Professional Documents

Culture Documents

Online Payment Fraud Detection

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Online Payment Fraud Detection

Copyright:

Available Formats

Volume 8, Issue 10, October – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Online Payment Fraud Detection

1 2

NagaBabu Pachhala, Assistant Professor Mallipudi Devi Siva Sai, Palaparthi Prudhvi, Gollapudi M

Department of Information Technology Naga Venkata Sai Gopi , Indla Ganeswara Naga Sai Ram,

Vasireddy Venkatadri Institute of Technology, Guntur Mandadi Ram Sandeep

Department of Information Technology

Vasireddy Venkatadri Institute of Technology, Guntur

Abstract:- The rise of the internet and e-commerce notion of mathematical learning. Since a few days ago, the

appears to entail the usage of online payment Random Forest Classifier has been employed in commercial

transactions. The increased usage of online payments is applications including credit rating analysis, bankruptcy

leading to a rise in fraud. However, as the number of prediction, and time series prediction and classification.

online transactions increases, so does the number of fraud Random Forest Classifier is used here to estimate the data for

instances. Fraud detection is an important component of fraud detection.

online payment systems since it serves to protect both

customers and merchants from financial damages. In this II. LITERATURE SURVEY

project, we propose a fraud detection system for online

payments that uses machine learning techniques to The Online Transaction Fraud Detection System has

identify and prevent fraudulent transactions. Using been the subject of several studies. This study is conducted

machine learning algorithms, we can find unique data before beginning the project in order to comprehend the

patterns or uncommon data patterns that will be useful in numerous approaches that have been employed in the past.

detecting any fraudulent transactions. The Random The advantages and disadvantages of the current system were

Forest Classifier will be utilized to get the best results. highlighted by this study.

Our approach strives to improve fraud detection

accuracy while reducing the amount of false positives, These consequences have been fueled by the increased

resulting in a more efficient and effective method for complexity of fraud efforts and the expanding variety of

identifying and combating fraud. attack routes [1]. We focus on online and mobile price

channels as well as identity theft fraud (i.e., taking a person's

Keywords:- Fraud Detection, Machine Learning, Random personal information to commit fraud) (Amiri and Hekmat

Forest Algorithm, SVM, Classification, Data Pre- 2021). The objective is to identify external scammers who

Processing, Prediction. want to trigger invoices for their hobbies. Fraudsters cannot

be identified based on the account access technique since

I. INTRODUCTION they get access to the price systems as if they were the

proprietors of the bills. However, the fraudster behaves

Online payments have become a popular means of differently during a payment transaction than the account

payment. Every second, thousands of deals are completed on owner, and/or the price has unusual characteristics, such as

the internet trading platform. Because of the prevalence of an oddly high charge amount or a switch to an account in a

network transactions, certain criminals can perpetrate crimes. jurisdiction that doesn't match the buyer's lifestyle context

Personal property is vulnerable to theft in a complex network and payment behavior. On the basis of this supposition,

environment, which not only affects consumer interests but algorithms may detect behavioral irregularities during

also jeopardizes the network economy's healthy growth. payment transactions.

In recent past, security has been taken into serious [2] In the master card fraud and detection tactics

account as a crucial concern. Any form of approach may be advised with the assistance of the notion, fraud is one of the

used to find frauds in an online transaction. A lot of banks most moral challenges in the master card sector. It aims to

have increased their security measures as a result of the large identify the many types of unique credit card fraud and,

credit card scams. All systems must get proper and secure secondly, to look at the exchange techniques utilized in fraud

authentication. detection. The secondary goal is to present, examine, and

analyze recently reported consequences on the identification

The Random Forest Classifier may be used to tackle of master card fraud. In their essay, they define commonly

classification issues in noisy and complicated environments. used terms for master card fraud and emphasize significant

The Random Forest Classifier was crucial in the facts and numbers about the incident. Depending on the type

generalization of performance in a variety of machine of fraud that banks encounter, different actions are also

learning issues, including face identification, web page provided and put into action. Implementation of a suspicious

categorization, and handwriting digital recognition. In scorecard on a current information set and its evaluation are

applications using Random Forest Classifiers, overfitting is often done as a subsequent step.

significantly less of an issue. The minimum problem and

curse of dimensionality seldom appears in Random Forest

Classifier. The Random Forest Classifier is based on the

IJISRT23OCT1251 www.ijisrt.com 1191

Volume 8, Issue 10, October – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[3] Even after taking a number of efforts to avoid fraud, A. Data collection:

con artists continue to look for fresh ways and methods to The act of obtaining, acquiring, and combining the data

defraud people. As a result, we would need a strong fraud that will be used to develop, test, and verify a machine

detection system to thwart these scams, one that not only learning model is known as data collection in machine

finds the fraud but also finds it accurately and before it learning. The fundamental phase in the machine learning

occurs. Additionally, we would like our systems to pick up pipeline is data collection for training the ML model. The

lessons from earlier frauds and be able to modify themselves accuracy of the predictions provided by machine learning

to deal with brand-new fraud techniques in the future. (ML) systems is only as good as the training data.

