Professional Documents

Culture Documents

Test Ii Accounts MS

Uploaded by

Dhrisha GadaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Ii Accounts MS

Uploaded by

Dhrisha GadaCopyright:

Available Formats

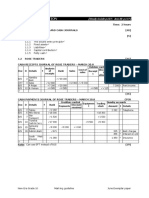

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

1(a)(i) Shakir 3

Journal

Debit Credit

Date Details

$ $

2023

1 Sep Motor vehicle 9 500 }

Inventory 1 240 } (1)

Bank 1 682 }

Latif 200 }

Harrison 237 } (1)

Capital _____ 11 985 (1)}

12 422 12 422 }}}}

1(a)(ii) Full details are available about the assets, liabilities, revenues and expenses of the business (1) 2

The preparation of financial statements is relatively straightforward (1)

The calculation of the profit or loss for the year is likely to be reliable and accurate (1)

More informed decision-making is possible (1)

A greater degree of control over business activities can be exercised (1)

The possibility of fraud is reduced (1)

Comparisons with the results of previous years and with other businesses are possible (1)

Detailed records are available for reference purposes (1)

Information required by a bank or other lender is readily available (1)

Max (2)

© UCLES 2023 Page 6 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

1(b) Shakir 11

Cash Book

Date Details Disc Cash Bank Date Details Disc Cash Bank

Alld Rec

2023 $ $ $ 2023 $ $ $

Sep 1 Balance b/d (1) 1 682 Sep 2 Rent (1) 420

4 Bank (1) 350 4 Cash (1) 350

17 Sales } 290 7 Latif (1) 6 194

28 Sydney } (1) 100 Wages (1) 161

12 Harrison (1) 5 95

29 Balances c/d 189 1013

30

– 350 2 072 11 350 2 072

Oct 1 Balances b/d 189 1 013 (1)OF

*(1) OF

*For both balances

+(1) dates

1(c) Cash book balance 1 013 (1)OF Balance per bank statement 763 (1) 4

Sales by credit transfer 175 (1) Outstanding lodgement 100 (1)

Less bank charges (35) (1) OR Bank error 290 (1)

Corrected bank balance 1 153 (1)OF Corrected bank balance 1 153 (1)OF

© UCLES 2023 Page 7 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

2(a) Hilary 11

Manufacturing Account for the year ended 31 July 2023

$ $

Cost of material consumed

Opening inventory of raw material 9 100

Purchases of raw material 110 000

Less Purchases returns 2 200 107 800

116 900

Less Closing inventory of raw material 9 980

106 920 (1)

Direct wages 91 665 (1)

Prime cost 198 585 (1)OF

Factory overheads

Wages of factory supervisor 29 000

Heat, light and power (11 600 4/5) 9 280 (1)

Rates and insurance (8 250 – [5/12 4 440](1)) 3/5(1) 3 840

Factory repairs and renewals (5 125 + 644) 5 769 (1)

Depreciation of factory equipment

(124 000 – 35 500) 25% 22 125 (1) 70 014

268 599 (1)OF

Add opening work-in-progress 21 357 *

289 956

Less closing work-in-progress 22 446 * (1) both W in P

Cost of production 267 510 (1)OF

2(b) $ $ $ 4

Revenue 457 250

Cost of sales

Opening inventory 24 235 *

Cost of production 267 510 (1)OF

Purchases of finished goods 23 500 }

Less Purchases returns 4 700 }(1) 18 800

310 545

Less Closing inventory 25 110 *(1)Both 285 435

Gross profit 171 815 (1)OF

© UCLES 2023 Page 8 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

2(c) Advantages of stopping buying in finished goods 5

Not dependent on supplier for ensuring continuity of supplies of goods/more control if produce own goods (1)

May have more control over quality of goods produced in own factory (1)

Would have more control over cost (1)

May be more profitable/cheaper to produce and sell own goods (1)

Not all manufacturing costs will increase in proportion to any increase in production (1)

Currently a high proportion of purchases of finished goods are returned (1)

Accept other valid points

Max (3)

Disadvantages of stopping buying in finished goods

Increase in factory running costs/cost of production (1)

May need to purchase additional machinery (1)

May not be able to increase factory capacity by enough to meet demand (1)

