Professional Documents

Culture Documents

Ias 2 - Inventories

Uploaded by

angelinamaye990 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

IAS 2_ INVENTORIES

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesIas 2 - Inventories

Uploaded by

angelinamaye99Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

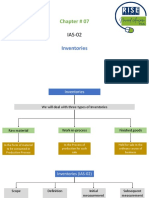

IAS 2: INVENTORIES

Notes and Quizzers: Theories of Accounts (IFRS Based) Empleo, 2016

EXCEPTION TO MEASUREMENT COSTS EXCLUDED FROM INVENTORIES

REQUIREMENTS ● Abnormal amounts of wasted

materials, labor or production cost

Measurement requirements of IAS 2 do ● Storage costs, unless necessary in the

not apply to inventories held by production process before a further

● Producers of Agricultural and Forest production stage

Products, Agricultural Produce after ● Administrative overheads, that do not

harvest to the extent that they are contribute to their present location

measured at net realizable value and condition

● Commodity broker-traders who ● Selling cost

measure their inventories at fair value

less costs to sell AGRICULTURAL PRODUCE harvested from

biological assets are measured at initial

recognition at fair value less estimated costs

INVENTORIES DEFINED

are initially recognized at cost to sell at the point of harvest

Goods held for sale in the ordinary course of MEASUREMENT SUBSEQUENT TO INITIAL

business RECOGNITION Inventories are measured at

the lower of cost and net realizable value

Goods in the process of production for such sale

In the form of materials or supplies to be COST FORMULAS

consumed in the production process or in the

rendering of services NOT ORDINARILY INTERCHANGEABLE and

goods segregated for specific projects

In the case of service providers, the cost of service - Specific identification method

for which the entity has not yet recognized the

related revenue

ORDINARILY INTERCHANGEABLE

- First-in, First-out (FIFO) method

- Weighted average method

COMPONENTS OF COST

COST OF PURCHASE USE OF COST FORMULAS

● Purchase price, net of trade discounts, ● An entity shall use the same cost

rebates and other similar items formula for all inventories having a

● Import duties and other taxes similar nature and use to the entity

● Transport, handling and other costs ● For inventories with a different nature

directly attributable to acquisition or use, different cost formula may be

justified

COST OF CONVERSION

● Direct labor

● Variable production overheads TECHNIQUES FOR MEASUREMENT OF COST

● Fixed production overheads

● The allocation of fixed overhead to units of STANDARD COST METHOD takes into

production is based on normal capacity

account normal levels of materials and supplies,

- Unallocated overheads due to

labor, efficiency and capacity utilization

operation below normal capacity

are charged as expenses

- In periods of high production, RETAIL METHOD the cost to retail percentage

fixed overhead per unit is takes into consideration inventory that has been

decreased (fixed overhead/actual marked down to below its original selling price. An

units) average percentage for each retail department is

often used

OTHER COSTS

● Included only to the extent that they NET REALIZABLE VALUE (NRV) is the

are incurred in bringing the inventories

estimated selling price in the ordinary course

to their present location and condition

● Examples are costs of designing of business less the estimated costs of

products for specific customers completion and the estimated costs of

disposal

BASES FOR DETERMINING SELLING PRICE TO

DISCLOSURE REQUIREMENTS

COMPUTE NET REALIZABLE VALUE (NRV)

For inventories Accounting policies adopted in measuring

covered by sales of The sales price is the inventories, including the cost formula used

contracts, the sales general selling price of

price is the contract the items Total carrying amounts and the carrying amount

price in the classification appropriate to the entity

Amount of inventoried recognized as an

INVENTORIES are usually written down to expense during the period

net realizable value on an item-by-item basis.

In some circumstances, it may be appropriate Amount of any write-down recognized as an

to group similar or related items expense

Amount of reversal of any write-down

RECOGNITION AS EXPENSE

Circumstances that led to the reversal of a

When inventories are sold, the carrying amount

write-down

is recognized as an expense in the period of

revenue recognition

Carrying amount of inventories pledged as

security for liabilities

The write-down or/and losses are recognized as an

expense in the period the write-down or loss

occurs

The reversal of write-down is recognized as

reduction in the amount of inventories

recognized as an expense in which the reversal

occurs

RECOGNITION OF EXPENSE FOR GOODS

SOLD

Under the function of expense method, the

expense is the cost of goods sold

Under the nature of expense method, the expense

on the income statement is the net cost of

purchases adjusted by the increase or decrease in

inventory

WRITE DOWN TO LOWER OF COST AND NET

REALIZABLE VALUE

The decline in net realizable value of

inventory is recognized either

As part of cost of goods sold (only under the

function of expense method)

