Professional Documents

Culture Documents

In Bsbda Sosc Sep17

Uploaded by

shekharsap284Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Bsbda Sosc Sep17

Uploaded by

shekharsap284Copyright:

Available Formats

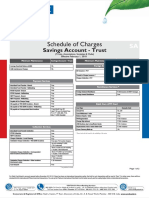

Basic Savings Bank Basic Savings Bank

Deposit Account Deposit Account

MINIMUM BALANCE REQUIREMENT Annual Fee (per card) Free

Monthly Average Balance (MAB) NA

Account Maintenance charges NA Platinum Debit Card

First Year Fee Free

GENERAL CHARGES Annual Fee (per card) Free

Account statements

Quarterly Statements Free m-Commerce Platinum Debit Card /Titanium Debit Card

Monthly Statements Free* First Year Fee NA

"*Available at domicile branch for” Annual Fee (per card) NA

"Customer-in-Person"" (CIP) Lost Card re-issuance

Passbook Free* ATM Card INR 150

SCHEDULE "*Available at domicile branch for”

"Customer-in-Person"" (CIP)

Shop Smart debit card

Platinum Debit Card

INR 200

INR 799

OF Duplicate passbook issuance Free "m-Commerce Platinum Debit Card /Titanium Debit Card"

Cross-currency mark-up charges on cross border

NA

3.5% +

Cheque book transactions on debit card* applicable taxes

SERVICE Personalized cheque book (local)

Multicity Cheque Book (Personalised)

Free

Free

*The exchange rate will be the VISA / MasterCard

wholesale exchange rate prevailing at the time of

transaction/merchant settlement"

CHARGES ATM Usage

Manual cash withdrawal

At designated VISA partner bank branches in India NA

Standard Chartered ATM's in India Free

At designated VISA partner bank branches outside India* NA

Non Standard Chartered ATM's in India *Subject to Reserve Bank of India guidelines

First 5 (Financial & Non-financial^) transactions Free*

Replacement of PIN Free

Above First 5 (Financial & Non-financial^) transactions

in a month (per transaction)" Free* BRANCH TRANSACTION CHARGES

^ Balance enquiry is considered as non Cash Deposit / Withdrawal Free

financial transaction Pay order / demand draft Free

* The maximum cash you can withdraw using your PHONE BANKING SERVICE CHARGES

Debit Card at other bank ATM's is INR 10,000 per Self-service IVR calls Free

Basic Savings Bank transaction. However, this limit may vary as per the

discretion of the other Bank"

Non IVR calls attended by phone banking officers Free

OTHER ACCOUNT RELATED CHARGES

Deposit Account ATM's outside India*

*Cash withdrawal subject to RBI guidelines

Free

Duplicate statement

Statement upto 3 months old Free

aaSaan Savings Account ATM Cards

Statement more than 3 months old Free

First Year Fee Free Account closure Free

Annual Fee (per card) Free Stop payment

Single cheque Free

Corporate Platinum Card Range of cheques Free

First Year Fee Free

Cheque return

Annual Fee (per card) Free

Due to technical reasons Free

Effective 15th September 2017

Cheque issued by the customer (due to financial reason) Free

ShopSmart Debit Card

Cheque deposited by customer (due to financial reason) Free

First Year Fee Free

sc.com/in

Basic Savings Bank Basic Savings Bank

Deposit Account Deposit Account Please Note:

Standard Chartered Bank, India, has produced this brochure to keep you informed of our

Foreign currency cheque* NA

broad range of services. Our fees and charges reflect our commitment to providing our

*Other Bank charges additional Real Time Gross Settlement Transfer customers with quality service at competitive prices.

Electronic Clearing Service return Inward Free The Bank reserves the right to amend the terms, conditions or rate stated in the brochure

ECS debit instruction issued by the customer and Outward Free and to assess charges on transactions which are not covered by this schedule.

returned unpaid Free Immediate Payment Service (IMPS) Free Safe Deposit Lockers are available at certain branches and can be offered to a customer

upon request. Charges for the same are available at the respective branches.

Pay orders / Demand Draft drawn on our branches 0.15%

SPECIAL SERVICES Min. fee INR 50, Max. INR 1,500 Charges in this document are exclusive of applicable taxes

Foreign Inward Remittance Certificate / Form 10H

Within one month of the transaction NA DD drawn on correspondent banks GST NOTE:

After one month upto 1 year of the transaction NA (specified Locations*) 0.25% GST will be levied at the applicable rates in force on all taxable supplies with effect from a date

to be notified by the Government.

