Professional Documents

Culture Documents

DSRP Dangote Sugar Refinery PLC PIB 20230727174619

DSRP Dangote Sugar Refinery PLC PIB 20230727174619

Uploaded by

Ftu NGUYỄN THỊ NGỌC MINHCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DSRP Dangote Sugar Refinery PLC PIB 20230727174619

DSRP Dangote Sugar Refinery PLC PIB 20230727174619

Uploaded by

Ftu NGUYỄN THỊ NGỌC MINHCopyright:

Available Formats

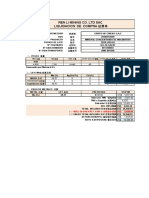

Dangote Sugar Refinery PLC: Company Profile

Company Info Financial Summary

Company FY2018/12 FY2019/12 FY2020/12 FY2021/12 FY2022/12 FY2023/12

Dangote Sugar Refinery PLC (Unit: SGD Million) Con Con Con Con Con -

Actual Actual Actual Actual Actual Consensus

Ticker DSRP I/S Total Revenue 560 603 771 901 1,303 794

Description EBITDA 140 133 191 110 278 203

Dangote Sugar Refinery PLC is engaged in refining raw sugar into edible sugar and selling EBITDA Margin 25.0% 22.0% 24.7% 12.3% 21.3% 25.6%

refined sugar. Operating Profit 119 112 176 127 263 -

Operating Margin 21.3% 18.6% 22.9% 14.1% 20.2% -

Industry Net Profit 83 84 107 72 177 110

Sugar Processing

Net Margin 14.7% 13.9% 13.9% 8.0% 13.6% 13.8%

Representative BS Total Assets 653 712 926 1,175 1,478 -

Aliko Dangote (Chairman),Ravindra Singh Singhvi (Chief Executive Officer)

Address

Shldr' Eq. 371 399 415 420 514 367

Terminal E, Shed 20 3rd Floor, GDNL Administrative Building NPA Wharf Port Complex, Apapa

Shldr' Eq. Ratio 56.72% 56.05% 44.86% 35.78% 34.77% -

Phone +234 8150983259 Debt(IBD) 5 13 325 516 660 -

Website https://sugar.dangote.com D/E Ratio 0.01x 0.03x 0.78x 1.23x 1.28x -

Founded 2005 ROE 23.07% 21.59% 25.52% 17.41% 36.51% -

IPO Date ROA 11.98% 12.17% 12.62% 6.92% 12.85% -

08/03/2007

Main Stock Exchange

C/F Operating CF 13 144 217 417 341 -

- Investing CF -31 -79 -94 -163 -63 -

Capital Stock 18 SGD Million (FY2022/12) Financing CF -56 -53 -50 -65 -45 -

Headcount 9,041 ( 2022/12Consolidated )

Shareholders Segment Info

Last Updated: 06/2023

No. of Shares Ownership

Rank Shareholders ('000) (%)

1 Trustus Capital Management 48,540 0.40

2 Global X Management Co. LLC 30,231 0.25

3 Robeco Institutional Asset 9,800 0.08

4 Parametric Portfolio Associates 6,140 0.05

5 BPI Gestão de Activos SGOIC 1,510 0.01

- Non Disclosed Shareholders 12,050,657 99.21

Total 12,146,878 100.00

Source:FY2022/12Sales(Business Segments)、Sales(Geographic Segments)

Note: The negative segment's value is not displayed on the Pie Chart.

Note: When the sum of positive segment value is less than Consolitated total, The negative segment's value is integrated to

Unclassified item.

Note: Other Segment is the sum of segments which percentage is less than 5% of total.

