Professional Documents

Culture Documents

72825cajournal Feb2023 22

Uploaded by

S M SHEKAROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

72825cajournal Feb2023 22

Uploaded by

S M SHEKARCopyright:

Available Formats

919

FINANCE

Why Do We Need One More Form of

Digital Money- e` in Financial Markets?

Sunil Dasari

Author is an expert in Banking and Finance services. He may be reached

at sunildasari755@gmail.com and eboard@icai.in

Present Payment Systems

T

he Payment Network Effects increase the Value of the

Network Exponentially for the Participants / Public with

increased adoption. Network effects have resulted in

Consolidation of Payment Networks by creating a barrier to the

entry for the Newer Participants (Payment Network Entities), even

though they are having Better Technology. This results Merging

There are various ‘Digital of Payment Networks Creates Monopoly Power in the Country,

Forms of Money’ available thereby Higher Cost Per Transaction especially for Smaller

to the public today for ‘Store Merchants / Individuals of the Country. Concentration of the

of Value and for Payments’, Payment Function in a Few Enterprises increases “Systemic Risk”

including Regular Bank i.e., once they failed or insolvent, then it creates problem to the

Deposits of Commercial Merchants / Individuals. Central Bank Digital Currency (CBDC)

Banks accessed through can provide an alternate to the Retail or Wholesale Payments

Banking Apps and also System. This is independent of any ‘Private System’ whose failure

through Debit Cards etc.

could impact Citizens. A Central Bank Digital Currency Run by a

Another arrangement Central Bank (Reserve Bank of India) and provides a Public Payment

using money or payments Alternative System in Times of Stress and Crisis as well as provides

transaction through ‘Credit Competition to Curb Monopolies of Closed Payment Systems in

Cards’ or ‘Closed Systems’

the Country.

such as: PhonePe, Google

Pay, Paytm, Amazon Commerce in India has grown due to the Globalization of Supply

Pay, BHIM, FreeCharge, Chains. Remittances from abroad keep many Economies flooded.

JioMoney, Mobikwik, Airtel These are some of the reasons for the growth in Cross Border

Money, Pockets By ICICI Payments of the Country. Cross Border Payments include

Bank. Wholesale, Large Value Payments, and Smaller Retail Payments.

Big or Small Commercial Cross Border Payments today use a System of Correspondent

Banks, Financial Market Banks (through Nostro Accounts) and many messages, leading to

Utilities, and others who the Delays and Costs. Cross Border Payments can be Simplified by

have Accounts at the Central using the Central Bank Digital Currency of the Country.

Bank of the Country have

Payments Payment Systems substitute the Economic

access to their Reserves

Vision 2025 Development and the Financial Stability as well as

(Like Cash Reserve Ratio

support to the Financial Inclusion. It will Ensuring

Account Maintenance with Safe, Secure, Reliable, Accessible, Affordable and

RBI), which are also Digital. for Efficient Payment Systems has been one of the

One purpose of a Central important Strategic Objectives and the Goals of the

Bank Digital Currency Reserve Bank of India (RBI).

(CBDC) is to provide a

Method of Speedy of Towards the achievement of these objectives, India

Digital Payments with has developed one of the most Modern Payment

Systems in the World, whether it may be the

‘Central Bank Money’,

large value, retail or fast. For the past decade has

fitting the current methods witnessed the Prospering of quite a few payment

of Commerce and Trade systems, all for the convenience to the common

Transactions, which is man with enhanced level of confidence through

progressively through various Safety and Security measures.

Online Payment Systems.

There is no Equivalent The Role of RBI has transformed from being a

Form of the ‘Digital Money’ Regulator, Operator and Facilitator to Creator of

available to the Public. an Environment for the Structured Development of

the Payments Ecosystem in India.

www.icai.org THE CHARTERED ACCOUNTANT FEBRUARY 2023 91

920

FINANCE

The Central Bank Digital • IDFC First Bank • Though Digital, the e₹-R

Currency (CBDC) is meant And it will comprise the First comes with all features of

to exist alongside all other Phase in the Four Cities, to the ‘Physical Cash’ like:

forms of ‘Fiat’ for the Short to Residents of: • Safety.

Medium Term. Payments using • Settlement Finality and

• Mumbai.

Central Bank Digital Currency

• Bengaluru. • Trust, etc.