May not be able to meet increase in demand/if demand falls may have surplus capacity and increased inventory (1)

Quality of goods purchased may be inferior (1)

Accept other valid points

Max (3)

Recommendation (1)

© UCLES 2023 Page 9 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

3(a) Logan 3

Inventory account

Date Details $ Date Details $

2022 2023

Oct 1 Balance b/d (1) 8 400 Sep 30 Income statement (1) 8 400

8 400 8 400

2023

Sep 30 Income statement (1) 8 675

3(b) Logan 4

Provision for doubtful debts account

Date Details $ Date Details $

2023 2022

Sep 30 Balance c/d (1) 335 Oct 1 Balance b/d (1) 300

2023

___ Sep 30 Income statement (1)OF 35

335 335

2023

Oct 1 Balance b/d (1)OF 335

3(c) Logan 6

Rent payable account

Date Details $ Date Details $

2022 2023

Oct 1 Balance b/d (1) 820 Sep 30 Income statement (1) 4 940

Dec 1 Bank (1) 2 460 Balance c/d 830

2023

Jun 1 Bank (1) 2 490 ____

5 770 5 770

Oct 1 Balance b/d (1)OF 830

+(1) Dates

© UCLES 2023 Page 10 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

3(d)(i) Inventory is valued at the lower of cost and net realisable value (1) 1

3(d)(ii) The rent relating to the current year is transferred to the income statement (1) 1

The total rent paid is adjusted for prepayments before transfer to the income statement (1)

Max (1)

3(e) Advantages of buying premises using loan 5

Would not have to pay rent (1)

Will not be subject to future rent increases (1)

May be cheaper in the long run (1)

Property will be owned so can adapt to requirements/rent out etc. (1)

Have several years to repay the loan (1)

No further obligation after loan repaid (1)

Over a period of time property may increase in value (1)

Accept other valid points

Max (3)

Disadvantages of buying premises using loan

Have to pay interest on loan (1)

Loan must be repaid when due (1)

Loan would probably be secured on the property/assets may be at risk is loan not repaid (1)

Will be responsible for maintenance of property (1)

Percentage of interest on loan may increase (1)

Accept other valid points

Max (3)

Recommendation (1)

© UCLES 2023 Page 11 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

4(a) Asia 11

Journal

Error Details Debit Credit

number $ $

1 Jacques 112 (1)

Purchases 112 (1)

2 Suspense 300 (1)

Wages 300 (1)

3 Suspense 75 (1)

Savanah 75 (1)

4 Sales returns 396 (1)

Purchases returns 198 (1)

Suspense 594 (1)

5 Sophie 54 (1)

Suspense 54 (1)

4(b) Asia 5

Suspense account

Date Details $ Date Details $

2023 2023

Aug 31 Difference on trial balance (1) 273 Aug 31 Sales returns } 396

Wages (1) 300 Purchases returns }(1) 198

Savanah (1) 75 Sophie (1) 54

648 648

© UCLES 2023 Page 12 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

4(c) 4

Error Profit for the No

Error Gross profit

number year effect

+ – + –

1 A credit purchase, $112, from Jacques,

had been debited twice to the purchases account. ✓ ✓

2 The wages account had been overcast by $300. (1)

✓

3 Cash received, $75 from Savanah, a trade

receivable, had only been entered in the cash ✓ (1)

book.

4 The total of the sales returns journal for August

2023, $198, had been credited to both the sales ✓ ✓ (1)

returns account and the purchases returns

account.

5 A payment to Sophie, $93, had been ✓ (1)

recorded as $39 in Sophie’s account.

© UCLES 2023 Page 13 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

5(a) B Limited 6

Income Statement for the year ended 30 June 2023

$ $

Revenue (135 040 – 9 240) 125 800 (1)

Less Expenses

Wages and salaries 72 000

Motor expenses 9 820

Insurance (1/2 7 220)+(1/2 7 440) 7 320 (1)

General expenses (12 780 + 186) 12 966 (1)

Depreciation of motor vehicles (42 000 – 16 500) 25% 6 375 (1)