[4] Risk assessment models or qualitative models for B. Data processing:

assessing fraud risk are commonly mentioned in the literature Data processing in machine learning refers to the many

on fraud risk models. To our knowledge, no quantitative processes and transformations carried out on data to make it

solution to fraud risk management incorporates the statistical appropriate for analysis and model training. Cleaning,

impact of the fraud detection process into risk modeling. preprocessing, and preparing the data for use in machine

When we address procedural, legal, and organizational risk learning algorithms requires a number of procedures. The

components, we quote the relevant literature. Montague's usefulness and performance of machine learning models can

2010 book focuses on preventing online payment fraud, be significantly impacted by the quality of data processing.

although it skips over risk management and machine Before it can be used to develop models, the imported dataset

learning. has to be cleaned.

[5] In recent years, people have been increasingly C. Analyzing Data and Visualization:

concerned about security. There are various methods used to Data analysis and visualization are iterative processes

identify fraud in an online transaction. Many banks have in machine learning, frequently requiring you to return and

improved their security mechanisms as a result of credit card improve your knowledge of the data as you unearth new

theft. All systems must be equipped with secure insights. Effective visualization and analysis aid in improved

authentication techniques. As soon as possible, fraud must be model selection, feature engineering, and the dissemination

discovered. Therefore, fast security and authentication are of findings to non-technical stakeholders. To ensure openness

required for system transactions. and confidence in the model's predictions, it is a crucial

phase in the machine learning workflow.

III. METHODOLOGY

D. Model construction:

It entails the creation and application of prediction

models to spot and stop fraudulent activity in real-time or

almost real-time during online financial transactions. This is

a crucial part of contemporary payment systems where

fraudulent transactions are automatically detected and

handled using machine learning techniques.

E. Model Training and Testing:

A subset of the dataset called training data is used to

train the machine learning model to identify patterns and

make predictions. It is made up of input characteristics and

the labels or goal values that correspond to the output

features. Test data is a different subset of the dataset that is

used to gauge the model's effectiveness and determine its

capacity to make predictions on brand-new, unforeseen data.

F. Application Development:

The process of creating software systems or

applications that use machine learning models to address

particular problems in the real world is known in the field of

machine learning as "application building." These apps use

the predictive power of machine learning models to make

decisions, recommend actions, or automate operations.

G. Predicting Output:

Predicting output is the process of utilizing a trained

model to create predictions or forecasts based on input data.

These predictions, which are basically the expected outcomes

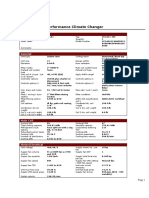

Fig 1 METHODOLOGY or answers produced by the model, might take a variety of

IJISRT23OCT1251 www.ijisrt.com 1192

Volume 8, Issue 10, October – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

shapes depending on the type of problem you're attempting to B. Read the dataset:

address. Our dataset format might be in .csv, excel files, .txt,

.json, etc. We can read the dataset with the help of pandas.

IV. ARCHITECTURE

Fig 4 Reading Data set

C. Data preprocessing:

The df.isnull() method is used to verify that no values

Fig 2 Random Forest Classifer are present. We employ the sum () function to add up those

null values. Two null values were discovered in our dataset,

The purpose of this project report is to present the we discovered. We thus start by investigating the data.

design, implementation, and evaluation of an online payment

fraud detection system using machine learning. The main D. Using A Heat Map To Check The Correlation

objectives of this project are: I'm using a heat map to check the correlation in this

To analyze and understand the various types of fraud that instance. Using different color combinations, it displays the

occur in online payment systems. data as 2-D colored maps. Instead of numbers, it will be

To propose and design a machine learning-based fraud plotted on both axes to describe the relationship variables.

detection system that can accurately identify and prevent

fraudulent transactions.

To implement the proposed system and evaluate its

performance using real-world data

To find the accuracy we can use the Random Forest

Classifier Algorithm(99.6%)

V. SYSTEM IMPLEMENTATION

A. Importing the libraries:

Import the necessary libraries as shown in the image.

