Professional Documents

Culture Documents

Accrual & Prepayments

Uploaded by

ronstarcaristaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accrual & Prepayments

Uploaded by

ronstarcaristaCopyright:

Available Formats

PRINCIPLES OF ACCOUNTS

ACCRUALS & PREPAYMENTS

LEARNING OBJECTIVES:

a) Know how an accrual arise

b) Double enter accruals in the Ledger

c) Know how a prepayment arise

d) Double enter prepayments in the Ledger

______________________________________________________________________________

1. ACCRUALS/ACCRUED EXPENSES: (owing/arrears/outstanding/due)

These are expenses which are incurred during the period but is still being owed at the end of the

period.

• All Expenses are debited in the general ledger.

• Accrued expenses must be added to current expenses before being subtracted from Gross

profit in the Income Statement or Trading & Profit & Loss a/c.

• It is also listed under current liabilities in the Balance Sheet.

HOW TO DOUBLE ENTER IN LEDGER:

EXAMPLE: Rent for year $12000, $3000 is payable every 3 months.

1. $3000 due 31 march, 2017 paid on 31 March 2017

2. $3000 due 30 June, 2017 paid on 02 July 2017

3. $3000 due 30 Sept, 2017 paid on 04 Oct 2017

4. $3000 due 31 Dec, 2017 paid on 05 Jan, 2018

RENT EXPENSE A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Mar 31 Bank 3000 Dec 31 Profit & Loss 12000

Jul 02 Bank 3000

Oct 04 Bank 3000

Dec 31 Accrued c/d 3000

12000 12000

2018

Jan 01 Accrued b/d 3000

2. PREPAYMENTS/PREPAID EXPENSES: (In Advance)

These are expenses that are paid in advance for the following period.

• Prepaid expenses are subtracted from current expenses before being subtracted from

Gross Profit in the Income Statement or Trading & Profit & Loss a/c

• Prepaid expenses are listed under current assets in the Balance Sheet.

HOW TO DOUBLE ENTER IN LEDGER:

EXAMPLE: Insurance for a company is $840 for the year, $210 is payable every 3 months

1. $210 due 31 march 2017 paid 28 Feb, 2017

2. $210 due 30 June 2017 --------

3. $210 due 30 Sept 2017 paid $420 31 Aug, 2017

4. $210 due 31 Dec 2017 paid $420 18 Nov, 2017

INSURANCE EXPENSES A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Feb 28 Bank 210 Dec 31 Profit & Loss 840

Aug 31 Bank 420 Dec 31 Prepaid c/d 210

Nov 18 Bank 420

1050 1050

2018

Jan 01 Prepaid b/d 210

Example 28.1 page 269

RENT EXPENSE A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Nov 30 Bank 3300 Dec 31 Profit & Loss 3600

Dec 31 Accrued c/d 300

3600 3600

2018

Jan 01 Accrued b/d 300

TELEPHONE EXPENSES A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Dec 31 Bank 589 Dec 31 Profit & Loss 696

Dec 31 Accrued c/d 107

696 696

2018

Jan 01 Accrued b/d 107

WAGES EXPENSES A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Dec 31 Bank 14690 Dec 31 Profit & Loss 15020

Dec 31 Accrued c/d 330

15020 15020

2018

Jan 01 Accrued b/d 330

D)

RATES EXPENSES A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Dec 31 Bank 5250 Dec 31 Profit & Loss 4200

Dec 31 Prepaid c/d 1050

5250 5250

2018

Jan 01 Prepaid b/d 1050

INSURANCE EXPENSE A/C

DATE DETAILS AMT. $ DATE DETAILS AMT.

