Professional Documents

Culture Documents

Module 7 - Management Plan

Uploaded by

Blackwolf SocietyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 7 - Management Plan

Uploaded by

Blackwolf SocietyCopyright:

Available Formats

Module 7

Management

33

PLAN

ECF3

ENTREPRENEURAL

Management

to your 7TH

module!

This module is a combination of

synchronous & asynchronous learning

and will last for one week

Long Test will be given via

Google Form in asynchronous test

Identify & Meet a Market Need

ARLENE F. MUSONES, MBA

Instructor

No part of this module may be

reproduced in any form without prior

permission in writing from the

Instructor.

November 21, 2023

November 26, 2023

Date of Completion

Marketing Plan

MODULE 6 OUTLINE

MODULE DURATION

November 21 to November 26, 2023 Synchronous Meeting and Asynchronous Learning

For asynchronous learning inquiries, you may reach me through the messenger group chat from Monday to Thursday

at 5pm to 8pm. or thru my GMAIL – arlenemusones143@gmail.com

LEARNING OBJECTES

After completing this module, you are expected to:

1. Describe the internal organizational structure;

2. Describe how manpower affect the process on setting up a business;

3. Discuss the staffing process;

4. Describe compensation schedule;

5. Identify and classify the different government agencies and areas for registration; and

6. Project Schedule

INPUT INFORMATION

Management Plan

LEARNING ACTIVITIES

1. Group discussion during a synchronous meeting

2. Asynchronous Learning

ASSESSMENT/EVALUATION

I. Synchronous Test with a time limit.

A long test link will be provided through our group chat. This is a synchronous test with a time limit.

II. Asynchronous Learning

a. Individual Activity – Individual Learning Portfolio

b. Group Activity – Case Study

ASSIGNMENT

Individual Learning Portfolio. In your own words, (minimum of 30 words each question):

1. Differentiate the four types of business organization?

2. Identify the basic issue that must be resolved in defining the internal structure of the organization.

3. Differentiate the three types of internal organizational structure?

4. What are the different activities to be undertaken in determining the staffing requirements of an

organization?

Deadline: To be announced in the GC.

Group Activity:

Actual Writing of the Management PLAN for the Group Business Plan. .

Deadline: To be announced in the GC.

San Mateo Municipal College Module 7/ECF3/Page 2

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

LEARNING RESOURCES

Book/E-book:

Entrepreneurship by Cynthia L. Greene @2013 Cengage Learning Asia Pte. Ltd.

Entrepreneurship by Bruce R. Barringer and R. Duane Ireland, Fourth Edition

San Mateo Municipal College Module 7/ECF3/Page 3

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

Management Plan of a BUSINESS PLAN

MODULE 7 PROPER

OBJECTIVES OF THE MANAGEMENT Plan

1. Describe the internal organizational structure.

2. Describe how manpower affect the process on setting up a business.

3. Discuss the staffing process.

4. Compensation

5. Identify and classify the different government agencies and areas for registration.

6. Project Schedule

Major Parts of the Management Plan

A. Form of ownership

B. Internal Organizational Structure

C. Staffing Requirements and Roles & Responsibilities of members of organization

D. Legal Requirements

A. Forms of Ownership

What type of business organization must be formed to carry out effectively the objectives of the proposed project?

There are three types of business organization. These are

1. Sole Proprietorship

2. Partnership

3. Corporation

4. Cooperative

Factors Affecting the Choice of Business Organization

1. Capital Requirement

2. Liability of owner or owners

3. Managerial skills needed

4. Ease of information

5. Taxation implication

6. Government intervention

7. Nature of business

8. External financing

CASH REQUIREMENT

1. May come from CASH INFUSION of the owners.

2. May be sources from creditors like financial institutions.

3. The amount of capital needed may be enough to cover the infrastructure requirements and the scale of

operation.

Liability of Owner or Owners

1. The liability of the owner or owners may either be LIMITED OR UNLIMITED.

2. LIMITED LIABILITY – means the owner is liable only to the extent of his capital contributions.

San Mateo Municipal College Module 7/ECF3/Page 4

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

3. UNLIMITED LIABILITY – implies the creditors may run after the personal properties of the owner in case the

business cannot fully settle to financial obligations

Managerial Skills

SOLE PROPRIETORSHIP and PARTNERSHIP need only small capital requirements, the operation is simple.