Composed by SPEEDA 1/13

Dangote Sugar Refinery PLC: KPI Charts

Trends of Sales and Margin Cost-related Ratios

No Data

Composed by SPEEDA 2/13

Dangote Sugar Refinery PLC: KPI Charts

Historical ROE/ROA Historical Turnover Period

Composed by SPEEDA 3/13

Dangote Sugar Refinery PLC: KPI Charts

Trends of Leverage Trend of Shareholders Equity to Asset Ratio

Composed by SPEEDA 4/13

Dangote Sugar Refinery PLC: KPI Charts

Cash Flows Dividend Payout Ratio

No Data

Composed by SPEEDA 5/13

Competitor Analysis : Basic Information

Earnings Result Valuation

Ticker Total Revenue Net Profit Enterprise P/E P/BV

Description Market Cap

Company Name Latest FY Attribute to Last closing price Value(EV) LTM LTM

SGD Million parent company SGD Million LTM x x

DSRP Dangote Sugar Refinery PLC is engaged in refining raw sugar into

Dangote Sugar Refinery PLC 1,303 177 N/A N/A N/A N/A

edible sugar and selling refined sugar.

中粮集有限公司(COFCO)是立足中国的国一流粮食企,是全球布局、全、有最

COFCO Corporation (Private) 152,018 4,954 N/A N/A N/A N/A

大市和展潜力的及粮油食品企,集易、加工、售、研于一体的投控股公司。

097950 CJ CheilJedang Corp. is the food company in Korea.

CJ CheilJedang Corp 32,169 637 4,103 18,853 9.5 0.55

ABF Associated British Foods is a diversified international retail, food, and

Associated British Foods PLC 30,186 1,243 24,661 28,971 20.1 1.34

ingredients group with 130,000 employees and operations in 50

countries across Europe, southern Africa, the Americas, Asia, and

Australia.

SZU Suedzucker AG has five major segments: Sugar, Special products,

Suedzucker AG 13,638 567 4,604 N/A 6.8 0.96

Crop energies, starch and Fruit.

CSAN3 Cosan SA engages in several services throughout the energy and

Cosan SA 10,628 315 9,720 27,970 N/A 1.95

logistics sectors.

2050 The Savola Group is a strategic investment holding company.

The Savola Group 10,287 272 N/A N/A N/A N/A

Sugar producer

Tereos SCA (Private) 7,975 270 N/A N/A N/A N/A

600737 Cofco Sugar Holding Co Ltd is engaged in sugar business and tomato

Cofco Sugar Holding Co Ltd 5,421 152 3,367 4,563 22.1 1.73

processing business.

AGR Agrana Beteiligungs AG is a processor of raw materials that

Agrana Beteiligungs AG 5,223 23 1,438 2,738 56.5 0.82

manufactures foods and intermediate products for the downstream

food industry as well as for non-food applications.

AGRO Ros Agro PLC is a Russian company which is engaged in agricultural

Ros Agro PLC 4,957 140 2,805 4,759 15.1 0.97

production and cultivation of sugar beet, grain, and other agricultural

crops as well as cultivation of pigs, processing of raw sugar and

production of sugar from sugar beet, production, and processing of

vegetable oil.

000070 Samyang Holdings Corp is involved in chemical, consumer food stuff,

Samyang Holdings Corp 3,547 76 564 1,915 10.9 0.29

bottle and ion exchange resin business.

Note: Sales = Net Sale which is calculated as Gross Sales - Sales Allowance Return. Depending on industry, sales is defined as Operating Income, Ordinary Income.

Note: Enterprise Value = Market Cap+(Interest-bearing debt- Cash Equivalents and Short Term Investments)+Minority Interests. The negative Enterprise Value is displayed as N/A.

Note: P/E = Market Cap / Net Profit.

Note: P/BV = Market Cap / Total Shareholders Equity.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 6/13

Competitor Analysis : Valuation

Market Cap EV P/E P/BV EV/Sales EV/EBITDA EV/Operating Income

Ticker Company Name Last closing

LTM Latest FY LTM LTM Latest FY LTM Latest FY LTM Latest FY LTM

price

SGD Million SGD Million x x x x x x x x x

DSRP Dangote Sugar Refinery N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

097950 CJ CheilJedang Corp 4,103 18,853 6.5 9.5 0.55 0.60 0.61 6.1 7.6 10.8 12.4

ABF Associated British Foods 24,661 28,971 21.6 20.1 1.34 1.00 0.95 8.4 8.7 13.4 14.4

