Professional Documents

Culture Documents

New Tax Rates

Uploaded by

SIVAKUMAROriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Tax Rates

Uploaded by

SIVAKUMARCopyright:

Available Formats

Winman CA-ERP

New feature

Improvements

Minor improvements are made in the software.

New Features

Feature - Previous Release

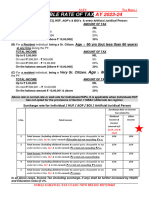

AY 2024-25 computation (as on 23-Nov-23)

AY 24-25 version is now released and software is updated incorporating all the necessary changes.

Key Changes:

Taxation u/s 115BAC is made If Total income is up to Rs. 300,000 - 0%

default Tax regime and tax rates

rate are Rs.3,00,001 to Rs.6,00,000

Rs. - 5%

Rs.6,00,001 to Rs.9,00,000

Rs. - 10%

changed:

Rs.9,00,001 to Rs.12,00,000

Rs. - 15%

Rs.12,00,001 to Rs.15,00,000

Rs - 20%

Above Rs.15,00,000 - 30%

Surcharge rate changes In case of taxation u/s 115BAC,, if Total income (excluding

dividend income/ income u/s 111A, 112 & 112A) exceeds Rs. 2

crore, Surcharge rate is 25%.

New Tax regime u/s 115BAE Applicable for co-operative society regd. on or after 1-Apr-23

1 &

commenced manufacturing within 31-Mar--24.

Tax rate: 15%

Surcharge: 10% irrespective of Income limit

This option can be selected in ‘Tax rate’ row in ‘IT Computation’

window.

Rebate u/s 87A In case of taxation u/s 115BAC, increased the income limit for

Rebate u/s 87A to Rs. 7 lakh and amount of rebate up to Rs.25,000.

Further, benefit of marginal relief is also available where income

exceeds Rs.7 lakh.

Presumptive business u/s 44AD / Turnover limit increased to amount mentioned below, if Receipts in

44ADA Cash & non-a/c payee modes do not exceed 5% of Total Receipts:

- u/s 44AD - Rs.3 crore

- u/s 44ADA - Rs. 75 lakh

STCG - New asset type New list item 'Market linked debenture / Units of specified mutual

fund - Sec. 50AA' is given under the asset type 'Shares / Debentures

/ Units / Bonds' in STCG tables.

Other features:

Option to disclose ‘Winnings from Online games taxable u/s 115BBJ’ is given in 'Winnings:

Lotteries, Games, Bettings' table.

New list item ‘115A(1)(a)(

115A(1)(a)(i) - Dividend income from unit in Intl. Financial Services Centre’

Centre is added

in 'Income taxable at special rates' and 'DTAA income' tables.

The exemption u/s 54 & 54F is restricted to Rs. 10 crore.

New list item 'Payment to micro/ small enterprise after the time limit under MSMED Act' is added in

‘43B disallowance’ table under the head Business/Profession.

In 'Taxable income u/s 58, 59 & 56(2)(ix), (xii), (xiii)' table, below two rows are given:

given

- Sum received from Business trust u/s 56(2)(xii)

- Sum received under life insurance policy u/s 56(2)(xiii)

Other minor improvements are also made in the software

oftware design & working to enhance the user-friendliness.

user

You might also like

- Payment FactoryDocument22 pagesPayment FactoryIgnacio KristofNo ratings yet

- Income Tax Rates For FY 2023-24 (AY 2024-25)Document13 pagesIncome Tax Rates For FY 2023-24 (AY 2024-25)ghs niduvani niduvaniNo ratings yet

- How Underdogs Can Out-Market Bigger Better LeadersDocument5 pagesHow Underdogs Can Out-Market Bigger Better LeadersStalfoNo ratings yet

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- Qy5p9 Salesforce Service Cloud Joe PoozhikunnelDocument120 pagesQy5p9 Salesforce Service Cloud Joe PoozhikunnelANo ratings yet

- Engineering Reference DocumentDocument50 pagesEngineering Reference DocumentjeddijNo ratings yet

- Account Statement 1000013254935Document1 pageAccount Statement 1000013254935Ebrahim Maru60% (10)

- Testmax™ Atpg and Testmax Diagnosis DRC Rules: Version S-2021.06, June 2021Document435 pagesTestmax™ Atpg and Testmax Diagnosis DRC Rules: Version S-2021.06, June 2021Gopinathan Muthusamy100% (2)

- Consumers Buying Behaviour in Life InsuranceDocument36 pagesConsumers Buying Behaviour in Life InsuranceRajeshsatpute74% (19)

- Note On Budget Proposals-2020Document7 pagesNote On Budget Proposals-2020Mayur VartakNo ratings yet

- Final Home Work IrelDocument27 pagesFinal Home Work IrelFansurey Ab Ghani100% (1)

