Professional Documents

Culture Documents

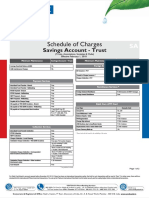

Schedule of Service Charges: Basic Savings Bank Deposit Account Aasaan Savings Account

Uploaded by

Arvind Reddy4.0Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule of Service Charges: Basic Savings Bank Deposit Account Aasaan Savings Account

Uploaded by

Arvind Reddy4.0Copyright:

Available Formats

Basic Savings Aasan Basic Savings Aasan

Bank Deposit Savings Bank Deposit Savings

Account account Account account

MINIMUM BALANCE REQUIREMENT ShopSmart Debit Card

Business Essential Account Monthly Average Balance (MAB) NA NA First Year Fee Free Free

Account Maintenance charges NA NA Annual Fee (per card) Free Free

GENERAL CHARGES Platinum Debit Card

Account statements First Year Fee Free Free

Quarterly Statements Free Free Annual Fee (per card) Free Free

Monthly Statements Free* Free*

"*Available at domicile branch for” m-Commerce Platinum Debit Card /Titanium Debit Card

"Customer-in-Person"" (CIP) First Year Fee NA NA

SCHEDULE

Passbook Free* Free* Annual Fee (per card) NA NA

"*Available at domicile branch for” Lost Card re-issuance

"Customer-in-Person"" (CIP) ATM Card INR 150 INR 150

OF Duplicate passbook issuance Free Free Shop Smart debit card

Platinum Debit Card

INR 200

INR 799

INR 200

INR 799

SERVICE

Cheque book "m-Commerce Platinum Debit Card /Titanium Debit Card" NA NA

Personalized cheque book (local) Free Free Cross-currency mark-up charges on cross border 3.5% + 3.5% +

Multicity Cheque Book (Personalised) Free Free transactions on debit card* applicable taxes applicable taxes

CHARGES ATM Usage

*The exchange rate will be the VISA / MasterCard

wholesale exchange rate prevailing at the time of

transaction/merchant settlement”

Standard Chartered ATM's in India Free Free

Manual cash withdrawal

Non Standard Chartered ATM's in India

At designated VISA partner bank branches in India NA NA

First 5 (Financial & Non-financial^) transactions Free* Free*

At designated VISA partner bank branches outside India* NA NA

Above First 5 (Financial & Non-financial^) transactions

*Subject to Reserve Bank of India guidelines

in a month (per transaction)" Free* Free*

^ Balance enquiry is considered as non Replacement of PIN Free Free

financial transaction BRANCH TRANSACTION CHARGES

* The maximum cash you can withdraw using your Cash Deposit / Withdrawal Free Free

Debit Card at other bank ATM's is INR 10,000 per Pay order / demand draft Free Free

Basic Savings Bank transaction. However, this limit may vary as per the

discretion of the other Bank"

PHONE BANKING SERVICE CHARGES

Self-service IVR calls Free Free

Deposit Account ATM's outside India*

*Cash withdrawal subject to RBI guidelines

Free Free

Non IVR calls attended by phone banking officers Free Free

OTHER ACCOUNT RELATED CHARGES

aaSaan Savings Account ATM/POS decline charges due to insufficient funds in the Free INR 25 per Duplicate statement

account - failed Statement upto 3 months old Free Free

transaction

Statement more than 3 months old Free Free

ATM Cards Account closure Free Free

First Year Fee Free Free

Stop payment

Annual Fee (per card) Free Free

Single cheque Free Free

Range of cheques Free Free

Effective 1st October 2020 Corporate Platinum Card

Cheque return

First Year Fee Free Free

Due to technical reasons Free Free

Annual Fee (per card) Free Free

sc.com/in

Basic Basic

Savings

SavingsAasan

Bank Basic Savings Aasan

Bank Deposit

Deposit Account

Savings Bank Deposit Savings Please Note:

Account account Account account

Standard Chartered Bank, India, has produced this brochure to keep you informed of our

Cheque issued by the customer (due to financial reason) Other locations Free Free

broad range of services. Our fees and charges reflect our commitment to providing our

• First cheque return in the last 12 months INR 500 INR 500 customers with quality service at competitive prices.