As other operating losses/expenses in the income

statement(under either the function of expense

method or the nature of expense method)

REVERSAL OF WRITE-DOWN for the same

inventory is limited to the amount of original

write-down, so that the new carrying amount

is the lower of cost and the revised net

realizable value

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- IAS 2 - InventoriesDocument17 pagesIAS 2 - InventoriesraopraniNo ratings yet

- Objective: Scope Inventories Net Realisable ValueDocument14 pagesObjective: Scope Inventories Net Realisable ValueZohair HumayunNo ratings yet

- UFAS2Document4 pagesUFAS2Romylen De GuzmanNo ratings yet

- 2nd Group - IASDocument63 pages2nd Group - IASmohihsanNo ratings yet

- 2 - 2 - 3 - Inventory ValuationDocument12 pages2 - 2 - 3 - Inventory ValuationJohanNo ratings yet

- Mas.02 Variable and Absorption CostingDocument6 pagesMas.02 Variable and Absorption CostingRhea Royce CabuhatNo ratings yet

- LKAS 2 / IAS 2 - InventoriesDocument29 pagesLKAS 2 / IAS 2 - InventoriesShihan Haniff100% (9)

- FINACC1 Inventories PDFDocument6 pagesFINACC1 Inventories PDFJerico DungcaNo ratings yet

- 13.3 As 2 Valuation of Inventories Revision Notes by Nitin Goel Sir PDFDocument6 pages13.3 As 2 Valuation of Inventories Revision Notes by Nitin Goel Sir PDFSrinishaNo ratings yet

- C16-MFRS 102 InventoriesDocument2 pagesC16-MFRS 102 InventoriesNur ain Natasha ShaharudinNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document22 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Acc 203 RevDocument6 pagesAcc 203 RevHazel DimaanoNo ratings yet

- As 2, Valuation of Inventories: Excluded Inventories (Not Dealt With Byas2)Document2 pagesAs 2, Valuation of Inventories: Excluded Inventories (Not Dealt With Byas2)manvinderNo ratings yet

- Scope: Allocation of Fixed Production OverheadsDocument8 pagesScope: Allocation of Fixed Production OverheadsjayveeNo ratings yet

- AS 2 - Valuation of Inventories: Paper 1: Financial Reporting Chapter 1 Unit 3Document32 pagesAS 2 - Valuation of Inventories: Paper 1: Financial Reporting Chapter 1 Unit 3arvindNo ratings yet

- Product Cost MethodsDocument3 pagesProduct Cost Methodsjaninasachadelacruz0119No ratings yet

- Module 05 - Inventories, Agricultural Assets and ImpairmentDocument21 pagesModule 05 - Inventories, Agricultural Assets and Impairmentpaula manaloNo ratings yet

- Accounts Chapter 4Document13 pagesAccounts Chapter 4lalitshreya1No ratings yet

- 04 InventoriesDocument52 pages04 InventoriesKhalid MahmoodNo ratings yet

- As - 2: Valuation of InventoriesDocument18 pagesAs - 2: Valuation of InventoriesrajuNo ratings yet

- IAS 2 Inventories PDFDocument12 pagesIAS 2 Inventories PDFViplav RathiNo ratings yet

- MODULE 1 Variable and Absorption CostingDocument9 pagesMODULE 1 Variable and Absorption Costingjerico garciaNo ratings yet

- Philippine Accounting Standards 2 - InventoriesDocument5 pagesPhilippine Accounting Standards 2 - InventoriesJohn Rafael Reyes PeloNo ratings yet

- Chapter 8 IAS 2 InventoriesDocument7 pagesChapter 8 IAS 2 InventoriesClarissa BorbonNo ratings yet

- Accounting StandardsDocument56 pagesAccounting StandardsAkshay KumarNo ratings yet

- G Ias 2Document19 pagesG Ias 2Daniel MNo ratings yet

- Ojas FR Module 1Document280 pagesOjas FR Module 1AnupNo ratings yet

- 07 Module 03 AVC PDFDocument12 pages07 Module 03 AVC PDFMarriah Izzabelle Suarez RamadaNo ratings yet

