Professional Documents

Culture Documents

Evaluative Activity Module 5 Finance

Uploaded by

ScribdTranslationsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evaluative Activity Module 5 Finance

Uploaded by

ScribdTranslationsCopyright:

Available Formats

POLYTECHNI

C

FROM COLOMBIA

POLYTECHNICIAN OF COLOMBIA

CONTINUOUS TRAINING

DIPLOMA IN FINANCE

Activity Format – Module 5

CODE: NOT APPLICABLE Week: 5 VERSION 1

Dear student: PAOLA ANDREA GUTIERREZ RAMIREZ

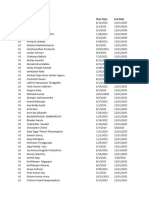

1. Amortization table

Suppose that you have recently decided to buy a motorcycle which has a cost of

$5,600,000, a financial institution provides you with a loan for the value of the

vehicle to pay it in 24 months at an interest rate of 0.90% per month and fixed

payment. of $260,484.21

Build the credit amortization table:

Rk

Month Debt ik (Interest) (Constant flow) Or

CK (Amortization) fixed fee

1 $ 5.600.000,00 $ 50.400,00 $ 210.084,21 $ 260.484,21

2 $ 5.389.915,79 $ 48.509,24 $ 211.974,97 $ 260.484,21

3 $ 5.177.940,82 $ 46.601,47 $ 213.882,74 $ 260.484,21

4 $ 4.964.058,07 $ 44.676,52 $ 215.807,69 $ 260.484,21

5 $ 4.748.250,38 $ 42.734,25 $ 217.749,96 $ 260.484,21

6 $ 4.530.500,43 $ 40.774,50 $ 219.709,71 $ 260.484,21

7 $ 4.310.790,72 $ 38.797,12 $ 221.687,10 $ 260.484,21

8 $ 4.089.103,62 $ 36.801,93 $ 223.682,28 $ 260.484,21

9 $ 3.865.421,34 $ 34.788,79 $ 225.695,42 $ 260.484,21

10 $ 3.639.725,92 $ 32.757,53 $ 227.726,68 $ 260.484,21

11 $ 3.411.999,24 $ 30.707,99 $ 229.776,22 $ 260.484,21

12 $ 3.182.223,02 $ 28.640,01 $ 231.844,20 $ 260.484,21

13 $ 2.950.378,82 $ 26.553,41 $ 233.930,80 $ 260.484,21

14 $ 2.716.448,02 $ 24.448,03 $ 236.036,18 $ 260.484,21

15 $ 2.480.411,84 $ 22.323,71 $ 238.160,51 $ 260.484,21

16 $ 2.242.251,33 $ 20.180,26 $ 240.303,95 $ 260.484,21

17 $ 2.001.947,38 $ 18.017,53 $ 242.466,69 $ 260.484,21

18 $ 1.759.480,70 $ 15.835,33 $ 244.648,89 $ 260.484,21

19 $ 1.514.831,81 $ 13.633,49 $ 246.850,73 $ 260.484,21

20 $ 1.267.981,08 $ 11.411,83 $ 249.072,38 $ 260.484,21

21 $ 1.018.908,70 $ 9.170,18 $ 251.314,03 $ 260.484,21

22 $ 767.594,67 $ 6.908,35 $ 253.575,86 $ 260.484,21

23 $ 514.018,81 $ 4.626,17 $ 255.858,04 $ 260.484,21

DIPLOMA IN BASIC ACCOUNTING

0 POLYTECHNIC

(' DE COLOMBIA ” sim Nmites educations

24|$ 258.160,77 |$ 2.323,45 |$ 258.160,77| $ 260.484,21

2. Financial indicators

The company A&G SAS presents the following financial information:

Current assets

Cash in hand 1,520,000

Cash in Banks 16,423,855

Accounts Receivable from Customers 8,469,000

Inventories 12,000,000

Total Current Assets $ 38,412,855

Current Liabilities

Financial obligations 10,621,000

Goods Suppliers 5,854,960

Taxes to pay 1,496,322

Other Accounts Payable 3,871,333

Total current liabilities $ 21,843,615

Based on the information provided by the Company A&G SAS: Calculate and

interpret the Liquidity Indicators:

