Professional Documents

Culture Documents

Quiz 1 - FT - Print

Uploaded by

nicolearetano4170 ratings0% found this document useful (0 votes)

9 views1 pageNotes

Original Title

Quiz 1_ Ft - print

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNotes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageQuiz 1 - FT - Print

Uploaded by

nicolearetano417Notes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

MICROFINANCE

Final Term Quiz # 1

Score:

Name: ____________________________

1. Why is microfinance crucial for small-scale farmers?

a. To help them buy needs and wants and expand their social status 11. What is the primary goal of public-private partnerships (PPPs) in

b. To provide access to small loans and financial services, addressing agricultural development?

their unique needs a. To maximize corporate profits to cater more MFI clients

c. To encourage migration to urban areas b. To reduce government involvement in agriculture

d. To ensure food security for the farmers c. To create obstacles for small-scale farmers

2. What is one key challenge in providing microfinance services to small- d. To enhance efficiency and promote infrastructure development

scale farmers? 12. What is the primary focus of production cost-based lending in

a. High interest rates agricultural microfinance?

b. Insufficient demand for loans a) Evaluating the borrower's credit history

c. Lack of traditional collateral b) Providing loans to cover specific agricultural production costs

d. Lacks government subsidies c) Offering loans without assessing the borrower's needs

3. How does microfinance help mitigate the financial risks associated with d) Providing technical assistance to reduce production cost in farming

agriculture? 13. Which of the following is a benefit of production cost-based lending?

a. By offering financial products like insurance to protect against losses a) Increased reliance on collateral

b. By providing crop insurance and encouraging farmers to take more b) Mitigating financial risks for farmers

risks c) Reduced focus on responsible lending

c. By avoiding risky agricultural investments altogether d) Limited flexibility in loan terms

d. By charging exorbitant interest rates 14. In cash flow-based lending, what is the primary factor considered when

4. What is a common opportunity associated with microfinance in determining the borrower's repayment capacity?

agriculture? a) The borrower's social connections

a. Increased risk due to the cyclical nature of agriculture b) The value of the borrower's assets

b. Improved food security c) The borrower's credit score

c. Increase farming efficiency d) The borrower's cash inflows and outflows

d. Lower agricultural production cost 15. How does cash flow-based lending contribute to financial inclusion?

5. In the context of microfinance, what is "value chain integration"? a) By extending credit to those with irregular income streams

a. A financial product tailored for urban entrepreneurs b) By considering credit scores

b. A strategy to create rural unemployment c) By requiring high collateral

c. A way to connect farmers to markets and enhance their income d) By charging high-interest rates

d. A type of crop insurance 16. Cash flow-based lending helps reduce the risk of default by:

6. What is one challenge microfinance institutions face when providing a) Ignoring the borrower's financial situation

loans to small-scale farmers during planting and harvesting period? b) Setting a rigid repayment schedule

a. Farmers don't need loans during these seasons c) Aligning loan repayments with the borrower's income cycle

b. High interest rates on loans d) Offering loans with high-interest rates

c. Loans are readily available without challenges 17. How can microfinance institutions support borrowers in cash flow-

d. Seasonal cash flow and repayment scheduling based lending?

7. Which of the following is a challenge for microfinance institutions when a) By providing financial literacy training and capacity-building support

serving geographically isolated farmers? b) By offering loans with variable interest rates

a. Easy access to rural areas c) By ignoring the borrower's financial needs

b. Low demand for loans d) By requiring a high credit score for all borrowers

c. Costly and logistically challenging operations 18. How does cash flow-based lending promote responsible lending

d. Complicated client preferences practices?

8. What is a common challenge in providing microfinance services in a) By aligning loan terms with the borrower's cash flow and income

agriculture due to the unpredictability of agricultural income? cycle

a. Higher risk of loan defaults b) By offering loans with rigid, fixed terms

b. Low comprehension from clients c) By providing loans without assessing repayment capacity

c. Loan demand stability d) By charging high-interest rates

d. High repayment rates 19. In the context of agri-value chains, what do impact investors focus on?