• More than one cheque return in the last 12 months INR 750 INR 750 Foreign Currency Cheque NA NA The Bank reserves the right to amend the terms, conditions or rate stated in the brochure

(per return) and to assess charges on transactions which are not covered by this schedule.

REMITTANCES

Cheque deposited by customer (due to financial reason) INR 150 INR 150 Safe Deposit Lockers are available at certain branches and can be offered to a customer

National Electronic Funds Transfer

Foreign currency cheque* INR 181* INR 181* upon request. Charges for the same are available at the respective branches.

Inward Free Free

*Other Bank charges additional

Outward Free Free Charges in this document are exclusive of applicable taxes

Electronic Clearing Service return GST NOTE:

Real Time Gross Settlement Transfer

ECS debit instruction issued by the customer and GST will be levied at the applicable rates in force on all taxable supplies with effect from a date

Inward Free Free

returned unpaid to be notified by the Government.

Outward Free Free

• First ECS in the last 12 months INR 500 INR 500 Once GST is implemented, it will be levied at the applicable rates in force on foreign currency

Immediate Payment Service (IMPS) Free Free conversion. For the purpose of determination of value of in relation to supply of foreign

• More than one ECS return in the last 12 months INR 750 INR 750 currency, including money changing, the following table (as provided in the draft rules) should

(per return) Pay orders / Demand Draft drawn on our branches 0.15% 0.15%

be used:

Min. fee INR 50, Max. INR 1,500

SPECIAL SERVICES Value of Service on which GST to be paid.

Foreign Inward Remittance Certificate / Form 10H DD drawn on correspondent banks Less than or equal to INR 1,00,000 1% of the transaction amount, subject to minimum of INR 250/-

(specified Locations*) 0.25% 0.25% Greater than INR 1,00,000 and less

Within one month of the transaction NA NA INR 1000 + 0.5% of the transaction amount

than or equal to INR 10,00,000

After one month upto 1 year of the transaction NA NA *List available at all our branches Greater than 10,00,000 INR 5,500 + 0.1% of the transaction amount, subject to maximum of

INR 60,000/-

After 1 year of the transaction NA NA Min. fee INR 250, Max. INR 5,000

The GST at applicable rates would be levied on the value calculated as per above table.

For other locations, correspondent bank

Certficate of Balance / Certificate of Interest charges will apply additionally

PHONE BANKING NUMBERS

Certificate upto one year old Free Free Allahabad, Amritsar, Bhopal, Bhubaneshwar, Chandigarh, 66014444 / 39404444

Certificate more than one year (per year) Free Free Foreign Currency Draft NA NA

Cochin / Ernakulam, Coimbatore,Indore, Jaipur, Jalandhar,

Cancellation / revaildation Kanpur, Lucknow, Ludhiana, Nagpur, Patna, Rajkot, Surat,

Demand Draft / Pay Order INR 100 INR 100 Vadodara

Retrieval of documents

Ahmedabad, Bangalore, Chennai, Delhi, Hyderabad, Kolkata,

Document upto 6 months old Free Free 66014444 / 39404444

Mumbai, Pune

Document more than 6 months old Free Free Lost / duplicate instrument Free* Free*

*Correspondent bank's charges additional Gurgaon, Noida 011 - 66014444

011 - 39404444

Standing Instructions Jalgaon, Guwahati, Cuttack, Mysore, Thiruvananthpuram,

Funds transfer 1800 345 1000

Setting up charges Free Free Vishakhapatnam, Proddatur, Dehradun, Mathura, Saharanpur,

Execution fee Free Free Transmission in Foreign Currency (Telex transfer)

Siliguri 1800 345 5000

Charges / commission on transaction additional Free Free Remittances upto USD 50,000 or equivalent value* NA NA