Current active

• Current Ratio: = current ratio $38,412,855/ $21,843,615 = 1.758539

Current Assets-Inventory

• Acid test: =-------------- past _-------------- ($38,412,855-$12,000,000) /$21,843,615 = 1,209179

current _

• Net Working Capital: = Current Assets - Current Liabilities $38,412,855 - $21,843,615 = $16,569,240

Develop the activity in the following table:

No. INDICATOR RESULT INTERPRETATION

Reason This means that for every peso it owes, the company has

1,758539 1.758539 pesos to pay or support that debt.

Current:

1

Since we have a value greater than 1, the company has no

Acid test: 1,209179 problem meeting its short-term obligations.

DIPLOMA IN BASIC ACCOUNTING 2

POLYTECHNI

C

FROM COLOMBIA This means that the company has $16,569,240 pesos to

Net Working

$16,569,240 carry out its normal operations.

Capital:

3

Delivery conditions:

1. Timeliness of delivery is also taken into account in grading.

2. Develop the exercises proposed in the tables

3. Do not modify the tables (do not add or delete columns)

4. Save in PDF format with NAMES AND SURNAMES OF THE

STUDENT , upload only the results, according to the format for the

presentation of the activity

5. Attach the file to the link available on the virtual platform.

DIPLOMA IN BASIC ACCOUNTING 3

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Valuation AssignmentDocument20 pagesValuation AssignmentHw SolutionNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- BL SheetDocument3 pagesBL Sheetroselle oronganNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Strategic planning budget and financial projectionsDocument14 pagesStrategic planning budget and financial projectionsDamaris MoralesNo ratings yet

- Case Study #1: Bigger Isn't Always Better!Document4 pagesCase Study #1: Bigger Isn't Always Better!Marilou GabayaNo ratings yet

- Annual Income Statement and Financial Ratios ReportDocument6 pagesAnnual Income Statement and Financial Ratios ReportAnwar Ul HaqNo ratings yet

- Chapter 3 ProFormaDocument15 pagesChapter 3 ProFormaNancy LuciaNo ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- Proforma Financial Statements of Walt DisneyDocument44 pagesProforma Financial Statements of Walt DisneyArif.hossen 30No ratings yet

- Projections of BusinessDocument4 pagesProjections of BusinessJawwad JabbarNo ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- Solutions To Chapter 15 Questions - Managing Current AssetsDocument5 pagesSolutions To Chapter 15 Questions - Managing Current AssetsSyeda MiznaNo ratings yet

- Institución Formación Técnica ProfesionalDocument16 pagesInstitución Formación Técnica ProfesionalFRANXIS ALMEYDANo ratings yet

- Câ-Can Spa, Wellness and Organic Garden Project CostDocument35 pagesCâ-Can Spa, Wellness and Organic Garden Project CostMartin Quidta SevillaNo ratings yet

- Coffee Shop Financial PlanDocument27 pagesCoffee Shop Financial PlankkornchomNo ratings yet

- P&G Supply Chain Finance Example Table BreakdownDocument37 pagesP&G Supply Chain Finance Example Table BreakdownKunal Mehta100% (2)

- 3 Statement Financial Model: How To Build From Start To FinishDocument9 pages3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNo ratings yet

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Problem Case Financial Manager Chapter 1Document5 pagesProblem Case Financial Manager Chapter 1Sukindar Ari Shuki SantosoNo ratings yet

- M C R E ,: Inicase: Onch Epublic LectronicsDocument4 pagesM C R E ,: Inicase: Onch Epublic Lectronicsnara100% (3)

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- ანრი მაჭავარიანი ფინალურიDocument40 pagesანრი მაჭავარიანი ფინალურიAnri MachavarianiNo ratings yet

- MGFB10 CapitalBudgeting Chapter8 NotesDocument42 pagesMGFB10 CapitalBudgeting Chapter8 NotesnigaroNo ratings yet

- Lease Financing AssignmentDocument8 pagesLease Financing AssignmentAshraful IslamNo ratings yet

