Professional Documents

Culture Documents

RDS W9 2023

Uploaded by

juyla5479Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RDS W9 2023

Uploaded by

juyla5479Copyright:

Available Formats

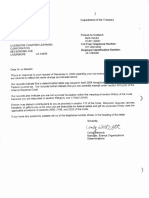

Form W-9

(Rev. Ocloher 20 1 8)

Request for Taxpayer

Identification Number and Certification

G ive Form to the

requester. Do not

0er,artmenl of Ille Tre.1•1J,Y send to the IRS.

ln!Pmai Revenue Service ► Go to www.irs.gov/FormW9 for instructions and the latest information.

1 Name (as sl1own on your in<,ome 1�, rel,1r n). Nan,e is requ;rw on tl 1is line: do not leave this line blank.

2 Business nameldisr<,garded enlily nami;. if different f1om aoove

RDS of Virqinia, LLC

c,j

a, 3 C!ieck approprialJ? box for fed-=- 1dl I.A:<. classifil ;il ir,q of the pi;..rson who,;,e name is en1�1ed on line 1 . Chl?Ck only one of II,e 4 E>'-mp:ions (CodPs apply only to

following seven bnxi=i,s. c.:-rtrtin e11tit1�':i. not individu::ils; s0�

0

Ill

□ Individual/sole prop6Plor or

single-member LLC

D C Co1 pv, al int1 D S Cm poralinn D Partnership D Trusl/esl�le

inslru,ot ions on p�ge 3):

Gi E,.,mpl pn;•Ce code (if any)

..

C:

0. 0

� 'fl::, 0 Limited liahiiity comp,Iny. Enl�r the ta< ci�ssifica lion (C=C co, po,alion. S=S <-eo1 po1dlinn, P=Partnership) ►

.. -

0 .. Note: Ch.,r.k the app,op,iate bo,: in the line abov.a for the 1a, cl,15,ifi.-:�tion of the single-member owner. Do not cl ,eGk EX<'lll[)l;on from FATCA r,iporting

1: ti LLC if lhe LLC is clas,ifif'd as a single-member LLC lhat is disrega• d?d f,om the ow11er unl�ss l11e owner of the LLC is

·- C:

another LLC lhat is not disi;,go•d 0d from the owner for U.S. f<erl<'ral 1 ,1 ' purpos->s. Olherwis". a single-member LLC that code fif any)

.!a! is clisrll?garrlcd from t11e owner s!1()uld chi:-rk the app1 0µ, t,1ltl- bnx for the l�x r:lassificalion of its owner.

□ Other (<;ee in<;l1Licl in11s) ►

5 Address (number. slr""t. and apl. or suile no.) Soe instruct;r,ns.

(,".r;,i;...� -� ,. ,,, •:� , ,..,,/ , ''''"'" ., - '

Requ.,,,.,r·s name and adclrns, (opl innal)

,"f• "

(/)

a,

632 N Witchduck Rd., Ste 1 08

6 City. state. and ZIP code

Virqinia Beach, VA 23462

7 Lisi arrount number(s) here (oplionill)

mu Taxpayer Identification N u mber (TIN)

I Social security number I

[Il] -DJ -I I I I I

Enter your. TIN in. the appropriate

. . . box. The TIN provided must .match the name given on line 1 lo avoid

.

backup w1lhhold111g. Fot 1nd1v1duals, th,s ,s generally your social secu11ty number (SSN). However. for a

resident alien, sole proprietor, or disregarded entity, see the inst ructions for Part I, !filer. For other

en l i l iPs. il is your employer ident i fication number (EIN). It you do not have a number, see How to get a

TIN, later. or

Note: If the account is in more than one name. see the inst ructions for line 1 . Also see What Name and I Employer identification number

Number To Give the Requester for g uidelines on whose numbe, to enter.

