Professional Documents

Culture Documents

Principles of Taxation Law

Principles of Taxation Law

Uploaded by

Anita Mariya0 ratings0% found this document useful (0 votes)

8 views2 pagesThis document appears to be an exam for a B.B.A., LL.B. (Honours) degree course on Principles of Taxation Law. It contains 3 parts with multiple choice questions. Part I has 6 questions worth 5 marks each on topics like tax holidays, methods of taxation, the Indian Constitution's Seventh Schedule, and the difference between a tax and fee. Part II has 2 questions worth 10 marks each about the Central Board of Direct Taxes and a court case challenging entertainment tax rates. Part III has 2 questions worth 12.5 marks each about freedom of trade under the Indian Constitution, constitutional provisions on taxation, and the functions of Finance Commissions.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document appears to be an exam for a B.B.A., LL.B. (Honours) degree course on Principles of Taxation Law. It contains 3 parts with multiple choice questions. Part I has 6 questions worth 5 marks each on topics like tax holidays, methods of taxation, the Indian Constitution's Seventh Schedule, and the difference between a tax and fee. Part II has 2 questions worth 10 marks each about the Central Board of Direct Taxes and a court case challenging entertainment tax rates. Part III has 2 questions worth 12.5 marks each about freedom of trade under the Indian Constitution, constitutional provisions on taxation, and the functions of Finance Commissions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesPrinciples of Taxation Law

Principles of Taxation Law

Uploaded by

Anita MariyaThis document appears to be an exam for a B.B.A., LL.B. (Honours) degree course on Principles of Taxation Law. It contains 3 parts with multiple choice questions. Part I has 6 questions worth 5 marks each on topics like tax holidays, methods of taxation, the Indian Constitution's Seventh Schedule, and the difference between a tax and fee. Part II has 2 questions worth 10 marks each about the Central Board of Direct Taxes and a court case challenging entertainment tax rates. Part III has 2 questions worth 12.5 marks each about freedom of trade under the Indian Constitution, constitutional provisions on taxation, and the functions of Finance Commissions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

c 34A62

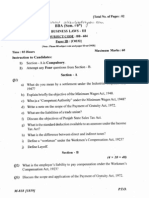

SE\IENTH SEMESTER B.B.A, LL.B. (HONOURS) DEGREE EXAMINATION

JUNE 2018

B.B.A., LL.ts.

CL 1g-PRINCIPLES OF TAXATION LAW

fime : Three Hours Maximum : 75 Marks

Part I

Answer d,ny six questions.

Each question carries 5 marks.

' 1. Write a note on'tax holiday'.

2. Explain regredsive method of taxation

3. Explain the relevance of the Seventh Sched.ule of Indian Constitution.

4. Examine Article 27 of Indian constitution uis-a-uis taxation.

5. Distinguish between {tax, and,fee,.

6. Write a note on Money Bill.

7. Examine the system of toration in Arthasasthra

8. Exav'''ine the merits and demerits of direct and indirect taxes.

(6x5=30marks)

Part II

Answer any two questions.

Each camies lO marhs.

1. Explain the functions of the Central Board of Direct Taxes (CBDT).

2. Compared to the entertainment tax levied on cinema theatres located in villages, a higher rate of

ta:r was levied on cinema theatres Iocated in metropolitan cities. IWs Crowl Cirr"*ui, a theatre

lgcated in a metropolitan city challenges this as violative of the right to equality guaranieed under

the Constitution of India. Decide.

3. Explain the four carurons of taxation enumerated by Adam smith.

(2 x 10 = 20 marks)

Part III

Answer any two questions.

Each carries L2.5 marks.

