Professional Documents

Culture Documents

Sec 183 3

Sec 183 3

Uploaded by

goelshubham92Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sec 183 3

Sec 183 3

Uploaded by

goelshubham92Copyright:

Available Formats

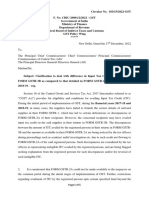

S. No.

Scenario Clarification

supply, instead of B2B supply, in

his FORM GSTR-1, due to which

the said supply does not get

reflected in FORM GSTR-2A of

the said registered person.

d. Where the supplier has filed FORM In such cases, the difference in ITC claimed by

GSTR-1 as well as return in FORM the registered person in his return in FORM

GSTR-3B for a tax period, but he GSTR-3B and that available in FORM GSTR-2A

has declared the supply with wrong may be handled by following the procedure

GSTIN of the recipient in FORM provided in para 4 below.

GSTR-1.

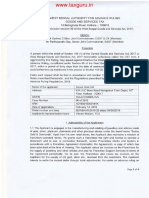

In addition, the proper officer of the actual

recipient shall intimate the concerned

jurisdictional tax authority of the registered

person, whose GSTIN has been mentioned

wrongly, that ITC on those transactions is

required to be disallowed, if claimed by such

recipients in their FORM GSTR-3B. However,

allowance of ITC to the actual recipient shall not

depend on the completion of the action by the tax

authority of such registered person, whose

GSTIN has been mentioned wrongly, and such

action will be pursued as an independent action.

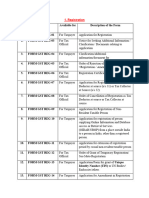

4. The proper officer shall first seek the details from the registered person regarding all

the invoices on which ITC has been availed by the registered person in his FORM GSTR 3B

but which are not reflecting in his FORM GSTR 2A. He shall then ascertain fulfillment of the

following conditions of Section 16 of CGST Act in respect of the input tax credit availed on

such invoices by the said registered person:

i) that he is in possession of a tax invoice or debit note issued by the supplier or such

other tax paying documents;

ii) that he has received the goods or services or both;

iii) that he has made payment for the amount towards the value of supply, along with

tax payable thereon, to the supplier.

Page 3 of 5

You might also like

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- India Prowessdx Data Dictionary PDFDocument5,841 pagesIndia Prowessdx Data Dictionary PDFRiturajPaulNo ratings yet

- Cir 183 15 2022 CGSTDocument5 pagesCir 183 15 2022 CGSTAmritesh RaiNo ratings yet

- How To Handle Difference of Itc Availed inDocument5 pagesHow To Handle Difference of Itc Availed inNishanth SrinivasNo ratings yet

- Sec 183 2Document1 pageSec 183 2goelshubham92No ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- Presentation 09.03.2017 CA - Shivani ShahDocument29 pagesPresentation 09.03.2017 CA - Shivani ShahPARESH KUVADIYANo ratings yet

- Relief For ITC Claimed For Unmatched Invoices in GSTR 2A For FYs 2017-18Document3 pagesRelief For ITC Claimed For Unmatched Invoices in GSTR 2A For FYs 2017-18sanket lunkadNo ratings yet

- GST Pratical ApproachDocument20 pagesGST Pratical ApproachSanthoshNo ratings yet

- GST Notices and CompliancesDocument7 pagesGST Notices and CompliancesSubhash VishwakarmaNo ratings yet

- Taxmann's Analysis - Rule 37A - Navigating Through The Intricacies and GSTN AdvisoryDocument10 pagesTaxmann's Analysis - Rule 37A - Navigating Through The Intricacies and GSTN AdvisoryThouseefNo ratings yet

- Summary of Notififcation Dated 26.12.2022Document3 pagesSummary of Notififcation Dated 26.12.2022Akshat MehariaNo ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- Cancellation of RegistrationDocument2 pagesCancellation of RegistrationRajdev AssociatesNo ratings yet

- Registration in Continuation With Class NotesDocument5 pagesRegistration in Continuation With Class NotesRahul KumarNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- Registration in GST NovDocument8 pagesRegistration in GST Novvinod.sale1No ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismjaipalmeNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- Response To SCNDocument2 pagesResponse To SCNshikshadhariwal1No ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- GST Circulars Issued On 6th July - A SummaryDocument8 pagesGST Circulars Issued On 6th July - A SummaryVijaya ChandNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- Indirect Tax Laws 1Document10 pagesIndirect Tax Laws 1GunjanNo ratings yet