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- New Features - Previous Releases: Major ChangesDocument1 pageNew Features - Previous Releases: Major ChangesAnonymous atsRZVKHxNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- Compliance ManualDocument52 pagesCompliance ManualNupur GajjarNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocument52 pagesCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGNo ratings yet

- Old Vs New Personal Tax Regime 010323Document20 pagesOld Vs New Personal Tax Regime 010323Sreehari RaoNo ratings yet

- 16 Total IncomeDocument7 pages16 Total IncomeHritik HarlalkaNo ratings yet

- Columbia WHTDocument7 pagesColumbia WHTAnilNo ratings yet

- ESS Guidance - DocDocument5 pagesESS Guidance - DocEr Sundeep RachakondaNo ratings yet

- Income Tax Amendments Nov 2020Document25 pagesIncome Tax Amendments Nov 2020Cloxan India Pvt LtdNo ratings yet

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Union Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualDocument2 pagesUnion Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualCA Upendra Singh ThakurNo ratings yet

- 78.calculation of Taxable Salary IncomeDocument6 pages78.calculation of Taxable Salary Incomeyaya007500No ratings yet

- Tax RTP May 2020Document35 pagesTax RTP May 2020KarthikNo ratings yet

- 96 - Paper-4Taxation-min Income TaxDocument35 pages96 - Paper-4Taxation-min Income TaxAbhilash MeherNo ratings yet

- Budget Analysis 23-24Document2 pagesBudget Analysis 23-24santhoshNo ratings yet

- CA Final May 2020 Question Bank PDFDocument1,624 pagesCA Final May 2020 Question Bank PDFAjay JosephNo ratings yet

- CA Final May 2020 Last Minute Revision PDFDocument390 pagesCA Final May 2020 Last Minute Revision PDFLaxmisha GowdaNo ratings yet

- Union Budget 2023-2024 Changes in Tax Slabs, Standard Deduction, Surcharge, Tax Rebate and LEA ExemptionDocument5 pagesUnion Budget 2023-2024 Changes in Tax Slabs, Standard Deduction, Surcharge, Tax Rebate and LEA ExemptionPankaj KumarNo ratings yet

- Student Handout - Income Tax (Part 2) - 1Document4 pagesStudent Handout - Income Tax (Part 2) - 1debNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- Taxation AmendmentsDocument33 pagesTaxation AmendmentscawinnersofficialNo ratings yet

- Unit 2 - Scope of Income and Residential Status, Rebate and ReliefDocument25 pagesUnit 2 - Scope of Income and Residential Status, Rebate and ReliefKhushi ThakurNo ratings yet

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanDocument18 pagesIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanNo ratings yet

- Tax RatesDocument9 pagesTax RatesSai SwarupNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- IT RatesDocument6 pagesIT RatesAnjali Krishna SNo ratings yet

- Circular NoCO-04-24-02983-NW-2983-DIRECT 4 - 15 B - 240405 - 161615Document2 pagesCircular NoCO-04-24-02983-NW-2983-DIRECT 4 - 15 B - 240405 - 161615Debashis SwainNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Karthik PenakaNo ratings yet

- Tax RatesDocument4 pagesTax RatesOnkar BandichhodeNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Tax RTP 2 Nov 2020Document41 pagesTax RTP 2 Nov 2020KarthikNo ratings yet

- How To View UAE VAT Return Report in TallyPrimeDocument49 pagesHow To View UAE VAT Return Report in TallyPrimeAhmad KhanNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- CHP 15. Budget Costing - CAPRANAVDocument21 pagesCHP 15. Budget Costing - CAPRANAVAYUSH RAJNo ratings yet

- Paper 4: Taxation Section A: Income Tax Law: Part I: Statutory UpdateDocument12 pagesPaper 4: Taxation Section A: Income Tax Law: Part I: Statutory UpdateAbhiNo ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22Document15 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22MOHAMMED LayeeqNo ratings yet

- Paper 4: Taxation Section A: Income Tax Law: Part I: Statutory UpdateDocument35 pagesPaper 4: Taxation Section A: Income Tax Law: Part I: Statutory UpdaterifahiNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- 16 Summer 2018 BT SADocument8 pages16 Summer 2018 BT SApabloescobar11yNo ratings yet

- Guidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFDocument3 pagesGuidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFgowtham DevNo ratings yet

- FAQSDocument2 pagesFAQSsachushinde1992No ratings yet

- Union Budget 2023-2024 Changes in Tax Slabs, Standard Deduction, Surcharge, Tax Rebate and LEA ExemptionDocument3 pagesUnion Budget 2023-2024 Changes in Tax Slabs, Standard Deduction, Surcharge, Tax Rebate and LEA ExemptionSrinivasNo ratings yet