- TVM Practice Problems SolutionsDocument3 pagesTVM Practice Problems SolutionsEmirī PhoonNo ratings yet

- Annual Financial Statement ComparisonDocument6 pagesAnnual Financial Statement ComparisonHamza Farooq KoraiNo ratings yet

- Chapter 6 PDFDocument23 pagesChapter 6 PDFreyNo ratings yet

- Running Head: RESEARCH PAPER 1: Name Institutional Affiliation DateDocument5 pagesRunning Head: RESEARCH PAPER 1: Name Institutional Affiliation DateSana FarhanNo ratings yet

- Session 2c Accounting For LiabilitiesDocument16 pagesSession 2c Accounting For LiabilitiesFeku RamNo ratings yet

- Answer Keys - Financial Planning and GrowthDocument16 pagesAnswer Keys - Financial Planning and GrowthsanjitypingNo ratings yet

- Laquayas Research Paper - NetflixDocument18 pagesLaquayas Research Paper - Netflixapi-547930687No ratings yet

- RBSMI Achieves Over P1 Billion in Total Assets in 2021Document14 pagesRBSMI Achieves Over P1 Billion in Total Assets in 2021Vicxie Fae CupatanNo ratings yet

- IVD.-FINANCIAL-STATEMENTDocument4 pagesIVD.-FINANCIAL-STATEMENTDre AclonNo ratings yet

- PPP Report Public 210531-508Document9 pagesPPP Report Public 210531-508Luis CordeiroNo ratings yet

- PPP Key Ratio Analysis I Cba June 122019Document33 pagesPPP Key Ratio Analysis I Cba June 122019Kelvin Namaona NgondoNo ratings yet

- Year 2021 2022 2023 2024 2025 Opening Balance Projected Cash Flow StatementDocument1 pageYear 2021 2022 2023 2024 2025 Opening Balance Projected Cash Flow StatementLailanie NuñezNo ratings yet

- Ac Start UpDocument8 pagesAc Start UpUdayan KidderporeNo ratings yet

- Chapter 3 End of Chapter Solutions - EvensDocument4 pagesChapter 3 End of Chapter Solutions - EvensAna StitelyNo ratings yet

- Basic - Controller KPI DashboardDocument26 pagesBasic - Controller KPI Dashboardhitesh nandawaniNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Fabricycle FinancialsDocument3 pagesFabricycle FinancialsRahul AchaяyaNo ratings yet

- Case Study #3Document5 pagesCase Study #3Jenny OjoylanNo ratings yet

- Presentation 1Document7 pagesPresentation 1Avinash SalarpuriaNo ratings yet

- FINC 721 Project 2Document2 pagesFINC 721 Project 2Sameer BhattaraiNo ratings yet

- Patisserie Haya (PP) FinalDocument10 pagesPatisserie Haya (PP) FinalWolfManNo ratings yet

- Cash Flow Analysis of Sunset Boards, Inc. 2008-2009Document3 pagesCash Flow Analysis of Sunset Boards, Inc. 2008-2009phátNo ratings yet

- BSBFIM601 Manage FinancesDocument34 pagesBSBFIM601 Manage Financesneha0% (1)

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Bill Snow Financial Model 2004-03-09Document35 pagesBill Snow Financial Model 2004-03-09nsadnanNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Pickins Mining Case Analysis - NPV, IRR, PaybackDocument5 pagesPickins Mining Case Analysis - NPV, IRR, PaybackWarda AhsanNo ratings yet

- Project Report Ca SignDocument9 pagesProject Report Ca SignRavindra JondhaleNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Capital Budgeting Techniques AnalysisDocument5 pagesCapital Budgeting Techniques AnalysisChristopher KipsangNo ratings yet

- Final Exam - Financial Administration - Group N°11Document9 pagesFinal Exam - Financial Administration - Group N°11ScribdTranslationsNo ratings yet

- Concept Map T8.2Document2 pagesConcept Map T8.2ScribdTranslationsNo ratings yet

- Case 4 ASICS QuestionsDocument1 pageCase 4 ASICS QuestionsScribdTranslationsNo ratings yet

