Professional Documents

Culture Documents

Inventories Solution

Uploaded by

maliaerica7380 ratings0% found this document useful (0 votes)

11 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesInventories Solution

Uploaded by

maliaerica738Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Page |3

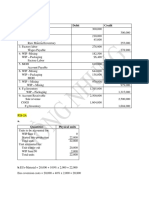

SOLUTIONS:

5. B 70 + 6 = 76

8. C Solution:

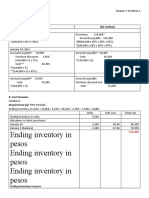

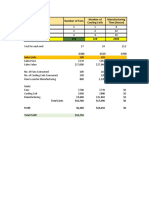

Date Transaction Units

Feb. 1 Beginning inventory 100

7 Purchase 300

12 Sale (320)

21 Purchase 200

Ending inventory (in units) 280

Units Unit cost Total cost

From Feb. 21 purchase 200 ₱21 ₱4,200

From Feb. 7 purchase (280 - 200) 80 18 1,440

Ending inventory (at cost) ₱5,640

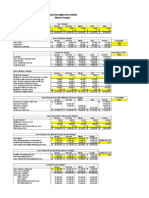

9. A Solution:

Date Transaction Units Unit cost Total cost

Feb. 1 Beginning inventory 100 ₱15 ₱1,500

7 Purchase 300 18 5,400

21 Purchase 200 21 4,200

Total goods available for sale 600 ₱11,100

Formula:

Weighted Total goods available for sale (TGAS) in pesos

=

ave. cost Total goods available for sale (TGAS) in units

Weighted average unit cost = ₱11,100 ÷ 600 = ₱18.50

Ending inventory (in units) - see computation above 280

Weighted average unit cost ₱18.50

Ending inventory (at cost) ₱5,180

10. C Solution:

Date Transaction Units Unit cost Total cost

Feb. 1 Beginning inventory 100 ₱15.00 ₱1,500.00

7 Purchase 300 18.00 5,400.00

400 17.25 (a) 6,900.00

12 Sale (320) (5,520.00)

21 Purchase 200 21.00 4,200.00

Ending inventory 280 ₱5,580.00

Page |4

(a) Moving ave. cost = TGAS at cost ÷ TGAS in units

= (₱6,900 ÷ 400) = ₱17.25

Cost of sales = 320 units sold x ₱11.50 moving ave. cost = ₱5,520

You might also like

- Moving AverageDocument3 pagesMoving AveragedorpianabsaNo ratings yet

- Lesson 5 InventoriesDocument6 pagesLesson 5 InventoriesCha Eun WooNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Inventories P2Document7 pagesInventories P2jangjangNo ratings yet

- Pa LeonipannaDocument22 pagesPa Leonipannaleoni pannaNo ratings yet

- Accounting CHAP 6 - Sheet1Document2 pagesAccounting CHAP 6 - Sheet1Nguyễn Ngọc MaiNo ratings yet

- Answer 4Document7 pagesAnswer 4Sinclair faith galarioNo ratings yet

- Module 11-Inventory Cost FlowDocument8 pagesModule 11-Inventory Cost FlowCreative BeautyNo ratings yet

- Grace Fidelia - AKD (Pertemuan Ke 12)Document6 pagesGrace Fidelia - AKD (Pertemuan Ke 12)Grace FideliaNo ratings yet

- Pas 2 InventoryDocument16 pagesPas 2 InventoryCrizhae OconNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- Ending Inventory in Pesos Ending Inventory in Pesos Ending Inventory in PesosDocument2 pagesEnding Inventory in Pesos Ending Inventory in Pesos Ending Inventory in PesosIvan Lorenz DimaandalNo ratings yet

- Finals Quiz and ActivityDocument4 pagesFinals Quiz and ActivityHello PMNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Date Particular Debit Credit: Ans To The Question No - 1Document8 pagesDate Particular Debit Credit: Ans To The Question No - 1Abdul AhadNo ratings yet

- Book Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanDocument2 pagesBook Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanRynaldo xf100% (1)

- Inventory IllustrationDocument6 pagesInventory IllustrationVatchdemonNo ratings yet

- Tutorial Test 8 Solution Requirement 1Document3 pagesTutorial Test 8 Solution Requirement 1Minh HiềnNo ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Grace Fidelia - AKD (Pertemuan 11)Document6 pagesGrace Fidelia - AKD (Pertemuan 11)Grace FideliaNo ratings yet

