Professional Documents

Culture Documents

BIR Form 1901

BIR Form 1901

Uploaded by

jenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form 1901

BIR Form 1901

Uploaded by

jenCopyright:

Available Formats

(To be filled out by BIR) DLN: __________________________

BIR Form No.

Republic of the Philippines

Department of Finance

Application for Registration 1901

Bureau of Internal Revenue

July 2021(ENCS) P1

For Self-Employed (Single Proprietor/Professional),

Mixed Income Individuals, Non-Resident Alien - - -

Engaged in Trade/Business, Estate and Trust TIN to be issued, if applicable (To be filled out by BIR)

Fill in all applicable white spaces. Mark all appropriate boxes with an “X”.

1 Registering Office 2 BIR Registration Date 3 PhilSys Card Number (PCN)

(To be filled out by BIR)(MM/DD/YYYY)

Head Office Branch Office Facility N/A

Part I – Taxpayer Information

4 Taxpayer Identification Number (TIN)

(For Taxpayer with Existing TIN) 704 - 490 - 448 - 0 0 0 0 0 5 RDO Code

(To be filled out by BIR)

6 Taxpayer Type

Single Proprietorship Only (Resident Citizen) Mixed Income Earner – Compensation Income Earner & Professional

Resident Alien – Single Proprietorship Mixed Income Earner – Compensation Income Earner, Single Proprietorship & Professional

Resident Alien - Professional Non-Resident Alien Engaged in Trade/Business

Professional – Licensed (PRC, IBP) Estate – Filipino Citizen

Professional – In General Estate – Foreign National

Professional and Single Proprietor Trust – Filipino Citizen

Mixed Income Earner – Compensation Income Earner & Single Proprietor Trust – Foreign National

7 Taxpayer’s Name (Last Name) (First Name) (Middle Name) (Suffix) (Nickname)

TALAVER JENNY MAE SAAVEDRA JENNY

(If ESTATE, ESTATE of First Name, Middle Name, Last Name, Suffix) (If TRUST, FAO: First Name, Middle Name, Last Name, Suffix)

8 Gender Male Female 9 Civil Status Single Married Widow/er Legally Separated

10 Date of Birth/Organization (In case of Estate/Trust) 0 7

(MM/DD/YYYY) 1 8 1 9 9 6 11 Place of Birth (if applicable) ZAMBOANGA CITY

12 Mother’s Maiden Name ERLINDA SAAVEDRA 13 Father’s Name JOSEPH TALAVER

14 Citizenship FILIPINO 15 Other Citizenship

16 Local Residence Address

Unit/Room/Floor/Building No. Building Name/Tower Lot/Block/Phase/House No. Street Name Subdivision/Village/Zone

NUNEZ EXTENSION

Barangay Town/District Municipality/City Province ZIP Code

Zone II ZAMBOANGA CITY 7000

17 Business Address

Unit/Room/Floor/Building No. Building Name/Tower Lot/Block/Phase/House No. Street Name Subdivision/Village/Zone

Barangay Town/District Municipality/City Province ZIP Code

18 Foreign Address N/A

19 Municipality Code 20 Purpose of TIN Application

(To be filled out by BIR)

21 Identification Details [government issued ID (e.g., passport, driver’s license, company ID, etc.)]

Type ID Number Effectivity Date (MM/DD/YYYY) Expiry Date (MM/DD/YYYY) Issuer Place/Country of Issue

22 Preferred Contact Type

Landline Number Fax Number Mobile Number Email Address (required)

09234221858 talaverjenny@gmail.com

23 Are you availing of the 8% income tax rate option in lieu of graduated income tax rates? Yes No

Part II – Spouse Information

24 Employment Status of Spouse Unemployed Employed Locally Employed Abroad Engaged in Business/Practice of Profession

25 Spouse Name (Last Name, First Name, Middle Name, Suffix) 26 Spouse TIN

- - - 0 0 0 0 0

27 Spouse Employer’s Name (If Individual, Last Name, First Name, Middle Name, Suffix) (If Non- 28 Spouse Employer’s TIN

Individual Registered Name)(Attach additional sheet/s, if necessary)

- - -

Part III – Authorized Representative

29 Relationship Name (For Authorized Representative)

If Individual (Last Name) (First Name) (Middle Name) (Suffix) (Nickname)