SZU Suedzucker AG 4,604 N/A 8.2 6.8 0.96 0.63 N/A 5.6 N/A 8.7 N/A

CSAN3 Cosan SA 9,720 27,970 32.5 N/A 1.95 2.68 2.59 9.5 9.2 18.2 17.0

2050 The Savola Group N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

600737 Cofco Sugar Holding Co 3,367 4,563 23.5 22.1 1.73 0.77 0.90 14.0 16.0 15.5 17.4

AGR Agrana Beteiligungs AG 1,438 2,738 63.6 56.5 0.82 0.49 0.51 6.2 N/A 11.1 11.0

AGRO Ros Agro PLC 2,805 4,759 22.8 15.1 0.97 1.23 1.22 13.5 10.2 14.6 18.9

000070 Samyang Holdings Corp 564 1,915 7.4 10.9 0.29 0.56 0.57 7.2 N/A 14.1 20.7

Mean 6,408 12,824 23.3 20.2 1.08 0.99 1.05 8.8 10.3 13.3 16.0

Median 3,735 4,759 22.2 15.1 0.96 0.70 0.90 7.8 9.2 13.7 17.0

Minimum 564 1,915 6.5 6.8 0.29 0.49 0.51 5.6 7.6 8.7 11.0

Maximum 24,661 28,971 63.6 56.5 1.95 2.68 2.59 14.0 16.0 18.2 20.7

Note: Enterprise Value = Market Cap+(Interest-bearing debt- Cash Equivalents and Short Term Investments)+Minority Interests.

Note: P/E = Market Cap / Net Profit.

Note: P/BV = Market Cap / Total Shareholders Equity.

Note: N/A stands for EV/Sales, EV/EBITDA, and EV/Operating Profit are negative or unreleased.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 7/13

Competitor Analysis : Profitability

EBITDA Margin Operating Profit Margin Net Profit Margin (Attribute to parent

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

% % % % % % % % %

DSRP Dangote Sugar Refinery 12.3 21.3 21.3 14.1 20.2 20.2 8.0 13.6 13.6

COFCO Corporation N/A N/A N/A N/A N/A N/A 2.4 3.3 3.3

097950CJ CheilJedang Corp 10.4 9.9 8.0 5.8 5.5 4.9 2.3 2.0 1.3

ABF Associated British Foods 11.9 N/A 11.0 7.5 N/A 6.6 4.1 N/A 4.0

SZU Suedzucker AG 7.9 11.2 N/A 3.9 7.2 8.3 0.9 4.2 4.8

CSAN3 Cosan SA 49.0 28.2 28.2 15.4 14.7 15.2 24.4 3.0 -0.6

2050 The Savola Group 8.6 9.9 10.6 3.6 3.6 4.3 0.9 2.6 3.0

Tereos SCA (Private) 7.5 N/A 7.5 N/A N/A N/A 3.4 N/A 3.4

600737Cofco Sugar Holding Co 5.2 5.5 5.6 4.9 4.9 5.1 2.1 2.8 3.0

AGR Agrana Beteiligungs AG 6.7 7.8 N/A 2.6 4.4 4.6 -0.4 0.4 0.5

AGRO Ros Agro PLC 25.3 9.0 12.0 19.0 8.4 6.5 18.6 2.8 4.5

000070Samyang Holdings Corp 14.7 7.8 N/A 11.3 4.0 2.7 7.6 2.1 1.5

Mean 14.5 12.3 13.0 8.8 8.1 7.8 6.2 3.7 3.5

Median 10.4 9.9 10.8 6.6 5.5 5.8 2.9 2.8 3.2

Minimum 5.2 5.5 5.6 2.6 3.6 2.7 -0.4 0.4 -0.6

Maximum 49.0 28.2 28.2 19.0 20.2 20.2 24.4 13.6 13.6

Note: Profitability items are calculated as each profit items/Sales×100. Sales = Net Sale which is calculated as Gross Sales - Sales Allowance Return. Depending on industry, sales is defined as Operating

Income, Ordinary Income.