4 7 - 4 3 6 7 1 1 6

Certification

Under penalties of perj ury. I ce, lily that:

1 . The nu mber shown on this fo1 111 is my correct ta� r,ayer iclf'n l i f;cfllion num ber (or I am wail ing for a number to be issued to me): and

2 . I am not subject to backup wit hholding bec11use: (a) I am ex<>mpt from backup withl1olding. or (b) I have not been notified by the I n ternal Revenue

Se,vice (IRS) that I am subj ect lo back1 1p wi thholdi ng as a result of a failure lo report all interest or diviclends, or (c) lhe IRS has noti fied me that I am

no longer subject to b;ickup wi thl1olding: and

3. I am a U.S. cil izen or oth e,· U .S. person (defi ned below); and

4. Tl1e FATCA code(s) en tered on this form (if any) indiraling lhal I am exempl from FATCA reporting is correct.

Certification instructions. You must cross out item 2 above if you have been notified by lhe IRS that you are cuI rently subject lo backup withholding beca1 1�9

you have failed to report all interest and dividends on your tax return. For real estate transact ions. item 2 do\'s nol apply. For mortgage interest paid.

acqu isition or abandonment of secured property, cancell ation of debt. contributions to an individual relirement arrangement (IRA) . and generally, payme,>ls

other than interest and dividends, you are not required lo sign llie certification. bul you must provide your correct TIN. See lhe instructions for Part II, lalPr.

Sign Signature of

Here U.S. person ► Date ► 1/9/2023

• Form 1 099-DIV (dividends. including those from stocks or mutual

funds)

Section references are to t he Inter nal Revenue Code unless ol11erwise • Forrn 1 099- MISC (various types of income. prizes, awards, or gross

noted. proceeds)

Future developments. For the lalest in forma t ion about developments • Form 1 099-B (stock or mutual fund sales and certa i n other

related lo Fo1 1n W-9 and its instructions. such as legisla t ion enacted transactions by brokers)

after they were published. go to www.irs.gov/Form W9.

• Form 1 099-S (proceeds from real es tale transactions)

Purpose of Form • Form 1 099-K (me,chant card and third party nelwot k transactions)

An individual or entity (Form W-9 requPsler) who is required lo file an • Form 1 098 (home morlg<1ge inle, es l), 1 098-E (student loan int erest),

informa tion return with the IRS must obtain your correct taxpayer 1 098-T (tuit ion)

iden lification num ber (T I N) whir:h may be your soci;il securil11 number • Form 1 099-C (r:anceled debt)

(SSN). individual tax payer idenli fieo l ion number (ITIN). ado ption

taxpayer identification number (ATI N). or employer iden l ific;, tion number • Forrn 1 099-A (ac quisition or abandonment ot secured propert y)

(EI N). lo report on an informa l inn return lhe amount paid lo you. or o l11er Use Form W-9 only if you are a U.S. person (including a resident

amounl reportable on an info, malion re turn. Examples of info, nv1l ion alien ) . lo provide your crn-rect TIN.

re t urns include. but are not limil"'d lo. the following. Ifyou do not return Fom, W-9 to the requester wil/1 a TIN, you might

• Form 1 099-INT (in terest earned or paid) be subject to barkup withholding. See Whal is backup withholding.

la ter.

C�l. No. 1 023 1 X Form W-9 (Rev. 1 0-20 1 8)

You might also like

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- Img 0001 PDFDocument9 pagesImg 0001 PDFAnonymous mzkNojivNo ratings yet

- An Option Greeks Primer: Building Intuition with Delta Hedging and Monte Carlo Simulation using ExcelFrom EverandAn Option Greeks Primer: Building Intuition with Delta Hedging and Monte Carlo Simulation using ExcelNo ratings yet

- Tax ID-W9Document1 pageTax ID-W9traduccionesluisahurtadoNo ratings yet

- Whistleblowers: Incentives, Disincentives, and Protection StrategiesFrom EverandWhistleblowers: Incentives, Disincentives, and Protection StrategiesNo ratings yet

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- w9 Form Irs SignedDocument1 pagew9 Form Irs SignedAdriana RamirezNo ratings yet

- Sbi Nri Banking FormDocument10 pagesSbi Nri Banking FormRajesh AlampalliNo ratings yet

