Professional Documents

Culture Documents

Quiz 4-Ch4-Investment Apprasal Method

Quiz 4-Ch4-Investment Apprasal Method

Uploaded by

Chheuy Sok Lin0 ratings0% found this document useful (0 votes)

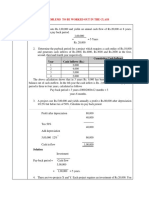

4 views1 pageThis document provides information to calculate the net present value (NPV) and internal rate of return (IRR) for two potential machine investments, Machine A and Machine B. It lists the cash flows for each machine over several years and asks the reader to calculate the NPV for each by applying the given discount factors and determining which machine option has a higher NPV. It also provides cash flow information for Machine A to calculate its IRR.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information to calculate the net present value (NPV) and internal rate of return (IRR) for two potential machine investments, Machine A and Machine B. It lists the cash flows for each machine over several years and asks the reader to calculate the NPV for each by applying the given discount factors and determining which machine option has a higher NPV. It also provides cash flow information for Machine A to calculate its IRR.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageQuiz 4-Ch4-Investment Apprasal Method

Quiz 4-Ch4-Investment Apprasal Method

Uploaded by

Chheuy Sok LinThis document provides information to calculate the net present value (NPV) and internal rate of return (IRR) for two potential machine investments, Machine A and Machine B. It lists the cash flows for each machine over several years and asks the reader to calculate the NPV for each by applying the given discount factors and determining which machine option has a higher NPV. It also provides cash flow information for Machine A to calculate its IRR.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Quiz 4- Ch4 : Investment Appraisal Method

1. Find the NPV of the two project (10 marks)

Initial Investment Cost = 80000

Year Discount Machine A Machine B

Factors

(12%) Cash Flow P.V ($) Cash Flow P.V ($)

1 ? 24000 ? 8000 ?

2 ? 32000 ? 24000 ?

3 ? 40000 ? 32000 ?

4 ? 24000 ? 48000 ?

5 ? 16000 ? 32000 ?

6 ? 22000 ? 22000 ?

7 ? 20000 ? 20000 ?

? ?

What option should you buy ? Why?

2. Find the Internal Rate of Return (IRR) (10 marks)

Initial Investment Cost = 1000

Year Discount Machine A

Factors

(12%) Cash Flow P.V ($)

1 ? 5000 ?

2 ? 2000 ?

3 ? 2000 ?

4 ? 3000 ?

?

You might also like

- Accounting - Week 2 - Syndicate 3 - CVP Excel DemoDocument3 pagesAccounting - Week 2 - Syndicate 3 - CVP Excel DemoKrishna Rai0% (1)

- Financial Feasibility: 4.1 Total Start Up Cash NeededDocument5 pagesFinancial Feasibility: 4.1 Total Start Up Cash NeededAmna Arif100% (1)

- Assignment 3: Aggregate Planning: Name: Nguyen Khanh Linh ID: IELSIU18219Document7 pagesAssignment 3: Aggregate Planning: Name: Nguyen Khanh Linh ID: IELSIU18219Khánh Linh NguyễnNo ratings yet

- Intangible Finance Standards: Advances in Fundamental Analysis and Technical AnalysisFrom EverandIntangible Finance Standards: Advances in Fundamental Analysis and Technical AnalysisNo ratings yet

- Question #1: Jordan Enterprises Raw MaterialDocument35 pagesQuestion #1: Jordan Enterprises Raw MaterialAimen sakimdadNo ratings yet

- Biogas FinanceDocument9 pagesBiogas FinanceEngr Peter Iyke EboghaNo ratings yet

- Bajaj Auto - BIDADocument26 pagesBajaj Auto - BIDASandeep SagarNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2NOEL ThomasNo ratings yet

- Working Capital ManagementDocument2 pagesWorking Capital ManagementpreetiNo ratings yet

- IFC 2024 Proposed BudgetDocument4 pagesIFC 2024 Proposed BudgetPranith Kumar RoyNo ratings yet

- Af 160145Document4 pagesAf 160145nurinNo ratings yet

- Accounts Unajusted Trial Balance Adjusted Trial Balance DR CR DR CRDocument2 pagesAccounts Unajusted Trial Balance Adjusted Trial Balance DR CR DR CRAlexa RamosNo ratings yet

- Model Paper 1 For IBPS PO MainsDocument42 pagesModel Paper 1 For IBPS PO MainsKetan V. JoshiNo ratings yet

- Cost Benefit AnalysisDocument19 pagesCost Benefit AnalysisGauri chughNo ratings yet

- Sri Siddhartha Institute of Business ManagementDocument1 pageSri Siddhartha Institute of Business ManagementvanajaNo ratings yet

- Basic Accounting NotesDocument17 pagesBasic Accounting NotesAdilrabia rslNo ratings yet