1. "Trade, cornmerce and intercourse throughout ttre territory of India shall be free,, (Article 801,

Constitution of India)-Elucidate

2. Examine the Indian Constitutional provisions relating to taxation

3. Examine ttre functions of Finance Commissions.

(2 x L2.5 = 25 marks)

You might also like

- Editable Share Certificate Template DownloadDocument1 pageEditable Share Certificate Template DownloadAmandeep Singh Manku74% (19)

- Syllabus of Professional Exam PDFDocument19 pagesSyllabus of Professional Exam PDFPareshNo ratings yet

- LNCS-Springer Copyright FormDocument2 pagesLNCS-Springer Copyright Formalfa20No ratings yet

- COI PyqDocument3 pagesCOI PyqAparna PandeyNo ratings yet

- Constitutional Law - II Question PapersDocument16 pagesConstitutional Law - II Question Papersnotreallyachanger1112No ratings yet

- 26 Business Regulations December 2019Document2 pages26 Business Regulations December 2019JustinNo ratings yet

- Business Laws-IIDocument2 pagesBusiness Laws-IIjasmit02kaurNo ratings yet

- Constitution of India Law and Engineering KNC 501 1Document1 pageConstitution of India Law and Engineering KNC 501 1ashwin tyagiNo ratings yet

- Mcn202 Constitution of India (FN), July 2021Document2 pagesMcn202 Constitution of India (FN), July 2021Radhakrishnan PuthalathNo ratings yet

- Btech NC 5 Sem Constitution of India Law and Engineering knc501 2022Document1 pageBtech NC 5 Sem Constitution of India Law and Engineering knc501 2022mohitsinghaks1234No ratings yet

- Bba 45Document2 pagesBba 45MariyaNo ratings yet

- Professional Ethics and Professional Accounting SystemDocument2 pagesProfessional Ethics and Professional Accounting SystemSahil KambojNo ratings yet

- 1st, 2nd & 3rd - Trimester-2018Document28 pages1st, 2nd & 3rd - Trimester-2018AbhinavNo ratings yet

- 906 Principles of Taxation LawDocument2 pages906 Principles of Taxation LawNidhi ZurmureNo ratings yet

- 4TH SEM NCBS-Administrative Law 2157Document1 page4TH SEM NCBS-Administrative Law 2157rahul muleNo ratings yet

- IPC Last Year PPRDocument6 pagesIPC Last Year PPRnamanNo ratings yet

- Dec 2008Document2 pagesDec 2008Muneendhar Reddy ANo ratings yet

- Civil Procedure CodeDocument3 pagesCivil Procedure CodeVansh SharmaNo ratings yet

- MCN202 ADocument2 pagesMCN202 ADr. J.HussainNo ratings yet

- Labour LawDocument2 pagesLabour Lawsalunkeakshay649No ratings yet

- Ba &bballb 4TH Sem 2023Document20 pagesBa &bballb 4TH Sem 2023tanaxep311No ratings yet

- LL B 6TH Sem 2023Document11 pagesLL B 6TH Sem 2023himanshu chhokraNo ratings yet

- D.T.L (2006 Pattern)Document14 pagesD.T.L (2006 Pattern)KuNdAn DeOrENo ratings yet

- Caribbean Legal Systems PP (Compilation)Document9 pagesCaribbean Legal Systems PP (Compilation)Marissa450% (1)

- Hidayatullah National Law University 2012Document8 pagesHidayatullah National Law University 2012Noel PannaNo ratings yet

- LL.B. III Term: Paper - LB - 3033 - Taxation-I (Income Tax)Document9 pagesLL.B. III Term: Paper - LB - 3033 - Taxation-I (Income Tax)Vishnu BajpaiNo ratings yet

- 6 TaxationDocument183 pages6 TaxationMehraan AhmedNo ratings yet

- 2 Ball.b Ii Sem PDFDocument8 pages2 Ball.b Ii Sem PDFALOK RAONo ratings yet

- B-I - Economics IDocument20 pagesB-I - Economics IANAND R. SALVENo ratings yet

- Banking QPDocument1 pageBanking QPPadmaja NaiduNo ratings yet

- Bcom 5 Sem Co Operative Legal System 21101660 Jul 2021Document2 pagesBcom 5 Sem Co Operative Legal System 21101660 Jul 2021Internet 223No ratings yet

- 10 Course Outlines Sem - VIII Law Relating To Customs & Customs TariffDocument3 pages10 Course Outlines Sem - VIII Law Relating To Customs & Customs TariffSarthak JainNo ratings yet

- Taxation Syllabus Law FacDocument183 pagesTaxation Syllabus Law FacVikram VermaNo ratings yet