(CBDC) will exist alongside all

other Existing Payment barriers • New Delhi and • Convert the Digital Rupee

through Innovation in Central • Bhubaneswar.

into the other Forms of

Bank Digital Currency and Money like Commercial

Payment Systems will happen Process of Central Bank Bank Deposits, but it will

if the Right Technology is Digital Currency-CBDC not Earn any Interest.

chosen. Dynamic Interest • The e-Rupee Pilot will

Rate setting and other Smart People can used ‘Digital conduct a Real-time

Features require Programmable Wallets’ provided by the Assessment of the Retail

Money. ‘Partnering Banks’ to exchange use of Digital Rupees,

‘Digital Rupees’. Another Four Distribution, and the Stability

As per the Central Bank of Banks will join the pilot for the of complete creation.

India, there are Two Types of Second Phase soon. Furthermore, the Reserve

Digital Rupee will be launched Bank of India will evaluate

in India, namely: These ‘Participating Banks’

have launched their Digital different Uses and Aspects of

≈ Retail or General Purpose the ‘Digital Token’ according

Rupee e` (R) App to make

(CBDC-Retail-e₹(R)) and to this Assessment.

Transactions more accessible.

≈ Wholesale (CBDC-

Wholesale-e₹(W)). The following are for ‘Buying Benefits to the Public

or Making’ transactions with • CBDC can easily Convert

Non-financial Consumers, the Digital Rupee (e`-R) during

Private Sectors, Businessmen, Digital Money into Cash or

Pilot Launch of Reserve Bank of Commercial Bank Money.

etc., can use CBDC-R, while the India:

Use of CBDC-W is restricted • As the Digital Rupee is a

to the Selected Financial • A Closed User Group (CUG) Flexible Legal Tender, it can

Institutions such as Interbank consists of Participating use it even if don’t hold a

Transfers particularly in ‘Merchants and the Bank Account to the user.

Call Money Markets, Money Customers’. The e-pilot cover • It cannot be destroyed by

Markets, Government Securities in the selected locations in tearing apart, burning or any

Market etc. CUG. other physical damage.

Hence, the Reserve Bank of • The e-rupee will be issued in • Any other Digital Form

India launched the Digital the ‘Same Denominations’ as of money Cannot replace

Rupee in India to offer a followed by ‘Paper Currency e-rupees i.e., CBDC.

Safe and Hazardless Digital or Coins’ of the Country i.e., • Digital Money is equal to the

Experience during Monetary (₹1 to ₹ 2000 Notes + Coins). Paper Currency. Hence, it will

Transactions. It is a Digital Token of the last as long as Paper Money

prevailing money that will be last.

Besides, it does not come with distributed through ‘Banks as • Unlike the Cryptocurrency,

a Risk of Volatility etc. It is just an Intermediary Point’. the Digital Rupee is Governed

a Digital Form of the Physical • The identified Banks will by the Central Authority.

Money/Currency. Reserve offer a ‘Digital Wallet’ that Thus, it has a Low Risk of

Bank of India has selected Eight use through ‘Smartphones being Volatile and provides the

Banks to take part in phase- or Laptops’ for the Online Security to its User.

wise e-` (R) pilot program Transactions of e-Rupee.

w.e.f. 1st December, 2022 in the • Public may opt for both Risks Associated with

following Banks. ‘Person-to-Person (P2P)’ and Central Bank Digital

‘Person-to-Merchant (P2M)’ Currency

• State Bank of India

Transactions by using ‘QR Privacy Concerns: The first issue

• ICICI Bank

Codes’ displayed at Malls or to tackle is the heightened Risk to

• Yes Bank Shops. the privacy of users-given that the

92 THE CHARTERED ACCOUNTANT FEBRUARY 2023 www.icai.org

921

FINANCE

Central Bank could Potentially end cause the Central Bank to Lose which leaves the Track of

up handling an enormous amount Control of Monetary Policy. Different Entries.

of data regarding user transactions. The provision of Central Bank

If the Central Bank Digital

This has the serious implications Digital Currency (CBDC)

Currency could function like

given that the digital currencies by the Central Bank allows

the Physical Cash and realize

will not offer users the level of Transmission of Monetary

no interest income, in normal

privacy and anonymity offered Policy through One more

times, “Economic Agents”

by transacting in cash. Channel. The Central Bank can

(There are four main types of

• Compromise of Credentials is break through the ‘Zero’ Lower

economic agents: Households

another major issue. Bound of Cash to stimulate the

or Individuals, Businesses,

Economy. The Central Bank

Disintermediation of Banks: Governments, and Central

Can Curb Inflation through

If sufficiently large and broad- banks) would prefer to keep

positive Interest Rates.

based, the shift to CBDC can their money in interest bearing

impinge upon the Bank’s ability bank deposits as Opposed to

to plough back the funds into Central Bank Digital Currency.

credit intermediation.

