Professional Documents

Culture Documents

Sadasf

Uploaded by

.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sadasf

Uploaded by

.Copyright:

Available Formats

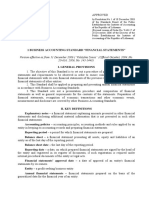

IFRS 10 - CONSOLIDATED FINANCIAL STATEMENTS

METHOD OF CONSOLIDATION

Acquisition method is based on the concept of single economic entity.

Single economic entity results in elimination of:

• Investment in subsidiary by underlying asset and liabilities

• Share Capital and pre-acquisition reserves of subsidiary

• Intra group balances – sales & purchases, payables & receivables, loans & advance

• Unrealized gain on sale and purchase of fixed assets and inventory (opening and

closing both), however, losses on sale or purchase are assumed to be impairment

losses and need not be eliminated.

• Interest and dividend from Subsidiary

• The resultant deferred tax arising on temporary differences because of elimination of

profits / gains on intra-group transactions will be recognized.

• The consolidated financial statements will be prepared using same accounting

policies for like transactions.

CONSOLIDATION WORKING

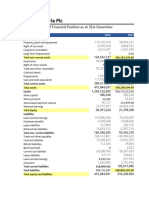

The Statement Of Financial Position

1. Prepare the working in following steps:

W 1: Establish group structure

Percentage of holding by Parent company %

W 2: Net assets of subsidiary

at acquisition date at reporting date

Share capital XXX XXX

Reserves:

Share premium XXX XXX

Retained earnings XXX XXX

XXX XXX

W 3: Goodwill calculation

Purchase consideration XXX

Add: NCI at acquisition date (at fair value or proportionate share) XXX

XXX

Less: Fair value of net assets at acquisition XXX

Goodwill (balancing figure) XXX

Less: Impairment of goodwill (subsequently) XXX

Goodwill after impairment XXX

W 4: Non-controlling interest

NCI at acquisition date (W3) XXX

Add/Less: Share of post-acquisition reserves (W2) XXX

Less: Impairment (fair value method only) XXX

XXX

W 5: Group retained earnings

Parent's retained earnings (100%) XXX

Add/Less: Parent's % of Subsidiary's post-acquisition retained earnings XXX

Less: Parent share of impairment (W3) XXX

XXX

You might also like

- Rightmove ACF768Document38 pagesRightmove ACF768Ghazaal HassanzadehNiriNo ratings yet

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (2)

- FABM 2 - Comprehensive TaskDocument3 pagesFABM 2 - Comprehensive TaskJOHN PAUL LAGAO100% (1)

- Business Unit Performance Measurement: True / False QuestionsDocument188 pagesBusiness Unit Performance Measurement: True / False QuestionsElaine Gimarino100% (1)

- SAP Asset Accounting - Journal EntriesDocument2 pagesSAP Asset Accounting - Journal EntriesShareef MdNo ratings yet

- Consolidated Financial Statements - Notes PDFDocument2 pagesConsolidated Financial Statements - Notes PDFKeanna Denise GonzalesNo ratings yet

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (1)

- (Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR CompleteDocument12 pages(Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR Completets tanNo ratings yet

- Basic Consol Acc2 & 3Document17 pagesBasic Consol Acc2 & 3fortuinpdNo ratings yet

- Questions in ConsolidatedDocument2 pagesQuestions in ConsolidatedvanessaNo ratings yet

- Buscom NotesDocument2 pagesBuscom NotesLiza SoberanoNo ratings yet

- Buscom DoaDocument2 pagesBuscom DoaChristian GoNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- Buscom Summary NotesDocument14 pagesBuscom Summary Notesaaaaa aaaaaNo ratings yet

- Consolidated Statement of Financial PositionDocument6 pagesConsolidated Statement of Financial PositionRameen FatimaNo ratings yet

- XXXX XXX XXX XXX XXX XXX XXXDocument3 pagesXXXX XXX XXX XXX XXX XXX XXXIzaya -kunNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Intermediate Accounting Second Sem ReviewerDocument7 pagesIntermediate Accounting Second Sem ReviewerchxrlttxNo ratings yet

- Business CombinationDocument2 pagesBusiness CombinationMarie GonzalesNo ratings yet

- Consolidation Subsequent To Date of Acquisitionpdf PDF FreeDocument9 pagesConsolidation Subsequent To Date of Acquisitionpdf PDF FreelixvanterNo ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- Fund From OperationDocument1 pageFund From OperationGood VibesNo ratings yet

- ADVACDocument17 pagesADVACHohohoNo ratings yet

- Accounting For Corporations Pro-Forma Entries: Memorandum Entry Method Journal Entry MethodDocument5 pagesAccounting For Corporations Pro-Forma Entries: Memorandum Entry Method Journal Entry MethodKent Logarta100% (2)

- Consolidated Balance Sheet: Consolidation SummaryDocument3 pagesConsolidated Balance Sheet: Consolidation SummaryRah EelNo ratings yet

- Formulas For Business Combination PDFDocument28 pagesFormulas For Business Combination PDFJulious CaalimNo ratings yet

- Vertical Income Statement: FormatDocument5 pagesVertical Income Statement: FormatHermann Schmidt EbengaNo ratings yet

- SHAREHOLDERSDocument13 pagesSHAREHOLDERSJanisseNo ratings yet

- Xintacctg1-Reviewer For Shareholders' EquityDocument5 pagesXintacctg1-Reviewer For Shareholders' Equitymushroompolice100% (2)

