Professional Documents

Culture Documents

Libantino, Jessica T. 11262481 80030501 11,350.00 05/15/2018 04/30/2019

Uploaded by

meijibrielle23Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Libantino, Jessica T. 11262481 80030501 11,350.00 05/15/2018 04/30/2019

Uploaded by

meijibrielle23Copyright:

Available Formats

*This is an original copy.

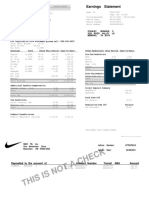

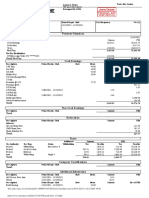

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 14,036.33

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 127.58

..............................................................................................................................................................

Less: Total Deductions 1,655.27

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 764.76

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 890.51

Semi-monthly Pay Rate 11,350.00

Advice Date 05/15/2018

Net Pay 12,253.48

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 469.66 Basic Pay - Tx 102,150.00 HDMF EE Contribution 100.00 Excess Leaves 7,305.76

Basic Pay 11,350.00 Holiday Overtime 6,731.73 PhilHealth Cont EE Share 156.06 HDMF EE Cont. 500.00

De minimis (NonTx Allow) 2,216.67 Misc. Benefits - NTx 11,083.35 SSS EE Contribution 508.70 PhilHealth EE Share 1,404.58

Night Diff. - Tx 5,771.56 SSS Cont - EE Share 2,833.90

NTx Allowance 2,048.00

Overtime - Tx 10,319.39

Tx Allowance 592.00

TOTAL: 14,036.33 132,924.47 TOTAL: 764.76 12,044.24

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

SPF Staff Voluntary 567.50 Loans 2,907.09 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 130.00

SSS Loan - Salary 323.01 SPF Voluntary 5,107.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 500.00

Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 1,404.58

SS EE Compensation by ER 10.00 SPF Cont-ER Shr 6,129.00

SSS ER Contribution 1,031.30 SSS Cont - ER Share 5,746.10

TOTAL: 890.51 8,114.59 TOTAL: 1,978.36 13,909.68

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 15,158.74

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 877.01

..............................................................................................................................................................

Less: Total Deductions 473.16

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 228.67

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 244.49

Semi-monthly Pay Rate 11,350.00

Advice Date 05/31/2018

Net Pay 13,808.57

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Holiday Overtime 2,139.54 Basic Pay - Tx 113,500.00 PhilHealth Cont EE Share 156.07 Excess Leaves 7,305.76

*Meal Allowance NTx 128.00 Holiday Overtime 8,871.27 SSS EE Contribution 72.60 HDMF EE Cont. 500.00

*Meal Allowance Tx 37.00 Misc. Benefits - NTx 11,083.35 PhilHealth EE Share 1,560.65

*ND Paymnt Tx 147.42 Night Diff. - Tx 5,918.98 SSS Cont - EE Share 2,906.50

*Overtime Pay 1,356.78 NTx Allowance 2,176.00

Basic Pay 11,350.00 Overtime - Tx 11,676.17

Tx Allowance 629.00

TOTAL: 15,158.74 147,935.79 TOTAL: 228.67 12,272.91

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*SSS Loan - Salary -323.01 Loans 2,584.08 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 150.00

SPF Staff Voluntary 567.50 SPF Voluntary 5,675.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 500.00

Staff Advances 100.00 SS EE Compensation by ER 20.00 PhilHealth ER Share 1,560.65

SSS ER Contribution 147.40 SPF Cont-ER Shr 6,810.00

SSS Cont - ER Share 5,893.50

TOTAL: 244.49 8,359.08 TOTAL: 1,004.47 14,914.15

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

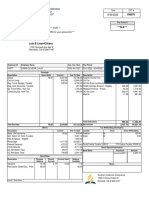

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 15,044.78

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 3,455.92

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 2,888.42

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 567.50

Semi-monthly Pay Rate 11,350.00

Advice Date 06/15/2018

Net Pay 11,588.86

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 121.33 Basic Pay - Tx 124,850.00 *Excess SL Dedn 2,087.36 Excess Leaves 9,393.12

*Overtime Pay 1,356.78 Holiday Overtime 8,871.27 HDMF EE Contribution 100.00 HDMF EE Cont. 600.00

Basic Pay 11,350.00 Misc. Benefits - NTx 13,300.02 PhilHealth Cont EE Share 156.06 PhilHealth EE Share 1,716.71

De minimis (NonTx Allow) 2,216.67 Night Diff. - Tx 6,040.31 SSS EE Contribution 545.00 SSS Cont - EE Share 3,451.50

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 15,044.78 162,859.24 TOTAL: 2,888.42 15,161.33

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

SPF Staff Voluntary 567.50 Loans 2,584.08 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 180.00

SPF Voluntary 6,242.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 600.00

Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 1,716.71

SS EE Compensation by ER 30.00 SPF Cont-ER Shr 7,491.00

SSS ER Contribution 1,105.00 SSS Cont - ER Share 6,998.50

TOTAL: 567.50 8,926.58 TOTAL: 2,072.06 16,986.21

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 11,451.76

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 73.02

..............................................................................................................................................................