However, in the tail-risk event

• If e-cash becomes popular of Economic Instability or a

and the Reserve Bank of India System-wide Bank Run, Central

(RBI) places no limit on the Bank Digital Currency (CBDC)

amount that can be stored in could be viewed as a Safer

mobile wallets, Weaker Banks Substitute of Bank Deposits.

may struggle to retain low- According to BIS CPMI-

MC Report (2018), Central It is fully Guaranteed by the

Cost Deposits. Central Bank with ‘No Risk’ of

Bank Digital Currency does

Other Risks not alter the Basic System of losing its face value and easily

Monetary Policy; rather, it has stored in large amounts.

• Faster Obsolescence of

the possible to enable Timely This easy switch to Central

the Technology could

Spread of Monetary Policy. Bank Digital Currency can

pose a threat to the

CBDC ecosystem calling possibly Speed up a Bank Run.

The Consequences of Central The Consequent damage to

for Higher Costs of Bank Digital Currency (CBDC)

upgradation. financial intermediation would

for the Monetary Policy is directly weaken the ‘Efficacy of

• Operational Risks of basically depends on the way Monetary Policy’.

intermediaries as the staff it is Designed and its Degree of

will have to be retrained and Usage etc.

groomed to work in the CBDC

environment. In particular, it would depend

• Elevated Cyber Security on the following Policy

Decisions of the Central Bank: The provision

Risks, Vulnerability Testing of Central Bank

and Costs of protecting the i. Whether Central Bank Digital Digital Currency

Firewalls. Currency will be Non-

(CBDC) by the

• Operational burden and remunerated (Without Interest)

or Remunerated (With Central Bank allows

Costs for the Central Bank in

managing CBDC. Interest); Transmission of

Monetary Policy

Efficacy of Monetary Policy ii. Whether it would be

through One more

Implementation extensively reachable just

like Physical Currency, Channel. The

The Migration of most or Limited to Wholesale Central Bank can

of the Citizens to Private Customers such as break through the

Money, including Stablecoins Banks (as in the Case of ‘Zero’ Lower Bound

(The Stablecoins are Central Bank Reserves etc.); of Cash to stimulate

Cryptocurrencies that attempt and the Economy.

to Peg their Market Value to

some External Reference) or iii. Whether it will be Unnamed

other Forms of Money, may like Physical Currency or

Ownership will be Identifiable,

www.icai.org THE CHARTERED ACCOUNTANT FEBRUARY 2023 93

922

FINANCE

Outflow. This Outflow of

Deposits (or Banks’ Durable

Liquidity) to Central Bank

Digital Currency (CBDC) could While the intent of

Motivate Banks to Compete for Central Bank Digital

Deposits, which in turn could Currency and the

Increase Deposit Rates and

thus also Retail Lending Rates,

expected benefits are

despite no increase in the Policy well understood, it is

An associated Reduction in the Rate. important to identify

availability, and/or an increase Innovative Methods

in the ‘Cost of Credit’ from the To avert this Risk, the Central and compelling

Banking Sector would likely to Bank (Reserve Bank of India) use cases that will

have important Consequences may have to pro-actively inject make Central Bank

for both Aggregate Supply and larger durable liquidity to the

Banking System more regularly.

Digital Currency as

Demand in the Economy. Attractive as Cash if

Any fall in the Total amount The Impact of CBDC on key not More.

of Bank Lending would also Monetary Variables can be

lessen the importance of Summarised as:

Bank Lending in the overall

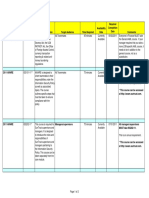

Transmission of Monetary Non-remunerated Remunerated

Impact on

Policy. CBDCs CBDCs

However, such issues can Reserve Money Yes/No Yes

be addressed by ensuring Money Supply No Yes

limits on Central Bank Digital Velocity No Yes

Currency (CBDC) holdings and

transactions. Money Multiplier Yes/No Yes

Liquidity Conditions/LAF Yes/No Yes

Another School of Thought

advocates that Interest Bearing Monetary Policy

No Yes

Central Bank Digital Currency (Repo Rate)

could transmit ‘Monetary

Policy’ actions directly to Conclusion the intent of Central Bank Digital

Economic Agents, increasing Currency and the expected benefits

Reserve Bank of India has been

the efficiency of Monetary are well understood, it is important

exploring the Pros and Cons of

Policy. Under this Modality, to identify Innovative Methods

during Pilot launch of the Central

Economic Agents could also and compelling use cases that

Bank Digital Currency. CBDC,

switch to Central Bank Digital will make Central Bank Digital

the Central Bank Digital Currency,

Currency from Bank Deposits, Currency as Attractive as Cash if

holds a lot of promises by way of

which could lead to a Deposit not More.

ensuring Transparency, and Low

Cost of Operation among other

benefits and the potential to expand References:

the existing payment systems 1. Reserve Bank of India

to address the needs of a wider Concept Note on CBDC.

Reserve Bank of category of users.

2. Guidelines on CBDC - Bank

India has been Central Bank Digital Currency, for International Settlements.

exploring the Pros across the World, is in Conceptual, nnn

and Cons of during Development, or at Pilot Stages.

Pilot launch of Therefore, in the absence of a

the Central Bank precedence, extensive stakeholder

Digital Currency. consultation along with iterative

Technology Design must take

place to develop a Solution that

meets the requirements. While

94 THE CHARTERED ACCOUNTANT FEBRUARY 2023 www.icai.org

You might also like

- Central Bank Digital Currency - PPTDocument13 pagesCentral Bank Digital Currency - PPTSachin ChauhanNo ratings yet

- YONO - India's Leading Digital BankDocument16 pagesYONO - India's Leading Digital BankMohit manwaniNo ratings yet

- Certification of Trust ExampleDocument2 pagesCertification of Trust Examplejpschubbs100% (11)

- Accenture Digital Payments Transformation From Transaction InteractionDocument32 pagesAccenture Digital Payments Transformation From Transaction InteractionSweta AggarwallNo ratings yet

- Decentralized Finance (DeFi) for Beginners: DeFi and Blockchain, Borrow, Lend, Trade, Save & Invest in Peer to Peer Lending & FarmingFrom EverandDecentralized Finance (DeFi) for Beginners: DeFi and Blockchain, Borrow, Lend, Trade, Save & Invest in Peer to Peer Lending & FarmingRating: 5 out of 5 stars5/5 (1)

- LGR Finite Ch5Document42 pagesLGR Finite Ch5FrancoSuperNo ratings yet

- Digital Revolution Changing IndiaDocument4 pagesDigital Revolution Changing IndiaMary DenizeNo ratings yet

- Building CBDCDocument30 pagesBuilding CBDCChandan DNo ratings yet

- E RupeeDocument3 pagesE RupeeHritam BoseNo ratings yet

- Future of Digital Currency in India 1694942271Document16 pagesFuture of Digital Currency in India 1694942271KeshavNo ratings yet

- MagzineDecember 221209 122110Document67 pagesMagzineDecember 221209 122110चालू पांडेयNo ratings yet

- RBI Digital Currency (CBDC) - A Tax Perspective RBI Digital Currency (CBDC) - A Tax PerspectiveDocument4 pagesRBI Digital Currency (CBDC) - A Tax Perspective RBI Digital Currency (CBDC) - A Tax PerspectiveSandeep SinghNo ratings yet

- 209 290 43 MoneyAndBankingDocument12 pages209 290 43 MoneyAndBankingPalak GuptaNo ratings yet

- Central Bank Digital Currencies:: Building Block of The Future of Value TransferDocument36 pagesCentral Bank Digital Currencies:: Building Block of The Future of Value TransferYosi YonahNo ratings yet

- EcoMatrix KKDocument5 pagesEcoMatrix KKKunal KumarNo ratings yet

- Chapter-2: Technology Driven Banking ServicesDocument25 pagesChapter-2: Technology Driven Banking ServicesAnisha SapraNo ratings yet

- RC Mains Level PracticeDocument16 pagesRC Mains Level PracticeVaividhya SrivastavaNo ratings yet