Fig 5 Heat map

E. Feature selection:

Using a variety of machine learning algorithms,

including Random Forest, KNN, Decision Tree, etc., I have

discovered a number of metrics in this case. For the testing

dataset, we are receiving the random forest model's best

accuracy here.

F. Distribution Plots Are Now Plotted To Examine The

Distribution In Numerical Data:

Fig 3 Importing modules and libraries

Plotting the displot requires the usage of the

seaborn.displot() method. The displot returns the plot 12 with

the density distribution and accepts the univariate distribution

of the data variable as an input. I used distribution(displot) on

the 'amount' column in this case.

IJISRT23OCT1251 www.ijisrt.com 1193

Volume 8, Issue 10, October – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

VII. LIMITATIONS

There is little doubt that the following five restrictions

apply to machine learning-based efforts to identify online

fraud:

A. Imbalanced Data

Sets showing a mismatch between legitimate and

fraudulent transactions may provide problems. As a result, it

may be challenging to successfully detect fraud since models

may become biased in favor of the dominant class.

Fig 6 Distribution B. Adaptive Fraud Techniques

Static machine learning algorithms find it challenging to

G. Converting to .pkl file: keep up with fraudsters' rapidly changing and developing

Now we need to convert the file to pickle file and save techniques. New fraud patterns that the models haven't been

the model as shown below. taught to recognize may start to appear.

C. Data Quality

It is essential that the training data be of a high standard.

A model's predictions may be inaccurate if there are gaps in

Fig 7 converting to .pkl file the data or if it contains errors. Clear up the trash you made.

H. APPLICATION BUILDING: D. Privacy Concerns

Building HTML and CSS pages Online fraud detection frequently entails the use of

Build python code sensitive client data. Ensuring data privacy and compliance

with rules such as GDPR can be difficult to achieve when

VI. PREREQUISITES adopting machine learning systems.

Several requirements must be taken into account in E. False Positives

order to create an efficient machine learning system for Overly active fraud detection might result in a large

detecting online payment fraud. These requirements cover number of false positives, which can annoy legitimate users

data, technology, subject-matter expertise, and regulatory and negatively impair the user experience. Balancing fraud

considerations. These are the essential requirements: detection with a low false positive rate is a difficult

Access to a large database of earlier internet payments, challenge.

containing both honest and dishonest cas.es. The

information must be accurate, well-organized, and It is critical to be aware of these limitations and to

representative of actual situations. continually modify and enhance machine learning models

Machine learning models must be trained and evaluated and tactics for online fraud detection.

using data that has been clearly labelled and in which

each transaction is classified as either legal or fraudulent. VIII. FUTURE SCOPE

Strict adherence to payment card industry standards (PCI

DSS) and data protection laws (such as GDPR) when The future of online payment fraud detection using

machine learning seems promising, with various developing

handling sensitive payment information. Implement tight

access controls and data encryption. trends and advances on the horizon. Here are some important

areas of future opportunity for online payment fraud

proficiency in a programming language, such as Python

detection:

or R, for the creation and implementation of models for

data analysis

A. Advanced Machine Learning Models:

Considering that fraudulent transactions are often rare Continued development of increasingly advanced

compared to legitimate ones, there are strategies for machine learning models, including deep learning and

dealing with the class imbalance in the dataset. reinforcement learning, to increase the accuracy and

flexibility of fraud detection systems.

B. Explainable AI (XAI):

Addressing the interpretability of machine learning

models to make them more transparent and intelligible,

enabling for better decision-making and regulatory

compliance.

IJISRT23OCT1251 www.ijisrt.com 1194

Volume 8, Issue 10, October – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

C. Defense Against Adversarial Machine Learning: [3]. Zhang Z, Zhou X, Zhang X, et al: A Convolutional

Defending against adversarial assaults on machine Neural Network-Based Model for Detecting Online

learning models used in fraud detection. Transaction Fraud. Security and Communication

Networks, 10(2), pp. 1-9, 2018.

D. Model Updating on a Constant Basis: [4]. Jain V: Perspective study of telecommunication fraud

Implementing systems capable of constantly updating detection utilizing data stream analytics and neural

and adapting machine learning models when new fraud network classification-based data mining. International

tendencies arise. Journal of Information Technology, 9(3):303-310, 2017.

