Professional Documents

Culture Documents

Pte Map

Uploaded by

Vikram rajput0 ratings0% found this document useful (0 votes)

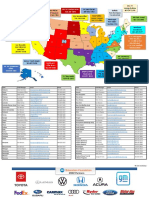

50 views2 pages36 states and 1 locality have enacted pass-through entity (PTE) level taxes since the limitation on state and local tax deductions under the Tax Cuts and Jobs Act. These PTE taxes allow businesses organized as pass-through entities like partnerships or S-corps to pay taxes at the entity level rather than having the income passed through to owners' individual returns. The effective years for these PTE taxes range from 2018 to 2023 depending on the state. Three additional states have proposed PTE tax bills but have not enacted them yet. Nine states have no personal income tax on PTE income.

Original Description:

Original Title

56175896-pte-map

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document36 states and 1 locality have enacted pass-through entity (PTE) level taxes since the limitation on state and local tax deductions under the Tax Cuts and Jobs Act. These PTE taxes allow businesses organized as pass-through entities like partnerships or S-corps to pay taxes at the entity level rather than having the income passed through to owners' individual returns. The effective years for these PTE taxes range from 2018 to 2023 depending on the state. Three additional states have proposed PTE tax bills but have not enacted them yet. Nine states have no personal income tax on PTE income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views2 pagesPte Map

Uploaded by

Vikram rajput36 states and 1 locality have enacted pass-through entity (PTE) level taxes since the limitation on state and local tax deductions under the Tax Cuts and Jobs Act. These PTE taxes allow businesses organized as pass-through entities like partnerships or S-corps to pay taxes at the entity level rather than having the income passed through to owners' individual returns. The effective years for these PTE taxes range from 2018 to 2023 depending on the state. Three additional states have proposed PTE tax bills but have not enacted them yet. Nine states have no personal income tax on PTE income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

States with Enacted or Proposed Pass-Through Entity (PTE) Level Tax

As of July 20, 2023

36 states (& 1 locality) that enacted a PTE tax

WA since TCJA SALT deduction limitation, effective

for 2021 (or earlier) unless noted:

MT ND ME AL, AR1, AZ1, CA, CO3, CT4, HI2, GA1, IA1, ID, IL,

OR VT IN1, KS1, KY1 (& KY) ,LA, MA, MI, MD, MN, MO1,

MN

ID NH MS1, MT2, NC1, NE3, NJ, NM1, NY, OH1, OK, OR1,

SD WI NY, MA RI, SC, UT1, VA, WI, WV1, and NYC1

WY NYC CT

MI RI 1 Effective in 2022

IA PA NJ 2 Effective in 2023 or later

NV NE

OH 3 Retroactive to 2018

MD

UT IL IN DE

4 Mandatory 2018-2023, elective starting 2024

CA CO WV

VA

KS MO DC

KY 3 states with proposed PTE tax bills:

NC

ME - LD 1891 introduced

TN

AZ OK PA – SB 659 and HB 1584 introduced

NM AR SC

GA

VT – SB45 passed Senate, in House

MS AL

AK

TX

LA 9 states with no owner-level personal

income tax on PTE income:

HI AK, FL, NH, NV, SD, TN, TX, WA, WY

FL

3 states with an owner-level personal

income tax on PTE income that have not

yet proposed or enacted PTE taxes:

DC, DE, and ND

Current PTE tax workarounds (36 states and 1 locality)

• State

State Effective Year State Effective Year

Alabama 2021 Minnesota 2021

Arizona 2022 Mississippi 2022

Arkansas 2022 Missouri 2022

California 2021 Montana 2023

Colorado 2018 (retroactive) Nebraska 2018 (retroactive)

