Professional Documents

Culture Documents

Ey Aarsrapport 2021 22 22

Ey Aarsrapport 2021 22 22

Uploaded by

Ronald RunruilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ey Aarsrapport 2021 22 22

Ey Aarsrapport 2021 22 22

Uploaded by

Ronald RunruilCopyright:

Available Formats

On initial recognition, financial liabilities are recognised at fair Parent Company

value less transaction costs. Subsequently, financial liabilities The accounting policies applied in the parent company

are measured at amortised cost. financial statements deviate from the accounting policies

applied in the consolidated financial statements as described

Other payables are measured at amortised cost, which above in the following respects.

substantially corresponds to the nominal value.

Dividends from subsidiaries

Cash flow statement Distribution of retained earnings in subsidiaries is recognised

Cash flows from operating activities are calculated based on as income in the statement of comprehensive income in

the indirect method as profit/loss after tax adjusted for non- the year of declaration. Impairment tests are performed

cash operating items, changes in working capital, interest if dividend distributions exceed the given subsidiary’s

received and paid, dividends received and corporation tax comprehensive income for the period.

paid.

Tax for the year

Cash flows for investing activities comprise payments in The Parent Company is not an independent taxable entity,

connection with acquisitions and disposals of intangible and consequently, no provision for tax on the Parent

assets, property, plant and equipment and other non-current Company’s profit/loss is made in the annual report.

assets.

The Parent Company’s profit/loss is taxed at the Parent

Cash flows from financing activities comprise changes in the Company’s partners in accordance with applicable rules in

size or composition of the share capital and related costs Danish tax law.

as well as changes in balances with group entities and other

related parties, the raising of loans, repayment of interest- Equity investments in subsidiaries

bearing debt including lease liabilities, as well as payment of Equity investments in subsidiaries are measured at cost.

dividend to shareholders. In case of evidence of impairment, an impairment test is

conducted. In connection with the impairment test, the

Cash and cash equivalents comprise cash at bank and in subsidiary’s recoverable amount is calculated. Equity

hand. investments are written down to the lower of the carrying

amount and the recoverable amount. Impairment losses are

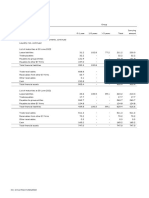

Financial ratios recognised in the statement of comprehensive income as

The financial ratios stated under “Financial highlights” have financial expenses.

been calculated as follows:

Impairment losses are reversed in so far as the assumptions

Current assets x 100 and estimates underlying the impairment losses have

Current ratio

Current liabilities changed.

Equity at year end x 100

Solvency ratio

Total liabilities at year end

Profit/loss for the year x 100

Return on equity

Average equity

22 | Annual Report 2021/2022

You might also like

- Kunci Jawaban Advance Accounting Chapter 3Document25 pagesKunci Jawaban Advance Accounting Chapter 3jiajia67% (6)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Slideworks - Consulting Toolkit - OVERVIEW-8Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-8Ronald RunruilNo ratings yet

- A. External Financial Reporting Decisions NotesDocument146 pagesA. External Financial Reporting Decisions Notesamitsinghslideshare100% (2)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Chapter 3 - 12thEDITIONDocument21 pagesChapter 3 - 12thEDITIONHyewon43% (7)

- Chp3 Advanced Acc Beams 11eDocument21 pagesChp3 Advanced Acc Beams 11eFelixNovendraNo ratings yet

- Raymart - Notes To FS 2018Document7 pagesRaymart - Notes To FS 2018gerald padua100% (3)

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Ey Aarsrapport 2021 22 21Document1 pageEy Aarsrapport 2021 22 21Ronald RunruilNo ratings yet

- Accounting For A PartnershipDocument2 pagesAccounting For A Partnershipdrin filesNo ratings yet

- Notes To Fs - SeDocument8 pagesNotes To Fs - SeMilds LadaoNo ratings yet

- 8.auditing Balance SheetDocument31 pages8.auditing Balance SheetHenok FikaduNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- Module 5Document7 pagesModule 5lilian.doan98No ratings yet

- What Is A Financial InstrumentDocument7 pagesWhat Is A Financial InstrumentNozimanga ChiroroNo ratings yet

- Notes To FS EncodingDocument11 pagesNotes To FS EncodingPappi JANo ratings yet

- Chapter 3Document28 pagesChapter 3Kibrom EmbzaNo ratings yet

- Holding Company AccountsDocument8 pagesHolding Company AccountsHasnain MahmoodNo ratings yet

- UBL Annual Report 2018-87Document1 pageUBL Annual Report 2018-87IFRS LabNo ratings yet

- Consolidated Financial Statements Indian GAAP Dec07Document15 pagesConsolidated Financial Statements Indian GAAP Dec07martynmvNo ratings yet

- Learning Outcome StatementsDocument3 pagesLearning Outcome StatementsGUTIERREZ, Ronalyn Y.No ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAbinash MishraNo ratings yet

- PPT-7 (Intercorporate Investments)Document61 pagesPPT-7 (Intercorporate Investments)Taniya GuptaNo ratings yet

