Professional Documents

Culture Documents

Task 1 - Email

Uploaded by

Ishrak Zaman0 ratings0% found this document useful (0 votes)

29 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views2 pagesTask 1 - Email

Uploaded by

Ishrak ZamanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

To: Anna

From: Ishrak

Subject: Potential M&A targets in Asia

Hello Anna,

Hope you are well. I have compiled a list of potential M&A targets for Mr. Carlos’s WorldWide Brewing’s

expansion in the Asia.

Below you will find an comprehensive idea of a few companies and their portfolios to decide for M&A for Mr.

Carlos:

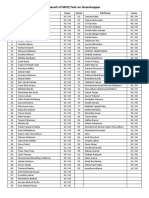

Company Description Relevance to WorldWide Recommendation

Brewing

HappyHour HappyHour Co. is the largest It has similar operations to Recommend

Co. player in Singapore and WorldWide Brewing across the

Malaysia, in the segments of same segments and is the

beer, spirits and non- leading player in Singapore and

alcoholic beverages. Its Malaysia, suggesting the

operations include potential for strategic benefits

manufacturing facilities, and synergies. It has solid

distribution and direct sales financial results and an

and it has demonstrated ownership structure that is

strong growth in EBITDA in owned by 3 families, rendering a

FY2020 which was up 20% potential acquisition relatively

pcp and amounted to simple and feasible. HappyHour

US$300mm. Co. would be appropriate to

share.

Spirit Bay is the #2 player in It has similar operations to Recommend

Spirit Bay Singapore and Malaysia and WorldWide Brewing across the

#1 in Indonesia, in the same segments and is the

segments of beer, spirits and leading player in Singapore,

non-alcoholic beverages. Its Indonesia, and Malaysia,

operations include suggesting the potential for

manufacturing facilities, strategic benefits and synergies.

distribution and direct sales It has solid financial results and

and it has demonstrated an ownership structure that is

strong growth in EBITDA in 60% owned by Global Sponsor,

FY2020 which was up 40% 40% employee owned,

pcp and amounted to rendering a potential acquisition

US$400mm. relatively simple and feasible.

Spirit Bay would be appropriate

to share.

Hipsters’ Ale is operating in It is operating profitably in many Not Recommend

Hipsters’ many countries like Asian countries, suggesting the

Ale Singapore, Malaysia, potential for strategic benefits

Indonesia, Japan, Korea, and synergies. It has solid

Cambodia in the segments of financial results but an

beer and spirits. Its ownership structure that is

operations include owned by 30 independent

manufacturing facilities, breweries, rendering the

distribution and direct sales acquisition relatively complex

and it has demonstrated and hard.

decent growth in EBITDA in

FY2020 which was up 15%

pcp and amounted to

US$200mm.

Brew Co. Brew Co. is the #1 alcohol Although it is the leading player Not Recommend

manufacturer in Malaysia in in Malaysia, its EBITDA declined

the segments of beer and in the past years and has an

spirits. Its operations include ownership structure that is

manufacturing facilities only mostly owned by institutional

and it has shown decline in shareholders in the stock

EBITDA in FY2020 by 5% pcp market, rendering a potential

and amounted to acquisition relatively complex. It

US$800mm. is operating only in Malaysia and

might not be the best option for

the M&A deal as the operating

locations is not diversified.

Bevy’s Bevy’s Direct is operating in It It is operating profitably in Recommend

Direct many countries like many Asian countries,

Singapore, Malaysia, suggesting the potential for

Indonesia, Japan, Korea, strategic benefits and synergies.

Cambodia, China, Australia, It has solid financial results and

New Zealand in the segments an ownership structure that is

of beer, spirits and non- owned by 1 family only,

alcoholic beverages. Its rendering a potential acquisition

operations include wholesale relatively simple and feasible.

distribution only and it has Bevy’s Direct would be

demonstrated strong growth appropriate to share.

in EBITDA in FY2020 which

was up 20% pcp and

amounted to US$3250mm.

Hope that helps and please let me know if you have any more queries on these companies. Have a great day!

