Professional Documents

Culture Documents

Relso Score Card - V29jan2024 - 18 - 06

Relso Score Card - V29jan2024 - 18 - 06

Uploaded by

khalsa.taranjitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relso Score Card - V29jan2024 - 18 - 06

Relso Score Card - V29jan2024 - 18 - 06

Uploaded by

khalsa.taranjitCopyright:

Available Formats

INFLECTION POINT VENTURES

Downloaded by : Balwant singh (9503054144) via IPV App on 30-Jan-2024 03:21 PM

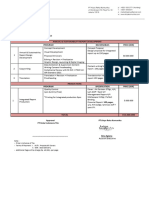

SCORE CARD - Relso

Date: 03 February 2024

CXO Genie initiative

Fireants Sourcing Technologies Private Limited

Executive Summary: With a vision to "Make in India" and sell globally to furniture retailer & brands, Relso has evidenced encouraging initial traction to build a managed manufacturing platform for solid wood furniture. Furniture market is India and globally is expected to grow at CAGR of 11% and 8%, from current market size of US$17.6B and US$766B respectively, presenting a large white space for Relso. Relso is leveraging the enabler role in this value chain by bridging the

gap between growing curated furniture demand from domestic and overseas brands & retailers with unorganised SME furniture manufacturers having excess production capacity. Founders Anshul Choubey (CEO), Abhinav Agrawal (COO) and Jay Trivedi (CTO) collectively having an experience of 24+ years in sales & marketing; technology and supply chain have built initial revenues of INR 1 Cr+ in furniture orders in 2 (two) months of starting operations. Existing customers are

Livspace, Homelane, Urban Ladder and Antiques & More for export orders.

About the start-up Scores

Porter's 5 Forces (In terms of influence over following factors)

Comments Comments Comments

Disrupting / New market Influence on Customers (Brands/Retailers) Influence on Suppliers (SME Factories)

Proof of concept Ample supply @ target cost Vision

Relso is catering to B2B segment in furniture market for - High quality modern design furniture made available - Optimising capacity utilisation through standardise Founders have a clear vision of organising a

both India and Global. at competative price. processes (currently have tied up with 4 manufacturers Relso Managed Manufacturing Contracts large & fragmented solid wood furniture 85

75

in Jodhpur with capacity of 650k Sq Ft) 80

with 4 (four) mid sized manufacturers with market on the supply & demand side by

They are playing an eco-system enablers' role wherein one - High fulfillment experience ensuring adherence to Early revenues of INR 1 Cr from solid wood

cumuative 600,000 SqFt space. Higher upgrading small and medium manufacturers

side they have contract manufacturing agreements with delivery timelines with reliable manifacturing processes - Reducation in rejections at customer front with Relso furniture orders in two months validates

frequency of orders placed with these with technology enabled production practices.

SME Furniture manufacturers catering demand of brands ultimately resulting in lower rejection rate. centrally handling procurement of seasoned wood early traction in a tough market

onboarded manufacturers will drive cost

and retailers across the globe with modular design in solid meeting quality standards. efficiency.

and engineered wood segment, - Flexibility on MOQs (Minimum order quantity) as low Build manufacturer base Leadership

75

as 30 pieces for a product category. - Payment surity with 20% advance against the order to drive scale and adopt

In-house developing technology for operational intelligence and remaining 80% received at the time of delivery. Size of market disruption Managing the business complexity technology enabled

and demand aggregation aims at end to end digitisation of - Addressing exigencies in demand is accomodated standardised Need a strong Finance Controller as well as

Supply Chain

supply chain giving traceability of raw material sourcing, with cloud factory set up. - Efficiency in production lead time with just in time Rising household manufacturing SOPs by second layer in Sales, Design, Operations &

Managing working capital for material 75 Tech team to augment business expansion. 1. Founders have deep

inventory, logistics and wastage at supplier front and purchase of material from customer PO received 85 incomes & aspirational SME units to manage

Huge Furniture Market - India US$17.6B procurement & receivables; On-boarding old understanding of the

getting quick quotes based on quanity & customisations spend on home décor efficient supply chain

and Global US$760+B. Global wood school-promoter driven manufacturers, problem that they are

with order tracking for the B2B customers. driving demand for Solid from raw material

furniture market is ~ US$413B and enhancing tech platform for production solving.

Wood furniture in India procurement to dispatch Business acumen

estimated to be at US$644B by 2030. processes; and implementing manufacturing

and globally. Curated of finished products to 85

SOPs to be tested on scale. 2. They are passionate &

range of contemperory B2B customers.

bring complementary

Differentiator / Disruption

designs with MOQ Anshul focuses on growth and overall

Cost to operation flexibility for Small & Ability to execute/scale leadership; Abhinav handles entire supply functional skills.

