Professional Documents

Culture Documents

Blue Jet Healthcare - IPO Note

Uploaded by

ashutosh chaudharyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blue Jet Healthcare - IPO Note

Uploaded by

ashutosh chaudharyCopyright:

Available Formats

INDIAN INSTITUTE OF MANAGEMENT, INDORE

IPO: Blue Jet Healthcare Ltd

THE INVESTMENT AND EQUITY RESEARCH CLUB

Issue opens from 25-Oct-2023 to 27-Oct-2023 Sector: Pharmaceuticals

Business Overview Issue Snapshot

Blue Jet Healthcare develops and supplies speciality pharmaceutical

and healthcare ingredients and intermediates under a contract Issue Open 25-Oct-2023

development and manufacturing organization business model. They Issue Close: 27-Oct-2023

have specialized chemistry capabilities in contrast media intermediates

and high-intensity sweeteners and have built a long-term customer Issue Price: Rs. 329 – Rs. 346 per share

base of innovator and multi-national generic pharmaceutical Lot Size: Multiples of 43 shares

companies, supported by multi-year contracts. BJHL supplies a critical

starting intermediate and several advanced intermediates to three of Offer Size: ~ Rs. 840 Crore

the largest contrast media manufacturers in the world.

Offer Breakup

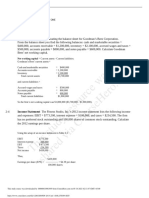

Key Financials

Issue Size (Cr)

(in Cr.) FY’21 FY’22 FY’23 Categories Allocation

Lower Band

Income 498.93 683.46 720.98

QIB: 50% 420

PAT 135.78 181.59 160.02

V O YA G E C A P I TA L – I P O N O T E

NII: 15% 126

EBITDA(%) 41.30% 36.47% 30.39%

EPS(in Rs.) 7.98 10.47 9.23 Retail: 35% 294

RONW (%) 39.96% 34.82% 23.48% Employees - -

Investment Rationale Tentative timetable

▪ Over the past three financial years, the company has conducted Allotment: 01-Nov-2023

business with more than 350 customers in 35 countries. They

Initiation of Refund: 02-Nov-2023

have established a loyal customer base, particularly with

innovator pharmaceutical companies and multinational generic Listing: 06-Nov-2023

pharmaceutical companies, often through long-term contracts.

IPO Lead Managers

▪ The company has developed specialized chemistry capabilities in

two primary areas: contrast media intermediates and high- Lead Kotak Mahindra Capital, JP

intensity sweeteners with no concrete competitors. Managers: Morgan India, ICICI Securities

▪ BJHL has developed strong R&D process engineering skills, which Registrar: Link Intime India Private Limited

allows it to convert lab-developed technologies into multi-

kilogram scale up. Objective of the issue

Key Risks ▪ The company will not receive any funds from

the IPO as the issue is entirely an OFS by

▪ Almost 84% of firm revenue comes from top 10 clients. The firm, existing shareholders.

results of operations, financial position, and cash flows could ▪ The proceeds from the issue will also be used

suffer if one or more of these clients left, their financial status for meeting general corporate purposes.

worsened, or demand for the company's products dropped.

Broker Outlook

▪ The company generates nearly 80% of its revenue from Europe

and the US which are highly regulated markets. The outlook of brokerages is generally positive,

with most recommending a "Subscribe" rating.

Brokerages believe that BJHL has a

commendable position in contrast media

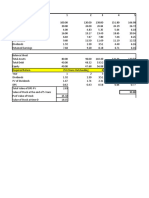

Major listed peers

manufacturing. The product portfolio is niche

Company P/E ROE ROCE with high barriers to entry.

Syngene International 56.57 13.40% 14.53%

Summary of Broker Ratings

Alkem Laboratories 36.60 12.10% 13.70%

Reliance Securities Subscribe

Source: Draft Red Herring Prospectus, (*)Equity research Indsec Securities Subscribe

Disclaimer: Voyage capital provides the IPO Note with an intention to provide market knowledge. The

IPO Note should not any in manner be considered as a sign of the club's endorsement for the IPO. The Angel One Subscribe

club takes no responsibility for the outcome of the IPO

26 October 2023 VOYAGE CAPITAL - THE INVESTMENT AND EQUITY RESEARCH CLUB, IIM INDORE IPO – Note

You might also like

- Yatharth Hospital - IPO NoteDocument1 pageYatharth Hospital - IPO NoteCapa EshenaNo ratings yet