- ACCT2511 Topic 2 Tutorial Solutions STUDENTDocument8 pagesACCT2511 Topic 2 Tutorial Solutions STUDENTKJSAdNo ratings yet

- Round 5 ReprtsDocument29 pagesRound 5 ReprtsrahulNo ratings yet

- Excel Budget Problem TemplateDocument2 pagesExcel Budget Problem Templateapi-324651338No ratings yet

- Intermediate Accounting Volume 3 ValixDocument12 pagesIntermediate Accounting Volume 3 ValixVyonne Ariane Ediong0% (1)

- Chap 6 PracticeDocument4 pagesChap 6 PracticeThắng NguyễnNo ratings yet

- Key Chapter 6Document6 pagesKey Chapter 6JinAe NaNo ratings yet

- Q1Document5 pagesQ1Thảo Hương PhạmNo ratings yet

- Answers Exercises Book Chap 7 Inventories PDFDocument11 pagesAnswers Exercises Book Chap 7 Inventories PDFMonica MonicaNo ratings yet

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- PS 1 Process Costing Answer KeyDocument56 pagesPS 1 Process Costing Answer KeyKelvin CulajaráNo ratings yet

- Prelim Exam-Boticario D. (SBA)Document5 pagesPrelim Exam-Boticario D. (SBA)Dominic E. BoticarioNo ratings yet

- Answer c21Document8 pagesAnswer c21Võ Huỳnh BăngNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Ss 3Document32 pagesSs 3Trần Nguyễn Quỳnh GiaoNo ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Le Nguyen Thu UyenNo ratings yet

- Principles of Accounting Vol 2 Managerial Accounting Chapter 3 - Answer KeysDocument4 pagesPrinciples of Accounting Vol 2 Managerial Accounting Chapter 3 - Answer KeysAnonymous MNo ratings yet

- Hansell Income Statement Group 1Document5 pagesHansell Income Statement Group 1Ashish RanjanNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Pratice InventoryDocument4 pagesPratice InventoryBbjhe SilfavanNo ratings yet

- PA1 Team1 P6Document5 pagesPA1 Team1 P6Phuong Nguyen MinhNo ratings yet

- Inventory Valuation ExamplesDocument6 pagesInventory Valuation ExamplesTIARAHDENISE DELVO100% (1)

- Model Number of Fans Number of Cooling Coils Manufacturing Time (Hours)Document5 pagesModel Number of Fans Number of Cooling Coils Manufacturing Time (Hours)RahulNo ratings yet

- Cost Accounting (Discussion)Document4 pagesCost Accounting (Discussion)CarlNo ratings yet

- Problem 1:: Bianca Regina Lizardo Mr. Tadiwan BS AccountancyDocument3 pagesProblem 1:: Bianca Regina Lizardo Mr. Tadiwan BS AccountancyBianca LizardoNo ratings yet

- Act 4 Masay Company (Is)Document4 pagesAct 4 Masay Company (Is)Reginald MundoNo ratings yet

- Solución de Problemas Planteados PresupuestosDocument13 pagesSolución de Problemas Planteados PresupuestosAndre AliagaNo ratings yet

- Exercise AccountingDocument5 pagesExercise AccountingTaufan PutraNo ratings yet

- Inventories Problems 4-1 (Crossings Company)Document7 pagesInventories Problems 4-1 (Crossings Company)ExequielCamisaCrusperoNo ratings yet

- Tugas Kel 15 PaDocument3 pagesTugas Kel 15 PaGiorgio LowonganNo ratings yet

- SCM Chap 3 Probs 1-3Document4 pagesSCM Chap 3 Probs 1-3aj dumpNo ratings yet

- Cash 5,000 Accounts Receivable 1,500 Raw Materials Inventory 258 Finished Goods Inventory 1,462Document17 pagesCash 5,000 Accounts Receivable 1,500 Raw Materials Inventory 258 Finished Goods Inventory 1,462Nhu Le ThaoNo ratings yet

- Chapter 7 SolutionDocument16 pagesChapter 7 SolutionErika Anne JaurigueNo ratings yet

- P1 Solution Dec 2018Document6 pagesP1 Solution Dec 2018Awal ShekNo ratings yet

- CostCon ProblemsDocument3 pagesCostCon ProblemsElla Mae SaludoNo ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- Sol Man - Pas 2 InventoriesDocument3 pagesSol Man - Pas 2 InventoriesDaniella Mae ElipNo ratings yet