If Non-Individual (Registered Name)

30 Relationship Date (MM/DD/YYYY) 31 Address Type

Residence Place of Business Employer Address

Page 2 – BIR Form No. 1901

32 Address

Unit/Room/Floor/Building No. Building Name/Tower Lot/Block/Phase/House No. Street Name Subdivision/Village/Zone

Barangay Town/District Municipality/City Province ZIP Code

33 Preferred Contact Type

Landline Number Fax Number Mobile Number Email Address (required)

Part IV – Business Information

34 Single Business Number/Philippine Business Number

35 Primary/Secondary Industries (attach additional sheet/s, if necessary)

Industry Trade/Business Name Regulatory Body

Primary Wasteless PH

Secondary

Business Registration Business Registration Date PSIC Code

Industry (To be filled out by BIR)

Line of Business

Number (MM/DD/YYYY)

Primary

Secondary

36 Incentives Details

36A Investment Promotion (e.g., PEZA, BOI) 36B Legal Basis (e.g., R.A., E.O.) 36C Incentive Granted (e.g., Exempt from IT, VAT, etc.)

36D No. of Years 36E Incentive Start Date 36F Incentive End Date

(MM/DD/YYYY) (MM/DD/YYYY)

37 Details of Registration/Accreditation

37A Registration/Accreditation Number 37B Effectivity Date (MM/DD/YYYY) 37C Date Issued (MM/DD/YYYY)

FROM TO

37D Registered Activity 37E Tax Regime (Regular, Special, Exempt) 37F Activity Start Date (MM/DD/YYYY) 37G Activity End Date (MM/DD/YYYY)

Part V – Facility Details

38 Facility Details (PP-Place of Production/Plant; SP-Storage Place; WH-Warehouse; SR-Showroom; GG-Garage; BT-Bus Terminal; RP-Real Property for Lease with No Sales Activity)

38A Facility Code (To be filled out by BIR) 38B Facility Type

F PP SP WH SR GG BT RP Others (specify)

38C Facility Address

Unit/Room/Floor/Building No. Building Name/Tower Lot/Block/Phase/House No. Street Name Subdivision/Village/Zone

Barangay Town/District Municipality/City Province ZIP Code

Part VI – Tax Types

39 Tax Types (this portion determines your tax liability/ies) (To be filled out by BIR)

Form Type ATC Form Type ATC

Income Tax Registration Fee

Individual Income Tax Value-Added Tax

Capital Gains – Real Property Excise Tax

Capital Gains – Stocks Alcohol Products

Withholding Tax Automobile & Non-Essential Goods

Compensation Cosmetic Procedures

Expanded Mineral Products

Final Petroleum Products

Fringe Benefits Sweetened Beverages

Value-Added Tax Tobacco Products

Other Percentage Tax Tobacco Inspection & Monitoring Fees

ONETT not subject to CGT Vapor Products

Percentage Tax on Winnings & Prizes Documentary Stamp Tax (DST)

On Interest Paid on Deposits and Yield on

Deposits/Substitutes Regular

Percentage Tax One-Time Transactions (ONETT)

Stocks Transfer Tax

Stocks-Initial Public Offering (IPO) Donor’s Tax

Overseas Dispatch And Amusement Taxes Estate Tax

Under Special Laws Miscellaneous Tax (specify)

Other Percentage Taxes under NIRC (specify)

Others (specify)

Page 3 – BIR Form No. 1901

Part VII – Receipts and Invoices

40 BIR Printed Receipts and Invoices

40A Do you intend to use BIR Printed Receipts and Invoices? 40B Type 40C No. of Booklets 40D Serial Number

Start End

Yes No VAT NON-VAT

41 Authority to Print Receipts and Invoices

41A Printer’s Name

41B Printer’s TIN 41C Printer’s Accreditation Number 41D Date of Accreditation (MM/DD/YYYY)

- - -

41E Registered Address

Unit/Room/Floor/Building No. Building Name/Tower Lot/Block/Phase/House No. Street Name Subdivision/Village/Zone