- III Semester CSE & CSTDocument11 pagesIII Semester CSE & CSTSuthari AmbikaNo ratings yet

- LLB 2003Document60 pagesLLB 2003concast_pankajNo ratings yet

- Roll No : NOTE: Answer ALL QuestionsDocument4 pagesRoll No : NOTE: Answer ALL QuestionsAnonymous yPWi8p3KkANo ratings yet

- Business Legislation 2022-23Document1 pageBusiness Legislation 2022-23bhavneshbhayana12No ratings yet

- Ba9207 - Legal Aspects of Business June 2010Document2 pagesBa9207 - Legal Aspects of Business June 2010Mridula MNo ratings yet

- 2022 PDFDocument8 pages2022 PDFRiya NitharwalNo ratings yet

- MBA II Semester 2023 Question Paper - CompressedDocument18 pagesMBA II Semester 2023 Question Paper - Compressedcsoni7991No ratings yet

- Taxation LawDocument9 pagesTaxation LawAshish Singh0% (1)

- Law & Ethics (Cma-1) - Test Q.P (23.8.2022)Document3 pagesLaw & Ethics (Cma-1) - Test Q.P (23.8.2022)RajeshNo ratings yet

- Labour Laws-I End Term PYQDocument8 pagesLabour Laws-I End Term PYQSidhant SinghNo ratings yet

- QP End Term April 2012Document49 pagesQP End Term April 2012ChhatreshNo ratings yet

- 2023 Ballb End Term Sem 8Document26 pages2023 Ballb End Term Sem 8Anurag RaiNo ratings yet

- B.A.LL.B. V Sem.2015-16Document7 pagesB.A.LL.B. V Sem.2015-16Shubham RawatNo ratings yet

- MCN202 Constitution of India (An), July 2021Document2 pagesMCN202 Constitution of India (An), July 2021Adinath SNo ratings yet

- Interpretation of Statutes692 Gdwqs5KpVqDocument4 pagesInterpretation of Statutes692 Gdwqs5KpVqkrish bhatiaNo ratings yet

- LLB 2003Document79 pagesLLB 2003Umang AggarwalNo ratings yet

- Managerial Economics Financial Accountancy June July 2022 PDFDocument8 pagesManagerial Economics Financial Accountancy June July 2022 PDFblack mailNo ratings yet

- Mains 2023 Paper 4Document8 pagesMains 2023 Paper 4jecjabalpur9No ratings yet

- HRMG 430 2010Document2 pagesHRMG 430 2010hamdi mohamedNo ratings yet

- Jun16 MBL II 35282Document7 pagesJun16 MBL II 35282Shrikant BudholiaNo ratings yet

- LL.M. (Semester - I) Examination, 2011 Lw-101: Constitutional and Legal Order - I (New Course)Document63 pagesLL.M. (Semester - I) Examination, 2011 Lw-101: Constitutional and Legal Order - I (New Course)Lovely PrinceNo ratings yet

- BBA (Sern. LL 6'o) 0 Business Laws - Iit: M-818 FsselDocument2 pagesBBA (Sern. LL 6'o) 0 Business Laws - Iit: M-818 FsselJaspreet SinghNo ratings yet

- Managerial Economics Financial Analysis June July 2022Document8 pagesManagerial Economics Financial Analysis June July 2022Ashwik YadavNo ratings yet

- 2019 20 3 Ball.b Iii Sem 19 PDFDocument9 pages2019 20 3 Ball.b Iii Sem 19 PDFVinayak GuptaNo ratings yet

- 2018 19 3 Ball.b Iii Sem PDFDocument10 pages2018 19 3 Ball.b Iii Sem PDFVinayak GuptaNo ratings yet

- Labour Law Question Paper.Document1 pageLabour Law Question Paper.Harpreet KaurNo ratings yet

- After The Completion of English SolutionsDocument72 pagesAfter The Completion of English SolutionsHimangshu KalitaNo ratings yet

- AI-Powered Bitcoin Trading: Developing an Investment Strategy with Artificial IntelligenceFrom EverandAI-Powered Bitcoin Trading: Developing an Investment Strategy with Artificial IntelligenceNo ratings yet