In most instances, one person with managerial skills is employed to handle the daily operating activities of the business.

Corporation or Cooperatives. Operation of the business is highly complicated and covers a wide market. There is a need to

hire several managers to run the day-to-day operations.

Ease of formation

SOLE PROPRIETORSHIP & PARTNERSHIPS are easily formed. Do not require the preparation of documentary papers.

Not usually registered with the Securities And Exchange Commission (SEC).

CORPORATION

Requires the services of legal counsel and a certified public accountant.

Requires its legal personality after complying with all the legal requirements and formalities.

Taxation Implication

SOLE PROPRIETORSHIP - Computed using the scheduled tax rates and the amount is usually lower compared to that of a

partnership and a corporation.

The owner of the business includes the income realized from the business in the computation of his or her gross income.

PARTNERSHIP and CORPORATION - Are presently taxed at the rate of 30% based on the computed net taxable income

or at 2% of the gross income, whichever is higher.

The tax liability is usually higher than that of a sole proprietorship

Government Intervention

SOLE PROPREITORSHIP - comply with the local government reportorial and legal requirements. Less intervention is

imposed by the national government.

CORPORATIONS – the government usually imposes greater and wider control. Various government agencies closely

monitor the operations of corporations and they impose more stringent measures to be complied with.

Nature of Business

MERCHANDISING and SERVICE ENTITITES – do not have complicated operations. They carry out routine activities

throughout the year. Sole proprietorship and partnership are advisable for this kinds of business.

MANUFACTURING BUSINESS – requires high capital base and the nature of operation is more complicated that those of

merchandizing and service entities.

External Financing

Corporate entities can easily seek external funding from outside sources like banks should they need additional working

capital, as against sole proprietorship and partnership.

B. Internal Organizational Structure

This serves as FRAMEWORK that outlines the communication process between employees and departments. It defines the

responsibilities and functions of each employee in the organization.

Factors affecting the design of the Internal Organizational Structures:

San Mateo Municipal College Module 7/ECF3/Page 5

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

1. The SIZE of the business

2. Type of product the business sells or service it offers.

The design of the internal structure of the business usually follows once the type of business organization has been chosen.

Impliedly, the internal organizational structure of the business cannot be defined unless the type of business organization

has been chosen.

Internal Organization Structure may either be a:

1. Flat Structure

2. Department Focus Structure

3. Product-Focused Structure

Flat Structure

1. Advisable for SOLE PROPRIETORSHIPS and PARTNERSHIPS where there are few personnel.

2. There are only two or three levels of reporting.

3. It hastens the decision making process by empowering the employees to formulate decisions.

4. Bureaucracy is minimized

5. Productivity is increased

6. Lesser management budget is required.

Department-Focused Structure

1. Applicable to CORPORATE ENTITIES

2. The work to accomplish is broken down into different functions.

3. Prevailing functional areas of the business:

a. Operation

b. Marketing

c. Finance

d. Human Resources

4. Values teamwork in the attainment of its objectives and goals.

Product Focused Structure

1. Importance to the product that the business offers.

2. All efforts are joined together to deliver quality products or services to customers.

3. Enhancement of product quality is the primary concern of a product-focused structure.

4. Often adopted by huge retail corporate stores in corporate form with very strong leadership teams across several

functional areas.

Organizational Chart

1. It is a diagram of the structure of the organization which shows the positions, ranks, and relationships of the employees

in the organization.

2. Identifies the positions that execute line or staff functions.

San Mateo Municipal College Module 7/ECF3/Page 6

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

C. STAFFING REQUIREMENTS

1. Determining the appropriate NUMBER OF EMPLOYEES required by the organization.

2. RECRUITING employees who qualify for the position based on education, knowledge, training, experience,

skills and abilities.