- _4246 (1)Document12 pages_4246 (1)Bagmee SampannaNo ratings yet

- BCG Google Digital Payments 2020 July 2016 - tcm21 39245 PDFDocument56 pagesBCG Google Digital Payments 2020 July 2016 - tcm21 39245 PDFIshan PadgotraNo ratings yet

- India'S Key To Success: Integration of Cbdcs Into The Payment Ecosystem by Abhijeet UpadhyayDocument2 pagesIndia'S Key To Success: Integration of Cbdcs Into The Payment Ecosystem by Abhijeet UpadhyayABHIJEET UPADHYAYNo ratings yet

- Considerations of CBDCDocument2 pagesConsiderations of CBDCvkaware20No ratings yet

- Technology Driven Banking ServicesDocument28 pagesTechnology Driven Banking ServicesThe Cultural CommitteeNo ratings yet

- Payments 2025 & Beyond: Evolution To Revolution: Six Macro Trends Shaping The Future of Payments in VietnamDocument17 pagesPayments 2025 & Beyond: Evolution To Revolution: Six Macro Trends Shaping The Future of Payments in VietnamĐăng HuyNo ratings yet

- Digital IndiaDocument28 pagesDigital IndiahumairaNo ratings yet

- RBI Circulars March 2023Document8 pagesRBI Circulars March 2023Udya singhNo ratings yet

- SM & CRMDocument5 pagesSM & CRMnimishaNo ratings yet

- PAYMENTSVISIONF4D4Document30 pagesPAYMENTSVISIONF4D4Neelajit ChandraNo ratings yet

- What Is Central Bank Digital CurrencyDocument5 pagesWhat Is Central Bank Digital Currencyguptaom9839No ratings yet

- CN - 9 - Digital PaymentsDocument24 pagesCN - 9 - Digital PaymentsAbhishek KashyapNo ratings yet

- Digital KYC Digitals Next FrontierDocument8 pagesDigital KYC Digitals Next Frontiersaramoujit131521No ratings yet

- Digitalindia PPTDocument38 pagesDigitalindia PPTAnkit ShrivastavNo ratings yet

- Digital Banking in BangladeshDocument6 pagesDigital Banking in Bangladeshshakib hasnatNo ratings yet

- A Study On Digital Payments System & Consumer Perception: An Empirical SurveyDocument11 pagesA Study On Digital Payments System & Consumer Perception: An Empirical SurveyDeepa VishwakarmaNo ratings yet

- Payment and Settlement SystemsDocument12 pagesPayment and Settlement SystemsEntertainment 99No ratings yet

- SP So 2020 10 14Document12 pagesSP So 2020 10 14knwongabNo ratings yet

- Digital Payment (PAYTM)Document35 pagesDigital Payment (PAYTM)Ankit PashteNo ratings yet

- Digital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz TajDocument6 pagesDigital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz Tajnilofer shallyNo ratings yet

- Individual TaskDocument5 pagesIndividual TaskNiraj MantriNo ratings yet

- Research On The Impact of Digital Currency On Commercial BanksDocument5 pagesResearch On The Impact of Digital Currency On Commercial Banks05-Xll C-Riya BaskeyNo ratings yet

- Rural Financial Inclusions Through Digital Banking Services in IndiaDocument4 pagesRural Financial Inclusions Through Digital Banking Services in IndiaShishir GuptaNo ratings yet

- ĐỀ CƯƠNG TỰ LUẬN CUỐI KỲ EBANKINGDocument11 pagesĐỀ CƯƠNG TỰ LUẬN CUỐI KỲ EBANKINGminhanhtran.chubbNo ratings yet

- The Role of RBI On Implementation of Digital Currencies in IndiaDocument5 pagesThe Role of RBI On Implementation of Digital Currencies in IndiaEditor IJTSRDNo ratings yet

- RBI Vision 2019-2021: The Way Forward: August 2019Document17 pagesRBI Vision 2019-2021: The Way Forward: August 2019hitesh ganvirNo ratings yet

- 6 Dec 2022 - Digital Rupee For Retail Segment - Finance CADocument12 pages6 Dec 2022 - Digital Rupee For Retail Segment - Finance CAprateekNo ratings yet

- ORF IssueBrief 584 Fintech-India-AfricaDocument22 pagesORF IssueBrief 584 Fintech-India-AfricaMegha GautamNo ratings yet

- Summer Internship Report - HDFC Digital BankingDocument32 pagesSummer Internship Report - HDFC Digital BankingMantosh SinghNo ratings yet

