Professional Documents

Culture Documents

T12 Ans 1 (I & Ii)

T12 Ans 1 (I & Ii)

Uploaded by

PUI TUNG CHONGOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T12 Ans 1 (I & Ii)

T12 Ans 1 (I & Ii)

Uploaded by

PUI TUNG CHONGCopyright:

Available Formats

TAR UC (FAFB) – RAC Year 3 (ACADEMIC YEAR 2022/2023)

BBFT3014/BBFT3013 ADVANCED TAXATION

Tutorial 12: Deceased individual & Estate

Suggested answer to Q1

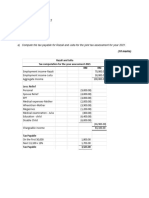

(a) Tax Computation for the Year of Assessment 2022

Alan (deceased) Executors, Estate of Alan

1.1.2022 to 30.9.2022 1.10.2022 to 31.12.2022

RM RM

Employment (Malaysia)

Salary 80,000

Bonus 30,000

Gratuity (due to illness, Para. 25 of Sch. 6) Exempt

Compensation (due to illness, Para. 15 of Sch. 6) Exempt

110,000

Dividend (Malaysia)

Single tier dividend rec'd on 10.1.22 Exempt

- (Para. 12B of Sch. 6)

Interest (Malaysia)

Interest received on 1.4.2022 Exempt Interest (Malaysia) received on 10.10.2022 50,000

- IT (Exemption) No. 7 Order 2008

Aggregate income 110,000 50,000

Less: Donation in cash to M'sian Govt. 10,000 Annuity (RM10,000 x 2) 20,000

Cash distribution to his 2 sons (note 1 below) 0

Total income 100,000 30,000

Less: Personal reliefs

Self 9,000 Special relief 9,000

EPF (Max) 4,000 (Alan died domiciled in Malaysia)

Child relief (Alvin) 8,000

Chargeable income 79,000 21,000

Tax payable

Tax on RM70,000 4,400.00 Tax on RM20,000 150.00

Next on RM9,000 @ 21% 1,890.00 Next on RM1,000 @ 3% 30.00

6,290.00 180.00

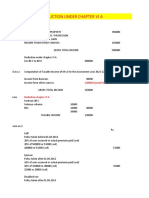

Notes:

1 There is no deduction for the distributions of totalled RM200,000 (RM100,000 x 2) to both his sons,

Albert and Alivin which are capital in nature.

Both the receipients, Albert and Alivn will not be subject to tax as it was capital in nature.

2 The tax rebate of RM400 is given to a resident individual with a chargeable income not exceeding RM35,000 and

an executor is not an individual, hence the tax rebate of RM400 is not given.

You might also like

- ACC 3013 - FWA - Revision - 202110Document14 pagesACC 3013 - FWA - Revision - 202110falnuaimi001No ratings yet

- QualityControl VIDASDocument3 pagesQualityControl VIDAScassNo ratings yet

- Quiz 1 Answers and Solutions (Partnership Formation and Operation)Document6 pagesQuiz 1 Answers and Solutions (Partnership Formation and Operation)cpacpacpaNo ratings yet

- Flexi EDGE BTS ConfigurationsDocument52 pagesFlexi EDGE BTS ConfigurationsEm Peerayut100% (16)

- Mathematics: Practice TestDocument8 pagesMathematics: Practice TestJeni100% (3)

- Individual TaxationDocument5 pagesIndividual TaxationMasidayu MehatNo ratings yet

- 4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsDocument39 pages4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsKASHISH GUPTANo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Estate ExercisesDocument12 pagesEstate ExercisesAmira SyahiraNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- Tutorial Bkat2013 (288748)Document3 pagesTutorial Bkat2013 (288748)Hafizzudin ZolkifelyNo ratings yet

- 2Document4 pages2Dan Shadrach DapegNo ratings yet

- Investments: SolutionDocument8 pagesInvestments: SolutionAce LimpinNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- T11 Ans. 1Document1 pageT11 Ans. 1PUI TUNG CHONGNo ratings yet

- Salary Mock Solution - March-24Document2 pagesSalary Mock Solution - March-24syedameerhamza762No ratings yet

- HW 16.1.24 Personal TaxationDocument8 pagesHW 16.1.24 Personal TaxationhusninanorzainNo ratings yet

- Midterms Sa2 FARDocument6 pagesMidterms Sa2 FAREloiNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Answer Keys For Midterm Exam PART 2Document3 pagesAnswer Keys For Midterm Exam PART 2Angel MaghuyopNo ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- Corporate AccountingDocument19 pagesCorporate AccountingByron TanNo ratings yet

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- Reviewer TAXDocument3 pagesReviewer TAXAnnabel MendozaNo ratings yet

- Finalchapter 19Document5 pagesFinalchapter 19Jud Rossette ArcebesNo ratings yet

- CV Raun Jurnal Penyesuaian Bulan Desember 2021 (Dalam Rupiah)Document4 pagesCV Raun Jurnal Penyesuaian Bulan Desember 2021 (Dalam Rupiah)Rheza Eko WidhiartoNo ratings yet

- Chapter 12 FAR Millan Chapter 12 FAR MillanDocument4 pagesChapter 12 FAR Millan Chapter 12 FAR MillanJoanah AquinoNo ratings yet

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- T2A 20542021 Employment IDocument6 pagesT2A 20542021 Employment IChan Chun HaoNo ratings yet

- Financial Accounting and Reporting - JA - 2022 - Suggested AnswersDocument8 pagesFinancial Accounting and Reporting - JA - 2022 - Suggested AnswersMonira afrozNo ratings yet