Less: Total Deductions 759.87

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 192.37

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 567.50

Semi-monthly Pay Rate 11,350.00

Advice Date 06/30/2018

Net Pay 10,618.87

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 101.76 Basic Pay - Tx 136,200.00 PhilHealth Cont EE Share 156.07 Excess Leaves 9,393.12

Basic Pay 11,350.00 Holiday Overtime 8,871.27 SSS EE Contribution 36.30 HDMF EE Cont. 600.00

Misc. Benefits - NTx 13,300.02 PhilHealth EE Share 1,872.78

Night Diff. - Tx 6,142.07 SSS Cont - EE Share 3,487.80

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 11,451.76 174,209.24 TOTAL: 192.37 15,353.70

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

SPF Staff Voluntary 567.50 Loans 2,584.08 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 180.00

SPF Voluntary 6,810.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 600.00

Staff Advances 100.00 SSS ER Contribution 73.70 PhilHealth ER Share 1,872.78

SPF Cont-ER Shr 8,172.00

SSS Cont - ER Share 7,072.20

TOTAL: 567.50 9,494.08 TOTAL: 910.77 17,896.98

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 15,745.35

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 8,387.16

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 7,081.34

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,305.82

Semi-monthly Pay Rate 11,350.00

Advice Date 07/15/2018

Net Pay 7,358.19

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Holiday Overtime 2,113.45 Basic Pay - Tx 147,550.00 *Excess SL Dedn 6,262.08 Excess Leaves 15,655.20

*ND Paymnt Tx 65.23 Holiday Overtime 10,984.72 HDMF EE Contribution 100.00 HDMF EE Cont. 700.00

Basic Pay 11,350.00 Misc. Benefits - NTx 15,516.69 PhilHealth Cont EE Share 156.06 PhilHealth EE Share 2,028.84

De minimis (NonTx Allow) 2,216.67 Night Diff. - Tx 6,207.30 SSS EE Contribution 563.20 SSS Cont - EE Share 4,051.00

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 15,745.35 189,889.36 TOTAL: 7,081.34 22,435.04

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

SPF Staff Voluntary 567.50 Loans 3,322.40 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 210.00

SSS Loan - Salary 738.32 SPF Voluntary 7,377.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 700.00

Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 2,028.84

SS EE Compensation by ER 30.00 SPF Cont-ER Shr 8,853.00

SSS ER Contribution 1,141.80 SSS Cont - ER Share 8,214.00

TOTAL: 1,305.82 10,799.90 TOTAL: 2,108.86 20,005.84

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 11,467.41

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 1,479.99

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 174.17

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,305.82

Semi-monthly Pay Rate 11,350.00

Advice Date 07/31/2018

Net Pay 9,987.42

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 117.41 Basic Pay - Tx 158,900.00 PhilHealth Cont EE Share 156.07 Excess Leaves 15,655.20

Basic Pay 11,350.00 Holiday Overtime 10,984.72 SSS EE Contribution 18.10 HDMF EE Cont. 700.00

Misc. Benefits - NTx 15,516.69 PhilHealth EE Share 2,184.91

Night Diff. - Tx 6,324.71 SSS Cont - EE Share 4,069.10

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 11,467.41 201,239.36 TOTAL: 174.17 22,609.21

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

SPF Staff Voluntary 567.50 Loans 4,060.72 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 210.00

SSS Loan - Salary 738.32 SPF Voluntary 7,945.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 700.00

Staff Advances 100.00 SSS ER Contribution 36.90 PhilHealth ER Share 2,184.91

SPF Cont-ER Shr 9,534.00

SSS Cont - ER Share 8,250.90

TOTAL: 1,305.82 12,105.72 TOTAL: 873.97 20,879.81

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 14,388.57

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 4,760.45

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 2,870.22

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 08/15/2018

Net Pay 9,628.12

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 821.90 Basic Pay - Tx 170,250.00 *Excess SL Dedn 2,087.36 Excess Leaves 17,742.56

Basic Pay 11,350.00 Holiday Overtime 10,984.72 HDMF EE Contribution 100.00 HDMF EE Cont. 800.00

De minimis (NonTx Allow) 2,216.67 Misc. Benefits - NTx 17,733.36 PhilHealth Cont EE Share 156.06 PhilHealth EE Share 2,340.97

Night Diff. - Tx 7,146.61 SSS EE Contribution 526.80 SSS Cont - EE Share 4,595.90

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 14,388.57 214,806.03 TOTAL: 2,870.22 25,479.43

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 5,383.45 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 220.00

SPF Staff Voluntary 567.50 SPF Voluntary 8,512.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 800.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 2,340.97

SS EE Compensation by ER 10.00 SPF Cont-ER Shr 10,215.00

SSS ER Contribution 1,068.20 SSS Cont - ER Share 9,319.10

TOTAL: 1,890.23 13,995.95 TOTAL: 2,015.26 22,895.07

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

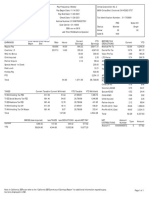

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 12,263.22

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,100.80

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 210.57

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 08/31/2018

Net Pay 10,162.42

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 913.22 Basic Pay - Tx 181,600.00 PhilHealth Cont EE Share 156.07 Excess Leaves 17,742.56

Basic Pay 11,350.00 Holiday Overtime 10,984.72 SSS EE Contribution 54.50 HDMF EE Cont. 800.00

Misc. Benefits - NTx 17,733.36 PhilHealth EE Share 2,497.04

Night Diff. - Tx 8,059.83 SSS Cont - EE Share 4,650.40

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 12,263.22 226,156.03 TOTAL: 210.57 25,690.00

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 6,706.18 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 240.00

SPF Staff Voluntary 567.50 SPF Voluntary 9,080.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 800.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SS EE Compensation by ER 20.00 PhilHealth ER Share 2,497.04

