Professional Documents

Culture Documents

JBS Formgstr-3b

Uploaded by

maxxban23060 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

JBS_FORMGSTR-3B

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesJBS Formgstr-3b

Uploaded by

maxxban2306Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

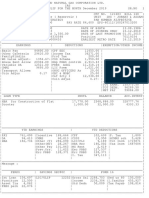

JAWERCHAND BHUTAJI

HALWAI MARKET, SHEOGANJ-30

FORM GSTR-3B

Report for Quarter of : IIIrd

'GSTIN :08AUCPD6952E1ZS Legal Name of registered person : JAWERC

'3.1 Details of Outward Supplies and inward supplies liable to reverse charge

'================================================================================

' Nature of Supplier | Txbl.Value| IGST|

'================================================================================

'(a)Outward txbl. supplies(other than | 66,28,856.78| 2,595.24| 2,7

'zero rated, nil rated and exempted) | | |

'(b)Outward taxable supplies(zero rated)| | |

'(c)Other outward supp.(Nil rated,exmptd| 14,63,432.00| |

'(d)Inward supp.(liable to Rev. charge) | | |

'(e)Non-GST outward supplies | | |

' Total| 80,92,288.78| 2,595.24| 2,7

'--------------------------------------------------------------------------------

'3.2 Of the Supplies shown in 3.1(a) above, details of inter-State supplies made

' taxable persons and UIN holders

'================================================================================

' | Place of Supply(State/UT) | Total Ta

'================================================================================

'Supplies made to UnReg. Persons | Maharashtra |

' | Telangana |

' | Tamilnadu |

' | Total|

'Supp. made to Composition Dealers| |

' | Total|

'Supplies made to UIN holders | |

' | Total|

'--------------------------------------------------------------------------------

'4. Eligible ITC

'================================================================================

' Details | Integrated Tax| Central Tax

'================================================================================

'(A) ITC Available(whether in full | |

'or part) | |

' (1)Import of goods | | -------

' (2)Import of services | | -------

' (3)Inward supplies liable to reverse | |

' (other than 1 & 2 above) | |

' (4)Inward supplies from ISD | |

' (5)All other ITC | 95,436.40| 2,04,831.59

'(B) ITC Reversed | |

' (1)As per rules 42 & 43 of CGST Rules| |

' (2)Others | |

'(C) Net ITC Available(A)-(B) | 95,436.40| 2,04,831.59

'(D) Ineligible ITC | |

' (1)As per section 17(5) | |

' (2)Others | |

'--------------------------------------------------------------------------------

'5. Values of exempt, nil-rated and non-GST inward supplies

'================================================================================

' Nature of supplies | Inter-State

'================================================================================

'From a supplier under composition scheme, Exempt and Nil|

'rated supply |

'Non GST supply |

'--------------------------------------------------------------------------------

'6.1 Payment of tax

'================================================================================

' Description | Tax | Paid through ITC |

' | payable | ----------------------------------------------- |

' | | IGST | CGST |SGST/UTGST | Cess |

'================================================================================

'Other than Reverse Charge

'Integrated Tax| 2,595.24| 2,595.24| | | |

'Central Tax | 2,72,894.49| 66,564.70|2,06,329.79| ------- | |

'State/UT Tax | 2,72,894.49| 25,811.79| ------- |2,06,329.79| |

'Cess | | ------- | ------- | ------- | |

'--------------------------------------------------------------------------------

'Reverse Charge

'Integrated Tax| | ------- | ------- | ------- | ------- |

'Central Tax | | ------- | ------- | ------- | ------- |

'State/UT Tax | | ------- | ------- | ------- | ------- |

'Cess | | ------- | ------- | ------- | ------- |

'--------------------------------------------------------------------------------

'6.2 TDS/TCS Credit

'================================================================================

' Details | Integrated Tax | Central Ta

'================================================================================

'TDS | |

'TCS | |

'--------------------------------------------------------------------------------

'

You might also like

- Excel GSTR 3b May 2020Document2 pagesExcel GSTR 3b May 2020Sanjay Mahajan AmritsarNo ratings yet

- Gstr3b Dec 23Document2 pagesGstr3b Dec 23AbhishekSinghPatelNo ratings yet

- Opp. OBC Bank, Bank Road, Dhuri - 148024: For October, 2017Document2 pagesOpp. OBC Bank, Bank Road, Dhuri - 148024: For October, 2017Sunshine ComputersNo ratings yet

- $valueDocument1 page$valueBIJAY KRUSHNA MOHANTYNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- 111110120003621ffd PSPDocument3 pages111110120003621ffd PSPPranay JainNo ratings yet

