Professional Documents

Culture Documents

0V7 MP 05

Uploaded by

Ahmed MarghaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0V7 MP 05

Uploaded by

Ahmed MarghaniCopyright:

Available Formats

Chapter Five

Capital Improvement Program

And Financial Plan

INTRODUCTION

Future development at the Kayenta Airport, as included in this study, covers a twenty-year

period. Development items are grouped into three stages. Phase I is short-term (1-5 years),

Phase II is intermediate-term (6-10) years) and Phase III is long-term (11-20 years).

Estimated development costs based on the airport layout plan are included for each item in

the CIP. These costs are also based on the recommended facility requirements discussed in

Chapter 3 and the development projects selected in Chapter 4. The phasing of projects

assists the airport sponsor in budgetary planning for construction improvements that are

needed to provide safe and functional facilities for aviation demands. Phased development

schedules also assist the airport sponsor in contingencies and construction. The

recommended airport development items are summarized below.

The ultimate goal of any airport should be the capability to support its own operation and

development through revenues generated at the airport. Unfortunately, few general aviation

airports the size of Kayenta Airport are able to do this. For example, an airport cannot break

even when the fees received from hangar rentals, land leases and other revenues will not

adequately amortize the cost of construction, operations and maintenance. This is the case

all too frequently and it therefore comes as no surprise when communities complain about the

high costs of maintaining their airport’s operation. Even by increasing fees, these airports

might not reach the break-even point. Yet the effort to become self-sufficient will certainly

gain a more positive attitude by the community towards airport development interests.

One point that should be brought up at this time, however, is the fact that while many general

aviation airports the size of Kayenta Airport are not self-sustaining, the intrinsic value that a

well maintained airport brings to a community or region goes far beyond the day to day

operational costs of that airport. In other words, the money spent and benefits received in the

community or region by individuals or businesses that use the airport, exceeds the expenses,

which are a result of operations at the airport. The Economic Impact of Airports in Arizona

report completed by the Arizona Division of Aeronautics in 2002 estimates a total annual

economic impact of $1,014,172 and 16 jobs are attributable to the Kayenta Airport. These

figures were developed by using the multiplier effect which took into account spending by

suppliers and users of aviation which circulates in the community’s economy.

In the case of the Kayenta Airport, the additional revenues generated as a result of increased

tour company aircraft operations (and increased tourists to the Kayenta area) are anticipated

to be substantial.

CAPITAL IMPROVEMENT PROJECTS

Short Term

Construct Access Road

Reconstruct Runway/Airport Pavements

Construct Apron Area (Phase I)

Construct Partial Parallel Taxiway (Phase I)

Install Terminal Area Fencing and Access Gates

Armstrong Consultants, Inc. 5-1 Kayenta Airport

Install Utility Lines to Airport

Medium Term

Install AWOS

Install GPS Approach

Construct Vehicle Parking Area

Construct Terminal Building/Snow Removal Equipment Building

Partial Parallel Taxiway (Phase II)

Construct Helipads

Airport Layout Plan Update

Pavement Preservation

Long Term

Partial Parallel Taxiway (Phase III)

Construct Apron Area (Phase III)

Update Airport Master Plan

DEVELOPMENT FUNDING

The estimated development costs for the aforementioned items are located in Table 5-1. The

cost shares in Table 5-1 assume that the FAA will continue to provide 95 percent grant

funding for eligible projects in the State of Arizona. Grant eligible items typically include

airfield and aeronautical related facilities such as runways, taxiways, aprons, lighting and

visual aids, as well as land acquisition and environmental tasks needed to accomplish the

improvements. Under new legislation, certain items, such as hangars and fuel facilities, are

eligible for federal funding. Despite eligibility for funding assistance, these development items

represent a low priority in competition for funds and are generally funded by the Sponsor or by

third party sources.

Kayenta Airport 5-2

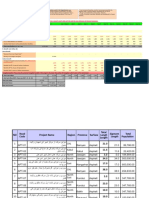

TABLE 5-1 CAPITAL IMPROVEMENT PROGRAM (CIP)

Sequence Project Description Dimension/Quantity Total Federal Local*

A1 Construct Access Road (2,000’x24’) $260,000 $247,000 $13,000

A2 Reconstruct/Shift Runway (7,100’x75’) $2,700,000 $2,565,000 $135,000

A3 Rehab/Replace MIRL, $320,000 $304,000 $16,000

Signage and Visual Aids

A4 Construct Apron Area (16,000 s.y.) $260,000 $247,000 $13,000

(Phase I)

A5 Construct Partial (10,000 s.y.) $320,000 $304,000 $16,000

Parallel/Bypass (PhaseI)

