Professional Documents

Culture Documents

Lecture 4 With Notes - PDF - 1

Uploaded by

Chan Chin Chun0 ratings0% found this document useful (0 votes)

13 views3 pages1. The document summarizes a lecture on decision analysis and decision making under risk and uncertainty. It includes examples of probability distributions, decision making steps, and decision criteria like EMV, EVPI, and sensitivity analysis.

2. An in-class exercise on ordering donuts for a café is presented, including the demand probabilities and payoff table. Students are asked questions about the exercise.

3. Sensitivity analysis in Excel is demonstrated to investigate how changing a parameter like probability would impact the optimal decision.

Original Description:

Original Title

Lecture 4 with Notes_pdf_1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document summarizes a lecture on decision analysis and decision making under risk and uncertainty. It includes examples of probability distributions, decision making steps, and decision criteria like EMV, EVPI, and sensitivity analysis.

2. An in-class exercise on ordering donuts for a café is presented, including the demand probabilities and payoff table. Students are asked questions about the exercise.

3. Sensitivity analysis in Excel is demonstrated to investigate how changing a parameter like probability would impact the optimal decision.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesLecture 4 With Notes - PDF - 1

Uploaded by

Chan Chin Chun1. The document summarizes a lecture on decision analysis and decision making under risk and uncertainty. It includes examples of probability distributions, decision making steps, and decision criteria like EMV, EVPI, and sensitivity analysis.

2. An in-class exercise on ordering donuts for a café is presented, including the demand probabilities and payoff table. Students are asked questions about the exercise.

3. Sensitivity analysis in Excel is demonstrated to investigate how changing a parameter like probability would impact the optimal decision.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

2 12

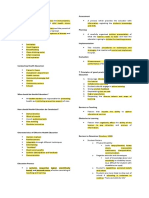

Recap of Last Lecture In-class Exercise: Café du Donut

• Poisson distribution à number of arrivals • Monetary Payoff (Profit) Table

▫ Relationship with binomial distribution

• Exponential distribution à time • Cost = $40, revenue = $60

▫ Relationship with Poisson distribution

D=4 D=5 D=6 D=7 D=8 D=9 D = 10 EMV

• Uniform distribution

• Normal distribution Q=6 0 60 120 120 120 120 120 105

▫ Standard normal distribution and Z table Q=7 -40 20 80 140 140 140 140 104

• Steps in decision making Prob. 0.05 0.15 0.15 0.20 0.25 0.10 0.10

▫ Define the problem

▫ List all possible alternatives, states of nature, and corresponding

payoff for each combination

• Should we reduce the order size from 6 to 5? What is the EMV of Q=5?

▫ Select a decision theory model and make the decision

• Decision making under certainty

• Decision making under risk • If we can only choose between 6 and 7, what is the EVPI?

▫ Maximize EMV & Minimize EOL

▫ EVPI = EVwPI – max EMV or EVPI = min EOL

11

In-class Exercise: Café du Donut

• The Café buys donuts each day for $40 per carton of 20 dozen

Chapter 02 donuts. Any cartons not sold are thrown away at the end of

the day. If a carton is sold, the total revenue is $60.

Decision Analysis DAILY DEMAND PROBABILITY CUMULATIVE

(CARTONS) PROBABILITY

IIMT3636 • The original plan 4 0.05 0.05

Faculty of Business and Economics is to order 6 5 0.15 0.2

The University of Hong Kong cartons per day. 6 0.15 0.35

Should the Café 7 0.20 0.55

Instructor: Dr. Yipu DENG

increase the 8 0.25 0.8

9 0.10 0.9

order size to 7?

10 0.10 1.0

Total 1.00

15 17

Decision Making under Risk Sensitivity Analysis in Excel

EMV

Point1: 0=120,000p

• Step 1: setup the payoff table (data and formulas)

$300,000 • Step 2: setup the data table

Point2: 380,000p ▫ Set a list of values in the first column for the parameter to be

$200,000 EMV (large plant) explored, except for the first row.

Point 2 380,000p-180,000

0.45 ▫ Reference the output values in the first row, starting from the

$100,000

Point 1

EMV (small plant) second column.