3. Deploying and retraining employees.

San Mateo Municipal College Module 7/ECF3/Page 7

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

D. COMPENSATION

Computation of SALARIES, COMPENSATION, and FRINGE BENEFITS

The proponent should consider the following:

1. The amount legally provided in the Labor Code.

2. The statutory minimum wage in the regions as stipulated by the Regional Tripartite Wage and Productivity Board.

3. The prevailing practice in the industry.

4. The demands of the position based on expertise, qualifications, and work experience.

5. The technical requirements of the work to be performed.

E. Legal Requirements

The government requires all enterprise of whatever size, type, and forms to secure a permit before it can do business.

Business registration involves enlisting the enterprise with the proper government agencies and obtaining the necessary

permits to conduct business.

The entrepreneur, before selecting the form of ownership and registering it with the government agencies concerned,

must analyze carefully the advantages and disadvantages of the various forms of business organization. The entrepreneur

must see for himself the kind of management control and how the business will be able to generate his projected profitable

investment.

1. Application of Business Registration

2. Application for Judicial Personality

3. Payment of Filing Fee, license fee, and registration fees

San Mateo Municipal College Module 7/ECF3/Page 8

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

Initial Business Registration

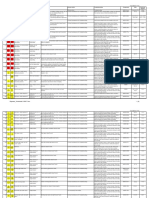

F. Project Schedule

The preparatory to the actual operation should be enumerated here. The entrepreneur should list the different activities or

steps in the preparatory stage of the project and present them in a Gantt chart to exhibit the duration of each activity. In every

activity the entrepreneur should indicate the length of time needed to do it and the amount of money spent.

San Mateo Municipal College Module 7/ECF3/Page 9

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

The Gantt Chart is an important of the organization plan. It is the list of all the activities to do prior to launching the business

and the timeframe for accomplishing them. Preparing the Gantt Chart is a useful exercise that allows a person to have a view

of the pre-operating activities.

Sample Gantt Chart

San Mateo Municipal College Module 7/ECF3/Page 10

College of Business and Accountancy Prepared by: Arlene F. Musones, MBA

You might also like

- GURPS 4ed - Warhammer 40kDocument65 pagesGURPS 4ed - Warhammer 40kDarth SHAKERNo ratings yet

- Bi-Pump Instruction ManualDocument2 pagesBi-Pump Instruction ManualRigoberto VillafuerteNo ratings yet

- Working (Assignment)Document636 pagesWorking (Assignment)Jason SecretNo ratings yet

- Sales Case Digest Part 2Document6 pagesSales Case Digest Part 2lchieSNo ratings yet

- BM Midterm Chapter 7Document10 pagesBM Midterm Chapter 7James MontesNo ratings yet

- OrganisingDocument55 pagesOrganisingskirubaarunNo ratings yet

- Land Titles Digests FINALSDocument113 pagesLand Titles Digests FINALSCyrus Vincent TroncoNo ratings yet

- How To Set Up A Pmo PDFDocument18 pagesHow To Set Up A Pmo PDFMona NabilNo ratings yet

- ABM-BUSINESS FINANCE 12 - Q1 - W1-W2 - Mod1 PDFDocument17 pagesABM-BUSINESS FINANCE 12 - Q1 - W1-W2 - Mod1 PDFKaren Lacuban77% (26)

- BUSINESS FINANCE 12 - Q1 - W1 - Mod1Document18 pagesBUSINESS FINANCE 12 - Q1 - W1 - Mod1LeteSsie100% (1)

- Electrical Basic Test With AnswersDocument5 pagesElectrical Basic Test With AnswersCesar BlNo ratings yet

- SIP-Based Media Recording (SIPREC)Document16 pagesSIP-Based Media Recording (SIPREC)Asit SwainNo ratings yet

- Why Is Organizational Structure ImportantDocument5 pagesWhy Is Organizational Structure ImportantSheeba ThomasNo ratings yet

- Org and Managment Q2 Week 1Document14 pagesOrg and Managment Q2 Week 1Kee Jay Pondoc100% (1)

- B Grade 12 Business Finance q1m3 Learner Copy Final LayoutDocument22 pagesB Grade 12 Business Finance q1m3 Learner Copy Final LayoutShakira ashley LejerosNo ratings yet