- GST Return & FilingDocument14 pagesGST Return & Filingjibin samuelNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- Cir 170 02 2022 CGSTDocument7 pagesCir 170 02 2022 CGSTTushar AgrawalNo ratings yet

- GST RegistrationDocument10 pagesGST RegistrationThakreNo ratings yet

- Mismatch in Tax Liabilities-No Longer A Factual ConcernDocument4 pagesMismatch in Tax Liabilities-No Longer A Factual ConcernKunwarbir Singh lohatNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- GST FormDocument16 pagesGST FormPruthiv RajNo ratings yet

- Summary and Scrutiny Under GSTDocument2 pagesSummary and Scrutiny Under GSTjabbi2100No ratings yet

- 180 Days ITC Reversal On Non-Payment of Consideration – A Dilemma For Taxpayer - Taxguru - inDocument9 pages180 Days ITC Reversal On Non-Payment of Consideration – A Dilemma For Taxpayer - Taxguru - inkvmkinNo ratings yet

- GST Forms Available 25092019Document13 pagesGST Forms Available 25092019Jethwa AaryaNo ratings yet

- TS-367-HCCAL-2023-GST-Suncraft Energy 1 CompressedDocument3 pagesTS-367-HCCAL-2023-GST-Suncraft Energy 1 CompressedA-BAZZNo ratings yet

- Circular CGST 123Document4 pagesCircular CGST 123AKSHATANo ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- Chapter 7 Input Tax Credit Under GSTDocument28 pagesChapter 7 Input Tax Credit Under GSTDR. PREETI JINDALNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- Forms in GSTDocument11 pagesForms in GSTsagayNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- In Re Senco Gold LTD GST AAR West BangalDocument4 pagesIn Re Senco Gold LTD GST AAR West Bangalkinnar2013No ratings yet

- Registration of CGSTDocument3 pagesRegistration of CGSTambikaagarwal1934No ratings yet

- Casual Taxable Person Brochure - 10 November 2022Document2 pagesCasual Taxable Person Brochure - 10 November 2022KumariNo ratings yet

- GST Return FilingDocument9 pagesGST Return FilingSanthosh K SNo ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Chapter 8 - Input Tax CreditDocument21 pagesChapter 8 - Input Tax Creditmadaanakansha91No ratings yet

- ITC Reversal For Non-Payment of Tax by Supplier and Re-Availment - Taxguru - inDocument7 pagesITC Reversal For Non-Payment of Tax by Supplier and Re-Availment - Taxguru - inaeudaipur5500No ratings yet

- CGST 16 (2) (C)Document31 pagesCGST 16 (2) (C)noorensaba01No ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Format of Draft Reply On DRC-01Document3 pagesFormat of Draft Reply On DRC-01Awanish SrivastavaNo ratings yet

- The Digital Newspaper: Major Recommendations of The 45 GST Council MeetingDocument3 pagesThe Digital Newspaper: Major Recommendations of The 45 GST Council MeetingDevendra AryaNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- GST Reverse Charge: A Three Phased AnalysisDocument8 pagesGST Reverse Charge: A Three Phased AnalysisRashi AroraNo ratings yet

- "Last Date For Availing Itc For 2017-2018 IS 31 AUGUST, 2019": Gujarat High CourtDocument2 pages"Last Date For Availing Itc For 2017-2018 IS 31 AUGUST, 2019": Gujarat High Courtsukantabera215No ratings yet

- GST Reverse Charge Mechanism Converted MergedDocument20 pagesGST Reverse Charge Mechanism Converted MergedPriyal ShethNo ratings yet

- 28.01.2020, 1. v.D.N.sravanthi Madam, Asst. Commissioner (ST), Persons Liable To Registration, Compulsory Registration, ProcedureDocument52 pages28.01.2020, 1. v.D.N.sravanthi Madam, Asst. Commissioner (ST), Persons Liable To Registration, Compulsory Registration, ProcedureArchana LNo ratings yet

- 11 CIR vs. Next MobileDocument20 pages11 CIR vs. Next MobileDianne LingalNo ratings yet

- A Project Report On Asset Liability Management in Andhra BankDocument89 pagesA Project Report On Asset Liability Management in Andhra Banksimran kumariNo ratings yet