Barangay Town/District Municipality/City Province ZIP Code

41F Contact Number (Landline/Cellphone No.) 41G Email Address

41H Type of Receipt/Invoice Bound Loose Leaf

41I Description of Primary/Secondary Receipts and Invoices (Attach additional sheet/s, if necessary)

No. of No. of Sets

TYPE Serial No. No. of Copies

Description Boxes/Booklets per Box/

per Set

VAT Non-VAT Loose Bound Booklet Start End

Part VIII – For Employee with Two or More Employers (Multiple Employments) Within the Calendar Year

Successive Employments (With previous employer/s Concurrent Employments (With two or more employers at the

42 Type of Multiple Employments within the calendar year) same time within the calendar year)

(If successive, enter previous employer/s; if concurrent, enter secondary employer/s) (Attach additional sheet/s, if necessary)

42A Name of Employer Primary Employer 42B TIN of Employer

- - -

42C Name of Employer Primary Employer 42D TIN of Employer

- - -

Primary/Current Employer Information

43 Relationship Start 44 Contact Type

Date (MM/DD/YYYY) Landline Number Fax Number Mobile Number Email Address (required)

45 Declaration Receiving Office and Date of Receipt

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me and to the best of my knowledge and

belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under the authority

thereof. Further, I give my consent to the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for

legitimate and lawful purposes.

JENNY MAE S. TALAVER

___________________________

Taxpayer/Authorized Representative

(Signature over Printed Name)

Part IX – Payment Order Form for New Business Registrant

(For BIR Payment Acceptance Only. Not to be filed in AABs)

BIR Form No. 46 Taxpayer’s Identification Number (TIN) Branch Code 47 RDO Code 48 For the Year

- - -

0605 49 Taxpayer’s Name

(Part of BIR Form No. 1901) JENNY MAE TALAVER

Payment Details (To be filled out by BIR-Revenue Collection Officer)

50 Date of Payment (MM/DD/YYYY)

eROR/ROR No. ATC Particulars

51 MC180 Registration Fee 51A

52 MC200 BIR Printed Receipts / Invoices 52A

53 Add: Penalties Surcharge Interest Compromise

53A 53B 53C 53D

54 Total Amount Payable (Sum of Items 56A, 57A and 58D) 54A

*NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph) (Please sign at the back.)

Documentary Requirements:

BRANCH AND FACILITY

1. For Sole Proprietor/Professionals not regulated by the Professional Regulation

REGISTRATION OF BRANCH

Commission (PRC):

1. BIR Printed Receipt/Invoice (Available for sale at the New Business Registrant

Any government-issued ID (e.g., Birth Certificate, passport, driver’s license,

Counter); or

Community Tax Certificate, PhilID) that shows the name, address and birthdate of

Final and clear sample of OWN Principal Receipts/Invoices. (1 original)

the applicant. In case the ID has no address, any proof of residence or business

(Sample layout is also available at the New Business Registrant Counter)

address; (1 photocopy) or

In case of the practice of profession regulated by PRC: Note: In case taxpayer-applicant will opt to print its own receipts/invoices, taxpayer-

Valid PRC ID and government ID showing address or proof of residence or applicant should choose an Accredited Printer who will print the receipts/invoices.

business address. (1 photocopy)

2. Payment of P530.00, if applicable, for the following:

Note: IDs shall be presented and should be readable, untampered and contains

P500.00 Annual Registration Fee (RF);

consistent information with the documents submitted upon application.

P30.00 Loose Stamp/s (DST) to be affixed on the Certificate of

2. BIR Printed Receipt/Invoice (Available for sale at the New Business Registrant Registration.

Counter); or Note: If the Registration Fee of P500.00 was already paid, the proof of

Final and clear sample of OWN Principal Receipts/Invoices. (1 original) payment (1 photocopy) shall be submitted.

(Sample layout is also available at the New Business Registrant Counter)

REGISTRATION OF FACILITY

Note: In case taxpayer-applicant will opt to print its own receipts/invoices, taxpayer- 1. BIR Form No. 1901. (2 originals)

applicant should choose an Accredited Printer who will print the receipts/invoices.

