Professional Documents

Culture Documents

Macroeconomics Canadian 15th Edition Blanchard Solutions Manual

Uploaded by

drusilladaisyvlz9aCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macroeconomics Canadian 15th Edition Blanchard Solutions Manual

Uploaded by

drusilladaisyvlz9aCopyright:

Available Formats

Macroeconomics Canadian 15th Edition

Blanchard Solutions Manual

Visit to download the full and correct content document: https://testbankdeal.com/dow

nload/macroeconomics-canadian-15th-edition-blanchard-solutions-manual/

Chapter 7

The Goods Market in an Open Economy

1. True/False/Uncertain

a. Uncertain – they simply reflect high domestic demand. Increases in domestic demand

could be from investment, government spending or consumption.

b. Uncertain or true – looser fiscal policy, all else equal, is usually associated with an

increase in the trade deficit.

c. False.

d. False.

e. True.

f. True.

g. False

2. Real Exchange Rates and The Balance of Trade

a. ε =EP*/P. Apply proposition 8 to (EP*)/P and then proposition 7 to (EP*).

b. If ∆P/P > ∆P*/P* and ∆E/E = 0, then ∆ε/ε <0, then the real exchange rate is decreasing

(appreciating from the point of view of the domestic country) over time. Given the

Marshall-Lerner condition, this implies net exports are falling. The price of domestic

goods is rising faster than the price of foreign goods, while the exchange rate is constant.

As domestic goods are becoming more expensive than foreign goods, consumers in both

countries shift their purchases away from goods in the high-inflation country to the low-

inflation one.

3. Coordination and Fiscal Policy

a. Y = C + I + G + X – Q = 20 + 0.8*(Y - 10) + G + 0.3Y*- 0.3Y

Y = [1/(1 - .8 + .3)](12 + G + 0.3Y*) = 2*(12 + G + 0.3Y*) = 44 + 0.6Y*

The multiplier is 2 (=1/(1-.8+.3)) when foreign output is fixed. The closed economy

multiplier is 5 (=1/.5). It differs from the open economy multiplier because, in the open

economy, only some of an increase demand falls on domestic goods.

b. Since the countries are identical, Y=Y*=110. Taking into account the endogeneity of

foreign income, the multiplier equals [1/(1-0.8 -0.3*0.6 +0.3)]=3.125. The multiplier is

higher than the open economy multiplier in part (a) because it takes into account the fact

that an increase in domestic income leads to an increase in foreign income (as a result of

Copyright © 2015 Pearson Canada Inc.

7-1

Macroeconomics, Fifth Canadian Edition

Instructor’s Solutions Manual

an increase in domestic imports of foreign goods). The increase in foreign income leads

to an increase in domestic exports.

c. If Y=125, then foreign output Y*= 44+0.6*125=119. Using these two facts and

the equation Y = 2(12+G+0.3Y*) yields: 125 = 24+2G+0.6*(119). Solving for G

gives G=14.8. In the domestic country, NX = 0.3*(119)-0.3*(125) = -1.8; T-G =

10-14.8=-4.8. In the foreign country, NX*=1.8; T*-G*=0.

d. If Y=Y*=125, then we have: 125=24+2G+0.6*(125), which implies G=G*=13.

In both countries, net exports are zero, but the budget deficit has increased by 3.

e. In part, fiscal coordination is difficult to achieve because of the benefits of doing

nothing, as indicated from part (c).

4. A U.S. Recession and the Canadian Economy

a. The share of US spending on Canadian goods relative to Canadian GDP is

(0.8)(0.40)=32% of Canadian GDP.

b. A 5% decline in US GDP would be about a 0.5% decline in US imports which

corresponds to 0.16% of Canadian GDP.

c. If exports to all countries fell by 5%, this would reduce Canadian exports by 1.8%

of Canadian GDP, with a multiplier of 2, Canadian GDP would fall by 3.6%,

d. This is a pretty fair characterization of the Canadian economy. The US demand

for our exports is 32% of our GDP. That is big.

