Professional Documents

Culture Documents

Invoice Management Brochure

Uploaded by

erol1656Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice Management Brochure

Uploaded by

erol1656Copyright:

Available Formats

Notice of disclaimer: Case studies, statistics, research and recommendations are provided “AS IS” and intended for

informational purposes only and should not be relied upon for

operational, marketing, legal, technical, tax, financial or other advice. When implementing any new strategy or practice, you should consult with your legal counsel to determine Invoice Management

what laws and regulations may apply to your specific circumstances. The actual costs, savings and benefits of any recommendations or programs may vary based upon your

specific business needs and program requirements. By their nature, recommendations are not guarantees of future performance or results and are subject to risks, uncertainties

and assumptions that are difficult to predict or quantify. Assumptions were made by us in light of our experience and our perceptions of historical trends, current conditions and

expected future developments and other factors that we believe are appropriate under the circumstance. Recommendations are subject to risks and uncertainties, which may cause

actual and future results and trends to differ materially from the assumptions or recommendations. Visa is not responsible for your use of the information contained herein (including

errors, omissions, inaccuracy or non-timeliness of any kind) or any assumptions or conclusions you might draw from its use. Visa makes no warranty, express or implied, and explicitly

disclaims the warranties of merchantability and fitness for a particular purpose, any warranty of non-infringement of any third party’s intellectual property rights, any warranty that the

information will meet the requirements of a client, or any warranty that the information is updated and will be error free. To the extent permitted by applicable law, Visa shall not be

Business grows

liable to a client or any third party for any damages under any theory of law, including, without limitation, any special, consequential, incidental or punitive damages, nor any damages

for loss of business profits, business interruption, loss of business information, or other monetary loss, even if advised of the possibility of such damages.

when money flows

This publication could include technical inaccuracies or typographical errors. Changes are periodically added to the information herein. These changes will be incorporated in new

editions of the publication. Visa may make improvements and/or changes in the product(s) and/or the programs(s) described in this publication any time.

© 2015 Visa Worldwide Pte Limited. All rights reserved.

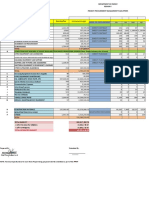

Are inefficiencies Invoice Management Capability Summary

putting your Remove the friction in B2B Despite high labor costs, only 50% 01 02 03

corporation payments to pay and get

paid better of leading regional businesses use an P2P Automation Payables Automation Spend Management

at risk? What are

Delivers automated spend data analysis, Works independently or with existing Gain visibility, control and manage

electronic collection platform to manage compliance focused strategic sourcing financial management systems, and business spend, with the objective of

capabilities, supplier managed web automates accounting and payment reducing operating costs associated with

Invoice management capabilities help

their revenues. Of these, only 14.5% of their

your challenges? businesses capture information from

paper and electronic invoices while

automating invoice processing and data revenues are managed electronically1. It is

content and eCommerce payment

functionalities. Reconcile purchase orders,

contracts and invoices for accuracy, full

processes. Simplifies information

extraction from an invoice, reconciliation

and approval processes. Payables

doing business. This capability includes

corporate expenses management

encompassing management of

visibility and optimization of procurement automation cuts down staff time and procurement expenses, compliance

entry. It includes best practice workflows

for discrepancy processing, resolution observed that the lack of automation leads activities throughout the organization. costs while increasing control. management and spend analysis.

Buyer and accounting details and real-time

integration with Enterprise Resource to inefficiencies and delay in payments.

Planning (ERP), other finance processing

Inefficiencies in cash flow and systems and supplier portals. How does your business compare to others in the region?

working capital Visit Visa commercial solutions’ website to find out more.

It ensures accurate invoicing for

Inadequate control and visibility suppliers based on client agreements

is arriving. This visibility leads to cash - Improve eCommerce possibilities

and purchase orders, driving shorter

Inefficient payment process flow predictability that helps you make with cross border customers

Days Sales Outstanding (DSO)2 times.

critical business decisions. When your

It also assists suppliers to expand their

money flows in on time, it can be quickly Let Visa and your financial institution

Inability to focus on core capabilities that businesses as the system opens up

reinvested to grow your business. do the heavy lifting so that you can

will drive revenue eCommerce opportunities with cross

focus on what you do best… growing

border customers.

Make the Change Now. It’s Time and your business.