- Presentation4.1 - Audit of Inventories, Cost of Sales and Other Related AccountsDocument37 pagesPresentation4.1 - Audit of Inventories, Cost of Sales and Other Related AccountsRoseanne Dela CruzNo ratings yet

- IAS 2 - InventoriesDocument11 pagesIAS 2 - Inventoriesfarukh.kitchlewNo ratings yet

- Variable and Absorption CostingDocument4 pagesVariable and Absorption CostingFranz CampuedNo ratings yet

- Inventories Accounting StandardDocument25 pagesInventories Accounting StandardvijaykumartaxNo ratings yet

- CH # 07 To 10 RevisionDocument61 pagesCH # 07 To 10 RevisionAbdul SalamNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- Chapter 3 - IND AS 2 InventoriesDocument18 pagesChapter 3 - IND AS 2 InventoriesAmbati Madhava ReddyNo ratings yet

- Other Cost Incurred in Bringing The Inventories To Their Present Location andDocument3 pagesOther Cost Incurred in Bringing The Inventories To Their Present Location andMarianne SironNo ratings yet

- Pas 2Document2 pagesPas 2Ella MaeNo ratings yet

- BookDocument1,240 pagesBookAmitNo ratings yet

- Ias 2 - InventoriesDocument11 pagesIas 2 - InventoriesmulualemNo ratings yet

- NOTE CHAPTER 9 - Absorption Costing & Marginal CostingDocument18 pagesNOTE CHAPTER 9 - Absorption Costing & Marginal CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- IAS 2 InventoriesDocument17 pagesIAS 2 InventoriesfitusNo ratings yet

- Onlineaccounting - LK: Definition of InventoryDocument3 pagesOnlineaccounting - LK: Definition of InventoryayeshaNo ratings yet

- Ind As On Assets of The Financial Statements: Unit 1: Indian Accounting Standard 2: InventoriesDocument37 pagesInd As On Assets of The Financial Statements: Unit 1: Indian Accounting Standard 2: Inventorieswacky chitchatNo ratings yet

- Ind As On Assets of The Financial Statements: Unit 1: Indian Accounting Standard 2: InventoriesDocument38 pagesInd As On Assets of The Financial Statements: Unit 1: Indian Accounting Standard 2: InventoriesSri KanthNo ratings yet

- As 2Document7 pagesAs 2sanjay sNo ratings yet

- Ias 2Document4 pagesIas 2Abdullah Al Amin MubinNo ratings yet

- Chapter 5 InventoriesDocument12 pagesChapter 5 InventoriesMelvin OngNo ratings yet

- (Cpar2017) Mas-8205 (Product Costing) PDFDocument12 pages(Cpar2017) Mas-8205 (Product Costing) PDFSusan Esteban Espartero50% (2)

- Ias2 SNDocument7 pagesIas2 SNEmaan QaiserNo ratings yet

- InventoriesDocument3 pagesInventoriesNikki RañolaNo ratings yet

- Ias 2 SummaryDocument5 pagesIas 2 Summaryp.dashaelaineNo ratings yet

- Ind As 2 Inventories 74892bos60524-Cp6-U1Document42 pagesInd As 2 Inventories 74892bos60524-Cp6-U1kedar bhideNo ratings yet

- Chapter 18 IAS 2 InventoriesDocument6 pagesChapter 18 IAS 2 InventoriesKelvin Chu JYNo ratings yet

- 08 Ias 2Document3 pages08 Ias 2Irtiza AbbasNo ratings yet

- Chapter 4 - Inventories - 27 PagesDocument27 pagesChapter 4 - Inventories - 27 PagesSamartha UmbareNo ratings yet

- Inventories: Learning OutcomesDocument28 pagesInventories: Learning OutcomesCA Kranthi KiranNo ratings yet

- Accounting For Inventories: Financial Reporting and AnalysisDocument28 pagesAccounting For Inventories: Financial Reporting and AnalysisrehanNo ratings yet

- Ias 7 - Statement of Cash FlowsDocument2 pagesIas 7 - Statement of Cash Flowsangelinamaye99No ratings yet

- Ias 1 - Presentation of Financial StatementsDocument3 pagesIas 1 - Presentation of Financial Statementsangelinamaye99No ratings yet

- The Accounting ProcessDocument2 pagesThe Accounting Processangelinamaye99No ratings yet

- Conceptual Framework For Financial ReportingDocument2 pagesConceptual Framework For Financial Reportingangelinamaye99No ratings yet