ADDITIONAL DOCUMENTS FOR BRANCH/FACILITY, IF APPLICABLE:

3. Payment of P530.00, if applicable, for the following:

P500.00 Annual Registration Fee (RF); 1. If transacting through a Representative:

P30.00 Loose Stamp/s (DST) to be affixed on the Certificate of 1.1 Special Power of Attorney (SPA); (1 original)

Registration. 1.2 Any government-issued ID of the taxpayer and authorized

Note: If the Registration Fee of P500.00 was already paid, the proof of representative; (1 photocopy)

payment (1 photocopy) shall be submitted. 2. DTI Certificate (if with business name); (1 photocopy) (for Branch only)

3. Franchise Documents (e.g., Certificate of Public Convenience) (for Common

Additional documents, if applicable: Carrier); (1 photocopy) (for Branch only)

4. Franchise Agreement; (1 photocopy) (for Branch only)

1. If transacting through a Representative: 5. Memorandum of Agreement (for JOINT VENTURE); (1 photocopy) (for

1.1 Special Power of Attorney (SPA); (1 original) Branch only)

1.2 Any government-issued ID of the taxpayer and authorized representative; (1 6. Certificate of Authority, if Barangay Micro Business Enterprises (BMBE)

photocopy) registered entity; (1 photocopy) (for Branch only)

2. DTI Certificate (if with business name); (1 photocopy) 7. Proof of Registration/Permit to Operate BOI/BOI-ARMM, PEZA, BCDA,

3. Work Visa (9g) for Foreign Nationals; (1 photocopy) TIEZA/TEZA, SBMA, etc. (1 photocopy) (for Branch only)

4. Franchise Documents (e.g., Certificate of Public Convenience) (for Common

Carrier); (1 photocopy)

5. Trust Agreement (for Trusts); (1 photocopy)

6. Death Certificate of the deceased (for Estate under judicial settlement); (1

photocopy)

7. Certificate of Authority, if Barangay Micro Business Enterprises (BMBE)

registered entity; (1 photocopy)

8. Proof of Registration/Permit to Operate BOI/BOI-ARMM, PEZA, BCDA,

TIEZA/TEZA, SBMA, etc. (1 photocopy)

POSSESSION OF MORE THAN ONE TAXPAYER INDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE

PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED

For Voluntary Payment Stamp of BIR Receiving Office

and Date of Receipt

I declare, under the penalties of perjury that this document has been made in good faith, verified by me and to the best of my knowledge

and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under

the authority thereof.

__________________________________________________________ __________________________

Signature over Printed Name of Taxpayer/Authorized Representative Title/Position of Signatory

You might also like

- Redmi Note 10 InvoiceDocument1 pageRedmi Note 10 InvoiceGaurav GandhiNo ratings yet

- 2023 Scouting Month ActivitiesDocument3 pages2023 Scouting Month ActivitiesREYNOLD LIBATO100% (1)

- Understanding Corporate FinanceDocument98 pagesUnderstanding Corporate FinanceJosh KrishaNo ratings yet

- Ayaw at GustoDocument4 pagesAyaw at GustoJed VillaluzNo ratings yet

- MTN Annual Financial Results Booklet 2014Document40 pagesMTN Annual Financial Results Booklet 2014The New VisionNo ratings yet

- Benchmarking by XeroxDocument6 pagesBenchmarking by XeroxTanmay JagetiaNo ratings yet

- Editorial CartooningDocument1 pageEditorial Cartooningacutjy100% (2)

- Certificate of Recognition Template Room Examineer ICT CoordinatorDocument2 pagesCertificate of Recognition Template Room Examineer ICT CoordinatorEngelbert TejadaNo ratings yet

- Ipcrf Core Values 2019 - FinalDocument23 pagesIpcrf Core Values 2019 - FinalFrendelyn p. Gador100% (4)

- IPCRF-DEVELOPMENT PLAN e-SAT Results SY 2020-2021Document2 pagesIPCRF-DEVELOPMENT PLAN e-SAT Results SY 2020-2021John Neil PolinarNo ratings yet

- Weekly Learning Plan in English 2 Third QuarterDocument2 pagesWeekly Learning Plan in English 2 Third QuarterEvelyn DEL ROSARIONo ratings yet

- DM 172, S. 2023-Trengthening The Brigada Pagbasa Projects of The Schools Division of BatangasDocument2 pagesDM 172, S. 2023-Trengthening The Brigada Pagbasa Projects of The Schools Division of BatangasZedrick Salvador TorresNo ratings yet