Early Revenue Stage to establish steady Medium Sized B2B chain and Jay leads technology.

state gross margins. Current initial furniture customers is key 3. Anshul Choubey, CEO

75 Adoption of Relso specified Manufacturing Passionate & motivation

orders accruing 10% gross margins on differentiator. Relso is 80 has over 8 years of

SOPs by SMEs and securing repeat export

domestic orders due to inefficiencies in focusing on solid wood experience in B2B sales &

orders are critical to drive profitability at

Founders / Promoters

production systems. However as supply Passionate founding team to identify white 85

manufacturing focused

category whereby India scale.

chain inefficiencies are solved for, domestic space in furniture cloud manufacturing space supply chain through his

has a distinct advantage

orders are expected to accrue 18% grorss with focus on building successful business experience with ITC, Bain

Quality vs incumbents due to availability of Comments

Product / Services Substitutes Investor's view natural wood. End and Shadowfax.

Unit economics Execution

consumer's persona for

Relso offers 10k+ standardised SKU designs in solid and Direct : Basant; Latiyal, Mahadev Crafts, other Positives: To be tested at scale. Initial feedback from Founding team has evidenced execution 4. Abhinav, COO is an IIM

solid wood has the Positive unit economics at current stage 80

engineered wood category. unorganised SME furniture exporters 1. Large market, conseting multiple players to exist. customers on quality, order fulfillment and capabilities with intial traction of orders, Calutta & IIT Roorkee

80 propensity to pay a higher from domestic orders; Gross Margins are at 75

2. Passionate and visionary founding team; with each design range has been as per Industry including first few export orders in a graduate with deep

price for premium fit & ~ 9.5%; Export Orders will give better

B2B customers are given elasticity in MOQ with as low as Indirect: IKEA; Amazon; Craftmills has 8+ years experience standards. challenging space. understanding in sourcing

finish of the home decor. blended gross margins of ~24%.

30 items in a specifically curated product cateogry with 3. Curated SKU designs with competitive price points Experimental mindset & supply chain challenges

- Low revenue base

price and quality standards matching with Industry. and Flexible MOQs Speed vs incumbents Long term sustainability currently mainly from Continuous expansion of design catelogue having worked for Kearney

4. Supply chain standardisation to bring efficiency and domestic orders with with modularity in solid wood that can be mass 85 and Shadowfax.

Relso is building trust factor with overseas customers by cost benefit for both supplier and customer. blended gross margin of customised for flexible MOQs, Technology

creating execution experience warranting speed of delivery Capturing export customers; dynamic 80

~9%, Export business has adoption by mid sized units. To be tested at 5. Jay, CTO is also an IIM

of quality furniture through realible manufacturing Risk/ Mitigants: 75 design catalogue; modularity in

To be tested at scale with increasing potential to earn gross scale for quality consistency & design novelty. Calcutta & IIT Roorkee

manuafacturing at high volumes and rapid

Business quality

processes. 1. At scale, credit risk and working capital management volumes for domestic & export orders. margin of ~30%. alumnus, bringing his

technology adoption for managed Problem solving

will be a challenge; Need to bring in strong Current traction with 4 SME suppliers was - Long Term sustainability enterpreneurial experience

underwriting specialist to maintain risk along with ECGC manufacturing will drive long term business in building tech at Relso.

easily managed. is not a challenge 80

2. Building tech and ensuring adoption by SME moat.

considering business A focused team with deep industry knowledge,

supplier; Solutions exist, need to integrate and execute acumen & execution adept at receiving and implementing feedback,

3. Adherence to delivery schedule; Include penalty Funding in sight capability of founders. and skilled in creating standardized designs

clause in PO issued to SME suppliers. - V Cats is in process of

Comments

closing funding

documents for current

Real significant problem Current raise will provide runway for around 80 round; Networking ability

80

12 months, however will require venture

debt to fund working capital to increase

Large & fragment base of micro & mid sized The team is able to network well to build

order book.

furniture manufacturers for solid wood that relationships with owners of units, B2B

have sub-optimal capacity utilization.