Note: If company’s account standard is US GAAP(SEC), Ordinary Income is defined as Profit Before Income Taxes.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 8/13

Competitor Analysis : Growth

Sales Growth Operating Profit Growth Net Profit Growth EPS Growth

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

% % % % % % % % % % % %

DSRP Dangote Sugar Refinery 28.8 46.1 46.1 -20.5 109.1 109.1 -25.9 148.2 148.2 -25.7 147.8 147.8

COFCO Corporation 25.4 11.5 11.5 N/A N/A N/A 7.3 52.5 52.5 N/A N/A N/A

097950CJ CheilJedang Corp 8.4 14.4 11.4 12.1 9.2 -5.9 -10.6 -2.8 -37.6 -10.6 -2.8 N/A

ABF Associated British Foods 22.4 N/A 20.9 44.7 N/A 2.2 46.4 N/A -5.2 46.4 N/A N/A

SZU Suedzucker AG 13.8 25.0 19.9 33.3 130.9 95.8 N/A 502.0 243.0 N/A 503.1 N/A

CSAN3 Cosan SA 26.6 53.6 42.7 24.0 46.5 45.8 634.4 -81.4 -103.9 634.4 -81.7 N/A

2050 The Savola Group 13.7 13.7 8.3 -12.6 13.0 22.3 -75.6 234.8 155.1 -75.4 231.0 N/A

Tereos SCA (Private) 17.8 N/A 17.8 N/A N/A N/A N/A N/A N/A N/A N/A N/A

600737Cofco Sugar Holding Co 19.1 5.1 2.2 -5.3 5.9 7.1 -1.8 43.1 43.9 -1.8 43.1 N/A

AGR Agrana Beteiligungs AG 13.9 25.4 20.6 33.1 109.6 60.4 -121.1 N/A 102.7 -120.8 N/A N/A

AGRO Ros Agro PLC 40.2 7.8 -3.6 54.5 -52.4 -67.2 70.3 -83.7 -72.3 N/A N/A N/A

000070Samyang Holdings Corp 25.7 6.7 1.9 106.5 -62.4 -71.6 132.3 -70.1 -76.1 132.3 -70.1 N/A

Mean 21.3 20.9 16.6 27.0 34.4 19.8 65.6 82.5 40.9 72.3 110.1 147.8

Median 20.8 14.1 14.7 28.6 13.0 14.7 2.7 43.1 43.9 -6.2 43.1 147.8

Minimum 8.4 5.1 -3.6 -20.5 -62.4 -71.6 -121.1 -83.7 -103.9 -120.8 -81.7 147.8

Maximum 40.2 53.6 46.1 106.5 130.9 109.1 634.4 502.0 243.0 634.4 503.1 147.8

Note: Note: Growth rates are calculated using the formula (Current FY Figure/Previous FY Figure - 1)×100. Rates are listed as “N/A” in cases where figures have not yet been released, there has been

a change in FY closing date, the period of comparison contains consolidated and non-consolidated statements, there have been changes in accounting standards or currency, or a previous FY figure is

negative.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 9/13

Competitor Analysis : Efficiency

ROE ROA Total Assets Turnover Ratio ROIC(Invested Capital)

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

% % % % % % % % %

DSRP Dangote Sugar Refinery 17.41 36.51 36.51 6.92 12.85 12.85 0.87 0.95 0.95 8.24 14.35 14.35

COFCO Corporation 8.04 11.54 11.54 2.34 3.50 3.50 0.98 1.07 1.07 N/A N/A N/A

097950CJ CheilJedang Corp 10.76 9.26 6.04 2.34 2.10 1.38 1 1.06 1.03 5.62 5.18 2.62

ABF Associated British Foods 6.55 N/A 6.95 3.82 N/A 4.08 0.93 N/A 1.01 5.50 N/A 5.78

SZU Suedzucker AG 2.41 13.15 23.54 0.80 4.35 5.22 0.93 1.05 1.08 2.78 9.46 19.85

CSAN3 Cosan SA 63.12 6.65 -1.35 6.95 1.01 -0.21 0.28 0.34 0.36 14.74 9.12 9.01

2050 The Savola Group 2.72 9.09 10.37 0.80 2.56 2.88 0.89 0.97 0.94 4.38 7.25 8.18

Tereos SCA (Private) 8.63 N/A 8.63 2.54 N/A 2.54 0.75 N/A 0.75 N/A N/A N/A

600737Cofco Sugar Holding Co 5.46 7.21 7.74 2.87 3.85 3.61 1.39 1.37 1.21 5.41 5.94 5.39