- Annex A. LAC Implementation Plan On School Disaster Risk Reduction ManagementDocument2 pagesAnnex A. LAC Implementation Plan On School Disaster Risk Reduction ManagementJHON REY BALICOCONo ratings yet

- Mervin G. Oliva Maee 2 9/3/2020: Prepared By: Lyha L. Fias-Ilon, Maengl. InstructorDocument1 pageMervin G. Oliva Maee 2 9/3/2020: Prepared By: Lyha L. Fias-Ilon, Maengl. InstructorDon Mariano Marcos Elementary SchoolNo ratings yet

- Least Learned Competencies in FilipinoDocument4 pagesLeast Learned Competencies in FilipinoMarietta ArgaoNo ratings yet

- DM 173 S.2019Document10 pagesDM 173 S.2019Michael GreenNo ratings yet

- Philippine Informal Reading Inventory: (Phil-IRI)Document26 pagesPhilippine Informal Reading Inventory: (Phil-IRI)Luisa Francisco Garcillan100% (1)

- Sagip Action Plan Sy2022-2023Document7 pagesSagip Action Plan Sy2022-2023ANGELICA AGUNODNo ratings yet

- Performance Task Term 2 - 2016-2017Document3 pagesPerformance Task Term 2 - 2016-2017api-318967773No ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesWilliam Felisilda100% (1)

- Lesson Log Filipino 2Document7 pagesLesson Log Filipino 2Aiza ChulipaWakit TabaresNo ratings yet

- Project Work Plan and Budget Matrix Filipino Department School Year 2019-2020Document1 pageProject Work Plan and Budget Matrix Filipino Department School Year 2019-2020EdlynNacionalNo ratings yet

- Narrative Report CybersafetyDocument4 pagesNarrative Report CybersafetyMa Aillen Adona Averilla100% (2)

- Catch Up Friday 1STDocument9 pagesCatch Up Friday 1STCatherine FajardoNo ratings yet

- Q1 Week 2 - Filipino DLPDocument9 pagesQ1 Week 2 - Filipino DLPLenz BautistaNo ratings yet

- Work and Financial Plan School-Based Feeding Program (SBFP)Document9 pagesWork and Financial Plan School-Based Feeding Program (SBFP)Joan Del Castillo Naing0% (1)

- Accomplishment ReportDocument3 pagesAccomplishment ReportReneleen FabiaNo ratings yet

- ESP Intervention 22 23Document1 pageESP Intervention 22 23Litrix Valdez De Guzman-Garampil100% (2)

- Score SheetsDocument22 pagesScore SheetsJunjen Latoza PalomarNo ratings yet

- INFOMERCIAL MechanicsDocument2 pagesINFOMERCIAL MechanicsHA Mes100% (1)

- School Forms CoverDocument5 pagesSchool Forms CoverLinaflor IlogonNo ratings yet

- Acr Project SykapDocument3 pagesAcr Project SykapLea SambileNo ratings yet

- Dep Ed 4 PS Attendance SheetDocument1 pageDep Ed 4 PS Attendance SheetArsenio MalapitNo ratings yet

- Brigada Eskwela Template For Volunteers and Resources GeneratedDocument13 pagesBrigada Eskwela Template For Volunteers and Resources GeneratedLimar Anasco EscasoNo ratings yet

- Accomplishment Report in FilipinoDocument2 pagesAccomplishment Report in FilipinoAiza Banan100% (1)

- Phil IRI Form 3A and 3BDocument6 pagesPhil IRI Form 3A and 3BRowelyn Garcia Boongaling100% (1)

- 10 Approaches in Teaching Civics, Philippine History & CultureDocument2 pages10 Approaches in Teaching Civics, Philippine History & CultureKISHA MICHA LUMIKIDNo ratings yet

- Letter of TransferDocument1 pageLetter of TransferoolalaiNo ratings yet

- Annexes To The PSF GuidelinesDocument20 pagesAnnexes To The PSF GuidelinesLoidaCarameNo ratings yet

- Acr Parent Meeting 3RD QuarterDocument3 pagesAcr Parent Meeting 3RD QuarterRIA TOBIASNo ratings yet