[5]. Hendrycks D, Gimpel K: Gaussian Error Linear Units

IX. RESULT (GELUs), 2016.

[6]. Glorot X, Bordes A, Bengio Y: Deep Sparse Rectifier

Machine Learning was used to build Online Payment Neural Networks. Proceedings of the 14th International

Fraud Detection. Because the fraud (categorical values) is the Conference on Artificial Intelligence and Statistics

target or dependent variable, this is a classification problem. (AISTATS), 2011, 15:315-323.

The goal of online payment fraud is to divide the available [7]. Lin T Y, Goyal P, Girshick R, et al: Focal Loss for

supply of usable online payments into groups that differ in Dense Object Detection. IEEE Transactions on Pattern

quality. Analysis and Machine Intelligence, 42:2999-3007,

2017.

To launch the application, follow these steps: [8]. Prusti D, Rath S K: Fraudulent Transaction Detection in

• From the start menu, launch the anaconda prompt. Credit Cards Using Ensemble Machine Learning

• Open the folder containing your Python script. Techniques. The tenth International Conference on

• Now enter the command "python app.py" Computing, Communication, and Networking

• Go to the localhost to view your web page. Technologies (ICCCNT) will be held in 2019. IEEE,

• Fill in the blanks, then click the submit button to view the 2019.

outcome/prediction. [9]. Shimin Lei et al. : An Xgboost-based system for

financial fraud detection. E3S Web of Conferences,

2020, 214(2).

X. CONCLUSION [10]. Bergstra J, et al. : Hyperopt: A Python Library for

Optimizing the Hyperparameters of Machine Learning

This Project describes the creation of a machine Algorithms. Computational Science & Discovery, 8(1),

learning model for detecting online fraud transactions using 2015.

the Random Forest technique. The fundamental function of

this model is to categorize the supplied dataset transactions as

fraudulent or authentic. With the supplied dataset, this model

produced a superior AUC score, accuracy score, and efficient

output. The dataset is preprocessed together with the feature

choices, and the data is then classified into several variables

before being delivered to the Random Forest method model.

The ultimate result is to determine if the transactions are

genuine or fraudulent. This model may then be tested and

trained with greater data volumes in the future to provide

more precise and accurate findings.

We may argue that Random Forest is a superior tool for

detecting fraud than any other algorithm. Random forest has

99% accuracy in Python programming and 93% accuracy in

R programming. As a result, it is regarded as the best

approach.

REFERENCES

[1]. E. Kurshan and H. Shen: Graph Computing for

Financial Crime and Fraud Detection: Trends,

Challenges, and Outlook. 2020 Second International

Conference on Transdisciplinary AI (TransAI), 2020.

[2]. Dheepa V, Dhanapal R: An examination of credit card

fraud detection systems. International journal of

contemporary developments in engineering, 2009,

2(3):126.

IJISRT23OCT1251 www.ijisrt.com 1195

You might also like

- Anti fraud for Cheques and use of AI: Next gen realtime anti fraud 4 cheque processingFrom EverandAnti fraud for Cheques and use of AI: Next gen realtime anti fraud 4 cheque processingNo ratings yet

- Security Testing Handbook for Banking ApplicationsFrom EverandSecurity Testing Handbook for Banking ApplicationsRating: 5 out of 5 stars5/5 (1)

- Use Machine Learning Techniques To Identify Credit Cards Fraud DetectionDocument5 pagesUse Machine Learning Techniques To Identify Credit Cards Fraud DetectionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Credit Card Fraud Detection1Document5 pagesCredit Card Fraud Detection1Yachna DharwalNo ratings yet

- UPI Fraud DetectionDocument5 pagesUPI Fraud DetectionpachoryNo ratings yet

- Credit Cards Fraud Detection System SynopsisDocument18 pagesCredit Cards Fraud Detection System SynopsisGaurav Chouksey100% (1)

- Irjet V6i3710Document5 pagesIrjet V6i3710Bhagyashri KhaireNo ratings yet

- Synopsis ON "Credit Card Fraud Detection System"Document14 pagesSynopsis ON "Credit Card Fraud Detection System"Roshan Prasad100% (1)

- Online Transaction Fraud Detection System Based On Machine LearningDocument4 pagesOnline Transaction Fraud Detection System Based On Machine LearningtechieNo ratings yet

- Credit Card Fraud DetectionDocument7 pagesCredit Card Fraud DetectionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Project ZeroDocument15 pagesProject Zerosandravinod033No ratings yet

- MITS6011 - ResearchReportDocument15 pagesMITS6011 - ResearchReportsugunaNo ratings yet