Connecticut 2018 (mandatory 2018-2023, New Jersey 2020

elective starting 2024) New Mexico 2022

Georgia 2022 New York 2021

Hawaii 2023 New York City 2022

Idaho 2021 North Carolina 2022

Illinois 2021 Ohio 2022

Indiana 2022 (retroactive) Oklahoma 2019

Iowa 2022 (retroactive) Oregon 2022

Kansas 2022 Rhode Island 2019

Kentucky 2022 (retroactive) South Carolina 2021

Louisiana 2019 Utah 2022

Maryland 2020 Virginia 2021

Massachusetts 2021 West Virginia 2022

Michigan 2021 Wisconsin 2018

You might also like

- Question On Consideration 2018 VinayDocument3 pagesQuestion On Consideration 2018 VinayYoushreen Washeelah ChoomkaNo ratings yet

- Case Whose Side Are U On AnywayDocument2 pagesCase Whose Side Are U On AnywayVasu Rastogi0% (1)

- ALYANSA PARA SA BAGONG PILIPINAS Vs ERCDocument2 pagesALYANSA PARA SA BAGONG PILIPINAS Vs ERCCherlene Tan0% (1)

- Northcap University, GurgaonDocument14 pagesNorthcap University, GurgaonAnmol AroraNo ratings yet

- American Gaming Association MapDocument3 pagesAmerican Gaming Association MapRick ArmonNo ratings yet

- State Puppy Mill LawsDocument1 pageState Puppy Mill LawsFOX 17 NewsNo ratings yet

- ASCO NEC Requirements For SPDDocument7 pagesASCO NEC Requirements For SPDJOSE LUIS FALCON CHAVEZNo ratings yet

- Technical News: Adoption of The 2017 National Electric CodeDocument3 pagesTechnical News: Adoption of The 2017 National Electric CodeFelipe GustavoNo ratings yet

- Coronavirus Latest News and Breaking Stories NBC NewsDocument1 pageCoronavirus Latest News and Breaking Stories NBC NewsMikey HanNo ratings yet

- West Region: Bruce Russell Blaine Russell Eric Stuck Steve Maybee Canada: AB, BC & SKDocument1 pageWest Region: Bruce Russell Blaine Russell Eric Stuck Steve Maybee Canada: AB, BC & SKA.Subin DasNo ratings yet

- Longitudinal Joint Workshop Slides 3 2017 1Document214 pagesLongitudinal Joint Workshop Slides 3 2017 1m.basim.technitalNo ratings yet

- 50-State Analysis: School Attendance Age LimitsDocument5 pages50-State Analysis: School Attendance Age LimitsshahNo ratings yet

- Intermediate Directions: U. S. CitiesDocument2 pagesIntermediate Directions: U. S. CitiesNouvel Malin BashaNo ratings yet

- Numeric Change Resident Population All Stateapport2010 Map2Document1 pageNumeric Change Resident Population All Stateapport2010 Map2Helen BennettNo ratings yet

- NPMS HeatMap GTIncidents WPointsDocument1 pageNPMS HeatMap GTIncidents WPoints01CaUKM Zhaffran AsyrafNo ratings yet

- The State of U.S. Cannabis Laws, AbridgedDocument6 pagesThe State of U.S. Cannabis Laws, AbridgedPaul Marini100% (1)

- 1arasteh - ICDM - Columbus, OH (4-16-18)Document40 pages1arasteh - ICDM - Columbus, OH (4-16-18)La FoliakNo ratings yet

- 2018 Carter's RealEstate Brochure v5 PDFDocument2 pages2018 Carter's RealEstate Brochure v5 PDFAmanda Logan100% (1)

- UCC1 - Fact Sheet - 2022 - ADADocument1 pageUCC1 - Fact Sheet - 2022 - ADAmadamed4uNo ratings yet

- NLC MapDocument1 pageNLC MapFrances fernandezNo ratings yet

- Cancer Prevention and Early DetectonDocument64 pagesCancer Prevention and Early DetectonRicho WijayaNo ratings yet

