Professional Documents

Culture Documents

FL Tax Efiling

Uploaded by

alvarez.jayden12070 ratings0% found this document useful (0 votes)

5 views9 pages1) Individuals in India are required to file an income tax return if their total income without deductions exceeds the exemption limit, which is Rs. 250,000 for normal individuals and higher for senior and super senior citizens.

2) There are late fees for filing income tax returns for Fiscal Year 2022-23 after the July 31st, 2023 deadline, ranging from Rs. 1,000 to Rs. 5,000 depending on taxable income.

3) Individuals can now file an updated income tax return for FY 2022-23 by December 31st, 2023 to declare additional income and pay additional tax on the income and interest. The additional tax rates are 25% until March

Original Description:

financial literacy tax efiling notes

Original Title

FL-Tax-eFiling

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Individuals in India are required to file an income tax return if their total income without deductions exceeds the exemption limit, which is Rs. 250,000 for normal individuals and higher for senior and super senior citizens.

2) There are late fees for filing income tax returns for Fiscal Year 2022-23 after the July 31st, 2023 deadline, ranging from Rs. 1,000 to Rs. 5,000 depending on taxable income.

3) Individuals can now file an updated income tax return for FY 2022-23 by December 31st, 2023 to declare additional income and pay additional tax on the income and interest. The additional tax rates are 25% until March

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views9 pagesFL Tax Efiling

Uploaded by

alvarez.jayden12071) Individuals in India are required to file an income tax return if their total income without deductions exceeds the exemption limit, which is Rs. 250,000 for normal individuals and higher for senior and super senior citizens.

2) There are late fees for filing income tax returns for Fiscal Year 2022-23 after the July 31st, 2023 deadline, ranging from Rs. 1,000 to Rs. 5,000 depending on taxable income.

3) Individuals can now file an updated income tax return for FY 2022-23 by December 31st, 2023 to declare additional income and pay additional tax on the income and interest. The additional tax rates are 25% until March

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

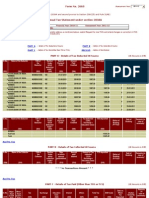

Filing of Income Tax Return

Section 139 (1) (b) read with Fifth Proviso

1. Individual is required to submit return of income,

if Income without claiming deductions under Section

80C to 80U exceeds the amount of Exemption Limit

(Rs. 250,000 / Sr Citizen 300,000 / Super Sr 500,000)

2. Electricity Bill Payment Rs. 100,000 or More

3. Foreign Travel Expenditure Rs. 200,000 or more

Income Tax Return FY 2022-23 (AY 2023-24)

Late Fees u/s 234F for Filing ITR after due date (31-07-2023)

If GTI not exceeding Basic Exemption Limit Late Fees “NIL”

If Taxable Income not exceeding Rs. 5,00,000

Late Fees Rs. 1000 (01-08-2023 to 31-12-2023)

If Taxable Income exceeding Rs. 5,00,000

Late Fees Rs. 5000 (01-08-2023 to 31-12-2023)

Sec 139(8A) inserted for Promoting Voluntary Tax Compliance

Filing of Updated ITR of FY 2022-23, irrespective of ITR Filed or not

Income which was not declared earlier (Annual Information Statement)

Additional Tax will be levied on Tax & Interest due on the

Additional Income to be declared under Updated Return

Additional Tax (i) 25% till 31-03-2025 (ii) 50% till 31-03-2026

Types of Income Tax Forms

1. ITR-1 Salary, One House Property, Other Sources

2. ITR-2 Salary, H.Prop, Capital Gain, Other Sources,

Clubbing, Losses Carried Forward/BF, Agri Income

3. ITR-3 Salary/H.Prop/CG/Business or Profession

4. ITR-4 Salary, One H.Prop, Business or Profession,

Income not exceeding Rs. 50 Lakhs, No Tax Audit

5. ITR-5 Partnership Firms

6. ITR-6 Companies

7. ITR-7 Trust

Methods of Filing: Online or Off Line by downloading Utilities

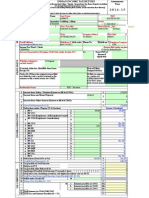

Filing of ITR-1 (SAHAJ)

• JSON Utility (Advanced Java Format)

• Excel Utility

• Online on www.incometax.gov.in

• One House Property only (Allowed 2 Self-Occupied)

• Taxable Income not more than 50,00,000

• Agricultural Income not exceeding Rs. 5,000

• No Sale of Assets-Shares / Property / Gold…

• No Clubbing Income (Spouse_Minor_Son’s wife)

• No Income from Business / Profession

• No Investment in Unlisted Shares

Filing of ITR of FY 2022-23 (AY 2023-24)

• Due Date of Filing by 31-07-2023

• With Late Fees by 31-12-2023

• With Penalty (Additional Tax) by 31-03-2026

On or before Due Date u/s 139(1)