- ADT US Holdings Inc W-9Document1 pageADT US Holdings Inc W-9Asfandyar KhalidNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- O F) Voui: ExemptionsDocument2 pagesO F) Voui: ExemptionsNETER432No ratings yet

- Identification Number: Request Taxpayer IDocument1 pageIdentification Number: Request Taxpayer IEdwin PerezNo ratings yet

- ALLENDocument6 pagesALLENhiroshi palmaNo ratings yet

- 2006 03 16 - DR1Document1 page2006 03 16 - DR1Zach EdwardsNo ratings yet

- P ................................ Dupbiuuve: UrdueDocument2 pagesP ................................ Dupbiuuve: UrdueJuan LopaNo ratings yet

- US Internal Revenue Service: f8453 - 1995Document2 pagesUS Internal Revenue Service: f8453 - 1995IRSNo ratings yet

- US Internal Revenue Service: F8453ol - 2005Document2 pagesUS Internal Revenue Service: F8453ol - 2005IRSNo ratings yet

- Nra 2018 990Document108 pagesNra 2018 990jpr9954No ratings yet

- 2004 09 14 - DR1Document1 page2004 09 14 - DR1Zach EdwardsNo ratings yet

- New 1904 Bir FormDocument2 pagesNew 1904 Bir FormEikaSorianoNo ratings yet

- Salina BibiDocument4 pagesSalina BibiAtibur RahamanNo ratings yet

- PhilHealth Form Simplifies EnrollmentDocument3 pagesPhilHealth Form Simplifies EnrollmentAngelo PalamingNo ratings yet

- 2018 Audited Financial StatementDocument175 pages2018 Audited Financial StatementTULIO, Jeremy I.No ratings yet

- RCBC Home Loan ApplicationDocument4 pagesRCBC Home Loan ApplicationGABRONINO CATHERINENo ratings yet

- Barack Obama Foundation Irs Form 990 2015Document35 pagesBarack Obama Foundation Irs Form 990 2015Jerome CorsiNo ratings yet

- TL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Document1 pageTL M Ry: Distributed: C. Outstanding:....... / C. No - Otsslettersoutstanding:....... ."/.. E. Issuecl:.Osman BanguraNo ratings yet

- STI Education Services Group, Inc. SEC Form 17-A for Fiscal Year Ended March 31, 2020Document254 pagesSTI Education Services Group, Inc. SEC Form 17-A for Fiscal Year Ended March 31, 2020Alexander Jacob SmithNo ratings yet

- Tax filing documents for individuals and non-individualsDocument2 pagesTax filing documents for individuals and non-individualsMa. Princess NavarroNo ratings yet

- 1904 Bir FormDocument2 pages1904 Bir Formal bentulanNo ratings yet

- WPI - SEC 17-L April 12, 2021Document4 pagesWPI - SEC 17-L April 12, 2021dawijawof awofnafawNo ratings yet

- 1041 155063161 Claim of Exemption & Request For The Hearing de 1021 Writ of Garnishment BuDocument2 pages1041 155063161 Claim of Exemption & Request For The Hearing de 1021 Writ of Garnishment Bularry-612445No ratings yet

- Revised Peoples FOI Manual of The BIR Annex A FOI Request FormDocument1 pageRevised Peoples FOI Manual of The BIR Annex A FOI Request FormANA REYESNo ratings yet

- Trans America ContractingDocument14 pagesTrans America ContractingWilliam RowanNo ratings yet

- Remittance Application FormDocument2 pagesRemittance Application FormasifwtNo ratings yet

- Narayan Lal BalaiDocument1 pageNarayan Lal BalaiRamsnehi ChikitsalayaNo ratings yet

- Illililll: IliliDocument4 pagesIllililll: IliliRR Online SevaNo ratings yet

- SALN FAQsDocument18 pagesSALN FAQsrosalragontonNo ratings yet

- Royal Loans: D D D D D D 0 O D D DDocument2 pagesRoyal Loans: D D D D D D 0 O D D DJAY-R OSUMONo ratings yet