- Unit 2 Part 1 CHP 02-SPM-Project EvaluationDocument32 pagesUnit 2 Part 1 CHP 02-SPM-Project Evaluationabc xyzNo ratings yet

- 2122promana HW3 G5Document7 pages2122promana HW3 G5Dương NgNo ratings yet

- Assignment 3 Capital Budgeting TechniqueDocument5 pagesAssignment 3 Capital Budgeting TechniqueProma MandalNo ratings yet

- Practice Prob 2Document19 pagesPractice Prob 2Cleofe Mae Piñero AseñasNo ratings yet

- Chapter 4, Accounting CycleDocument33 pagesChapter 4, Accounting Cyclemuhammad.g27254No ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Power PointsDocument10 pagesPower PointsMohsin ALINo ratings yet

- Lecture 10 Depreciation MethodsDocument15 pagesLecture 10 Depreciation MethodsMohamed KhalilNo ratings yet

- Chapter 4, Accounting CycleDocument13 pagesChapter 4, Accounting CyclekhanNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- 1805-0301 FentanylDocument1 page1805-0301 FentanylGreg FontanaNo ratings yet

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanNo ratings yet

- Sattva Paints F-Plan FinalDocument44 pagesSattva Paints F-Plan FinalShrushti MehtaNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Garrison Ch04 FS ConversionDocument2 pagesGarrison Ch04 FS ConversionHome Made Cookin'No ratings yet

- DB6 - Worksheet & FS Prep For Merchandising BusinessDocument4 pagesDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Quiz 4 Declared 10.08.2019Document3 pagesQuiz 4 Declared 10.08.2019Amit GodaraNo ratings yet

- Acc STD 9-P-2 KcsDocument3 pagesAcc STD 9-P-2 Kcsshipra shilNo ratings yet

- Class Creating and Claiming Value s1Document20 pagesClass Creating and Claiming Value s1karishma nairNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Patym - Masterclass Edelweiss AMCDocument15 pagesPatym - Masterclass Edelweiss AMCDaniel JamesNo ratings yet

- Eps Calculation and Value of FirmDocument5 pagesEps Calculation and Value of Firmrangamkumar99No ratings yet

- Civil Engineering Construction Project (Ecm 317) : Group MembersDocument28 pagesCivil Engineering Construction Project (Ecm 317) : Group MembersSafi HusseinNo ratings yet

- Time Series Graphs of Weekday/Weekend For The Months of October, November, DecemberDocument20 pagesTime Series Graphs of Weekday/Weekend For The Months of October, November, DecemberYASEEN AKBARNo ratings yet

- EasyJet vs. RyanairDocument22 pagesEasyJet vs. RyanairDiana CostaNo ratings yet

- Mb0040 - Statistics For Management-4 Credits Assignment Set - 1 (60 Marks) Note: Each Question Carries 10 Marks. Answer All The QuestionsDocument5 pagesMb0040 - Statistics For Management-4 Credits Assignment Set - 1 (60 Marks) Note: Each Question Carries 10 Marks. Answer All The Questionsrr8183No ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Bar Graph BanyakDocument2 pagesBar Graph BanyaktwinkleterryNo ratings yet

- Oppenheimer Holdings Inc. Annual Report 2010Document52 pagesOppenheimer Holdings Inc. Annual Report 2010lulupupututuNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- CE168P-2 S-Curve SampleDocument4 pagesCE168P-2 S-Curve SampleCat BugNo ratings yet

- Capacity Production PlaningDocument4 pagesCapacity Production PlaningUchenna 'Bonex' OgbonnaNo ratings yet

- Activities and Assesment 2Document4 pagesActivities and Assesment 2Mante, Josh Adrian Greg S.No ratings yet

- Financial AnalysisDocument18 pagesFinancial Analysismaizatul rosniNo ratings yet

- Homework Problem Chapter 7Document3 pagesHomework Problem Chapter 7ARMANDO SORIANONo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- Homework - Supply Chain Design Chapter 6: Supply Contracts: P C $ 125 $ 55 $ 70 C S $ 55 $ 20 $ 35Document3 pagesHomework - Supply Chain Design Chapter 6: Supply Contracts: P C $ 125 $ 55 $ 70 C S $ 55 $ 20 $ 35Anh Cao Thị MinhNo ratings yet

- Ch5 Financial Statements AnalysisDocument13 pagesCh5 Financial Statements AnalysisMUSTAFANo ratings yet

- Accounting RatiosDocument7 pagesAccounting Ratios27h4fbvsy8No ratings yet

- Worksheet 1 FinalDocument1 pageWorksheet 1 FinalLovely MafiNo ratings yet

- Intangible Management: Tools for Solving the Accounting and Management CrisisFrom EverandIntangible Management: Tools for Solving the Accounting and Management CrisisNo ratings yet