- DD124 Exam 2Document7 pagesDD124 Exam 2ScribdTranslationsNo ratings yet

- Network Layers ExplanationDocument3 pagesNetwork Layers ExplanationScribdTranslationsNo ratings yet

- Rpas Exam Syllabus SOLVED - WordDocument9 pagesRpas Exam Syllabus SOLVED - WordScribdTranslationsNo ratings yet

- Coca Cola Performance EvaluationDocument1 pageCoca Cola Performance EvaluationScribdTranslationsNo ratings yet

- EXCEL PracticeDocument10 pagesEXCEL PracticeScribdTranslationsNo ratings yet

- Case Study - Solution - Alternative FinancingDocument6 pagesCase Study - Solution - Alternative FinancingScribdTranslationsNo ratings yet

- M2 - TI - Skills For Oral and Written Communication PDFDocument5 pagesM2 - TI - Skills For Oral and Written Communication PDFScribdTranslationsNo ratings yet

- Risk Matrix Going On African Photo SafariDocument15 pagesRisk Matrix Going On African Photo SafariScribdTranslationsNo ratings yet

- PC3 Simulation Tools For Decision MakingDocument9 pagesPC3 Simulation Tools For Decision MakingScribdTranslationsNo ratings yet

- Exercises and ProblemsDocument65 pagesExercises and ProblemsScribdTranslationsNo ratings yet

- Bank Questions PC Virtual Unit 2Document13 pagesBank Questions PC Virtual Unit 2ScribdTranslationsNo ratings yet

- Furuno FMD ECDIS PDFDocument14 pagesFuruno FMD ECDIS PDFScribdTranslations100% (1)

- Final Work Caixabank CaseDocument7 pagesFinal Work Caixabank CaseScribdTranslationsNo ratings yet

- Final Questionnaire Module 2 CNDH Prevention of TortureDocument7 pagesFinal Questionnaire Module 2 CNDH Prevention of TortureScribdTranslationsNo ratings yet

- Administration Financière t2 UPNDocument10 pagesAdministration Financière t2 UPNScribdTranslationsNo ratings yet

- Solved T-Student Distribution ExercisesDocument4 pagesSolved T-Student Distribution ExercisesScribdTranslationsNo ratings yet

- SEQUENCE The Process of Construction of The Argentine National State (1853-1880) - 6th MODIFIEDDocument13 pagesSEQUENCE The Process of Construction of The Argentine National State (1853-1880) - 6th MODIFIEDScribdTranslationsNo ratings yet

- Final Work - Applied Statistics For Business.Document28 pagesFinal Work - Applied Statistics For Business.ScribdTranslationsNo ratings yet

- Activity Module 4 CNDH What Mechanisms Appropriate in Mexico According To Cases of Violation of Human RightsDocument6 pagesActivity Module 4 CNDH What Mechanisms Appropriate in Mexico According To Cases of Violation of Human RightsScribdTranslationsNo ratings yet

- TaskDocument2 pagesTaskScribdTranslationsNo ratings yet

- Final Questionnaire Module 1 CNDH Prevention of TortureDocument5 pagesFinal Questionnaire Module 1 CNDH Prevention of TortureScribdTranslationsNo ratings yet

- Valeria Vargas Activity6Document5 pagesValeria Vargas Activity6ScribdTranslationsNo ratings yet

- Legal Analysis of George OrwellsDocument10 pagesLegal Analysis of George OrwellsScribdTranslationsNo ratings yet

- Life Center - Worthy Are You - Forever PDFDocument1 pageLife Center - Worthy Are You - Forever PDFScribdTranslationsNo ratings yet

- Lease Agreement With Express Eviction and Future Search Clauses.Document4 pagesLease Agreement With Express Eviction and Future Search Clauses.ScribdTranslationsNo ratings yet

- Introduction - ISEB AccountingDocument18 pagesIntroduction - ISEB AccountingScribdTranslationsNo ratings yet

- Exercises 4 ProgramDocument5 pagesExercises 4 ProgramScribdTranslationsNo ratings yet

- Unicorn_Entry_Function_-_Component_Four_-_Unicorn_Entry_ModelDocument6 pagesUnicorn_Entry_Function_-_Component_Four_-_Unicorn_Entry_ModelbacreatheNo ratings yet