120,000p-20,000

• Step 3: generate the one-way data table

0 EMV (do nothing)

0 ▫ Select the entire data table.

.167 .615 1

▫ Click: DATA -> What-If Analysis -> Data Table.

–$100,000 Values of p

▫ Set the Column input cell to the parameter cell in the original

model.

–$200,000

13 16

Decision Making under Risk Results of Sensitivity Analysis

• If the estimation of probability is changed, how will John change his

decision?

• A sensitivity analysis is needed! It investigates how our decision

BEST ALTERNATIVE RANGE OF P VALUES

might change given a change in the problem data.

STATE OF NATURE Construct a large plant >0.615

FAVORABLE UNFAVORABLE EMV Construct a small plant 0.167 - 0.615

ALTERNATIVE MARKET (profit in $) MARKET (profit in $) (in $1,000) Do nothing <0.167

Construct a large plant 200,000 –180,000 380p – 180

Construct a small plant 100,000 –20,000 120p – 20

Do nothing 0 0 0

Probability p 1–p

19 4

In-Class Exercise Decision Making under Uncertainty

• Given Opportunity Loss Table What if we do not know the probabilities for all states of

State I State II nature?

Option A 5 1

Option B 0 3

Option C 6 0

• Maximax (optimistic)

Probability 0.3 0.7 • Maximin (pessimistic)

Payoff table

• How to restore the payoff table? • Criterion of realism (Hurwicz)

State I State II • Equally likely (Laplace)

Option A 1 3

EVwPI = 6(0.3) + 4(0.7) = 4.6 • Minimax regret Opportunity loss table

Option B 6 1

Option C 0 4

• What is the EVwPI?

18 3

In-Class Exercise In-class Exercises

• Assume directly measuring monetary payoff is infeasible • The Monty Hall Problem Revisited

▫ Suppose you're on a game show, and you're given the choice of three doors:

• Opportunity Loss Table Behind one door is a car; behind the others, goats. You pick a door, say No. 1, and

the host, who knows what's behind the doors, opens another door, say No. 3,

State I State II which has a goat. He then says to you, "Do you want to pick door No. 2?" Is it to

your advantage to switch your choice?

Option A 5 1

• Timeline

Option B 0 3

• Payoff table (payoff = 1 if you get a car; 0 otherwise)

Option C 6 0

Given door 1 is Car behind Car behind Car behind Expected

Probability 0.3 0.7 chosen door 1 door 2 door 3 Value

Switch 0 1 1 2/3

• Which is the option that maximizes EMV? Do not switch 1 0 0 1/3

Probability 1/3 1/3 1/3

You might also like

- Om4 Spreadsheet TemplatesDocument103 pagesOm4 Spreadsheet TemplatesAmR ZakiNo ratings yet

- Managerial EconomicsDocument28 pagesManagerial EconomicsPrakhar SahayNo ratings yet

- McMillan 2007. Fish - Histology PDFDocument603 pagesMcMillan 2007. Fish - Histology PDFMarcela Mesa100% (1)

- Basic Survival Skills Training For Survival GroupsDocument5 pagesBasic Survival Skills Training For Survival GroupsevrazianNo ratings yet

- Airbnb 2018 PDFDocument8 pagesAirbnb 2018 PDFyodhisaputraNo ratings yet

- Bernoulli's EquationDocument14 pagesBernoulli's EquationMae Medalla DantesNo ratings yet

- IIMT3636 Lecture 4 With NotesDocument35 pagesIIMT3636 Lecture 4 With NotesChan Chin ChunNo ratings yet

- Marginal Analysis: Marginal Cost v. Marginal BenefitDocument14 pagesMarginal Analysis: Marginal Cost v. Marginal BenefitRashe FasiNo ratings yet

- 3874 AutomMethDev SeparationsNow CompressedMF151108Document53 pages3874 AutomMethDev SeparationsNow CompressedMF151108dvdthomasNo ratings yet

- Project P1 P2 P3 P4 P5 Accept 0 0 1 0 1: Capital Budgeting Model Decision VariablesDocument11 pagesProject P1 P2 P3 P4 P5 Accept 0 0 1 0 1: Capital Budgeting Model Decision Variablesingbarragan87No ratings yet