Amendment Free Free Remittances above USD 50,000 or equivalent value * NA NA

*Other Bank's charges additional

Banker's report Free Free

Signature verification Free Free Remittances from abroad NA NA

DOORSTEP BANKING NA NA

OUTSTATION CHEQUE COLLECTION

Cheque drawn on any of our branches Free Free

Cheque drawn on another bank

(Our Branch Locations) Free Free

Speed clearing location Free Free

You might also like

- Project Handover Letter - DraftDocument1 pageProject Handover Letter - DraftVidya198674% (91)

- Sosc Credit CardsDocument2 pagesSosc Credit CardsPersonal Finance GyanNo ratings yet

- Damages FlowchartDocument1 pageDamages FlowchartRon HusmilloNo ratings yet

- AMLC Registration and Reporting GuidelinesDocument235 pagesAMLC Registration and Reporting GuidelinesTere TongsonNo ratings yet

- CARDEX - Communication-to-ParentsDocument1 pageCARDEX - Communication-to-ParentsGladzangel Loricabv100% (1)

- Credit CardsDocument4 pagesCredit CardsOmNo ratings yet

- Solution Manual For Dynamics of Structures 4 e Anil K ChopraDocument36 pagesSolution Manual For Dynamics of Structures 4 e Anil K Chopracrantspremieramxpiz100% (43)

- WWII Europe Organization ChartsDocument56 pagesWWII Europe Organization ChartsCAP History Library100% (1)

- Roman V GrimaltDocument2 pagesRoman V GrimaltClarence ProtacioNo ratings yet

- Danguilan V IAC DigestDocument2 pagesDanguilan V IAC DigestPepper PottsNo ratings yet

- In Bsbda Sosc Sep17Document2 pagesIn Bsbda Sosc Sep17shekharsap284No ratings yet

- Standard CharteredDocument2 pagesStandard Charteredsan_sam3No ratings yet

- SOB Indus PartnerDocument2 pagesSOB Indus Partnerrajprince26460No ratings yet

- Sahyog Savings Account Samarth Pravasi Savings Account ParameteinrDocument2 pagesSahyog Savings Account Samarth Pravasi Savings Account ParameteinrNeeraj SinghviNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- Au Abhi 31-MarchDocument2 pagesAu Abhi 31-MarchShubhra Kanti GopeNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsAnkitNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsRahulNo ratings yet

- Sosc Credit CardsDocument10 pagesSosc Credit Cardsvishakanksha01No ratings yet

- FC EliteDocument1 pageFC Elitejpdeleon20No ratings yet

- Schedule of Charges Current AccountDocument8 pagesSchedule of Charges Current AccountAshif RejaNo ratings yet

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocument3 pagesKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadNo ratings yet

- TASC AccountDocument2 pagesTASC AccountShwetank SinghNo ratings yet

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNo ratings yet

- Value Chart For YES Prosperity Edge Credit CardDocument1 pageValue Chart For YES Prosperity Edge Credit CardRajeev KumarNo ratings yet

- Application To Open A Savings Account & Other Services: The Manager Commercial Bank of Ceylon PLCDocument2 pagesApplication To Open A Savings Account & Other Services: The Manager Commercial Bank of Ceylon PLCDilshan DewanagalaNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsromola613No ratings yet

- Channel Request Form: Tracker/ID No.: Branch CodeDocument2 pagesChannel Request Form: Tracker/ID No.: Branch CodeikmNo ratings yet

- Debit and Prepaid Fees and Charges ENDocument1 pageDebit and Prepaid Fees and Charges ENhadi01287412304No ratings yet

- Changes in Upcoming Schedule of Charges (Jul-Dec-2022)Document1 pageChanges in Upcoming Schedule of Charges (Jul-Dec-2022)Nasir MuhmoodNo ratings yet

- State Bank of India - Personal BankingDocument2 pagesState Bank of India - Personal BankingeSupport GlobalIT Business Solutions LimitedNo ratings yet

- Au Royale: Schedule ofDocument2 pagesAu Royale: Schedule ofsahilNo ratings yet

- Indus Online Savings Account SocDocument4 pagesIndus Online Savings Account Socrushi44No ratings yet