- Credit Card Fraud Detection Using Machine Learning PDFDocument6 pagesCredit Card Fraud Detection Using Machine Learning PDFKritik BansalNo ratings yet

- Credit Card Fraud Detection Using Machine LearningDocument6 pagesCredit Card Fraud Detection Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fraud Detection in Credit Cards System Using ML With AWS Stage MakerDocument6 pagesFraud Detection in Credit Cards System Using ML With AWS Stage MakerIJRASETPublicationsNo ratings yet

- Malini 2017Document4 pagesMalini 2017poojithaaalamNo ratings yet

- Srinivasulu JournalDocument5 pagesSrinivasulu JournalLalitha PonnamNo ratings yet

- Analysis of Credit Card Fraud Detection Using Machine Learning Models On Balanced and Imbalanced DatasetsDocument7 pagesAnalysis of Credit Card Fraud Detection Using Machine Learning Models On Balanced and Imbalanced DatasetsWARSE Journals100% (1)

- Implementation of Credit Card Fraud Detection Using Support Vector MachineDocument13 pagesImplementation of Credit Card Fraud Detection Using Support Vector Machinemendelchristian144No ratings yet

- MPML10 2022 FRDocument24 pagesMPML10 2022 FRMaliha MirzaNo ratings yet

- 01 - Minastireanu, MesnitaDocument12 pages01 - Minastireanu, Mesnitaravi prakashNo ratings yet

- Credit Card Fraud Detection by Data Analytics Using Python: Malay Joshi, Yudhishthir Bhunwal and Dr. Smita AgarwalDocument4 pagesCredit Card Fraud Detection by Data Analytics Using Python: Malay Joshi, Yudhishthir Bhunwal and Dr. Smita AgarwalFinger igNo ratings yet

- SSRN Id4135514 PDFDocument6 pagesSSRN Id4135514 PDFInder Kumar SinghNo ratings yet

- Performance Evaluation of Machine Learning Algorithms For Credit Card Fraud DetectionDocument7 pagesPerformance Evaluation of Machine Learning Algorithms For Credit Card Fraud DetectionGiuseppeLegrottaglieNo ratings yet

- Real-Time Credit Card Fraud Detection Using Machine LearningDocument6 pagesReal-Time Credit Card Fraud Detection Using Machine LearningFor ytNo ratings yet

- Doi: 10.5281/zenodo.7922883: ISSN: 1004-9037Document18 pagesDoi: 10.5281/zenodo.7922883: ISSN: 1004-9037Chaitanya KapilaNo ratings yet

- Autonomous Credit Card Fraud Detection Using Machine Learning ApproachDocument23 pagesAutonomous Credit Card Fraud Detection Using Machine Learning Approachspectra testNo ratings yet

- Menakshi SatwinderDocument10 pagesMenakshi SatwinderZubia FNo ratings yet

- 10.1007@s41870 020 00430 y PDFDocument9 pages10.1007@s41870 020 00430 y PDFEdi SuwandiNo ratings yet

- AI Based Credit Card Fraud Detection Using Machine Learning TechniqueDocument10 pagesAI Based Credit Card Fraud Detection Using Machine Learning TechniqueWeb ResearchNo ratings yet

- Machine Learning Approaches For Credit Card Fraud Detection: International Journal of Engineering & Technology May 2018Document5 pagesMachine Learning Approaches For Credit Card Fraud Detection: International Journal of Engineering & Technology May 2018Ioana MateutNo ratings yet

- Synopsis Major Project CreditCardFraudDetectionDocument16 pagesSynopsis Major Project CreditCardFraudDetectionRohit RanjanNo ratings yet

- Easychair Preprint: Harshita Anand, Richa Gautam and Raman ChaudhryDocument8 pagesEasychair Preprint: Harshita Anand, Richa Gautam and Raman ChaudhryENG20CS0271Qudsia Samar.BNo ratings yet

- Credit Card Fraud DetectionDocument4 pagesCredit Card Fraud DetectionEditor IJTSRDNo ratings yet

- Credit Card Fraud Detection Using Machine LearningDocument5 pagesCredit Card Fraud Detection Using Machine LearningAhmad Warrich100% (1)

- An Artificial Intelligence AppDocument16 pagesAn Artificial Intelligence AppWassie GetahunNo ratings yet

- Performance Evaluation of Machine LearningDocument5 pagesPerformance Evaluation of Machine Learningjaskeerat singhNo ratings yet

- CSEIT1831366Document11 pagesCSEIT1831366HamzaNo ratings yet

- Deep Learning Methods For Credit Card Fraud DetectDocument8 pagesDeep Learning Methods For Credit Card Fraud Detectsatyabrata mohapatraNo ratings yet