SSS ER Contribution 110.50 SPF Cont-ER Shr 10,896.00

SSS Cont - ER Share 9,429.60

TOTAL: 1,890.23 15,886.18 TOTAL: 967.57 23,862.64

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 13,749.31

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 5,767.83

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 3,877.60

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 09/15/2018

Net Pay 7,981.48

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 182.64 Basic Pay - Tx 192,950.00 *Excess SL Dedn 3,131.04 Excess Leaves 20,873.60

Basic Pay 11,350.00 Holiday Overtime 10,984.72 HDMF EE Contribution 100.00 HDMF EE Cont. 900.00

De minimis (NonTx Allow) 2,216.67 Misc. Benefits - NTx 19,950.03 PhilHealth Cont EE Share 156.06 PhilHealth EE Share 2,653.10

Night Diff. - Tx 8,242.47 SSS EE Contribution 490.50 SSS Cont - EE Share 5,140.90

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 13,749.31 239,722.70 TOTAL: 3,877.60 29,567.60

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 8,028.91 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 250.00

SPF Staff Voluntary 567.50 SPF Voluntary 9,647.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 900.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 2,653.10

SS EE Compensation by ER 10.00 SPF Cont-ER Shr 11,577.00

SSS ER Contribution 994.50 SSS Cont - ER Share 10,424.10

TOTAL: 1,890.23 17,776.41 TOTAL: 1,941.56 25,804.20

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 11,350.00

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,137.10

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 246.87

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 09/30/2018

Net Pay 9,212.90

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

Basic Pay 11,350.00 Basic Pay - Tx 204,300.00 PhilHealth Cont EE Share 156.07 Excess Leaves 20,873.60

Holiday Overtime 10,984.72 SSS EE Contribution 90.80 HDMF EE Cont. 900.00

Misc. Benefits - NTx 19,950.03 PhilHealth EE Share 2,809.17

Night Diff. - Tx 8,242.47 SSS Cont - EE Share 5,231.70

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 11,350.00 251,072.70 TOTAL: 246.87 29,814.47

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 9,351.64 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 270.00

SPF Staff Voluntary 567.50 SPF Voluntary 10,215.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 900.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SS EE Compensation by ER 20.00 PhilHealth ER Share 2,809.17

SSS ER Contribution 184.20 SPF Cont-ER Shr 12,258.00

SSS Cont - ER Share 10,608.30

TOTAL: 1,890.23 19,666.64 TOTAL: 1,041.27 26,845.47

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 15,497.48

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,709.49

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 819.26

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 10/15/2018

Net Pay 12,787.99

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*VL BPO ENC NTx 1,930.81 Basic Pay - Tx 215,650.00 HDMF EE Contribution 100.00 Excess Leaves 20,873.60

Basic Pay 11,350.00 Holiday Overtime 10,984.72 PhilHealth Cont EE Share 156.06 HDMF EE Cont. 1,000.00

De minimis (NonTx Allow) 2,216.67 Leave Encashment - NTx 1,930.81 SSS EE Contribution 563.20 PhilHealth EE Share 2,965.23

Misc. Benefits - NTx 22,166.70 SSS Cont - EE Share 5,794.90

Night Diff. - Tx 8,242.47

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 15,497.48 266,570.18 TOTAL: 819.26 30,633.73

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 10,674.37 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 300.00

SPF Staff Voluntary 567.50 SPF Voluntary 10,782.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 1,000.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 2,965.23

SS EE Compensation by ER 30.00 SPF Cont-ER Shr 12,939.00

SSS ER Contribution 1,141.80 SSS Cont - ER Share 11,750.10

TOTAL: 1,890.23 21,556.87 TOTAL: 2,108.86 28,954.33

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 11,584.83

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,064.40

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 174.17

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 10/31/2018

Net Pay 9,520.43

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 234.83 Basic Pay - Tx 227,000.00 PhilHealth Cont EE Share 156.07 Excess Leaves 20,873.60

Basic Pay 11,350.00 Holiday Overtime 10,984.72 SSS EE Contribution 18.10 HDMF EE Cont. 1,000.00

Leave Encashment - NTx 1,930.81 PhilHealth EE Share 3,121.30

Misc. Benefits - NTx 22,166.70 SSS Cont - EE Share 5,813.00

Night Diff. - Tx 8,477.30

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 11,584.83 277,920.18 TOTAL: 174.17 30,807.90

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 11,997.10 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 300.00

SPF Staff Voluntary 567.50 SPF Voluntary 11,350.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 1,000.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SSS ER Contribution 36.90 PhilHealth ER Share 3,121.30

SPF Cont-ER Shr 13,620.00

SSS Cont - ER Share 11,787.00

TOTAL: 1,890.23 23,447.10 TOTAL: 873.97 29,828.30

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 38,479.92

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,727.59

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 837.36

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 11/15/2018

Net Pay 35,752.33

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

13th mth bns 22,700.00 Basic Pay - Tx 238,350.00 HDMF EE Contribution 100.00 Excess Leaves 20,873.60

Basic Pay 11,350.00 Bonus 24,913.25 PhilHealth Cont EE Share 156.06 HDMF EE Cont. 1,100.00

De minimis (NonTx Allow) 2,216.67 Holiday Overtime 10,984.72 SSS EE Contribution 581.30 PhilHealth EE Share 3,277.36

Ind Perf Bonus Final 2,213.25 Leave Encashment - NTx 1,930.81 SSS Cont - EE Share 6,394.30