9. What does "financial inclusion" refer to in the context of microfinance? a. Solely financial returns

a. Prioritizing farmers as Microfinance clients b. Balanced financial, social, and environmental impact

b. Ensuring all farmers have access to credit c. Exclusively environmental sustainability

c. Supporting wealthy individuals in urban areas d. Immediate profitability without long-term sustainability

d. Extending access to banking and credit services to underserved and 20. What role do value chains play in connecting producers to markets?

unbanked rural populations a. They act as intermediaries, purchasing products from farmers

10. Which agency in the Philippines oversees the regulation of b. They create artificial barriers to market access for farmers

microfinance NGOs? c. They ensure that farmers receive the highest market prices

a. Department of Agriculture (DA) d. They facilitate the connection between producers and markets

b. Securities and Exchange Commission (SEC)

c. Central Bank of the Philippines (BSP)

d. Ministry of Rural Development

You might also like

- The Greater Mekong Subregion Economic Cooperation Program Strategic Framework 2030From EverandThe Greater Mekong Subregion Economic Cooperation Program Strategic Framework 2030No ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- Banking and Financial InstitutionsDocument6 pagesBanking and Financial InstitutionsAriel ManaloNo ratings yet

- Test Finance and EconDocument4 pagesTest Finance and EconJay ElizanNo ratings yet

- Fmi BazaDocument18 pagesFmi BazaАнель ПакNo ratings yet

- RURAL DEVELOPMENT AK UpdatedDocument6 pagesRURAL DEVELOPMENT AK UpdatedAdrian D'souzaNo ratings yet

- Financial MarketsDocument6 pagesFinancial MarketsAmie Jane MirandaNo ratings yet

- Summative Assessment Business Finance Part 2 With KeyDocument3 pagesSummative Assessment Business Finance Part 2 With KeyRealyn GonzalesNo ratings yet

- Question Bank Economics Class: Xi Gr11/Eco/Ch /QB Unit: Ii Topic: CHP 6.rural DevelopmentDocument5 pagesQuestion Bank Economics Class: Xi Gr11/Eco/Ch /QB Unit: Ii Topic: CHP 6.rural Developmentnumashito chikapitoNo ratings yet

- MCQ On Current Trends Cases in FinanceDocument20 pagesMCQ On Current Trends Cases in FinanceSanju Das100% (1)

- Ncert Solutions For Class 12 Economics Chapter - Rural DevelopmentDocument12 pagesNcert Solutions For Class 12 Economics Chapter - Rural DevelopmentRounak BasuNo ratings yet

- Material 2008 BDocument227 pagesMaterial 2008 BshikumamaNo ratings yet

- Financial Literacy Exam ReviewDocument3 pagesFinancial Literacy Exam ReviewDiane GuilaranNo ratings yet

- LIC Assistant Mains 2019 MCQDocument9 pagesLIC Assistant Mains 2019 MCQWasif FayazNo ratings yet

- MF Sample PaperDocument17 pagesMF Sample PaperPrem KumarNo ratings yet

- Pce Sample Questions 2016 - EngDocument39 pagesPce Sample Questions 2016 - EngImran Azman100% (1)

- Exam Questions (91%)Document13 pagesExam Questions (91%)Stuti SinghalNo ratings yet

- MF0007 Treasury Management MQPDocument11 pagesMF0007 Treasury Management MQPNikhil Rana0% (1)

- RF TechguideDocument18 pagesRF TechguideanuyadaNo ratings yet

- Finance Setting ADocument4 pagesFinance Setting APenn CollinsNo ratings yet

- Ans Test Set 2Document10 pagesAns Test Set 2vinayNo ratings yet

- Sample ExamDocument5 pagesSample Exam范明奎No ratings yet

- MoneyBankingQestions - AbdusalomDocument4 pagesMoneyBankingQestions - AbdusalomAbdusalom MuhammadjonovNo ratings yet

- MCQ CFDocument21 pagesMCQ CFPrem kumarNo ratings yet

- c2 Financial Markets and Institutions يطDocument6 pagesc2 Financial Markets and Institutions يطfeedbackalone feedbackNo ratings yet