5 Dynamics of a Depreciation

a. Initially, net exports and output fall.

b. After six months, net exports and output increase.

6. Export Ratios

Answers will vary.

Copyright © 2015 Pearson Canada Inc.

7-2

You might also like

- Macroeconomics 7th Edition Mankiw Test BankDocument11 pagesMacroeconomics 7th Edition Mankiw Test Bankodetteisoldedfe100% (27)

- Macroeconomics Canadian 1st Edition Hubbard Solutions ManualDocument20 pagesMacroeconomics Canadian 1st Edition Hubbard Solutions Manualmabelleonardn75s2100% (28)

- Macroeconomics Canadian 2nd Edition Hubbard Test BankDocument94 pagesMacroeconomics Canadian 2nd Edition Hubbard Test Bankspadeoctoate.nhur1100% (22)

- Macroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDocument42 pagesMacroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test Bankberthaluyenkaq9w100% (21)

- Econ Macro Canadian 1st Edition Mceachern Solutions ManualDocument8 pagesEcon Macro Canadian 1st Edition Mceachern Solutions Manualkathleenjonesswzrqcmkex100% (15)

- Macroeconomics For Today 8th Edition Tucker Test BankDocument46 pagesMacroeconomics For Today 8th Edition Tucker Test Bankmabelleonardn75s2100% (26)

- Nutrition For Healthy Living 3rd Edition Schiff Test BankDocument34 pagesNutrition For Healthy Living 3rd Edition Schiff Test Banknancyruizftycjqbnip100% (29)

- Management of Occupational Health and Safety Canadian 7th Edition Kelloway Solutions ManualDocument12 pagesManagement of Occupational Health and Safety Canadian 7th Edition Kelloway Solutions Manualnhattranel7k1100% (26)

- Macroeconomics 4th Edition Krugman 1464110379 9781464110375 Solution ManualDocument25 pagesMacroeconomics 4th Edition Krugman 1464110379 9781464110375 Solution Manualmichaelwhiteixkomfjedz100% (22)

- Macroeconomics Canada in The Global Environment 10th Edition Parkin Test BankDocument35 pagesMacroeconomics Canada in The Global Environment 10th Edition Parkin Test Bankberthaluyenkaq9w100% (32)

- Macroeconomics Australia 7th Edition Mctaggart Solutions ManualDocument17 pagesMacroeconomics Australia 7th Edition Mctaggart Solutions Manualdencuongpow5100% (22)

- Macroeconomics Canadian 15th Edition Ragan Solutions ManualDocument13 pagesMacroeconomics Canadian 15th Edition Ragan Solutions Manualmabelleonardn75s2100% (30)

- Macroeconomics Principles Applications and Tools 9th Edition Osullivan Solutions ManualDocument9 pagesMacroeconomics Principles Applications and Tools 9th Edition Osullivan Solutions Manualspadeoctoate.nhur1100% (19)

- Full Download Advanced Accounting 12th Edition Hoyle Solutions ManualDocument35 pagesFull Download Advanced Accounting 12th Edition Hoyle Solutions Manualrojeroissy2232s100% (32)

- Essentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test BankDocument28 pagesEssentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test Bankdipolarramenta7uyxw100% (19)

- Macroeconomics 11th Edition Gordon Test BankDocument37 pagesMacroeconomics 11th Edition Gordon Test Bankmarthayen44da100% (33)

- International Economics 9th Edition Krugman Test Bank DownloadDocument20 pagesInternational Economics 9th Edition Krugman Test Bank Downloadodiletoanhyx2p3100% (29)

- Operations Management 1st Edition Cachon Solutions ManualDocument11 pagesOperations Management 1st Edition Cachon Solutions Manualeiranguyenrd8t100% (20)

- Cosmic Perspective 7th Edition Bennett Solutions ManualDocument14 pagesCosmic Perspective 7th Edition Bennett Solutions Manualparol.ainom70sd8100% (21)

- E Commerce 2017 13th Edition Laudon Test BankDocument26 pagesE Commerce 2017 13th Edition Laudon Test Bankexoynambuj7100% (31)