Depreciation of equipment (5 000 20%) 1 000 (1) 109 481

Profit for the year 16 319 (1)OF

5(b) B Limited 5

Statement of Changes in Equity for the year ended 30 June 2023

Ordinary General Retained Total

Details share capital Reserve earnings

$ $ $ $

On 1 July 2022 10 000 2 000 13 490 25 490 (1) row

Profit for the year .............. .............. 16 319 16 319 (1)OF row

Dividend paid ............... .............. (4 800) (4 800) (1) row

Transfer to general reserve …………. 1 000 (1 000) .............. (1) row

On 30 June 2023 10 000 3 000 24 009 37 009 (1)OF row

5(c)(i) The company provides a service rather than a product (1) 2

The clients provide their own cleaning materials (1)

Max (2)

© UCLES 2023 Page 14 of 15

7707/23 Cambridge O Level – Mark Scheme October/November 2023

PUBLISHED

Question Answer Marks

5(c)(ii) There were no irrecoverable debts during the year/there are no irrecoverable trade receivables (1) 2

There are very few trade receivables/trade receivables represent less than a week’s revenue (1)

Some customers are paying in advance (1)

Max (2)

5(d) 5

Issuing debentures Issuing ordinary shares

Annual interest is payable (1) A dividend may be paid (1)

Are a liability\are a loan\must be repaid (1) Do not have to be repaid (1)

If company is wound up they are repaid before If company is wound up they are repaid after

ordinary shareholders (1) debenture holders (1)

Debenture holders are not members of the Shares will carry same voting rights/rank equally

company/cannot vote (1) as existing shares (1)

Issue of debentures will not dilute the control of May dilute control of existing shareholders (1) (if

the existing ordinary shareholders (1) some purchase a greater proportion of shares)

Interest is a fixed amount (1) (and so can be Dividend is not fixed (and may depend on profit

budgeted for) levels) (1)

Interest must be paid irrespective of profits (1) Directors they can decide on amount of dividend

they will pay (1)

May be secured on the non-current assets of the May take longer to raise the funds (1)

company (1)

Issue may not raise adequate funds (1) Issue may not raise adequate funds (1)

Max (3) Max (3)

Recommendation (1)

© UCLES 2023 Page 15 of 15

You might also like

- A Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)From EverandA Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)No ratings yet

- Test I Accounts MSDocument10 pagesTest I Accounts MSDhrisha GadaNo ratings yet

- Accruals Q1 AnswerDocument2 pagesAccruals Q1 AnswerRiyu RimmyNo ratings yet

- Mark Scheme PrinciplesDocument23 pagesMark Scheme PrinciplesV-academy MathsNo ratings yet

- MEI 202311 eDocument22 pagesMEI 202311 eChathura WickramaNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Document12 pagesCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716No ratings yet

- 7110 w13 Ms 22Document10 pages7110 w13 Ms 22Muhammad UmairNo ratings yet

- Business Book o LevelDocument7 pagesBusiness Book o LevelaviiishiiNo ratings yet

- 7110 w15 Ms 22 PDFDocument9 pages7110 w15 Ms 22 PDFRachel RAMSAMYNo ratings yet

- 1700378027.9185524 - Bdcom 2023-2024 Q1Document13 pages1700378027.9185524 - Bdcom 2023-2024 Q1Anwar Hossain ReponNo ratings yet

- Cambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Document9 pagesCambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Taha AhmedNo ratings yet

- Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017Document13 pagesCambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017Makanaka MutandariNo ratings yet

- Ase20093 01 Results Mark Scheme 220826 June 2022 SeriesDocument17 pagesAse20093 01 Results Mark Scheme 220826 June 2022 SeriesTheint ThiriNo ratings yet

- n560 - Financial Accounting n5 Memo June 2019 - AdallDocument9 pagesn560 - Financial Accounting n5 Memo June 2019 - AdallemgnNo ratings yet

- Accruals Q2 AnswerDocument1 pageAccruals Q2 AnswerRiyu RimmyNo ratings yet

- Dashboard FormatDocument2 pagesDashboard FormatahamedmubeenNo ratings yet

- MOCK Test SOLUTIONDocument5 pagesMOCK Test SOLUTIONNcebakazi DawedeNo ratings yet

- 03 0452 12 MS Final ScorisDocument10 pages03 0452 12 MS Final ScorisFarman FaheemNo ratings yet

- 7110 w15 Ms 21 PDFDocument11 pages7110 w15 Ms 21 PDFRachel RAMSAMYNo ratings yet