After Due Date u/s 139(4) – Belated

Revised u/s 139(5) – for Changes

Updated u/s 139(8A) – After 31-12-2023

PAN Formation: AHH PM 8993 N

10 Alpha-Numeric Digits

• First Three Alphabets: Series

• Fourth Alphabet: Category of Assessee*

• Fifth Alphabet: Surname of the Individual

• Next Numerals: Four Numbers

• Last Alphabet: Check

Narendra Damodardas Modi AHH PM 8993 N

* Firm-F; Individuals-P; Comp-C; Local Authority-L

Tax deduction Account Number

• Shyam Lal College DEL S 25849 F

• Name of City in which Organisation Regd: DELHI

• First Initial letter of the Organisation Shyam

• Five Numericals (Computer generated) 25849

• Alpha Check (A to G):Divide the above number by

7, ..if remainder is Zero, then it will be A,

..if remainder is one, then Alpha check will be B

• AND so on….In this case, remainder is 5, so it is ‘F’

• Excel Utility allowing ….But Softwares…Show Error

11-Nov-23 Dr SB Rathore 7

Advance Tax / Self Assessment Tax

Generation of Challan with PAN/TAN

BSR Code (BASIC STATISTICAL RETURNS)

It is a 7-Numerical Digits Code allotted to Banks by

RBI; It is used in Challan details

SBI, Delhi University 0001067

HDFC Bank, Punjabi Bagh 0510079 (Net-0510308)

ICICI Bank, Mayur Vihar-I 6390311

CIN (Challan Identification Number) 20 Digits

BSR-7 + Date-8 + Challan-5 : 6390311 09112023 00045

B a n k ’s I F S C

IFSC is the Indian Financial System Code

Alpha-numeric code of 11 characters

It is a Unique Number

First Four Characters are Alpha

Fifth Character is Zero

Last Six Characters = Alpha / Numbers

• State Bank of India, Jwala Heri SBIN0006623

• HDFC Bank, Punjabi Bagh HDFC0000091

• Delhi Nagrik Sehkari Bank, Tri Nr YESB0DNB004

You might also like

- Historical Background of "General Post-Office"Document13 pagesHistorical Background of "General Post-Office"kronnickjohn26No ratings yet

- Tally ERP AssignmentDocument42 pagesTally ERP Assignmentdisha_200983% (93)

- Tally Erp AssignmentDocument42 pagesTally Erp Assignmentdeepisaini100% (1)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- ABB Oil Corporation Offer LetterDocument2 pagesABB Oil Corporation Offer LetterAparna Sutradhar100% (2)

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Gross Sales Declaration Form 2023Document1 pageGross Sales Declaration Form 2023Ramon Vinzon67% (9)

- Chelladurai Form16Document4 pagesChelladurai Form16sundar1111No ratings yet

- Resignation Acceptance LetterDocument1 pageResignation Acceptance LetterJahnvi KanwarNo ratings yet

- Assignment TallyDocument12 pagesAssignment TallyShivam PatelNo ratings yet

- QT12009Document2 pagesQT12009Piyush SrivastavaNo ratings yet

- Region Xi Orientation On Memorandum Circular 2021-054Document40 pagesRegion Xi Orientation On Memorandum Circular 2021-054keith tanueco100% (2)

- Erp ExerciseDocument44 pagesErp Exercisedebasri_chatterjeeNo ratings yet

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111No ratings yet

- Milton Form16Document4 pagesMilton Form16sundar1111No ratings yet

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111No ratings yet

- Babu Form 16Document4 pagesBabu Form 16sundar1111No ratings yet

- Quotation For BizelevateDocument2 pagesQuotation For Bizelevateindrajit.officialsNo ratings yet

- DT Icai MCQ 4Document5 pagesDT Icai MCQ 4Anshul JainNo ratings yet

- Form No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)Document4 pagesForm No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)jay_yashwanteNo ratings yet

- E-Filling of ReturnDocument6 pagesE-Filling of ReturnNeelanjan MitraNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- BCO 11 Block 03Document70 pagesBCO 11 Block 03Al OkNo ratings yet

- Www-Besttaxinfo-InDocument8 pagesWww-Besttaxinfo-Insukantabera215No ratings yet

- ChalanDocument1 pageChalandildar123No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Expenses Disallowed Under PGBPDocument6 pagesExpenses Disallowed Under PGBPsubhash mandwalNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- ItrDocument5 pagesItrdgdhandeNo ratings yet

- Income Tax2022 GuidelinesDocument4 pagesIncome Tax2022 GuidelinesSANDEEP SAHUNo ratings yet

- BCC BR 107 127Document182 pagesBCC BR 107 127DasthagiriBhashaNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Tally Assignment: Company CreationDocument26 pagesTally Assignment: Company CreationVidyadhara HegdeNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocument2 pagesSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNo ratings yet

- SBI Online-Banking Made Easy: Team MembersDocument9 pagesSBI Online-Banking Made Easy: Team Membersanup godeNo ratings yet

- GauriDocument12 pagesGauriRahul MittalNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Aug2010Document4 pagesAug2010Mohd ShoaibNo ratings yet

- India Budget Statement 2023 PDFDocument31 pagesIndia Budget Statement 2023 PDFSatyaki RoyNo ratings yet