AGR Agrana Beteiligungs AG -1.01 1.31 1.42 -0.49 0.56 0.63 1.13 1.29 1.31 -0.25 1.87 1.25

AGRO Ros Agro PLC 30.28 4.47 6.59 12.99 1.70 2.63 0.7 0.6 0.58 13.56 1.65 2.71

000070Samyang Holdings Corp 14.53 4.01 2.71 5.69 1.58 1.06 0.74 0.74 0.72 8.32 3.28 2.65

Mean 14.08 10.32 10.06 3.96 3.40 3.35 0.88 0.94 0.92 6.83 6.45 7.18

Median 8.34 8.15 7.34 2.70 2.33 2.75 0.91 1.01 0.98 5.56 5.94 5.58

Minimum -1.01 1.31 -1.35 -0.49 0.56 -0.21 0.28 0.34 0.36 -0.25 1.65 1.25

Maximum 63.12 36.51 36.51 12.99 12.85 12.85 1.39 1.37 1.31 14.74 14.35 19.85

Note: ROE = Net Profit/Average Total Shareholders Equity at beginning and end of the period×100.

Note: ROA = Net Profit/Average Total Assets at beginning and end of the period×100.

Note: ROIC = NOPAT/Invested Capital×100. NOPAT is defined as EBIT(Net Profit Before Income Taxes+Interest Expenses)-Income Taxes. NOPAT of Japanese Company is defined as Total Operating

Profit-Income Taxes. Invested Capital = Interest-bearing debt + Total Stockholders Equity

Note: Ordinary Income/Total Assets = Ordinary Income/Average Total Assets at beginning and end of the period×100. If company’s account standard is US GAAP(SEC), Ordinary Income is defined as

Profit Before Income Taxes.

Note: Total Assets Turnover Ratio = Sales/Average Total Assets at beginning and end of the period

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 10/13

Competitor Analysis : Leverage

D/E Ratio Net D/E Ratio Total Interest Bearing Debt/EBITDA Net Total Interest Bearing Debt/EBITDA Shareholders' Equity Ratio

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

x x x x x x x x x x x x % % %

DSRP Dangote Sugar Refinery 1.23 1.28 1.28 0.43 0.26 0.26 4.66 2.56 2.56 1.62 0.53 0.53 35.78 34.77 34.77

COFCO Corporation N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 29.61 30.99 30.99

097950CJ CheilJedang Corp 1.60 1.72 1.78 1.42 1.45 1.51 3.59 3.90 5.13 3.19 3.30 4.33 22.76 22.51 22.75

ABF Associated British Foods 0.34 N/A 0.34 0.15 N/A 0.23 1.92 N/A 1.86 0.87 N/A 1.27 57.89 N/A 58.86

SZU Suedzucker AG 0.68 0.71 N/A 0.56 0.63 N/A 3.15 2.14 N/A 2.62 1.91 N/A 32.95 33.26 35.10

CSAN3 Cosan SA 3.32 2.74 2.86 2.22 2.09 2.28 3.86 5.04 4.80 2.59 3.85 3.83 15.07 15.36 14.86

2050 The Savola Group 1.52 1.44 1.39 1.35 1.26 1.12 5.84 4.28 3.91 5.18 3.76 3.15 28.30 27.92 28.02

Tereos SCA (Private) N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 29.28 N/A 29.28

600737Cofco Sugar Holding Co 0.37 0.38 0.80 N/A N/A N/A 2.79 2.83 5.46 N/A N/A N/A 53.46 53.20 43.05

AGR Agrana Beteiligungs AG 0.53 0.69 0.77 0.45 0.59 0.67 3.38 2.88 N/A 2.85 2.47 N/A 46.32 39.75 40.14

AGRO Ros Agro PLC 1.21 1.55 1.35 0.90 1.41 1.16 3.18 11.02 7.97 2.36 10.03 6.85 40.83 35.74 39.13

000070Samyang Holdings Corp 0.74 0.77 0.74 0.64 0.64 0.62 2.85 5.33 N/A 2.47 4.44 N/A 39.27 39.40 39.71