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsakshayvps32No ratings yet

- Core Bundled Savings AccountDocument2 pagesCore Bundled Savings AccountSweta MistryNo ratings yet

- Credit Card Application DubaiDocument9 pagesCredit Card Application DubaitharunsathyaNo ratings yet

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- Priority Banking Soc Con Nov 2019Document1 pagePriority Banking Soc Con Nov 2019sundarkspNo ratings yet

- GH Web Version 2016 Tariff GDocument8 pagesGH Web Version 2016 Tariff Gkofiduah10No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsshabbirali0963No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsMohd NaimNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardstotayuvrajNo ratings yet

- Mercantile Bank Consolidated Pricing Guide - 11march2022Document5 pagesMercantile Bank Consolidated Pricing Guide - 11march2022sipho5mlnNo ratings yet

- FandC FLYER COREDocument1 pageFandC FLYER COREtech.filnipponNo ratings yet

- Issuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesIssuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABSäñtôsh Kûmãr PrâdhäñNo ratings yet

- Key Fact Sheet For Islamic Digital AccountDocument7 pagesKey Fact Sheet For Islamic Digital Accountwaqas wattooNo ratings yet

- RBL Free AccountDocument3 pagesRBL Free AccountDineshKumarPandaNo ratings yet

- Amex FCDocument1 pageAmex FCAlyssa AmoresNo ratings yet

- Choose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageChoose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingElibom DnegelNo ratings yet

- Compendium of Service Charges NewDocument18 pagesCompendium of Service Charges NewMuhammad Al javadNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- MarcomDocument6 pagesMarcomSoham NayakNo ratings yet

- NMB Tariff Guide 2023Document2 pagesNMB Tariff Guide 2023MabulaNo ratings yet

- Savings ChargesDocument1 pageSavings ChargesAbhishek MitraNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsmanishasurywanshi91No ratings yet

- Product Features and Applicable ChargesDocument4 pagesProduct Features and Applicable ChargesDesignNo ratings yet

- NMB Tariff Guide 2021Document2 pagesNMB Tariff Guide 2021Adul MahmoudNo ratings yet

- Meghna Credit Card SOC - Effective From 6th July 2023Document1 pageMeghna Credit Card SOC - Effective From 6th July 2023Rana HamidNo ratings yet

- HBank Savings Account - Speciale Activ DeckDocument33 pagesHBank Savings Account - Speciale Activ DeckSrinivasan NarayananNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Core Savings Account - IDBIDocument2 pagesCore Savings Account - IDBIprasanNo ratings yet

- The Umbrex Field Guide to Sales Methodologies (1)Document67 pagesThe Umbrex Field Guide to Sales Methodologies (1)Arvind Reddy4.0No ratings yet

- 07-Browse AbandonmentDocument4 pages07-Browse AbandonmentArvind Reddy4.0No ratings yet

- 08-How To Setup The Added To Cart MetricDocument4 pages08-How To Setup The Added To Cart MetricArvind Reddy4.0No ratings yet

- Scientific MethodDocument56 pagesScientific MethodArvind Reddy4.0No ratings yet

- 04-Overview of The 4 Abandoned FlowsDocument4 pages04-Overview of The 4 Abandoned FlowsArvind Reddy4.0No ratings yet

- 03-Welcome Series For Non Buyers - Email 2, 3 and 4Document4 pages03-Welcome Series For Non Buyers - Email 2, 3 and 4Arvind Reddy4.0No ratings yet

- IA-1 Time Table - 7th Sem EECE-TAB - Oct-2022Document1 pageIA-1 Time Table - 7th Sem EECE-TAB - Oct-2022Arvind Reddy4.0No ratings yet

- UNC Call ScriptDocument4 pagesUNC Call ScriptArvind Reddy4.0No ratings yet

- 02-Auto Resend Welcome Email 1 To Non-OpenersDocument4 pages02-Auto Resend Welcome Email 1 To Non-OpenersArvind Reddy4.0No ratings yet