85 customers, investors and potential key hires to

Experienced HR professional, with deep understanding of sector. Able to sustain and focus on growth; need some leadership guidance- Furniture retailers/consumer facing brands build the business

Huge demand of

seeking contemporary solid wood furniture contemporary solid wood

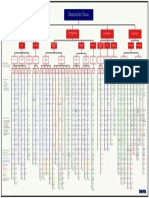

Anshul Choubey Abhinav Agrawal Jay Trivedi designs with customisatable MOQs. Comments Comments

Founder evaluation criteria Overall furniture as market is

CEO COO CTO

Cost of acquisition experiencing a surge in Entry barriers Domestic scalability

Customer / Traction

1 Vision Low CAC with organic and word of mouth demand due to rising Relationships with owners of mid sized Furlenco, Homelane, Livspace already

growth till now; Plan is to hire furniture disposable incomes, manufacturers;Relationships with B2B 70 customers to Relso. With growing demand for 85

2 Leadership

designers to expand design catalogue and 80 higher spend on home furniture buyers;Tech enabled managed solid wood furniture, huge scalability for

3 Business Acumen on-field business development team to tap furnishing. Founders have manufacturing platform for solid wood domestic furniture market

4 Passion & Motivation overseas markets. been able to onboard well- furniture. International scalability

"Antiques & More"; "To the Market" are couple

5 Execution Customer stickiness known customers like New entrants The market for solid wood 70

of export retailers as current customers. Recent traction with solid

6 Experimental Mindset Homelane, Livspace, Blended advantage of in-house design furniture is large and

Stickiness on Relso managed manufacturers Demonstrating fulfillment capability will ensure wood furniture supply to

Substitutes

Scalability

7 Problem Solving 75 Urban Ladder, along with capabilities, initial network of manufacturers 70 growing that can absorb 2

and B2B furniture buyers to be tested at higher orderbook and customers. Homelane (domestic) and

8 Networking ability export customers such as for solid wood work and flexibile MOQs (three) to 4 (four) tech Possible downside

scale. 60 Antiques & More (exports)

Antiques & More. along with initial export orders. enabled managed

Tech adoption by SME manufacturers, validate a global market

manufacturing platforms

*Valuation Summary: Relso is looking to raise INR5 Cr in current round with IPV carve out of INR 1.5 Cr with INR0.50 Cr green shoe option at a pre-money valuation of Pricing Substitutes elongated working capital cycles and delay in opportunity.

in the long term.

Floor INR 40 Cr and Cap INR 52 Cr. (15% discount for a priced round done within 6 months and 25% discount for a priced round done within 12 months. Else conversion will order fulfillment are key challenges to scale.

happen at floor valuation). V Cats have already committed INR2 Cr with other angels bringing in INR1.5 Cr. Maximum 25 cap table seats are available, accordingly in case of In line with other players in market; scope

for price optimisation to improve production Global funiture expos such as IHGF Fair, Global comparatives

oversubscription commitment with higer amount will be given preference.

margins and unit economics. Pricing for 80 Neocon Canton Fair, Milan Furniture Fair 75 75

With the launch of the MBA (Main Bhi Angel) program, you have an option to commit a minimum amount of INR 1 Lakh applicable for your first 5 deals while committing via Export markets expected to be higher than whereby furniture buyers currently procure. QW Furniture, Amazon, IKEA

AIF route only. for domestic markets for a like-to-like MOQ.

Comments INVESTMENT RECOMMENDATION

Disruption Customer Supply Chain Business Substitutes Team Scalability Investor's View Exit options

J J J J K J K J Series A, Strategic investment; Strong VC

80

J

interest observed globally Huge growth space will

attract both VC and 78

79 80 77 78 72 82 73 82

Strategic investor interest;

Profitability

Investors View

Disclosure How can IPV help the start-up to grow (Defined action items) A lot of room of cost optimisation with Export business will drive

Overall

process standardisation, with increase of higher profitability but will

80

IPV Team export business, gross margin of ~24% is also need more working

Mentor : Mitesh Shah 1 : Facilitate customer connect via IPV & CXO members to scale (large logistics companies) projected. capital hence manging

WC efficiently would drive

Lead Member : Rajiv Indimath 2 : Specific mentoring / guidance by SMEs on leadership, execution at scale and build effective supply chain Growth

the business towards

Analysts : Chintan Vyas, Simran Mehta, Akshay RS & Gunjan Verma 3 : Exploring synergies by connecting other portfolio companies like Boingg; Walter systems Rapidly creating a netowrk effect between

profitability & growth.

mid sized manufacturers & B2B customers,

Legal Expert : Ashrika Rastogi 4 : Creating a Let's Grow team to facilitate senior leadership guidance and support to help scale the business. VIEW: RECOMMENDED

5 : AWS Credits worth $25k and other partnerships payment gateway, receivables management, etc. Downloaded by : Balwant singh (9503054144) via IPV App on 30-Jan-2024 03:21 PM design iterations, deepening operational

team and technology adoption are critical

85

for growth

Disclaimer : Although IPV performs an extensive business and financial analysis of the proposal with the available industry expert help also, the views in the documents represent personal views of the respective IPV HQ Lead / Co Lead / experts based on the past financial performance,

future projections and estimates shared by the start-up. Each investing member should apply their own reasonable judgement based on their risk appetite and individual understanding of the concerned business before taking the investment decision.