Mean 1.15 1.25 1.26 0.90 1.04 0.98 3.52 4.44 4.53 2.64 3.79 3.33 35.96 33.29 34.72

Median 0.98 1.28 1.28 0.64 0.95 0.90 3.28 3.90 4.80 2.59 3.53 3.49 34.37 34.02 34.94

Minimum 0.34 0.38 0.34 0.15 0.26 0.23 1.92 2.14 1.86 0.87 0.53 0.53 15.07 15.36 14.86

Maximum 3.32 2.74 2.86 2.22 2.09 2.28 5.84 11.02 7.97 5.18 10.03 6.85 57.89 53.20 58.86

Note: Capital Adequacy Ratio = Total Shareholders Equity/Total Asset at the end of the period×100.

Note: D/E Ratio = Interest-bearing debt/Total Shareholders Equity. Net D/E Ratio = Interest-bearing debt - Cash and Cash Equivalents/Total Shareholders Equity.

Note: If Interest-bearing debt is zero or each items are negative, D/E Ratio, Net D/E Ratio, Interest-bearing debt/EBITDA, Net Interest-bearing debt/EBITDA are displayed as N/A.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 11/13

Competitor Analysis : Productivity

Total Sales/Employee Operating Profit/Employee Net Profit/Employee

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM FY2021 FY2022 LTM

SGD SGD SGD SGD SGD SGD SGD SGD SGD

DSRP Dangote Sugar Refinery 304,814 144,116 144,116 43,018 29,110 29,110 24,356 19,563 19,563

COFCO Corporation N/A N/A N/A N/A N/A N/A N/A N/A N/A

097950CJ CheilJedang Corp 3,783,103 3,764,632 N/A 219,370 208,348 N/A 88,197 74,584 N/A

ABF Associated British Foods N/A N/A N/A N/A N/A N/A N/A N/A N/A

SZU Suedzucker AG 664,977 743,559 728,988 26,008 53,728 60,267 5,741 30,915 35,316

CSAN3 Cosan SA 609,515 950,546 N/A 94,073 139,851 N/A 148,747 28,132 N/A

2050 The Savola Group N/A N/A N/A N/A N/A N/A N/A N/A N/A

Tereos SCA (Private) N/A N/A N/A N/A N/A N/A N/A N/A N/A

600737Cofco Sugar Holding Co N/A N/A N/A N/A N/A N/A N/A N/A N/A

AGR Agrana Beteiligungs AG 526,436 598,264 603,595 13,781 26,180 27,779 -2,288 2,601 2,893

AGRO Ros Agro PLC 213,659 250,527 N/A 40,690 21,053 N/A 39,752 7,053 N/A

000070Samyang Holdings Corp 7,582,066 6,630,197 N/A 858,173 264,515 N/A 580,006 141,946 N/A

Mean 1,954,939 1,868,834 492,233 185,016 106,112 39,052 126,359 43,542 19,257

Median 609,515 743,559 603,595 43,018 53,728 29,110 39,752 28,132 19,563

Minimum 213,659 144,116 144,116 13,781 21,053 27,779 -2,288 2,601 2,893

Maximum 7,582,066 6,630,197 728,988 858,173 264,515 60,267 580,006 141,946 35,316

Note: Sales = Net Sale which is calculated as Gross Sales - Sales Allowance Return. Depending on industry, sales is defined as Operating Income, Ordinary Income.

Note: : If company’s account standard is US GAAP(SEC), Ordinary Income is defined as Profit Before Income Taxes.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 12/13