- Students Email ID 3rd 5th & 7th Sem VerificationDocument16 pagesStudents Email ID 3rd 5th & 7th Sem VerificationArvind Reddy4.0No ratings yet

- Google IITK 05Document2 pagesGoogle IITK 05Arvind Reddy4.0No ratings yet

- Admission Ticket For Examination: Rukmini Knowledge Park, Kattigenahalli, Yelahanka, Bengaluru-560 064Document1 pageAdmission Ticket For Examination: Rukmini Knowledge Park, Kattigenahalli, Yelahanka, Bengaluru-560 064Arvind Reddy4.0No ratings yet

- Unit 3 Chapter2 Deadlock NotesDocument29 pagesUnit 3 Chapter2 Deadlock NotesArvind Reddy4.0No ratings yet

- I KGF: I Rajakumara 'L SDocument5 pagesI KGF: I Rajakumara 'L SArvind Reddy4.0No ratings yet

- Annexure IVDocument1 pageAnnexure IVArvind Reddy4.0No ratings yet

- Settlement of International DisputesDocument8 pagesSettlement of International DisputesLata SinghNo ratings yet

- Pricing TechniquesDocument10 pagesPricing Techniquesvijay_kumar1191No ratings yet

- Docusign: Customer Success Case Study SamplerDocument7 pagesDocusign: Customer Success Case Study Samplerozge100% (1)

- SBD 99Document11 pagesSBD 99Mudasir Bashir KoulNo ratings yet

- Parliamentary Research Digest: EditorialDocument28 pagesParliamentary Research Digest: EditorialAamir MugheriNo ratings yet

- B1 Note 4Document4 pagesB1 Note 4SBNo ratings yet

- Cases - NatresDocument17 pagesCases - NatresJamey SimpsonNo ratings yet

- 4 Security of Data OnlineDocument5 pages4 Security of Data OnlineJedediah PhiriNo ratings yet

- U3. l3. The Methodology of Islam in Family BuildingDocument18 pagesU3. l3. The Methodology of Islam in Family BuildingHuzaifa Jamal2No ratings yet

- 22 Beware of Banking Fees (B) - 703063Document3 pages22 Beware of Banking Fees (B) - 703063tryguy088No ratings yet

- A New Sancta Et Fidelis Societas For SaiDocument34 pagesA New Sancta Et Fidelis Societas For SaiNoemi NemethiNo ratings yet

- Dato Seri Najib Razak V PP (Review) .Final @001Document32 pagesDato Seri Najib Razak V PP (Review) .Final @001sivamunusamyNo ratings yet

- Master Circular On Exposure NormsDocument30 pagesMaster Circular On Exposure NormssohamNo ratings yet

- Advisory Opinion No. 2021-027 - SGDDocument6 pagesAdvisory Opinion No. 2021-027 - SGDDan Warren NuestroNo ratings yet

- BGDRV1368F22DW800701Document2 pagesBGDRV1368F22DW800701alamgir80100% (1)

- Internship Report 2023-2Document64 pagesInternship Report 2023-2Kajal Dnyaneshwar MhasalNo ratings yet

- CS Foundation - Cyber LawsDocument30 pagesCS Foundation - Cyber Lawsuma mishraNo ratings yet

- F-A-M-, AXXX XXX 992 (BIA Jan. 26, 2017)Document4 pagesF-A-M-, AXXX XXX 992 (BIA Jan. 26, 2017)Immigrant & Refugee Appellate Center, LLC100% (1)

- John Hatton and Motion On Mafia 1990Document59 pagesJohn Hatton and Motion On Mafia 1990JozefimrichNo ratings yet

- Noachites SchwarzschildDocument37 pagesNoachites SchwarzschildpruzhanerNo ratings yet

- Ford Investment ThesisDocument7 pagesFord Investment Thesispatricialeatherbyelgin100% (1)

- 7925-2005-Bir Ruling No. 009-05Document4 pages7925-2005-Bir Ruling No. 009-05Alexander Julio Valera100% (1)