Professional Documents

Culture Documents

Taxation

Uploaded by

Bhumika BapatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation

Uploaded by

Bhumika BapatCopyright:

Available Formats

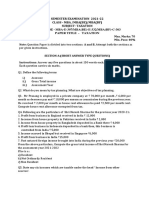

S. S.

DEMPO COLLEGE OF COMMERCE AND ECONOMICS

B.B.A. DEPARTMENT - TERM END EXAMINATION – JANUARY 2023

TAXATION – 25 MARKS

Duration: 1.5 hour

________________________________________________________________________________________________________________

1] Following is the income of Mr. Vijay for the previous year 2021-22.

i. Salary earned in India but received in London Rs. 50000

ii. Income from business in Dubai controlled from Mumbai Rs.200000

iii. Rent from property in Bangladesh but received in Delhi Rs.100000

iv. Income from business in USA controlled from USA Rs 50500

Find out his gross total income if he is :

1) Resident and ordinarily resident

2) Non resident of India.

2] Mrs. Seema, Central Govt. employee provides you the following information for the year

Ending 31st March 2022

Basic Salary Rs. 50,000 P.M

Dearness Allowance 45% up to August 2021 and thereafter 50%

Conveyance Allowance Rs. 20,000 (spent Rs. 15,000)

Arrears of salary received Rs. 1,50,000

In March 2022 she took Rs. 13,000 advance against salary

She received Entertainment Allowance Rs. 4,500 (spent Rs. 6,000)

Compute her income from ‘Salaries’ for the Assessment Year 2022-23

3] Mr. Mohan received the following gifts during the previous year 2021-22.

A] Received Rs. 40000 as gift from his friend on occasion of his marriage anniversary.

B] Received gold chain worth Rs. 50000 from his mother.

C] Received Rs 20000 from his sister’s friend.

D] Received Rs 60000 as gift on occasion of his birthday from his father in law.

Determine the taxability of the above gifts for AY 2022-23.

4] Mr. Tarun purchases a house for Rs 50000 in the year 1987-88. He constructs an additional

room in the year 2007-08 for Rs 90000. He constructs the first floor of the house in the year

2011-12 for Rs 500000. Mr Tarun sells the house property for Rs 35,00,000 on 30th March

2022, brokerage paid Rs 20000. The fair market value of the property as on 1st April is Rs

450000. Compute the capital gains for AY 2022-23.

5] Mr. David is a resident in India. His taxable income from all sources is Rs. 12,00,000.

Compute the tax payable if he is aged: a] 25 years b] 82 years as per the old Tax regime for

AY 2022-23.

You might also like

- Assignment - DTDocument2 pagesAssignment - DTKhushi ThakurNo ratings yet

- Salaries 3Document2 pagesSalaries 3soumyajeetkundu123No ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Salary QuestionsDocument3 pagesSalary QuestionsgixNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- PFTP - Unit II - Income From Salary - Short SumsDocument3 pagesPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974No ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Residential Status Problems 2021-2022-1Document5 pagesResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANo ratings yet

- Tax Planning & Financial Reporting 2nd Mid TermDocument6 pagesTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNo ratings yet

- Mid Term Examination questions on residential status, income from house property, and capital gainsDocument3 pagesMid Term Examination questions on residential status, income from house property, and capital gainssid pjNo ratings yet

- Paper 7: Direct Tax Laws & International Taxation: Questions and AnswersDocument19 pagesPaper 7: Direct Tax Laws & International Taxation: Questions and Answersneeraj sharmaNo ratings yet

- The Income Tax ActDocument32 pagesThe Income Tax Actapi-3832224No ratings yet

- Calculating Income Tax for Individuals and BusinessesDocument36 pagesCalculating Income Tax for Individuals and BusinessesVelayudham ThiyagarajanNo ratings yet

- Tax QuestionDocument1 pageTax QuestionK V RamanathanNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Personal Taxation Final QuestionsDocument5 pagesPersonal Taxation Final QuestionsKarthik RamanathanNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Assesment of Individuals Q-1Document4 pagesAssesment of Individuals Q-1kalyanikamineniNo ratings yet

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- Calculating Tax LiabilityDocument3 pagesCalculating Tax LiabilityRafia TasnimNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- Assignment No. 2 (Fall 2022)Document3 pagesAssignment No. 2 (Fall 2022)Bluewings Travel &ToursNo ratings yet

- Eco 11Document4 pagesEco 11Deepak GautamNo ratings yet

- Total Computation QB by CA Pranav ChandakDocument37 pagesTotal Computation QB by CA Pranav ChandakSurajNo ratings yet

- MCQ Taxation 2Document24 pagesMCQ Taxation 2Mahesh VekariyaNo ratings yet

- Tax Calculation for Income and BusinessDocument10 pagesTax Calculation for Income and BusinessSichen UpretyNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatNo ratings yet

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Assignment For Residential StatusDocument4 pagesAssignment For Residential StatusRaj HanumanteNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- Problems On Income From Other SourcesDocument3 pagesProblems On Income From Other Sourcesgoli pandeyNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Calculating Salary, Gratuity and TaxabilityDocument19 pagesCalculating Salary, Gratuity and TaxabilityHrishit Raj SardaNo ratings yet

- Residential Status, Exempt Income & AMT - PaperDocument6 pagesResidential Status, Exempt Income & AMT - PaperBharatbhusan RoutNo ratings yet

- Full Length DT TestDocument7 pagesFull Length DT Testyvispute71No ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- CA INTER Super 30 Questions - (01-70)Document70 pagesCA INTER Super 30 Questions - (01-70)Jalaludeen SNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- ACC315A JAN 2023 Taxation CAT 1Document2 pagesACC315A JAN 2023 Taxation CAT 1Abuk AyulNo ratings yet

- Calculating Income from House PropertyDocument5 pagesCalculating Income from House PropertyROHAN DESAINo ratings yet

- Problems On Tax ManagementDocument44 pagesProblems On Tax ManagementBalaji Elangovan25% (4)

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhNo ratings yet

- 010jan Vijay CaseDocument14 pages010jan Vijay CaseKr PrajapatNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Finance Management Specialisation - Ii 304 - B: Direct TaxationDocument3 pagesFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarNo ratings yet

- Bba Sem-6 AssignmentDocument9 pagesBba Sem-6 Assignmentshyam visanaNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- TLP-MCQ 100Document16 pagesTLP-MCQ 100ankur100% (1)

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Income from salaries and house propertyDocument21 pagesIncome from salaries and house propertyAshish TomsNo ratings yet

- Problem On Scope of Total IncomeDocument2 pagesProblem On Scope of Total Incomegoli pandeyNo ratings yet

- VELS INSTITUTE OF SCIENCE, TECHNOLOGY AND ADVANCED STUDIESDocument3 pagesVELS INSTITUTE OF SCIENCE, TECHNOLOGY AND ADVANCED STUDIESAndalNo ratings yet