After 1 year of the transaction NA *List available at all our branches

Once GST is implemented, it will be levied at the applicable rates in force on foreign currency

Min. fee INR 250, Max. INR 5,000 conversion. For the purpose of determination of value of in relation to supply of foreign

Certficate of Balance / Certificate of Interest For other locations, correspondent bank currency, including money changing, the following table (as provided in the draft rules) should

be used:

Certificate upto one year old Free charges will apply additionally

Certificate more than one year (per year) Free

Value of Service on which GST to be paid.

Foreign Currency Draft NA Less than or equal to INR 1,00,000 1% of the transaction amount, subject to minimum of INR 250/-

Retrieval of documents Cancellation / revaildation Greater than INR 1,00,000 and less

INR 1000 + 0.5% of the transaction amount

than or equal to INR 10,00,000

Document upto 6 months old Free Demand Draft / Pay Order INR 100 Greater than 10,00,000 INR 5,500 + 0.1% of the transaction amount, subject to maximum of

INR 60,000/-

Document more than 6 months old Free

The GST at applicable rates would be levied on the value calculated as per above table.

Lost / duplicate instrument Free*

Standing Instructions *Correspondent bank's charges additional

Setting up charges Free

PHONE BANKING NUMBERS

Allahabad, Amritsar, Bhopal, Bhubaneshwar, Chandigarh, 66014444 / 39404444

Execution fee Free Funds transfer Cochin / Ernakulam, Coimbatore,Indore, Jaipur, Jalandhar,

Charges / commission on transaction additional Free Transmission in Foreign Currency (Telex transfer) Kanpur, Lucknow, Ludhiana, Nagpur, Patna, Rajkot, Surat,

Amendment Free Remittances upto USD 50,000 or equivalent value* NA Vadodara

Remittances above USD 50,000 or equivalent value * NA Ahmedabad, Bangalore, Chennai, Delhi, Hyderabad, Kolkata,

66014444 / 39404444

Banker's report Free Mumbai, Pune

*Other Bank's charges additional

Signature verification Free Gurgaon, Noida 011 - 66014444

011 - 39404444

Remittances from abroad NA

Jalgaon, Guwahati, Cuttack, Mysore, Thiruvananthpuram,

OUTSTATION CHEQUE COLLECTION DOORSTEP BANKING NA 1800 345 1000

Vishakhapatnam, Proddatur, Dehradun, Mathura, Saharanpur,

Cheque drawn on any of our branches Free

Siliguri 1800 345 5000

Cheque drawn on another bank

(Our Branch Locations) Free

Speed clearing location Free

Other locations Free

Foreign Currency Cheque NA

REMITTANCES

National Electronic Funds Transfer

Inward Free

Outward Free

You might also like

- Trading Checklist BH v2Document2 pagesTrading Checklist BH v2Tong SepamNo ratings yet

- Estmt - 2022 06 27Document6 pagesEstmt - 2022 06 27Carla Bermudez RamirezNo ratings yet

- List of Appellate Authorities / C P I Os / Acpios in State Bank of India Corporate Centre and Its EstablishmentsDocument17 pagesList of Appellate Authorities / C P I Os / Acpios in State Bank of India Corporate Centre and Its EstablishmentsJatinder SadhanaNo ratings yet

- CIV REV 2 - G.Modes of Extinguishment Case Digest - v2Document46 pagesCIV REV 2 - G.Modes of Extinguishment Case Digest - v2Celine GarciaNo ratings yet

- Fundamentals of Accounting Theory Practice 1B FQ1-FQ2Document10 pagesFundamentals of Accounting Theory Practice 1B FQ1-FQ2Benjamin RamosNo ratings yet

- SOC Credit Card MayDocument20 pagesSOC Credit Card MayBDT Visa PaymentNo ratings yet

- Citibank Vs SabenianoDocument2 pagesCitibank Vs SabenianoBrian Jonathan ParaanNo ratings yet

- Schedule of Service Charges: Basic Savings Bank Deposit Account Aasaan Savings AccountDocument2 pagesSchedule of Service Charges: Basic Savings Bank Deposit Account Aasaan Savings AccountArvind Reddy4.0No ratings yet

- Standard CharteredDocument2 pagesStandard Charteredsan_sam3No ratings yet

- SOB Indus PartnerDocument2 pagesSOB Indus Partnerrajprince26460No ratings yet

- FC EliteDocument1 pageFC Elitejpdeleon20No ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges NewMuhammad Al javadNo ratings yet