- Old Tax Regime Vs New Tax Regime Comparision - FinalDocument1 pageOld Tax Regime Vs New Tax Regime Comparision - FinalRajNo ratings yet

- Income Tax Provisions For FY 2019-20Document26 pagesIncome Tax Provisions For FY 2019-20Mohit SharmaNo ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- RSM India Union Budget 2021 HighlightsDocument132 pagesRSM India Union Budget 2021 HighlightsSunil KumarNo ratings yet

- Tax Updates For June 2015 Examination - 20!03!15Document37 pagesTax Updates For June 2015 Examination - 20!03!15kumar_anil666No ratings yet

- EngEco 6 - CFATDocument29 pagesEngEco 6 - CFATNPCNo ratings yet

- Personal Income Tax Under The New Regime and Old RegimeDocument4 pagesPersonal Income Tax Under The New Regime and Old RegimeAiswarya BNo ratings yet

- Income Taxes: Sri Lanka Accounting Standard - LKAS 12Document46 pagesIncome Taxes: Sri Lanka Accounting Standard - LKAS 12Sineth NeththasingheNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- Cutover Strategy Document For ARASCO V1.0Document12 pagesCutover Strategy Document For ARASCO V1.0Anonymous hCDnyHWjTNo ratings yet

- Consumer Loans, Credit Cards and Real Estate Lending: Prepared By: Banking Department Faculty of Finance and BankingDocument93 pagesConsumer Loans, Credit Cards and Real Estate Lending: Prepared By: Banking Department Faculty of Finance and BankingPhương NguyễnNo ratings yet

- Intermediate Course Study Material: TaxationDocument34 pagesIntermediate Course Study Material: TaxationMd IbrarNo ratings yet

- SM Harshad Mehta ScamDocument14 pagesSM Harshad Mehta ScamVenu GudlaNo ratings yet

- Ifrs4 PDFDocument18 pagesIfrs4 PDFLorraine TomasNo ratings yet

- Dealing With Outside Agencies Like Consultants, Contractors EtcDocument13 pagesDealing With Outside Agencies Like Consultants, Contractors EtcSAJANCHRISNo ratings yet

- Justin Chak: EducationDocument1 pageJustin Chak: EducationDanishevNo ratings yet

- A1573945525 - 19813 - 11 - 2020 - MGN303 At2 Q2005Document9 pagesA1573945525 - 19813 - 11 - 2020 - MGN303 At2 Q2005Ravi SharmaNo ratings yet

- Cost of Capital Lecture NotesDocument52 pagesCost of Capital Lecture NotesPRECIOUSNo ratings yet

- Answer Key CH3 PalmDocument2 pagesAnswer Key CH3 PalmaghaNo ratings yet

- Financial Institutions Ch-1Document28 pagesFinancial Institutions Ch-1Shimelis Tesema100% (1)

- Atul Trimbak Prabhu: Regd. Office: T E W CINDocument19 pagesAtul Trimbak Prabhu: Regd. Office: T E W CINvirupakshudu kodiyalaNo ratings yet

- Axios Systems: Arab Bank ITIL ITSM Case StudyDocument3 pagesAxios Systems: Arab Bank ITIL ITSM Case StudyAxiosSystemsNo ratings yet

- Corporate Brochure 2019: Mitsui & Co., LTDDocument12 pagesCorporate Brochure 2019: Mitsui & Co., LTDjason6686pNo ratings yet

- M003-81111 QSPSC11Document54 pagesM003-81111 QSPSC11harimaumalayaNo ratings yet

- Chapter Seven Strategy Review, Evaluation and ControlDocument31 pagesChapter Seven Strategy Review, Evaluation and ControlEmebet TesemaNo ratings yet

- Resume Lokesh Chawla PDFDocument3 pagesResume Lokesh Chawla PDFvaibhav.manchester9372No ratings yet

- Business Studies Note For Ub1 Second TermDocument29 pagesBusiness Studies Note For Ub1 Second TermStefan OgunjioforNo ratings yet

- Tapping Into Global Markets: Marketing Management, 13 EdDocument9 pagesTapping Into Global Markets: Marketing Management, 13 EdFarabiTsmNo ratings yet

- Wepik The Tata Marketing Strategy Driving Success in A Competitive Landscape 20230831120114ftwbDocument8 pagesWepik The Tata Marketing Strategy Driving Success in A Competitive Landscape 20230831120114ftwbJojoNo ratings yet

- Retail Management Imp QuestionsDocument21 pagesRetail Management Imp QuestionsDinesh kumar JenaNo ratings yet

- Williams, Brian K., Dan Sawyer, Stacey C. 2007. Using Information TechnologyDocument2 pagesWilliams, Brian K., Dan Sawyer, Stacey C. 2007. Using Information TechnologyM Fathur100% (1)