Misc. Benefits - NTx 24,383.37

Night Diff. - Tx 8,477.30

NTx Allowance 2,176.00

Overtime - Tx 13,032.95

Tx Allowance 629.00

TOTAL: 38,479.92 316,400.10 TOTAL: 837.36 31,645.26

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 13,319.83 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 330.00

SPF Staff Voluntary 567.50 SPF Voluntary 11,917.50 PhilHealth Cont ER Share 156.06 HDMF ER Cont. 1,100.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SPF Firm Con Staff 681.00 PhilHealth ER Share 3,277.36

SS EE Compensation by ER 30.00 SPF Cont-ER Shr 14,301.00

SSS ER Contribution 1,178.70 SSS Cont - ER Share 12,965.70

TOTAL: 1,890.23 25,337.33 TOTAL: 2,145.76 31,974.06

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 17,871.78

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,046.30

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 156.07

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 1,890.23

Semi-monthly Pay Rate 11,350.00

Advice Date 11/30/2018

Net Pay 15,825.48

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Holiday Overtime 1,356.78 Basic Pay - Tx 249,700.00 PhilHealth Cont EE Share 156.07 Excess Leaves 20,873.60

*Meal Allowance NTx 128.00 Bonus 24,913.25 HDMF EE Cont. 1,100.00

*Meal Allowance Tx 37.00 Holiday Overtime 12,341.50 PhilHealth EE Share 3,433.43

Basic Pay 11,350.00 Leave Encashment - NTx 1,930.81 SSS Cont - EE Share 6,394.30

Christmas Gift 5,000.00 Misc. Benefits - NTx 29,383.37

Night Diff. - Tx 8,477.30

NTx Allowance 2,304.00

Overtime - Tx 13,032.95

Tx Allowance 666.00

TOTAL: 17,871.78 334,271.88 TOTAL: 156.07 31,801.33

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 14,642.56 PhilHealth Cont ER Share 156.07 Emp Comp Cont - ER Share 330.00

SPF Staff Voluntary 567.50 SPF Voluntary 12,485.00 SPF Firm Con Staff 681.00 HDMF ER Cont. 1,100.00

SSS Loan - Salary 738.32 Staff Advances 100.00 PhilHealth ER Share 3,433.43

SPF Cont-ER Shr 14,982.00

SSS Cont - ER Share 12,965.70

TOTAL: 1,890.23 27,227.56 TOTAL: 837.07 32,811.13

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

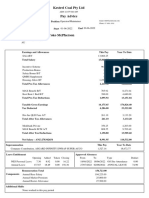

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 32,477.22

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 3,334.91

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 842.18

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 12/15/2018

Net Pay 29,142.31

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Ind Perf Bonus Final 1,721.41 Basic Pay - Tx 261,400.00 HDMF EE Contribution 100.00 Excess Leaves 20,873.60

*ND Paymnt Tx 39.14 Bonus 43,434.66 PhilHealth Cont EE Share 160.88 HDMF EE Cont. 1,200.00

13th mth bns 700.00 Holiday Overtime 12,341.50 SSS EE Contribution 581.30 PhilHealth EE Share 3,594.31

Basic Pay 11,700.00 Leave Encashment - NTx 1,930.81 SSS Cont - EE Share 6,975.60

De minimis (NonTx Allow) 2,216.67 Misc. Benefits - NTx 31,600.04

Ind Perf Bonus Final 16,100.00 Night Diff. - Tx 8,516.44

NTx Allowance 2,304.00

Overtime - Tx 13,032.95

Tx Allowance 666.00

TOTAL: 32,477.22 366,709.96 TOTAL: 842.18 32,643.51

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 15,965.29 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 360.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 13,655.00 PhilHealth Cont ER Share 160.88 HDMF ER Cont. 1,200.00

SSS Loan - Salary 738.32 Staff Advances 100.00 SPF Firm Con Staff 702.00 PhilHealth ER Share 3,594.31

SS EE Compensation by ER 30.00 SPF Cont-ER Shr 15,684.00

SSS ER Contribution 1,178.70 SSS Cont - ER Share 14,144.40

TOTAL: 2,492.73 29,720.29 TOTAL: 2,171.58 34,982.71

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 13,965.40

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes -151.04

..............................................................................................................................................................

Less: Total Deductions 5,881.12

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 3,388.39

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 12/31/2018

Net Pay 8,235.32

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Holiday Overtime 2,113.45 Basic Pay - Tx 273,100.00 *Excess SL Dedn 3,227.52 Excess Leaves 24,101.12

*Meal Allowance NTx 128.00 Bonus 43,434.66 PhilHealth Cont EE Share 160.87 HDMF EE Cont. 1,200.00

*Meal Allowance Tx 37.00 Holiday Overtime 14,454.95 PhilHealth EE Share 3,755.18

*ND Paymnt Tx -13.05 Leave Encashment - NTx 1,930.81 SSS Cont - EE Share 6,975.60

Basic Pay 11,700.00 Misc. Benefits - NTx 31,600.04

Night Diff. - Tx 8,503.39

NTx Allowance 2,432.00

Overtime - Tx 13,032.95

Tx Allowance 703.00

TOTAL: 13,965.40 380,688.41 TOTAL: 3,388.39 36,031.90

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 17,288.02 PhilHealth Cont ER Share 160.87 Emp Comp Cont - ER Share 360.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 14,825.00 SPF Firm Con Staff 702.00 HDMF ER Cont. 1,200.00

SSS Loan - Salary 738.32 Staff Advances 100.00 PhilHealth ER Share 3,755.18

SPF Cont-ER Shr 16,386.00

SSS Cont - ER Share 14,144.40

TOTAL: 2,492.73 32,213.02 TOTAL: 862.87 35,845.58

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 13,916.67

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 101.43

..............................................................................................................................................................