- A Synergistic Approach For Enhancing Credit Card Fraud Detection Using Random Forest and Naïve Bayes ModelsDocument9 pagesA Synergistic Approach For Enhancing Credit Card Fraud Detection Using Random Forest and Naïve Bayes ModelsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Review On Credit Card Fraud Detection Using Machine Learning AlgorithmsDocument5 pagesReview On Credit Card Fraud Detection Using Machine Learning AlgorithmsGiuseppeLegrottaglieNo ratings yet

- Credit Card Fraud Detection Using Machine LearningDocument6 pagesCredit Card Fraud Detection Using Machine LearningMadhav SinghNo ratings yet

- Credit Card Duplicity Spotting On Gaining The Knowledge On Machine LearningDocument4 pagesCredit Card Duplicity Spotting On Gaining The Knowledge On Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Credit Card Fake Revealing Analysis and Prediction of AlgorithmsDocument14 pagesCredit Card Fake Revealing Analysis and Prediction of AlgorithmsIJRASETPublicationsNo ratings yet

- CPP SynopsisDocument4 pagesCPP Synopsis1531-Sujal Dnyanesh HanamgharNo ratings yet

- Credit Card Fraud Detection Using Various Machine Learning AlgorithmsDocument15 pagesCredit Card Fraud Detection Using Various Machine Learning AlgorithmsIJRASETPublicationsNo ratings yet

- Credit Card Research PaperDocument12 pagesCredit Card Research PaperVidushi YadavNo ratings yet

- 216 649 4 PB - 3Document9 pages216 649 4 PB - 3Hendaryie TjoengNo ratings yet

- Credit Card Fraud Detection Using Hidden Markov ModelDocument4 pagesCredit Card Fraud Detection Using Hidden Markov ModelIJASRETNo ratings yet

- Credit Card Fraud DetectionDocument38 pagesCredit Card Fraud Detectionshaa51021No ratings yet

- IT35 Publish PaperDocument5 pagesIT35 Publish PapersilvaNo ratings yet

- Guru Tegh Bahadur Institute of Technology: Credit Card Fraud DetectionDocument31 pagesGuru Tegh Bahadur Institute of Technology: Credit Card Fraud Detectionmrritesh2580No ratings yet

- A Study On Credit Card Fraud Detection Using Machine LearningDocument4 pagesA Study On Credit Card Fraud Detection Using Machine LearningEditor IJTSRDNo ratings yet

- A Review On Credit Card Fraud Detection Techniques Using MLDocument7 pagesA Review On Credit Card Fraud Detection Techniques Using MLksav yadavNo ratings yet

- 1.credit Card Fraud Detection Using Hidden Markov ModelDocument4 pages1.credit Card Fraud Detection Using Hidden Markov ModelsulhanNo ratings yet

- Fraud Detection in Banking Data by Machine LearningDocument11 pagesFraud Detection in Banking Data by Machine Learninganhttv21406No ratings yet

- Application of Artificial Intelligence For FraudulDocument19 pagesApplication of Artificial Intelligence For Fraudultech techNo ratings yet

- Protecting E-Commerce Systems From Online FraudDocument6 pagesProtecting E-Commerce Systems From Online FraudseventhsensegroupNo ratings yet

- Analysis On Credit Card Fraud Detection MethodsDocument5 pagesAnalysis On Credit Card Fraud Detection MethodsFor ytNo ratings yet

- Detection of Phishing WebsitesDocument6 pagesDetection of Phishing WebsitesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Vertical Farming System Based on IoTDocument6 pagesVertical Farming System Based on IoTInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Detection and Counting of Fake Currency & Genuine Currency Using Image ProcessingDocument6 pagesDetection and Counting of Fake Currency & Genuine Currency Using Image ProcessingInternational Journal of Innovative Science and Research Technology100% (9)

- Osho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)Document8 pagesOsho Dynamic Meditation; Improved Stress Reduction in Farmer Determine by using Serum Cortisol and EEG (A Qualitative Study Review)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Influence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaDocument13 pagesInfluence of Principals’ Promotion of Professional Development of Teachers on Learners’ Academic Performance in Kenya Certificate of Secondary Education in Kisii County, KenyaInternational Journal of Innovative Science and Research Technology100% (1)

- The Impact of Music on Orchid plants Growth in Polyhouse EnvironmentsDocument5 pagesThe Impact of Music on Orchid plants Growth in Polyhouse EnvironmentsInternational Journal of Innovative Science and Research Technology100% (1)