- Ecology Canadian 4th Edition Molles Test BankDocument10 pagesEcology Canadian 4th Edition Molles Test Banksahebmostwhatgr91100% (27)

- Managerial Economics 8th Edition Samuelson Test BankDocument22 pagesManagerial Economics 8th Edition Samuelson Test Bankstarfishcomposero5cglt100% (28)

- Management Accounting Canadian 6th Edition Horngren Solutions ManualDocument30 pagesManagement Accounting Canadian 6th Edition Horngren Solutions Manualeliasvykh6in8100% (30)

- Advertising and Imc Principles and Practice 10th Edition Moriarty Test BankDocument41 pagesAdvertising and Imc Principles and Practice 10th Edition Moriarty Test Bankquyenthamrww6100% (29)

- Principles of Cost Accounting 16th Edition Vanderbeck Test BankDocument49 pagesPrinciples of Cost Accounting 16th Edition Vanderbeck Test Bankbeckhamkhanhrkjxsk100% (24)

- Macroeconomics Canadian 14th Edition Mcconnell Test BankDocument25 pagesMacroeconomics Canadian 14th Edition Mcconnell Test BankMadisonKirbyeqko100% (49)

- Lone Star Politics Tradition and Transformation in Texas 5th Edition Collier Test BankDocument18 pagesLone Star Politics Tradition and Transformation in Texas 5th Edition Collier Test Bankgiangdoankqb1rc100% (32)

- Intermediate Accounting 12th Edition Kieso Test BankDocument31 pagesIntermediate Accounting 12th Edition Kieso Test Bankesperanzatrinhybziv100% (38)

- Macroeconomics Canadian 2nd Edition Hubbard Solutions ManualDocument26 pagesMacroeconomics Canadian 2nd Edition Hubbard Solutions ManualStephenChavezgkze100% (55)

- Management Global 13th Edition Robins Solutions ManualDocument13 pagesManagement Global 13th Edition Robins Solutions Manuallionelthitga2100% (20)

- Management Accounting Canadian 6th Edition Horngren Test BankDocument28 pagesManagement Accounting Canadian 6th Edition Horngren Test Bankphelimletitiaioxb0100% (30)

- Maders Understanding Human Anatomy and Physiology 8th Edition Susannah Nelson Longenbaker Test BankDocument57 pagesMaders Understanding Human Anatomy and Physiology 8th Edition Susannah Nelson Longenbaker Test Bankletitiahypatiawf76100% (21)

- Principles of Cost Accounting 17th Edition Vanderbeck Test BankDocument40 pagesPrinciples of Cost Accounting 17th Edition Vanderbeck Test Bankrandallperrykdepbtozqf100% (32)

- E Commerce 2018 14th Edition Laudon Test BankDocument25 pagesE Commerce 2018 14th Edition Laudon Test Bankhaodienb6qj100% (32)

- Macroeconomics Principles Applications and Tools 8th Edition Osullivan Test BankDocument40 pagesMacroeconomics Principles Applications and Tools 8th Edition Osullivan Test Banknhanselinak9wr16100% (21)

- Macroeconomics 11th Edition Arnold Test BankDocument32 pagesMacroeconomics 11th Edition Arnold Test Banklouisbeatrixzk9u100% (32)

- Solution Manual For Stats Modeling The World 4th Edition Bock Velleman Veaux 0321854012 9780321854018Document36 pagesSolution Manual For Stats Modeling The World 4th Edition Bock Velleman Veaux 0321854012 9780321854018brendamcdanielrjinxqtdwp100% (23)

- Test Bank For Environmental Geology 9th Edition by Montgomery Full DownloadDocument10 pagesTest Bank For Environmental Geology 9th Edition by Montgomery Full Downloadlaurarichardson09021986rnq100% (23)

- Principles of Economics 12th Edition Case Solutions ManualDocument14 pagesPrinciples of Economics 12th Edition Case Solutions Manualbrainykabassoullw100% (23)