- Online PaymentsDocument21 pagesOnline PaymentsTania StoicaNo ratings yet

- Varshitha (1HK19IS082) Online MoneyDocument22 pagesVarshitha (1HK19IS082) Online MoneyS VarshithaNo ratings yet

- Digital Payments in IndiaDocument23 pagesDigital Payments in Indiaabhinav sethNo ratings yet

- Azadi Ka Amrut MahotsavDocument11 pagesAzadi Ka Amrut MahotsavpranjalcabmNo ratings yet

- Fintech PresentationDocument12 pagesFintech PresentationAnjali BhardwajNo ratings yet

- Digital Payment Evolution in IndiaDocument50 pagesDigital Payment Evolution in IndiaEldorado OSNo ratings yet

- BANk CIA1.2 1720253Document14 pagesBANk CIA1.2 1720253Aashish mishraNo ratings yet

- Internet BankingDocument24 pagesInternet BankingAnanya SinghNo ratings yet

- BDBL Mobile Banking Success StoryDocument4 pagesBDBL Mobile Banking Success StorySandy WellsNo ratings yet

- Bernstein WebinarDocument16 pagesBernstein WebinargopalkrizNo ratings yet

- Pulse Report 2021 M BDocument49 pagesPulse Report 2021 M BPadmaja MahadikNo ratings yet

- PhonePe PulseDocument49 pagesPhonePe PulseAbcd123411No ratings yet

- Trends of E-Commerce in the Banking SectorDocument13 pagesTrends of E-Commerce in the Banking SectorShriya AgarwalNo ratings yet

- FintechDocument22 pagesFintechazim asyraf67% (3)

- Cajournal March2023 5Document1 pageCajournal March2023 5S M SHEKARNo ratings yet

- 72831cajournal Feb2023 28Document1 page72831cajournal Feb2023 28S M SHEKARNo ratings yet

- 72817cajournal Feb2023 14Document5 pages72817cajournal Feb2023 14S M SHEKARNo ratings yet

- 72828cajournal Feb2023 25Document6 pages72828cajournal Feb2023 25S M SHEKARNo ratings yet

- Cajournal Jan2023 3Document1 pageCajournal Jan2023 3S M SHEKARNo ratings yet

- GST Update Liquidated DamageDocument4 pagesGST Update Liquidated DamageDheeraj YadavNo ratings yet

- Cajournal March2023 4Document2 pagesCajournal March2023 4S M SHEKARNo ratings yet

- Cajournal March2023 3Document1 pageCajournal March2023 3S M SHEKARNo ratings yet

- 72827cajournal Feb2023 24Document1 page72827cajournal Feb2023 24S M SHEKARNo ratings yet

- 72813cajournal Feb2023 10Document17 pages72813cajournal Feb2023 10S M SHEKARNo ratings yet

- 72817cajournal Feb2023 14Document5 pages72817cajournal Feb2023 14S M SHEKARNo ratings yet

- 74977cajournal July2023 26Document2 pages74977cajournal July2023 26S M SHEKARNo ratings yet

- 72820cajournal Feb2023 17Document5 pages72820cajournal Feb2023 17S M SHEKARNo ratings yet

- 72815cajournal Feb2023 12Document5 pages72815cajournal Feb2023 12S M SHEKARNo ratings yet

- 72805cajournal Feb2023 2Document1 page72805cajournal Feb2023 2S M SHEKARNo ratings yet

- 72804cajournal Feb2023 1Document1 page72804cajournal Feb2023 1S M SHEKARNo ratings yet

- 74966cajournal July2023 15Document4 pages74966cajournal July2023 15S M SHEKARNo ratings yet

- 74955cajournal July2023 3Document1 page74955cajournal July2023 3S M SHEKARNo ratings yet

- 75361cajournal August2023 12Document8 pages75361cajournal August2023 12S M SHEKARNo ratings yet

- 74975cajournal July2023 24Document3 pages74975cajournal July2023 24S M SHEKARNo ratings yet

- 72806cajournal Feb2023 3Document1 page72806cajournal Feb2023 3S M SHEKARNo ratings yet

- 74964cajournal July2023 13Document4 pages74964cajournal July2023 13S M SHEKARNo ratings yet

- 74974cajournal July2023 23Document3 pages74974cajournal July2023 23S M SHEKARNo ratings yet