- Design Space Process Models With Monte Carlo SimulationDocument38 pagesDesign Space Process Models With Monte Carlo Simulationsellerm4c1n2No ratings yet

- Post Graduate Session 2 OperationsDocument129 pagesPost Graduate Session 2 Operationssujithgec1No ratings yet

- 2023 2 Linear ProgrammingDocument26 pages2023 2 Linear ProgrammingNatasha Angelica SusantoNo ratings yet

- ECO1018 Supply Decision 2023 - 2024Document13 pagesECO1018 Supply Decision 2023 - 2024aaliya dubcatNo ratings yet

- Perfection Workbook - Arabic - 2019Document56 pagesPerfection Workbook - Arabic - 2019sherif mahmoudNo ratings yet

- WK 10 Homework TemplateDocument8 pagesWK 10 Homework TemplatefranklinNo ratings yet

- RKCDocument13 pagesRKCPoojaNo ratings yet

- Distribution of Sample Mean Monte Carlo Simulations: ECO220Y - Intro To Data Analysis and Applied EconometricsDocument27 pagesDistribution of Sample Mean Monte Carlo Simulations: ECO220Y - Intro To Data Analysis and Applied EconometricsChristina ZhangNo ratings yet

- SWE1301: Introduction To Problem Solving and Software DevelopmentDocument8 pagesSWE1301: Introduction To Problem Solving and Software DevelopmentAbdulhalimNo ratings yet

- Overview: Production and Cost II: - Opportunity Costs in Practice - Example: Valuing A 1998 Boeing 737-700Document12 pagesOverview: Production and Cost II: - Opportunity Costs in Practice - Example: Valuing A 1998 Boeing 737-700venuputtamrajuNo ratings yet

- LPP-Lecture 4-6Document31 pagesLPP-Lecture 4-6Japa SonNo ratings yet

- AB1202 Statistics and Analysis: Model BuildingDocument20 pagesAB1202 Statistics and Analysis: Model BuildingxtheleNo ratings yet

- FM Topic 8 Lecture 2Document12 pagesFM Topic 8 Lecture 2xebulemNo ratings yet

- Services' Value-Price Nash-Equilibrium: Normative PrinciplesDocument33 pagesServices' Value-Price Nash-Equilibrium: Normative PrinciplesMaximiliano OlivaresNo ratings yet

- Lecture 05Document18 pagesLecture 05Zhu KNo ratings yet

- 3.1x1 PROBLEM SOLVINGv9 Apr8 2018Document64 pages3.1x1 PROBLEM SOLVINGv9 Apr8 2018Jechuuy HerreraNo ratings yet

- Lecture-Leveling - Crashing-2Document30 pagesLecture-Leveling - Crashing-2Ahmed AbdelkariemNo ratings yet

- Lbomgts Bip & NLPDocument6 pagesLbomgts Bip & NLPDenize Angela PinedaNo ratings yet

- Sample 2Document9 pagesSample 2Mustafa MangalNo ratings yet

- UntitledDocument36 pagesUntitledCiana SacdalanNo ratings yet

- Advanced and Multivariate SPCDocument62 pagesAdvanced and Multivariate SPCLeonardo RamosNo ratings yet

- Adjusted Mock Final Exam PM 19.8.2021 With Answer 1Document13 pagesAdjusted Mock Final Exam PM 19.8.2021 With Answer 1Phương PhạmNo ratings yet

- Operation Research Lab Manual - Lab 03Document5 pagesOperation Research Lab Manual - Lab 03Atif HussainNo ratings yet

- 10-Introduction To Discrete OptimizationDocument32 pages10-Introduction To Discrete OptimizationshermaineNo ratings yet

- Shao OptimizeGroundImprovementProgramDocument136 pagesShao OptimizeGroundImprovementProgramhpaige422No ratings yet

- Engineering Risk Benefit AnalysisDocument27 pagesEngineering Risk Benefit Analysismbajpai07No ratings yet