- Labour LawDocument14 pagesLabour LawRichi MonaniNo ratings yet

- Contoh Tinjauan Pustaka "Administrasi Penggajian"Document13 pagesContoh Tinjauan Pustaka "Administrasi Penggajian"rizka natasya dwitiandiNo ratings yet

- Drug Pricing in India Final PDFDocument4 pagesDrug Pricing in India Final PDFAnil Bhard WajNo ratings yet

- TCDN (Bank Test c28)Document28 pagesTCDN (Bank Test c28)Nguyễn Thanh TrúcNo ratings yet

- Williamson's Managerial Discretionary Theory:: I. Expansion of StaffDocument3 pagesWilliamson's Managerial Discretionary Theory:: I. Expansion of StaffAhim Raj JoshiNo ratings yet

- Employment Potential of Renewable Energy in Saudi ArabiaDocument36 pagesEmployment Potential of Renewable Energy in Saudi ArabiaEng. RocketNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFSiva ThotaNo ratings yet

- GHRM ppt-1Document20 pagesGHRM ppt-1Khizer PashaNo ratings yet

- Swot Analysis FeasibDocument2 pagesSwot Analysis FeasibIan Kirby AlegadoNo ratings yet

- (Chapter 5) C5.1 Nature of Management + Four Basic Functions How Big Are Organizations and Businesses?Document24 pages(Chapter 5) C5.1 Nature of Management + Four Basic Functions How Big Are Organizations and Businesses?IsaNo ratings yet

- Energy Scenario in IndiaDocument14 pagesEnergy Scenario in IndiaAbhinav Kumar Yadav89% (9)

- AI in SUPPLY CHAINDocument11 pagesAI in SUPPLY CHAINkunal sadhukhan100% (2)

- Fundamentals of TaxationDocument17 pagesFundamentals of TaxationPetersonNo ratings yet

- Case Study - Ben & Jerry'sDocument7 pagesCase Study - Ben & Jerry'sLinh Phan Thị MỹNo ratings yet

- Group 7 Research Paper - ENDELITADocument22 pagesGroup 7 Research Paper - ENDELITALorna Ignacio GuiwanNo ratings yet

- The Gazette: of IndiaDocument4 pagesThe Gazette: of Indiagurpreet06No ratings yet

- Kaushik Saha CVDocument2 pagesKaushik Saha CVKaushik SahaNo ratings yet

- Week 2 SM AVMVO - v1.0 ShareDocument28 pagesWeek 2 SM AVMVO - v1.0 Shareabhishek guptaNo ratings yet

- UGC - NET With MCQ (English)Document145 pagesUGC - NET With MCQ (English)Preeti BalharaNo ratings yet

- Fund Performance 31 Aug 21Document6 pagesFund Performance 31 Aug 21Al SharifNo ratings yet

- Final Examination PART I. ESSAY (50 Points) : 1 Prepared By: Dr. Gregorio E. Baccay IIIDocument2 pagesFinal Examination PART I. ESSAY (50 Points) : 1 Prepared By: Dr. Gregorio E. Baccay IIIgregbaccayNo ratings yet

- Ludwig Von Mises - A Critique of Bohm-BawerkDocument6 pagesLudwig Von Mises - A Critique of Bohm-Bawerknbk13geo100% (2)

- Fly DubaiDocument8 pagesFly DubaiEmna AchourNo ratings yet

- HRM Term PaperDocument26 pagesHRM Term PaperImtiaz AhmedNo ratings yet

- Syndicated Loan AgreementDocument49 pagesSyndicated Loan Agreementcasey9759949No ratings yet

- Xii Commercial Geography Target Paper by Sir MuneebDocument7 pagesXii Commercial Geography Target Paper by Sir MuneebMuhammad BilalNo ratings yet

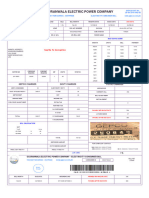

- GEPCO Gujranwala Electric Power CompanyDocument1 pageGEPCO Gujranwala Electric Power CompanyPara NoidNo ratings yet

- James Reveley - The Exploitative Web, Misuses of Marx in Critical Social Media StudiesDocument24 pagesJames Reveley - The Exploitative Web, Misuses of Marx in Critical Social Media StudieslabpjrNo ratings yet