- 2022 AI Index Report - Master (181 230)Document50 pages2022 AI Index Report - Master (181 230)Alex ChuquisanaNo ratings yet

- Risk Managment in EnterprisesDocument56 pagesRisk Managment in EnterprisesThaoanh NguyenNo ratings yet

- States in The USADocument1 pageStates in The USAVeronicaGelfgren100% (2)

- Natural Gas PricesDocument3 pagesNatural Gas PricesdownbuliaoNo ratings yet

- Regional Briefing Central U.S.: Dave Zwicke, Sr. Director & Regional EconomistDocument25 pagesRegional Briefing Central U.S.: Dave Zwicke, Sr. Director & Regional EconomistStanislav ZemskovNo ratings yet

- EstrellasDocument2 pagesEstrellasfernandezjose998No ratings yet

- Demographics, Experiences and Pathways To Equity: The Legal Landscape: Protections For LGBT WorkersDocument3 pagesDemographics, Experiences and Pathways To Equity: The Legal Landscape: Protections For LGBT WorkersLucas SpragueNo ratings yet

- Jurisdictional Regulations For Tank Risk Based Inspection E2G (Aug 2021)Document10 pagesJurisdictional Regulations For Tank Risk Based Inspection E2G (Aug 2021)jonnie myersNo ratings yet

- Jurisdictional Regulations For Tank Risk Based Inspection E2G (Aug 2021)Document10 pagesJurisdictional Regulations For Tank Risk Based Inspection E2G (Aug 2021)Robert J MayNo ratings yet

- US Map Time Zones InitialsDocument1 pageUS Map Time Zones InitialsVet. Ghulam AbbaSNo ratings yet

- ALTEC Maintenance ProductsDocument56 pagesALTEC Maintenance Productsraul alcaNo ratings yet

- Northeast South North Central West: FL TXDocument1 pageNortheast South North Central West: FL TXPetrutNo ratings yet

- VUEWorks Overview Presentation - Vinci - April 2022Document32 pagesVUEWorks Overview Presentation - Vinci - April 2022Fabián Quesada UribeNo ratings yet

- Directions: North, South, East or West? PDFDocument1 pageDirections: North, South, East or West? PDFNini CarrilloNo ratings yet

- Aashto and Astm Standards and Harmonization Update For Fall 2009 MTC MeetingDocument37 pagesAashto and Astm Standards and Harmonization Update For Fall 2009 MTC MeetingSaabir GariireNo ratings yet

- Kestabilan Transien Multi MesinDocument30 pagesKestabilan Transien Multi MesinDeddy Ardyansyah Regz GedanganNo ratings yet

- What Your Council Should Be Doing Right Now!: Tom Mccaffrey VP, Fraternal OperationsDocument70 pagesWhat Your Council Should Be Doing Right Now!: Tom Mccaffrey VP, Fraternal OperationsRamon BrionesNo ratings yet

- US Internal Revenue Service: F940saDocument2 pagesUS Internal Revenue Service: F940saIRSNo ratings yet

- Arizona Swirls MapDocument1 pageArizona Swirls Mapjames guajardoNo ratings yet

- Progress and Precision: The NCSBN 2018 Environmental ScanDocument46 pagesProgress and Precision: The NCSBN 2018 Environmental ScanRazak AbdullahNo ratings yet

- Total Fertility Rates by State and Race and Hispanic Origin: United States, 2017Document11 pagesTotal Fertility Rates by State and Race and Hispanic Origin: United States, 2017WXYZ-TV Channel 7 DetroitNo ratings yet

- Cancer Facts and Figures 2019 PDFDocument76 pagesCancer Facts and Figures 2019 PDFdgggrgrgrgrgrgrrNo ratings yet

- All in VA Deck - VDOEDocument19 pagesAll in VA Deck - VDOECaitlyn FroloNo ratings yet

- Field Managers: ND, SD: Michael Lehn 320-249-3650Document3 pagesField Managers: ND, SD: Michael Lehn 320-249-3650Manuel D.PadillaNo ratings yet

