Professional Documents

Culture Documents

1702-RT Annual Income Tax Return

1702-RT Annual Income Tax Return

Uploaded by

Jr Reyes PedidaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1702-RT Annual Income Tax Return

1702-RT Annual Income Tax Return

Uploaded by

Jr Reyes PedidaCopyright:

Available Formats

BIR Form No.

1702RTv2018 Page 1 of 1

BIR Form No.

1702-RT Annual Income Tax Return

Corporation, Partnership and Other Non-Individual

January 2018(ENCS)

Taxpayer Subject Only to REGULAR Income Tax Rate

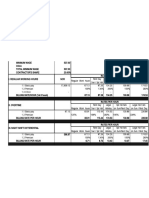

Page 3 1702-RT 01/18ENCS P3

Taxpayer Identification Number(TIN) Registered Name

448 673 718 00000 MERANO, SHANE NIÑONUEVO

Part VI - Schedules (DO NOT enter Centavos; 49 Centavos or Less drop down; 50 or more round up)

Schedule I - Ordinary Allowable Itemized Deductions (Attach additional sheet/s if necessary)

1 Amortization 0

2 Bad Debts 0

3 Charitable and Other Contributions 0

4 Depletion 0

5 Depreciation 0

6 Entertainment, Amusement and Recreation 0

7 Fringe Benefits 0

8 Interest 0

9 Losses 0

10 Pension Trusts 0

11 Rental 0

12 Research and Development 0

13 Salaries, Wages and Allowances 20,000,000

14 SSS, GSIS, Philhealth, HDMF and Other Contributions 8,000,000

15 Taxes and Licenses 12,000,000

16 Transportation and Travel 0

17 Others(Deductions Subject to Withholding Tax and Other Expenses) (Specify below; Add additional sheet(s), if necessary)

a Janitorial and Messengerial Services 0

b Professional Fees 20,000,000

c Security Services 0

d 0

e 0

f 0

g 0

h 0

i 0

18 Total Ordinary Allowable Itemized Deductions (Sum of Items 1 to 17i) 60,000,000

Schedule II - Special Allowable Itemized Deductions (Attach additional sheet/s, if necessary)

Description Legal Basis Amount

1 0

2 0

3 0

4 0

5 Total Special Allowable Itemized Deductions (Sum of Items 1 to 4) 0

file:///C:/Users/Asus/AppData/Local/Temp/%7B5B5801C3-2BF8-488D-B9A0-BABF65... 15/07/2023

You might also like

- Cebu Pac Official Receipt PDFDocument1 pageCebu Pac Official Receipt PDFjoeric1100% (1)

- Cash Payment Voucher in Ms ExcelDocument1 pageCash Payment Voucher in Ms ExcelShuhaime Ishak75% (4)

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- Policy PDFDocument6 pagesPolicy PDFUMESH KUMAR YadavNo ratings yet

- Page 3Document1 pagePage 3Carol MNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet

- For. Retefte Jasm Oct 2023Document1 pageFor. Retefte Jasm Oct 2023osoriomartinezd26No ratings yet

- Sample ITR Page 3Document1 pageSample ITR Page 3Eduardo BallesterNo ratings yet

- Laetitia Kalunga - Payslip February 2021Document1 pageLaetitia Kalunga - Payslip February 2021officialteeyaNo ratings yet

- Page 3 ItrDocument1 pagePage 3 ItrariannemungcalcpaNo ratings yet

- StocksDocument3 pagesStocksnagaraja h iNo ratings yet

- Load Auto EstimateDocument2 pagesLoad Auto EstimatedlovasibongileNo ratings yet

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Document2 pages1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNo ratings yet

- Ack 2020-21Document1 pageAck 2020-21mailinspectoryadavNo ratings yet

- PaySlip Dec 2021Document30 pagesPaySlip Dec 2021Pushparaj BNo ratings yet

- Crystal Report Viewer 2Document1 pageCrystal Report Viewer 2Rahul JadhavNo ratings yet

- Sarath 201-21 NewDocument1 pageSarath 201-21 Newbindu mathaiNo ratings yet

- PDF 912540700271220Document1 pagePDF 912540700271220Dhruv KNo ratings yet

- 2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - AcknowledgementDocument1 page2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - Acknowledgementarpan mukherjeeNo ratings yet