- Nama: ENDANG TRISTAFIANI (221700550) Logistic Regression: Case Processing SummaryDocument5 pagesNama: ENDANG TRISTAFIANI (221700550) Logistic Regression: Case Processing SummaryJuLio MissaNo ratings yet

- Module A: Discussion QuestionsDocument10 pagesModule A: Discussion Questionskaranjangid17No ratings yet

- C2 Linear Programing orDocument89 pagesC2 Linear Programing orvznp2vpp9qNo ratings yet

- Chapter 7Document77 pagesChapter 7Faisal SiddiquiNo ratings yet

- Decision Making AnalysisDocument17 pagesDecision Making AnalysisRowena MalinaoNo ratings yet

- Lecture13 03 PDFDocument35 pagesLecture13 03 PDFMichael FralaideNo ratings yet

- Supply & Demand 2Document27 pagesSupply & Demand 2mgpchangNo ratings yet

- OM AssignmentDocument15 pagesOM AssignmentShameel AndhoorathodiNo ratings yet

- 5.2.basic Concepts of Quality Management: Om-Unit VDocument37 pages5.2.basic Concepts of Quality Management: Om-Unit VTummala Akhil DattaNo ratings yet

- Data Presentation - Descriptive Stats - PGPEXDocument87 pagesData Presentation - Descriptive Stats - PGPEXAnuj MittalNo ratings yet

- His To GramsDocument9 pagesHis To GramsYap Mei EnNo ratings yet

- Telecommunications Company - Investigating The Amount of The First Bill For New CustomersDocument9 pagesTelecommunications Company - Investigating The Amount of The First Bill For New CustomersCarlos Andre Payares LunaNo ratings yet

- His To GramsDocument9 pagesHis To GramsFabian LlanosNo ratings yet

- Histograms PDFDocument9 pagesHistograms PDFRodolfo Andres Torres GonzalezNo ratings yet

- Lecture 14 11 - 17Document24 pagesLecture 14 11 - 17ChristopherNo ratings yet

- Comparing Two Means: ECO220Y - Intro To Data Analysis and Applied EconometricsDocument36 pagesComparing Two Means: ECO220Y - Intro To Data Analysis and Applied EconometricsChristina ZhangNo ratings yet

- WS - Data Analytics Fundamental-RDocument51 pagesWS - Data Analytics Fundamental-RStanislaus AdityaNo ratings yet

- I Teach Like This... : "FM Rocks"Document24 pagesI Teach Like This... : "FM Rocks"Saksham TehriNo ratings yet

- OptimisationDocument15 pagesOptimisationNaveen KaranNo ratings yet

- 24-01-22 Marked SlidesDocument50 pages24-01-22 Marked Slideselyan.dummyaccNo ratings yet

- CS 20 Risk - Transfer - Review 2Document19 pagesCS 20 Risk - Transfer - Review 2Stanley WangNo ratings yet

- Decision Tree Case Study: OptionsDocument5 pagesDecision Tree Case Study: OptionsMehmet ZirekNo ratings yet

- C&E Matrix: Identify Contributing / Causal Factors of An Adverse EventDocument11 pagesC&E Matrix: Identify Contributing / Causal Factors of An Adverse EventNajem A. SakorNo ratings yet

- BB107 PPT Microecon CH01Document30 pagesBB107 PPT Microecon CH01Bintang David SusantoNo ratings yet

- Minggu 7 Difficulties in Solving For IRR - 12eDocument23 pagesMinggu 7 Difficulties in Solving For IRR - 12eAchmad Nabhan YamanNo ratings yet

- Service Orient or Be Doomed!: How Service Orientation Will Change Your BusinessFrom EverandService Orient or Be Doomed!: How Service Orientation Will Change Your BusinessRating: 4.5 out of 5 stars4.5/5 (1)

- Partnership - Goodwill QDocument7 pagesPartnership - Goodwill QChan Chin ChunNo ratings yet

- Partnership I - NotesDocument11 pagesPartnership I - NotesChan Chin ChunNo ratings yet

- 7 Class Freud and Religion Revised 22-3-2023Document52 pages7 Class Freud and Religion Revised 22-3-2023Chan Chin ChunNo ratings yet