- Salary SlipDocument1 pageSalary SlipJohn HallNo ratings yet

- Annexure 630430Document3 pagesAnnexure 630430mohammadNo ratings yet

- Payslip - 2023 05 29Document1 pagePayslip - 2023 05 29ttamilpNo ratings yet

- Payslip 00037846Document1 pagePayslip 00037846Monti SiwachNo ratings yet

- FITT Feb 2021Document6 pagesFITT Feb 2021Shivam JaiswalNo ratings yet

- Araling Panlipunan 1Document1 pageAraling Panlipunan 1Ricardo Cal ParadelaNo ratings yet

- CombinepdfDocument19 pagesCombinepdfYashodhaNo ratings yet

- Annexure 1991 PDFDocument3 pagesAnnexure 1991 PDFDARSHAN NAIKNo ratings yet

- Annexure 5541028 PDFDocument3 pagesAnnexure 5541028 PDFJaydeep SuryawanshiNo ratings yet

- Payslip - 2018 09 28 - ID 48027903 PDFDocument2 pagesPayslip - 2018 09 28 - ID 48027903 PDFMvans MnlstsNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedarunshinde408No ratings yet

- Form PDFDocument1 pageForm PDFVinod KumarNo ratings yet

- 1 30Document2 pages1 30Jocelyn Requillo FlordelizNo ratings yet

- Paystub 202205Document2 pagesPaystub 202205Sandeep RakholiyaNo ratings yet

- Get Payslip by Offset PDFDocument1 pageGet Payslip by Offset PDFanon_535796411100% (1)

- 21566340Document1 page21566340AYUSH PRADHANNo ratings yet

- Payslip - 2021 03 29Document1 pagePayslip - 2021 03 29Loan LoanNo ratings yet

- Mandla - Reddy PayslipDocument1 pageMandla - Reddy PayslipMedi Srikanth NethaNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctJoshua GarrettNo ratings yet

- Payslip - 2022 08 29Document1 pagePayslip - 2022 08 29SHIVARAM KULKARNINo ratings yet

- The CompanyDocument1 pageThe Companyकपिल चौहानNo ratings yet

- Payslip - 2023 01 27Document1 pagePayslip - 2023 01 27kamalhakimi18No ratings yet

- DecDocument1 pageDecnegishilpa051No ratings yet

- FormDocument2 pagesFormShamsher SinghNo ratings yet

- Blce 3Document4 pagesBlce 3Cri5tobalNo ratings yet

- Jindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Document1 pageJindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Tatwa NandaNo ratings yet

- Payslip - 2019 09 30Document1 pagePayslip - 2019 09 30Khatija PinjrawalaNo ratings yet

- Mar 2021Document1 pageMar 2021Srinivas HkNo ratings yet

- Glo-Stick, Inc.: Financial Statement Investigation A02-11-2015Document3 pagesGlo-Stick, Inc.: Financial Statement Investigation A02-11-2015碧莹成No ratings yet

- American ExpressDocument1 pageAmerican ExpressKolkata Jyote MotorsNo ratings yet

- Payslip - 2022 04 24Document1 pagePayslip - 2022 04 24Fatima SalahuddinNo ratings yet

- Oct2023 PSDocument1 pageOct2023 PSRavi KanheNo ratings yet

- Salary SlipDocument2 pagesSalary Slipashish.20scse1300001No ratings yet

- Payslip 202310Document1 pagePayslip 202310st376213No ratings yet

- IBM Payslip April 2012 PDFDocument1 pageIBM Payslip April 2012 PDFtaraivanNo ratings yet

- Salary Slip - Feb. 2019Document1 pageSalary Slip - Feb. 2019Akibkhan PathanNo ratings yet

- Form PDFDocument1 pageForm PDFKanha SatyaranjanNo ratings yet

- Payslip January, 2024Document1 pagePayslip January, 2024negishilpa051No ratings yet

- Form PDFDocument1 pageForm PDFanby1No ratings yet

- 8ebda9db-ca4e-4b59-a33c-d19736a0183bDocument1 page8ebda9db-ca4e-4b59-a33c-d19736a0183bVenkata RajaNo ratings yet

- UnknownDocument1 pageUnknownPriyaprasad PandaNo ratings yet

- Aug Pay SlipDocument1 pageAug Pay SlipDAYA SHANKARNo ratings yet

- January 2023Document1 pageJanuary 2023biplab chowdhuryNo ratings yet

- 31 03Document1 page31 03balaNo ratings yet

- I.T - Sem-I Results C-Scheme Nov-2019Document64 pagesI.T - Sem-I Results C-Scheme Nov-2019TestuserNo ratings yet

- FormDocument1 pageFormDeepakNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipHanish Meena100% (1)

- Sybcom Sem III July Session Ledger Second Half 2022march 2023Document6,018 pagesSybcom Sem III July Session Ledger Second Half 2022march 2023PrahladNo ratings yet