- Annual Implementation Plan FinalDocument3 pagesAnnual Implementation Plan FinalMichelle Ann Narvino100% (2)

- Air Quality StandardsDocument2 pagesAir Quality StandardsJanmejaya BarikNo ratings yet

- Factors Affecting Pakistani English Language LearnersDocument19 pagesFactors Affecting Pakistani English Language LearnersSaima Bint e KarimNo ratings yet

- Management From RamayanaDocument14 pagesManagement From Ramayanasaaket batchuNo ratings yet

- Cebex 305: Constructive SolutionsDocument4 pagesCebex 305: Constructive SolutionsBalasubramanian AnanthNo ratings yet

- But Flee Youthful Lusts - pdf2Document2 pagesBut Flee Youthful Lusts - pdf2emmaboakye2fNo ratings yet

- SAP Group Reporting 1909Document28 pagesSAP Group Reporting 1909SUDIPTADATTARAY86% (7)

- Litotriptor Intracorporeo NeumaticoDocument4 pagesLitotriptor Intracorporeo NeumaticoJuan VasquezNo ratings yet

- 1b.exadata X9M 2Document29 pages1b.exadata X9M 2Edu KiaiNo ratings yet

- B737 AutothrottleDocument103 pagesB737 AutothrottleZaw100% (1)

- CanagliflozinDocument7 pagesCanagliflozin13201940No ratings yet

- Exercise 3 - Wireframe Geometry Creation and Editing - Rev ADocument33 pagesExercise 3 - Wireframe Geometry Creation and Editing - Rev AdevNo ratings yet

- 1250kva DG SetDocument61 pages1250kva DG SetAnagha Deb100% (1)

- AQA Power and Conflict GCSE Revision Guide LADocument49 pagesAQA Power and Conflict GCSE Revision Guide LAderaw11557No ratings yet

- Case Presentation On Management of Depressive Disorders-1Document40 pagesCase Presentation On Management of Depressive Disorders-1Fatima MuhammadNo ratings yet

- M7Ge-Iiib-1: Renante Tillo JosolDocument3 pagesM7Ge-Iiib-1: Renante Tillo JosolRenante T. JosolNo ratings yet

- Mat210 LectureNotes 1Document7 pagesMat210 LectureNotes 1Franch Maverick Arellano LorillaNo ratings yet

- Tahmina Ferdousy Jhumu: HND Btec Unit 15 Psychology For Health and Social CareDocument29 pagesTahmina Ferdousy Jhumu: HND Btec Unit 15 Psychology For Health and Social CareNabi BoxNo ratings yet

- Inspection and Test Plan (ITP) For Spherical Storage Tanks: Dehloran Olefin PlantDocument9 pagesInspection and Test Plan (ITP) For Spherical Storage Tanks: Dehloran Olefin PlantbahmanNo ratings yet

- REACH ArticlesDocument12 pagesREACH ArticlesChristian SugasttiNo ratings yet

- Antai Solar Mounting Systems: Components List 2016Document12 pagesAntai Solar Mounting Systems: Components List 2016fedegarinNo ratings yet

- BarDocument1 pageBarJoannalyn Libo-onNo ratings yet

- UntitledDocument4 pagesUntitledapi-223522684No ratings yet

- Bubbles in Transformer Oil Dynamic Behavior Internal Discharge and Triggered Liquid BreakdownDocument9 pagesBubbles in Transformer Oil Dynamic Behavior Internal Discharge and Triggered Liquid BreakdownMuhammad Irfan NazhmiNo ratings yet

- PlayStation MagazineDocument116 pagesPlayStation MagazineFrank Costello67% (3)

- Shrutiand SmritiDocument9 pagesShrutiand SmritiAntara MitraNo ratings yet

- Impacts of Extracurricular Activities On The Academic Performance of Student AthletesDocument3 pagesImpacts of Extracurricular Activities On The Academic Performance of Student AthletesKarlo VillanuevaNo ratings yet

- Pricelist LV Siemens 2019 PDFDocument96 pagesPricelist LV Siemens 2019 PDFBerlianiNo ratings yet

- Artificial Intelligence in Power System OperationsDocument8 pagesArtificial Intelligence in Power System OperationsDummyofindiaIndiaNo ratings yet

- IBEF Cement-February-2023Document26 pagesIBEF Cement-February-2023Gurnam SinghNo ratings yet