A6 Install Terminal-Area (6,000 l.f.) $100,000 $95,000 $5,000

Fencing and Access Gates

A7 Utilities $180,000 $171,000 $9,000

A8 Pavement Preservation $105,000 $99,750 $5,250

Total Short-Term (0-5 years) $4,245,000 $4,032,750 $212,250

B1 Install AWOS-3 $150,000 $142,500 $7,500

B2 405 Obstruction Survey $36,000 $34,200 $1,800

(GPS)

B3 Construct Vehicle Parking (6,000 s.y.) $240,000 $228,000 $12,000

Area

B4 Construct Terminal Building $420,000 $399,000 $21,000

B5 Construct Apron (Phase II) (15,000 s.y.) $260,000 $247,000 $13,000

B6 Construct Helipads $210,000 $199,500 $10,500

B7 Partial Parallel Taxiway (10,000 s.y.) $240,000 $228,000 $12,000

(Phase II)

B8 Airport Layout Plan Update $100,000 $95,000 $5,000

B9 Pavement Preservation $105,000 $99,750 $5,250

Total Medium-Term $1,761,000 $1,672,950 $88,050

C1 Parallel Taxiway (Phase III) (10,000 s.y.) $480,000 $456,00 $24,000

C2 Construct Apron Area (15,000 s.y.) $210,000 $199,500 $10,500

(Phase III)

C3 Update Airport Master Plan $130,000 $123,500 $6,500

Total Long-Term $820,000 $779,000 $41,000

TOTAL $6,826,000 $6,484,700 $341,300

Estimated cost in 2005 dollars (Includes 25% Engineering, Inspection, Administration and Contingencies)

*Local share costs are expected to be offset by 5% local Township Gross Receipts Tax.

The Airport and Airways Act of 1982 created and authorized the Airport Improvement Program

(AIP) to assist in the development of a nationwide system of public-use airports adequate to

meet the projected growth of civil aviation. The Act provides funding for airport planning and

development projects at airports included in the National Plan of Integrated Airport Systems

(NPIAS).

As previously discussed, the FAA participates with grants of up to 95 percent of total project

costs for eligible projects. Typical eligible projects include planning studies, airside (runways,

taxiways and aprons) construction, expansion and rehabilitation, airport lighting, visual aids,

construction of access roads and land acquisition. New legislation has authorized the

eligibility of revenue producing items such as fuel systems and hangars, provided a plan is

established for funding the airside needs of the airport. Local funding must provide the

remaining 5 percent of the total cost. The State of Arizona does not currently participate in

funding airport development projects on Indian Reservations.

FUNDING THE LOCAL SHARE

The airport sponsor has several methods available for funding the capital required to meet the

local share of airport development costs. The most common methods involve general fund

Armstrong Consultants, Inc. 5-3 Kayenta Airport

appropriations, debt financing which amortizes the debt over the useful life of the project, force

accounts, in-kind service, third-party support and donations.

General Fund Appropriations: Depending on their financial position, the airport sponsor may

have the resources to directly allocate the funds needed for the local share of capital projects.

These allocations are normally included in the annual budgeting process for the various city or

county departments. Early planning and identification of the funds needed helps the sponsor

prepare for these allocations. The Kayenta Township imposes a gross receipts tax on all

projects; this should offset all local share costs for development at the airport.

Bank Financing: Some airport sponsors use bank financing as a means of funding airport

development. Generally, two conditions are required. First, the sponsor must have the ability

to repay the loan plus interest and second, the cost of capital improvements must be less than

the value of the present facility or some other collateral must be used to secure the loan.

These are standard conditions that are applied to almost all bank loan transactions.

General Obligation Bonds: General Obligation Bonds (GO) are a common form of municipal

bonds whose payment is secured by the full faith credit and taxing authority of the issuing

agency. GO bonds are instruments of credit and because of the community guarantee,

reduce the available debt level of the sponsoring community. This type of bond uses tax

revenues to retire debt and the key element becomes the approval by the voters of a tax levy

to support airport development. If approved, GO bonds are typically issued at a lower interest

rate than other types of bonds.

Self-Liquidating General Obligation Bonds: As with GO Bonds, Self-Liquidating General

Obligation Bonds are secured by the issuing government agency. They are retired, however,

by cash flow from the operation of the facility. Providing the state court determines that the

project is self-sustaining, the debt may be legally excluded from the community’s debt limit.

Since the credit of the local government bears the ultimate risk of default, the bond issue is

still considered, for the purpose of financial analysis, as part of the debt burden of the

community. Therefore, this method of financing may mean a higher rate of interest on all

bonds sold by the community. The amount of increase in the interest rate depends, in part,

upon the degree of risk of the bond. Exposure risk occurs when there is insufficient net airport

operating income to cover the level of service plus coverage requirements, thus forcing the

community to absorb the residual.