- Economics of Social Issues 20th Edition Sharp Solutions ManualDocument7 pagesEconomics of Social Issues 20th Edition Sharp Solutions Manualemilyreynoldsopctfdbjie100% (22)

- Business and Society Ethics Sustainability and Stakeholder Management 8th Edition Carroll Solutions ManualDocument8 pagesBusiness and Society Ethics Sustainability and Stakeholder Management 8th Edition Carroll Solutions Manualmichelenguyendqjfcwarkn100% (26)

- Business Law 9th Edition Cheeseman Test BankDocument26 pagesBusiness Law 9th Edition Cheeseman Test Bankambuscadobrakyquqn100% (29)

- Macroeconomics For Today 8th Edition Tucker Solutions ManualDocument7 pagesMacroeconomics For Today 8th Edition Tucker Solutions Manualjerryholdengewmqtspaj100% (33)

- Human Relations in Organizations Applications and Skill Building 10th Edition Lussier Test BankDocument49 pagesHuman Relations in Organizations Applications and Skill Building 10th Edition Lussier Test Banklagantrongcnswd100% (24)

- Managing Supply Chain and Operations An Integrative Approach 1st Edition Foster Solutions ManualDocument7 pagesManaging Supply Chain and Operations An Integrative Approach 1st Edition Foster Solutions Manualreumetampoeqnb100% (34)

- Life Span Development A Topical Approach 3rd Edition Feldman Test BankDocument39 pagesLife Span Development A Topical Approach 3rd Edition Feldman Test Banksray4y100% (14)

- Multinational Financial Management 10th Edition Shapiro Test BankDocument8 pagesMultinational Financial Management 10th Edition Shapiro Test Bankletitiahypatiaxjhv100% (31)

- Prescotts Microbiology 9th Edition Willey Test BankDocument31 pagesPrescotts Microbiology 9th Edition Willey Test Bankorborneuyeno5bdvx100% (27)

- Essentials of Management Information Systems 10th Edition Laudon Solutions ManualDocument26 pagesEssentials of Management Information Systems 10th Edition Laudon Solutions Manualmantlingunturnedggxqaz100% (23)

- Living in The Environment 17th Edition Miller Test BankDocument21 pagesLiving in The Environment 17th Edition Miller Test Bankkerenzajoshuapqpt100% (30)

- Local Anesthesia For The Dental Hygienist 1st Edition Logothetis Test BankDocument9 pagesLocal Anesthesia For The Dental Hygienist 1st Edition Logothetis Test Bankamandatrangyxogy100% (29)

- Developing Person Through The Life Span 10th Edition Berger Test BankDocument24 pagesDeveloping Person Through The Life Span 10th Edition Berger Test BankMichaelRobertskneda100% (22)

- International Financial Management Canadian Canadian 3rd Edition Brean Test BankDocument16 pagesInternational Financial Management Canadian Canadian 3rd Edition Brean Test Bankscathreddour.ovzp100% (16)

- Understanding Social Problems Canadian 5th Edition Holmes Test BankDocument32 pagesUnderstanding Social Problems Canadian 5th Edition Holmes Test Bankkieueugene55ec6100% (25)

- Essentials of Abnormal Psychology 8th Edition Durand Test BankDocument24 pagesEssentials of Abnormal Psychology 8th Edition Durand Test Bankthenarkaraismfq9cn100% (28)

- Management 10th Edition Daft Test BankDocument34 pagesManagement 10th Edition Daft Test Bankpatrickpandoradb6i100% (26)

- Majority Minority Relations Census Update 6th Edition Farley Test BankDocument8 pagesMajority Minority Relations Census Update 6th Edition Farley Test Bankphelimletitiaioxb0100% (33)

- Macroeconomics 15th Edition Mcconnell Test BankDocument21 pagesMacroeconomics 15th Edition Mcconnell Test Bankodetteisoldedfe100% (30)

- Macroeconomics Canadian 5th Edition Blanchard Solutions ManualDocument4 pagesMacroeconomics Canadian 5th Edition Blanchard Solutions Manualstarfishcomposero5cglt100% (24)