- Chapter 19Document4 pagesChapter 19Bella RonahNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Deductions Dec 21Document26 pagesDeductions Dec 21snowbell 95No ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- THE State University of Zanzibar: Lecturer: Cpa Masoud Rashid Course: Taxation Group No: 3Document24 pagesTHE State University of Zanzibar: Lecturer: Cpa Masoud Rashid Course: Taxation Group No: 3tembo groupNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetpalkwahNo ratings yet

- AFA Class 11 Income Taxes Answers AllDocument18 pagesAFA Class 11 Income Taxes Answers AllaniaNo ratings yet

- In Class Exercise - Personal TaxDocument3 pagesIn Class Exercise - Personal TaxNur AsnadirahNo ratings yet

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Programme Subject Commerce Semester V Semester Session No. 42 Topic Problems On Taxable Salary Created by Prof Asharani, CDocument6 pagesProgramme Subject Commerce Semester V Semester Session No. 42 Topic Problems On Taxable Salary Created by Prof Asharani, Ctharunm451No ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- @ProCA - Inter Income Tax Book Vol 2 Solution May2022Document139 pages@ProCA - Inter Income Tax Book Vol 2 Solution May2022Indhuja MNo ratings yet

- Solution SalariesDocument16 pagesSolution SalariesAniket AgrawalNo ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Example Deferred TaxDocument7 pagesExample Deferred TaxTEIK LOONG KHORNo ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- Postemployment Benefits Wendy CompanyDocument6 pagesPostemployment Benefits Wendy CompanyArmelen DeloyNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Income Tax Volume 2 Answer KeyDocument137 pagesIncome Tax Volume 2 Answer KeyManish RajNo ratings yet

- Inter-Group TransactionDocument11 pagesInter-Group Transaction庄敏敏No ratings yet

- Jawaban LKS AccountingDocument69 pagesJawaban LKS AccountingAnggi PukjkNo ratings yet

- Arogyamasika May2020 N PDFDocument116 pagesArogyamasika May2020 N PDFjose_sebastian_2No ratings yet

- Eltham 20 x85 Ec75d53d8aDocument3 pagesEltham 20 x85 Ec75d53d8aGuang JunNo ratings yet

- CSP 2018 Engl FDocument171 pagesCSP 2018 Engl FavinashgusainNo ratings yet

- Technical Guide To SRAN Network Design (GO Applicable To SRAN10.0 & GBSS17.0 & BSC6910) - 20140902-A-1.0Document258 pagesTechnical Guide To SRAN Network Design (GO Applicable To SRAN10.0 & GBSS17.0 & BSC6910) - 20140902-A-1.0Lee Nghia100% (1)

- Equipos Fijos Particulas Magneticas MagnafluxDocument67 pagesEquipos Fijos Particulas Magneticas MagnafluxEric Figueroa UribeNo ratings yet

- Chapter 14 - Question & AnswersDocument45 pagesChapter 14 - Question & AnswersCh saab14No ratings yet

- Plumbing Method Statement Rev 01Document21 pagesPlumbing Method Statement Rev 01Firash ImranNo ratings yet

- Instruction Candidate RegnDocument5 pagesInstruction Candidate RegnRebanta BeraNo ratings yet

- Harris Cheese BitsDocument18 pagesHarris Cheese BitssankopubNo ratings yet

- SEPDocument4 pagesSEPSandesh FulzeleNo ratings yet

- 2332 - InFO - BacTALERT VIRTUO - User Manual Language Translation DiscrepanciesDocument2 pages2332 - InFO - BacTALERT VIRTUO - User Manual Language Translation Discrepanciesluisoft88No ratings yet

- CHQP PiqcDocument3 pagesCHQP PiqcShehzad Muhammad KhanNo ratings yet

- EER ETD 1 Ferrite TransformerDocument2 pagesEER ETD 1 Ferrite Transformerhason06No ratings yet

- Mypost Business Postage Rates GuideDocument8 pagesMypost Business Postage Rates GuidemoneycycleNo ratings yet

- Contract of EmploymentDocument3 pagesContract of Employmentcar3laNo ratings yet

- Vdocuments - MX Spare Parts Catalog ZF 4 WG 200 PDFDocument92 pagesVdocuments - MX Spare Parts Catalog ZF 4 WG 200 PDFQuang TranNo ratings yet

- Binamira Vs GarruchoDocument5 pagesBinamira Vs GarruchoLorelei B RecuencoNo ratings yet

- Trial Balance SampleDocument6 pagesTrial Balance SampleOjhal RaiNo ratings yet

- BS 5950-1 2000 - Part 1 - Code of Practice For Design-Rolled and Welded SectionsDocument224 pagesBS 5950-1 2000 - Part 1 - Code of Practice For Design-Rolled and Welded Sectionsjexa88No ratings yet

- A Study On Ratio Analysis in Tata MotorsDocument63 pagesA Study On Ratio Analysis in Tata MotorsMeena Sivasubramanian100% (3)

- Chapter 1Document10 pagesChapter 1nathaliebonquin04No ratings yet

- PadiniDocument30 pagesPadinikristin_kim_13No ratings yet

- G.R. No. 129978. May 12, 1999Document9 pagesG.R. No. 129978. May 12, 1999Tovy BordadoNo ratings yet

- Prac1sol PDFDocument132 pagesPrac1sol PDFfortino_sanchezNo ratings yet

- NVIDIA P40 Supported ServersDocument13 pagesNVIDIA P40 Supported ServersGomishChawlaNo ratings yet

- TECHNOLOGY3 AnswerDocument7 pagesTECHNOLOGY3 AnswerNashaat DhyaaNo ratings yet

- Pa Test Bank Psych Assessment Test BankDocument120 pagesPa Test Bank Psych Assessment Test BankfanchasticommsNo ratings yet