- Combine - B. Eco. Sem 5 - SSTDocument93 pagesCombine - B. Eco. Sem 5 - SSTDINESH ALWANINo ratings yet

- Mishkin 6ce TB Ch10Document27 pagesMishkin 6ce TB Ch10JaeDukAndrewSeo100% (1)

- Trade Tests Questions - MiscDocument40 pagesTrade Tests Questions - MiscJayalakshmi RajendranNo ratings yet

- CL Real Estate Test 01Document34 pagesCL Real Estate Test 01CKD CCTVNo ratings yet

- Monetary EconomicsDocument19 pagesMonetary EconomicsSarah FaridNo ratings yet

- Answer To Review Question FINM3404 UQDocument6 pagesAnswer To Review Question FINM3404 UQHenry WongNo ratings yet

- Answer KeyDocument24 pagesAnswer KeyUdita YadavNo ratings yet

- Financial Institutions Markets and Money 12th Edition Kidwell Test BankDocument16 pagesFinancial Institutions Markets and Money 12th Edition Kidwell Test Banktrancuongvaxx8r100% (24)

- (Final) Fima 101 - Banking and Financial InstitutionsDocument13 pages(Final) Fima 101 - Banking and Financial InstitutionsJona kelssNo ratings yet

- Financial Institutions Markets and Money 12Th Edition Kidwell Test Bank Full Chapter PDFDocument37 pagesFinancial Institutions Markets and Money 12Th Edition Kidwell Test Bank Full Chapter PDFclubhandbranwq8100% (10)

- TB Bank loans-đã chuyển sang wordDocument8 pagesTB Bank loans-đã chuyển sang wordVi TrươngNo ratings yet

- Bank L0 DumpDocument503 pagesBank L0 Dumpdhootankur60% (5)

- Banking OR Financial - Porter's Five Force Analysis: Bargaining Power of BuyersDocument2 pagesBanking OR Financial - Porter's Five Force Analysis: Bargaining Power of BuyersTurant SundariNo ratings yet

- B. A Company That Manages Investment Portfolios: MF Sample Paper 1Document34 pagesB. A Company That Manages Investment Portfolios: MF Sample Paper 1pradeep johnNo ratings yet

- Sub-Innovative Financial Services Multiple Choice Questions (MCQ) Ty Bms Sem-ViDocument12 pagesSub-Innovative Financial Services Multiple Choice Questions (MCQ) Ty Bms Sem-Viarjun pradeepNo ratings yet

- Ifs Tybms Sem Vi Mcqs FinalDocument12 pagesIfs Tybms Sem Vi Mcqs FinalSudhakar Guntuka0% (1)

- BANKING LAW AND PRACTICE MCQsDocument38 pagesBANKING LAW AND PRACTICE MCQsChris Shean100% (1)

- Chapter04 TestbankDocument39 pagesChapter04 Testbankphuoc.tran23006297No ratings yet

- 20230918Quiz1.2Document3 pages20230918Quiz1.2Bazif AhmedNo ratings yet

- University of Calicut: Service ManagementDocument7 pagesUniversity of Calicut: Service Managementprajitha manjapettaNo ratings yet

- BFM RecollectedDocument8 pagesBFM RecollectedGURPREET KAURNo ratings yet

- BWFF2033 A221 Final Exam Answer SchemeDocument16 pagesBWFF2033 A221 Final Exam Answer SchemecorinnatsyNo ratings yet

- Microfinance Appendix Provides OverviewDocument4 pagesMicrofinance Appendix Provides OverviewEmilenn Kate Sacdalan-Pateño (Dimples)No ratings yet

- Abm Question PDFDocument9 pagesAbm Question PDFDurgaNo ratings yet

- Examination for Financial Advice Programme Level 1 Module 2Document9 pagesExamination for Financial Advice Programme Level 1 Module 2AhmedNo ratings yet

- Financial Market Multiple Choice QuestionsDocument3 pagesFinancial Market Multiple Choice QuestionsOllid Kline Jayson JNo ratings yet

- CCP Question PDF for 2022 Exam PreparationDocument10 pagesCCP Question PDF for 2022 Exam PreparationhariNo ratings yet