Less: Total Deductions 3,262.31

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 769.58

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 01/15/2019

Net Pay 10,552.93

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

Basic Pay 11,700.00 Basic Pay - Tx 11,700.00 HDMF EE Contribution 100.00 HDMF EE Cont. 100.00

De minimis (NonTx Allow) 2,216.67 Misc. Benefits - NTx 2,216.67 PhilHealth Cont EE Share 160.88 PhilHealth EE Share 160.88

Meal Allowance NTx 6.25 NTx Allowance 6.25 SSS EE Contribution 508.70 SSS Cont - EE Share 508.70

Meal Allowance Tx -6.25 Tx Allowance -6.25

TOTAL: 13,916.67 13,916.67 TOTAL: 769.58 769.58

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 1,322.73 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 10.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 1,170.00 PhilHealth Cont ER Share 160.88 HDMF ER Cont. 100.00

SSS Loan - Salary 738.32 SPF Firm Con Staff 702.00 PhilHealth ER Share 160.88

SS EE Compensation by ER 10.00 SPF Cont-ER Shr 702.00

SSS ER Contribution 1,031.30 SSS Cont - ER Share 1,031.30

TOTAL: 2,492.73 2,492.73 TOTAL: 2,004.18 2,004.18

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 11,700.00

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 11,700.00

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 10,991.87

..............................................................................................................................................................

Cost Center 80030501

Total After Tax Deductions 708.13

Semi-monthly Pay Rate 11,700.00

Advice Date 01/31/2019

Net Pay 0.00

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

Basic Pay 11,700.00 Basic Pay - Tx 23,400.00 *Excess SL Dedn 10,758.40 Excess Leaves 10,758.40

Misc. Benefits - NTx 2,216.67 PhilHealth Cont EE Share 160.87 HDMF EE Cont. 100.00

NTx Allowance 6.25 SSS EE Contribution 72.60 PhilHealth EE Share 321.75

Tx Allowance -6.25 SSS Cont - EE Share 581.30

TOTAL: 11,700.00 25,616.67 TOTAL: 10,991.87 11,761.45

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Dedn Carry Forward -205.47 Loans 2,645.46 PhilHealth Cont ER Share 160.87 Emp Comp Cont - ER Share 30.00

Dedn Carry Forward -1,784.60 SPF Voluntary 2,340.00 SPF Firm Con Staff 702.00 HDMF ER Cont. 100.00

Dedn Previous Period 205.47 YTD Dedn Carry Forward -1,990.07 SS EE Compensation by ER 20.00 PhilHealth ER Share 321.75

HDMF Multi-Purpose Loan 584.41 SSS ER Contribution 147.40 SPF Cont-ER Shr 1,404.00

SPF Staff Voluntary 1,170.00 SSS Cont - ER Share 1,178.70

SSS Loan - Salary 738.32

TOTAL: 708.13 2,995.39 TOTAL: 1,030.27 3,034.45

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 14,037.70

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 8,274.43

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 3,997.10

..............................................................................................................................................................

Cost Center 80031737

Total After Tax Deductions 4,277.33

Semi-monthly Pay Rate 11,700.00

Advice Date 02/15/2019

Net Pay 5,763.27

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 121.03 Basic Pay - Tx 35,100.00 *Excess SL Dedn 3,227.52 Excess Leaves 13,985.92

Basic Pay 11,700.00 Misc. Benefits - NTx 4,433.34 HDMF EE Contribution 100.00 HDMF EE Cont. 200.00

De minimis (NonTx Allow) 2,216.67 Night Diff. - Tx 121.03 PhilHealth Cont EE Share 160.88 PhilHealth EE Share 482.63

NTx Allowance 6.25 SSS EE Contribution 508.70 SSS Cont - EE Share 1,090.00

Tx Allowance -6.25

TOTAL: 14,037.70 39,533.34 TOTAL: 3,997.10 15,758.55

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Dedn Carry Forward -3,106.49 Loans 3,968.19 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 40.00

Dedn Previous Period 4,891.09 SPF Voluntary 3,510.00 PhilHealth Cont ER Share 160.88 HDMF ER Cont. 200.00

HDMF Multi-Purpose Loan 584.41 YTD Dedn Carry Forward -3,106.49 SPF Firm Con Staff 702.00 PhilHealth ER Share 482.63

SPF Staff Voluntary 1,170.00 SS EE Compensation by ER 10.00 SPF Cont-ER Shr 2,106.00

SSS Loan - Salary 738.32 SSS ER Contribution 1,031.30 SSS Cont - ER Share 2,210.00

TOTAL: 4,277.33 4,371.70 TOTAL: 2,004.18 5,038.63

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 14,277.57

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 3,802.04

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 1,309.31

..............................................................................................................................................................