$

2017 2017

Dec 31 Bank 1200 Dec 31 Profit & Loss 800

Dec 31 Prepaid c/d 400

1200 1200

2018

Jan 01 Prepaid b/d 400

You might also like

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- In Class Activity Solution 4.1Document17 pagesIn Class Activity Solution 4.1Jeanelle ColaireNo ratings yet

- Lembar Kerja KeseluruhanDocument41 pagesLembar Kerja Keseluruhanhoney100% (1)

- Bzops9157a 2018 PDFDocument4 pagesBzops9157a 2018 PDFVikas AhlawatNo ratings yet

- May 2018 and 2017 SolutionsDocument43 pagesMay 2018 and 2017 SolutionsgNo ratings yet

- Grade 10 Poa Section 6Document17 pagesGrade 10 Poa Section 6Princess InnissNo ratings yet

- Exercises and Answers Q1 To 4 - Ledger Account For Accruals and PrepaymentsDocument1 pageExercises and Answers Q1 To 4 - Ledger Account For Accruals and PrepaymentsNayaz EmamaulleeNo ratings yet

- 2018 Shelby Township Bill RunsDocument893 pages2018 Shelby Township Bill RunsBlahNo ratings yet

- Cherry Vantica - 201950336 - Uts - Ak318d - Apliaud - LBR JawabDocument13 pagesCherry Vantica - 201950336 - Uts - Ak318d - Apliaud - LBR JawabCherry VanticaNo ratings yet

- AY1718 Finals (Actual) Sem 1 SolutionsDocument33 pagesAY1718 Finals (Actual) Sem 1 SolutionsshermaineNo ratings yet

- Aahpw9410b 2018Document4 pagesAahpw9410b 2018Abhijit WaghNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/21 October/November 2017Document9 pagesCambridge Assessment International Education: Accounting 0452/21 October/November 20171234No ratings yet

- POA Test - Accruals and PrepaymentsDocument2 pagesPOA Test - Accruals and PrepaymentsGeneva GomezNo ratings yet

- Session 25 Accruals, Prepayments and Other Adjustments For Financial StatementsDocument10 pagesSession 25 Accruals, Prepayments and Other Adjustments For Financial Statementsol.iv.e.a.gui.l.ar412No ratings yet

- Chapter 10 AnswersDocument3 pagesChapter 10 AnswersThe Nightwatchmen100% (1)

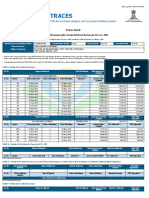

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajen sahaNo ratings yet

- Exercises 20.4A Bad DebtsDocument1 pageExercises 20.4A Bad DebtsCarolnesa Dorie Tan Kar MeanNo ratings yet

- Bad Debts and Provision For Bad DebtsDocument28 pagesBad Debts and Provision For Bad DebtsRaiqueNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961safiNo ratings yet

- PDFDocument4 pagesPDFsamaadhuNo ratings yet

- Atepb6797n 2018Document4 pagesAtepb6797n 2018hvacpps3No ratings yet

- ACCA F3 CH#10: Accruals and Prepayments NotesDocument26 pagesACCA F3 CH#10: Accruals and Prepayments NotesMuhammad AzamNo ratings yet

- W 12 Receivables2344Document8 pagesW 12 Receivables2344DaddyNo ratings yet

- REVIEW Chap 1 - 2 - 3Document9 pagesREVIEW Chap 1 - 2 - 3Khánh AnNo ratings yet

- Arupr6491f 2019 PDFDocument4 pagesArupr6491f 2019 PDFVeda PrakashNo ratings yet

- Solution Accrual and Prepayment (Tutorial in Class 23 May 2023)Document9 pagesSolution Accrual and Prepayment (Tutorial in Class 23 May 2023)mardhiahNo ratings yet

- Template Jawaban UTS Aplikasi Audit Ganjil 2021 - 2022Document12 pagesTemplate Jawaban UTS Aplikasi Audit Ganjil 2021 - 2022Cherry VanticaNo ratings yet

- Date Particulars DR Amount CR Amount Ledger Folio NoDocument23 pagesDate Particulars DR Amount CR Amount Ledger Folio NoHarmeet kapoorNo ratings yet

- Acct101-3 - (Your Name)Document9 pagesAcct101-3 - (Your Name)Vedanshi BihaniNo ratings yet