You might also like

- Marketing & Digital Strategy - #40047588 - April 2022Document24 pagesMarketing & Digital Strategy - #40047588 - April 2022SIA Innovita marketingsNo ratings yet

- Loewe: Commitment To Lean Management?Document8 pagesLoewe: Commitment To Lean Management?Hamza MoshrifNo ratings yet

- Day3 Function FMEADocument56 pagesDay3 Function FMEAPaul StarkNo ratings yet

- Competitive Audit TravelPro Connect - TemplateDocument1 pageCompetitive Audit TravelPro Connect - TemplateAce BuddyNo ratings yet

- Cost Audit and Its Excellences What WhyDocument1 pageCost Audit and Its Excellences What WhyJKonsultoresNo ratings yet

- Cost Audit and Its Excellences What Why PDFDocument1 pageCost Audit and Its Excellences What Why PDFFahmida AkhterNo ratings yet

- Annual Report 2018 2019Document253 pagesAnnual Report 2018 2019Ankaj AroraNo ratings yet

- Orient Refractories LTD Initiating Coverage 21062016Document15 pagesOrient Refractories LTD Initiating Coverage 21062016Tarun MittalNo ratings yet

- DIDIN - Design For Six Sigma - 3Document30 pagesDIDIN - Design For Six Sigma - 3Mas OlisNo ratings yet

- Strategic Planning 6bDocument1 pageStrategic Planning 6bBaher WilliamNo ratings yet

- India Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankDocument19 pagesIndia Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankGugaNo ratings yet

- Daily Labor Report: For Term Service ContractsDocument1 pageDaily Labor Report: For Term Service ContractsNAEEM AL-HASSANNo ratings yet

- MIS - Wipro LimitedDocument7 pagesMIS - Wipro LimitedMehul DevatwalNo ratings yet

- Proposal For The Proposed Community HallDocument3 pagesProposal For The Proposed Community HallAshik M RasheedNo ratings yet

- Product Note - Ipo: Issue HighlightsDocument3 pagesProduct Note - Ipo: Issue Highlightsvidhyaeswaran2143No ratings yet

- FSCM900 Business Process MapsDocument343 pagesFSCM900 Business Process Mapsnareshkumar09No ratings yet

- Procurement & Supply Chain InnovationDocument7 pagesProcurement & Supply Chain InnovationPaula Lande CoralNo ratings yet

- EBI DiagramaDocument1 pageEBI DiagramaJULIAN MENESESNo ratings yet

- S-Quot PT Koka Indonesia TBKDocument1 pageS-Quot PT Koka Indonesia TBKHans HendryanNo ratings yet

- Assignment I - Aldira Jasmine Rizky Arifin - 12010119190284Document2 pagesAssignment I - Aldira Jasmine Rizky Arifin - 12010119190284dirski noonaNo ratings yet

- Managerial Accounting (Act 202) : Name IDDocument15 pagesManagerial Accounting (Act 202) : Name IDDipta Chowdhury 1811951630No ratings yet

- Business Model CanvasDocument1 pageBusiness Model Canvasmariloop9No ratings yet

- Ton Nu Hanh Nguyen - 23DM075 - Chapter 4 Customer-Driven Marketing Strategy MindmapDocument1 pageTon Nu Hanh Nguyen - 23DM075 - Chapter 4 Customer-Driven Marketing Strategy Mindmapsenbinguyen112No ratings yet

- MRF100401 De2Document126 pagesMRF100401 De2Petros TsenesNo ratings yet

- Devops Field GuideDocument34 pagesDevops Field GuidePadmakumar KarthikNo ratings yet

- Brightcom Group - Appointment of Senior Management ProfessionalDocument4 pagesBrightcom Group - Appointment of Senior Management ProfessionalVivek AnandNo ratings yet

- Premium Seller PackageDocument19 pagesPremium Seller PackageVipul RathodNo ratings yet