Lack of interoperable system to support Cost Efficient

payment processes How Does it Work

Seize the full benefits of Visa’s invoice To find out more about Visa’s invoice

The capabilities automatically capture

management capabilities with minimal management capabilities and how

details such as dates, product and

Managing changing regulations including service descriptions, and amounts

or no disruption to your existing you can eliminate time-intensive

tax regulations to enable a three-way match of POs,

business systems or processes: processes and decrease DSO, contact

your banker today.

invoices and payment instructions, - Significantly increase your

Increasing costs of issuing checks eliminating time-consuming manual responsiveness to your customers

intervention. Data is delivered to you

- Reduce your DSO to just three days

in flexible formats that enable you to

with quicker and reliable invoice

Seller seamlessly integrate information into

your existing ERP systems. Data analysis

reconciliation

01 Procure-to-Pay Automation

02

is timely and accurate, enabling greater - Support payment and reconciliation

Inefficiencies in cash flow and Payables Automation

visibility into expenditures, collections when payments are made through

working capital

03

and cash flow. Visa’s 16-digit account and

automatically highlight any Spend Management

Unable to manage down cost of doing

04

How Do You Benefit inconsistencies and inaccuracies to

business Manage Staff Costs suppliers Invoice Management

05

Businesses sometimes overlook

Keeping up with customers’ payment - Track re-invoicing and number Commercial Payment Consulting

man-hours and staff costs involved in

of outstanding invoices through

requirements preparing and issuing invoices, follow-

supplier accuracy reports and

05

up for payment, conflict resolution

Multiple methods of payment receivables and reconciliation. Automating

such processes frees man-hours and

monthly reports

- Streamline invoices from multiple

04

facilitates redeployment of staff into suppliers and invoices with different Visa commercial solutions. Invoice Management Consulting

more value-adding work. information in different areas into Powering businesses Captures information from invoices and Works with financial institutions to

one consistent file everywhere. automates invoice processing and data bring customers value-creating services

Reinvest Quickly to Grow Your entry. Includes best practice workflows while maximizing the profitability and

- Capture and transform invoice details 1 The 2014 Visa Cash Flow Visibility Index research was done in August-

Business for discrepancy processing, resolution operational effectiveness of employing

into data, making it easier and faster September with CFOs / Treasurers of 811 leading corporations in ten

Automating invoice management helps countries/regions to better understand challenges that organizations

and accounting details while integrating Visa’s portfolio of solutions. Through our

for validation payment and analysis may face with managing cash flow and ensuring visibility and

to reduce DSO significantly. The chance predictability. The research was done by East & Partners, an with finance processing systems and partners, Visa equips corporations with

independent specialist business banking market research and analysis

of human error is eliminated, hence - Build corporate rules and firm. Regional data cover findings of Australia, Hong Kong, India, Japan, supplier portals. Eliminate time-intensive effective cost and finance management

conflicts will be minimal. You get full requirements into the system to Malaysia and Singapore. processes while streamlining account tools, process mapping and training.

visibility of where and when your cash ensure that compliance is maintained 2 DSO refers to the average number of days that a company takes to payables and receivables operations. All rights reserved © Visa Worldwide Pte Limited

collect revenue after a sale has been made.

You might also like

- CSG Interconnect DatasheetDocument4 pagesCSG Interconnect DatasheetLeonardo CapoNo ratings yet

- Gifmis BriefDocument2 pagesGifmis BriefJetmark MarcosNo ratings yet

- Whitepaper Transaction IntelligenceDocument4 pagesWhitepaper Transaction Intelligencemaverick_vishNo ratings yet

- 7 Strategies For Larg Scal ICM PDFDocument10 pages7 Strategies For Larg Scal ICM PDFrashmipushparajNo ratings yet

- E-Payables Manager: Business Overview Datamatics' Solution Data To IntelligenceDocument2 pagesE-Payables Manager: Business Overview Datamatics' Solution Data To IntelligenceRobinNo ratings yet

- Abacus Power Suit Datasheet PDFDocument4 pagesAbacus Power Suit Datasheet PDFtomaNo ratings yet

- Product Sap Vim Product OverviewDocument2 pagesProduct Sap Vim Product OverviewHarshaNo ratings yet

- Open Text Vendor Invoice Management (VIM) For SAP Solutions PDFDocument3 pagesOpen Text Vendor Invoice Management (VIM) For SAP Solutions PDFVideesh KakarlaNo ratings yet