- YatharthDocument8 pagesYatharthCp918315No ratings yet

- BajconDocument22 pagesBajcon354Prakriti SharmaNo ratings yet

- INVPPT310522PVFINDocument41 pagesINVPPT310522PVFINRADHESHYAM SINGHNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- IdeaForge Technology IPO Note Motilal OswalDocument9 pagesIdeaForge Technology IPO Note Motilal OswalKrishna GoyalNo ratings yet

- Concord Biotech Ltd-IPO NoteDocument11 pagesConcord Biotech Ltd-IPO NoteSabyasachi JenaNo ratings yet

- Annual Report FY 2022 23Document172 pagesAnnual Report FY 2022 23bharath reddyNo ratings yet

- Tatva Chintan Pharma Chem LTD IPODocument1 pageTatva Chintan Pharma Chem LTD IPOparmodNo ratings yet

- Clean Science ICDocument35 pagesClean Science ICErr DatabaseNo ratings yet

- Praj Industries 270822 PrabhuDocument32 pagesPraj Industries 270822 PrabhuPiyush PatilNo ratings yet

- IPO Vijaya Diagnostic - 01092021 1630476491Document6 pagesIPO Vijaya Diagnostic - 01092021 1630476491Neil MannikarNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- Rossari BiotechDocument8 pagesRossari Biotechzeeshan_iraniNo ratings yet

- TTKH Angel PDFDocument14 pagesTTKH Angel PDFADNo ratings yet

- Financial Derivatives and Risk Management Interim ReportDocument5 pagesFinancial Derivatives and Risk Management Interim ReportPriyanka MajumdarNo ratings yet

- Praj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11Document8 pagesPraj Industries LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 11samraatjadhavNo ratings yet

- TTLDRDocument8 pagesTTLDRSam KoshyNo ratings yet

- O/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Document8 pagesO/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Muhammad ImranNo ratings yet

- Vijaya Diagnostic Centre LTD: UnratedDocument14 pagesVijaya Diagnostic Centre LTD: UnratedPavankopNo ratings yet

- Impressive Background and Business Model.Document6 pagesImpressive Background and Business Model.Bb DarkNo ratings yet

- July 21 2022 HDFC - Securities - Retail - Research - Initiation - Supriya - LifescienceDocument17 pagesJuly 21 2022 HDFC - Securities - Retail - Research - Initiation - Supriya - LifescienceHarish SubramaniamNo ratings yet

- Narayana Health: The Initial Ipo DecisionDocument9 pagesNarayana Health: The Initial Ipo DecisionKANVI KAUSHIKNo ratings yet

- Date: 19: Ameya Masurkar Company Secretary and Compliance OfficerDocument233 pagesDate: 19: Ameya Masurkar Company Secretary and Compliance OfficerAaron AllenNo ratings yet

- Supriya Lifescience LTD - IPO Note - Dec'2021Document11 pagesSupriya Lifescience LTD - IPO Note - Dec'2021Tejesh GoudNo ratings yet

- WWW - Starhealth.in.: Jayashree SethuramanDocument18 pagesWWW - Starhealth.in.: Jayashree Sethuramankrutika.blueoceaninvestmentsNo ratings yet

- PVR LTD: Strong Fundamentals To Withstand UncertaintiesDocument4 pagesPVR LTD: Strong Fundamentals To Withstand UncertaintiesVinay HonnattiNo ratings yet

- Rossari Biotech LTD: SubscribeDocument9 pagesRossari Biotech LTD: SubscribeDavid BassNo ratings yet

- Nutresa Nov 3Document13 pagesNutresa Nov 3SemanaNo ratings yet

- M. Bects Fod SpeciDocument7 pagesM. Bects Fod SpeciRohit KumarNo ratings yet

- MC Investor Presentation VF Q3 23Document24 pagesMC Investor Presentation VF Q3 23l91179909No ratings yet

- CDSL-Stock RessearchDocument13 pagesCDSL-Stock RessearchSarah AliceNo ratings yet

- Tatva Chintan Limited. F: SubscribeDocument7 pagesTatva Chintan Limited. F: Subscribeturbulence iitismNo ratings yet