- Apqpa0045n 2018Document4 pagesApqpa0045n 2018samaadhuNo ratings yet

- Module 5 Answer KeysDocument5 pagesModule 5 Answer KeysJaspreetNo ratings yet

- Topan Mega R - 201870086 - Kertas Kerja Kelas ApliDocument46 pagesTopan Mega R - 201870086 - Kertas Kerja Kelas ApliRizky FebriansyaahNo ratings yet

- Assignment 1 Principles of AccountingDocument13 pagesAssignment 1 Principles of AccountingMmonie MotseleNo ratings yet

- Acppk4010m 2018Document4 pagesAcppk4010m 2018Rohit GuptaNo ratings yet

- RtgsDocument3 pagesRtgsFungaiNo ratings yet

- Apple Academy Exams Trainers: Monday 19th July, 2021 Principles of Accounts Summer ClassesDocument10 pagesApple Academy Exams Trainers: Monday 19th July, 2021 Principles of Accounts Summer ClassesAnthony JulesNo ratings yet

- Question No 06 Chapter No 12 - D.K Goal 11 ClassDocument1 pageQuestion No 06 Chapter No 12 - D.K Goal 11 ClassNafe MNo ratings yet

- Steff AnyDocument13 pagesSteff AnyROSE MARIE HERMOSANo ratings yet

- ADJUSTMENTSDocument10 pagesADJUSTMENTSRissy MushyNo ratings yet

- Aol AccDocument19 pagesAol AccANGELYCA LAURANo ratings yet

- Chapter 3 (Mathematical)Document10 pagesChapter 3 (Mathematical)Sabbir HossainNo ratings yet

- AUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyDocument12 pagesAUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyKathrine Gayle BautistaNo ratings yet

- 1210 B C A T A (1071)Document6 pages1210 B C A T A (1071)rindah100% (2)

- Session 12 Capital Account and Further Considerations For The Final AccountsDocument4 pagesSession 12 Capital Account and Further Considerations For The Final Accountsol.iv.e.a.gui.l.ar412No ratings yet

- Accounting Test TravelokaDocument8 pagesAccounting Test TravelokaGabriella CikaNo ratings yet

- Hire Purchase and Installament SystemDocument16 pagesHire Purchase and Installament SystemMujieh NkengNo ratings yet

- Jockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)Document5 pagesJockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)ouo So方No ratings yet

- 10 - Account CurrentDocument5 pages10 - Account Currentjyotsanakirad1234No ratings yet

- Lembar Jawaban Megah ElektronikDocument20 pagesLembar Jawaban Megah Elektronikresa.praditaNo ratings yet

- Chapter 8Document6 pagesChapter 8swaroopcharmiNo ratings yet

- BK Form Iii Package 2023Document9 pagesBK Form Iii Package 2023jasmina.mushy22No ratings yet

- 3 000 011 707 199Document1 page3 000 011 707 199nindidavid628No ratings yet

- Group8 1836 139304 PA2 GroupAssignment GROUP8Document8 pagesGroup8 1836 139304 PA2 GroupAssignment GROUP8Uyển Nhi TrầnNo ratings yet

- 4281554Document6 pages4281554mohitgaba19No ratings yet

- Aefpm5487a 2023Document4 pagesAefpm5487a 2023enjoy enjoy enjoyNo ratings yet

- Ia 2 AssignmentDocument8 pagesIa 2 AssignmentJotaro KujoNo ratings yet

- Chapter 7 HBLDocument47 pagesChapter 7 HBLKeyran DavianNo ratings yet

- Accruals and PrepaymentsDocument8 pagesAccruals and PrepaymentsShaikh Ghassan AbidNo ratings yet

- Dock PDFDocument2 pagesDock PDFsharad sharmaNo ratings yet

- DockDocument2 pagesDocksharad sharmaNo ratings yet

- EN Vibrating Screens EDT-N EDT-2N PDFDocument4 pagesEN Vibrating Screens EDT-N EDT-2N PDFMichael DavenportNo ratings yet