- Centrally Billed Travel CardsDocument22 pagesCentrally Billed Travel CardsIloNo ratings yet

- Us Advisory Improving Intercompany Accounting Through Process and Technology Design Featuring Blackline and SapDocument13 pagesUs Advisory Improving Intercompany Accounting Through Process and Technology Design Featuring Blackline and SapSubba ReddyNo ratings yet

- Ariba Network Enabling Business Commerce in The Digital EconomyDocument14 pagesAriba Network Enabling Business Commerce in The Digital EconomyRafishfullNo ratings yet

- Pega Customer - Decision.hub Intro Apr'23 ThakralOne VNDocument32 pagesPega Customer - Decision.hub Intro Apr'23 ThakralOne VNbaochau21082kNo ratings yet

- SAP Convergent Mediation: Beyond UsageDocument16 pagesSAP Convergent Mediation: Beyond UsageMOORTHY.KE100% (1)

- RC Import Brochure Automate Invoice Process ConcurDocument5 pagesRC Import Brochure Automate Invoice Process ConcurAmreeshNo ratings yet

- Delivering A Cost Efficient and Integrated A/P Automation Solution With Oracle Webcenter ImagingDocument14 pagesDelivering A Cost Efficient and Integrated A/P Automation Solution With Oracle Webcenter ImagingMuhammad ImtiazNo ratings yet

- Unisys + C2P OPFDocument4 pagesUnisys + C2P OPFdebajyotiguhaNo ratings yet

- Fss Smart Recon Fast Accurate Zero Touch Transaction Reconciliation 0Document9 pagesFss Smart Recon Fast Accurate Zero Touch Transaction Reconciliation 0Mahesh PawarNo ratings yet

- OpenSAP Byd6 Week 2 All SlidesDocument70 pagesOpenSAP Byd6 Week 2 All Slidesraj uniqueNo ratings yet

- OpenSAP Byd6 Week 2 Unit 1 OCO PresentationDocument22 pagesOpenSAP Byd6 Week 2 Unit 1 OCO PresentationGaurab BanerjiNo ratings yet

- SAP Credit Management - ChangeswithS4HANADocument16 pagesSAP Credit Management - ChangeswithS4HANAlastuffNo ratings yet

- B Billing TransformationDocument4 pagesB Billing TransformationKomal PatelNo ratings yet

- SE Training - Registering On CSP Invoicing and Sourcing EventDocument34 pagesSE Training - Registering On CSP Invoicing and Sourcing EventdioNo ratings yet

- BlackLine Accounting Process Automation Solution DatasheetDocument2 pagesBlackLine Accounting Process Automation Solution DatasheetAnuj GuptaNo ratings yet

- Brochure - Icontrol E&UDocument8 pagesBrochure - Icontrol E&U39.Anandadeep Bala XII S4No ratings yet

- Collections & Deposits OperationsDocument9 pagesCollections & Deposits Operationssambal mitraNo ratings yet

- Chapter 13Document40 pagesChapter 13Diandra OlivianiNo ratings yet

- Unified Charging and Billing Solution Unified - Next Generation of Charging Systems in Mobile NetworksDocument8 pagesUnified Charging and Billing Solution Unified - Next Generation of Charging Systems in Mobile NetworkslrcapoNo ratings yet

- Don Hefner 09Document8 pagesDon Hefner 09lrcapoNo ratings yet

- Financials DsDocument4 pagesFinancials DsLeela ManoharNo ratings yet

- Telecom Billing Time For A Change COMARCH White PaperDocument11 pagesTelecom Billing Time For A Change COMARCH White PaperAjith PrinceNo ratings yet

- Platform: Reconciliation Operations Made EasyDocument5 pagesPlatform: Reconciliation Operations Made EasyRishi SrivastavaNo ratings yet

- Payment Payment: Gateway OrchestrationDocument18 pagesPayment Payment: Gateway OrchestrationGeorges AxelNo ratings yet

- Information Needs and Business ProcessesDocument5 pagesInformation Needs and Business ProcessesMarc Jason LanzarroteNo ratings yet

- Intelligent Finance With SAP - Value - SnapshotDocument6 pagesIntelligent Finance With SAP - Value - SnapshotMandarNo ratings yet