- 75358cajournal August2023 9Document3 pages75358cajournal August2023 9S M SHEKARNo ratings yet

- 76351cajournal Oct2023 25Document6 pages76351cajournal Oct2023 25S M SHEKARNo ratings yet

- 75356cajournal August2023 7Document1 page75356cajournal August2023 7S M SHEKARNo ratings yet

- 74957cajournal July2023 5Document4 pages74957cajournal July2023 5S M SHEKARNo ratings yet

- 74953cajournal July2023 1Document1 page74953cajournal July2023 1S M SHEKARNo ratings yet

- 76349cajournal Oct2023 23Document1 page76349cajournal Oct2023 23S M SHEKARNo ratings yet

- 76331cajournal Oct2023 5Document4 pages76331cajournal Oct2023 5S M SHEKARNo ratings yet

- Credit Card Application FormDocument19 pagesCredit Card Application FormTasneef ChowdhuryNo ratings yet

- Business Mathematics & Statistics (MTH 302)Document10 pagesBusiness Mathematics & Statistics (MTH 302)John WickNo ratings yet

- Percentage Completion Revenue RecognitionDocument31 pagesPercentage Completion Revenue RecognitionGigo Kafare BinoNo ratings yet

- Acc CH 3Document7 pagesAcc CH 3Tajudin Abba RagooNo ratings yet

- Syllabus Math InvestmentDocument8 pagesSyllabus Math InvestmentMphilipTNo ratings yet

- SAP Bills of ExchangeDocument9 pagesSAP Bills of ExchangeVijay RamNo ratings yet

- HVPNL Power Training Syllabus RevisionDocument27 pagesHVPNL Power Training Syllabus Revisionharsh11511151No ratings yet

- HDFC BankDocument18 pagesHDFC BankManthan Ashutosh MehtaNo ratings yet

- Hapter: Income TaxesDocument40 pagesHapter: Income TaxesGray JavierNo ratings yet

- Expanding The Indian Equities Market Through ETFsDocument62 pagesExpanding The Indian Equities Market Through ETFsdanielpolk100% (2)

- Budgetary Changes TrainingDocument2 pagesBudgetary Changes TrainingNoel ArenaNo ratings yet

- Disbursement Voucher PaymentDocument6 pagesDisbursement Voucher PaymentBhen Almodal100% (1)

- Act 553 Insurance Act 1996Document141 pagesAct 553 Insurance Act 1996Adam Haida & CoNo ratings yet

- Sana Oil Medical Clinic financial recordsDocument2 pagesSana Oil Medical Clinic financial recordsMharva Mae Ilagan LiwanagNo ratings yet

- Payment Instructions FormDocument1 pagePayment Instructions FormalfonsxxxNo ratings yet

- Fall of A Sea CliffDocument172 pagesFall of A Sea CliffAbhijeet DhakaneNo ratings yet

- Tumkur Grain Merchants CoDocument35 pagesTumkur Grain Merchants CoAnand Sk100% (1)

- Accounting for Construction Contracts Using Different MethodsDocument4 pagesAccounting for Construction Contracts Using Different MethodsMerliza JusayanNo ratings yet

- Cbwas 1Document7 pagesCbwas 1PFENo ratings yet

- Colgate Financial Model SolvedDocument36 pagesColgate Financial Model SolvedSundara MoorthyNo ratings yet

- Garcia, Almira C. 1. Prepare Journal Entries To Record The Foregoing Transactions For Branch Books Home OfficeDocument4 pagesGarcia, Almira C. 1. Prepare Journal Entries To Record The Foregoing Transactions For Branch Books Home Officealmira garciaNo ratings yet

- Resume of Ronaldperry1966Document2 pagesResume of Ronaldperry1966api-23836341No ratings yet

- Historycal of The Development Bank of SingaporeDocument3 pagesHistorycal of The Development Bank of SingaporeNur NasuhaNo ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- Introduction AlifDocument19 pagesIntroduction AlifNiaz AhmedNo ratings yet

- TDCT Accounts FSTDocument10 pagesTDCT Accounts FSTAlex ANo ratings yet

- Irda Regulation Policy HoldersDocument7 pagesIrda Regulation Policy HoldersANILNo ratings yet

- Corona Kavach Insurance BrochureDocument5 pagesCorona Kavach Insurance Brochurekishore2648No ratings yet