- Inclusive Communites 990Document81 pagesInclusive Communites 990Texas WatchdogNo ratings yet

- Application For New Certificate of Title PVDocument1 pageApplication For New Certificate of Title PVConveyancers DirectoryNo ratings yet

- Companies (Registration of Charges) Rules 2018 Amendment NotificationDocument13 pagesCompanies (Registration of Charges) Rules 2018 Amendment Notificationamit nakraNo ratings yet

- RbgunDocument4 pagesRbgunRob LoweNo ratings yet

- 120s Az FormDocument19 pages120s Az FormStacey CanaleNo ratings yet

- Citizenship c3 c4Document5 pagesCitizenship c3 c4yinjian0001No ratings yet

- NKC Form w9 SignedDocument4 pagesNKC Form w9 SignedLakes EvansNo ratings yet

- FL oZZ B 57o: WithdrawalDocument1 pageFL oZZ B 57o: WithdrawalGideon K. KilonzoNo ratings yet

- For Instructions, See Back of Fo Check One. II DR-1: This Is An Initial'Document1 pageFor Instructions, See Back of Fo Check One. II DR-1: This Is An Initial'Zach EdwardsNo ratings yet

- FF.,T (LT: Ldentification CertificationDocument1 pageFF.,T (LT: Ldentification CertificationÉzsaiás JiménezNo ratings yet

- 7-Eleven FS 2016 pg.94Document171 pages7-Eleven FS 2016 pg.94Myles Ninon LazoNo ratings yet

- US Internal Revenue Service: f8453 - 1996Document2 pagesUS Internal Revenue Service: f8453 - 1996IRSNo ratings yet

- Blank Vendor FormDocument2 pagesBlank Vendor FormKeith AugustineNo ratings yet

- 2009 04 02 - DR 1Document1 page2009 04 02 - DR 1Zach EdwardsNo ratings yet

- US Internal Revenue Service: F8453ol - 1997Document2 pagesUS Internal Revenue Service: F8453ol - 1997IRSNo ratings yet

- For Additional: Transaction Redemption SwitchDocument1 pageFor Additional: Transaction Redemption SwitchGanesha C GoudaNo ratings yet

- IIFL Demat Account FormDocument23 pagesIIFL Demat Account FormSreeram MandavalliNo ratings yet

- Resolution 110Document1 pageResolution 110Larry LeachNo ratings yet

- Img S2 P.1Document1 pageImg S2 P.1larrybecker59No ratings yet

- Ve'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?ODocument1 pageVe'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?OMatthew Robert QuinnNo ratings yet

- 24. IRS Determination Letter Re 501(c)(3) Status of BorrowerDocument22 pages24. IRS Determination Letter Re 501(c)(3) Status of BorrowerzoneequizNo ratings yet

- Forest City Realty Trust Investor Presentation July 10, 2017, 8K To SECDocument46 pagesForest City Realty Trust Investor Presentation July 10, 2017, 8K To SECNorman OderNo ratings yet

- The Role of Accounting and Auditing Board of Ethiopia (AABE) in Enhancing The Accounting ProfessionDocument13 pagesThe Role of Accounting and Auditing Board of Ethiopia (AABE) in Enhancing The Accounting Professionhabtamu100% (2)

- Invoice #3793: Qloudin Technologies PVT LTDDocument1 pageInvoice #3793: Qloudin Technologies PVT LTDRandi RonaNo ratings yet

- CHP 4 EconDocument10 pagesCHP 4 Econld123456No ratings yet

- Disability AssistanceDocument3 pagesDisability Assistancepavitra pawan chandNo ratings yet

- Mobil Philippines Exploration Inc Vs Customs Arrastre ServiceDocument2 pagesMobil Philippines Exploration Inc Vs Customs Arrastre Servicerodel_odz100% (2)