- CBS UG BSTC1003 Syllabus 2022 23Document5 pagesCBS UG BSTC1003 Syllabus 2022 23Chan Chin ChunNo ratings yet

- IIMT3636 Lecture 6 With NotesDocument39 pagesIIMT3636 Lecture 6 With NotesChan Chin ChunNo ratings yet

- AEB Mortgage Services - Capacity Planning and ControlDocument2 pagesAEB Mortgage Services - Capacity Planning and ControlDua LeoNo ratings yet

- Assessment IG 6 - Sem 2 - Informal LetterDocument6 pagesAssessment IG 6 - Sem 2 - Informal Lettersuruchi dhingraNo ratings yet

- 7th Circular Motion SolutionsDocument60 pages7th Circular Motion SolutionsAjay D KumarNo ratings yet

- Independent Contractor Agreement For Accountant & BookkeeperDocument7 pagesIndependent Contractor Agreement For Accountant & BookkeeperWen' George BeyNo ratings yet

- Soal Pas B.ing KLS 7Document2 pagesSoal Pas B.ing KLS 7Hernadi TaLaNo ratings yet

- Javascript: Case Study To Be Used For Hands-On SessionsDocument14 pagesJavascript: Case Study To Be Used For Hands-On SessionsSettiNagarajuNo ratings yet

- IA EconomicsDocument3 pagesIA EconomicsElisa ElisaNo ratings yet

- Problems - Tax and BSDocument5 pagesProblems - Tax and BSNguyễn Thùy LinhNo ratings yet

- Aileen Flores Lesson Plan 2021Document8 pagesAileen Flores Lesson Plan 2021Sissay SemblanteNo ratings yet

- Top Tips For Marriage Habits For A Happy Marriage 2019Document2 pagesTop Tips For Marriage Habits For A Happy Marriage 2019Marcel Henri Pascal Patrice Moudiki KingueNo ratings yet

- Information TechnologyDocument7 pagesInformation TechnologyDEVANAND ANo ratings yet

- Ellena's Book of Birds in SingaporeDocument38 pagesEllena's Book of Birds in SingaporeEllena GabrielleNo ratings yet

- J4500 Basic Electrical Schematics (Epa2017, Gen V) W/Parker VMM, Effective With Unit 68229Document91 pagesJ4500 Basic Electrical Schematics (Epa2017, Gen V) W/Parker VMM, Effective With Unit 68229HamiltonNo ratings yet

- New Alternatives For Continuity Plates in I-Beam To Box ColumnsDocument15 pagesNew Alternatives For Continuity Plates in I-Beam To Box ColumnstaosyeNo ratings yet

- Tele BRANCHES 01.06.2021Document23 pagesTele BRANCHES 01.06.2021Abhishek BarwalNo ratings yet

- IT1251 Information Coding TechniquesDocument23 pagesIT1251 Information Coding TechniquesstudentscornersNo ratings yet

- Unauthenticated Download Date - 1/31/17 4:04 AMDocument5 pagesUnauthenticated Download Date - 1/31/17 4:04 AMFahmi RaziNo ratings yet

- 2021 Holiday Consumer Protection GuideDocument61 pages2021 Holiday Consumer Protection GuidePeterBurkeNo ratings yet

- Principles of Health EducationDocument3 pagesPrinciples of Health EducationJunah DayaganonNo ratings yet

- CS317 IR W1aDocument20 pagesCS317 IR W1aHatim Juzer KhambatwalaNo ratings yet

- General Specification (Building) 30-01-21 198-380Document183 pagesGeneral Specification (Building) 30-01-21 198-380shujaNo ratings yet

- Inside Job PDFDocument87 pagesInside Job PDFAriel MarascalcoNo ratings yet

- 0332713Document200 pages0332713JS DUFFEYNo ratings yet

- Module 5 Advanced MechanicsDocument60 pagesModule 5 Advanced Mechanicsiknowvictoriassecret49No ratings yet

- Philex MiningDocument13 pagesPhilex Miningchristine reyesNo ratings yet

- Part - I: Subjective Questions: Introduction To ChemistryDocument7 pagesPart - I: Subjective Questions: Introduction To ChemistryMohini DeviNo ratings yet