Competitor Analysis : Shareholder Return

Dividends per Share Dividend Yield

Ticker Company Name FY2021 FY2022 LTM FY2021 FY2022 LTM

SGD SGD SGD % % %

DSRP Dangote Sugar Refinery 0.00 0.00 0.00 N/A N/A N/A

COFCO Corporation N/A N/A N/A N/A N/A N/A

097950CJ CheilJedang Corp 5.87 5.88 5.78 1.3 1.4 2.1

ABF Associated British Foods 0.61 N/A N/A 2.2 N/A N/A

SZU Suedzucker AG 0.32 0.57 N/A 1.6 2.5 N/A

CSAN3 Cosan SA 0.16 0.11 0.11 N/A 2.5 2.1

2050 The Savola Group 0.27 0.07 0.07 N/A N/A N/A

Tereos SCA (Private) N/A N/A N/A N/A N/A N/A

600737Cofco Sugar Holding Co 0.02 0.05 N/A N/A N/A N/A

AGR Agrana Beteiligungs AG 1.34 1.08 N/A 5.1 4.4 N/A

AGRO Ros Agro PLC N/A N/A N/A N/A N/A N/A

000070Samyang Holdings Corp 3.52 3.74 3.68 3.1 5.1 5.1

Mean 1.35 1.44 1.93 2.7 3.2 3.1

Median 0.32 0.34 0.11 2.2 2.5 2.1

Minimum 0.00 0.00 0.00 1.3 1.4 2.1

Maximum 5.87 5.88 5.78 5.1 5.1 5.1

Note: Dividend Payout Ratio = Annual Total of Dividends/Net Profit×100. Annual Total of Dividends is defined as Nonconsolidated value, and Net Profit is defined as Consolidated value prior to

Nonconsolidated.

Note: Dividend Yield = (Dividends per Share / Stock Price) × 100. Dividends per Share refers to data disclosed by the company. The dividend yield at the end of previous fiscal years refers to the

closing stock price at fiscal year end of each company. For latest fiscal year and LTM, the last closing price is used.

Note: * in company name indicates automatic industry classifications by algorithm.

Composed by SPEEDA 13/13

You might also like

- Cont RM Air CondDocument60 pagesCont RM Air CondKurniawan Eko PrasetyoNo ratings yet

- Financial Report'sDocument2 pagesFinancial Report'sDeva sNo ratings yet

- (9434) ソフトバンクの株価・業績・競合 - 会社四季報オンラインDocument3 pages(9434) ソフトバンクの株価・業績・競合 - 会社四季報オンラインya aNo ratings yet

- Cong Ty TNHH Thuong Mai Thien Long Pib 20230721151234Document14 pagesCong Ty TNHH Thuong Mai Thien Long Pib 20230721151234Ftu NGUYỄN THỊ NGỌC MINHNo ratings yet

- IR Presentation FY18Document32 pagesIR Presentation FY18choiand1No ratings yet

- 4231 Tigers Polymer Corporation Company Finance PLDocument6 pages4231 Tigers Polymer Corporation Company Finance PLRikuriNo ratings yet

- 講義資料 v1 ii 10月24日以降Document9 pages講義資料 v1 ii 10月24日以降진쿤No ratings yet

- 4231 Tigers Polymer Corporation Company Finance CompanyInfoDocument27 pages4231 Tigers Polymer Corporation Company Finance CompanyInfoRikuriNo ratings yet

- Irpdf 001384Document36 pagesIrpdf 001384houhuixin2021No ratings yet

- Fact201003 FDDocument23 pagesFact201003 FDLeinadNo ratings yet

- 経営戦略Document3 pages経営戦略yusuke20020724No ratings yet

- Calculos Finanzas EjercicioDocument4 pagesCalculos Finanzas Ejerciciorichard vacaNo ratings yet

- 個股報告 力成 (6239)Document6 pages個股報告 力成 (6239)皓名No ratings yet

- Financial ComparisonDocument13 pagesFinancial ComparisonABHISHEK YADAVNo ratings yet

- Yo 00242319Document105 pagesYo 00242319Bibin CherianNo ratings yet

- Japanese-Bank StatementDocument2 pagesJapanese-Bank StatementSANDHI SARKARNo ratings yet

- 14 - Note Répartition Régionale de L'investissement - FRDocument117 pages14 - Note Répartition Régionale de L'investissement - FRHichamNo ratings yet

- US AMAZON blackBoxProducts 1Document4 pagesUS AMAZON blackBoxProducts 1Đinh Mạnh HùngNo ratings yet

- FACTURE NNDocument1 pageFACTURE NNkassi kacouNo ratings yet

- Invoice - INV47Document2 pagesInvoice - INV47Muhammad MusaNo ratings yet

- Informe FinancieroDocument1 pageInforme FinancieroWaldir Fernandez HoyosNo ratings yet