- Reconciliation of Cost & Financial AccountsDocument13 pagesReconciliation of Cost & Financial AccountsRahulNo ratings yet

- Corporate Financial ReportingDocument18 pagesCorporate Financial ReportingHunairArshadNo ratings yet

- Accounting Policies BataDocument5 pagesAccounting Policies BataHarini SundarNo ratings yet

- Notes To Accounts CompanyDocument9 pagesNotes To Accounts CompanyMy NameNo ratings yet

- Bad Debts and Provision For Doubtful Debts Bad DebtsDocument28 pagesBad Debts and Provision For Doubtful Debts Bad DebtsAngel LawsonNo ratings yet

- Income Based Valuation - l3Document14 pagesIncome Based Valuation - l3Kristene Romarate DaelNo ratings yet

- Adjusting Entries HandoutsDocument12 pagesAdjusting Entries HandoutsKim Patrick VictoriaNo ratings yet

- The Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingDocument12 pagesThe Accounting Process: Adjusting The Accounts Cash Versus Accrual Basis of AccountingKim Patrick Victoria100% (1)

- Financial-Accounting-Analysis Dec2021Document11 pagesFinancial-Accounting-Analysis Dec2021Chief MaxNo ratings yet

- Summary Pointer Chapter 2 Advanced AccountingDocument6 pagesSummary Pointer Chapter 2 Advanced Accountingahmed arfanNo ratings yet

- Partnership FormationDocument32 pagesPartnership FormationLean Campo100% (1)

- Chapter 2Document6 pagesChapter 2bobby brownNo ratings yet

- Pertemuan 9BDocument36 pagesPertemuan 9Bleny aisyahNo ratings yet

- Assignment: Prepared For: Md. Sajib Hossain, CFA Assistant Professor Department of Finance University of DhakaDocument9 pagesAssignment: Prepared For: Md. Sajib Hossain, CFA Assistant Professor Department of Finance University of DhakaMd Ohidur RahmanNo ratings yet

- Ch03 Beams12ge SMDocument22 pagesCh03 Beams12ge SMWira Moki50% (2)

- FIN3702 SummaryDocument26 pagesFIN3702 SummaryQuentin SchwartzNo ratings yet

- Note On End of The YearDocument5 pagesNote On End of The YearojimawilliamsNo ratings yet

- Afar NotesDocument6 pagesAfar NotesGio BurburanNo ratings yet

- Adjustments of Final AccountsDocument11 pagesAdjustments of Final AccountsUmesh Gaikwad50% (10)

- Ia2 Current LiabilitiesDocument26 pagesIa2 Current LiabilitiesNicole Ann MercurioNo ratings yet

- Ilovepdf - Merged (Autosaved) - 1-20Document20 pagesIlovepdf - Merged (Autosaved) - 1-20Danny FarrukhNo ratings yet

- The Evocative Essential Oil and Scented Candles: 2.1 Basis of Preparation of Financial StatementsDocument12 pagesThe Evocative Essential Oil and Scented Candles: 2.1 Basis of Preparation of Financial StatementsExequiel AmbasingNo ratings yet

- Adjustments of Final AccountsDocument5 pagesAdjustments of Final AccountsKashif KhanNo ratings yet

- Special Accounting ConsiderationsDocument9 pagesSpecial Accounting ConsiderationsIvy Claire SemenianoNo ratings yet

- Module 3 Partnership OperationsDocument17 pagesModule 3 Partnership OperationsClaire CastrenceNo ratings yet

- 1 IFRS 9 - Financial InstrumentsDocument31 pages1 IFRS 9 - Financial InstrumentsSharmaineMirandaNo ratings yet

- Cost of Capital: Financial Management ProjectDocument10 pagesCost of Capital: Financial Management ProjectMoinak DasNo ratings yet

- Lecture Note-Foreign SubsidiaryDocument10 pagesLecture Note-Foreign Subsidiaryptnyagortey91No ratings yet

- Assignment 2: Measuring and Reporting Assets and LiabilitiesDocument9 pagesAssignment 2: Measuring and Reporting Assets and LiabilitiesDerek DalgadoNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Ey Aarsrapport 2021 22 40Document1 pageEy Aarsrapport 2021 22 40Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 14Document1 pageEy Aarsrapport 2021 22 14Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 38Document1 pageEy Aarsrapport 2021 22 38Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 39Document1 pageEy Aarsrapport 2021 22 39Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 11Document1 pageEy Aarsrapport 2021 22 11Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 35Document1 pageEy Aarsrapport 2021 22 35Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 36Document1 pageEy Aarsrapport 2021 22 36Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 37Document1 pageEy Aarsrapport 2021 22 37Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 13Document1 pageEy Aarsrapport 2021 22 13Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 7Document1 pageEy Aarsrapport 2021 22 7Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 9Document1 pageEy Aarsrapport 2021 22 9Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 10Document1 pageEy Aarsrapport 2021 22 10Ronald RunruilNo ratings yet