- Voice of The CustomerDocument1 pageVoice of The Customervis360No ratings yet

- MyXvBcppsW2FkNYCX Tata RNxyTL8SS7uzNQEaP 1673451027621 Completion CertificateDocument1 pageMyXvBcppsW2FkNYCX Tata RNxyTL8SS7uzNQEaP 1673451027621 Completion CertificateAditya JhaNo ratings yet

- Structural Design Dilemma: Fe415 D Fe500 D Fe550 D Fe600Document2 pagesStructural Design Dilemma: Fe415 D Fe500 D Fe550 D Fe600Deepika DeepuNo ratings yet

- You Exec - Timeline Template CompleteDocument56 pagesYou Exec - Timeline Template CompleteanmNo ratings yet

- Estrategy EngDocument3 pagesEstrategy EngJoseph GaonaNo ratings yet

- Guder Quarterly Report 2022Document7 pagesGuder Quarterly Report 2022mohammedamin oumerNo ratings yet

- Heartland Robotics Hires Scott Eckert As Chief Executive OfficerDocument2 pagesHeartland Robotics Hires Scott Eckert As Chief Executive Officerapi-25891623No ratings yet

- Expanded Mobile Ad Unit Sizes Whitepaper: JUNE 3, 2010Document6 pagesExpanded Mobile Ad Unit Sizes Whitepaper: JUNE 3, 2010fookenukenNo ratings yet

- Shubham SaxenaDocument104 pagesShubham SaxenaShubham SaxenaNo ratings yet

- TATA CertificateDocument1 pageTATA CertificateSHREYASH MENDHE MENDHENo ratings yet

- Sona BLW Precision Forgings LTD.: Equitas Small Finance Bank Equitas Small Finance BankDocument22 pagesSona BLW Precision Forgings LTD.: Equitas Small Finance Bank Equitas Small Finance BankrajpvikNo ratings yet

- Moledro: QuotationDocument5 pagesMoledro: QuotationRachana DasNo ratings yet

- Companies - Dealroom - Co - 04Document1 pageCompanies - Dealroom - Co - 04Tyler JohnsonNo ratings yet

- Should You Buy Stocks in Anticipation of Good Results?: Exponential Pro Ts - July 2021 IssueDocument9 pagesShould You Buy Stocks in Anticipation of Good Results?: Exponential Pro Ts - July 2021 IssuebapunrituNo ratings yet

- I-Byte Energy April 2021Document78 pagesI-Byte Energy April 2021IT ShadesNo ratings yet

- WellFood National DistributionDocument11 pagesWellFood National DistributionmizanNo ratings yet

- Business Communications Final Exam: John GuerinDocument13 pagesBusiness Communications Final Exam: John GuerinThomas RiallinNo ratings yet

- Virbhadra Swami: Technology Consulting Virtual InternshipDocument1 pageVirbhadra Swami: Technology Consulting Virtual InternshipvirNo ratings yet

- Intro MergedDocument2 pagesIntro MergedBerni BernaldNo ratings yet

- Phoenix Lamps 231007Document18 pagesPhoenix Lamps 231007rahul.pms100% (1)

- Value-Map TM DeloitteDocument1 pageValue-Map TM DeloitteHugo SalazarNo ratings yet

- PFD - Reviewed 1Document1 pagePFD - Reviewed 1Premium ServiceNo ratings yet

- Management Training Construction Professionals For: TutorialDocument137 pagesManagement Training Construction Professionals For: TutorialYasir ArafatNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Press ReleaseDocument4 pagesBSE Limited National Stock Exchange of India Limited: Press ReleaseVivek AnandNo ratings yet

- Fra 1Document1 pageFra 1khaipham7302No ratings yet

- LEAF1 National Finals Enterprise PortfolioDocument11 pagesLEAF1 National Finals Enterprise PortfoliodeepinordNo ratings yet

- ACES Doha - Company Profile 2020 Rev.2 - EmailDocument112 pagesACES Doha - Company Profile 2020 Rev.2 - Emailshakir69No ratings yet

- Priyanka Kumari Python 3yrsDocument3 pagesPriyanka Kumari Python 3yrsPriyankaJhaNo ratings yet

- Bond With Pidilite: by Team The Right WritersDocument3 pagesBond With Pidilite: by Team The Right WritersPrabuNo ratings yet

- No Place Left To SqueezeDocument8 pagesNo Place Left To SqueezedesikanNo ratings yet

- Deepu CertificateDocument1 pageDeepu CertificateBåd CaptaiñNo ratings yet

- Group Project Design PosterDocument1 pageGroup Project Design PosterYasir IsmailNo ratings yet

- TOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2From EverandTOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2Rating: 5 out of 5 stars5/5 (1)