Cost Center 80031737

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 02/28/2019

Net Pay 10,475.53

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Holiday Overtime 1,538.45 Basic Pay - Tx 46,800.00 *Excess SL Dedn 1,075.84 Excess Leaves 15,061.76

*Meal Allowance NTx 134.25 Holiday Overtime 1,538.45 PhilHealth Cont EE Share 160.87 HDMF EE Cont. 200.00

*Meal Allowance Tx 30.75 Misc. Benefits - NTx 4,433.34 SSS EE Contribution 72.60 PhilHealth EE Share 643.50

*ND Paymnt Tx 874.12 Night Diff. - Tx 995.15 SSS Cont - EE Share 1,162.60

Basic Pay 11,700.00 NTx Allowance 140.50

Tx Allowance 24.50

TOTAL: 14,277.57 52,936.79 TOTAL: 1,309.31 17,067.86

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 5,290.92 PhilHealth Cont ER Share 160.87 Emp Comp Cont - ER Share 60.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 4,680.00 SPF Firm Con Staff 702.00 HDMF ER Cont. 200.00

SSS Loan - Salary 738.32 SS EE Compensation by ER 20.00 PhilHealth ER Share 643.50

SSS ER Contribution 147.40 SPF Cont-ER Shr 2,808.00

SSS Cont - ER Share 2,357.40

TOTAL: 2,492.73 9,970.92 TOTAL: 1,030.27 6,068.90

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 16,463.31

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 3,334.90

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 842.17

..............................................................................................................................................................

Cost Center 80031737

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 03/15/2019

Net Pay 13,128.41

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*Holiday Overtime 1,520.97 Basic Pay - Tx 58,500.00 HDMF EE Contribution 100.00 Excess Leaves 15,061.76

*Meal Allowance NTx 134.25 Holiday Overtime 3,059.42 PhilHealth Cont EE Share 160.87 HDMF EE Cont. 300.00

*Meal Allowance Tx 30.75 Misc. Benefits - NTx 6,650.01 SSS EE Contribution 581.30 PhilHealth EE Share 804.37

*ND Paymnt Tx 860.67 Night Diff. - Tx 1,855.82 SSS Cont - EE Share 1,743.90

Basic Pay 11,700.00 NTx Allowance 274.75

De minimis (NonTx Allow) 2,216.67 Tx Allowance 55.25

TOTAL: 16,463.31 68,539.43 TOTAL: 842.17 17,910.03

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 6,613.65 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 90.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 5,850.00 PhilHealth Cont ER Share 160.88 HDMF ER Cont. 300.00

SSS Loan - Salary 738.32 SPF Firm Con Staff 702.00 PhilHealth ER Share 804.38

SS EE Compensation by ER 30.00 SPF Cont-ER Shr 3,510.00

SSS ER Contribution 1,178.70 SSS Cont - ER Share 3,536.10

TOTAL: 2,492.73 12,463.65 TOTAL: 2,171.58 8,240.48

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 12,224.47

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 2,653.61

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 160.88

..............................................................................................................................................................

Cost Center 80031737

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 03/31/2019

Net Pay 9,570.86

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 524.47 Basic Pay - Tx 70,200.00 PhilHealth Cont EE Share 160.88 Excess Leaves 15,061.76

Basic Pay 11,700.00 Holiday Overtime 3,059.42 HDMF EE Cont. 300.00

Misc. Benefits - NTx 6,650.01 PhilHealth EE Share 965.25

Night Diff. - Tx 2,380.29 SSS Cont - EE Share 1,743.90

NTx Allowance 274.75

Tx Allowance 55.25

TOTAL: 12,224.47 80,239.43 TOTAL: 160.88 18,070.91

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 7,936.38 PhilHealth Cont ER Share 160.87 Emp Comp Cont - ER Share 90.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 7,020.00 SPF Firm Con Staff 702.00 HDMF ER Cont. 300.00

SSS Loan - Salary 738.32 PhilHealth ER Share 965.25

SPF Cont-ER Shr 4,212.00

SSS Cont - ER Share 3,536.10

TOTAL: 2,492.73 14,956.38 TOTAL: 862.87 9,103.35

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 14,508.38

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 3,333.60

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 840.87

..............................................................................................................................................................

Cost Center 80031737

Total After Tax Deductions 2,492.73

Semi-monthly Pay Rate 11,700.00

Advice Date 04/15/2019

Net Pay 11,174.78

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 591.71 Basic Pay - Tx 81,900.00 HDMF EE Contribution 100.00 Excess Leaves 15,061.76

Basic Pay 11,700.00 Holiday Overtime 3,059.42 PhilHealth Cont EE Share 160.87 HDMF EE Cont. 400.00

De minimis (NonTx Allow) 2,216.67 Misc. Benefits - NTx 8,866.68 SSS EE Contribution 580.00 PhilHealth EE Share 1,126.12

Night Diff. - Tx 2,972.00 SSS Cont - EE Share 2,323.90

NTx Allowance 274.75

Tx Allowance 55.25

TOTAL: 14,508.38 94,156.10 TOTAL: 840.87 18,911.78

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

HDMF Multi-Purpose Loan 584.41 Loans 9,259.11 HDMF ER Contribution 100.00 Emp Comp Cont - ER Share 100.00

SPF Staff Voluntary 1,170.00 SPF Voluntary 8,190.00 PhilHealth Cont ER Share 160.88 HDMF ER Cont. 400.00

SSS Loan - Salary 738.32 SPF Firm Con Staff 702.00 PhilHealth ER Share 1,126.13

SS EE Compensation by ER 10.00 SPF Cont-ER Shr 4,914.00

SSS ER Contribution 1,160.00 SSS Cont - ER Share 4,696.10

TOTAL: 2,492.73 17,449.11 TOTAL: 2,132.88 11,236.23

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

*This is an original copy.

Accenture Inc. Payslip Summary

7th floor Robinsons Cybergate1

Total Gross 12,184.13

Pioneer St., Mandaluyong City * 1554 Philippines ..............................................................................................................................................................

Tel: +63 2 580 5888 * Fax: +63 2 702 9171

Less: Total Taxes 0.00

..............................................................................................................................................................