- School - Based Learning Action Cell (Slac) For The Month of November 2020Document3 pagesSchool - Based Learning Action Cell (Slac) For The Month of November 2020MIRAFLOR PAGLINAWANNo ratings yet

- Pandistritong Tagisan NG Talento Sa Filipino 2018: Petsa: Pagpapatala: SimulaDocument2 pagesPandistritong Tagisan NG Talento Sa Filipino 2018: Petsa: Pagpapatala: SimulaKristian Gatchalian100% (1)

- House RulesDocument1 pageHouse RulesAdas MisNo ratings yet

- Filipino Department Work PlanDocument4 pagesFilipino Department Work PlanJhonlee Ganan100% (1)

- Certificate WinnersDocument13 pagesCertificate WinnersFely Grace Anciano Cezar-AguipoNo ratings yet

- Project Proposal LisDocument1 pageProject Proposal LisJenivanValezaAvilaNo ratings yet

- Pagsasaling Wika Group ActivityDocument7 pagesPagsasaling Wika Group ActivityPegie Parreño JamiliNo ratings yet

- BIR FORM NO. 2305 Certificate of Update of Exemption and Employers and Employees InformationDocument1 pageBIR FORM NO. 2305 Certificate of Update of Exemption and Employers and Employees InformationrbolandoNo ratings yet

- IPCRF - KRAs 2017-2018Document8 pagesIPCRF - KRAs 2017-2018Marlyn E. AzurinNo ratings yet

- Grade 4 6 - Edukasyon Sa PagpapakataoDocument50 pagesGrade 4 6 - Edukasyon Sa PagpapakataoShamanta Camero Perez - CachoNo ratings yet

- Club Officers: FILIPINO Department SamafilDocument2 pagesClub Officers: FILIPINO Department SamafilEder Aguirre100% (1)

- Certificate of Paticipation-BrigadaDocument1 pageCertificate of Paticipation-BrigadaAxle Brent DayocNo ratings yet

- Report For SOCIAL Behavioral Change MaterialsDocument1 pageReport For SOCIAL Behavioral Change Materialsfrenalyne.tabernillaNo ratings yet

- Phil-IRI-Reading Monitoring and Evaluation Tool-1Document4 pagesPhil-IRI-Reading Monitoring and Evaluation Tool-1Jessabelle Onza100% (1)

- Week 10 IL - Maysan A Manang Ni Maria (Ate Na Si Maria) PDFDocument20 pagesWeek 10 IL - Maysan A Manang Ni Maria (Ate Na Si Maria) PDFnesa viente100% (1)

- COT Q2 DLP FILIPINO 6 Naibabahagi Ang Isang Pangyayaring NasaksihanDocument8 pagesCOT Q2 DLP FILIPINO 6 Naibabahagi Ang Isang Pangyayaring NasaksihanArlyn FacalarinNo ratings yet

- CLASS CARD - TemplateDocument2 pagesCLASS CARD - TemplateJonathan BulawanNo ratings yet

- Cip 2014 by Krisette Cruz of Tiaong Elem - School PM 111214Document10 pagesCip 2014 by Krisette Cruz of Tiaong Elem - School PM 111214Krisette Basilio CruzNo ratings yet

- Rubrics 1ST Oral Language in FILIPINODocument1 pageRubrics 1ST Oral Language in FILIPINOCaroline Salvador VivasNo ratings yet

- Estratehiya Sa Pagtuturo NG FilipinoDocument40 pagesEstratehiya Sa Pagtuturo NG FilipinoChelsea Anne PermejoNo ratings yet

- Buwan NG Wika MinuteDocument2 pagesBuwan NG Wika Minutenoraisah33No ratings yet

- Video Editing Training DesignDocument4 pagesVideo Editing Training Designliezl ann g. valdezNo ratings yet

- Bir Form 1901 New VersionDocument4 pagesBir Form 1901 New Versionchato law office80% (5)

- Annex A - 1901Document4 pagesAnnex A - 1901Eugene D Napster100% (1)

- Poa - Fast Track (2 Years)Document44 pagesPoa - Fast Track (2 Years)Yenny TigaNo ratings yet