- Business Requirements: Group MembersDocument6 pagesBusiness Requirements: Group MembersUmerNo ratings yet

- Lite /express: Next-Gen Integrated Receivables and Bill PayDocument5 pagesLite /express: Next-Gen Integrated Receivables and Bill PayBrent WattersNo ratings yet

- Opentext Vim Product OverviewDocument4 pagesOpentext Vim Product Overviewlourenço marcosNo ratings yet

- Operational Systems ExampleDocument3 pagesOperational Systems ExampleShahid RasheedNo ratings yet

- ERP - FIN - 500 - Accounting FlowsDocument65 pagesERP - FIN - 500 - Accounting FlowsyousefahmadmuhamadNo ratings yet

- Intro To Inflooens - Best Mortgage Loan Origination SystemDocument12 pagesIntro To Inflooens - Best Mortgage Loan Origination SysteminflooensNo ratings yet

- 100 RPA Opportunities Across The EnterpriseDocument1 page100 RPA Opportunities Across The EnterpriseSrikanthNo ratings yet

- ERP SCM 500 Accounting FlowsDocument71 pagesERP SCM 500 Accounting FlowsWaelNo ratings yet

- Expenses Management Tool - PresentationDocument158 pagesExpenses Management Tool - PresentationTruc ThanhNo ratings yet

- ASUG - Southwest Utilities Days TXU EnergyDocument16 pagesASUG - Southwest Utilities Days TXU EnergyRomulo QuispeNo ratings yet

- Telkomsigma Core-Finance English - 2014smallDocument12 pagesTelkomsigma Core-Finance English - 2014smallFrenky Cardinal PasaribuNo ratings yet

- Avalara Government: Fuel Tax Filing Automation For Government AgenciesDocument3 pagesAvalara Government: Fuel Tax Filing Automation For Government AgenciesJonathan ArcherNo ratings yet

- Líneas de Crédito para Pymes: Beatriz Elena Londoño PatiñoDocument18 pagesLíneas de Crédito para Pymes: Beatriz Elena Londoño PatiñoValeria GonzálezNo ratings yet

- 2022 Account Payables Processes IOFMDocument12 pages2022 Account Payables Processes IOFMCRISNo ratings yet

- For Micro Podcast E BookDocument6 pagesFor Micro Podcast E BookAditi TarafdarNo ratings yet

- 5 Critical Automation Best Practices: To Positively Impact The Accounts Receivable ProcessDocument7 pages5 Critical Automation Best Practices: To Positively Impact The Accounts Receivable ProcessChetan ParmarNo ratings yet

- Order To Cash (Standardized Services) ENDocument20 pagesOrder To Cash (Standardized Services) ENomar khaledNo ratings yet

- Order-to-Cash (Standardized Services) : Scenario OverviewDocument20 pagesOrder-to-Cash (Standardized Services) : Scenario OverviewYuri SeredaNo ratings yet

- Financial AutomationDocument10 pagesFinancial AutomationluckykannanNo ratings yet

- Best Practices For It Telecom WPDocument6 pagesBest Practices For It Telecom WPmbirkenhauerNo ratings yet

- Inspyrus - White PaperDocument8 pagesInspyrus - White PaperBayCreativeNo ratings yet

- Payables Automation - BLDG BLK - August 2009Document16 pagesPayables Automation - BLDG BLK - August 2009sl7789No ratings yet

- LogStar Billing BrochureDocument1 pageLogStar Billing BrochureGayatri AtishNo ratings yet

- Fusion Receivables Versus EBSDocument32 pagesFusion Receivables Versus EBSAvaneeshNo ratings yet

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationFrom EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- ICC Cost CalculatorDocument3 pagesICC Cost Calculatorerol1656No ratings yet

- Offline Banking Network in International Banking System05Document5 pagesOffline Banking Network in International Banking System05erol1656100% (1)

- Offline Banking Network in International Banking System04Document6 pagesOffline Banking Network in International Banking System04erol1656No ratings yet

- Offline Banking Network in International Banking System 03Document5 pagesOffline Banking Network in International Banking System 03erol1656No ratings yet

- Lovely Professional University Mittal School of BusinessDocument2 pagesLovely Professional University Mittal School of BusinessPuru RajNo ratings yet

- Cbmec 1 - Week-13-CuestasDocument3 pagesCbmec 1 - Week-13-CuestasMelvin CuestasNo ratings yet