Less: Total Deductions 1,704.79

Name Libantino, Jessica T. ..............................................................................................................................................................

Employee ID 11262481 Total Before Tax Deductions 380.88

..............................................................................................................................................................

Cost Center 80031737

Total After Tax Deductions 1,323.91

Semi-monthly Pay Rate 11,700.00

Advice Date 04/30/2019

Net Pay 10,479.34

Current Date 04/30/2019

Payslip Breakdown

Earnings Before Tax Deductions

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*ND Paymnt Tx 484.13 Basic Pay - Tx 93,600.00 PhilHealth Cont EE Share 160.88 Excess Leaves 15,061.76

Basic Pay 11,700.00 Holiday Overtime 3,059.42 SSS EE Contribution 220.00 HDMF EE Cont. 400.00

Misc. Benefits - NTx 8,866.68 PhilHealth EE Share 1,287.00

Night Diff. - Tx 3,456.13 SSS Cont - EE Share 2,543.90

NTx Allowance 274.75

Tx Allowance 55.25

TOTAL: 12,184.13 105,856.10 TOTAL: 380.88 19,292.66

For your reference only.

After Tax Deductions Employer Paid Benefits Not included in your Net Pay computation.

DESCRIPTION CURRENT DESCRIPTION YTD DESCRIPTION CURRENT DESCRIPTION YTD

*HDMF Multi-Purpose Loan -584.41 Loans 9,413.02 PhilHealth Cont ER Share 160.87 Emp Comp Cont - ER Share 120.00

*SSS Loan - Salary SPF Voluntary 9,360.00 SPF Firm Con Staff 702.00 HDMF ER Cont. 400.00

SPF Staff Voluntary 1,170.00 SS EE Compensation by ER 20.00 PhilHealth ER Share 1,287.00

SSS Loan - Salary 738.32 SSS ER Contribution 440.00 SPF Cont-ER Shr 5,616.00

SSS Cont - ER Share 5,136.10

TOTAL: 1,323.91 18,773.02 TOTAL: 1,322.87 12,559.10

Disclaimer: This is electronically generated, no signature required.

Should verification is needed to determine the authenticity of the information stated in this document, please contact AEE.Phils.PayrollMail@accenture.com

Copyright 2016 Accenture. All Rights Reserved. Accenture Highly Confidential.

You might also like

- Earnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Document1 pageEarnings Statement: Stanley, Monique S 3232 River Valley LN Memphis, TN 38119Miquel JonesNo ratings yet

- 9:30:22Document1 page9:30:22Rosa Medina AlbarránNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVKaren OHareNo ratings yet

- Bwi North America, Inc. Abhishek Inchal: Expenserei GTL LTD RegularDocument1 pageBwi North America, Inc. Abhishek Inchal: Expenserei GTL LTD RegularSandra BenjaminNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income DetailsarbyjamesNo ratings yet

- Earnings: Hourly Ot Bonus Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Bonus Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- FOREIGN DOLL CORP April 2023 TD Statement - EditedDocument4 pagesFOREIGN DOLL CORP April 2023 TD Statement - Editedlesly malebrancheNo ratings yet

- Pay Stub 2Document2 pagesPay Stub 2Antionette JewelNo ratings yet

- Net Pay 25,021.51: Confidential Payslip Fold LineDocument1 pageNet Pay 25,021.51: Confidential Payslip Fold LineTumelo MoloiNo ratings yet

- Car Rental AgreementDocument2 pagesCar Rental AgreementRon Yhayan72% (32)

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadNo ratings yet

- Barcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023Document1 pageBarcela, John Christian 13634019 80031904 10,000.00 02/15/2023 02/15/2023JCNo ratings yet

- Sop CanadaDocument6 pagesSop CanadaajayNo ratings yet

- FOREIGN DOLL CORP May 2023 TD StatementDocument4 pagesFOREIGN DOLL CORP May 2023 TD Statementlesly malebrancheNo ratings yet

- Oblicon Reviewer - Anton MercadoDocument320 pagesOblicon Reviewer - Anton MercadoJL100% (1)

- Operators ManualDocument230 pagesOperators ManualAyaovi Jorlau100% (5)

- Payment Advice: Labour Solutions Australia PTY LTDDocument1 pagePayment Advice: Labour Solutions Australia PTY LTDZulfiqar AliNo ratings yet

- Pay SlipDocument1 pagePay Slipraj Kumar Thapa chhetriNo ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument2 pagesPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- Hard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Document330 pagesHard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Adriel senciaNo ratings yet

- 01-18-2020 Payslip PDFDocument1 page01-18-2020 Payslip PDFCarla ZanteNo ratings yet

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocument2 pages3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- Payslip: Employee Details Payment & Leave DetailsDocument1 pagePayslip: Employee Details Payment & Leave DetailsKushal MalhotraNo ratings yet

- Payslip MAY 2019 PDFDocument1 pagePayslip MAY 2019 PDFKushal Malhotra100% (1)

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- Rsgio24 Company LegalDocDocument6 pagesRsgio24 Company LegalDocMr Tarun PalNo ratings yet

- 2 J PLUS ASIA v. UTILITYDocument3 pages2 J PLUS ASIA v. UTILITYWally CalaganNo ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- Onofre, Christian Emmanuel Alcantara 11541758 80032336 10,800.00 05/15/2022 06/07/2022Document2 pagesOnofre, Christian Emmanuel Alcantara 11541758 80032336 10,800.00 05/15/2022 06/07/2022Gerard OlvidadoNo ratings yet

- Catalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023Document4 pagesCatalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023catalbasNo ratings yet