- MA Economics Syllabus Bharathiar University 2013Document14 pagesMA Economics Syllabus Bharathiar University 2013Mia MiatriacNo ratings yet

- Key Benefits and Features of The ICAV: General Introduction and BackgroundDocument2 pagesKey Benefits and Features of The ICAV: General Introduction and BackgroundDeepshikha BhattacharjeeNo ratings yet

- Paper20A Set2Document8 pagesPaper20A Set2Ramanpreet KaurNo ratings yet

- PPG 275 14Document27 pagesPPG 275 14Seraph EndNo ratings yet

- Chapter 8-1. ProblemsDocument10 pagesChapter 8-1. ProblemsCloudKielGuiangNo ratings yet

- Ros Rof S1356148Document1 pageRos Rof S1356148Siddharth SatyarthiNo ratings yet

- Notice: Sanctions, Blocked Persons, Specially-Designated Nationals, Terrorists, Narcotics Traffickers, and Foreign Terrorist Organizations: Narcotics-Related Blocked Persons Additional DesignationsDocument5 pagesNotice: Sanctions, Blocked Persons, Specially-Designated Nationals, Terrorists, Narcotics Traffickers, and Foreign Terrorist Organizations: Narcotics-Related Blocked Persons Additional DesignationsJustia.comNo ratings yet

- ROHA - ProjectDocument29 pagesROHA - ProjectNidhish DevadigaNo ratings yet

- Corporation ReviewerDocument22 pagesCorporation Reviewerevlyn aplacaNo ratings yet

- Toyota Financial Calculate InterestDocument6 pagesToyota Financial Calculate InterestShashank BelvadiNo ratings yet

- MAS Printable LectureDocument17 pagesMAS Printable LectureNiña Mae NarcisoNo ratings yet

- RD011 ReceivablesDocument7 pagesRD011 ReceivablesAnusha ReddyNo ratings yet

- Small and Medium EnterprisesDocument9 pagesSmall and Medium EnterprisesGaurav KumarNo ratings yet

- Performance Manager PDFDocument146 pagesPerformance Manager PDFparivijjiNo ratings yet

- Project 1 Comprehensive 2022-23Document1 pageProject 1 Comprehensive 2022-23PRANATI RANJANNo ratings yet

- Group2 - Hong Kong DisneyLandDocument10 pagesGroup2 - Hong Kong DisneyLandNidhiAgarwalNo ratings yet

- FFM14, CH 06, Slides, 11-03-14Document21 pagesFFM14, CH 06, Slides, 11-03-14Pratana Puspa MidiastutyNo ratings yet

- Philippines Tax ComputationDocument19 pagesPhilippines Tax ComputationJoy Chrisky Vinluan-Lobendino67% (3)

- Resc ProfileDocument15 pagesResc ProfileVICELIVENo ratings yet

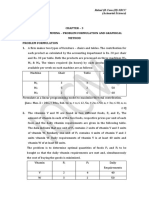

- Chapter - 3 Linear Programming - Problem Formulation and Graphical Method Problem Formulation 1. A Firm Makes Two Types of Furniture - Chairs and Tables. The Contribution ForDocument11 pagesChapter - 3 Linear Programming - Problem Formulation and Graphical Method Problem Formulation 1. A Firm Makes Two Types of Furniture - Chairs and Tables. The Contribution ForYamica ChopraNo ratings yet

- Galaxy Surfactants Limited: Niranjan Arun KetkarDocument41 pagesGalaxy Surfactants Limited: Niranjan Arun KetkarparthchillNo ratings yet

- GL Requirement QuestionnaireDocument3 pagesGL Requirement QuestionnaireSandip GhoshNo ratings yet

- The Revised VAT Forms, Which Are Now Operative Under The Punjab VAT Act & Rules, 2005Document6 pagesThe Revised VAT Forms, Which Are Now Operative Under The Punjab VAT Act & Rules, 2005Dinamite ThestrikerNo ratings yet

- Home Office and Branched Agencies by Little Boy AsperoDocument43 pagesHome Office and Branched Agencies by Little Boy AsperoShielarien Donguila100% (1)

- Jyske Bank Jun 24 FX Spot OnDocument29 pagesJyske Bank Jun 24 FX Spot OnMiir ViirNo ratings yet