Revenue Bonds: Revenue Bonds are payable solely from the revenues of a particular project

or from operating income of the borrowing agency, such as an airport commission which lacks

taxing power. These types of bonds are common with passenger terminal developments in

which there is a contracted stream of revenue from airlines, rental car agencies and other

tenants. Generally, they fall outside of constitutional and statutory limitations and in many

cases do not require voter approval. Because of the limitations on the other public bonds,

airport sponsors are increasingly turning to revenue bonds whenever possible. However,

revenue bonds normally carry a higher rate of interest because they lack the guarantees of

municipal bonds.

Combined Revenue/General Obligation Bonds: These bonds, also known as “Double-Barrel

Bonds”, are secured by a pledge of back-up tax revenues to cover principal and interest

payments in cases where airport revenues are insufficient. The combined Revenue/General

Obligation Bond interest rates are usually lower than Revenue Bonds, due to their back-up tax

provisions.

Kayenta Airport 5-4

Force Accounts, In-Kind Service, Donations: Depending on the capabilities of the Sponsor,

the use of force accounts, in-kind service or donations may be approved by the FAA and the

State for the Sponsor to provide their share of the eligible project costs. An example of force

accounts would be the use of heavy machinery and operators for earthmoving and site

preparation of runways taxiways; the installation of fencing; or the construction of

improvements to access roads. In-kind service may include surveying, engineering or other

services. Donations may include land or materials, such as gravel or water, needed for the

project. The value of these items must be verified and approved by the FAA prior to initiation

of the project.

Third-Party Support: Several types of funding fall into this category. For example, individuals

or interested organizations may contribute portions of the required development funds (Pilot

Associations, Economic Development Associations, Chambers of Commerce, etc.). Although

not a common means of airport financing, the role of private financial contributions not only

increases the financial support of the project, but also stimulates moral support to airport

development from local communities. Because of the existing and projected demand for

aircraft hangars, private developers may be persuaded to invest in hangar development.

PAVEMENT MAINTENANCE PLAN

Periodic maintenance is necessary to prolong the useful life of the airport pavements. The

affects of weather damage, oxidation and aircraft usage cause the pavement to deteriorate.

The accumulation of moisture in the pavement causes heaving and cracking and is one of the

greatest causes of pavement distress. The sun’s ultraviolet rays oxidize and break down the

asphalt binder in the pavement mix. This accelerates raveling and erosion and can reduce

asphalt thickness.

The appropriate pavement maintenance will minimize the affects of weather damage and

oxidation. Crack sealing is accomplished to keep moisture from accumulating inside and

underneath the pavement and should be accomplished at least every five years and prior to

fog sealing or overlaying the pavements. Fog seals, slurry seals and coal tar emulsion (fuel

resistant) seals are spread over the entire paved area to replenish the binder lost through

oxidation and to seal, rejuvenate and waterproof the pavement. Slurry seals also include an

aggregate to increase the friction coefficient of the pavement. Asphalt overlays are

accomplished near the end of the useful life of the pavement. A layer of new asphalt is placed

over the existing pavement to renew the life of the pavement and to recover lost strength due

to deterioration. Unless specially designed, the overlay is not intended to increase the weight

bearing capacity of the pavement. Overlays may be supplemented with a porous friction

course or grooving to increase friction and minimize hydroplaning. Remarking of pavement is

required following a fog seal or overlay.

The theoretical pavement maintenance cycle time frames are listed below in Table 5-2.

Actual pavement deterioration will be affected by use of the airport and weather exposure.

Maintenance actions should be programmed as necessary through close monitoring and

inspection of the pavements.

Armstrong Consultants, Inc. 5-5 Kayenta Airport

TABLE 5-2 PAVEMENT MAINTENANCE SCHEDULE

Pavement Maintenance Cycle Approximate Time Frames

Crack Seal Pavement 0 – 2 years

Crack Seal, Seal Coat and Remark Pavements 3 – 8 years

Overlay Pavement 15 – 18 years

FINANCIAL PLAN

The ultimate goal of any airport should be the provision of aeronautical services at a self-

sustaining level. Facilities that are self-sustaining can provide services with minimal outside

funding and reciprocal influence. Unfortunately, few airports are able to accomplish this

objective. For example, it is difficult to break even when the fees received from hangar rentals

and fuel flowage will not adequately amortize the cost of construction. This occurs with great

frequency in communities that are attempting to balance increased traffic levels with the

financial requirements needed to fund these levels. The cost of airport maintenance can, if left

unchecked, reach levels where airport needs begin to compete with other local or regional

programs. Airport sponsors should, consequently, strive to become a vehicle for economic

development and self-sufficiency.

There are intrinsic values that an airport offers to a community that must also be considered in

the financial planning. In other words, funds spent in the community or in the region by airport

users contribute to the local economy and tax base. Furthermore, Kayenta Airport provides

access for valuable services to Kayenta and surrounding communities that would not

otherwise be available.