- AGW4RDocument10 pagesAGW4RLucia SabadoNo ratings yet

- Common Efficiency Mistakes Companies Make And How To Avoid ThemFrom EverandCommon Efficiency Mistakes Companies Make And How To Avoid ThemRating: 5 out of 5 stars5/5 (1)

- Company Structure Inggris BisnisDocument12 pagesCompany Structure Inggris BisnisZulkarnainNo ratings yet

- Module 2Document93 pagesModule 2HarishNo ratings yet

- Business Finance: Identifying The Roles in A Corporate OrganizationDocument15 pagesBusiness Finance: Identifying The Roles in A Corporate OrganizationMabelle Marie CutaraNo ratings yet

- (Ba 213) CH 10 - Foundations of Organizational StructureDocument7 pages(Ba 213) CH 10 - Foundations of Organizational StructureMae PandoraNo ratings yet

- Entrepreneurship: Organization Plan, Production Plan, and Operational PlanDocument19 pagesEntrepreneurship: Organization Plan, Production Plan, and Operational PlanFunny Juan0% (1)

- Chapter - 5Document11 pagesChapter - 5sonal2901No ratings yet

- Organizational Structure of BanksDocument32 pagesOrganizational Structure of BanksVineetaNo ratings yet

- Business Finance Week 1-2Document15 pagesBusiness Finance Week 1-2Emariel CuarioNo ratings yet

- Module 3 - Develop A Business PlanDocument12 pagesModule 3 - Develop A Business PlanitschloeannecucioNo ratings yet

- Mid Term - ENT - 20205-MPU3233-BBACPSDocument9 pagesMid Term - ENT - 20205-MPU3233-BBACPSStacy Shareena TajulNo ratings yet

- Organising NotesDocument13 pagesOrganising NotesSuryansh NiranjanNo ratings yet

- Corporate Governance Course OutlineDocument15 pagesCorporate Governance Course OutlineMuddasar AbbasiNo ratings yet

- M4 Q A 3 SentueloDocument5 pagesM4 Q A 3 SentueloRiza C. SentueloNo ratings yet

- Foundations of Organizational StructureDocument24 pagesFoundations of Organizational StructureJainah Dalidig DumadalegNo ratings yet

- EED 423 Entrepreneurship Development Lecture NotesDocument37 pagesEED 423 Entrepreneurship Development Lecture NotesUdeme Usanga100% (1)

- ThesisDocument3 pagesThesisJhas MynNo ratings yet

- Importance of OrganisingDocument8 pagesImportance of OrganisingchaimaNo ratings yet

- S T. J Ohn's Academy: Junior High SchoolDocument2 pagesS T. J Ohn's Academy: Junior High SchoolMarlon EllamilNo ratings yet

- Report On Organizing: From: Group3 To Teacher: Souvanny Rattanavong Subject: Essential of ManagementDocument5 pagesReport On Organizing: From: Group3 To Teacher: Souvanny Rattanavong Subject: Essential of ManagementSouksakhone PHIAVONGNo ratings yet

- ABM-11 ORGANIZATION-AND-MANAGEMENT Q1 W3 Mod3 PDFDocument14 pagesABM-11 ORGANIZATION-AND-MANAGEMENT Q1 W3 Mod3 PDFJessebel Dano AnthonyNo ratings yet

- Planning, Organizing and Managing The EnterprisesDocument2 pagesPlanning, Organizing and Managing The EnterprisesMarlon Ellamil100% (2)

- Abm-11 Organization-And-management q1 w3 Mod3Document12 pagesAbm-11 Organization-And-management q1 w3 Mod3Edsel EscoberNo ratings yet

- IC2 ENTREP Study Guide Unit 3.1Document10 pagesIC2 ENTREP Study Guide Unit 3.1Jessa Mae FontanillaNo ratings yet

- MGMT 321 Chapter VI Organizational Structure & Design 1Document23 pagesMGMT 321 Chapter VI Organizational Structure & Design 112ab07cd91ef25No ratings yet