- Ack Abrpb9358a 2021-22 389091440190322Document1 pageAck Abrpb9358a 2021-22 389091440190322Ayush BhandarkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- 1655200445Document3 pages1655200445avdesh7777No ratings yet

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFDocument1 page2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJaydeep WayalNo ratings yet

- Itr Sag Pipes 21 22Document1 pageItr Sag Pipes 21 22prateek gangwaniNo ratings yet

- JulyDocument1 pageJulychiruNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- 2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementDocument1 page2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementAnshu SinghNo ratings yet

- Itr 21-22Document1 pageItr 21-22MoghAKaranNo ratings yet

- Ack Aacar1829b 2021-22 562508250310322Document1 pageAck Aacar1829b 2021-22 562508250310322Amma FoundationNo ratings yet

- Screenshot 2023-10-16 at 11.38.24 AMDocument1 pageScreenshot 2023-10-16 at 11.38.24 AMappurajan51No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun KumarNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedBHASKAR pNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJai GaneshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Neetu Singh - FY 2019 20 - Detailed ITRVDocument1 pageNeetu Singh - FY 2019 20 - Detailed ITRVRakesh PatilNo ratings yet

- 2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - AcknowledgementDocument1 page2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - Acknowledgementsekhar bandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKyra MehtaNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Itr-V Bogpp6352h 2020-21 767088050301120Document1 pageItr-V Bogpp6352h 2020-21 767088050301120DEVIL RDXNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBANDARU SRINUNo ratings yet

- Samvith - Financials - FY 2020-21Document6 pagesSamvith - Financials - FY 2020-21raghav shettyNo ratings yet

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- 2020-21 ItDocument95 pages2020-21 Itsriharidhana.financialservicesNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusameer bakshiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNavis AntonyNo ratings yet

- 2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementDocument1 page2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementGautam MNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- MURALIDHARAN PILLAI - 10-Jan-2021 - 193247100Document1 pageMURALIDHARAN PILLAI - 10-Jan-2021 - 193247100raghav shettyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSaurabh GholapNo ratings yet

- Confidential PayslipDocument1 pageConfidential PayslipNiteesh KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruYogesh SainiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruChinmay BhattNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Meralco Bill 470322010101 04142023Document2 pagesMeralco Bill 470322010101 04142023Ric Dela CruzNo ratings yet

- The Knot Wedding Planning SpreadsheetDocument46 pagesThe Knot Wedding Planning SpreadsheetRic Dela CruzNo ratings yet

- Financial Requirements - V1 Ver.1Document3 pagesFinancial Requirements - V1 Ver.1Ric Dela CruzNo ratings yet

- PayrollDocument553 pagesPayrollRic Dela CruzNo ratings yet

- Uid 10052022Document11 pagesUid 10052022Ric Dela CruzNo ratings yet

- Template SummaryDocument1 pageTemplate SummaryRic Dela CruzNo ratings yet

- Legal LogicDocument7 pagesLegal LogicRic Dela CruzNo ratings yet

- Legal Ethic1Document12 pagesLegal Ethic1Ric Dela CruzNo ratings yet

- Film Viewing IIDocument7 pagesFilm Viewing IIRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Bulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLDocument8 pagesBulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLRic Dela Cruz100% (1)

- Legal Writing TSN With Direct and CrossDocument12 pagesLegal Writing TSN With Direct and CrossRic Dela Cruz100% (1)

- College of Law: Bulacan State UniversityDocument2 pagesCollege of Law: Bulacan State UniversityRic Dela CruzNo ratings yet

- Memorandum For The AccusedDocument6 pagesMemorandum For The AccusedRic Dela CruzNo ratings yet

- p1 p446 Legal Ethics PinedaDocument446 pagesp1 p446 Legal Ethics PinedaRic Dela CruzNo ratings yet

- Annual FactorDocument1 pageAnnual FactorRic Dela CruzNo ratings yet

- Alex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Document11 pagesAlex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Ric Dela CruzNo ratings yet

- Ricardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityDocument2 pagesRicardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Judicial Affidavit of Paul David C. ZaldivarDocument6 pagesJudicial Affidavit of Paul David C. ZaldivarRic Dela CruzNo ratings yet