Sincerely,

Ishrak Zaman

You might also like

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Task 1 - Email Template v2 WORLDWIDE BREWINGDocument2 pagesTask 1 - Email Template v2 WORLDWIDE BREWINGbilalzahid1969No ratings yet

- To: From: SubjectDocument3 pagesTo: From: SubjectHephzibah LeannaNo ratings yet

- Task 1 - Email Template v2 PDFDocument2 pagesTask 1 - Email Template v2 PDFtannushokeen66No ratings yet

- Task 1 - Email Model Answer v2Document2 pagesTask 1 - Email Model Answer v2Siddhant Aggarwal100% (1)

- Task 1Document2 pagesTask 1Aakash GuliaNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2PriyanshulNo ratings yet

- Happyhour Co. Recommend: To: From: SubjectDocument2 pagesHappyhour Co. Recommend: To: From: SubjectAyush ChandwaniNo ratings yet

- ProjectDocument2 pagesProjectYash YashNo ratings yet

- ProjectDocument2 pagesProjectYash YashNo ratings yet

- EmailDocument3 pagesEmailbhartisoni292No ratings yet

- Task 1 - Email Template v2 - To Anna From Muhammad Ahmed Subject Potential M&Amp A Targets For - StudocuDocument1 pageTask 1 - Email Template v2 - To Anna From Muhammad Ahmed Subject Potential M&Amp A Targets For - Studocugannusingh1112No ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2mohak guptaNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Study HardNo ratings yet

- Task 1Document4 pagesTask 1aNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2李式奇No ratings yet

- Task 1 - EmailDocument2 pagesTask 1 - EmailLouis P0% (1)

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Jatin SinghNo ratings yet

- JP Morgan IB TaskDocument2 pagesJP Morgan IB TaskDhanush JainNo ratings yet

- Task 1Document2 pagesTask 1blobNo ratings yet

- Task 1Document2 pagesTask 1Sire desireNo ratings yet

- Potential M&A Targets From WorldWide BrewingDocument2 pagesPotential M&A Targets From WorldWide BrewinggogunikhilNo ratings yet

- Task 1 - Email Template v2Document3 pagesTask 1 - Email Template v2dkaisabekovNo ratings yet

- To: From: SubjectDocument2 pagesTo: From: SubjectMaxime JeanNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2IshitaNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2AKANSHA100% (1)

- Task 1Document2 pagesTask 1Safiullah Tariq DogarNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Stuti MathurNo ratings yet

- Carlos Johnson: To: From: SubjectDocument2 pagesCarlos Johnson: To: From: SubjectsukeshNo ratings yet

- Email To AnnaDocument2 pagesEmail To AnnaShravan DeshmukhNo ratings yet

- Happy Hour Co.: Company Description Relevance RecommendationDocument2 pagesHappy Hour Co.: Company Description Relevance RecommendationMansi VermaNo ratings yet

- Task 1 M&A (Aman Upadhyay)Document2 pagesTask 1 M&A (Aman Upadhyay)Aman UpadhyayNo ratings yet

- Task 1 - DavinDocument3 pagesTask 1 - Davindavin nathanNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2paragjindal703No ratings yet

- Task 1 ForageDocument2 pagesTask 1 ForageAditya KatareNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2zf8dkk8fnzNo ratings yet

- JPMorgan 1Document2 pagesJPMorgan 1ajayrajachoosNo ratings yet

- Task 1 Forage JPDocument2 pagesTask 1 Forage JPrevanth tNo ratings yet

- Task 1 - Email Prepared by Nandhu PMDocument2 pagesTask 1 - Email Prepared by Nandhu PMNandhu PMNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Mamata PatraNo ratings yet

- To: From: SubjectDocument3 pagesTo: From: SubjectserisvsNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2aKSHAT sHARMANo ratings yet

- Task 1Document2 pagesTask 1Subhav GoyalNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2sasta jiNo ratings yet

- Task 1 - SolutionDocument3 pagesTask 1 - SolutionJoan PujolNo ratings yet

- To: From: Subject:: Spirit Bay RecommendDocument2 pagesTo: From: Subject:: Spirit Bay Recommendtony montanaNo ratings yet

- M&A TargetDocument2 pagesM&A Targetthomasenvrai2005No ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2ashirwad modiNo ratings yet

- M&ADocument2 pagesM&Akrishnavgupta74No ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Chin Ying SiawNo ratings yet