- Cartographywk 1 No 2Document1 pageCartographywk 1 No 2api-534097793No ratings yet

- 1SC Case BubblesDocument1 page1SC Case BubblesNEWS CENTER MaineNo ratings yet

- Cancer Facts and Figures 2020Document76 pagesCancer Facts and Figures 2020preetNo ratings yet

- Emerson Impact Partner Organizations en 132218Document2 pagesEmerson Impact Partner Organizations en 132218Abdullah HassanNo ratings yet

- ECE4762011 Lect4Document43 pagesECE4762011 Lect4icovinyNo ratings yet

- Delaware Health Care PerformanceDocument7 pagesDelaware Health Care PerformanceWHYY NewsNo ratings yet

- Mac Dorman Mathews PresentationDocument24 pagesMac Dorman Mathews PresentationSuzana VoiculescuNo ratings yet

- Arrival ListDocument1 pageArrival ListKhas RestoNo ratings yet

- ECE4762011 Lect4Document43 pagesECE4762011 Lect4anılNo ratings yet

- Retail Banking Insights: Radically Simplifying The Retail BankDocument10 pagesRetail Banking Insights: Radically Simplifying The Retail BankElitaZesfNo ratings yet

- Publicly Available 1 NASDAQ - BLBD - 2022Document112 pagesPublicly Available 1 NASDAQ - BLBD - 2022Ngqabutho NdlovuNo ratings yet

- Description: Tags: REL 2007017Document35 pagesDescription: Tags: REL 2007017anon-376992No ratings yet

- Addendum Group I 06 01 2023Document4 pagesAddendum Group I 06 01 2023Surya NarayanaNo ratings yet

- Field of DreamsDocument6 pagesField of DreamscontentionNo ratings yet

- Opening HorizonsDocument5 pagesOpening HorizonsSuperfonfyNo ratings yet

- Beauty Is LonesomeDocument2 pagesBeauty Is LonesomecontentionNo ratings yet

- Alphas Are No OmegasDocument5 pagesAlphas Are No OmegascontentionNo ratings yet

- Skies of A Deep PurpleDocument4 pagesSkies of A Deep PurplecontentionNo ratings yet

- Pennsylvania Nonresidence Form Rev 420 3Document1 pagePennsylvania Nonresidence Form Rev 420 3Vikram rajputNo ratings yet

- Pel 2022 PML Report 1Document37 pagesPel 2022 PML Report 1Vikram rajputNo ratings yet

- PA Income Tax InfoDocument2 pagesPA Income Tax InfoVikram rajputNo ratings yet

- Tax Reform Code of 1971 Cl. 72 Act of Mar. 4, 1971, P.L. 6, No. 2Document632 pagesTax Reform Code of 1971 Cl. 72 Act of Mar. 4, 1971, P.L. 6, No. 2Vikram rajputNo ratings yet

- Pa Taxation ManualDocument113 pagesPa Taxation ManualVikram rajputNo ratings yet

- Petition Form With InstructionsDocument4 pagesPetition Form With InstructionsVikram rajputNo ratings yet

- Blank BPTDocument2 pagesBlank BPTVikram rajputNo ratings yet

- Eo Reorganizing BDCDocument3 pagesEo Reorganizing BDCgalileo jr romaNo ratings yet

- Module - 5Document22 pagesModule - 5Jack Stephen.GNo ratings yet

- Full Download Test Bank For Contemporary Management 10th Edition Gareth Jones Jennifer George PDF Full ChapterDocument33 pagesFull Download Test Bank For Contemporary Management 10th Edition Gareth Jones Jennifer George PDF Full Chapteraudreyrodgersezcafyxmip100% (17)

- Cases Before Judge BalumaDocument1 pageCases Before Judge BalumaCharlie BartolomeNo ratings yet