- EAP - 1 FormDocument4 pagesEAP - 1 Formsaifan007No ratings yet

- Credit Trans Cases CompleteDocument505 pagesCredit Trans Cases CompleteFaye Michelle LadanNo ratings yet

- Motion To Suppress StatementsDocument45 pagesMotion To Suppress Statementsscoopstrillacci100% (1)

- Ang Ladlad vs. Comelec, G.R. No. 190582, April 8, 2010Document4 pagesAng Ladlad vs. Comelec, G.R. No. 190582, April 8, 2010Michelle CatadmanNo ratings yet

- Del Socorro v. Val Wilsem (G.R. No. 193707, December 10, 2014)Document2 pagesDel Socorro v. Val Wilsem (G.R. No. 193707, December 10, 2014)Ann ChanNo ratings yet

- The Philippine Health Information Network Executive OrderDocument3 pagesThe Philippine Health Information Network Executive OrderDavid RobertNo ratings yet

- Moorish American Consulate GRIDDocument1 pageMoorish American Consulate GRIDאלוהי לוֹחֶםNo ratings yet

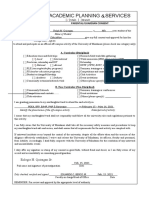

- Academic Planning Services: Main BranchDocument1 pageAcademic Planning Services: Main BranchDave RuizNo ratings yet

- Charitable Trusts Act 1957Document40 pagesCharitable Trusts Act 1957Thilak AtapattuNo ratings yet

- 001 - 2018 - 4 - B STUDY GUIDEDocument188 pages001 - 2018 - 4 - B STUDY GUIDECARONo ratings yet

- Complete Notes On CRPCDocument71 pagesComplete Notes On CRPCAfrasiab Hassan100% (1)

- Coast GuardDocument4 pagesCoast GuardほんやよいNo ratings yet

- You May Also Like..Document1 pageYou May Also Like..KhushiNo ratings yet

- Interphil Laboratories Employee Union v. Interphil Laboratories IncDocument4 pagesInterphil Laboratories Employee Union v. Interphil Laboratories Incmarie melanie BuenaventuraNo ratings yet

- Civil Procedure Q No 1. Write The Consequences Parties May Face Due To Nonappearance in The Court. Describe Available Remedy For ThemDocument14 pagesCivil Procedure Q No 1. Write The Consequences Parties May Face Due To Nonappearance in The Court. Describe Available Remedy For ThemGuser RazakNo ratings yet

- Sunio Vs NLRC DigestDocument1 pageSunio Vs NLRC DigestArthur John Garraton100% (1)

- Motion To RemandDocument13 pagesMotion To RemandCircuit Media100% (1)

- Nominated Subcontractors On International ProjectsDocument9 pagesNominated Subcontractors On International ProjectsChikwason Sarcozy MwanzaNo ratings yet

- DISEC-position PaperDocument3 pagesDISEC-position Papersana alsamanNo ratings yet

- Bar Questions Paras Bar QuestionDocument8 pagesBar Questions Paras Bar QuestionMizelle AloNo ratings yet

- Ignacio V AttyDocument2 pagesIgnacio V AttyEdith OliverosNo ratings yet

- Data Protection - Are We Prepared - Economic Laws Practice UpdatepdfDocument25 pagesData Protection - Are We Prepared - Economic Laws Practice UpdatepdfAnchit JassalNo ratings yet

- Poeple V Huang - Original PDFDocument10 pagesPoeple V Huang - Original PDFRst YuNo ratings yet

- Buenavista, MarinduqueDocument2 pagesBuenavista, MarinduqueSunStar Philippine NewsNo ratings yet

- Bit Mesra ApplicationDocument3 pagesBit Mesra ApplicationRajNo ratings yet

- AQUINO-v-ACOSTA - Crim2Document2 pagesAQUINO-v-ACOSTA - Crim2Ton SantosNo ratings yet

- Agusmin Promotional Enterprises V CADocument6 pagesAgusmin Promotional Enterprises V CABrian TomasNo ratings yet

- Eo RPRH LawDocument2 pagesEo RPRH LawSan Joaquin Norte Agoo100% (1)