- Task 1 - CompleteDocument2 pagesTask 1 - Completeaakashgoyal0909No ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Amardeep TayadeNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Nikhil AnantNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Hitesh NaikNo ratings yet

- Task 1 Solution JP Morgan Investment Banking Virtual ExperienceDocument3 pagesTask 1 Solution JP Morgan Investment Banking Virtual ExperiencePiyush KumarNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2Sakin KhanNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2gvswetha1423No ratings yet

- Task 1 - Email TemplateDocument2 pagesTask 1 - Email TemplateSpamNo ratings yet

- Task 1 - Email JP MorganDocument2 pagesTask 1 - Email JP MorganWilliam100% (1)

- Ans BOT CH-7 Gymnosperms MCQ TESTDocument2 pagesAns BOT CH-7 Gymnosperms MCQ TESTIshrak ZamanNo ratings yet

- Chap 7 Botany Lecture 1Document6 pagesChap 7 Botany Lecture 1Ishrak ZamanNo ratings yet

- Task 2 - Process Letter Summary TemplateDocument1 pageTask 2 - Process Letter Summary TemplateIshrak ZamanNo ratings yet

- Harrison BergeronDocument7 pagesHarrison BergeronNedim Malicbegovic100% (1)

- Dirksen Civil RightsDocument5 pagesDirksen Civil RightsIshrak ZamanNo ratings yet

- Happy Hour Co - Forecasts - v2Document1 pageHappy Hour Co - Forecasts - v2Siddhant AggarwalNo ratings yet

- Of 20 Hours Per Week When School Is in Session. During Break Periods or When School Is Not in SessionDocument2 pagesOf 20 Hours Per Week When School Is in Session. During Break Periods or When School Is Not in SessionIshrak ZamanNo ratings yet

- Aydin Et Al (2016) PDFDocument10 pagesAydin Et Al (2016) PDFNur FajriyahNo ratings yet

- Task 2 - Company Overview Template v2Document2 pagesTask 2 - Company Overview Template v2Ishrak ZamanNo ratings yet

- Welq: Mwyz - (M RBKXJ Cökœ)Document2 pagesWelq: Mwyz - (M RBKXJ Cökœ)Ishrak ZamanNo ratings yet

- Early Decision AgreementDocument1 pageEarly Decision AgreementIshrak ZamanNo ratings yet

- Undergraduate Scholarship and Grant Awards Terms and ConditionsDocument1 pageUndergraduate Scholarship and Grant Awards Terms and ConditionsIshrak ZamanNo ratings yet

- MCQ Higher Math 1st Paper, Chapter 01Document9 pagesMCQ Higher Math 1st Paper, Chapter 01Ishrak ZamanNo ratings yet

- Early Decision AgreementDocument1 pageEarly Decision AgreementIshrak ZamanNo ratings yet

- Study Guide - UNESCO - International MUN Online Conference 51.0Document12 pagesStudy Guide - UNESCO - International MUN Online Conference 51.0Ishrak ZamanNo ratings yet

- Lecture - 11Document20 pagesLecture - 11Ishrak ZamanNo ratings yet

- Mark Sheet (MCQ On Grasshopper)Document1 pageMark Sheet (MCQ On Grasshopper)Ishrak ZamanNo ratings yet

- Z - 2.a Hydra (1) 2021Document10 pagesZ - 2.a Hydra (1) 2021Ishrak ZamanNo ratings yet

- BOT Ch-2 Cell Division - 2020Document16 pagesBOT Ch-2 Cell Division - 2020Ishrak ZamanNo ratings yet

- Online Quiz - 2021: Cantonment English School & CollegeDocument1 pageOnline Quiz - 2021: Cantonment English School & CollegeIshrak ZamanNo ratings yet

- Notes 210117 124918Document1 pageNotes 210117 124918Ishrak ZamanNo ratings yet

- Section 89 of CPC: Significance and Case LawsDocument10 pagesSection 89 of CPC: Significance and Case LawsPragna NachikethaNo ratings yet

- Gsrtc. 2 - 1 - 24Document1 pageGsrtc. 2 - 1 - 24Mitanshu BhavsarNo ratings yet

- Who Moved My CheeseDocument12 pagesWho Moved My CheeseTYAGI PROJECTSNo ratings yet