- Shreyans BachhawatDocument34 pagesShreyans BachhawatKhushal ShahNo ratings yet

- Aditya Birla Sun Life AMC LTD.: Issue DetailsDocument6 pagesAditya Birla Sun Life AMC LTD.: Issue Detailsjitendra76No ratings yet

- BP Equities Keystone Realtors LTD IPO Note Subscribe 13th Nov 2022Document4 pagesBP Equities Keystone Realtors LTD IPO Note Subscribe 13th Nov 2022al.ramasamyNo ratings yet

- 205 FinalDocument42 pages205 FinalAustin BijuNo ratings yet

- INF179K01CR2 - HDFC Midcap OpportunitiesDocument1 pageINF179K01CR2 - HDFC Midcap OpportunitiesKiran ChilukaNo ratings yet

- Dhanuka Agritech Ltd-2QFY24 Results UpdateDocument4 pagesDhanuka Agritech Ltd-2QFY24 Results UpdatedeepaksinghbishtNo ratings yet

- Tarsons Products LTD: All You Need To Know AboutDocument7 pagesTarsons Products LTD: All You Need To Know AboutmedicostuffNo ratings yet

- Tarsons Products LTD: All You Need To Know AboutDocument7 pagesTarsons Products LTD: All You Need To Know AboutmedicostuffNo ratings yet

- Aarti Industries - Company Update - 170921Document19 pagesAarti Industries - Company Update - 170921darshanmaldeNo ratings yet

- New Year Report 2021 HDFC SecuritiesDocument25 pagesNew Year Report 2021 HDFC SecuritiesSriram RanganathanNo ratings yet

- Innova Captab Ipo NoteDocument3 pagesInnova Captab Ipo Notekumarprasoon99No ratings yet

- Jyothy Laboratories Ltd. - Update - CDDocument11 pagesJyothy Laboratories Ltd. - Update - CDagarohitNo ratings yet

- Credo Brands Marketing Limited - IPO NoteDocument9 pagesCredo Brands Marketing Limited - IPO NotedeepaksinghbishtNo ratings yet

- Bharti Enterprises LimitedDocument4 pagesBharti Enterprises LimitedjagadeeshNo ratings yet

- Majesco HDFC Sec PDFDocument25 pagesMajesco HDFC Sec PDFJatin SoniNo ratings yet

- Final BSNL ReportDocument50 pagesFinal BSNL ReportashishNo ratings yet

- Udayshivakumar Infra Limited: All You Need To Know AboutDocument8 pagesUdayshivakumar Infra Limited: All You Need To Know AboutShreyclassNo ratings yet

- An Tks 2019 EDocument192 pagesAn Tks 2019 EEric PhanNo ratings yet

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Cyient DLM LTD - IPO Note - June'2023Document16 pagesCyient DLM LTD - IPO Note - June'2023Mumbai IPLNo ratings yet

- Medplus IPO Note - VenturaDocument19 pagesMedplus IPO Note - Venturaaniket birariNo ratings yet

- Divis Laboratories Initiating Coverage 15062020Document7 pagesDivis Laboratories Initiating Coverage 15062020vigneshnv77No ratings yet

- Indigo Paints DetailedDocument8 pagesIndigo Paints DetailedMohit RuhalNo ratings yet

- Gandhar Oil Refinery IPO NoteDocument3 pagesGandhar Oil Refinery IPO NoteShivani NirmalNo ratings yet

- Investor Presentation - Distribution - March 2024Document54 pagesInvestor Presentation - Distribution - March 2024niks dNo ratings yet

- EnxeneDocument2 pagesEnxeneashutosh chaudharyNo ratings yet

- It Bytes - Oct 23Document1 pageIt Bytes - Oct 23ashutosh chaudharyNo ratings yet

- Adani HolcimDocument1 pageAdani Holcimashutosh chaudharyNo ratings yet

- Statistics Related To Indian EconomyDocument7 pagesStatistics Related To Indian Economyashutosh chaudharyNo ratings yet

- Credit-Linked UPI - An Evolving SagaDocument8 pagesCredit-Linked UPI - An Evolving Sagaashutosh chaudharyNo ratings yet

- Annual Report 2017 18 PDFDocument248 pagesAnnual Report 2017 18 PDFSACHIN GEORGE 1827726No ratings yet