- Macroeconomics Canadian 4th Edition Blanchard Solutions ManualDocument13 pagesMacroeconomics Canadian 4th Edition Blanchard Solutions Manualiradelahay921100% (16)

- Instant Download Macroeconomics 13th Edition Parkin Test Bank PDF Full ChapterDocument32 pagesInstant Download Macroeconomics 13th Edition Parkin Test Bank PDF Full Chapterdrusilladaisyvlz9a100% (9)

- Instant Download Macroeconomics 12th Edition Gordon Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Macroeconomics 12th Edition Gordon Solutions Manual PDF Full Chapterdrusilladaisyvlz9a100% (8)

- Instant Download Macroeconomics 12th Edition Michael Parkin Test Bank PDF Full ChapterDocument33 pagesInstant Download Macroeconomics 12th Edition Michael Parkin Test Bank PDF Full Chapterdrusilladaisyvlz9a100% (6)

- Instant Download Macroeconomics 12th Edition Arnold Test Bank PDF Full ChapterDocument21 pagesInstant Download Macroeconomics 12th Edition Arnold Test Bank PDF Full Chapterdrusilladaisyvlz9a100% (6)

- Project Management in Practice 4th Edition Mantel Test BankDocument35 pagesProject Management in Practice 4th Edition Mantel Test Bankmarcevansogujvs100% (26)

- Maders Understanding Human Anatomy and Physiology 9th Edition Longenbaker Test BankDocument59 pagesMaders Understanding Human Anatomy and Physiology 9th Edition Longenbaker Test Bankjohnnavarronpisaoyzcx100% (28)

- Making The Team A Guide For Managers 6th Edition Thompson Test BankDocument14 pagesMaking The Team A Guide For Managers 6th Edition Thompson Test Bankdrusilladaisyvlz9a100% (20)

- Macroeconomics Understanding The Global Economy 3rd Edition Miles Solutions ManualDocument9 pagesMacroeconomics Understanding The Global Economy 3rd Edition Miles Solutions Manualdrusilladaisyvlz9a100% (22)

- Macroeconomics Principles and Practice Australian 2nd Edition Littleboy Solutions ManualDocument6 pagesMacroeconomics Principles and Practice Australian 2nd Edition Littleboy Solutions Manualdrusilladaisyvlz9a100% (30)

- Macroeconomics Canadian 3rd Edition Krugman Solutions ManualDocument15 pagesMacroeconomics Canadian 3rd Edition Krugman Solutions Manualdrusilladaisyvlz9a100% (21)

- Macroeconomics Canadian 5th Edition Mankiw Solutions ManualDocument15 pagesMacroeconomics Canadian 5th Edition Mankiw Solutions Manualdrusilladaisyvlz9a100% (19)

- Macroeconomics Australia in The Global Environment Australian 1st Edition Parkin Solutions ManualDocument13 pagesMacroeconomics Australia in The Global Environment Australian 1st Edition Parkin Solutions Manualdrusilladaisyvlz9a100% (24)

- Macroeconomics Canada in The Global Environment 10th Edition Parkin Solutions ManualDocument11 pagesMacroeconomics Canada in The Global Environment 10th Edition Parkin Solutions Manualdrusilladaisyvlz9a100% (13)

- Approved 17.8.2020.cucspa - Contract General Terms For Copper CathodeDocument20 pagesApproved 17.8.2020.cucspa - Contract General Terms For Copper CathodeGervais AhoureNo ratings yet

- Mistakes I Made With MoneyDocument28 pagesMistakes I Made With Moneysgdgtf100% (1)

- Ibs Kulim 1 31/03/23 Megaviknan A/L Arumugam No 1137, Lorong 10/3A, Taman Kenari KULIM, 09000, KEDAH, MYS 152031-838533Document3 pagesIbs Kulim 1 31/03/23 Megaviknan A/L Arumugam No 1137, Lorong 10/3A, Taman Kenari KULIM, 09000, KEDAH, MYS 152031-838533Megaviknan35 ArumugamNo ratings yet