- Mark Scheme (Results) June 2015: International GCSE Accounting (4AC0)Document14 pagesMark Scheme (Results) June 2015: International GCSE Accounting (4AC0)Syeda Malika AnjumNo ratings yet

- NABARDDocument1 pageNABARDNitin PatelNo ratings yet

- 2018-GR-10-TEST-1-MEMODocument3 pages2018-GR-10-TEST-1-MEMOSuraj SukhuNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument11 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationMandrich AppadooNo ratings yet

- Suggested Solutions June 2006Document11 pagesSuggested Solutions June 2006kalowekamoNo ratings yet

- 0452 s03 Ms 2Document6 pages0452 s03 Ms 2lie chingNo ratings yet

- Cambridge O Level: Accounting 7707/23 October/November 2020Document14 pagesCambridge O Level: Accounting 7707/23 October/November 2020ImanNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaNo ratings yet

- BppuDocument2 pagesBppuni made safitriNo ratings yet

- 3 M Mastery ProblemDocument4 pages3 M Mastery ProblemAdam Hobbs100% (1)

- Service Tax Registration No. credit card statement summaryDocument4 pagesService Tax Registration No. credit card statement summarySamNo ratings yet

- Cambridge International Examinations: Accounting 0452/22 March 2017Document13 pagesCambridge International Examinations: Accounting 0452/22 March 2017Mike ChindaNo ratings yet

- Mark Scheme: Accounting 5121Document12 pagesMark Scheme: Accounting 5121SaadArshadNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The May/June 2014 SeriesMateeh-ur -rehmanNo ratings yet

- Swiss Cottage 2023 Prelim P1 AnswersDocument5 pagesSwiss Cottage 2023 Prelim P1 Answersvikalp.singh.sengarNo ratings yet

- June Grade 10 Marking Guideline PDFDocument7 pagesJune Grade 10 Marking Guideline PDFBasetsana MakuaNo ratings yet

- 4AC0 01 MSC 20150305 PDFDocument14 pages4AC0 01 MSC 20150305 PDFSabsNo ratings yet

- 0452 w10 2 1 Ms PDFDocument9 pages0452 w10 2 1 Ms PDFbipin jainNo ratings yet

- Procurement Tracking SheetDocument12 pagesProcurement Tracking SheetMohannad Abo SulbNo ratings yet

- 4ac1-02-rms-20220825Document10 pages4ac1-02-rms-20220825attackdfg2002No ratings yet

- TABLE-0 Executive SummaryDocument1 pageTABLE-0 Executive SummaryShrey SaxenaNo ratings yet

- Cambridge O Level: Accounting 7707/22 May/June 2020Document12 pagesCambridge O Level: Accounting 7707/22 May/June 2020rAJBS;DFNo ratings yet

- Diamer Basha Dam Project Preliminary Works Contracts: General Manager/Project Director Chief Executive OfficerDocument2 pagesDiamer Basha Dam Project Preliminary Works Contracts: General Manager/Project Director Chief Executive OfficerNauman LiaqatNo ratings yet

- 0452 m17 Ms 22Document13 pages0452 m17 Ms 22Mohammed MaGdyNo ratings yet

- Ruiz, Eric Gerard D.: Problem IDocument9 pagesRuiz, Eric Gerard D.: Problem IMyAccntNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperShona MaheshwariNo ratings yet

- Ap 3 Merge 3-1234Document4 pagesAp 3 Merge 3-1234api-295670758No ratings yet

- Quiz 4 - Problem 1Document2 pagesQuiz 4 - Problem 1KyleRhayneDiazCaliwagNo ratings yet

- ACFrOgDV - 7kt04AxDyGcNL79lC HfjgmZ6EO0SqXVcl2uZ5cAPbhNyMY4 LmmxCpo4Xo2Uo5GezhPw4E543REYaq9k2iN JkFqjIIYkAU9U4nEi16BAkFxkRK2pbvbEDocument5 pagesACFrOgDV - 7kt04AxDyGcNL79lC HfjgmZ6EO0SqXVcl2uZ5cAPbhNyMY4 LmmxCpo4Xo2Uo5GezhPw4E543REYaq9k2iN JkFqjIIYkAU9U4nEi16BAkFxkRK2pbvbEwlv hugoNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of Teacherspridegwatidzo2No ratings yet

- Jockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)Document5 pagesJockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)ouo So方No ratings yet

- Tax Certificate of Noh Sung Hwan - 20240310 - 0001Document2 pagesTax Certificate of Noh Sung Hwan - 20240310 - 0001Md RasalNo ratings yet

- 0452 Accounting: MARK SCHEME For The May/June 2013 SeriesDocument11 pages0452 Accounting: MARK SCHEME For The May/June 2013 SeriesIronMechKillerNo ratings yet

- Bsac 373 Audit Application 2 Prelim QuizDocument2 pagesBsac 373 Audit Application 2 Prelim QuizJ KimNo ratings yet

- Adobe Scan 26-Jul-2022Document1 pageAdobe Scan 26-Jul-2022shubham satamNo ratings yet

- Cambridge IGCSE™: Accounting 0452/23 October/November 2020Document14 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2020ATTIQ UR REHMANNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument9 pagesCambridge International General Certificate of Secondary Educationcheah_chinNo ratings yet

- CashbookDocument2 pagesCashbookJoshua AssinNo ratings yet

- Principles of Accounting 2 Exam Marking KeyDocument6 pagesPrinciples of Accounting 2 Exam Marking KeyYus LindaNo ratings yet

- Completion of Reviera Hotel-Remaining Works (Ah-239) : Payment Status Ytd Summary (As of 21/02/2023)Document115 pagesCompletion of Reviera Hotel-Remaining Works (Ah-239) : Payment Status Ytd Summary (As of 21/02/2023)Imad HamidaNo ratings yet

- PowerPoint Presentation1Document1 pagePowerPoint Presentation1Dhrisha GadaNo ratings yet

- Paper 4Document17 pagesPaper 4Dhrisha GadaNo ratings yet

- PowerPoint Presentation3Document1 pagePowerPoint Presentation3Dhrisha GadaNo ratings yet

- Paper 2 Section 3 and 4 EconomicsDocument2 pagesPaper 2 Section 3 and 4 EconomicsDhrisha GadaNo ratings yet

- Cambridge IGCSE Mathematics Paper 2Document8 pagesCambridge IGCSE Mathematics Paper 2Vũ Hà VânNo ratings yet

- TEST SHEET Practical Mock 3.2Document5 pagesTEST SHEET Practical Mock 3.2Dhrisha GadaNo ratings yet

- Equations and Inequalities Paper 1Document2 pagesEquations and Inequalities Paper 1Dhrisha GadaNo ratings yet

- CombinepdfDocument64 pagesCombinepdfDhrisha GadaNo ratings yet

- WS3Document1 pageWS3Dhrisha GadaNo ratings yet

- MPsALES IN462 9D00Document1 pageMPsALES IN462 9D00Dhrisha GadaNo ratings yet

- 0417 m17 QP 31Document8 pages0417 m17 QP 31Popi MastroianniNo ratings yet

- Class 9 IGCSE Business Studies Syllabus 2022-23Document1 pageClass 9 IGCSE Business Studies Syllabus 2022-23Dhrisha GadaNo ratings yet

- Supa ScubaDocument2 pagesSupa ScubaDhrisha GadaNo ratings yet

- Storage Devices Chapter 3: Magnetic, Optical, Solid-State MediaDocument13 pagesStorage Devices Chapter 3: Magnetic, Optical, Solid-State MediaDhrisha GadaNo ratings yet

- Chap 1, 2, RevisionDocument3 pagesChap 1, 2, RevisionDhrisha Gada100% (1)

- Syllabus For Class9 AccountingDocument1 pageSyllabus For Class9 AccountingDhrisha GadaNo ratings yet

- Maths SyllabusDocument1 pageMaths SyllabusDhrisha GadaNo ratings yet

- N19evidence9f08 1Document4 pagesN19evidence9f08 1Dhrisha GadaNo ratings yet

- CL 9 ICT Syllabus T1 2022 23 - IGCSEDocument1 pageCL 9 ICT Syllabus T1 2022 23 - IGCSEDhrisha GadaNo ratings yet

- Economics Syllabus 22 23Document1 pageEconomics Syllabus 22 23Dhrisha GadaNo ratings yet