- 06-08 Civic Grid Charger 1 - 1Document4 pages06-08 Civic Grid Charger 1 - 1MilosNo ratings yet

- Ee Room VentilationDocument7 pagesEe Room VentilationNiong DavidNo ratings yet

- Test Bank For Project Management Achieving Competitive Advantage 5th Edition PintoDocument6 pagesTest Bank For Project Management Achieving Competitive Advantage 5th Edition PintoCarlosSnydercmtyn97% (36)

- Professional GoalsDocument2 pagesProfessional Goalsapi-530115287No ratings yet

- Introduction of Hris Chapter No.1: Tayyaba IqbalDocument16 pagesIntroduction of Hris Chapter No.1: Tayyaba IqbalmahnooorNo ratings yet

- Isolating Antagonistic BacteriaDocument12 pagesIsolating Antagonistic BacteriaDesy rianitaNo ratings yet

- The Modern HackDocument12 pagesThe Modern Hackbrunobboss100% (1)

- Veritas Databerg ReportDocument10 pagesVeritas Databerg Reportboulou750No ratings yet

- Apparent Density of Free-Flowing Metal Powders Using The Hall Flowmeter FunnelDocument4 pagesApparent Density of Free-Flowing Metal Powders Using The Hall Flowmeter Funnelİrem Şebnem SorucuNo ratings yet

- Chap 21 Machining FundamentalsDocument87 pagesChap 21 Machining FundamentalsLê Văn HòaNo ratings yet

- PSY290 Presentation 2Document3 pagesPSY290 Presentation 2kacaribuantonNo ratings yet

- Ruini - A Workplace Canteen Education Program To Promote Healthy Eating and Environmental Protection. Barilla's "Sì - Mediterraneo" ProjectDocument4 pagesRuini - A Workplace Canteen Education Program To Promote Healthy Eating and Environmental Protection. Barilla's "Sì - Mediterraneo" ProjectISSSTNetwork100% (1)

- Stud Bolt Coating - XYLAN - 10701Document3 pagesStud Bolt Coating - XYLAN - 10701scott100% (2)

- DXR Series Refrigerated Air Dryers: Operator'S Instruction ManualDocument48 pagesDXR Series Refrigerated Air Dryers: Operator'S Instruction ManualDavid BarrientosNo ratings yet

- Nec Sl1100 and Sv8100 Sip Trunk Configuration GuideDocument8 pagesNec Sl1100 and Sv8100 Sip Trunk Configuration GuidealcewebNo ratings yet

- RBS LogDocument1,351 pagesRBS Logsalman7467No ratings yet

- WAPU Kufqr PDFDocument2 pagesWAPU Kufqr PDFAri TanjungNo ratings yet

- What is Bluetooth? The complete guide to the wireless technology standardDocument4 pagesWhat is Bluetooth? The complete guide to the wireless technology standardArpit SrivastavaNo ratings yet

- Lasco v. UN Revolving Fund G.R. Nos. 109095-109107Document3 pagesLasco v. UN Revolving Fund G.R. Nos. 109095-109107shannonNo ratings yet

- 5-Cyanophthalide ProjDocument7 pages5-Cyanophthalide ProjdrkrishnasarmapathyNo ratings yet

- Ibert Concerto Tremolo Fingerings by Nestor Herszbaum PDFDocument2 pagesIbert Concerto Tremolo Fingerings by Nestor Herszbaum PDFAmedeo De SimoneNo ratings yet

- 0076 0265 - Thy Baby Food LicenceDocument2 pages0076 0265 - Thy Baby Food LicenceSreedharanPNNo ratings yet

- MOTION - Pltf's 1st Mot. Compel and App.Document76 pagesMOTION - Pltf's 1st Mot. Compel and App.JUANITANo ratings yet

- Competency MatrixDocument11 pagesCompetency MatrixSunil AroraNo ratings yet

- Dengue Fever PresentationDocument11 pagesDengue Fever Presentationhira khanNo ratings yet

- Role of Business IncubatorsDocument11 pagesRole of Business IncubatorsayingbaNo ratings yet

- DBMS Lecture NotesDocument120 pagesDBMS Lecture NoteshawltuNo ratings yet