- 2020-1103-02 LiquidacionDocument1 page2020-1103-02 LiquidacionSFlorsita SesyNo ratings yet

- 00Document131 pages00appleNo ratings yet

- 2014経産省-もの作り白書 概要Document41 pages2014経産省-もの作り白書 概要MICK MINAMINo ratings yet

- Ar Sunson TextileDocument75 pagesAr Sunson TextileandiNo ratings yet

- 202208220536478028Document25 pages20220822053647802888risingbruhNo ratings yet

- 4231 Tigers Polymer Corporation Company Finance BSDocument6 pages4231 Tigers Polymer Corporation Company Finance BSRikuriNo ratings yet

- Balance 2023Document1 pageBalance 2023Edison Andres SantaNo ratings yet

- EirDocument143 pagesEirAtsushi YoshidaNo ratings yet

- 経済産業省, 蓄電池産業の現状と課題について, 2021年11⽉18⽇Document48 pages経済産業省, 蓄電池産業の現状と課題について, 2021年11⽉18⽇Seeary LinNo ratings yet

- Bizhub 421 Parts ManualDocument159 pagesBizhub 421 Parts ManualThuderboyNo ratings yet

- Indzona8 4Document2 pagesIndzona8 4Anush EriakianNo ratings yet

- فاتورة شراء 1Document1 pageفاتورة شراء 1Nour-eddine ArarNo ratings yet

- Tools Hitung New Motorising HP - 030124 - 092808Document18 pagesTools Hitung New Motorising HP - 030124 - 092808amar kren32No ratings yet

- リプラス有価証券報告書Document16 pagesリプラス有価証券報告書t05819kmNo ratings yet

- Struggle History of San Roque Dam in TheDocument44 pagesStruggle History of San Roque Dam in TheEmilNo ratings yet

- PCA アナリストレポートDocument40 pagesPCA アナリストレポートDNo ratings yet

- JapãoDocument64 pagesJapãoLevi SantosNo ratings yet

- Customs Declaration: HandlingDocument1 pageCustoms Declaration: HandlingMahmoud Al-MasryNo ratings yet

- 双葉電子工業 買収に向けてDocument41 pages双葉電子工業 買収に向けて俣野莉歩No ratings yet

- Balanço PatrimonialDocument3 pagesBalanço PatrimonialRusymberg Felix da CostaNo ratings yet

- SBKK Financial Report 20220511Document45 pagesSBKK Financial Report 20220511qicaiNo ratings yet

- KG28 WorksheetDocument10 pagesKG28 WorksheetAleeFloresNo ratings yet

- ERRORESDocument2 pagesERRORESDenisse EduardoNo ratings yet

- 2011 11Document28 pages2011 11h0s0No ratings yet

- 13442304704西至道利益計算Document2 pages13442304704西至道利益計算zhidaoxi496No ratings yet

- Keyeast JPDocument4 pagesKeyeast JPhongbo.liNo ratings yet

- bizhubC35PartsManual PDFDocument59 pagesbizhubC35PartsManual PDFmehdi_palangiNo ratings yet

- 1Document11 pages1Cay HNo ratings yet

- VGA Schematic PDFDocument1 pageVGA Schematic PDFGeraud Russel Goune ChenguiNo ratings yet

- Ey Japan Jbs India Flashnews c8 May 2020Document11 pagesEy Japan Jbs India Flashnews c8 May 2020Himanshu KashyapNo ratings yet

- Deber FINALDocument19 pagesDeber FINALlorenavh88No ratings yet

- DownloadDocument24 pagesDownloadNikhil MalankarNo ratings yet

- XL 640 Basic Data AST 見 20200427Document40 pagesXL 640 Basic Data AST 見 20200427Ko KyoNo ratings yet

- (3月3週目) マンスリー試算表Document3 pages(3月3週目) マンスリー試算表nakajima.jrNo ratings yet

- NG Lever 2DP IncomingDocument1 pageNG Lever 2DP IncomingWilman AlvrNo ratings yet

- Resumen Ejecutivo Final v4Document193 pagesResumen Ejecutivo Final v4yaninaNo ratings yet

- Anthropology StatisticsDocument16 pagesAnthropology StatisticsaRTNo ratings yet