- Chapter 5 Organising 1.4Document7 pagesChapter 5 Organising 1.4Kartik PalNo ratings yet

- Organizing: Ajith Kanthi at Ajith P P - SKMJ Hss Kalpetta Business Studies - Ii Chapter-5Document7 pagesOrganizing: Ajith Kanthi at Ajith P P - SKMJ Hss Kalpetta Business Studies - Ii Chapter-5arya tiwariNo ratings yet

- Pros and ConsDocument8 pagesPros and ConsBernadette loyolaNo ratings yet

- Pros and ConsDocument8 pagesPros and ConsBernadette loyolaNo ratings yet

- Organization and ManagementDocument15 pagesOrganization and ManagementJacqueline CabarronNo ratings yet

- Ch-3 MGTDocument16 pagesCh-3 MGThai manNo ratings yet

- Class 12 Business Studies Notes CH05 OrganisingDocument11 pagesClass 12 Business Studies Notes CH05 OrganisingKarthik RameshNo ratings yet

- Gen Miel Carlos Caesar Karlo Omania Jewen Fernandez Glen JaimeDocument37 pagesGen Miel Carlos Caesar Karlo Omania Jewen Fernandez Glen JaimeJayson G. GunioNo ratings yet

- Strategic Management AssDocument12 pagesStrategic Management AssShahriar KayesNo ratings yet

- Edited ChangeDocument7 pagesEdited ChangeJemalNo ratings yet

- Mid Term ENT - MOHD NAZRINDocument12 pagesMid Term ENT - MOHD NAZRINStacy Shareena TajulNo ratings yet

- Organisation Study at Big BazaarDocument70 pagesOrganisation Study at Big BazaarMohammed Ajfar100% (1)

- Carlos Hilado Memorial State College: Alijis Campus - Binalbagan Campus - Fortune Towne Campus - Talisay CampusDocument11 pagesCarlos Hilado Memorial State College: Alijis Campus - Binalbagan Campus - Fortune Towne Campus - Talisay CampusErnest John Seguisabal100% (1)

- Structure of OrganizationDocument21 pagesStructure of Organizationleonxchima SmogNo ratings yet

- 2 Module 2 Construction Project OrganizationDocument3 pages2 Module 2 Construction Project OrganizationElisa SabadoNo ratings yet

- BFN303Document237 pagesBFN303Monydit SantinoNo ratings yet

- PRNT. CH 6 Organization StructureDocument11 pagesPRNT. CH 6 Organization StructureAbdullah Al Mamun TusherNo ratings yet

- Organization Structure of Axis BankDocument16 pagesOrganization Structure of Axis BankSaroj Kumar Pinto70% (10)

- CH 5 - OrganisingDocument12 pagesCH 5 - Organisingsushen.sameerNo ratings yet

- Management and Operations 2Document15 pagesManagement and Operations 2Nguyễn HoànNo ratings yet

- Cire 070025Document11 pagesCire 070025nalioNo ratings yet

- Ch-5 OrganisingDocument8 pagesCh-5 OrganisingRonal DaisonNo ratings yet

- MboDocument8 pagesMboSingh AngadNo ratings yet

- TOPIC: Unit # 9 3. Management by Objectives 4. Educational FuturismDocument5 pagesTOPIC: Unit # 9 3. Management by Objectives 4. Educational FuturismRyan NegadNo ratings yet

- MBO Vs MBEDocument30 pagesMBO Vs MBEuma singhNo ratings yet

- Mba-Acc Consolidated Report PDFDocument342 pagesMba-Acc Consolidated Report PDFJoanne Alexis BiscochoNo ratings yet

- BBA 102 - Class PresentationDocument21 pagesBBA 102 - Class PresentationAnonymous djLVrBtiDNo ratings yet

- Outline Internship 2023Document6 pagesOutline Internship 2023Yasmin RabbaniNo ratings yet

- Special TopicsDocument5 pagesSpecial TopicsBlackwolf SocietyNo ratings yet

- Ratio ComputationDocument2 pagesRatio ComputationBlackwolf SocietyNo ratings yet