- Consistent Robust Analytical Approach for Outlier Detection in Multivariate Data using Isolation Forest and Local Outlier FactorDocument5 pagesConsistent Robust Analytical Approach for Outlier Detection in Multivariate Data using Isolation Forest and Local Outlier FactorInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Realigning Curriculum to Simplify the Challenges of Multi-Graded Teaching in Government Schools of KarnatakaDocument5 pagesRealigning Curriculum to Simplify the Challenges of Multi-Graded Teaching in Government Schools of KarnatakaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Sustainable Energy Consumption Analysis through Data Driven InsightsDocument16 pagesSustainable Energy Consumption Analysis through Data Driven InsightsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Entrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisDocument10 pagesEntrepreneurial Creative Thinking and Venture Performance: Reviewing the Influence of Psychomotor Education on the Profitability of Small and Medium Scale Firms in Port Harcourt MetropolisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Overview of Lung CancerDocument6 pagesAn Overview of Lung CancerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaDocument10 pagesDigital Finance-Fintech and it’s Impact on Financial Inclusion in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaDocument6 pagesImpact of Stress and Emotional Reactions due to the Covid-19 Pandemic in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Utilization of Waste Heat Emitted by the KilnDocument2 pagesUtilization of Waste Heat Emitted by the KilnInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Efficient Cloud-Powered Bidding MarketplaceDocument5 pagesAn Efficient Cloud-Powered Bidding MarketplaceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Designing Cost-Effective SMS based Irrigation System using GSM ModuleDocument8 pagesDesigning Cost-Effective SMS based Irrigation System using GSM ModuleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictDocument13 pagesEffect of Solid Waste Management on Socio-Economic Development of Urban Area: A Case of Kicukiro DistrictInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predictive Analytics for Motorcycle Theft Detection and RecoveryDocument5 pagesPredictive Analytics for Motorcycle Theft Detection and RecoveryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Tix: Automated Bus Ticket SolutionDocument5 pagesAuto Tix: Automated Bus Ticket SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Examining the Benefits and Drawbacks of the Sand Dam Construction in Cadadley RiverbedDocument8 pagesExamining the Benefits and Drawbacks of the Sand Dam Construction in Cadadley RiverbedInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ambulance Booking SystemDocument7 pagesAmbulance Booking SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparative Evaluation of Action of RISA and Sodium Hypochlorite on the Surface Roughness of Heat Treated Single Files, Hyflex EDM and One Curve- An Atomic Force Microscopic StudyDocument5 pagesComparative Evaluation of Action of RISA and Sodium Hypochlorite on the Surface Roughness of Heat Treated Single Files, Hyflex EDM and One Curve- An Atomic Force Microscopic StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Study Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoDocument6 pagesStudy Assessing Viability of Installing 20kw Solar Power For The Electrical & Electronic Engineering Department Rufus Giwa Polytechnic OwoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Computer Vision Gestures Recognition System Using Centralized Cloud ServerDocument9 pagesComputer Vision Gestures Recognition System Using Centralized Cloud ServerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyber Security Awareness and Educational Outcomes of Grade 4 LearnersDocument33 pagesCyber Security Awareness and Educational Outcomes of Grade 4 LearnersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Forensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsDocument12 pagesForensic Advantages and Disadvantages of Raman Spectroscopy Methods in Various Banknotes Analysis and The Observed Discordant ResultsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Blockchain Based Decentralized ApplicationDocument7 pagesBlockchain Based Decentralized ApplicationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Industry That Capitalizes Off of Women's Insecurities?Document8 pagesAn Industry That Capitalizes Off of Women's Insecurities?International Journal of Innovative Science and Research TechnologyNo ratings yet

- Factors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaDocument6 pagesFactors Influencing The Use of Improved Maize Seed and Participation in The Seed Demonstration Program by Smallholder Farmers in Kwali Area Council Abuja, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unmasking Phishing Threats Through Cutting-Edge Machine LearningDocument8 pagesUnmasking Phishing Threats Through Cutting-Edge Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- BS 6089 - 2010 - Assessment of Insitu Compressive TestDocument40 pagesBS 6089 - 2010 - Assessment of Insitu Compressive TestMike Chan100% (2)

- Dematron 60 70 Parlour Sheet 1.03Document1 pageDematron 60 70 Parlour Sheet 1.03Andrés HurtadoNo ratings yet

- Lovol - Fl936-Dhbo6g0131Document140 pagesLovol - Fl936-Dhbo6g0131LuzioNetoNo ratings yet