EXPENDITURES

Airport operating expenditures typically include insurance, utilities, maintenance and

management costs. Insurance costs include liability insurance for the airport and property

insurance for any real property on the airport owned by the Kayenta Township. Utility

expenses primarily consist of power costs to operate airfield lighting and visual aids and water

for public use areas or irrigation. Pavement maintenance consists of crack sealing on an

annual basis and seal coating and remarking the pavements every three to eight years.

Facility maintenance consists of mowing, snow removal, repair and replacement of parts and

equipment such as light bulbs, light fixtures, fences, et cetera. The amount of expenditures

was found from information from the Township and estimations from current and future

projected activity levels.

REVENUES

Airport revenues generally consist of land leases; tie down fees, fuel flowage fees and taxes.

There are no airport revenues currently being generated at the Kayenta Airport.

Building and Aeronautical Land Leases: Property on the airport that is not devoted to airfield

use, vehicle parking or contained within areas required to be cleared of structures may be

leased to individual airport users or aviation related businesses. Typically, the individual is

provided a long-term lease on which to construct a hangar, business or other facility.

Recommended land lease rates at Kayenta are $0.10 per square foot per year based on the

footprint of the building and any dedicated apron space. This rate is comparable to other

airports in the local region. For larger sized parcels a reduced rate for open

space/undeveloped area should be considered (ie $.10/sf/year for hangar/office, apron and

parking areas; $.05/sf/year for remaining area) with a minimum specified required developed

area (such as 60% or more).

Kayenta Airport 5-6

Non-Aeronautical Land Leases: Airport land can be leased for non-aeronautical purposes

(Revenue Generation) to generate revenue for the airport. To comply with FAA regulations,

the land must not be needed for aeronautical use and fair market value must be charged for

the land.

Fuel Flowage Fee: This fee is typically imposed on all aircraft fuels delivered to the airport and

would include all fuels used by aircraft including AvGas, Jet-A and MoGas at approximately

five cents per gallon. The fee would apply to fixed base operators, self-fueling users (if

authorized) and through-the-fence operators who conduct self-fueling. An average of 3

gallons of fuel per operation for Avgas and 15 gallons of fuel per operations for Jet-A were

used to estimate fuel flowage. These averages were found from general aviation airports of

similar size.

Tiedown Fee: A fee is typically established for the use of fixed ramp tiedowns on paved apron

areas. The fees are usually established on a monthly or annual basis for based aircraft and

on an overnight basis for transient aircraft

Construction Tax: The Kayenta Township collects a gross receipts tax. The amount of tax

collected is based on 5% of the total amount spent on public and private on projects in the

Township. This is the primary means of revenue for the Township.

TABLE 5-3 RATES AND CHARGES

Activities Typical Rates for Small General Aviation Airports

Aeronautical Land Leases $0.08-$0.15/sq.ft./year

Hangar Leases $1.00-$5.00/sq.ft./year

Tie-Down Fees $10.00-$30.00/month/aircraft

Through-the-Fence Fees $150.00-$450.00/aircraft/year

Fuel Flowage Fees $0.02-$0.12/gallon

Commercial Activity Fees $0.00-$500/activity/year

Non-Aeronautical Land Leases $1.00-$4.00/sq.ft/year

TABLE 5-4 ANNUAL AIRPORT REVENUES AND EXPENSES

Historical Projected1

Stage I Stage II Stage III

Annual Airport Revenues and Expenses 2004 (0-5 yrs) (6-10 yrs) (11-20 yrs)

REVENUES

Building & Land Leases - $4,000 $5,000 $6,000

Fuel Flowage Fee - $4,000 $5,000 $5,000

Tiedown Fee - $240 $360 $480

Non Operating Revenues

Construction Tax - $3,438 $6,738 $6,600

Total Revenues - $11,678 $17,098 $18,080

EXPENSES

Utilities $800 $800 $880 $968

Pavement Maintenance $700 $700 $770 $847

Facility Maintenance $1,500 $1,500 $1,650 $1,815

Insurance $3,000 $3,000 $3,300 $3,630

Total Expenses $6,000 $6,000 $6,600 $7,260

Balance (+)=surplus (-)=Subsidy -$6,000 +$5,678 +$10,498 +$10,820

Projections based on the last year of each time period (in 2005 dollars).

Armstrong Consultants, Inc. 5-7 Kayenta Airport

RECOMMENDATIONS

A review of airport revenues indicates that the level of rates and charges at Kayenta Airport

are non-existent. Implementing rates and charges will create revenue and are required in

order for the airport to receive funds from the FAA. The FAA requires the airport to take all

reasonable steps necessary to try to become self-sustaining. The most effective means of

increasing revenue at Kayenta is to accommodate existing unmet demand, to implement

reasonable rates and charges and to continue to attract new and additional users.