- LT32567 PDFDocument4 pagesLT32567 PDFNikolayNo ratings yet

- Computer Systems Servicing NC II CGDocument238 pagesComputer Systems Servicing NC II CGRickyJeciel100% (2)

- Relay ProtectionDocument26 pagesRelay Protectionnogeshwar100% (1)

- Cenomar Request PSA Form-NewDocument1 pageCenomar Request PSA Form-NewUpuang KahoyNo ratings yet

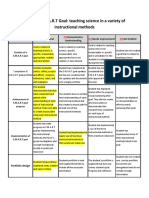

- Manipulatives/Interactive Media (Lecture B) : By: John T Franco 11 Humss-3Document25 pagesManipulatives/Interactive Media (Lecture B) : By: John T Franco 11 Humss-3tyron plandesNo ratings yet

- Right To Self OrganizationDocument7 pagesRight To Self OrganizationSALMAN JOHAYRNo ratings yet

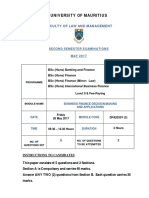

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilNo ratings yet

- V3 Hyundai Price ListDocument4 pagesV3 Hyundai Price Listdeepu kumarNo ratings yet

- Pravin Raut Sanjay Raut V EDDocument122 pagesPravin Raut Sanjay Raut V EDSandeep DashNo ratings yet

- Sendik's Oconomowoc Press AnnouncementDocument2 pagesSendik's Oconomowoc Press AnnouncementTMJ4 NewsNo ratings yet

- CIMB-Financial Statement 2014 PDFDocument413 pagesCIMB-Financial Statement 2014 PDFEsplanadeNo ratings yet

- Newcastle University Dissertation Cover PageDocument5 pagesNewcastle University Dissertation Cover PageThesisPaperHelpUK100% (1)

- RRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1Document58 pagesRRB Alp Tech. CBT 2 Master Question Paper Electrician Trade Date 22 1 2019 Shift 1arpitrockNo ratings yet

- Melissas ResumeDocument2 pagesMelissas Resumeapi-329595263No ratings yet

- Smart Goals Rubric 2Document2 pagesSmart Goals Rubric 2api-338549230100% (2)

- EY ScandalDocument3 pagesEY ScandalAndrea RumboNo ratings yet

- Oil and Gas CompaniesDocument4 pagesOil and Gas CompaniesB.r. SridharReddy0% (1)

- Lecture 02 Running EnergyPlusDocument29 pagesLecture 02 Running EnergyPlusJoanne SiaNo ratings yet

- 08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBDocument1 page08147-416H - LEGEND - Wahl - Fact Sheets - 5StarSeries - GBChristian ParedesNo ratings yet

- Child Has Does: The Adultery, Child Be and Entitled His Own, The Child's That His DueDocument1 pageChild Has Does: The Adultery, Child Be and Entitled His Own, The Child's That His DuerickmortyNo ratings yet

- Plaxis Products 2010 EngDocument20 pagesPlaxis Products 2010 EngAri SentaniNo ratings yet

- CFP The 17th International Computer Science and Engineering Conference (ICSEC 2013)Document1 pageCFP The 17th International Computer Science and Engineering Conference (ICSEC 2013)Davy SornNo ratings yet

- Nipcib 000036Document273 pagesNipcib 000036AlfoFS0% (1)

- Assignment 1technoDocument3 pagesAssignment 1technonadiyaxxNo ratings yet

- Summer Training Project (Completed)Document89 pagesSummer Training Project (Completed)yogeshjoshi362No ratings yet

- 3HAC9821-1 Rev01Document8 pages3HAC9821-1 Rev01TensaigaNo ratings yet

- VDO Gauge - VL Hourmeter 12 - 24Document2 pagesVDO Gauge - VL Hourmeter 12 - 24HanNo ratings yet

- Wheel Loader Manual Agrison PDFDocument138 pagesWheel Loader Manual Agrison PDFTravisReign Dicang02No ratings yet