- Sept 23Document1 pageSept 23cocblackx10No ratings yet

- November Pay 1111ssDocument2 pagesNovember Pay 1111ssHanish MeenaNo ratings yet

- IBM Payslip April 2012Document1 pageIBM Payslip April 2012NARESH KESAVANNo ratings yet

- UntitledDocument1,024 pagesUntitledHarry DavisNo ratings yet

- PeopleFirstPDF 2022 07 20T17 00 21Document1 pagePeopleFirstPDF 2022 07 20T17 00 21vishwas NayakNo ratings yet

- Balcanica: Institute For Balkan StudiesDocument17 pagesBalcanica: Institute For Balkan StudiesGajevic SlavenNo ratings yet

- BDC Call FlowDocument7 pagesBDC Call FlowJosue CastroNo ratings yet

- Sans 10160-4 (2017) PDFDocument53 pagesSans 10160-4 (2017) PDFPhillipus Kruger100% (2)

- The Law of ContractDocument19 pagesThe Law of ContractEmmanuel AbaiteyNo ratings yet

- Nylbond Product InformationDocument3 pagesNylbond Product Informationrimba kencanaNo ratings yet

- Poa T - 3Document2 pagesPoa T - 3SHEVENA A/P VIJIANNo ratings yet

- Quote US105785Document4 pagesQuote US105785Yamydal Bog-aconNo ratings yet

- GU 21 Transportation Freight CalculationDocument4 pagesGU 21 Transportation Freight Calculationvicky upreti100% (1)

- Construction Company ListDocument21 pagesConstruction Company ListRinkesh Makawana100% (1)

- Advanced Research Methods - Class 4Document19 pagesAdvanced Research Methods - Class 4Kito JabariNo ratings yet

- MAC (Misdirected Directive Case Analysis)Document3 pagesMAC (Misdirected Directive Case Analysis)Prasad GowdNo ratings yet

- 85th SLC MinutesDocument201 pages85th SLC MinutesSHANMUKHA INDUSTRIESNo ratings yet

- 12th Economics Model Unit Test - 02Document5 pages12th Economics Model Unit Test - 02Raaja YoganNo ratings yet

- The Mall Street Journal Is Considering Offering A New Service PDFDocument2 pagesThe Mall Street Journal Is Considering Offering A New Service PDFtrilocksp SinghNo ratings yet

- Koala PatternDocument5 pagesKoala PatterngersendehamoirNo ratings yet

- Trial Questions On Perfect CompetitionDocument2 pagesTrial Questions On Perfect CompetitionWise TetteyNo ratings yet

- Tax Invoice: Original For RecipientDocument2 pagesTax Invoice: Original For RecipientMisbah Ur RehmanNo ratings yet

- 01 Activity 1Document1 page01 Activity 1Monaliza PepitoNo ratings yet

- FM09-CH 05Document4 pagesFM09-CH 05Mukul KadyanNo ratings yet

- Presentation On Nutmeg Oil For IPB NOV 2022Document34 pagesPresentation On Nutmeg Oil For IPB NOV 2022KushDaiwikNo ratings yet

- Spartan Race Inc. - Numma Set 3Document24 pagesSpartan Race Inc. - Numma Set 3Furqan AnwarNo ratings yet

- The Rajasthan State Cooperative Bank LTD.: (RSCB)Document61 pagesThe Rajasthan State Cooperative Bank LTD.: (RSCB)Bullzeye StrategyNo ratings yet

- Economics Assignment QuestionsDocument5 pagesEconomics Assignment Questionsعبداللہ احمد جدرانNo ratings yet

- Exchange Rates - List of Foreign Currency Rates TodayDocument2 pagesExchange Rates - List of Foreign Currency Rates TodayHasan Bin AliNo ratings yet

- DK Automation ComplaintDocument48 pagesDK Automation ComplaintDhruv PandeyNo ratings yet

- Modern and Minimal Black and White Company Profile PresentationDocument20 pagesModern and Minimal Black and White Company Profile PresentationKaren MunozNo ratings yet

- Ride Details Fare Details: Thanks For Travelling With Us, Atul GargDocument3 pagesRide Details Fare Details: Thanks For Travelling With Us, Atul GargAtul GargNo ratings yet

- Classification of IndustriesDocument7 pagesClassification of IndustriesJeet ShahNo ratings yet

- Question: Below Is An Overview of The Financial Position For The Wicak, Xian, and YaniDocument3 pagesQuestion: Below Is An Overview of The Financial Position For The Wicak, Xian, and YaniAlfryda Nabila Permatasari AegyoNo ratings yet

- Invoice: Cliche Mode, IncDocument1 pageInvoice: Cliche Mode, IncShiro Daisuke XzeroNo ratings yet