- Adam Peabody Resume 2020Document2 pagesAdam Peabody Resume 2020api-255624589No ratings yet

- Suction Pile and FoundationDocument19 pagesSuction Pile and FoundationhaydarburedahNo ratings yet

- Abu Ibrahim Al-Hashimi Al-Qurashi: Abū Ibrāhīm Al-Hāshimi Al-Qurashi Mawli Al-SalbiDocument12 pagesAbu Ibrahim Al-Hashimi Al-Qurashi: Abū Ibrāhīm Al-Hāshimi Al-Qurashi Mawli Al-SalbiJosué Barrón GonzálezNo ratings yet

- Part 8 - Bibliography and ReferencesDocument31 pagesPart 8 - Bibliography and Referencessibhat mequanintNo ratings yet

- List of RAs UpdatedDocument12 pagesList of RAs UpdatedThe SuperstarNo ratings yet

- Perceived Effectiveness of Artificial Intelligence-Powered Calculators On The Academic Performance of Senior High School STEM Students in MathematicsDocument8 pagesPerceived Effectiveness of Artificial Intelligence-Powered Calculators On The Academic Performance of Senior High School STEM Students in MathematicsPsychology and Education: A Multidisciplinary JournalNo ratings yet

- Practical 9: Enthalpy Change of ReactionDocument4 pagesPractical 9: Enthalpy Change of ReactionJulia QistinaNo ratings yet

- Physics1ist Year Practical FilDocument27 pagesPhysics1ist Year Practical FilManish GoyalNo ratings yet

- A&D MGMU End Sem Exam Paper (2022-23) Part-IDocument5 pagesA&D MGMU End Sem Exam Paper (2022-23) Part-IAzar BargirNo ratings yet

- Goat Fattening Rs. 0.85 MillionDocument18 pagesGoat Fattening Rs. 0.85 MillionZakir Ali100% (1)

- Instant Download Principles of Virology Ebook PDF FREEDocument11 pagesInstant Download Principles of Virology Ebook PDF FREEwalter.penn362100% (51)

- 4.11 Radiation Protection - AHDocument112 pages4.11 Radiation Protection - AHGina RNo ratings yet

- Tarea 2 TermodinamicaDocument2 pagesTarea 2 TermodinamicaMario GonzalezNo ratings yet

- Dividido Trane 30 TonsDocument23 pagesDividido Trane 30 TonsairemexNo ratings yet

- The Pros and Cons of GlobalizationDocument7 pagesThe Pros and Cons of Globalizationmaverick auburnNo ratings yet

- Cut Pieces: From Flat Plates, Strips and Coil Stock. A. Shearing B. Bend Allowance C. Forming Dies D. Spring BackDocument100 pagesCut Pieces: From Flat Plates, Strips and Coil Stock. A. Shearing B. Bend Allowance C. Forming Dies D. Spring BackJade DigNo ratings yet

- Holmstrom1982 Moral Hazard in TeamsDocument18 pagesHolmstrom1982 Moral Hazard in TeamsfaqeveaNo ratings yet

- Fundamentals of Inviscid, Incompressible FlowDocument57 pagesFundamentals of Inviscid, Incompressible FlowpaariNo ratings yet

- How To Product ManualDocument250 pagesHow To Product ManualAmith M DNo ratings yet

- Clutch ComponentsDocument19 pagesClutch ComponentsCecilia Gil60% (5)

- Modules in Grade 12: Quarter 1 - Week 3 Academic Track - StemDocument23 pagesModules in Grade 12: Quarter 1 - Week 3 Academic Track - StemZenarose MirandaNo ratings yet

- Strategic Business Management November 2022 Mark PlanDocument34 pagesStrategic Business Management November 2022 Mark PlanWongani Kaunda0% (1)

- ECE Formula SheetDocument7 pagesECE Formula SheetMahendra ReddyNo ratings yet

- Did Tucson City Attorney Mike Rankin Commit A Half Million Dollar Fraud On Tucson Taxpayers?Document4 pagesDid Tucson City Attorney Mike Rankin Commit A Half Million Dollar Fraud On Tucson Taxpayers?Roy Warden50% (2)

- EAPP POWERPOINT BY Prof. Deo S. FabroaDocument98 pagesEAPP POWERPOINT BY Prof. Deo S. FabroaAlen Jay MagsicoNo ratings yet

- Aldabbagh 4417Document322 pagesAldabbagh 4417michael ballNo ratings yet

- PfroDocument4 pagesPfrobe3pNo ratings yet