- Gate - Movements Report - 2020 10 09 - 07 59 58 EDTDocument210 pagesGate - Movements Report - 2020 10 09 - 07 59 58 EDTAnderson VieiraNo ratings yet

- 12th Balance of Payment MCQsDocument41 pages12th Balance of Payment MCQsrimjhim sahuNo ratings yet

- Unit 1 Ib MCQDocument31 pagesUnit 1 Ib MCQHemant Deshmukh100% (2)

- Ms. Tasneem Bareen HasanDocument13 pagesMs. Tasneem Bareen HasanMahin TabassumNo ratings yet

- Chapter 04Document38 pagesChapter 04dimren20No ratings yet

- Detailed Statement: Transactions List - HI-TECH INDUSTRIAL SERVICE (INR) - 721605500022Document3 pagesDetailed Statement: Transactions List - HI-TECH INDUSTRIAL SERVICE (INR) - 721605500022Anand shuklaNo ratings yet

- Soft Currency Economics II Warren MoslerDocument69 pagesSoft Currency Economics II Warren MoslerBijou Smith100% (1)

- Icse Class 10: MathematicsDocument6 pagesIcse Class 10: MathematicsJaldi bolNo ratings yet

- Chapter 13 Capital Investment DecisionsDocument28 pagesChapter 13 Capital Investment Decisionsmuhammad alfariziNo ratings yet

- Improving Cycle Time Using Value Stream Mapping inDocument12 pagesImproving Cycle Time Using Value Stream Mapping indanuNo ratings yet

- Forex Gains and Losses Notes 2020Document46 pagesForex Gains and Losses Notes 2020chelasimunyolaNo ratings yet

- Fixed Exchange RateDocument7 pagesFixed Exchange RateGlenNo ratings yet

- Global Occupational Safety and Health Management HandbookDocument359 pagesGlobal Occupational Safety and Health Management HandbookKay AayNo ratings yet

- Theory of DistributionDocument37 pagesTheory of DistributionGETinTOthE SySteMNo ratings yet

- ShubakanthDocument1 pageShubakanthshubakanthNo ratings yet

- LC Guptha Committee On DerivativesDocument2 pagesLC Guptha Committee On DerivativesGopalRavi100% (1)

- Ficha 3Document3 pagesFicha 3Elsa MachadoNo ratings yet

- Ex 400-1 1ST BLDocument1 pageEx 400-1 1ST BLkeralainternationalNo ratings yet

- Class Notes Capital Rationing Sir Saud Tariq ST AcademyDocument13 pagesClass Notes Capital Rationing Sir Saud Tariq ST AcademyAhmed NisarNo ratings yet

- Basics of Financial ManagementDocument48 pagesBasics of Financial ManagementAntónio João Lacerda Vieira100% (1)

- AFSIC Marketing Brochure 2023Document17 pagesAFSIC Marketing Brochure 2023Memory Shonge RutsitoNo ratings yet

- Secretarial AuditDocument77 pagesSecretarial Auditdkdinesh100% (1)

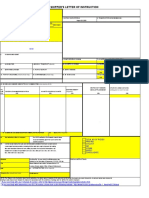

- Shipper's Letter of Instruction FormatDocument1 pageShipper's Letter of Instruction FormatMohanaNo ratings yet

- International Trade AssignmentDocument10 pagesInternational Trade AssignmentSaif RahmanNo ratings yet

- The Horde How The Mongols Changed The World by Marie FavereauDocument490 pagesThe Horde How The Mongols Changed The World by Marie FavereauLucianutte SartoNo ratings yet

- The Effects of Globalization On Procurement A Case of Nakumatt Holdings Kenya LTDDocument88 pagesThe Effects of Globalization On Procurement A Case of Nakumatt Holdings Kenya LTDadam mikidadi hijaNo ratings yet

- Ch-8 Investing Decision Capital BudgetingDocument58 pagesCh-8 Investing Decision Capital BudgetingAbdela AyalewNo ratings yet