- Alphalist Sched 1Document29 pagesAlphalist Sched 1Ric Dela CruzNo ratings yet

- Nature: Petition For Review On Certiorari of A Judgment of The CADocument10 pagesNature: Petition For Review On Certiorari of A Judgment of The CARic Dela CruzNo ratings yet

- Alpha ListDocument8 pagesAlpha ListRic Dela CruzNo ratings yet

- Front Office TerminologyDocument7 pagesFront Office TerminologyPurushothaman RamachandaranNo ratings yet

- ID Strategi Pengembangan Sistem Jaringan TRDocument20 pagesID Strategi Pengembangan Sistem Jaringan TRAnndy GaeNo ratings yet

- Thialand TripDocument5 pagesThialand TripravindracaNo ratings yet

- Magellan Manufacturing VDocument2 pagesMagellan Manufacturing VEdward Kenneth KungNo ratings yet

- 12 CONFUCIUS SY 2O23 For Insurance GPA TemplateDocument9 pages12 CONFUCIUS SY 2O23 For Insurance GPA TemplateIris Kayte Huesca EvicnerNo ratings yet

- PIF Bursary Pledge FormDocument2 pagesPIF Bursary Pledge Formbianca_brebnorNo ratings yet

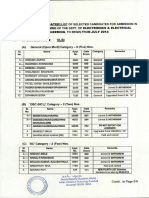

- Fourth & Final (Updated) List Mtech Electronics & Electrical Engineering, JULY 2014Document9 pagesFourth & Final (Updated) List Mtech Electronics & Electrical Engineering, JULY 2014S SharmaNo ratings yet

- 16,380 38,520 Br. 4, 810 and No. 2036 For BR 5000: Deduct 9810 FRM BBDocument2 pages16,380 38,520 Br. 4, 810 and No. 2036 For BR 5000: Deduct 9810 FRM BBBeamlak WegayehuNo ratings yet

- PNB 677 19-25Document3 pagesPNB 677 19-25bilal lekhaNo ratings yet

- Tally Erp 9 It AssignmentDocument8 pagesTally Erp 9 It AssignmentSanjay Kumar0% (1)

- Material ManagementDocument59 pagesMaterial Managementkenjisnack100% (1)

- March Payslip 2023.pdf - 1Document1 pageMarch Payslip 2023.pdf - 1Arbaz KhanNo ratings yet

- Types of Tax CollectionDocument2 pagesTypes of Tax CollectionNahid Hussain AdriNo ratings yet

- Sales in Transit Meaning, Procedure, Case Laws & ProvisionsDocument15 pagesSales in Transit Meaning, Procedure, Case Laws & ProvisionsChetanNo ratings yet

- Ax Ujjivn1707300775682Document38 pagesAx Ujjivn1707300775682salomiv98No ratings yet

- 2023 06 11 18 02 55 Statement - 1699273975024Document9 pages2023 06 11 18 02 55 Statement - 1699273975024Anandhu SNo ratings yet

- Invoices 22feb2022Document21 pagesInvoices 22feb2022Merliza JusayanNo ratings yet

- Date Narration Chq/Ref No Withdrawal (DR) Balance Deposit (CR)Document5 pagesDate Narration Chq/Ref No Withdrawal (DR) Balance Deposit (CR)Akhilesh JhaNo ratings yet

- Emulsion Rate 1APR16 PDFDocument2 pagesEmulsion Rate 1APR16 PDFRama Raju Gottumukkala0% (1)

- Retail Stores PuneDocument22 pagesRetail Stores Punejahangir nadafNo ratings yet

- 603 TimetableDocument8 pages603 Timetablegiudittaa_No ratings yet

- Social ScienceDocument4 pagesSocial Sciencesthandwa98mailNo ratings yet

- Banking Fees and Charges: Section A Rekening Giro 2Document9 pagesBanking Fees and Charges: Section A Rekening Giro 2Baram MadiramNo ratings yet

- Third Party Logistics / Fourth Party Logistics: Presented byDocument52 pagesThird Party Logistics / Fourth Party Logistics: Presented byABRAR AHMEDNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Sg-Sin-Esc: 018982 SINGAPORE SingaporeDocument3 pagesSg-Sin-Esc: 018982 SINGAPORE SingaporeRIO THRIVENI JAMBINo ratings yet

- Shipping Intelligence 26.novDocument20 pagesShipping Intelligence 26.novleejingsongNo ratings yet