- Meghna Credit Card SOC - Effective From 6th July 2023Document1 pageMeghna Credit Card SOC - Effective From 6th July 2023Rana HamidNo ratings yet

- Choose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageChoose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingElibom DnegelNo ratings yet

- HK Credit Card Key Facts StatementDocument12 pagesHK Credit Card Key Facts StatementTsea CaronNo ratings yet

- FandC FLYER COREDocument1 pageFandC FLYER COREtech.filnipponNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocument3 pagesKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadNo ratings yet

- Application To Open A Savings Account & Other Services: The Manager Commercial Bank of Ceylon PLCDocument2 pagesApplication To Open A Savings Account & Other Services: The Manager Commercial Bank of Ceylon PLCDilshan DewanagalaNo ratings yet

- Service Charges South Indian BankDocument18 pagesService Charges South Indian Bankmuthoot2009No ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges Newganesh gowthamNo ratings yet

- Au Abhi 31-MarchDocument2 pagesAu Abhi 31-MarchShubhra Kanti GopeNo ratings yet

- When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageWhen Making Credit Card Payments, Please Be Reminded of The FollowingJohn Paolo DionisioNo ratings yet

- TASC AccountDocument2 pagesTASC AccountShwetank SinghNo ratings yet

- Debit and Prepaid Fees and Charges ENDocument1 pageDebit and Prepaid Fees and Charges ENhadi01287412304No ratings yet

- State Bank of India - Personal BankingDocument2 pagesState Bank of India - Personal BankingeSupport GlobalIT Business Solutions LimitedNo ratings yet

- Yes Bank India ChargesDocument2 pagesYes Bank India ChargesRKNo ratings yet

- Channel Request Form: Tracker/ID No.: Branch CodeDocument2 pagesChannel Request Form: Tracker/ID No.: Branch CodeikmNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Tariff Guide PremierDocument9 pagesTariff Guide PremierJesse Kojo Appiah Baffoe-DansoNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- M Journey Corporate Application FormDocument5 pagesM Journey Corporate Application Formslipertraction77No ratings yet

- Indus AdvantageDocument1 pageIndus Advantagesubhasish paulNo ratings yet

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- All Debit Card Fees - ChargesDocument2 pagesAll Debit Card Fees - ChargesS.G. RudrakshaNo ratings yet

- NMB Tariff Guide 2023Document2 pagesNMB Tariff Guide 2023MabulaNo ratings yet

- Changes in Upcoming Schedule of Charges (Jul-Dec-2022)Document1 pageChanges in Upcoming Schedule of Charges (Jul-Dec-2022)Nasir MuhmoodNo ratings yet

- Au Royale: Schedule ofDocument2 pagesAu Royale: Schedule ofsahilNo ratings yet

- SOC RuPay Select Debit CardDocument4 pagesSOC RuPay Select Debit Cardrichards.prabhu1817No ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNo ratings yet

- Atb Tarifler Atb - Card Debit Azn Mob Eng March2024Document3 pagesAtb Tarifler Atb - Card Debit Azn Mob Eng March2024aloof aloofNo ratings yet

- English CCDocument6 pagesEnglish CCdsouzan071No ratings yet

- FC EliteDocument1 pageFC EliteNoli BenongoNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Schedule of Charges For MTB Debit CardDocument1 pageSchedule of Charges For MTB Debit CardshuvofinduNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- ABBL SOC Debit Credit CardsDocument3 pagesABBL SOC Debit Credit Cardsalaminshorkar76No ratings yet

- Abw2209 003 MW Priceupdate Web-99 PDFDocument1 pageAbw2209 003 MW Priceupdate Web-99 PDFBenny BerniceNo ratings yet

- Schedule of Charges Prepaid Card 15 09 2019Document1 pageSchedule of Charges Prepaid Card 15 09 2019Dihan AbdullahNo ratings yet

- MITC Document CustomerDocument19 pagesMITC Document CustomerKamal GauravNo ratings yet

- AIB Visa Corporate Business Card Additional UserDocument18 pagesAIB Visa Corporate Business Card Additional UserRafay HussainNo ratings yet

- Ringkasan Biaya Usage Summary: Halo Billing StatementDocument1 pageRingkasan Biaya Usage Summary: Halo Billing StatementTaufanNo ratings yet

- Digital Nov 2021Document64 pagesDigital Nov 2021jagadish madiwalarNo ratings yet