Building aircraft storage hangars at the airport would result in increased direct revenues

generated through property leases and indirect revenue through increased use of airport

services and facilities, such as fuel flowage fees. Locations for additional nested T-hangars

and individual box hangars have been identified on the terminal area drawing (TAD), included

in Chapter 7.

Business/corporate tenants are typically flight departments for local businesses and provide

employment in the local community. They generally operate multi-engine turboprop or

business jet aircraft. Their land lease parcels are usually large, the aircraft are typically

operated two to three times per week and fuel purchases are typically larger than other

general aviation users (several hundred gallons per fueling). The facilities are also more

extensive and generate higher property tax revenues. A dedicated corporate/executive

aviation area that includes large lease parcels, hangars with office space and automobile

parking with controlled access to the flightline have been included on the TAD.

COMMUNITY SUPPORT

While it would certainly be advantageous for an airport to support itself, the indirect and

intangible benefits of the airport to the community’s economy and growth must be considered.

People are directly or indirectly employed on the airport by the Township and individual

businesses. As airport activity increases, it is expected that employment on the airport will

also grow throughout the planning period. The local construction industry will also benefit

directly from implementation of the development programs. Other community benefits involve

business growth and development that is enhanced by the availability of air transportation

including commercial service, corporate and private aviation. Clients and suppliers of area

businesses will also benefit from the future improvement to the airfield.

The use of corporate and business aircraft is an increasing trend across the United States.

The movement of American industry from large metropolitan areas to smaller communities

offering lower taxes and labor costs has influenced this trend. Corporate aircraft are also

answering the need for quick and convenient access to and from these new locations for

executives and management personnel. The ability of a community to provide convenient

access to corporate aircraft will be reflected not only in benefits to existing businesses and

industries but will be a strong factor in attracting new industry.

These factors place the Kayenta Airport in a prime position to capitalize on the trends in the

general aviation industry and to maximize the benefits the airport provides to the community.

As previously stated the Economic Impact of Airports in Arizona report completed by the

Arizona Division of Aeronautics in 2002 estimates a total annual economic impact of

$1,014,172 and 16 jobs attributable to the Kayenta Airport. These figures were estimated by

using the multiplier effect which took into account spending by suppliers and users of aviation

circulates in the community’s economy.

Kayenta Airport 5-8

CONTINUOUS PLANNING PROCESS

Airport planning is a continuous process that does not end with the completion of a major

project. The fundamental issues upon which this master plan are based are expected to

remain valid for several years; however, several variables, such as based aircraft, annual

aircraft operations and socioeconomic conditions are likely to change over time. The

continuous planning process necessitates that Kayenta consistently monitor the progress of

the airport in terms of growth in based aircraft and annual operations, as this growth is critical

to the exact timing and need for new airport facilities. The information obtained from this

monitoring process will provide the data necessary to determine if the development schedule

should be accelerated, decelerated or maintained as scheduled.

Periodic updates of the Airport Layout Plan, Capital Improvement Plan and Airport Master

Plan are recommended to document physical changes to the airport, review changes in

aviation activity and to update improvement plans for the airport. The primary goal of this

Airport Master Planning effort is to develop a safe and efficient airport that will meet the

demands of its aviation users and stimulate economic development for Kayenta and the

Navajo Nation. The continuous airport planning process is a valuable tool for planning.

Armstrong Consultants, Inc. 5-9 Kayenta Airport

You might also like

- Estimate of Development CostsDocument5 pagesEstimate of Development CostsHector Alberto Garcia LopezNo ratings yet

- Oakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamDocument11 pagesOakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamZennie AbrahamNo ratings yet

- Oakland Raiders Las Vegas NFL Stadium SpreadsheetDocument11 pagesOakland Raiders Las Vegas NFL Stadium SpreadsheetZennie AbrahamNo ratings yet

- Pangalo Airport Final Report VolI Sec1to5Document88 pagesPangalo Airport Final Report VolI Sec1to5Elaiza Ann Taguse100% (3)

- Mets - Public Hearing Package - Jan - 2009Document46 pagesMets - Public Hearing Package - Jan - 2009Ylber PrekaziNo ratings yet

- B-C RatioDocument3 pagesB-C RatioJoselito DaroyNo ratings yet

- Oakland Raiders Las Vegas Project Pro Forma SpreadsheetDocument8 pagesOakland Raiders Las Vegas Project Pro Forma SpreadsheetZennie Abraham0% (1)

- School of Public & Environmental Affairs V346 (15309) Assignment V346-V Due Date: 08-Apr-10Document4 pagesSchool of Public & Environmental Affairs V346 (15309) Assignment V346-V Due Date: 08-Apr-10Zack HigginsNo ratings yet