- CA IPCC Taxation Mock Test Series 1 - Sept 2015Document7 pagesCA IPCC Taxation Mock Test Series 1 - Sept 2015Ramesh GuptaNo ratings yet

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanNo ratings yet

- 4 Service Tax Vat Ay 2011 12 NewDocument20 pages4 Service Tax Vat Ay 2011 12 NewJitendra VernekarNo ratings yet

- LM B K Vatsaraj 23june2010Document61 pagesLM B K Vatsaraj 23june2010Basavaraja C KNo ratings yet

- 5Document6 pages5Sunil DixitNo ratings yet

- Institute of Genomics & Integrative Biology - 632021102637328Document8 pagesInstitute of Genomics & Integrative Biology - 632021102637328robins chickuNo ratings yet

- TDS Presentation Taxguru - inDocument35 pagesTDS Presentation Taxguru - inBj Thivagar0% (2)

- ICWAI Inter Direct Tax Solved June 2011Document15 pagesICWAI Inter Direct Tax Solved June 2011rk_rkaushikNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Harmony 1111Document36 pagesHarmony 1111arvind-khanna-2954No ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- PL 88001297593Document23 pagesPL 88001297593Shaista BhatNo ratings yet

- EMC D S S (I) P L E P H: ATA Torage Ystems Ndia Rivate Imited Mployee Ayroll AndbookDocument38 pagesEMC D S S (I) P L E P H: ATA Torage Ystems Ndia Rivate Imited Mployee Ayroll AndbookArchana KadagoduNo ratings yet

- Internet Banking ModulesDocument13 pagesInternet Banking ModulesRahul GavandeNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Form 16 ADocument23 pagesForm 16 Amlkhantwal8404No ratings yet

- Instructions ItrDocument988 pagesInstructions ItrBalasubramanian NatarajanNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Analyze Company's Performance Using Ratios - Guided Project WorkbookDocument19 pagesAnalyze Company's Performance Using Ratios - Guided Project WorkbookAditya SeethaNo ratings yet

- Black MoneyDocument5 pagesBlack Moneyroy lexterNo ratings yet

- Nomination FormDocument2 pagesNomination FormKeyur SakhareNo ratings yet

- Module 7 Development Studies Paper 1&2Document28 pagesModule 7 Development Studies Paper 1&2rastiger92No ratings yet

- Li Register20210805Document134 pagesLi Register20210805Erick HernandezNo ratings yet

- ObliCon Online Activity 4 (Rommel A. Cabalhin)Document3 pagesObliCon Online Activity 4 (Rommel A. Cabalhin)Rommel CabalhinNo ratings yet

- Cetis D.D. Iso14001 Certificate 25082021 EngDocument2 pagesCetis D.D. Iso14001 Certificate 25082021 EngMonàm HadjiNo ratings yet

- BASI - Board Resolution - BIR PTU CAS - 30nov2023Document3 pagesBASI - Board Resolution - BIR PTU CAS - 30nov2023jayson.pagulongNo ratings yet

- Reserve Bank of AngolaDocument10 pagesReserve Bank of AngolaKahimbiNo ratings yet

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDocument15 pagesPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudencerunish venganzaNo ratings yet

- GeM Bidding 1955118Document4 pagesGeM Bidding 1955118Aditya SinghNo ratings yet

- Research Paper On GST PDFDocument2 pagesResearch Paper On GST PDFsamiullahNo ratings yet

- 71206Document6 pages71206Pandian KNo ratings yet

- IFCB2009 - 03.Xls - Sheet1Document192 pagesIFCB2009 - 03.Xls - Sheet1Amit SinghNo ratings yet

- 2017 Trump Carousel LLC New York City Vendor FilingDocument46 pages2017 Trump Carousel LLC New York City Vendor FilingjpeppardNo ratings yet

- MyGlamm Invoice 1682780534-39Document1 pageMyGlamm Invoice 1682780534-39Prince BaraiyaNo ratings yet

- Amrendra Kumar - Appointment LetterDocument6 pagesAmrendra Kumar - Appointment Letteramrendra sharmaNo ratings yet

- Test Bank For Intermediate Accounting 17th Edition SticeDocument13 pagesTest Bank For Intermediate Accounting 17th Edition SticeLawrence Gardin100% (33)

- The General Authority For Military Industries (GAMI)Document21 pagesThe General Authority For Military Industries (GAMI)OmaisNo ratings yet

- CNV Act & RulesDocument14 pagesCNV Act & RulesYamini SharmaNo ratings yet

- Sec RequirementsDocument3 pagesSec RequirementsTagolilongsNo ratings yet

- GST NotesDocument5 pagesGST NotesManjusha GantaNo ratings yet

- Field Visit To MsmeDocument10 pagesField Visit To MsmeviswaaruxNo ratings yet

- Construction Company Registration RequirementsDocument4 pagesConstruction Company Registration RequirementsMunusamy RajiNo ratings yet

- 13) Is LM ModelDocument32 pages13) Is LM Modelmedha surNo ratings yet