisuniversityofwah100% (1)

- Img 20240122 0027Document1 pageImg 20240122 0027Marvin CincoNo ratings yet

- Crypto Statement June 2023Document3 pagesCrypto Statement June 2023Marvin CincoNo ratings yet

- 1Document4 pages1Marvin CincoNo ratings yet

- Pagsasalin NG ProsaDocument3 pagesPagsasalin NG ProsaMarvin CincoNo ratings yet

- 1Document1 page1Marvin CincoNo ratings yet

- JoinsDocument6 pagesJoinsMarvin CincoNo ratings yet

- M2SR2 ADocument4 pagesM2SR2 AMarvin CincoNo ratings yet

- STPPT1 Vector RepresentationDocument11 pagesSTPPT1 Vector RepresentationMarvin CincoNo ratings yet

- STPPT2 Multiplication of VectorsDocument12 pagesSTPPT2 Multiplication of VectorsMarvin CincoNo ratings yet

- 2022 2 GT2 Abstraction and Inheritance 1Document3 pages2022 2 GT2 Abstraction and Inheritance 1Marvin CincoNo ratings yet

- MTPPT3 Motion in 1 DimensionDocument37 pagesMTPPT3 Motion in 1 DimensionMarvin CincoNo ratings yet

- STPPT2 Unit VectorsDocument7 pagesSTPPT2 Unit VectorsMarvin CincoNo ratings yet

- Business Analytics Midterm ExamDocument10 pagesBusiness Analytics Midterm ExamMarvin CincoNo ratings yet

- STPPT1 UarmDocument29 pagesSTPPT1 UarmMarvin CincoNo ratings yet

- STPPT2 UcmDocument8 pagesSTPPT2 UcmMarvin CincoNo ratings yet

- STPPT1 Projectile MotionDocument11 pagesSTPPT1 Projectile MotionMarvin CincoNo ratings yet

- Black Box TestingDocument9 pagesBlack Box TestingMarvin CincoNo ratings yet

- M3 Study GuideDocument1 pageM3 Study GuideMarvin CincoNo ratings yet

- IT0011 Final Project Project ProposalDocument5 pagesIT0011 Final Project Project ProposalMarvin CincoNo ratings yet

- Bus115 Project 08Document6 pagesBus115 Project 08Marvin CincoNo ratings yet

- MTPPT4 Motion in 2 DimensionsDocument20 pagesMTPPT4 Motion in 2 DimensionsMarvin CincoNo ratings yet

- Sample Chapter-3Document10 pagesSample Chapter-3Marvin CincoNo ratings yet

- Nemedez Rationale Paper Topic 1Document4 pagesNemedez Rationale Paper Topic 1Marvin CincoNo ratings yet

- Assignment Data Analysis PLMDocument4 pagesAssignment Data Analysis PLMMarvin CincoNo ratings yet

- Sample Chapter-1Document5 pagesSample Chapter-1Marvin CincoNo ratings yet

- CreatingreportsDocument6 pagesCreatingreportsMarvin CincoNo ratings yet

- TEAM2 - Forecasting Lab Activity 2Document10 pagesTEAM2 - Forecasting Lab Activity 2Marvin CincoNo ratings yet

- TitlesDocument6 pagesTitlesMarvin CincoNo ratings yet

- Sample Chapter-2Document23 pagesSample Chapter-2Marvin CincoNo ratings yet

- Subject Expert Qa - 1 - (2015-16) Module - 2Document7 pagesSubject Expert Qa - 1 - (2015-16) Module - 2Keyur PopatNo ratings yet

- GDPDocument5 pagesGDPMary Christine Formiloza MacalinaoNo ratings yet

- Post Office Time Deposit (Amendment) Rules, 2001.Document16 pagesPost Office Time Deposit (Amendment) Rules, 2001.Latest Laws TeamNo ratings yet

- S&P GlobalDocument3 pagesS&P Globalriyec98621No ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- A Study On Portfolio Analysis On Selected Securities With Reference To Angel OneDocument8 pagesA Study On Portfolio Analysis On Selected Securities With Reference To Angel OneEditor IJTSRDNo ratings yet

- Sun - MORNING NEWS DAILY, Dec 2020, SV PDFDocument6 pagesSun - MORNING NEWS DAILY, Dec 2020, SV PDFSHARON TVNo ratings yet

- The New' Theory of Optimum Currency Areas - George S. TavlasDocument23 pagesThe New' Theory of Optimum Currency Areas - George S. Tavlasskylord wiseNo ratings yet

- Assignment 2 (FA18-BBA-095)Document3 pagesAssignment 2 (FA18-BBA-095)Hamza RafaeyNo ratings yet

- FlakinessDocument8 pagesFlakinessAaditya VikramNo ratings yet

- Republic of The Philippines Social Security System - MemberDocument1 pageRepublic of The Philippines Social Security System - MemberLeonardo Oferio0% (1)

- Principles of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaDocument10 pagesPrinciples of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaRax-Nguajandja KapuireNo ratings yet

- Automatic Gearbox 0B6 Four-Wheel DriveDocument185 pagesAutomatic Gearbox 0B6 Four-Wheel DriveergdegNo ratings yet

- Greevio Techno Solutions: Payslip For The Month of June 2021 May 2021 To June 2021Document1 pageGreevio Techno Solutions: Payslip For The Month of June 2021 May 2021 To June 2021Ashok VarmaNo ratings yet

- Group Assignment 2014Document3 pagesGroup Assignment 2014Samuel AberaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- University of The Immaculate Conception: Master in Business Administration ProgramDocument21 pagesUniversity of The Immaculate Conception: Master in Business Administration ProgramCINDY MAE DUMAPIASNo ratings yet

- Designation BOMAG RollersDocument6 pagesDesignation BOMAG RollersTekooMohamed100% (1)

- Fundamentals of Economics Course OutlineDocument3 pagesFundamentals of Economics Course Outlinemeerdawood72No ratings yet

- Absensi PenggajianDocument11 pagesAbsensi PenggajianMuji BudionoNo ratings yet

- Ad Interim Ex Parte OrderDocument96 pagesAd Interim Ex Parte OrderSmita DharamshiNo ratings yet

- Lecture Notes C3Document12 pagesLecture Notes C3Levent ŞaşmazNo ratings yet