- Leido, Ivan Kyle Santiago 13288188 80035411 7,950.00 06/15/2023 06/17/2023Document1 pageLeido, Ivan Kyle Santiago 13288188 80035411 7,950.00 06/15/2023 06/17/2023ybn LdNo ratings yet

- Form 47Document2 pagesForm 47Ao DpoNo ratings yet

- Fllanx Xhekaj 11-23-2023 (US Regular) - CompleteDocument2 pagesFllanx Xhekaj 11-23-2023 (US Regular) - CompleteArlinda XhekajNo ratings yet

- Your Pay Advice For Pay Ending 30 09 2022Document2 pagesYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374No ratings yet

- 07 15 2018 PayDocument2 pages07 15 2018 PayB.ShivaniNo ratings yet

- Confidential: Rustan Supercenters, IncDocument1 pageConfidential: Rustan Supercenters, IncJenelle EulloNo ratings yet

- PayslipDocument1 pagePayslipJM GereroNo ratings yet

- Torch and Shield Security Agency: Cost DistributionDocument1 pageTorch and Shield Security Agency: Cost DistributionJomar Del BarrioNo ratings yet

- 4Document1 page4Victoria MrrNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- Checkstub For Kenny Cullison - 12 - 29 - 2022Document1 pageCheckstub For Kenny Cullison - 12 - 29 - 2022kbcullison61No ratings yet

- RPT Pay Slip YTDDocument1 pageRPT Pay Slip YTDTomola BlessingNo ratings yet

- Sarmiento 1 9 2022Document2 pagesSarmiento 1 9 2022Franz Gabriel CubillanNo ratings yet

- Payslip - 2023 07 31 1Document2 pagesPayslip - 2023 07 31 1maricrispedraza.phNo ratings yet

- Sheila Mae Platon: Company AIG Shared Services - Business Processing, IncDocument1 pageSheila Mae Platon: Company AIG Shared Services - Business Processing, IncHazel Ann AgacerNo ratings yet

- Paystub 2021 12 19 PDFDocument2 pagesPaystub 2021 12 19 PDFLuis MartinezNo ratings yet

- Auprecedadata PAY1 TOLF80 Payslips 9455479904493 Sessionid PG0 V1 D5 T8Document1 pageAuprecedadata PAY1 TOLF80 Payslips 9455479904493 Sessionid PG0 V1 D5 T8Eggy PalangatNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- 2012 20191025 StatementDocument2 pages2012 20191025 StatementDS QwerityNo ratings yet

- S A 9s A Oo: Ngs DeductionsDocument4 pagesS A 9s A Oo: Ngs DeductionsCheck 0No ratings yet

- FORM47Document2 pagesFORM47Kotyada Srinu RaoNo ratings yet

- Class C: ConfidentialDocument1 pageClass C: ConfidentialAnonymous iScW9lNo ratings yet

- Formato Nuevo Recibo de LuzDocument2 pagesFormato Nuevo Recibo de Luzkarla allegrettiNo ratings yet

- Valve Adj.Document1 pageValve Adj.Antoni ZelayaNo ratings yet

- Ed 9Document2 pagesEd 9Sanjay DuaNo ratings yet

- Cost Proposal For EditDocument1 pageCost Proposal For EditAdvance D ShieldNo ratings yet

- Elijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD AmountDocument1 pageElijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD Amountmdyafi8084No ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Earnings: PR Filing Status: S Exemptions: 0Document1 pageEarnings: PR Filing Status: S Exemptions: 0alfredo velezNo ratings yet

- LB US Online PayslipDocument2 pagesLB US Online PayslipJoali uwuNo ratings yet

- Cost Proposal For BulacanDocument1 pageCost Proposal For BulacanAdvance D ShieldNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Plaint SampleDocument6 pagesPlaint SamplejaymwanisawaNo ratings yet

- MPDFDocument6 pagesMPDFArabela BerganciaNo ratings yet

- Individual Assignment 2 (SET 4) Yu Xinlei ZP05872Document12 pagesIndividual Assignment 2 (SET 4) Yu Xinlei ZP05872Yu XinleiNo ratings yet

- Gross Profit From SaleDocument5 pagesGross Profit From SaleRosemarie CruzNo ratings yet

- WSP Rapid Transit BrochureDocument18 pagesWSP Rapid Transit BrochurePATEL MIHIKANo ratings yet

- Group - 6 Ohhh KakaninDocument27 pagesGroup - 6 Ohhh KakaninJAY LORD CAMARILLONo ratings yet

- Principles of Taxation - 2019Document2 pagesPrinciples of Taxation - 2019Anushka SinghNo ratings yet

- Guia Usa Nataly Largo 772134549015Document7 pagesGuia Usa Nataly Largo 772134549015samadhi sierraNo ratings yet

- Collaboration Saas Authorization: September 2019Document14 pagesCollaboration Saas Authorization: September 2019nomoxpsNo ratings yet

- Form 5Document3 pagesForm 5mirza faisalNo ratings yet

- Chapter 6Document24 pagesChapter 6Sebas GomezNo ratings yet

- Mecklai Financial: Markets AdvisoryDocument1 pageMecklai Financial: Markets AdvisoryMukesh GuptaNo ratings yet

- Financial Accounting 1: Accounting (Information For Decision Making)Document4 pagesFinancial Accounting 1: Accounting (Information For Decision Making)system020No ratings yet

- M Phil Thesis Topics in Human Resource ManagementDocument8 pagesM Phil Thesis Topics in Human Resource Managementtracydolittlesalem100% (1)