- Day 2 Dipifrs Weekend Batch 19022022Document21 pagesDay 2 Dipifrs Weekend Batch 19022022Kathleen De JesusNo ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Consolidated Financial StatementsDocument27 pagesConsolidated Financial StatementsAlyssa CasimiroNo ratings yet

- Classified Is and BSDocument1 pageClassified Is and BSSoumik MutsuddiNo ratings yet

- Operating Activities Are The Transactions From The Revenue Generating ActivitiesDocument3 pagesOperating Activities Are The Transactions From The Revenue Generating ActivitiesRaym FelixNo ratings yet

- Funds Flow Statement FormatDocument2 pagesFunds Flow Statement FormatBheemeswar ReddyNo ratings yet

- Retained Earnings ModuleDocument2 pagesRetained Earnings Modulehansel0% (1)

- Consolidated Statement Formula01 PDFDocument2 pagesConsolidated Statement Formula01 PDFNiña Rica PunzalanNo ratings yet

- 1-Cash Flow StatementDocument21 pages1-Cash Flow StatementOvais Zia100% (1)

- Shareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' EquityDocument12 pagesShareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' Equitycriszel4sobejanaNo ratings yet

- Cash Flow Statement - FormatDocument2 pagesCash Flow Statement - FormatHassan AsgharNo ratings yet

- Prepared By: Dyan Nicole M. Francisco, CPADocument4 pagesPrepared By: Dyan Nicole M. Francisco, CPABeatrice Ella DomingoNo ratings yet

- Increase in Shareholding - StudentDocument21 pagesIncrease in Shareholding - StudentNaim lalaNo ratings yet

- STUDYDocument10 pagesSTUDYkerniaserieuxxNo ratings yet

- Consolidation ProcedureDocument11 pagesConsolidation ProcedureShamim SarwarNo ratings yet

- Notes in Business CombinationDocument5 pagesNotes in Business CombinationEllen BuenafeNo ratings yet

- Corporate Liquidation DiscussionDocument4 pagesCorporate Liquidation DiscussionElizabeth DumawalNo ratings yet

- Ias 28 AssociateDocument19 pagesIas 28 AssociateĐức DuyNo ratings yet

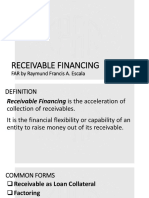

- 10 Receivable Financing For UploadDocument19 pages10 Receivable Financing For UploadMay Grethel Joy PeranteNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- Syed Atif Ali: ST HR SIC AC SC ECDocument1 pageSyed Atif Ali: ST HR SIC AC SC EC.No ratings yet

- Company Directors' SustainabilityDocument1 pageCompany Directors' Sustainability.No ratings yet

- DFSDDocument1 pageDFSD.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- DsasDocument1 pageDsas.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- Al - 62Document1 pageAl - 62.No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- MBA Pre-Term Ch2 BasicDocument53 pagesMBA Pre-Term Ch2 BasicJoe YunNo ratings yet

- PERMATA ILTIZAM SDN BHD-SME ScoreDocument8 pagesPERMATA ILTIZAM SDN BHD-SME ScoreFazlisha ShaharizanNo ratings yet

- Business Accounting Standard - LithuaniaDocument9 pagesBusiness Accounting Standard - Lithuaniafleur de VieNo ratings yet

- 3Document45 pages3Alex liaoNo ratings yet

- What Is The Formula For Creditor DaysDocument9 pagesWhat Is The Formula For Creditor DaysKathir HaiNo ratings yet

- Nestle Financial Statements - Keystone BankDocument15 pagesNestle Financial Statements - Keystone Bankemmanuelleonard54No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document7 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- PLDTDocument16 pagesPLDTPrince PerezNo ratings yet

- Chap-6-Verification of Assets and LiabilitiesDocument48 pagesChap-6-Verification of Assets and LiabilitiesAkash GuptaNo ratings yet

- Solution Manual Chapter 4 Intermediate Accounting - KIYOSIDocument13 pagesSolution Manual Chapter 4 Intermediate Accounting - KIYOSIIndra AminudinNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Part A & BDocument6 pagesPart A & BRiya PrajapatiNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Accountancy DepartmentDocument13 pagesAccountancy DepartmentGRACELYN SOJORNo ratings yet

- AUD Answer Key With SolutionsDocument5 pagesAUD Answer Key With SolutionsJerome MadrigalNo ratings yet

- Control Account QuestionsDocument6 pagesControl Account QuestionsJaneth Patrick100% (2)

- Week 1 Minicase Computron Industries Members:: Current Assets Current Liability 2680000 1039800Document10 pagesWeek 1 Minicase Computron Industries Members:: Current Assets Current Liability 2680000 1039800Eve Grace SohoNo ratings yet

- Accounting Acc106Document23 pagesAccounting Acc106zary100% (3)

- Case 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookDocument3 pagesCase 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookkimkimNo ratings yet

- Template For Group AssignmentDocument5 pagesTemplate For Group AssignmentIntan QamariaNo ratings yet

- Session 4 - WCMDocument68 pagesSession 4 - WCMMayank PatelNo ratings yet

- IFRS 5 Basis For ConclusionDocument29 pagesIFRS 5 Basis For ConclusionMariana Mirela100% (1)

- Flyleaf BooksDocument32 pagesFlyleaf BooksAzhar MajothiNo ratings yet

- Chapter+2 3Document14 pagesChapter+2 3kanasanNo ratings yet

- Godrej Consumer Products Limited 44 QuarterUpdateDocument9 pagesGodrej Consumer Products Limited 44 QuarterUpdateKhushboo SharmaNo ratings yet

- PNJ Update 20201207Document7 pagesPNJ Update 20201207Khoa PhamNo ratings yet