- DocxDocument2 pagesDocxMoazzam ShahNo ratings yet

- Risk Management - Sample QuestionsDocument11 pagesRisk Management - Sample QuestionsSandeep Spartacus100% (1)

- Af NoteDocument30 pagesAf NoteFasasi Abdul Qodir AlabiNo ratings yet

- trắc nghiệm qtrrDocument18 pagestrắc nghiệm qtrrLâm Hồng MaiNo ratings yet

- Nism Q & ADocument13 pagesNism Q & APriya PyNo ratings yet

- Maddela Marvelous Grace Christian School Inc. National Hi-Way, Buenavista, Maddela, Quirino Email AddDocument11 pagesMaddela Marvelous Grace Christian School Inc. National Hi-Way, Buenavista, Maddela, Quirino Email AddMark Gil GuillermoNo ratings yet

- Money and Credit Class X CBSEDocument5 pagesMoney and Credit Class X CBSERaj Rai100% (1)

- Connecting the Disconnected: Coping Strategies of the Financially Excluded in BhutanFrom EverandConnecting the Disconnected: Coping Strategies of the Financially Excluded in BhutanNo ratings yet

- Past 77Document3 pagesPast 77nicolearetano417No ratings yet

- FINAL EXAM - PrintDocument3 pagesFINAL EXAM - Printnicolearetano417No ratings yet

- MODULE 1 Practicing Japanese WritingDocument15 pagesMODULE 1 Practicing Japanese WritingUnknown UserNo ratings yet

- FINAL EXAM - PrintDocument3 pagesFINAL EXAM - Printnicolearetano417No ratings yet

- Past 81Document1 pagePast 81nicolearetano417No ratings yet

- Past 25Document1 pagePast 25nicolearetano417No ratings yet

- Past 80Document4 pagesPast 80nicolearetano417No ratings yet

- Past 79Document1 pagePast 79nicolearetano417No ratings yet

- Past 78Document1 pagePast 78nicolearetano417No ratings yet

- SometimesDocument2 pagesSometimesnicolearetano417No ratings yet

- Past 23Document1 pagePast 23nicolearetano417No ratings yet

- Past 21Document1 pagePast 21nicolearetano417No ratings yet

- Past 24Document2 pagesPast 24nicolearetano417No ratings yet

- Past 22Document1 pagePast 22nicolearetano417No ratings yet

- DhimanDocument3 pagesDhimannicolearetano417No ratings yet

- DhimanDocument3 pagesDhimannicolearetano417No ratings yet

- ValueDocument2 pagesValuenicolearetano417No ratings yet

- Lesson 58Document2 pagesLesson 58nicolearetano417No ratings yet

- MahatmaDocument2 pagesMahatmanicolearetano417No ratings yet

- English 101Document1 pageEnglish 101nicolearetano417No ratings yet

- English 102Document1 pageEnglish 102nicolearetano417No ratings yet

- Party Invitation: You're Invited To Celebrate With Us!Document1 pageParty Invitation: You're Invited To Celebrate With Us!nicolearetano417No ratings yet

- Report TitleDocument2 pagesReport TitleClaire QuirkeNo ratings yet

- Invoice: Date Date Invoice No NumberDocument1 pageInvoice: Date Date Invoice No NumberSci CalNo ratings yet

- Lesson 59Document2 pagesLesson 59nicolearetano417No ratings yet

- Lesson 56Document2 pagesLesson 56nicolearetano417No ratings yet

- Your Company Brochure: This Is A Great Spot For A Mission StatementDocument2 pagesYour Company Brochure: This Is A Great Spot For A Mission StatementZlata IveticNo ratings yet

- Lesson 60Document1 pageLesson 60nicolearetano417No ratings yet

- Lesson 57Document2 pagesLesson 57nicolearetano417No ratings yet

- Lesson 55Document3 pagesLesson 55nicolearetano417No ratings yet

- Rural Auto FinanceDocument78 pagesRural Auto FinanceLande AshutoshNo ratings yet