- Acknowledgement ReceiptDocument26 pagesAcknowledgement ReceiptMary Grace BaldeNo ratings yet

- Micro Observer Account DetailDocument20 pagesMicro Observer Account DetailpremNo ratings yet

- Assessment Form - TAXN6045 2020.2Document8 pagesAssessment Form - TAXN6045 2020.2bagasNo ratings yet

- SRJC JC2 H1 Econs / 2018 / Workbook - Economic GrowthDocument25 pagesSRJC JC2 H1 Econs / 2018 / Workbook - Economic GrowthXian LongNo ratings yet

- 08-2019-CA ListDocument36 pages08-2019-CA ListAshish SrivastavaNo ratings yet

- !beretta Fiyat Listesi - v010721 - VFDocument5 pages!beretta Fiyat Listesi - v010721 - VFCabir ÇakmakNo ratings yet

- PD List Midc AreaDocument50 pagesPD List Midc AreaPriyanka sharmaNo ratings yet

- Bank List in ZambiaDocument4 pagesBank List in ZambiaNavin TulsyanNo ratings yet

- Order Confirmation-OC3309Document1 pageOrder Confirmation-OC3309Chetan patilNo ratings yet

- Chairpersons: Karam Chand ThaparDocument3 pagesChairpersons: Karam Chand ThaparRachit KushwahaNo ratings yet

- Name of Student Date Amount CHK NoDocument14 pagesName of Student Date Amount CHK Nodharmendra_89No ratings yet

- Report 31032018Document825 pagesReport 31032018VikasNo ratings yet

- BRIGADA LIST 2 Grade 9Document24 pagesBRIGADA LIST 2 Grade 9moanaNo ratings yet

- PESONet ParticipantsDocument2 pagesPESONet ParticipantsKylene Maranan VillamarNo ratings yet

- instaPDF - in All Country Currency and Capitals Name List 415Document11 pagesinstaPDF - in All Country Currency and Capitals Name List 415Deepak KumarNo ratings yet

- Memorandum of Agreemen1-Dla PenaDocument2 pagesMemorandum of Agreemen1-Dla PenakristineNo ratings yet

- Sr. No. Bic Code Institution Name Branch Information CityDocument3 pagesSr. No. Bic Code Institution Name Branch Information Cityran4monuNo ratings yet

- Currency Support List - Matrix-Winvesta-MCADocument1 pageCurrency Support List - Matrix-Winvesta-MCANelson XaxaNo ratings yet

- E Passbook 2022 12 18 22 13 54 PMDocument64 pagesE Passbook 2022 12 18 22 13 54 PMBLESS PRINCENo ratings yet

- PESO Incentive ChecklistDocument13 pagesPESO Incentive ChecklistDOLE West Leyte Field OfficeNo ratings yet

- School Grant For The Year 2015-16 To Be Release On 07.12.2015Document88 pagesSchool Grant For The Year 2015-16 To Be Release On 07.12.2015Akram MohammadNo ratings yet

- Dombivli Nagari Sahakari Bank LTD - Http://dnsbank - In/default - AspxDocument4 pagesDombivli Nagari Sahakari Bank LTD - Http://dnsbank - In/default - AspxIMPEL Learning SolutionsNo ratings yet

- FIRMS ContactsDocument25 pagesFIRMS Contactspratyush1200No ratings yet

- Zonal OfficeDocument1 pageZonal OfficeDeeprajNo ratings yet

- Cross Rates - November 12 2019Document1 pageCross Rates - November 12 2019Lisle Daverin BlythNo ratings yet

- The Information Technology and Business Process Outsourcing Industry: Diversity and Challenges in AsiaDocument37 pagesThe Information Technology and Business Process Outsourcing Industry: Diversity and Challenges in AsiaAsian Development BankNo ratings yet

- Icici 3852 19-25Document15 pagesIcici 3852 19-25bilal lekhaNo ratings yet

- MSME Care ListDocument5 pagesMSME Care Listmksingh13No ratings yet

- Name of Countries - Capital - CurrencyDocument1 pageName of Countries - Capital - CurrencyAbdul BasitNo ratings yet

- Medicine WellnessDocument1 pageMedicine WellnessAyushiSrivastavaNo ratings yet