- Debit Card Fee and Charges: Sr. No Activity Charges 01 Issuance of Primary Card & One Additional CardDocument1 pageDebit Card Fee and Charges: Sr. No Activity Charges 01 Issuance of Primary Card & One Additional CardTechnical AirlineNo ratings yet

- BC 190701Document1 pageBC 190701picklescribd2No ratings yet

- YCADocument3 pagesYCAmuneebghouri13No ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Schedule of Charges For MTB Credit CardsDocument4 pagesSchedule of Charges For MTB Credit CardsRana BabuNo ratings yet

- Channel Access Request FormDocument3 pagesChannel Access Request FormRavi RamrakhaniNo ratings yet

- Aman Singh Mofs 2019 0806 0001 0004Document88 pagesAman Singh Mofs 2019 0806 0001 0004AMAN SINGHNo ratings yet

- Core Bundled Savings AccountDocument2 pagesCore Bundled Savings AccountSweta MistryNo ratings yet

- Updated MD TARRIFS A2 Amendments March 24thDocument1 pageUpdated MD TARRIFS A2 Amendments March 24thjustas kombaNo ratings yet

- In Priority International Banking July2015Document12 pagesIn Priority International Banking July2015shekharsap284No ratings yet

- CN en BB Aop LocalDocument20 pagesCN en BB Aop Localshekharsap284No ratings yet

- BD Platinum CCDocument17 pagesBD Platinum CCshekharsap284No ratings yet

- In Ita Sosc BrochureDocument2 pagesIn Ita Sosc Brochureshekharsap284No ratings yet

- In Premium Banking BrochureDocument2 pagesIn Premium Banking Brochureshekharsap284No ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisjoeNo ratings yet

- Question Bank - 2Document3 pagesQuestion Bank - 2Titus ClementNo ratings yet

- Mcqs Help FahadDocument7 pagesMcqs Help FahadAREEBA ABDUL MAJEEDNo ratings yet

- Comparitive Balance Sheet of ITC Assets Current AssetsDocument4 pagesComparitive Balance Sheet of ITC Assets Current AssetsArun BineshNo ratings yet

- Finance Q2Document5 pagesFinance Q2Paodou Hu100% (1)

- Financial Literacy Literature ReviewDocument7 pagesFinancial Literacy Literature Reviewf1gisofykyt3100% (1)

- Financial Risk Management - Case Studies With SKF and Elof HanssonDocument92 pagesFinancial Risk Management - Case Studies With SKF and Elof HanssonHaannaaNo ratings yet

- Perdisco WEEK3Document5 pagesPerdisco WEEK3malhar11100% (2)

- Indian Money MarketDocument7 pagesIndian Money Market777priyankaNo ratings yet

- Business 1! GICDocument2 pagesBusiness 1! GICChan Nyein Kyal SinNo ratings yet

- NRI TaxationDocument9 pagesNRI TaxationTekumani Naveen KumarNo ratings yet

- Indian Equity MArketDocument16 pagesIndian Equity MArketAshi RanaNo ratings yet

- Assignment 6 RORDocument7 pagesAssignment 6 RORKHANSA DIVA NUR APRILIANo ratings yet

- Answer Mini CaseDocument11 pagesAnswer Mini CaseJohan Yaacob100% (3)

- Op-1670 110719 136946 442230784903 1 PDFDocument3 pagesOp-1670 110719 136946 442230784903 1 PDFbaba babaNo ratings yet

- Lecture Guide 15 - KeyDocument5 pagesLecture Guide 15 - KeyFrancis VirayNo ratings yet

- Sinumpaang SalaysayDocument9 pagesSinumpaang SalaysayArgel CosmeNo ratings yet

- IA2 - Chapter 7 Leases Part 1Document27 pagesIA2 - Chapter 7 Leases Part 1ellyzamae quiraoNo ratings yet

- A Summer Internship Report On The Topic - FinancialDocument13 pagesA Summer Internship Report On The Topic - FinancialKunal AdwaniNo ratings yet

- Citta Di AgricolaDocument10 pagesCitta Di Agricolaivan josephNo ratings yet

- Scopia Capital Presentation On Forest City Realty Trust, Aug. 2016Document19 pagesScopia Capital Presentation On Forest City Realty Trust, Aug. 2016Norman OderNo ratings yet

- ACC 107 Practice ExamDocument29 pagesACC 107 Practice ExamAJ Jahara GapateNo ratings yet

- Bonds ch16 by Group 1Document5 pagesBonds ch16 by Group 1EriicpratamaNo ratings yet

- Start File DCF ExerciseDocument13 pagesStart File DCF ExerciseshashankNo ratings yet