- N 19 Evidence 9 F08Document1 pageN 19 Evidence 9 F08Dhrisha GadaNo ratings yet

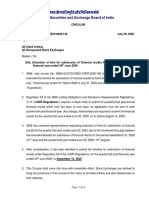

- Extension of Time For Submission of Financial Results For The Quarter - Half Year - Financial Year Ended 30th June 2020Document2 pagesExtension of Time For Submission of Financial Results For The Quarter - Half Year - Financial Year Ended 30th June 2020secretarial officerNo ratings yet

- CHAPTER 3 - Questions - EditedDocument9 pagesCHAPTER 3 - Questions - EditedEsraa TarekNo ratings yet

- 5 Adjusting Entries For Prepaid ExpenseDocument4 pages5 Adjusting Entries For Prepaid Expenseapi-299265916No ratings yet

- Public Private PartnershipsDocument14 pagesPublic Private PartnershipsCharu ModiNo ratings yet

- Strong Tie LTDDocument15 pagesStrong Tie LTDchitu1992100% (4)

- Indian Money Market Structure and ComponentsDocument9 pagesIndian Money Market Structure and ComponentsPrasun KumarNo ratings yet

- Basel III: Bank Regulation and StandardsDocument13 pagesBasel III: Bank Regulation and Standardskirtan patelNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- Individual Research Activity 1 BusinessDocument7 pagesIndividual Research Activity 1 BusinesshariNo ratings yet

- ScriptDocument3 pagesScriptMOHD AZAMNo ratings yet

- Wire Transfer Procedure PDFDocument7 pagesWire Transfer Procedure PDFombonoNo ratings yet

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- Types of Major Accounts and Financial Statements Chapter 4 ProblemsDocument6 pagesTypes of Major Accounts and Financial Statements Chapter 4 ProblemsAmie Jane MirandaNo ratings yet

- Accountancy NotesDocument23 pagesAccountancy NotesAlbana QemaliNo ratings yet

- Accounting For LeasesDocument9 pagesAccounting For LeasesNelson Musili100% (3)

- A0x8akqPTbqMfGpKj 26Zg BB Course1 Week4 Workbook-V2.02Document8 pagesA0x8akqPTbqMfGpKj 26Zg BB Course1 Week4 Workbook-V2.02Zihad HossainNo ratings yet

- Sampath Card Estatement 2020-10-28-4051226 PDFDocument1 pageSampath Card Estatement 2020-10-28-4051226 PDFBuddhika Gihan Wijerathne0% (1)

- Technical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEDocument30 pagesTechnical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEJayant Sharma100% (1)

- Chapter 5 - Health Insurance SchemesDocument0 pagesChapter 5 - Health Insurance SchemesJonathon CabreraNo ratings yet

- Consumers' Perceptions of Reliance Life Insurance Health PlansDocument105 pagesConsumers' Perceptions of Reliance Life Insurance Health Plans2014rajpointNo ratings yet

- CaseDocument4 pagesCaseRyza Mae BascoNo ratings yet

- Audit of CBS EnvironmentDocument28 pagesAudit of CBS EnvironmentPatricia UkemNo ratings yet

- Bank Reconciliation Statements: MBA ExecutiveDocument37 pagesBank Reconciliation Statements: MBA ExecutiveAreeb IqbalNo ratings yet

- Hilton SamplechapterDocument41 pagesHilton SamplechapterNinikKurniatyNo ratings yet

- 1 The Nature, Purpose and Scope of AuditingDocument12 pages1 The Nature, Purpose and Scope of Auditingyebegashet100% (1)

- Week 1 Assignment Fundamental Principles in TaxationDocument5 pagesWeek 1 Assignment Fundamental Principles in TaxationIan Paolo CaylanNo ratings yet

- Cash Management Models & TechniquesDocument3 pagesCash Management Models & Techniqueshae1234No ratings yet

- CMBS 101 Slides (All Sessions)Document41 pagesCMBS 101 Slides (All Sessions)Karan MalhotraNo ratings yet

- Capital Structure Test QuestionsDocument28 pagesCapital Structure Test QuestionsSardonna FongNo ratings yet

- ACCT5001 2022 S2 - Module 2 - Lecture Slides StudentDocument33 pagesACCT5001 2022 S2 - Module 2 - Lecture Slides Studentwuzhen102110No ratings yet