- Chapter 5 - History and Structure of American Law EnforcementDocument42 pagesChapter 5 - History and Structure of American Law EnforcementNaim KhalidNo ratings yet

- Bossism in Cavite and CebuDocument21 pagesBossism in Cavite and CebuDan Roniel CasiaNo ratings yet

- Heng Chew Lang & Ors V Heng Choon Wah & Ors (2021) MLJUDocument13 pagesHeng Chew Lang & Ors V Heng Choon Wah & Ors (2021) MLJUAISYAH FARZANA MOHD ZANNo ratings yet

- Hamdard University Hamdard Institute of Management Sciences (HIMS) Islamabad Campus Business Law Course OutlineDocument3 pagesHamdard University Hamdard Institute of Management Sciences (HIMS) Islamabad Campus Business Law Course OutlineSidra ArslanNo ratings yet

- 23 Codi Fication of Remedies For Breach of Commercial Contracts: A BlueprintDocument23 pages23 Codi Fication of Remedies For Breach of Commercial Contracts: A BlueprinthNo ratings yet

- 5 Safe Spaces ActDocument9 pages5 Safe Spaces ActDilgmabinay.3232No ratings yet

- DHS Request For Case Assistance Form 7001-10212022-FINALDocument9 pagesDHS Request For Case Assistance Form 7001-10212022-FINALČårl-Ünløćkēr EdouardNo ratings yet

- Legal Forms Notarial WillDocument4 pagesLegal Forms Notarial WillClaire Margot CastilloNo ratings yet

- Defendant's Response To State's Motion To Enter Protective Order For Evidence Gathered From The IdocDocument4 pagesDefendant's Response To State's Motion To Enter Protective Order For Evidence Gathered From The IdocMatt Blac inc.No ratings yet

- An Open Letter From Prosecutors On Trump's LawlessnessDocument3 pagesAn Open Letter From Prosecutors On Trump's LawlessnessJennifer0% (1)

- Motion For Ocular Inspection Scribd - Google SearchDocument3 pagesMotion For Ocular Inspection Scribd - Google Searchbatusay575499No ratings yet

- Tribunal Supremo Sobre Inmunidad de La Junta de Control FiscalDocument19 pagesTribunal Supremo Sobre Inmunidad de La Junta de Control FiscalMetro Puerto RicoNo ratings yet

- Final CV-Europass-20190916-MezakMatijević-EN (2) - Kopija PDFDocument4 pagesFinal CV-Europass-20190916-MezakMatijević-EN (2) - Kopija PDFMirela Mezak StastnyNo ratings yet

- Lecture Notes The Sources of The British Constitution PDFDocument8 pagesLecture Notes The Sources of The British Constitution PDFsamia100% (1)

- List of CasesDocument2 pagesList of CasesIshitaNo ratings yet

- CD - 15. Kho VS ComelecDocument1 pageCD - 15. Kho VS Comelecstella marizNo ratings yet

- Telangana State Real Estate Regulatory Authority: Form 'C'Document2 pagesTelangana State Real Estate Regulatory Authority: Form 'C'amarNo ratings yet

- List of Cases Selected For Audit Through Computer Ballot - Income TaxDocument49 pagesList of Cases Selected For Audit Through Computer Ballot - Income TaxFahid AslamNo ratings yet

- Camarilla City StructureDocument1 pageCamarilla City StructureVassilis TsipopoulosNo ratings yet

- Hangu PipiyaDocument5 pagesHangu PipiyaFiftys Sabz KedewaNo ratings yet

- Topic - Qualification & Disqualification: Election Commission of IndiaDocument31 pagesTopic - Qualification & Disqualification: Election Commission of IndiaGaurav GehlotNo ratings yet

- SST 10th Book Exercise The Rise of Nationalism in EuropeDocument8 pagesSST 10th Book Exercise The Rise of Nationalism in EuropeAriva khanNo ratings yet