- DPWHDocument2,166 pagesDPWHLGU SAN ANTONIONo ratings yet

- Den FY2021 Financial Report-8Document6 pagesDen FY2021 Financial Report-8PAVANKUMAR S BNo ratings yet

- 20200323161054PM 569752686 1709094 860275888Document14 pages20200323161054PM 569752686 1709094 860275888PopaNo ratings yet

- Chapter 7Document10 pagesChapter 7Shiekh HassanNo ratings yet

- CC 62 - EPIA Capital Improvement PlanDocument26 pagesCC 62 - EPIA Capital Improvement PlanErika EsquivelNo ratings yet

- 11 Chap Solution Gitman BookDocument23 pages11 Chap Solution Gitman BookAsim AltafNo ratings yet

- AARGM-ER US-Navy PB17 BudgetDocument8 pagesAARGM-ER US-Navy PB17 Budgetbring it onNo ratings yet

- Test#2 SampleDocument5 pagesTest#2 SamplelayanNo ratings yet

- Republic of The PhilippinesDocument5 pagesRepublic of The Philippinesjie yinNo ratings yet

- ROR BQ Arena 2DEC2022 (1) - LatestDocument261 pagesROR BQ Arena 2DEC2022 (1) - LatestJay JayNo ratings yet

- Avionics 2010Document36 pagesAvionics 2010bxlmichael8837No ratings yet

- Greater Asheville Regional Airport Authority - Aug. 10, 2018 Meeting AgendaDocument355 pagesGreater Asheville Regional Airport Authority - Aug. 10, 2018 Meeting AgendaDillon DavisNo ratings yet

- ROR BQ Arena 2DEC2022 - LatestDocument196 pagesROR BQ Arena 2DEC2022 - LatestJay JayNo ratings yet

- Section Six Airport Layout Plan Drawings: Campbell & Paris Engineers (Document4 pagesSection Six Airport Layout Plan Drawings: Campbell & Paris Engineers (Chen Inn TanNo ratings yet

- Tutorial 3 SheetDocument2 pagesTutorial 3 Sheetnourkhaled1218No ratings yet

- FINAL DRAFT FLL MPU - Chapter 8 CIP and Financial AnalysisDocument72 pagesFINAL DRAFT FLL MPU - Chapter 8 CIP and Financial AnalysislegutierrezNo ratings yet

- Ade Meyli (Hal 337-364)Document47 pagesAde Meyli (Hal 337-364)Untung PriambodoNo ratings yet

- Assignment 3Document8 pagesAssignment 3octoNo ratings yet

- Defence Works Procedure 2020 (DWP 2020) - Highlights DT 16 Dec 2020Document8 pagesDefence Works Procedure 2020 (DWP 2020) - Highlights DT 16 Dec 2020Aditya MallikNo ratings yet

- 06 Annual Worth AnalysisDocument19 pages06 Annual Worth Analysis王泓鈞No ratings yet

- National Rural Access Program CBADocument4 pagesNational Rural Access Program CBAMaiwand KhanNo ratings yet

- A. Project Brief & Design RequirementsDocument35 pagesA. Project Brief & Design Requirementskk kumarNo ratings yet

- Operations Management Recitation 2 SummaryDocument3 pagesOperations Management Recitation 2 SummaryiNo ratings yet

- Avionics October 2010Document36 pagesAvionics October 2010dougspyNo ratings yet

- Project 5 McCormick Workbook 2188Document13 pagesProject 5 McCormick Workbook 2188Vin JohnNo ratings yet

- RFP-01353 - Price Update 2Document69 pagesRFP-01353 - Price Update 2the next miamiNo ratings yet

- End of Chapter 11 SolutionDocument19 pagesEnd of Chapter 11 SolutionsaniyahNo ratings yet

- Uganda Road Fund Budgeting and Operational GuidelinesDocument46 pagesUganda Road Fund Budgeting and Operational Guidelinesrichard.musiimeNo ratings yet

- Municipal Parking (34) : Agency Plan: Statement of Purpose, Goals and Budget SummaryDocument15 pagesMunicipal Parking (34) : Agency Plan: Statement of Purpose, Goals and Budget SummaryMatt HampelNo ratings yet

- Liquidity and Solvency Ratios: Google vs Yahoo 2015Document57 pagesLiquidity and Solvency Ratios: Google vs Yahoo 2015cvilalobos198527100% (1)

- Union Station Next 100 Years Forward 2017Document7 pagesUnion Station Next 100 Years Forward 2017Helen BennettNo ratings yet

- Mas CeggDocument20 pagesMas CeggMaurice AgbayaniNo ratings yet

- Investment Appraisal Questions 2-1Document8 pagesInvestment Appraisal Questions 2-1Olajumoke SanusiNo ratings yet