- Ratio Computation1Document3 pagesRatio Computation1Blackwolf SocietyNo ratings yet

- Ecf2 Module 2Document6 pagesEcf2 Module 2Blackwolf SocietyNo ratings yet

- Pmcf7 Module 1Document7 pagesPmcf7 Module 1Blackwolf SocietyNo ratings yet

- PMCF7 Module 4Document8 pagesPMCF7 Module 4Blackwolf SocietyNo ratings yet

- Construction Logbook Rev. 0Document3 pagesConstruction Logbook Rev. 0Christian - Ian FarnacioNo ratings yet

- Mid 128 Pid435Document1 pageMid 128 Pid435Preett Rajin MenabungNo ratings yet

- Catalogo Donaghys - Marine Braid Range PerformanceDocument0 pagesCatalogo Donaghys - Marine Braid Range PerformancelmarinegroupNo ratings yet

- Module 3 Consignment Mar 26 2023Document26 pagesModule 3 Consignment Mar 26 2023Lorifel Antonette Laoreno TejeroNo ratings yet

- New AMLaboratoryDocument2 pagesNew AMLaboratoryblasphemer_morteNo ratings yet

- Types of RoutingDocument34 pagesTypes of RoutingmulukenNo ratings yet

- WIM (S2) Software Engineering Brochure PDFDocument18 pagesWIM (S2) Software Engineering Brochure PDFArmada YusufNo ratings yet

- Reserva Troncal NotesDocument2 pagesReserva Troncal NotesMela SuarezNo ratings yet

- RVCA241 GLOBAL SMALL ROLLER RVCA (Carry Over 231+232+233) Update 2022.11.02Document132 pagesRVCA241 GLOBAL SMALL ROLLER RVCA (Carry Over 231+232+233) Update 2022.11.02PHY0ENo ratings yet

- DOTr DO No. 2015-011 PDFDocument6 pagesDOTr DO No. 2015-011 PDFEarvin James AtienzaNo ratings yet

- Global Warming Causes, Effects, and SolutionsDocument3 pagesGlobal Warming Causes, Effects, and SolutionsLouisa Alexis TanuraharjaNo ratings yet

- COVID 19 and Ischemic Stroke: Mechanisms of Hypercoagulability (Review)Document13 pagesCOVID 19 and Ischemic Stroke: Mechanisms of Hypercoagulability (Review)Martha OktaviaNo ratings yet

- Assignment Report On: Basel'S NormsDocument8 pagesAssignment Report On: Basel'S NormsDeepa SharmaNo ratings yet

- Appendix B For Dormitory Agreement Residence Guidebook 2023Document30 pagesAppendix B For Dormitory Agreement Residence Guidebook 2023mahmoudzezoglalNo ratings yet

- Kathmandu Financial Group Case Study AnalysisDocument7 pagesKathmandu Financial Group Case Study Analysisjayan_unnithan2265No ratings yet

- Code Fig 1. Fig 2. Description Condition Limits Vehicle Drivers Action Troubleshooting Component Pins Electrical DiagramDocument8 pagesCode Fig 1. Fig 2. Description Condition Limits Vehicle Drivers Action Troubleshooting Component Pins Electrical DiagramIvan ErmolaevNo ratings yet

- Manual de Operacion y Mantenimiento - ManliftDocument117 pagesManual de Operacion y Mantenimiento - Manliftluis angel de la cruz olleroNo ratings yet

- (WWW - Entrance-Exam - Net) - Siemens Placement Sample Paper 2Document6 pages(WWW - Entrance-Exam - Net) - Siemens Placement Sample Paper 2sauravlodhNo ratings yet

- The Effect of Study Preparation On Test Anxiety AnDocument7 pagesThe Effect of Study Preparation On Test Anxiety AnjuneldelmundoNo ratings yet

- KAHLIDr Yehia45 PDFDocument36 pagesKAHLIDr Yehia45 PDFLuiz Rubens Souza CantelliNo ratings yet

- Soal B.Inggris Kelas IIXDocument8 pagesSoal B.Inggris Kelas IIXGokrolas Sitorus50% (2)