- Basic Manual For Chilies Fertigaton System, Feterlizer and Basic Business PlanningDocument2 pagesBasic Manual For Chilies Fertigaton System, Feterlizer and Basic Business PlanningMny MiraNo ratings yet

- Master Thesis Search Engine OptimizationDocument7 pagesMaster Thesis Search Engine Optimizationf60pk9dc100% (2)

- General Mills, Inc.: Yoplait Custard-Style Yogurt (A&B)Document4 pagesGeneral Mills, Inc.: Yoplait Custard-Style Yogurt (A&B)oNo ratings yet

- Power BI PDFDocument2,993 pagesPower BI PDFvipul kumar100% (2)

- Activity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004Document13 pagesActivity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004hardeep waliaNo ratings yet

- 5s Pillars of The Visual WorkplaceDocument35 pages5s Pillars of The Visual WorkplaceSaravana kumar NagarajanNo ratings yet

- Audit Report Final Draft - EditedDocument31 pagesAudit Report Final Draft - EditedKaran BhavsarNo ratings yet

- International Journal of Hospitality Management: Hyoung Ju Song, Jihwan Yeon, Seoki LeeDocument7 pagesInternational Journal of Hospitality Management: Hyoung Ju Song, Jihwan Yeon, Seoki LeeCarmenn LouNo ratings yet

- CV Mohammed KaziDocument2 pagesCV Mohammed KaziRizwan KaziNo ratings yet

- Please Refer To The Following Short Case As You Answer PDFDocument1 pagePlease Refer To The Following Short Case As You Answer PDFLet's Talk With HassanNo ratings yet

- Module 1.3 - Partnership Dissolution PDFDocument3 pagesModule 1.3 - Partnership Dissolution PDFMila MercadoNo ratings yet

- Corporate Social Responsibility Through The Lens of RolexDocument5 pagesCorporate Social Responsibility Through The Lens of RolexMeowvinNo ratings yet

- Region X: Audio and Visual Presentation and Composing EquiDocument4 pagesRegion X: Audio and Visual Presentation and Composing EquiKrizza Sajonia TaboclaonNo ratings yet

- KEY TO CONTROLLED WRITING Powerpoint. HCDHDocument21 pagesKEY TO CONTROLLED WRITING Powerpoint. HCDHTran LeNo ratings yet

- 04 NC CNC & DNC System-1Document23 pages04 NC CNC & DNC System-1Arsa Damara PNo ratings yet

- Zeta200 KR Brochure WebDocument12 pagesZeta200 KR Brochure WebTrần Văn ThảoNo ratings yet

- 2 Organisational Design and Structure Pres OddDocument10 pages2 Organisational Design and Structure Pres OddMatthew SailaNo ratings yet

- Aristo Interactive Geography 2nd Edition Book C5Document81 pagesAristo Interactive Geography 2nd Edition Book C5thomas011122100% (1)

- Partnership WorksheetDocument4 pagesPartnership WorksheetHamdan MushoddiqNo ratings yet

- Collaboration in Higher Education and Sustainable DevelopmentDocument17 pagesCollaboration in Higher Education and Sustainable Developmenthamza khanNo ratings yet

- OMNI 7000 Installation and ConfigurationDocument188 pagesOMNI 7000 Installation and Configurationfowl nguyen100% (1)

- BSN Plan FarmingDocument46 pagesBSN Plan FarmingEphraim UhuruNo ratings yet

- Date: 02/10/2022: Sale PriceDocument2 pagesDate: 02/10/2022: Sale PriceSiva PriyaNo ratings yet

- Revised Thesis PaperDocument87 pagesRevised Thesis PaperPrimo Ernesto CanoyNo ratings yet

- Yib 09 4800090967 ZVC01 00001 0000 06Document3 pagesYib 09 4800090967 ZVC01 00001 0000 06Anil Krishna JangitiNo ratings yet

- Business Ethics Literature Review PDFDocument6 pagesBusiness Ethics Literature Review PDFbctfnerif100% (1)

- Topic 4 File Diary ManagementDocument30 pagesTopic 4 File Diary ManagementsyakirahNo ratings yet

- Amino Expert Fix Diplyana UK WebDocument4 pagesAmino Expert Fix Diplyana UK WebCatalin LunguNo ratings yet