- SBI Assignment 1Document12 pagesSBI Assignment 1DeveshMittalNo ratings yet

- FRB White Paper Discusses U.S. Housing Conditions and Policy OptionsDocument28 pagesFRB White Paper Discusses U.S. Housing Conditions and Policy OptionsAdam DeutschNo ratings yet

- Faq of Banking WebsiteDocument110 pagesFaq of Banking Websitemoney coxNo ratings yet

- Time Value of Mony - Lecture 1Document2 pagesTime Value of Mony - Lecture 1rafeelNo ratings yet

- Ramon K. Ilusorio, Petitioner, vs. Hon. Court of AppealsDocument2 pagesRamon K. Ilusorio, Petitioner, vs. Hon. Court of AppealsrdNo ratings yet

- Group2 - Hong Kong DisneyLandDocument10 pagesGroup2 - Hong Kong DisneyLandNidhiAgarwalNo ratings yet

- Session 5 - 6 Financial Statements of BankDocument15 pagesSession 5 - 6 Financial Statements of BankArun KumarNo ratings yet

- Loan Agreement: MR Guy Bessette Domiciled at 5 CHEMIN DES BOULEAUX LAC-DES LOUPSDocument5 pagesLoan Agreement: MR Guy Bessette Domiciled at 5 CHEMIN DES BOULEAUX LAC-DES LOUPSelliche diorNo ratings yet

- How To Measure Bank SizeDocument24 pagesHow To Measure Bank SizeAsniNo ratings yet

- MyEG RHB CreditCard TNCDocument8 pagesMyEG RHB CreditCard TNCShobanraj LetchumananNo ratings yet

- Book Report Bank of BarodaDocument13 pagesBook Report Bank of BarodaYash HemnaniNo ratings yet

- Money market rolesDocument2 pagesMoney market rolesAilaJeanineNo ratings yet

- 6a. Cash BudgetDocument4 pages6a. Cash BudgetMadiha JamalNo ratings yet

- Debt Recovery Management of SBIDocument12 pagesDebt Recovery Management of SBIDipanjan DasNo ratings yet

- Derivaties AnswersDocument3 pagesDerivaties AnswersDavid DelvalleNo ratings yet

- Journalizing, Posting and BalancingDocument21 pagesJournalizing, Posting and Balancinganuradha100% (1)

- Ibs Taiping 1 30/11/22Document7 pagesIbs Taiping 1 30/11/22Nor AzitaNo ratings yet

- Individual Assignment: Subject: Eco121Document5 pagesIndividual Assignment: Subject: Eco121Doanh PhùngNo ratings yet

- Understanding Risks in BankingDocument68 pagesUnderstanding Risks in BankingDharmendra PillaiNo ratings yet

- Statement summary January-November 2020Document1 pageStatement summary January-November 202013KARAT0% (1)

- A Study On Customer Satisfaction HDFC HOJKJDocument79 pagesA Study On Customer Satisfaction HDFC HOJKJsakshi tomarNo ratings yet

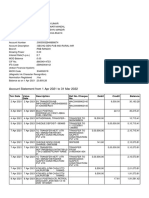

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument14 pagesAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRishav AnandNo ratings yet

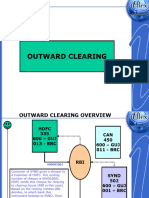

- 5-SETTLEMENT-Outward Clearing 1Document21 pages5-SETTLEMENT-Outward Clearing 1ola.cloudsNo ratings yet

- Mathematics of FinanceDocument22 pagesMathematics of FinanceJean Espanto100% (4)

- Handover NotesDocument4 pagesHandover NotesYAKUBU BABA TIJANINo ratings yet

- Project Manager or Mortgage Underwriter or Real Estate CompliancDocument2 pagesProject Manager or Mortgage Underwriter or Real Estate Compliancapi-121440766No ratings yet

- ShopassuranceDocument9 pagesShopassurancem_dattaiasNo ratings yet

- Ryan M Scharetg TMobile BillDocument3 pagesRyan M Scharetg TMobile BillJonathan Seagull LivingstonNo ratings yet

- Assignment - 4: TVM - A1Document4 pagesAssignment - 4: TVM - A1Aditi RawatNo ratings yet