- Taxguru - In-Depreciation As Per Schedule II of Companies Act 2013Document3 pagesTaxguru - In-Depreciation As Per Schedule II of Companies Act 2013Ravi SharmaNo ratings yet

- Indian Accounting Standards An Overview (Revised 2019)Document15 pagesIndian Accounting Standards An Overview (Revised 2019)Pooja GuptaNo ratings yet

- Lesson 10 Depreciation and Sunk CostDocument14 pagesLesson 10 Depreciation and Sunk CostDaniela CaguioaNo ratings yet

- Fin 201 1stsolution SetDocument6 pagesFin 201 1stsolution Set123xxNo ratings yet

- Diaper Case StudyDocument5 pagesDiaper Case StudyAbhijeet SarodeNo ratings yet

- Section B Answer Question 1 and Not More Than One Further Question From This Section. Question 1Document3 pagesSection B Answer Question 1 and Not More Than One Further Question From This Section. Question 1Kəmalə AslanzadəNo ratings yet

- Absorption (Full Costing) Variable (Direct Costing)Document4 pagesAbsorption (Full Costing) Variable (Direct Costing)Leo Sandy Ambe CuisNo ratings yet

- Financial Management Midterm Quiz 407Document1 pageFinancial Management Midterm Quiz 407Agna AegeanNo ratings yet

- Xex10 - Working Capital Management With SolutionDocument10 pagesXex10 - Working Capital Management With SolutionJoseph Salido100% (1)

- Standard Trust Deed-UmbrellaDocument20 pagesStandard Trust Deed-UmbrellahtokonNo ratings yet

- Worksheet 1 SolutionsDocument2 pagesWorksheet 1 SolutionsDen CelestraNo ratings yet

- MAS Synchronous May 13 Part 2Document4 pagesMAS Synchronous May 13 Part 2Marielle GonzalvoNo ratings yet

- Working With Financial Statements: Mcgraw-Hill/IrwinDocument32 pagesWorking With Financial Statements: Mcgraw-Hill/Irwinwahid_040No ratings yet

- 12 TallyDocument4 pages12 TallyAtif RahmanNo ratings yet

- Raymond WC MGMTDocument66 pagesRaymond WC MGMTshwetakhamarNo ratings yet

- LAPORAN KEUANGAN 2020 TrioDocument3 pagesLAPORAN KEUANGAN 2020 TrioMT Project EnokNo ratings yet

- April 2006Document8 pagesApril 2006Mohd HafizNo ratings yet

- Apple Inc. Profit & Loss Statement: Operating ExpensesDocument4 pagesApple Inc. Profit & Loss Statement: Operating ExpensesDevanshu YadavNo ratings yet

- Befa Unit 1Document19 pagesBefa Unit 1Naresh Guduru89% (71)

- Shares: Prepared By: R.AnbalaganDocument10 pagesShares: Prepared By: R.AnbalaganKishan SinghNo ratings yet

- M14 - Final Exam & RevisionDocument43 pagesM14 - Final Exam & RevisionJashmine Suwa ByanjankarNo ratings yet

- Hoshimo Ltd/Year 1 2 3 4 5 Income StatementDocument6 pagesHoshimo Ltd/Year 1 2 3 4 5 Income StatementSeemaNo ratings yet

- Subsidiary LedgerDocument8 pagesSubsidiary LedgerMagal LanesNo ratings yet

- 2012 CA ATC ListDocument26 pages2012 CA ATC Listardhipratomo4390No ratings yet

- Compagnie de La Baie de ST Augustin V Cornelius Finance Co LTD and Ors 2011 SCJ 1120160529032930912 - 1Document16 pagesCompagnie de La Baie de ST Augustin V Cornelius Finance Co LTD and Ors 2011 SCJ 1120160529032930912 - 1toshanperyagh1No ratings yet

- CH 04 Review and Discussion Problems SolutionsDocument23 pagesCH 04 Review and Discussion Problems SolutionsArman Beirami67% (3)

- UntitledDocument71 pagesUntitledIsaque Dietrich GarciaNo ratings yet

- JFW464 Analisis Penyata Kewangan Sidang Webex 5 Bab 10 Analisis KreditDocument39 pagesJFW464 Analisis Penyata Kewangan Sidang Webex 5 Bab 10 Analisis KreditM-Hilme M-HassanNo ratings yet