- Financial Service Powerpoint PresentationDocument9 pagesFinancial Service Powerpoint PresentationShujat AliNo ratings yet

- Data Rizmar Lezar DyaannasDocument15 pagesData Rizmar Lezar DyaannasTia BessieNo ratings yet

- Pitch Deck FinalDocument13 pagesPitch Deck FinalShivam GuptaNo ratings yet

- BSP M-2022-024 s2022 - Rural Bank Strengthening Program) PDFDocument5 pagesBSP M-2022-024 s2022 - Rural Bank Strengthening Program) PDFVictor GalangNo ratings yet

- Freddie Mac Scandal Report PDFDocument4 pagesFreddie Mac Scandal Report PDFaditikhasnisNo ratings yet

- Buying A House in The NetherlandsDocument24 pagesBuying A House in The NetherlandsABHIJIT MAHAJANNo ratings yet

- Principles of Marketing Global 17th Edition Kotler Solutions ManualDocument25 pagesPrinciples of Marketing Global 17th Edition Kotler Solutions ManualRandallLawrencegtkn100% (46)

- Du An 2 - EnglishDocument2 pagesDu An 2 - English6fxg774ggfNo ratings yet

- SONIA (Interest Rate)Document2 pagesSONIA (Interest Rate)timothy454No ratings yet

- Corporate Finance 11th Edition Ross Solutions Manual 1Document36 pagesCorporate Finance 11th Edition Ross Solutions Manual 1ashleecastillobtsrxeizqf100% (24)

- Chapter 7 Global Product PolicyDocument28 pagesChapter 7 Global Product PolicyMadihah MazhanNo ratings yet

- Active US ResourcesDocument12 pagesActive US ResourcesVarma PinnamarajuNo ratings yet

- Order Block Trading StrategiesDocument8 pagesOrder Block Trading StrategiesJunaid MasoodNo ratings yet

- Ross12e Chapter05 TBDocument19 pagesRoss12e Chapter05 TBHải YếnNo ratings yet

- Chapter One Assignment On ReceivablesDocument3 pagesChapter One Assignment On ReceivablesBee TadeleNo ratings yet

- Portfolio ManagementDocument26 pagesPortfolio ManagementNina CruzNo ratings yet

- Chapter 8 Unit 1 - UnlockedDocument21 pagesChapter 8 Unit 1 - UnlockedSanay ShahNo ratings yet

- The Only Technical Analysis Book You Will Ever Need (Brian Hale) (Z-Library)Document153 pagesThe Only Technical Analysis Book You Will Ever Need (Brian Hale) (Z-Library)Vijay Krishna Patra50% (2)

- Listening SectionDocument55 pagesListening SectionH. Tэлмэн100% (1)

- OlistDocument19 pagesOlistAnkush PawarNo ratings yet

- Assessment and EvaluationDocument9 pagesAssessment and EvaluationDhruv MalhotraNo ratings yet

- IMC Compilation 1Document45 pagesIMC Compilation 1Gaño, Alexander James R.No ratings yet

- Practice Questions & AnswersDocument10 pagesPractice Questions & AnswersKomal KothariNo ratings yet

- Tut 7 Without AnswerDocument7 pagesTut 7 Without AnswerNguyễn Thùy DươngNo ratings yet

- Towards A More Ethical Market: The Impact of ESG Rating On Corporate Financial PerformanceDocument17 pagesTowards A More Ethical Market: The Impact of ESG Rating On Corporate Financial PerformanceWihelmina DeaNo ratings yet

- Esg Sustainable Advantage 1Document20 pagesEsg Sustainable Advantage 1Jalagandeeswaran KalimuthuNo ratings yet

- CMA II 2016 Study Materials CMA Part 2 MDocument37 pagesCMA II 2016 Study Materials CMA Part 2 MJohn Xaver PerrielNo ratings yet

- Chapter 14: Working Capital ManagementDocument19 pagesChapter 14: Working Capital Management2221624No ratings yet

- Business ProposalDocument4 pagesBusiness Proposalzw8cvgxqhxNo ratings yet