- Brand Plan Workshop 8Document1 pageBrand Plan Workshop 8Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 8Document1 pageEy Aarsrapport 2021 22 8Ronald RunruilNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-45Document1 page(ES) +Mr+Jeff +Business+in+a+Box-45Ronald RunruilNo ratings yet

- Brand Plan Workshop 2Document1 pageBrand Plan Workshop 2Ronald RunruilNo ratings yet

- Brand Plan Workshop 4Document1 pageBrand Plan Workshop 4Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-5Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-5Ronald RunruilNo ratings yet

- (ES) +Mr+Jeff +Business+in+a+Box-1Document1 page(ES) +Mr+Jeff +Business+in+a+Box-1Ronald RunruilNo ratings yet

- BrandVal JBM10Document37 pagesBrandVal JBM10Ronald RunruilNo ratings yet

- Slideworks - Consulting Toolkit - OVERVIEW-4Document1 pageSlideworks - Consulting Toolkit - OVERVIEW-4Ronald RunruilNo ratings yet

- Academic Workbook Meddent v1.3 1Document52 pagesAcademic Workbook Meddent v1.3 1Ronald RunruilNo ratings yet

- BrandVal JBM10Document38 pagesBrandVal JBM10Ronald RunruilNo ratings yet

- BPTECHENDocument2 pagesBPTECHENRonald RunruilNo ratings yet

- Workbook User Guide en 2023Document27 pagesWorkbook User Guide en 2023Ronald RunruilNo ratings yet

- Accountancy 12 English Main PDFDocument173 pagesAccountancy 12 English Main PDFAshu SinghNo ratings yet

- Exercise Assignment Qstns FADocument3 pagesExercise Assignment Qstns FAdiveshNo ratings yet

- Activity 2 - 4B UpdatesDocument3 pagesActivity 2 - 4B UpdatesAngelo HilomaNo ratings yet

- MNRC Memorandum Circular No 2 Series of 2020Document33 pagesMNRC Memorandum Circular No 2 Series of 2020legworxcaNo ratings yet

- Manufacturing Accounts: Igcse - 2020 - Accounting (9-1) - Mahdi SamdaniDocument4 pagesManufacturing Accounts: Igcse - 2020 - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- 0452 w06 Ms 2Document8 pages0452 w06 Ms 2Osama SalamaNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- TBCH 09Document39 pagesTBCH 09Tornike JashiNo ratings yet

- Financial Analysis & Planning - ICAI Study Material PDFDocument80 pagesFinancial Analysis & Planning - ICAI Study Material PDFShivani GuptaNo ratings yet

- Statement of Cash FlowsDocument38 pagesStatement of Cash FlowsspringzingNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument35 pagesFinancial Statement Analysis: K R Subramanyam John J WildSeven seasNo ratings yet

- Financial Accounting and Reporting - Volume 1A Financial Accounting and Reporting - Volume 1ADocument62 pagesFinancial Accounting and Reporting - Volume 1A Financial Accounting and Reporting - Volume 1AKaren CaelNo ratings yet

- Besi o Nikki Rose A. Presentation of FSDocument29 pagesBesi o Nikki Rose A. Presentation of FSBrod Lee SantosNo ratings yet

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Document6 pagesAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNo ratings yet

- Financial Planning Part 2Document33 pagesFinancial Planning Part 2Carlsberg AndresNo ratings yet

- Term - I MCQ Base QuestionDocument41 pagesTerm - I MCQ Base QuestionKadam Kartikesh100% (3)

- Ricy Annual Report 2014Document118 pagesRicy Annual Report 2014Farida SetiawatiNo ratings yet

- Credit 5Document7 pagesCredit 5Maria SyNo ratings yet

- Full Report Ubs Group Ag Consolidated 3q23Document120 pagesFull Report Ubs Group Ag Consolidated 3q23José Guilherme MeloNo ratings yet

- CH 14Document39 pagesCH 14Iris MaNo ratings yet

- MANACCDocument12 pagesMANACCAllan Patrick AlsimNo ratings yet

- JEMPER (Jurnal Ekonomi Manajemen Perbankan) : Pengaruh Net Profit Margin, Return On Pertumbuhan LabaDocument14 pagesJEMPER (Jurnal Ekonomi Manajemen Perbankan) : Pengaruh Net Profit Margin, Return On Pertumbuhan LabaNasrul JamilNo ratings yet

- VerificationDocument34 pagesVerificationkiran malukaniNo ratings yet

- The Accounting Equation and The Double Entry SystemDocument41 pagesThe Accounting Equation and The Double Entry SystemVictorino LopezNo ratings yet

- Chapter 23 - Working Capital Management - General IssuesDocument86 pagesChapter 23 - Working Capital Management - General IssuesKamal Singh ChouhanNo ratings yet

- Do It! 2: Accounting Principles (1) First GradeDocument4 pagesDo It! 2: Accounting Principles (1) First GradeAmer Wagdy GergesNo ratings yet

- Accounting For Merchandising OperationsDocument53 pagesAccounting For Merchandising OperationsTanvirNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- Practical Accounting 2 SIR SALVADocument243 pagesPractical Accounting 2 SIR SALVAVirgo CruzNo ratings yet