- Unclassified: Operational Systems DevelopmentDocument18 pagesUnclassified: Operational Systems DevelopmentMASOUDNo ratings yet

- Evaluating Projects With Benefit-Cost Ratio: ECON 2004 Engineering EconomyDocument15 pagesEvaluating Projects With Benefit-Cost Ratio: ECON 2004 Engineering EconomyMustafa Gökhan YavuzNo ratings yet

- Cim 11000 11aDocument210 pagesCim 11000 11aMario CalamayaNo ratings yet

- TUTORIAL 2 - Development AppraisalDocument2 pagesTUTORIAL 2 - Development AppraisalMUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Faa DesignDocument296 pagesFaa DesignPutri KurniawatiNo ratings yet

- CH0620100916181206Document4 pagesCH0620100916181206Shubharth BharadwajNo ratings yet

- Revised Guidelines for Calculating Approved Budget Contract AmountsDocument6 pagesRevised Guidelines for Calculating Approved Budget Contract AmountsEngineering OfficeNo ratings yet

- Safety Management SystemDocument17 pagesSafety Management SystemMiko Judael TaperlaNo ratings yet

- FHRAOC - Outil Pour Formuler Le BudgetDocument40 pagesFHRAOC - Outil Pour Formuler Le BudgetTogoNo ratings yet

- IPC - 122 Shitoljhorna Khal RW DraftDocument73 pagesIPC - 122 Shitoljhorna Khal RW DraftArif AbedinNo ratings yet

- Final Formated Edited Airport Pavement R&D Program 03-8-2013Document55 pagesFinal Formated Edited Airport Pavement R&D Program 03-8-2013AkashNo ratings yet

- USP FINALDocument54 pagesUSP FINALsubhamoypatra949No ratings yet

- Bede Cost PlanDocument2 pagesBede Cost PlanDaphne Tan 丽文No ratings yet

- Salem Municipal Airport - Master Plan Executive SummaryDocument2 pagesSalem Municipal Airport - Master Plan Executive SummaryStatesman JournalNo ratings yet

- Project Appraisal TutorialDocument4 pagesProject Appraisal TutorialRahul SharmaNo ratings yet

- Appendix F Technical Update To Pavement Condition SurveyDocument26 pagesAppendix F Technical Update To Pavement Condition SurveyAbdulkalq A. SalamaNo ratings yet

- Airfield Design Enrique Villa CoronadoDocument19 pagesAirfield Design Enrique Villa Coronado100506402No ratings yet

- AVL Public Information Meeting - 10.26.23Document20 pagesAVL Public Information Meeting - 10.26.23whofmannNo ratings yet

- Reducing Business Jet Carbon Footprint: Using the Power of the Aircraft Electric Taxi SystemFrom EverandReducing Business Jet Carbon Footprint: Using the Power of the Aircraft Electric Taxi SystemNo ratings yet

- Zahra's Daily Schedule: Activity Numbe R Time Activity Detail NotesDocument3 pagesZahra's Daily Schedule: Activity Numbe R Time Activity Detail NotesAhmed MarghaniNo ratings yet

- 0V7 MP 06Document14 pages0V7 MP 06Ahmed MarghaniNo ratings yet

- ANSYS transient analysis load stepsDocument6 pagesANSYS transient analysis load stepskondalreddyNo ratings yet

- Marghani WPW2019 LondonConference PresemtationDocument8 pagesMarghani WPW2019 LondonConference PresemtationAhmed MarghaniNo ratings yet

- Michelin X TWEEL TURF, For Zero Turn MowersDocument2 pagesMichelin X TWEEL TURF, For Zero Turn MowersAhmed MarghaniNo ratings yet

- Pavement Cost Calculator Final Update 07 2014 - 201408141735233663Document1 pagePavement Cost Calculator Final Update 07 2014 - 201408141735233663Ahmed MarghaniNo ratings yet

- Rotary Hammer GuideDocument12 pagesRotary Hammer GuideAhmed MarghaniNo ratings yet

- Review of The Vibratory Laboratory Compaction TestDocument13 pagesReview of The Vibratory Laboratory Compaction TestAhmed MarghaniNo ratings yet

- Review of The Vibratory Laboratory Compaction TestDocument13 pagesReview of The Vibratory Laboratory Compaction TestAhmed MarghaniNo ratings yet

- ANSYS Mechanical APDL Contact Technology GuideDocument192 pagesANSYS Mechanical APDL Contact Technology GuideAhmed MarghaniNo ratings yet

- Review of The Vibratory Laboratory Compaction Test: Transportation Group 2019 Conference Te Papa 3-6 March 2019Document12 pagesReview of The Vibratory Laboratory Compaction Test: Transportation Group 2019 Conference Te Papa 3-6 March 2019Ahmed MarghaniNo ratings yet