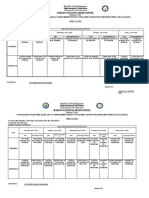

- Department of Education Badian National High School: Republic of The Philippines Division of Cebu Province Badian, CebuDocument6 pagesDepartment of Education Badian National High School: Republic of The Philippines Division of Cebu Province Badian, CebuSharon galabinNo ratings yet

- Official S&M ContractDocument2 pagesOfficial S&M ContractRajesh pvkNo ratings yet

- Accounting For Non-Profit Making Org-1Document14 pagesAccounting For Non-Profit Making Org-1Amelia Bailey100% (1)

- Introduction To Federal Income Taxation in Canada 43rd Edition 2022-2023 Edition by Nathalie Johnstone, Devan Mescall, Julie Robson Solution ManualDocument22 pagesIntroduction To Federal Income Taxation in Canada 43rd Edition 2022-2023 Edition by Nathalie Johnstone, Devan Mescall, Julie Robson Solution ManualTest bank WorldNo ratings yet

- 16081905721545314861RM Ias 2018Document97 pages16081905721545314861RM Ias 2018ho-cuhp100% (1)

- Bulletin No 06 March 7 2018632311 1551783943Document365 pagesBulletin No 06 March 7 2018632311 1551783943Subramanian Saravanan50% (2)

- Land Registry2Document1 pageLand Registry2Pritom NasirNo ratings yet

- Civil SocietDocument4 pagesCivil SocietAbdi Mucee TubeNo ratings yet

- LAW Sidd ProjectDocument3 pagesLAW Sidd ProjectNaitik PahujaNo ratings yet

- Board Resolution Approving Grant of OptionsDocument2 pagesBoard Resolution Approving Grant of OptionsGryswolfNo ratings yet

- physicalCustomerInvoice-9170519792-4036-b3c8c084 92fa 4b8f A606 58c6d645a5f65piwPugLHo-4470244159Document1 pagephysicalCustomerInvoice-9170519792-4036-b3c8c084 92fa 4b8f A606 58c6d645a5f65piwPugLHo-4470244159Radhika RamachandranNo ratings yet

- PG Assessing Organizational Governance in The Public SectorDocument36 pagesPG Assessing Organizational Governance in The Public SectorRobertoNo ratings yet

- Basic Savings Account-I: Penyata AkaunDocument2 pagesBasic Savings Account-I: Penyata AkaunPuspavathy NadarajahNo ratings yet

- Q1 Results Canara Bank 30.6.23Document31 pagesQ1 Results Canara Bank 30.6.23Hitendra KumarNo ratings yet

- Profile Jethani and AssociatesDocument8 pagesProfile Jethani and AssociatesCA UMESH KUMAR JETHANINo ratings yet

- Ex-Employee Exit Checklist v1.2Document9 pagesEx-Employee Exit Checklist v1.2Asheesh MishraNo ratings yet

- DC Universe RPG - DEO Agent Manual PDFDocument82 pagesDC Universe RPG - DEO Agent Manual PDFAdanArias100% (2)

- Circular 21092022Document4 pagesCircular 21092022Naveed HassanNo ratings yet

- SF Upper Int 11D Elesson Answers PDFDocument1 pageSF Upper Int 11D Elesson Answers PDFAlina NikitinaNo ratings yet

- Starting-Up A Corporation: Acquire Barangay ClearanceDocument4 pagesStarting-Up A Corporation: Acquire Barangay ClearanceDaniella CahutayNo ratings yet

- PUP GG & CSR IM Summer 2021Document48 pagesPUP GG & CSR IM Summer 2021Lye Fontanilla100% (1)

- Barangay Mintal Resolution Approves Business AddressDocument1 pageBarangay Mintal Resolution Approves Business AddressJan Brian BangcayaNo ratings yet

- Oath of Undertaking for Onboard TrainingDocument2 pagesOath of Undertaking for Onboard TrainingBERIÑA, JerichoNo ratings yet

- BarclaysDocument10 pagesBarclaysmarcos tokatlianNo ratings yet

- Confirmation For Booking ID # 638030100Document1 pageConfirmation For Booking ID # 638030100Sun Asia BoholNo ratings yet