- Review of The Vibratory Laboratory Compaction Test: Transportation Group 2019 Conference Te Papa 3-6 March 2019Document12 pagesReview of The Vibratory Laboratory Compaction Test: Transportation Group 2019 Conference Te Papa 3-6 March 2019Ahmed MarghaniNo ratings yet

- Case: Mcdonald'S - Are You Lovin' It? Mcdonald'S Ongoing Market ResearchDocument4 pagesCase: Mcdonald'S - Are You Lovin' It? Mcdonald'S Ongoing Market ResearchChandan ArunNo ratings yet

- Amgen PresentationDocument38 pagesAmgen PresentationrajendrakumarNo ratings yet

- Wolf Marshall's Guide To C A G E DDocument1 pageWolf Marshall's Guide To C A G E Dlong_tu02No ratings yet

- Physiology and Physiological Disorders of PepperDocument45 pagesPhysiology and Physiological Disorders of PepperKwesiga Julius75% (4)

- What Is Double Taxation PDFDocument3 pagesWhat Is Double Taxation PDFxyzNo ratings yet

- 9AKK102951 ABB Supplier Qualification QuestionnaireDocument6 pages9AKK102951 ABB Supplier Qualification Questionnairesudar1477No ratings yet

- TS Dry StonerDocument6 pagesTS Dry StonerChong Chan YauNo ratings yet

- Build a 3D Printer Extruder Using a Hot Glue GunDocument12 pagesBuild a 3D Printer Extruder Using a Hot Glue GunJuan Andrés Hdez SuárezNo ratings yet

- CHAP002 (Chapter 2 Information System Building Blocks)Document14 pagesCHAP002 (Chapter 2 Information System Building Blocks)Mohammed Atef0% (1)

- Local and Global TechnopreneursDocument25 pagesLocal and Global TechnopreneursClaire FloresNo ratings yet

- Cqi-8 LpaDocument32 pagesCqi-8 LpaMonica AvanuNo ratings yet

- Marc Mckinney: Current StudentDocument1 pageMarc Mckinney: Current Studentapi-534372004No ratings yet

- The List, Stack, and Queue Adts Abstract Data Type (Adt)Document17 pagesThe List, Stack, and Queue Adts Abstract Data Type (Adt)Jennelyn SusonNo ratings yet

- Coombs CaseDocument11 pagesCoombs CaseJessica Joyce PenalosaNo ratings yet

- ENGINE OVERHAUL 2.6 4cylDocument24 pagesENGINE OVERHAUL 2.6 4cylalbertoNo ratings yet

- Paf-Karachi Institute of Economics & Technology Spring - 2021Document3 pagesPaf-Karachi Institute of Economics & Technology Spring - 2021Basic Knowledge Basic KnowledgeNo ratings yet

- Integrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemDocument8 pagesIntegrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemMarko KojicNo ratings yet

- BIR - RMC.064-16.Tax Treatment Non-Stock Non ProfitDocument11 pagesBIR - RMC.064-16.Tax Treatment Non-Stock Non ProfitKTGNo ratings yet

- Human-Computer Interaction in Healthcare: A National PriorityDocument71 pagesHuman-Computer Interaction in Healthcare: A National PriorityTitus Schleyer100% (1)

- 3dpros 1.0 Documentation & Quick TourDocument18 pages3dpros 1.0 Documentation & Quick TourBambang SuhermantoNo ratings yet

- Click-O-Business: Krutik Bhavsar 10020116050Document26 pagesClick-O-Business: Krutik Bhavsar 10020116050Krutik BhavsarNo ratings yet

- CFPA E Guideline No 32 2014 F1Document38 pagesCFPA E Guideline No 32 2014 F1akramNo ratings yet

- Mining Gate2021Document7 pagesMining Gate2021level threeNo ratings yet

- Client Data Sector Wise BangaloreDocument264 pagesClient Data Sector Wise BangaloreOindrilaNo ratings yet

- MSC.NASTRAN Random Vibration ExampleDocument7 pagesMSC.NASTRAN Random Vibration ExampleManoj ManoharanNo ratings yet

- RC21 ServiceDocument32 pagesRC21 ServiceMuhammedNo ratings yet

- DB858DG90ESYDocument3 pagesDB858DG90ESYОлександр ЧугайNo ratings yet

- Boston Scientific Corporation v. Mabey, 10th Cir. (2011)Document8 pagesBoston Scientific Corporation v. Mabey, 10th Cir. (2011)Scribd Government DocsNo ratings yet

- Notes On Cash BudgetDocument26 pagesNotes On Cash BudgetJoshua P.No ratings yet

- SL 78r CK FRNC Lv2.0Document2 pagesSL 78r CK FRNC Lv2.0Huế Đà NẵngNo ratings yet